Verisk Launches First-of-its-Kind Insurance Index to Better Inform Pricing Decisions

July 09 2024 - 9:25AM

The insurance industry exceeded loss ratio levels that have not

been seen in nearly 20 years, with an estimated $21.2 billion

reported in underwriting losses in 2023. To help insurers, Verisk

(Nasdaq: VRSK), a leading global data analytics and technology

provider, has launched its ISO Experience Index, an innovative tool

designed to modernize how actuaries in the insurance industry

analyze risk patterns. The ISO Experience Index addresses the

increasing volatility and scale of loss patterns in the industry,

offering a responsive and up-to-date indicator of observed

underwriting experience.

"Insurance plays a pivotal role in society and the industry has

faced harsh market conditions over the last few years. Our new

Experience Index is one more way we empower our clients to react

quickly and effectively to changing market conditions, ultimately

saving them time, effort and resources while driving

profitability," said Saurabh Khemka, co-president of underwriting

solutions at Verisk. "Insurers can now assess risk patterns and

formulate responsive strategies with increased confidence."

As a benchmarking tool for insurers, ISO Experience Index

provides users with frequent and responsive insights to help

accelerate pricing decisions and bolster confidence in the

evaluation of market conditions.

Verisk’s new index:

- Offers quarterly

releases and streamlined data adjustments, with more frequent

updates compared to traditional loss cost reviews.

- Is directly tied to

specific points in time and maintains consistent methodology across

different states, to support uniformity in measurement.

- Provides carriers

with current information and contextual insights beyond the annual

review cycles.

Revolutionizing risk management through responsive

insights, in real time

Recent trends seen in the ISO Experience Index for Homeowners

underscore the importance of this tool, demonstrating the

fluctuation of loss levels throughout different markets. The

countrywide Experience Index rose 2.5% in the fourth quarter of

2023 compared to the previous quarter, reversing course from the

decline observed in the third quarter. The index remains 3.4%

higher than the mark at the end of 2022, and 24.4% above the level

at the end of 2021.

Khemka added, "This index provides insurers with timely

indicators to prioritize in-depth analysis, resource allocation,

and pricing activities. It also offers a comprehensive view of

changing conditions in various geographic markets, enabling

carriers to make informed decisions."

Beyond its responsiveness to the latest data trends, the tool

also helps illuminate longer-term patterns with its multi-year

view. By using the rolling five-year basis of data, the index

reveals a 17.2% increase in pure premiums for the fourth quarter of

2023, compared to the preceding five-year period. This provides

numerical context to issues such as severe convective storms that

have become increasingly relevant to property insurers and present

a new operating environment.

The ISO Experience Index is available today on existing product

delivery platforms for eligible subscribers of Verisk's Core Lines

Services. The initial launch is poised to introduce loss level

metrics by state for Homeowners, with expansion expected soon to

follow for other key lines of business.

About Verisk Verisk (Nasdaq: VRSK) is a

leading strategic data analytics and technology partner to the

global insurance industry. It empowers clients to strengthen

operating efficiency, improve underwriting and claims outcomes,

combat fraud and make informed decisions about global risks,

including climate change, extreme events, sustainability and

political issues. Through advanced data analytics, software,

scientific research and deep industry knowledge, Verisk helps build

global resilience for individuals, communities and businesses. With

teams across more than 20 countries, Verisk consistently earns

certification by Great Place to Work and fosters

an inclusive culture where all team members feel they

belong. For more, visit Verisk.com and the Verisk

Newsroom.

Morgan Hurley

Verisk

551-655-7858

morgan.hurley@verisk.com

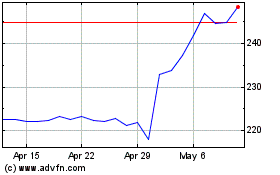

Verisk Analytics (NASDAQ:VRSK)

Historical Stock Chart

From Jun 2024 to Jul 2024

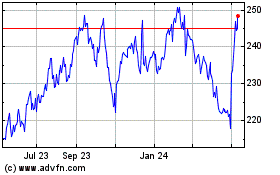

Verisk Analytics (NASDAQ:VRSK)

Historical Stock Chart

From Jul 2023 to Jul 2024