VEON publishes

preliminary 4Q22 and FY22

results

Sale of Russia will lead to a significant

reduction in debt

Amsterdam, 16 March 2022: A

correction has been issued for the release disseminated today at

07:00 CET. The figure for EBITDA in FY

2022 highlights was inaccurately cited. The

correct amount is USD 1,743 million. The complete and

corrected release follows:

Amsterdam, 16 March 2022 07:00

CET: VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a

global digital operator that provides converged connectivity and

online services, announces selected financial and operating results

for the fourth quarter and full year ended 31 December 2022,

excluding the results of the Russian operations, as they were

classified as ‘held for sale’ and ‘discontinued operations’ in

4Q22:

In Q4 2022, VEON’s local currency performance

accelerated sharply with total revenues of USD 940 million, -4.9%

YoY in reported currency (+18.6% YoY in local currency), service

revenues were USD 901 million, -4.4% YoY in reported currency

(+19.2% in local currency), and EBITDA was USD 453 million, +1.2%

YoY in reported currency (+30.1% YoY in local currency).

For FY 2022, VEON’s total revenues amounted to

USD 3,755 million, -2.4% YoY in reported currency (+14.0% YoY local

currency), service revenues were USD 3,600 million, -2.4% YoY in

reported currency (+13.9% YoY in local currency), and EBITDA was

USD 1,743 million, -5.3% YoY in reported currency (+12.6% YoY local

currency). Full-year capex of USD 832 million was 2.9% higher than

in 2021, with capex intensity up 1.1 p.p. as the company invested

in 4G network expansion. Total cash and cash equivalents were USD

3.1 billion, with USD 2.5 billion held at the HQ level.

Commenting on the results, Kaan Terzioğlu said:

“In the final quarter of 2022, we added further operational

momentum and recorded double-digit local currency revenue growth in

five of our countries, doubling the growth rate from a year ago.

With our Russian operations now classified as ‘held for sale’ and

‘discontinued operations’ and not contributing to Group revenues,

VEON’s topline growth in local currency for the full year 2022 was

14.0%. Furthermore, the sale of Russia will result in the

significant deleveraging of the Group balance sheet. While we are

smaller in size, we are now a faster growing company, serving

emerging markets with strong potential demand for the services that

VEON’s Digital Operator 1440 model offers.

In 2022, each of our operations achieved

significant growth, both in terms of financial performance and the

operational metrics that underpin our business. Our local operating

companies collectively added 14 million 4G customers, bringing

4G-powered digital ‘multiplay’ users to 22% of our subscriber base

while growing ARPU and customer engagement by providing more

relevant connected services for our core telecom users. This strong

operational performance has continued and YTD February 2023 local

currency revenues are up by 15.2% YoY and local currency EBITDA up

by 11.8% YoY. With continued focus on operational performance as

well as financial discipline and liquidity management, including

our strong liquidity position at year-end, we are well positioned

to deliver growth while significantly deleveraging VEON’s balance

sheet and enhancing VEON’s credit profile in 2023.”

Q4 2022 highlights

- Revenue of USD 940 million, -4.9% YoY (+18.6% YoY in local

currency)

- Service revenue of USD 901 million, -4.4% YoY (+19.2% YoY in

local currency)

- Data and digital revenues of USD 474 million, -7.5% YoY (+15.8%

YoY in local currency)

- EBITDA of USD 453 million, +1.2% YoY (+30.1% YoY in local

currency)

- Capex of USD 263 million, -5.1% YoY, with capex intensity of

22.1%

- Total cash and cash equivalents of USD 3.1 billion, +37.9% YoY,

with USD 2.5 billion at Headquarters

- 157 million mobile subscribers, up 2.7% YoY

- 85 million 4G users, up 19.4% YoY, with 53.9% penetration of

customer base

FY 2022 highlights

- Revenue of USD 3,755 million, -2.4% YoY (+14.0% YoY in local

currency)

- Service revenue of USD 3,600 million, -2.4% YoY (+13.9% YoY in

local currency)

- Data and digital revenues of USD 1,937 million, -0.7% YoY

(+16.5% YoY in local currency)

- EBITDA of USD 1,743 million, -5.3% YoY (+12.6% YoY in

local currency)

- Capex of USD 832 million, +2.9% YoY, with capex intensity of

22.1%

- Total cash and cash equivalents of USD 3.1 billion, +37.9% YoY,

with USD 2.5 billion at Headquarters

- 157 million mobile subscribers, up 2.7% YoY

- 85 million 4G users, up 19.4% YoY, with 53.9% penetration of

customer base

In 4Q22, VEON accelerated local currency

revenue & EBITDA growth and continued to gain market share in

each of its markets. The Group maintained strong liquidity, with

Group cash and cash equivalents of USD 3.1 billion as of 31

December 2022.

Total Group revenues decreased

by 4.9% YoY during 4Q22 in reported currency and increased by 18.6%

in local currency terms, with Ukraine revenues growing 8.7% YoY in

local currency and all other countries reporting double-digit local

currency revenue growth for the period. Service

revenues decreased by 4.4% YoY in reported currency and

rose by 19.2% YoY in local currency.

In 4Q22, Group EBITDA increased

by 1.2% YoY in reported currency terms (+30.1% in local currency),

with Group EBITDA margin of 48.2% (+2.9 p.p. YoY).

Energy costs increased across the Group +c.30% YoY negatively

impacting Group EBITDA margin. We remain focused on implementing

planned cost-efficiency measures across the Group and on applying

inflationary pricing across our operations. Project Optimum

delivered c.USD 95 million of savings in 2022 with cost intensity

improving by 2.5 p.p. YoY in local currency.

The Group’s YoY revenues and EBITDA performance

was impacted by several extraordinary non-recurring items in 4Q22

and in 4Q21, as noted in the Country Performance section. Excluding

these one-off items, Group total revenue increased by 15.4% YoY,

service revenue increased by 15.8% YoY and EBITDA increased by 7.4%

YoY in local currency.

In 4Q22, we reported subscriber

base growth of 2.7% YoY. The Group continued to focus on

overall customer experience, seeing improving Net Promoter Score

(“NPS”) across most of the countries. This supported a 19.4% YoY

increase in 4G users, which reached 84.6 million,

with 13.8 million users added during the year. As of 31 December

2022, 4G subscribers accounted for 53.9% of our total subscriber

base, up 7.5 p.p. from a year earlier supporting the execution

of VEON’s Digital Operator strategy.

Each of our operations have increased their ARPU

levels YoY as they delivered a broader range of services to their

customers, achieving greater wallet shares while also implementing

inflationary pricing.

Our operating companies continued to execute

VEON’s Digital Operator strategy (“DO1440”),

aiming to deliver digital experiences for every minute of the day

powered by high-quality mobile internet connectivity. On the back

of our growing 4G penetration and with increasing usage of our

digital services, we have expanded our multiplay customer

base by 40.3% YoY, with 28.4 million multiplay customers

at the end of December. While representing just 22% of the user

base, multiplay customers were the source of 38.6% of VEON’s B2C

revenues. Multiplay customer ARPU is 3.6 times

higher, and churn is 0.4 times lower than for

single play voice-only customers.

Media streaming services Toffee in Bangladesh

and Tamasha in Pakistan were among key drivers of growth in

multiplay, as well as our overall digital offering.

Toffee in Bangladesh reached 21.2 million

monthly active users (“MAUs”) in December 2022, a

3.3-fold YoY increase, with 5.2 million average daily

users (5.0 times higher YoY). Tamasha in

Pakistan reached 4.3 million MAUs, a 3.5-fold YoY increase.

Our digital financial services business in

Pakistan, JazzCash, increased its monthly

active users by 8.0% YoY, reaching 16.4 million MAUs and

increasing its 12-month total transaction volume

by 31.3% YoY.

In 4Q22, Group

capex was USD 263 million, driven by investment in

4G networks in Ukraine, Bangladesh and Uzbekistan, in line with our

growth strategy. At 22.1%, capex intensity

increased marginally by 1.1 p.p. YoY, primarily due to adverse FX

rate movements. We closed the fourth quarter with total

cash of USD 3.1 billion, including USD 2.5 billion at the

HQ level. Our operations remain largely self-funding.

In Ukraine, the team continued to work

to keep the country connected, with around 90% of our

radio network operational at the end of the quarter. However, over

the course of the quarter, damage to Ukrainian power infrastructure

impacted network availability at times. Kyivstar’s

revenues were up 8.7% YoY in local currency

(-20.7% YoY in reported currency); the Ukrainian hryvnia’s forex

performance negatively impacted reported currency growth rates.

Kyivstar’s 4G customer base grew 8.2% YoY, and our customers

consumed more data, with data usage rising 26.3% YoY.

EBITDA decreased by 7.3% YoY in local currency

(-32.4% YoY in reported currency) in 4Q22. EBITDA performance was

impacted by the change in revenue mix impacting margins,

operational cost pressures including energy costs, indexation of

frequency fees, as well as by charitable donations and the staff

care program, as Kyivstar continues to support its employees and

the community.

Pakistan revenues rose 24.3%

YoY in local currency (-2.6% YoY in reported currency), driven by

strong growth in data revenue, despite the negative impact of the

increase in withholding tax from 10% to 15% on 16 January 2022, and

the further reduction in mobile termination rates from PKR 0.70

last year to PKR 0.40 from 01 July 2022. The weakness in the

Pakistani rupee negatively impacted financial performance in

reported currency. Jazz grew its subscriber base (+1.5% YoY), 4G

users (+17.9% YoY) and ARPU (+22.0% YoY) in 4Q22.

EBITDA in Pakistan rose by 86.9% YoY in local

currency (+46.9% YoY in reported currency). Revenue and EBITDA

performance in 4Q22 was positively impacted by the reversal of a

provision following a favorable decision from the Islamabad High

Court on pending litigation, increasing recorded revenues by PKR

6.6 billion (c.USD 30 million) and EBITDA by PKR 20.2 billion

(c.USD 91 million). Higher energy prices in Pakistan negatively

impacted EBITDA margin by c.4 p.p.

In Kazakhstan, revenues

increased 20.0% YoY in local currency (+10.2% YoY in reported

currency), another quarter of strong growth supported by further

expansion of our mobile customer base (+6.8% YoY), higher data

usage (+19.2% YoY) and inflationary pricing of tariffs. This was

the seventh consecutive quarter of local-currency revenue YoY

growth above 20%, while Beeline Kazakhstan reached 68.3% 4G

penetration in the customer base (+4.7 p.p. YoY).

EBITDA rose by 7.0% YoY in local currency terms

(-1.6% YoY in reported currency).

In Bangladesh, Banglalink’s

revenues increased 16.9% YoY in local currency

(-2.5% YoY in reported currency). This was the third quarter of

double-digit local currency revenue growth. Banglalink’s execution

of its Digital Operator strategy, 4G focus and nation-wide

expansion continue to deliver results, with the rising number of

data and, in particular, 4G users, driving growth in data

consumption. Banglalink reported balanced expansion of its

subscriber base (+7.1% YoY) and ARPU (+5.0% YoY)

in 4Q22. EBITDA decreased 9.7% YoY in local

currency (-24.7% YoY in reported currency) impacted by the higher

network related costs and minimum tax on gross revenue paid in

4Q22.

In Uzbekistan, revenues

increased 30.3% YoY in local currency (+25.3% YoY in reported

currency), a sixth consecutive quarter of double-digit revenue

growth and a fourth consecutive quarter of revenue growth above

20%. This was driven by a 28.4% YoY expansion in the 4G subscriber

base and a solid increase in data revenues, which were 38.9% higher

YoY. EBITDA rose 14.4% YoY in local currency

(+10.0% YoY in reported currency).

As VEON Group strengthens its position

for accelerating growth, our 2023 local currency guidance

for both revenue and EBITDA is

growth of 10%-14%. VEON’s 2023 outlook for the Group’s

capex intensity is in the range of 18%-20% (See

Disclaimer on pages 25-26 below for a discussion of factors that

could cause actual results to differ from expectations).

Key recent developments

- Veon appoints Joop Brakenhoff as Group Chief Financial

Officer. On 15 March 2023, VEON announced the appointment

of Joop Brakenhoff as Group Chief Financial Officer (CFO),

effective from 1 May 2023. Joop will replace Serkan Okandan whose

three-year contract as Group CFO is set to expire at the end of

April 2023. Serkan will continue to serve VEON as a special advisor

to the Group CEO and CFO.

- VEON to accelerate Digital Operator

roll-out with appointment of Group DO1440 Officer. On 9

March 2023, VEON announced the appointment of a dedicated Group

DO1440 Officer, Lasha Tabidze, to support its operating companies

in executing its digital operator model. Lasha Tabidze has a strong

track record in delivering digital products and digital

transformation. His previous roles include CEO of Beeline Georgia,

which was sold by VEON in 2022. In his Group DO1440 Officer role,

Mr. Tabidze will report to VEON Group CEO Kaan Terzioglu.

- VEON’s Digital Operator 1440

recognized as “The Best Service for Connected Consumers” at GLOMO

Awards. On 1 March 2023, VEON announced that it had

received GSMA’s Global Mobile Award for “Best Mobile Operator

Service for Connected Consumers” with its Digital Operator 1440

model – DO1440. VEON Group CEO Kaan Terzioglu received the award on

behalf of the Group’s digital operators, who have implemented the

DO1440 model in their markets over the past 2 years, aiming to

deliver valuable digital experiences for their customers 1440

minutes of a day.

- VEON enters into agreement to sell its

Russian operations and obtains Russian regulatory

approval1. On 24 November 2022, VEON announced that

following a competitive process, it has entered into an agreement

to sell its Russian operations to certain senior members of the

management team of PJSC VimpelCom, led by Beeline Russia’s current

CEO Aleksander Torbakhov. The transaction is subject to customary

closing conditions, including receipt of requisite regulatory

approvals and licenses from relevant government authorities. The

target completion date for the transaction is on or before 1 June

2023, with options on both sides for extensions in case any

required regulatory license has not yet been received. As part of

the transaction, ownership of VEON’s Kazakhstan operations has been

transferred from PJSC VimpelCom to VEON headquarters on 7 December

2022. This ensures that VEON will continue to control its

Kazakhstan operations, with VEON Holdings B.V. taking direct

ownership of the Group’s 75% stake in Kar-Tel, which operates under

the Beeline brand in the country.

- On 7 February 2023, the Sub-Commission of the Government

Commission for Control over Foreign Investments in the Russian

Federation issued its approval of the proposed sale of VEON’s

Russian operations to certain senior members of the management of

PJSC VimpelCom, led by its current CEO Alexander Torbakhov, subject

to certain conditions. It is anticipated that the remaining closing

conditions will be satisfied and that, as previously communicated,

the transaction will complete on or before 1 June 2023.

- Scheme of arrangement to extend 2023 notes

maturities. On 30 January 2023, VEON announced that the

Scheme Sanction Hearing had taken place, at which the Court made an

order sanctioning the Scheme in respect of the Company’s 2023 Notes

(the “Order”). On 31 January 2023, VEON confirmed that the Order

had been delivered to the Registrar of Companies and become

effective. The amendments to the 2023 Notes will become effective

upon receipt of relevant licenses, at which time the maturity dates

of the February 2023 and April 2023 notes will be amended to

October and December 2023, respectively. Pursuant to the

amendments, the respective maturity dates of the February 2023

Notes and April 2023 Notes will be extended to October 2023 and

December 2023 respectively, noteholders will be entitled to payment

of an amendment fee of 200bps payable on the 2023 Notes outstanding

on their respective amended maturity dates and a put right will be

opened requiring the Company to repurchase 2023 Notes held by 2023

Noteholders exercising the Put Right, exercisable at a purchase

price of 102 per cent of the principal amount, together with

accrued and unpaid interest. The Put Right should only be open to

international investors.

- VEON management increased

ownership. On 21 February 2023, VEON announced the

completion of a further share transfer to Group Executive Committee

(“GEC”) member, Group Chief Internal Audit & Compliance

Officer, Joop Brakenhoff. A total of 104,047 shares vested as part

of VEON’s Deferred Share Plan. Of those, 52,543 shares were

transferred to Mr. Brakenhoff, with the remaining 51,504 withheld

to cover local withholding tax. This award followed the completion

of share transfers to the Group CEO and Group CFO announced on 11

July 2022 and the completion of share transfers to GEC members

announced on 18 July 2022 as part of the Group’s incentive program

announced in February 2022.

- VEON announced ratio change under its

American Depositary Receipt (“ADR”) program. On 6 February

2023, VEON announced that its Board of Directors approved a change

of ratio in the Company’s ADR program, comprising a change in the

ratio of American Depositary Shares (the “ADSs”) to VEON common

shares (the “Shares”) from one (1) ADS representing one (1) Share,

to one (1) ADS representing twenty-five (25) Shares (the “Ratio

Change”). On 6 March 2023, VEON announced postponement to

effectiveness of ratio change under its ADR program as The

Depository Trust & Clearing Corporation (“DTCC”) was not

prepared to make the new CUSIP with new ratio available on Monday,

6 March 2023 as scheduled. On 7 March 2023, VEON confirmed revised

timing for effectiveness of ratio change under its ADR program. The

effective date of the Ratio Change was 8 March 2023.

- US Treasury expanded General License to include both

VEON Ltd. and VEON Holdings. On 18 January 2023, VEON

announced that the U.S. Department of the Treasury, Office of

Foreign Assets Control (OFAC) has replaced the General License 54

originally issued on 18 November 2022 with General License 54A to

now include both VEON Ltd. and VEON Holdings B.V. (VEON Holdings).

This general license applies to all debt and equity securities of

VEON Ltd. or VEON Holdings that were issued before 6 June 2022, and

confirms that the authorization applies not only to the purchase

and receipt of debt and equity securities, but also to transactions

ordinarily incident and necessary to facilitating, clearing and

settling of such transactions. This General License ensures that

all market participants can trade the relevant securities with

confidence that such trading is consistent with E.O. 14071, which

targeted “new investment” in Russia.

- VEON appoints PWC as the Dutch statutory financial

statement auditors. On 11 January 2023, VEON announced the

appointment of PricewaterhouseCoopers Accountants N.V. as the Dutch

statutory financial statement auditors for the year ended 31

December 2022. As noted in the “Notice to Readers: Impact of The

Conflict”, the Company notes that due to the military conflict in

Ukraine and its consequences, it is unlikely that the 2022 Dutch

financial statements can be filed within the statutory deadline of

30 April 2023.

1 The sale of VEON’s Russian operations is subject to customary

closing conditions, including receipt of requisite regulatory

approvals and licenses from relevant government authorities. There

can be no assurance that the requisite approvals will be received

or that such sale will complete.

Additional information

View the full 4Q22 and FY22 earnings release

View 4Q22 and FY22 results presentation

View 4Q22 and FY22 factbook

About VEON

VEON is a global digital operator that currently

provides converged connectivity and online services to over 200

million customers in seven dynamic markets. We are transforming

people’s lives, empowering individuals, creating opportunities for

greater digital inclusion and driving economic growth across

countries that are home to more than 8% of the world’s population.

Headquartered in Amsterdam, VEON is listed on NASDAQ and Euronext.

For more information visit: https://www.veon.com.

Notice to reader: impact of conflict

VEON's results and other financial information

presented in these financial statements are, unless otherwise

stated, prepared in accordance with International Financial

Reporting Standards ("IFRS") based on internal management

reporting, are the responsibility of management, and have not been

externally audited, reviewed, or verified. As such, you should not

place undue reliance on this information. This information may not

be indicative of the actual results for any future period.

The ongoing conflict between Russia and Ukraine

and the sanctions imposed by the United States, member states of

the European Union, the European Union itself, the United Kingdom,

Ukraine and certain other nations, counter-sanctions by Russia and

other legal and regulatory responses, as well as responses by our

service providers, partners, suppliers and other counterparties,

and the consequences of all of the foregoing have impacted and, if

the conflict, sanctions and such responses continue or escalate,

may significantly impact our results and aspects of our operations

in Russia and Ukraine, and may significantly affect our results and

aspects of our operations in the other countries in which we

operate. We are closely monitoring events in Russia and Ukraine, as

well as the possibility of the imposition of further sanctions in

connection with the ongoing conflict between Russia and Ukraine and

any resulting further rise in tensions between Russia and the

United States, the United Kingdom and/or the European Union.

Although our Russian operations are now classified as ‘held for

sale’ and ‘discontinued operations’ and do not contribute to our

comparison base or actual reported numbers in this release (except

as specifically stated), our operations in Ukraine continue to be

affected by the conflict. We hope that there will be a peaceful and

amicable resolution and are doing everything we can to protect the

safety of our employees, while continuing to ensure the

uninterrupted operation of our communications, financial and

digital services.

The comprehensive sanctions on investment and

vendors in Russia and the ongoing conflict between Russia and

Ukraine have had and may continue to have a significant impact on

the Company’s operations and business plans in Russia and Ukraine.

During the twelve months-ended 31 December 2022, we have recorded

significant impairment charges related to the Russian and Ukrainian

operations. We may need to record future impairment charges, which

could be significant if the conflict continues or escalates and as

more information becomes available to management. It is possible

further impairment charges may rise to such a level on an

accounting basis as to require additional analysis of true asset

values in order to determine the true value of assets to be

compared to liabilities as outlined in the provisions of our debt

agreements.

Due to the ongoing conflict between Russia and

Ukraine and the consequences as mentioned above, the Company

requires additional time to complete all necessary disclosures in

its Annual Report on Form 20-F to be filed with the U.S. Securities

and Exchange Commission (“U.S. SEC”) as well as its Dutch financial

statements to be filed with the Autoriteit Financiële Markten

(“AFM”), including completing its preparation of VEON’s

consolidated financial statements and subsequently receiving the

related audit report on the financial statements and internal

control over financial reporting from its independent registered

public accounting firm. As a result, VEON anticipates it will not

be able to file its Dutch financial statements with the AFM by

April 30, 2023, nor its Annual Report on Form 20-F by May 1, 2023,

the respective deadlines for filing. If VEON is not able to

complete these filings by the prescribed deadlines (or the May 16,

2023 date for extension of the Form 20-F filing deadline provided

by U.S. Securities Exchange Act Rule 12b-25), it cannot be ruled

out that the AFM, Euronext, U.S. SEC or Nasdaq might, following the

missed deadline, take action against VEON, which could include

imposition of a fine or grant of a further grace period, or in the

most extreme cases, deregistration of VEON’s securities and/or

delisting of such securities from Nasdaq and/or Euronext.

Disclaimer

VEON’s results presented in this earnings

release are, unless otherwise stated, based on IFRS and have not

been externally reviewed and audited. The financial information

included in this earnings release is preliminary and is based on a

number of assumptions that are subject to inherent uncertainties

and subject to change. The financial information presented herein

is based on internal management accounts, is the responsibility of

management and is subject to financial closing procedures which

have not yet been completed and has not been audited, reviewed or

verified. Certain amounts and percentages that appear in this

earnings release have been subject to rounding adjustments. As a

result, certain numerical figures shown as totals, including those

in the tables, may not be an exact arithmetic aggregation of the

figures that precede or follow them. Although we believe the

information to be reasonable, actual results may vary from the

information contained above and such variations could be material.

As such, you should not place undue reliance on this information.

This information may not be indicative of the actual results for

the current period or any future period.

This earnings release contains “forward-looking

statements”, as the phrase is defined in Section 27A of the U.S.

Securities Act of 1933, as amended, and Section 21E of the U.S.

Securities Exchange Act of 1934, as amended. These forward-looking

statements may be identified by words such as “may,” “might,”

“will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “seek,” “believe,” “estimate,” “predict,” “potential,”

“continue,” “contemplate,” “possible” and other similar words.

Forward-looking statements include statements relating to, among

other things, VEON’s plans to implement its strategic priorities,

including operating model and development plans; anticipated

performance, including VEON’s ability to generate sufficient cash

flow; VEON’s assessment of the impact of the COVID-19 pandemic on

its current and future operations and financial condition; VEON’s

assessment of the impact of the conflict surrounding Russia and

Ukraine, including related sanctions and counter-sanctions, on its

current and future operations and financial condition; future

market developments and trends; operational and network development

and network investment, including expectations regarding the

roll-out and benefits of 3G/4G/LTE networks, as applicable;

spectrum acquisitions and renewals; the effect of the acquisition

of additional spectrum on customer experience; VEON’s ability to

realize the acquisition and disposition of any of its businesses

and assets and to execute its strategic transactions in the

timeframes anticipated, or at all; VEON’s ability to realize

financial improvements, including an expected reduction of net

pro-forma leverage ratio following the successful completion of

certain dispositions and acquisitions; our dividends; completion of

VEON’s sale of its Russian operations; and VEON’s ability to

realize its targets and commercial initiatives in its various

countries of operation.

The forward-looking statements included in this

earnings release are based on management’s best assessment of

VEON’s strategic and financial position and of future market

conditions, trends and other potential developments. These

discussions involve risks and uncertainties. The actual outcome may

differ materially from these statements as a result of, among other

things: further escalation in the conflict surrounding Russia and

Ukraine, including further sanctions and counter-sanctions and any

related involuntary deconsolidation of our Russian and/or Ukrainian

operations; further unanticipated developments related to the

COVID-19 pandemic, such as the effect on consumer spending, that

has negatively affected VEON’s operations and financial condition

in the past; demand for and market acceptance of VEON’s products

and services; our plans regarding our dividend payments and

policies, as well as our ability to receive dividends,

distributions, loans, transfers or other payments or guarantees

from our subsidiaries; continued volatility in the economies in

VEON’s markets; governmental regulation of the telecommunications

industries; general political uncertainties in VEON’s markets;

government investigations or other regulatory actions; litigation

or disputes with third parties or regulatory authorities or other

negative developments regarding such parties; the impact of export

controls and laws affecting trade and investment on our and

important third-party suppliers' ability to procure goods, software

or technology necessary for the services we provide to our

customers; risks associated with data protection or cyber security,

other risks beyond the parties’ control or a failure to meet

expectations regarding various strategic priorities, the effect of

foreign currency fluctuations, increased competition in the markets

in which VEON operates and the effect of consumer taxes on the

purchasing activities of consumers of VEON’s services.

Certain other factors that could cause actual

results to differ materially from those discussed in any

forward-looking statements include the risk factors described in

VEON’s Annual Report on Form 20-F for the year ended 31 December

2021 filed with the U.S. Securities and Exchange Commission (the

“SEC”) on 29 April 2022 and other public filings made from time to

time by VEON with the SEC. Other unknown or unpredictable factors

also could harm our future results. New risk factors and

uncertainties emerge from time to time and it is not possible for

our management to predict all risk factors and uncertainties, nor

can we assess the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause

actual results to differ materially from those contained in any

forward-looking statements. Under no circumstances should the

inclusion of such forward-looking statements in this press release

be regarded as a representation or warranty by us or any other

person with respect to the achievement of results set out in such

statements or that the underlying assumptions used will in fact be

the case. Therefore, you are cautioned not to place undue reliance

on these forward-looking statements. The forward-looking statements

speak only as of the date hereof. We cannot assure you that any

projected results or events will be achieved. Except to the extent

required by law, we disclaim any obligation to update or revise any

of these forward-looking statements, whether as a result of new

information, future events or otherwise, after the date on which

the statements are made, or to reflect the occurrence of

unanticipated events.

The sale of VEON’s Russian operations is subject

to customary closing conditions, including receipt of requisite

regulatory approvals and licenses from relevant government

authorities. There can be no assurance that the requisite approvals

will be received or that such sale will complete.

Furthermore, elements of this release contain or

may contain, “inside information” as defined under the Market Abuse

Regulation (EU) No. 596/2014.

Contact Information

VEONInvestor RelationsNik Kershaw

ir@veon.com

- 4Q22 EARNINGS RELEASE FINAL

- 4Q22 RESULTS PRES FINAL

- Factbook4Q2022

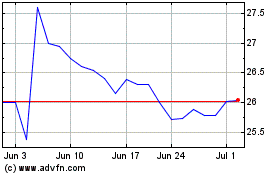

VEON (NASDAQ:VEON)

Historical Stock Chart

From Mar 2024 to Apr 2024

VEON (NASDAQ:VEON)

Historical Stock Chart

From Apr 2023 to Apr 2024