The Present and Future of Proptech Report: Capitalizing on Current Volatility

April 18 2023 - 8:00AM

Business Wire

Valley Bank released their second annual Present and Future of

Proptech Report that summarizes industry trends and the impact of

rising interest rates, remote work and economic uncertainty on the

property tech category. The report was developed in collaboration

with Pitchbook; Chase Gilbert, Co-Founder and CEO, Built

Technologies; Jeffrey E. Berman, General Partner of Camber Creek;

Chris Green, Founder and CEO of GreenPoint Partners, Kurt Ramirez,

General Partner, Nine Four Ventures and Bryan Kallenberg, Vice

President, Capital Markets.

The majority of Proptech investment in 2022 was in venture

capital with 213 deals closed for a combined value of $4 billion.

Transaction solutions and property management combined for a

plurality of deal volume.

“Despite rising interest rates and volatile economic factors,

Proptech remained a strong investment category in 2022,” said

Stuart Cook, Chief Innovation Officer, Valley Bank. “The shift

towards sustainably built new structures and retrofitting existing

assets is either in progress or being planned for extensively by

owners and investors. Investors are likely to remain active given

broader dynamics and longer-term horizons at play in regard to real

estate.”

Read the full report here.

Key highlights from the report:

- Investment dynamics in private markets for Proptech remained

more resilient than expected given the sheer volatility of 2022.

Popular segments held strong from property management to

transaction solutions. Especially in a cautious complicated

environment, investment in tech that is seen as readily accretive

to the bottom line will continue to attract capital.

- Private investment, primarily concentrated in venture given

Proptech’s maturation is ongoing – remains a key force in

propelling the digitization of many real estate workflows.

- Corporates joined in 45 completed venture transactions that

aggregated well over $1.8 billion, while nontraditional players

participated in 86 deals for nearly $3 billion in total deal value.

These figures compare favorably to the past, indicating that

although they may join in fewer deals during tumultuous times, they

will still participate in larger deals for more mature and

established businesses - much like they have in the past.

- Curbing emissions of greenhouse gases and improving

sustainability across all aspects of real estate is a priority with

players exploring and embracing innovation on all fronts. Builders

are deploying more sustainable concrete and recycling waste into

usefully adjacent products, such as gravel on construction sites

and fill; property managers are updating monitoring systems to

better improve energy consumption in residences and common areas;

brokers are investing in more secure and transparent portals with

improved visualizing and modeling systems; and remodelers are

utilizing recycled wood and novel designs.

Methodology behind the research

Estimates of market sizes and private investment activity within

the Proptech space differ widely due to a variety of factors, such

technology and types of real estate markets. This report views

Proptech through a much more rigorous lens, using the Pitchbook

platform to construct five distinct segments: asset utilization;

finance and investments; construction, maintenance and renovation;

property management; and transaction solutions. You can find more

information under the introduction page in the report.

About Valley Bank

As the principal subsidiary of Valley National Bancorp, Valley

National Bank is a regional bank with approximately $57 billion in

assets. Valley is committed to giving people and businesses the

power to succeed. Valley operates many convenient branch locations

across New Jersey, New York, Florida and Alabama, and is committed

to providing the most convenient service, the latest innovations

and an experienced and knowledgeable team dedicated to meeting

customer needs. Helping communities grow and prosper is the heart

of Valley’s corporate citizenship philosophy. To learn more about

Valley, go to www.valley.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230418005237/en/

Pam Golden pam@glapr.com 973-564-8591

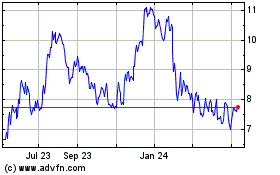

Valley National Bancorp (NASDAQ:VLY)

Historical Stock Chart

From Dec 2024 to Jan 2025

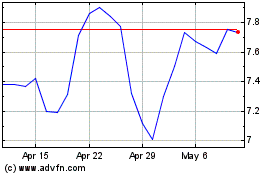

Valley National Bancorp (NASDAQ:VLY)

Historical Stock Chart

From Jan 2024 to Jan 2025