Form SCHEDULE 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

January 02 2025 - 8:45AM

Edgar (US Regulatory)

Exhibit 99.1

Fund

1 Investments LLC

100 Carr 115 Unit 1900

Rincon, Puerto Rico 00677

December 30, 2024

Vera Bradley, Inc.

12420 Stonebridge Road

Roanoke, Indiana 46783

Attention: Robert Hall

cc: Board of Directors

Bob,

Fund 1 Investments LLC (together with its affiliates,

“Fund 1”, or “we”) beneficially owns approximately 10.0% of the outstanding shares of common stock of Vera Bradley,

Inc. ("Vera Bradley" or the "Company"), and has economic exposure of 20.0% of the outstanding shares, making us the

Company's largest shareholder.

As we described to you over the phone, Fund 1

is a global long/short equity firm that makes both public and private investments primarily focused on the consumer, telecom, media, and

technology sectors. We possess significant retail expertise and have a long history of constructively engaging with management teams and

boards to offer value-enhancing ideas, introductions to relevant executives, and capital for strategic initiatives to our portfolio companies.

We encourage you to speak with executives from other companies that we have invested in to understand the valuable insight we endeavor

to bring and how we strive to approach each situation with humility and level-headedness.

We thank you and appreciate the time you spent

with us the other week as we have the utmost respect for you and the beloved brand your family has built over the past 40 years. As we

have conducted substantial research on the Company over the past few years, we can’t help but admire Barb’s vision and tenacity

- to build a business from scratch that, at its peak, generated ~$550 million of annual revenue is inspiring and representative of the

American Dream. Barb’s designs were iconic globally and the Vera Bradley name has been synonymous with innovation and disruption

for decades. The Company and its products have a truly remarkable legacy.

We, as your largest shareholder, simply want Vera

Bradley to return to its winning ways. In its first year of being public, Vera Bradley generated $366 million of revenue and nearly $50

million of free cash flow, translating into a $1.5 billion enterprise value company. Today, analysts expect $380 million of revenue –

essentially the same topline as when the Company IPO’d. Except, that same $360+ million of revenue is expected to burn cash and

that $1.5 billion enterprise value implies negative value today, adjusted for the acquisition of Pura Vida1.

1 Current Enterprise Value of $84 million less $85 million in cash paid for Pura Vida over two transactions.

The Company is now experiencing a perfect storm

– i) a history of value destruction and questionable capital allocation, ii) poor recent operational performance, iii) a failed

brand turnaround, iv) extremely negative macro sentiment for fashion brands, and v) a less than $60 million of public float. As you well

know, thriving as a microcap company in today’s public markets is near impossible. It is clear to us that the best option for

Vera Bradley and its shareholders is to commence a strategic alternatives process and pursue opportunities to fix the Company under the

umbrella of a larger organization or in the private markets. We were pleased to hear the Board of Directors believes everything is on

the table to maximize shareholder value and we are highly supportive of this.

We believe Vera Bradley can be a much more

valuable company and has a timely opportunity to return to its winning ways. If the Company were out of the public spotlight, there

are many advantages for Vera Bradley: i) ability to focus on the brand revival without quarterly earnings, ii) cost savings opportunities

unavailable in the public markets, and iii) more time for management to focus on the business as opposed to frequent meetings with shareholders.

We believe that a strategic or financial buyer

would be able to complete a transaction at an attractive premium for shareholders. If a financial buyer provides the best opportunity,

the Company should consider transaction structures that would enable existing stakeholders to participate in a transaction and maintain

or increase their interests in the Company, which we would be willing to do.

As we discussed the other week, we wish to continue

to have a constructive engagement with you and are available to discuss the contents of this letter at your convenience.

We look forward to supporting a successful outcome

for the shareholders, employees and customers of Vera Bradley.

Best Regards,

Fund 1 Investments LLC

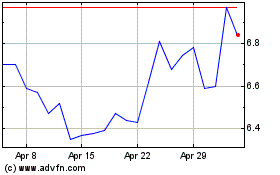

Vera Bradley (NASDAQ:VRA)

Historical Stock Chart

From Dec 2024 to Jan 2025

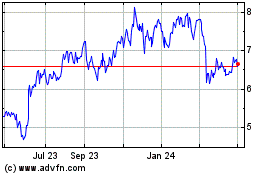

Vera Bradley (NASDAQ:VRA)

Historical Stock Chart

From Jan 2024 to Jan 2025