As

filed pursuant to Rule 424(b)(5)

Registration No. 333-264038

PROSPECTUS SUPPLEMENT

(to Prospectus dated April 14, 2022)

36,051,000

Shares of Common Stock

Verb

Technology Company, Inc. is offering 36,051,000 shares of its common stock pursuant to this prospectus supplement and the accompanying

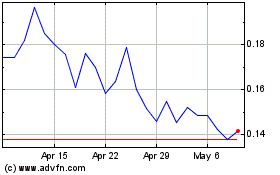

prospectus. Each share of common stock is being sold at a price of $0.20.

Our

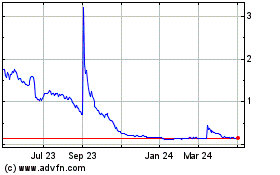

common stock is quoted on the Nasdaq Capital Market under the symbol “VERB.” On January 23, 2023, the last reported sale

price of our common stock on the Nasdaq Capital Market was $0.2287 per share.

You

should read this prospectus supplement and the accompanying prospectus and the documents incorporated by reference in this prospectus

supplement carefully before you invest.

INVESTING

IN OUR SECURITIES INVOLVES SIGNIFICANT RISKS. YOU SHOULD REVIEW CAREFULLY THE “RISK FACTORS” BEGINNING ON PAGE S-7 OF THIS PROSPECTUS SUPPLEMENT AND IN THE

DOCUMENTS INCORPORATED BY REFERENCE INTO THIS PROSPECTUS SUPPLEMENT.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

| | |

Per Share | | |

Total | |

| Public offering price | |

$ | 0.20 | | |

$ | 7,210,200 | |

| Underwriting discounts(1) | |

$ | 0.012 | | |

$ | 432,612 | |

| Proceeds to us, before expenses(2) | |

$ | 0.188 | | |

$ | 6,777,588 | |

| (1) |

See

“Underwriting” beginning on page S-11 of this prospectus supplement for additional information regarding total underwriting

compensation. For example, we have agreed to reimburse the underwriter for certain expenses. |

| (2) |

The

above summary of offering proceeds does not give effect to any proceeds from the exercise of the pre-funded warrants being issued

in this offering. |

Delivery

of the shares of common stock will be made through the book-entry facilities of The Depository Trust Company and is expected to

be made on or about January 26, 2023, subject to customary closing conditions.

Sole

Book-Running Manager

Aegis

Capital Corp.

The

date of this prospectus supplement is January 24, 2023

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and accompanying prospectus relates to the offering of our common stock. Before buying any of the securities that

we are offering, we urge you to carefully read this prospectus supplement, the accompanying prospectus, any free writing prospectus that

we have authorized for use in connection with this offering, and the information incorporated by reference as described under the headings

“Where You Can Find More Information” and “Information Incorporated by Reference” in this prospectus supplement.

These documents contain important information that you should consider when making your investment decision.

This

document is comprised of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering

and also adds to, and updates information contained in, the accompanying prospectus and the documents incorporated by reference into

this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus, including the documents incorporated

by reference into the accompanying prospectus, provides more general information, some of which may not apply to this offering. Generally,

when we refer to this prospectus, we are referring to the combined document consisting of this prospectus supplement and the accompanying

prospectus. In this prospectus supplement, as permitted by law, we “incorporate by reference” information from other documents

that we file with the Securities and Exchange Commission, or the SEC. This means that we can disclose important information to you by

referring to those documents. The information incorporated by reference is considered to be a part of this prospectus supplement and

the accompanying prospectus and should be read with the same care. When we make future filings with the SEC to update the information

contained in documents that have been incorporated by reference, the information included or incorporated by reference in this prospectus

supplement is considered to be automatically updated and superseded. In other words, in case of a conflict or inconsistency between information

contained in this prospectus supplement and information in the accompanying prospectus or incorporated by reference into this prospectus

supplement, you should rely on the information contained in the document that was filed later.

This

prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 that we filed on March 31, 2022

with the SEC using a “shelf” registration process with respect to up to $100,000,000 in securities that may be sold thereunder.

The shelf registration statement was declared effective by the SEC on April 14, 2022.

Under

the shelf registration process, we may offer and sell any combination of securities described in the accompanying prospectus in one or

more offerings. The purpose of this prospectus supplement is to provide supplemental information regarding us in connection with this

offering of common stock.

You

should rely only on the information contained in, or incorporated by reference into, this prospectus supplement, the accompanying prospectus,

and in any free writing prospectus that we have authorized for use in connection with this offering. We have not authorized any other

person to provide you with different information. We are not making an offer to sell or soliciting an offer to buy our securities in

any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or solicitation is not

qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information appearing

in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference into this prospectus supplement and

the accompanying prospectus, and in any free writing prospectus that we have authorized for use in connection with this offering, is

accurate only as of the date of those respective documents. Our business, financial condition, results of operations, and prospects may

have changed since those dates.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary description about us and our business highlights selected information contained elsewhere in this prospectus supplement or the

accompanying prospectus, or incorporated in this prospectus supplement or the accompanying prospectus by reference. This summary does

not contain all of the information you should consider before buying securities in this offering. You should carefully read this entire

prospectus supplement and the accompanying prospectus, including each of the documents incorporated herein or therein by reference, before

making an investment decision.

Unless

the context otherwise requires, the terms “Verb,” “the Company,” “we,” “us” and “our”

in this prospectus supplement and accompanying prospectus refer to Verb Technology Company, Inc.

Our

Business

Overview

We

are a Software-as-a-Service (“SaaS”) applications platform developer. Our platform is comprised of a suite of interactive

video-based sales enablement business software products marketed on a subscription basis. Our applications, available in both mobile

and desktop versions, are offered as a fully integrated suite, as well as on a standalone basis, and include verbCRM, our Customer Relationship

Management (“CRM”) application, verbLEARN, our Learning Management System application, verbLIVE, our Live Stream eCommerce

application, verbPULSE, our business/augmented intelligence notification and sales coach application, and verbTEAMS, our self-onboarding

video-based CRM and content management application for professional sports teams, small business and solopreneurs, with seamless synchronization

with Salesforce, that also comes bundled with verbLIVE, and verbMAIL, our interactive video-based sales communication tool integrated

into Microsoft Outlook. MARKET.live is our multi-vendor, multi-presenter, livestream social shopping platform, that combines ecommerce

and entertainment.

Our

Technology

Our

suite of applications can be distinguished from other sales enablement applications because our applications utilize our proprietary

interactive video technology as the primary means of communication between sales and marketing professionals and their customers and

prospects. Moreover, the proprietary data collection and analytics capabilities of our applications inform our users on their devices

in real time, when and for how long their prospects have watched a video, how many times such prospects watched it, and what they clicked

on, which allows our users to focus their time and efforts on ‘hot leads’ or interested prospects rather than on those that

have not seen such video or otherwise expressed interest in such content. Users can create their hot lead lists by using familiar, intuitive

‘swipe left/swipe right’ on-screen navigation. Our clients report that these capabilities provide for a much more efficient

and effective sales process, resulting in increased sales conversion rates. We developed the proprietary patent-pending interactive video

technology, as well as several other patent-issued and patent-pending technologies that serve as the unique foundation for all our platform

applications.

Our

Products

verbCRM

combines the capabilities of CRM lead-generation, content management, and in-video ecommerce capabilities in an intuitive, yet powerful

tool for both inexperienced as well as highly skilled sales professionals. verbCRM allows users to quickly and easily create, distribute,

and post videos to which they can add a choice of on-screen clickable icons which, when clicked, allow viewers to respond to the user’s

call-to-action in real-time, in the video, while the video is playing, without leaving or stopping the video. For example, our technology

allows a prospect or customer to click on a product they see featured in a video and impulse buy it, or to click on a calendar icon in

the video to make an appointment with a salesperson, among many other features and functionalities designed to eliminate or reduce friction

from the sales process for our users. The verbCRM app is designed to be easy to use and navigate and takes little time and training for

a user to begin using the app effectively. It usually takes less than four minutes for a novice user to create an interactive video from

our app. Users can add interactive icons to pre-existing videos, as well as to newly created videos shot with practically any mobile

device. verbCRM interactive videos can be distributed via email, text messaging, chat app, or posted to popular social media directly

and easily from our app. No software download is required to view Verb interactive videos on virtually any mobile or desktop device,

including smart TVs.

verbLEARN

is an interactive, video-based learning management system that incorporates all of the clickable in-video technology featured in

our verbCRM application and adapts them for use by educators for video-based education. verbLEARN is used by enterprises seeking to educate

a large sales team or a customer base about new products, or elicit feedback about existing products. It also incorporates Verb’s

proprietary data collection and analytics capabilities that inform users in real time when and for how long the viewers watched the video,

how many times they watched it, and what they clicked on, in addition to adding gamification features that enhance the learning aspects

of the application.

verbLIVE

is a next-generation interactive live-stream platform with in-video ecommerce capabilities for sales reps that allows them to utilize

a variety of novel sales-driving features, including placing interactive icons on-screen that appear on the screens of all viewers, providing

in-video click-to-purchase capabilities for products or services featured in the live video broadcast, in real-time, driving friction-free

selling. verbLIVE also provides the sales reps with real-time viewer engagement data and interaction analytics. verbLIVE is entirely

browser-based, allowing it to function easily and effectively on all devices without requiring the host or the viewers to download software,

and is secured through end-to-end encryption.

verbPULSE

is a business/augmented intelligence notification-based sales enablement platform feature set that tracks users’ interactions

with current and prospective customers and then helps coach users by telling them what to do next in order to close the sale, virtually

eliminating the lack of skill, training and experience among sales reps from the selling process.

verbTEAMS

is our interactive, video-based CRM for professional sports teams, small-and medium-sized businesses and solopreneurs. verbTEAMS

also incorporates verbLIVE as a bundled application. verbTEAMS features self-sign-up, self-onboarding, self-configuring, content management

system capabilities, user level administrative capabilities, and high-quality analytics capabilities in both mobile and desktop platforms

that sync with one another. It also has a built-in one-click sync capability with Salesforce.

MARKET.live

is akin to a virtual shopping mall, a centralized online destination where shoppers could explore hundreds, and over time thousands,

of shoppable stores for their favorite brands, influencers, creators and celebrities, all of whom can host livestream shopping events

from their virtual stores that can be seen by all shoppers at the virtual mall. Every store operator can host livestream events, even

simultaneously, and over time we expect there will be thousands of such events, across numerous product and service categories, being

hosted by people from all over the world, always on – 24/7 - where shoppers could communicate with the hosts and ask questions

about products directly to the host in real-time through an on-screen chat visible to all shoppers. Shoppers can invite their friends

and family to join them at any of the live shopping events to share the experience - to communicate directly with each other in real

time, and then simply click on a non-intrusive - in-video overlay to place items in an on-screen shopping cart for purchase – all

without interrupting the video. Shoppers can visit any number of other shoppable events to meet up and chat with friends, old and new,

and together watch, shop and chat with the hosts, discover new products and services, and become part of an immersive entertaining social

shopping experience. Throughout the experience, the shopping cart follows shoppers seamlessly from event to event, shoppable video to

shoppable video, host to host, product to product.

The

MARKET.live business model is a simple but next-level B to B play. It is a multi-vendor platform, with a single follow-me style unified

shopping cart, and robust ecommerce capabilities with the tools for consumer brands, big box brick and mortar stores, boutiques, influencers

and celebrities to connect with their clients, customers, fans, followers, and prospects by providing a unique, interactive social shopping

experience that we believe could keep them coming back and engaged for hours.

A

big differentiator for MARKET.live is that it also provides an online meeting place for friends and family to meet, chat, shop and enjoy

a fun, immersive shopping experience in real time together from anywhere and everywhere in the world. MARKET.live will provide vendors

with extensive business building analytics capabilities not available on, and not shared by many operators of other social media sites

who regard that information as valuable proprietary property. All vendors on MARKET.live will retain this valuable intelligence for their

own, unlimited use.

MARKET.live

allows vendors an opportunity to reach not only the shoppers they invite to the site from their own client and contact lists, but also

those shoppers who came to the site independently who will discover these vendors as they browse through the many other shoppable events

hosted simultaneously on MARKET.live 24/7, from around the world. We believe our revenue model will be attractive to vendors and will

consist of SaaS recurring revenue as well as a share of revenue generated through sales on the platform.

MARKET.live

is simply a platform; we hold no inventory, we take no inventory risk, and each vendor manages their own packing and fulfillment, as

well as returns. Only vendors that have a demonstrated ability to manage inventory and fulfillment are selected to participate on MARKET.live.

As

we continue onboarding vendors to the platform, we are seeing increased interest from product manufacturers seeking to embrace MARKET.live’s

direct-to-consumer selling capabilities, cutting-out distribution channel partners in order to reduce costs and increase profitability.

As the economy tightens, we expect that trend to accelerate.

MARKET.live

will also incorporate a modified version of our verbLIVE Attribution technology, allowing vendors who so choose, to leverage extremely

powerful, built-in affiliate marketing capabilities. Non-vendor visitors to the site can search for those vendors that have activated

the built-in affiliate marketing feature for their events and be compensated when people they referred to that vendor, purchase products

or services during that vendor’s shopping event. We expect that this feature, unique to MARKET.live, will drive many more shoppers

who will be referred from all over the world, producing a cross-pollination effect enhancing the revenue opportunities for all MARKET.live

vendors, while also creating an attractive income generating opportunity for non-vendor MARKET.live patrons.

MARKET.live

is an entirely new platform, built wholly independently and separate from our verbLIVE sales platform, representing what we believe is

the state of the art of shoppable video technology. Whereas verbLIVE is a sales tool for sales reps that subscribe either directly or

through their principal to verbCRM or verbTEAMS, MARKET.live is a multivendor social shopping platform for retailers, brands, manufacturers,

creators and influencers who seek to participate in an open market-style eco-system environment. More recently, we are beginning to see

interest from existing verbLIVE clients who see the value of MARKET.live as a corporate communications tool for use in sales, marketing,

lead-generation, training and recruitment initiatives.

We

recently launched our “Creators on MARKET,” a new program that allows creators to monetize their content through livestream

shopping and personalized storefronts on MARKET.live. The program is being marketed to video content creators across multiple social

media channels. Through this new program, creators and influencers can choose the products they love from hundreds of brands and retailers

on MARKET.live and offer their fans and followers those products through livestream shopping events broadcast live on MARKET.live and

simulcast on the creators’ existing social platforms. They can also offer their favorite products through the Creators’ personally

branded storefronts they can establish quickly and easily on MARKET.live. Depending on the products chosen, Creators can earn between

5% and 20% of their gross sales at no cost and no risk to the Creators selected to participate in the program.

With

more than 12 million products from brands like Athleta, Best Buy, Target, Container Store, Banana Republic, GAP, Saks Off 5th, SSENSE,

LOFT, DERMSTORE, INTERMIX, UNCOMMON GOODS, and many more, Creators can choose to feature their favorite products and promote and sell

them to their fans and followers. All MARKET.live events are interactive so followers and fans can chat with the Creators in real time,

as well as with one another, creating a more entertaining and engaging social shopping experience. When their interest level peaks, Creators’

fans and followers can click on the screen to buy the products. Creators accepted into the program are not required to make any investment

in inventory, nor do they have the burden of managing fulfillment or shipping. The only requirement for them to remain in the program

is for them to continue to create and promote the same videos they’re already doing on YouTube and elsewhere online. Livestream

events are recorded and available to watch in the Creators’ personally branded stores on MARKET.live for those fans and followers

to return 24/7 after the livestream events to browse and purchase the Creators’ featured products, as the recorded livestream videos

remain shoppable.

verbTV

will launch as a feature of our MARKET.live platform, serving to draw an audience of people seeking to consume video content that

is also interactive and shoppable. We expect this additional audience will also be exposed to and enhance the eco-system of shoppers

and retailers on MARKET.live. Over time it is anticipated that verbTV will feature concerts, game shows, sports, including e-sports,

sitcoms, podcasts, special events, news, including live events, and other forms of video entertainment that is all interactive and shoppable.

verbTV represents an entirely new distribution channel for all forms of content by a new generation of content creators looking for greater

freedom to explore the creative possibilities that a native interactive video platform can provide for their audience. We believe content

creators may also enjoy greater revenue opportunities through the native ecommerce capabilities the platform provides to sponsors and

advertisers who will enjoy real-time monetization, data collection and analytics. Through verbTV, sponsors and advertisers will be able

to accurately measure the ROI from their marketing spend, instead of relying on imprecise viewership information traditionally offered

to television sponsors and advertisers.

Verb

Partnerships and Integrations

verbMAIL

for Microsoft Outlook and Saleforce Integration of verbLIVE and verbTEAMS. verbMAIL is a product of our partnership with Microsoft

and is available as an add-in to Microsoft Outlook for Outlook and Office 365 subscribers. verbMAIL allows users to create interactive

videos seamlessly within Outlook by clicking the verbMAIL icon in the Outlook toolbar. The videos are automatically added to an email

and can be sent easily through Outlook using the user’s contacts they already have in Outlook. The application allows users to

easily track viewer engagement and together with other features represents an effective sales tool available for all Outlook users worldwide.

We have completed and deployed the integration of verbLIVE into Salesforce and have a verbTEAMS sync application for Salesforce users.

To date, adoption of these products has been low due in large part to management’s decision to reduce and deploy development and

marketing resources to other areas of the Company’s business that it believes can generate a greater return on investment.

Popular

Enterprise Back-Office System Integrations. We have integrated verbCRM into systems offered by 19 of the most popular direct sales

back-office system providers, such as Direct Scale, Exigo, By Design, Thatcher, Multisoft, Xennsoft, and Party Plan. Direct sales back-office

systems provide many of the support functions required for direct sales operations, including payroll, customer genealogy management,

statistics, rankings, and earnings, among other direct sales financial tracking capabilities. The integration into these back-office

providers, facilitated through our own API development, allows single sign-on convenience for users, as well as enhanced data analytics

and reporting capabilities for all users. Our experience confirms that our integration into these back-end platforms accelerates the

adoption of verbCRM by large direct sales enterprises that rely on these systems and as such, we believe this represents a competitive

advantage.

Non-Digital

Products and Services

Historically,

we provided certain non-digital services to some of our enterprise clients such as printing and fulfillment services. We designed and

printed welcome kits and starter kits for their marketing needs and provided fulfillment services, which consisted of managing the preparation,

handling and shipping of our client’s custom-branded merchandise they use for marketing purposes at conferences and other events.

Due to COVID-19, we experienced a marked decline in non-digital services and associated revenue, as reflected in our current and historical

financial statements, as our clients reduced or eliminated in-person conferences and other events. This reduction in non-digital services

was nevertheless consistent with management’s strategy to exit this area of our business due to the low margin, high costs and

limited scalability of this component of our business.

In

furtherance of the strategy, in May 2020, we executed a contract with Range Printing (“Range”), a company in the business

of providing enterprise class printing, sample assembly, warehousing, packaging, shipping, and fulfillment services. Pursuant to the

contract, through an automated process we have established for this purpose, Range receives orders for samples and merchandise from us

as and when we receive them from our clients and users, and print, assemble, store, package and ship such samples and merchandise on

our behalf. The Range contract provides for a service fee arrangement based upon the specific services to be provided by Range that is

designed to maintain our relationship with our clients by continuing to service their non-digital needs, while eliminating the labor

and overhead costs associated with the provision of such services by us. Effective April 1, 2022, we expanded our relationship with Range

when we entered into a customer referral agreement with them for our cart site and printing business. Under the agreement, we earn 10%

commission for customers referrals, 8% on merchandise sales and certain cart site design fees which will all be recognized as non-digital

revenue. Prior to entering into such agreement, we were recognizing revenues and cost of revenues associated with the non-digital business

in the condensed consolidated statements of operations.

For

these reasons, management has suggested that a more accurate measure of our performance is the historical growth of our SaaS and digital

business and associated revenue, which has been the focus of our initiatives, while we have continued to exit the low margin, non-digital

business. While the SaaS and digital business has grown year over year, that growth is not readily apparent when analyzing our top-line

revenue because the total revenue represents the growing SaaS and digital business upon which we are focused, off-set by the declining

non-digital business we are intentionally exiting.

Our

Market

Historically,

our client base consisted primarily of multi-national direct sales enterprises to whom we provide white-labeled, client-branded versions

of our products. During the year ended December 31, 2021, our client base expanded to include large enterprises in the life sciences

sector, professional sports franchises, educational institutions, and not-for-profit organizations, as well as clients in the entertainment

industry, and the burgeoning CBD industry, among other business sectors. As of September 30, 2022, we provided subscription-based application

services to approximately 150 enterprise clients for use in over 100 countries and in over 48 languages. Since inception, we have had

more than 3.4 million downloads of our verbCRM applications across all of the white-labelled versions created for clients on our platform.

Corporate

Information

We

are a Nevada corporation that was incorporated in February 2005. Our principal executive and administrative offices are located at 782

South Auto Mall Drive, American Fork, Utah 84003, and our telephone number is (855) 250-2300. Our website address is https://www.verb.tech/.

Information on or accessed through our website is not incorporated into this prospectus and is not a part of this prospectus.

THE

OFFERING

| Common

Stock to be Offered by Us |

|

36,051,000

shares. |

| |

|

|

| Common

Stock to be Outstanding Immediately after this Offering |

|

152,952,200

shares. |

| |

|

|

| Use

of Proceeds |

|

We

estimate the net proceeds to us from this offering will be approximately $6.6 million, after deducting underwriting discounts

and fees and estimated offering expenses payable by us. We intend to use the net proceeds from the sale of the securities offered

by this prospectus for general corporate purposes and repayment of outstanding debt in the amount of up to $1.6 million. See

“Use of Proceeds” on page S-9. |

| |

|

|

| Risk

Factors |

|

Investing

in our common stock involves significant risks. You should read the “Risk Factors” section beginning on page S-7 of this

prospectus supplement and in the documents incorporated by reference in this prospectus supplement and accompanying prospectus for

a discussion of factors to consider before deciding to purchase shares of our common stock. |

| |

|

|

| Listing |

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “VERB.” The shares of common stock offered hereby

will be listed on the Nasdaq Capital Market. |

The

number of shares of common stock that will be outstanding immediately after this Offering is based on shares of common stock outstanding

as of January 23, 2023 and excludes the following:

| |

● |

5,884,900

shares of common stock issuable upon the exercise of outstanding stock options with a weighted-average exercise price of $1.24 per

share; |

| |

|

|

| |

● |

3,091,470

shares of common stock issuable upon vesting of restricted stock unit awards with a weighted-average exercise price of $0.64 per

share; |

| |

|

|

| |

● |

641,924

shares of common stock reserved for future issuance under our 2019 Omnibus Incentive Plan; and |

| |

|

|

| |

● |

38,071,408

shares of common stock issuable upon exercise of warrants to purchase common stock with a weighted-average exercise price of $0.97

per share. |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described

in the section entitled “Risk Factors” in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports

on Form 10-Q, as filed with the SEC, each of which are incorporated by reference in this prospectus, as well as any amendments or updates

to our risk factors reflected in our subsequent filings with the SEC, including in any applicable prospectus supplement. If any of these

risks actually occur, our business, financial condition, results of operations and future prospects could be materially and adversely

affected. In that case, the trading price or value of our securities could decline and you might lose all or part of your investment.

For additional information, refer to the section entitled “Where You Can Find More Information.”

Risks

Related to This Offering

You

will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

Since

the price per share of our common stock being offered is higher than the net tangible book value per share of our common stock, you will

suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. Based on the public offering

price of $0.20 per share, and after deducting the underwriting discount and estimated offering expenses payable by us, if you

purchase shares of common stock in this offering, you will suffer immediate and substantial dilution of $0.17 per share in the

net tangible book value of the common stock. See the section entitled “Dilution” in this prospectus for a more detailed discussion

of the dilution you will incur if you purchase common stock in this offering.

Because

we will have broad discretion and flexibility in how we use the net proceeds from this offering, we may use the net proceeds in ways

in which you disagree.

We

currently intend to use the net proceeds from this offering for general corporate purposes including but not limited to, working capital,

potential acquisitions and other business opportunities. See “Use of Proceeds.” Our management will have significant discretion

and flexibility in applying the net proceeds of this offering. You will be relying on the judgment of our management with regard to the

use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the net proceeds

are being used appropriately. The failure of our management to use such funds effectively could have a material adverse effect on our

business, financial condition, operating results and cash flow.

Additional

stock offerings in the future may dilute then existing stockholders’ percentage ownership of our company.

Given

our plans and expectations that we may need additional capital, we may need to issue additional shares of common stock or securities

convertible or exercisable for shares of common stock, including convertible preferred stock, convertible notes, stock options or warrants.

The issuance of additional securities in the future will dilute the percentage ownership of then existing stockholders.

We

have no plans to pay dividends on our common stock.

We

do not anticipate paying any cash dividends on our common stock in the foreseeable future. We currently intend to retain future earnings,

if any, to finance the expansion of our business. Our future dividend policy is within the discretion of our board of directors and will

depend upon various factors, including our business, financial condition, results of operations, capital requirements and investment

opportunities.

There

is no public market for the pre-funded warrants being offered in this offering.

There

is no established public trading market for the pre-funded warrants being offered in this offering, and we do not expect a market to

develop. In addition, we do not intend to apply to list the pre-funded warrants on any securities exchange or nationally recognized trading

system. Without an active market, the liquidity of the pre-funded warrants will be limited.

Risks

Related to Our Common Stock

We

are not in compliance with The NASDAQ Capital Market $1.00 minimum bid price requirement and failure to maintain compliance with this

standard could result in delisting and adversely affect the market price and liquidity of our common stock.

Our

common stock is currently traded on The NASDAQ Capital Market under the symbol “VERB”. If we fail to meet any of the continued

listing standards of The NASDAQ Capital Market, our common stock will be delisted from The NASDAQ Capital Market. These continued listing

standards include specifically enumerated criteria, such as a $1.00 minimum closing bid price.

On

May 12, 2022, we received a letter from The NASDAQ Stock Market advising that the Company did not meet the minimum $1.00 per share bid

price requirement for continued inclusion on The NASDAQ Capital Market pursuant to NASDAQ Marketplace Listing Rule 5550(a)(2). The Company

initially had a period of 180 calendar days, or until November 8, 2022, to regain compliance. On November 9, 2022, we were granted an

additional 180-day period from the Nasdaq Stock Market Listing Qualifications Staff, through May 8, 2023, to regain compliance with the

$1.00 minimum bid price requirement for continued listing on the Nasdaq Capital Market. To demonstrate compliance with this requirement,

the closing bid price of our common stock needs to be at least $1.00 per share for a minimum of 10 consecutive business days before May

8, 2023. In order to satisfy this requirement, the Company intends to continue actively monitoring

the bid price for its common stock between now and May 8, 2023 and will consider available options to resolve the deficiency and regain

compliance with the minimum bid price requirement.

While

we intend to regain compliance with the minimum bid price rule, there can be no assurance that we will be able to maintain continued

compliance with this rule or the other listing requirements of The NASDAQ Capital Market. If we were unable to meet these requirements,

we would receive another delisting notice from the Nasdaq Capital Market for failure to comply with one or more of the continued listing

requirements. If our common stock were to be delisted from The NASDAQ Capital Market, trading of our common stock most likely will be

conducted in the over-the-counter market on an electronic bulletin board established for unlisted securities such as the OTC Markets

or in the “pink sheets.” Such a downgrading in our listing market may limit our ability to make a market in our common stock

and which may impact purchases or sales of our securities.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying base prospectus, and the documents incorporated by reference herein and therein, contain “forward-looking

statements” within the meaning of the federal securities laws, which statements are subject to considerable risks and uncertainties.

These forward-looking statements are intended to qualify for the safe harbor from liability established by the Private Securities Litigation

Reform Act of 1995. All statements included or incorporated by reference in this prospectus, other than statements of historical fact,

are forward-looking statements. You can identify forward-looking statements by the use of words such as “anticipate,” “believe,”

“continue” “could,” “expect,” “intend,” “may,” “will,” or the

negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating

to such statements. In particular, forward-looking statements included or incorporated by reference in this prospectus relate to, among

other things, our future or assumed financial condition, results of operations, liquidity, business forecasts and plans, strategic plans

and objectives, competitive environment and our expected use of the net proceeds from this Offering. We caution you that the foregoing

list may not include all of the forward-looking statements made in this prospectus.

Our

forward-looking statements are based on our management’s current assumptions and expectations about future events and trends, which

affect or may affect our business, strategy, operations or financial performance. Although we believe that these forward-looking statements

are based upon reasonable assumptions, they are subject to numerous known and unknown risks and uncertainties and are made in light of

information currently available to us. Our actual financial condition and results could differ materially from those anticipated in these

forward-looking statements as a result of various factors, including those set forth in the section entitled “Risk Factors”

beginning on page S-7 of this prospectus, beginning on page 1 of the accompanying base prospectus, as well as in the other reports

we file with the SEC. You should read this prospectus with the understanding that our actual future results may be materially different

from and worse than what we expect.

Moreover,

we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management

to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any

factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Forward-looking

statements speak only as of the date they were made, and, except to the extent required by law or the Nasdaq Listing Rules, we undertake

no obligation to update or review any forward-looking statement because of new information, future events or other factors.

We

qualify all of our forward-looking statements by these cautionary statements.

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering will be approximately $6.6 million, after deducting the estimated underwriting

discounts and commissions and estimated offering expenses payable by us.

We

intend to use the net proceeds from the sale of the common stock offered by this prospectus for general corporate purpose and repayment

of outstanding debt in the amount of up to $1.6 million.

Until

we use the net proceeds of this offering for the above purposes, we intend to invest the funds in short-term, investment grade, interest-bearing

securities. We cannot predict whether the proceeds invested will yield a favorable return. Until we have determined the amount or timing

of the expenditures, we will retain broad discretion over the use of the net proceeds from this offering.

CAPITALIZATION

The

following table sets forth our consolidated cash, cash equivalents and capitalization as of September 30, 2022: Such

information is set forth on the following basis:

| |

● |

on

an actual basis; and |

| |

|

|

| |

● |

on

an as adjusted basis to give effect to the sale by us of 36,051,000 shares of our common stock in this offering at a public

offering price of $0.20 per share, after deducting underwriting discounts and estimated offering expenses payable of $0.2

million by us. On the date of funding, the remaining amounts due on the convertible notes will be repaid amounting to $1.6

million. |

You

should read this table together with the section of this prospectus supplement entitled “Use of Proceeds” and with the financial

statements and related notes and the other information that we incorporate by reference into this prospectus supplement and the accompanying

prospectus.

| | |

As of September 30, 2022

(in thousands, except per

share data) | |

| | |

Actual | | |

As Adjusted | |

| Cash | |

$ | 921 | | |

$ | 5,921 | |

| Total debt, including current maturities | |

| 18,251 | | |

| 16,651 | |

| Total stockholders’ equity | |

| | | |

| | |

| Common Stock, par value $0.0001 per share, 200,000,000 shares authorized; 102,604,851 shares issued and outstanding actual; | |

| 10 | | |

| 14 | |

| Additional paid-in capital | |

| 153,940 | | |

| 160,536 | |

| Accumulated deficit | |

| (137,418 | ) | |

| (137,418 | |

| Total stockholders’ equity | |

$ | 16,532 | | |

| 23,132 | |

| Total capitalization | |

$ | 34,783 | | |

| 39,783 | |

DILUTION

If

you invest in our common stock, your interest will be diluted immediately to the extent of the difference between the offering price

per share and the adjusted net tangible book value per share of our common stock after this offering.

After

giving effect to the sale by us of 12,500,000 shares of Common Stock in October 2022 at the purchase price of $0.32 per share, resulting

in net proceeds of $3.6 million, our as adjusted

net tangible book value as of September 30, 2022 was approximately $(2.6) million, or $(0.02) per share. “Net tangible book value”

is total assets minus the sum of liabilities and intangible assets. “Net tangible book value per share” is net tangible book

value divided by the total number of shares outstanding.

After

giving effect to the sale of the common stock in this offering at the offering price set forth on the cover page of this prospectus supplement

and after deducting estimated underwriting discounts and expenses payable by us, our as adjusted net tangible book value as of September

30, 2022 would have been approximately $4.0 million or $0.03 per share of common stock. This represents an immediate increase

in net tangible book value of $0.05 per share to our existing stockholders and an immediate dilution in net tangible book value

of $0.17 per share to investors participating in this offering. The following table illustrates this dilution per share to investors

participating in this offering:

| Public offering price per share | |

| | | |

$ | 0.20 | |

| Net tangible book value per share as of September 30, 2022 | |

$ | (0.02 | ) | |

| | |

| Increase in net tangible book value per share attributable to new investors in this offering | |

$ | 0.05 | | |

| | |

| As adjusted net tangible book value per share after the offering | |

| | | |

$ | 0.03 | |

| Dilution per share to investors in this offering | |

| | | |

$ | 0.17 | |

The

number of shares of common stock used for purposes of this section is based on the 102,604,851 shares outstanding as of September 30,

2022 and excludes the following:

| |

● |

5,252,119

shares of common stock issuable upon the exercise of outstanding stock options, with a weighted-average exercise price of $1.55 per

share; |

| |

|

|

| |

● |

2,071,849

shares of common stock issuable upon vesting of restricted stock unit awards, with a weighted-average exercise price of $1.24 per

share; |

| |

● |

3,315,538

shares of common stock reserved for future issuance under our 2019 Omnibus Incentive Plan; |

| |

|

|

| |

● |

25,651,407

shares of common stock issuable upon exercise of warrants to purchase common stock, with a weighted-average exercise price of $1.52

per share; |

| |

|

|

| |

● |

1,209,610

shares of common stock issuable upon conversion of the outstanding principal amount, plus accrued interest, of convertible notes due

2023 issued pursuant to a Securities Purchase Agreement on January 12, 2022, which have a conversion price of $3.00 per share; and |

| |

|

|

| |

● |

Any

additional shares of common stock we have issued or may issue from time to time after that date. |

DESCRIPTION

OF THE SECURITIES WE ARE OFFERING

In

this offering, we are offering shares of our common stock.

Common

Stock

The

material terms and provisions of our common stock and each other class of our securities that qualifies or limits our common stock are

described under the caption “Description of Capital Stock” starting on page 7 of this prospectus supplement. Our common stock

is listed on the Nasdaq Capital Market under the symbol “VERB.” Our transfer agent and registrar for our common stock is

VStock Transfer, LLC.

UNDERWRITING

Aegis

Capital Corp. is the sole underwriter for the offering. We have entered into an underwriting agreement dated January 24, 2023

with the underwriter. Subject to the terms and conditions of the underwriting agreement, we have agreed to sell to the underwriter named

below and the underwriter has agreed to purchase, at the public offering price less the underwriting discounts and commissions set forth

on the cover page of this prospectus, the following respective number of shares of our common stock:

| Underwriter | |

Number of

Shares | |

| Aegis Capital Corp. | |

| 36,051,000 | |

The

underwriter is committed to purchase all the shares of common stock offered by us, if it purchases any shares. The obligations of the

underwriter may be terminated upon the occurrence of certain events specified in the underwriting agreement. Furthermore, pursuant to

the underwriting agreement, the underwriter’s obligations are subject to customary conditions, representations and warranties contained

in the underwriting agreement, such as receipt by the underwriter of officers’ certificates and legal opinions.

The

underwriter proposes to offer the shares of common stock for sale from time to time in one or more transactions on the NASDAQ Capital

Market, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale,

at prices related to prevailing market prices or at negotiated prices, subject to receipt of acceptance by it and subject to its right

to reject any order in whole or in part. The underwriter effects such transactions by selling the shares of common stock to or through

dealers, and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriter and/or purchasers

of shares of common stock for whom they may act as agents or to whom they may sell as principal. The difference between the price at

which the underwriter purchases shares of common stock and the price at which the underwriter resells such shares of common stock may

be deemed underwriting compensation

We

have agreed to indemnify the underwriter against specified liabilities, including liabilities under the Securities Act of 1933, as amended,

and to contribute to payments the underwriter may be required to make in respect thereof.

The

underwriter is offering the common stock, subject to prior sale, when, as and if issued to and accepted by it, subject to approval of

legal matters by its counsel and other conditions specified in the underwriting agreement. The underwriter reserves the right to withdraw,

cancel or modify offers to the public and to reject orders in whole or in part.

The

underwriter proposes to offer the common stock offered by us to the public at the public offering price set forth on the cover of this

prospectus supplement. In addition, the underwriter may offer some of the common stock to other securities dealers at such price less

a concession of $0.007 per share. After the initial offering, the public offering price and concession to dealers may be changed.

Discounts

and Commissions. The following table shows the public offering price, underwriting discount and proceeds, before expenses, to us.

| | |

Per Share | | |

Total | |

| Public offering price | |

$ | 0.20 | | |

$ | 7,210,200 | |

| Underwriting discount (6%) | |

$ | 0.012 | | |

$ | 432,612 | |

| Proceeds, before expenses, to us | |

$ | 0.188 | | |

$ | 6,777,588 | |

We

have also agreed to pay all expenses relating to the offering, including (a) all filing fees and expenses relating to the registration

of the shares to be sold in the offering with the Securities and Exchange Commission; (b) all fees associated with the review of the

offering by FINRA; (c) all fees and expenses relating to the listing of such shares on the NASDAQ Capital Market; (d) all fees, expenses

and disbursements relating to the registration, qualification or exemption of securities offered under the “blue sky” securities

laws designated by the underwriter; (e) all fees, expenses and disbursements relating to the registration, qualification or exemption

of securities offered under the securities laws of foreign jurisdictions designated by the underwriter; (f) the costs of all mailing

and printing of the offering documents; (g) transfer and/or stamp taxes, if any, payable upon the transfer of the shares from the Company

to the underwriter; (h) fees and expenses of our legal counsel and accountants; and (i) “road show” expenses, diligence fees

and the fees and expenses of the underwriter’s legal counsel not to exceed $75,000.

We

estimate that the total expenses of the offering, excluding the underwriting discount, will be approximately $0.2 million.

Discretionary

Accounts. The underwriter does not intend to confirm sales of the securities offered hereby to any accounts over which they have

discretionary authority.

Lock-Up

Agreements. Pursuant to certain “lock-up” agreements, (a) our executive officers and directors as of the pricing date

of the offering, have agreed, subject to certain exceptions, not to offer, issue, sell, contract to sell, encumber, grant any option

for the sale of or otherwise dispose of any securities of the company without the prior written consent of the underwriter, for a period

of 60 days from the date of the offering, and (b) we, and any successor, have agreed, subject to certain exceptions, not to for a period

of 60 days from the date of the offering (1) offer, sell or otherwise transfer or dispose of, directly or indirectly, any shares of capital

stock of the Company or (2) file or caused to be filed any registration statement with the SEC relating to the offering of any shares

of our capital stock or any securities convertible into or exercisable or exchangeable for shares of our capital stock.

This

lock-up provision applies to common stock and to securities convertible into or exchangeable or exercisable for common stock. It also

applies to common stock owned now or acquired later by the person executing the agreement or for which the person executing the agreement

later acquires the power of disposition. The exceptions permit, among other things and subject to restrictions, the issuance of common

stock upon the exercise of outstanding stock options and warrants or other outstanding convertible securities, the issuance of redeemable

voting preferred shares for the limited purpose of certain recapitalization matters and the issuance of certain common stock dividends

to all common shareholders.

Electronic

Offer, Sale and Distribution of Shares. A prospectus supplement in electronic format may be made available on the websites maintained

by the underwriter or selling group members, if any, participating in this offering and the underwriter participating in this offering

may distribute prospectus supplements electronically. The underwriter may agree to allocate a number of shares to underwriters and selling

group members for sale to their online brokerage account holders. Internet distributions will be allocated by the underwriter and selling

group members that will make internet distributions on the same basis as other allocations. Other than the prospectus supplement in electronic

format, the information on these websites is not part of this prospectus supplement or the registration statement of which this prospectus

supplement forms a part, has not been approved or endorsed by us or any underwriter in its capacity as underwriter, and should not be

relied upon by investors.

Other

Relationships. The underwriter and its affiliates may in the future provide various investment banking, commercial banking and other

financial services for us and our affiliates for which they may receive customary fees; however, except as disclosed in this prospectus

supplement, we have no present arrangements with the underwriter for any further services.

Stabilization.

In connection with this offering, the underwriter may engage in stabilizing transactions, syndicate covering transactions, and penalty

bids in connection with our common stock.

Stabilizing

transactions permit bids to purchase shares of common stock so long as the stabilizing bids to not exceed a specified maximum.

Syndicate

covering transactions involve purchases of common stock in the open market after the distribution has been completed in order to cover

syndicate short positions. Such a naked short position would be closed out by buying securities in the open market. A naked short position

is more likely to be created if the underwriter is concerned that there could be downward pressure on the price of the securities in

the open market after pricing that could adversely affect investors who purchase in the offering.

Penalty

bids permit the underwriter to reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate

member are purchased in a stabilizing or syndicate cover transaction to cover syndicate short positions. These stabilizing transactions,

syndicate covering transactions and penalty bids may have the effect of raising or maintain the market price of our common stock or preventing

a decline in the market price of our common stock. As a result, the price of our common stock in the open market maybe higher than it

would otherwise be in the absence of these transactions. Neither we nor the underwriter makes any representation or prediction as to

the effect that the transactions described above may have on the price of our common stock. These transaction may be effected on the

NASDAQ Capital Market, in the over-the-counter market or otherwise and, if commenced, may be discontinued at any time.

Passive

market making. In connection with this offering, the underwriter and selling group members may engage in passive market making transactions

in our common stock in accordance with Rule 103 of Regulation M under the Exchange Act, during a period before the commencement of offers

or sales of the shares and extending through the completion of the distribution. A passive market maker must display its bid at a price

not in excess of the highest independent bid of that security. However, if all independent bids are lowered below the passive market

maker’s bid, that bid must then be lowered when specified purchase limits are exceeded.

Offer

restrictions outside the United States

Other

than in the United States, no action has been taken by us or the underwriter that would permit a public offering of the securities offered

by this prospectus supplement in any jurisdiction where action for that purpose is required. The securities offered by this prospectus

supplement may not be offered or sold, directly or indirectly, nor may this prospectus supplement or any other offering material or advertisements

in connection with the offer and sale of any such securities be distributed or published in any jurisdiction, except under circumstances

that will result in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this prospectus

supplement comes are advised to inform themselves about and to observe any restrictions relating to the offering and the distribution

of this prospectus supplement. This prospectus supplement does not constitute an offer to sell or a solicitation of an offer to buy any

securities offered by this prospectus supplement in any jurisdiction in which such an offer or a solicitation is unlawful.

LEGAL

MATTERS

The

validity of the securities being offered under this prospectus by us will be passed upon for us by Sichenzia Ross Ference LLP, New York,

New York. The underwriter is being represented in connection with this offering by Kaufman & Canoles, P.C., Richmond, Virginia.

EXPERTS

The

consolidated financial statements of Verb Technology Company, Inc. as of December 31, 2021 and 2020, and for the years then ended appearing

in Verb Technology Company, Inc.’s From 10-K for the fiscal year ended December 31, 2021, have been audited by Weinberg & Company,

P.A., independent registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein

by reference. Such financial statements are incorporated by reference herein in reliance upon such report of Weinberg & Company,

P.A. pertaining to such financial statements given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and other reports, proxy statements and other information with the SEC. Our SEC filings are available to the public

over the Internet at the SEC’s website at http://www.sec.gov. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and

Current Reports on Form 8-K, including any amendments to those reports, and other information that we file with or furnish to the SEC

pursuant to Section 13(a) or 15(d) of the Exchange Act can also be accessed free of charge through the Internet. These filings will be

available as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

We

have filed with the SEC a registration statement under the Securities Act of 1933 relating to the offering of these securities. The registration

statement, including the attached exhibits, contains additional relevant information about us and the securities. This prospectus supplement

and the accompanying prospectus do not contain all of the information set forth in the registration statement. You can obtain a copy

of the registration statement, at prescribed rates, from the SEC at the address listed above. The registration statement and the documents

referred to below under “Information Incorporated by Reference” are also available on our Internet website, https://www.verb.tech/.

We have not incorporated by reference into this prospectus supplement or the accompanying prospectus the information on our website,

and you should not consider it to be a part of this prospectus supplement or the accompanying prospectus.

INFORMATION

INCORPORATED BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus much of the information we file with the SEC, which means

that we can disclose important information to you by referring you to those publicly available documents. The information that we incorporate

by reference into this prospectus is considered to be part of this prospectus. These documents may include Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy and information statements. You should read the information

incorporated by reference because it is an important part of this prospectus.

This

prospectus incorporates by reference the documents listed below, other than those documents or the portions of those documents deemed

to be furnished and not filed in accordance with SEC rules:

| |

● |

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed with the SEC on March 31, 2022; |

| |

|

|

| |

● |

our

Amendment No. 1 to our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2021 filed with the SEC on April 12, 2022; |

| |

|

|

| |

● |

Our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 filed with the SEC on May 16, 2022: |

| |

|

|

| |

● |

Our

Quarterly Report on Form 10-Q for the quarter ended June 30, 2022 filed with the SEC on August 15, 2022: |

| |

|

|

| |

● |

Our

Quarterly Report on Form 10-Q for the quarter ended September 30, 2022 filed with the SEC on November 14, 2022: |

| |

|

|

| |

● |

our

Current Reports on Form 8-K filed with the SEC on January 13, 2022, January 24, 2022, April 22, 2022, October 24, 2022, October 28, 2022, November 23, 2022, and January 9, 2023; and |

| |

|

|

| |

● |

the

description of our securities contained in Exhibit 4.17 of our Annual Report on Form 10-K for the fiscal year ended December 31,

2019 filed with the SEC on May 14, 2020, including any amendment or report filed for the purpose of updating such description. |

We

also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K, and

exhibits filed on such form that are related to such items, unless such Form 8-K expressly provides to the contrary) made with the SEC

pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement but prior to the termination

of the offering, and such future filings will become a part of this prospectus from the respective dates that such documents are filed

with the SEC. Any statement contained herein, or in a document incorporated or deemed to be incorporated by reference herein, shall be

deemed to be modified or superseded for purposes hereof or of the related prospectus supplement to the extent that a statement contained

herein or in any other subsequently filed document which is also incorporated or deemed to be incorporated herein modifies or supersedes

such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute

a part of this prospectus.

You

may obtain copies of the documents incorporated by reference in this prospectus from us free of charge by requesting them in writing

or by telephone at the following address:

Verb

Technology Company, Inc.

782

South Auto Mall Drive

American

Fork, Utah 84003

Attn:

Investor Relations

Telephone:

(855) 250-2300

PROSPECTUS

$100,000,000

VERB

TECHNOLOGY COMPANY, INC.

Common

Stock

Preferred

Stock

Debt

Securities

Warrants

Units

We

may offer and sell, from time to time in one or more offerings, any combination of common stock, preferred stock, debt securities, warrants

and/or units having an aggregate initial offering price not to exceed $100,000,000. The preferred stock may be convertible into or exchangeable

for shares of our common stock, other shares of our preferred stock or warrants. The debt securities may be convertible into or exchangeable

for shares of our common stock, shares of our preferred stock, warrants or other debt securities. The warrants may be exercisable for

shares of our common stock, shares of our preferred stock, debt securities and/or units. Each unit will be comprised of two or more of

the other securities described in this prospectus in any combination, which may or may not be separable from one another.

This

prospectus provides a general description of the securities we may offer. Each time we sell a particular class of securities, we will

provide specific terms of the securities offered in a supplement to this prospectus. The prospectus supplement may also add, update or

change information in this prospectus. You should read this prospectus and any prospectus supplement, as well as the documents incorporated

by reference or deemed to be incorporated by reference herein or therein, carefully before you invest in any of the securities offered

pursuant to this prospectus.

This

prospectus may not be used to offer or sell our securities unless accompanied by a prospectus supplement relating to the offered securities.

These

securities may be sold directly by us, through agents designated from time to time, to or through underwriters or dealers, or through

a combination of these methods on a continuous or delayed basis. For additional information on the methods of sale, refer to the section

entitled “Plan of Distribution.” We will describe the plan of distribution for any particular offering of our securities

in a prospectus supplement. If any agents, underwriters or dealers are involved in the sale of any securities with respect to which this

prospectus is being delivered, we will set forth in a prospectus supplement the names of such agents, underwriters or dealers and any

applicable fees, commissions, discounts and over-allotment options. We will also set forth in a prospectus supplement the price to the

public of such securities and the net proceeds we expect to receive from such sale.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “VERB.” On March 30, 2022, the last reported

sale price of our common stock on The Nasdaq Capital Market was $0.99 per share.

INVESTING

IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY REVIEW THE RISKS AND UNCERTAINTIES DESCRIBED IN THE SECTION ENTITLED

“RISK FACTORS” BEGINNING ON PAGE 4 OF THIS PROSPECTUS, AS WELL AS THE RISKS AND UNCERTAINTIES DESCRIBED UNDER A SIMILAR HEADING

IN ANY APPLICABLE PROSPECTUS SUPPLEMENT AND IN THE DOCUMENTS WE INCORPORATE BY REFERENCE HEREIN OR THEREIN.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is April 14, 2022

TABLE

OF CONTENTS

PROSPECTUS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) using

a “shelf” registration process. By using a shelf registration process, we may offer and sell any combination of the securities

described in this prospectus from time to time in one or more offerings with an aggregate initial offering price not to exceed $100,000,000.

We have provided to you in this prospectus a general description of the securities we may offer. Each time we offer or sell any of our

securities under this prospectus, we will provide specific terms of the securities offered in a supplement to this prospectus.

We

may add, update or change any of the information contained in this prospectus or in any accompanying prospectus supplement we may authorize

to be delivered to you. To the extent there is a conflict between the information contained in this prospectus and any accompanying prospectus

supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents

is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this

prospectus or any prospectus supplement—the statement in the document having the later date modifies or supersedes the earlier

statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so

superseded will be deemed not to constitute a part of this prospectus. This prospectus, together with any accompanying prospectus supplement,

includes all material information relating to an offering pursuant to this registration statement.

You

should rely only on the information contained in this prospectus, in any accompanying prospectus supplement, or in any document incorporated

by reference herein or therein. We have not authorized anyone to provide you with any different information. We take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may provide to you. The information contained

in this prospectus, in any applicable prospectus supplement, and in the documents incorporated by reference herein or therein, is accurate

only as of the date such information is presented. Our business, financial condition, results of operations and future prospects may

have changed since those respective dates.

This

prospectus and any accompanying prospectus supplement does not constitute an offer to sell or the solicitation of an offer to buy any

securities other than the registered securities to which they relate, nor does this prospectus and any accompanying prospectus supplement

constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful

to make such offer or solicitation in such jurisdiction. This prospectus may not be used to offer or sell our securities unless accompanied

by a prospectus supplement relating to the offered securities.

The

registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information

about us and the securities offered pursuant to this prospectus. For a more complete understanding of the offering of the securities,

you should refer to the registration statement, including its exhibits. The registration statement can be read on the SEC’s website

referenced within the section entitled “Where You Can Find More Information.”

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING INFORMATION

This

prospectus, any accompanying prospectus supplement, and the documents incorporated by reference herein and therein, include forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). These forward-looking statements are intended to qualify for the safe harbor from liability established

by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this prospectus,

any accompanying prospectus supplement, or the documents incorporated by reference herein or therein, are forward-looking statements,

and we have attempted to identify such forward-looking statements by terminology including “aims,” “anticipates,”

“believes,” “can,” “continue,” “could,” “estimates,” “expects,”

“goal,” “intends,” “may,” “plans,” “potential,” “predicts,” “seeks,”

“should,” “suggests,” “targets” or “will” or the negative of these terms or other comparable

terminology.

Forward-looking

statements are not guarantees of future performance. Our forward-looking statements are based on our management’s current assumptions

and expectations of future events and trends, which affect or may affect our business, strategy, operations or financial performance.

Although we believe these forward-looking statements are based upon reasonable assumptions, they are subject to numerous known and unknown

risks and uncertainties and are made in light of information currently available to us. Many factors, in addition to the factors described

in this prospectus, may materially and adversely affect our results as indicated in or implied by our forward-looking statements. Because

of these uncertainties, you should not place undue reliance on these forward-looking statements when making an investment decision. You

should read this prospectus, any accompanying prospectus supplement, and the documents we incorporate by reference herein and therein,

in their entirety and with the understanding that our actual future results may be materially different from and worse than what we expect.

Moreover,

we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management

to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any

factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Forward-looking

statements speak only as of the date they were made and, except to the extent required by law or the rules of the Nasdaq Stock Market,

we undertake no obligation to update or review any forward-looking statement because of new information, future events or other factors.

You should, however, review the risks and uncertainties we describe in the reports we will file from time to time with the SEC after

the date of this prospectus. For additional information, refer to the section entitled “Where You Can Find More Information.”