UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Form 10-K

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

For the fiscal year ended December 31, 2011

|

|

OR

|

|

£

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED)

|

|

|

|

|

|

For the transition period from to

|

Commission File No. 0-25969

RADIO

ONE, INC.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

52-1166660

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

5900 Princess Garden Parkway

7th Floor

Lanham, Maryland 20706

(Address of principal executive offices)

Registrant’s telephone number,

including area code

(301) 306-1111

Securities registered pursuant to Section 12(b)

of the Act:

None

Securities registered pursuant to Section 12(g)

of the Act:

Class A Common Stock, $.001 par

value

Class D Common Stock, $.001 par

value

Indicate by check mark if the registrant

is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

£

No

þ

Indicate by check mark if the registrant

is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes

£

No

þ

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days. Yes

þ

No

£

Indicate by check mark if disclosure of

delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the

best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III

of this Form 10-K or any amendment to this Form 10-K. Yes

£

No

þ

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and

large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer

£

Accelerated

filer

£

Non-accelerated

filer

þ

Indicate by check mark whether the registrant

is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes

£

No

R

The number of shares outstanding of each of

the issuer’s classes of common stock is as follows:

|

Class

|

|

Outstanding at March 23, 2012

|

|

Class A Common Stock, $.001 par value

|

|

2,731,860

|

|

Class B Common Stock, $.001 par value

|

|

2,861,843

|

|

Class C Common Stock, $.001 par value

|

|

3,121,048

|

|

Class D Common Stock, $.001 par value

|

|

41,409,667

|

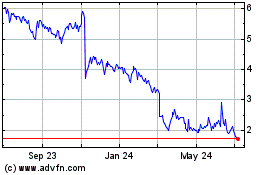

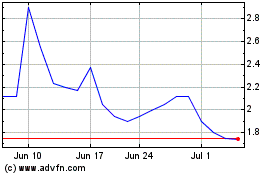

The aggregate market value of common stock

held by non-affiliates of the Registrant, based upon the closing price of the Registrant’s Class A and Class D

common stock on June 30, 2011, was approximately $52.6 million.

RADIO ONE, INC. AND SUBSIDIARIES

Form 10-K

For the Year Ended December 31,

2011

TABLE OF CONTENTS

|

|

|

|

Page

|

|

PART I

|

|

|

|

|

|

|

Item 1.

|

Business

|

|

5

|

|

Item 1A.

|

Risk Factors

|

|

26

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

43

|

|

Item 2.

|

Properties

|

|

43

|

|

Item 3.

|

Legal Proceedings

|

|

43

|

|

Item 4.

|

Removed and Reserved

|

|

44

|

|

|

|

|

|

PART II

|

|

|

|

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

45

|

|

Item 6.

|

Selected Financial Data

|

|

49

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

51

|

|

Item 7A.

|

Quantitative and Qualitative Disclosure About Market Risk

|

|

96

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

97

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

97

|

|

Item 9A.

|

Controls and Procedures

|

|

97

|

|

Item 9B.

|

Other Information

|

|

98

|

|

|

|

|

|

PART III

|

|

|

|

|

|

Item 10.

|

Directors and Executive Officers of the Registrant

|

|

99

|

|

Item 11.

|

Executive Compensation

|

|

99

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

99

|

|

Item 13.

|

Certain Relationships and Related Transactions

|

|

99

|

|

Item 14.

|

Principal Accounting Fees and Services

|

|

99

|

|

|

|

|

|

PART IV

|

|

|

|

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

|

100

|

|

|

|

|

|

SIGNATURES

|

|

107

|

CERTAIN DEFINITIONS

Unless otherwise noted,

throughout this report, the terms “Radio One,” “the Company,” “we,” “our” and “us”

refer to Radio One, Inc. together with its subsidiaries.

We use the term “local

marketing agreement” (“LMA”) in various places in this report. An LMA is an agreement under which a Federal Communications

Commission (“FCC”) licensee of a radio station makes available, for a fee, air time on its station to another party. The

other party provides programming to be broadcast during the airtime and collects revenues from advertising it sells for broadcast

during that programming. In addition to entering into LMAs, we will from time to time enter into management or consulting agreements

that provide us with the ability, as contractually specified, to assist current owners in the management of radio station assets

that we have contracted to purchase, subject to FCC approval. In such arrangements, we generally receive a contractually specified

management fee or consulting fee in exchange for the services provided.

The term “station

operating income” is also used throughout this report. “Station operating income” consists of net

loss or income before depreciation and amortization, corporate expenses, stock-based compensation, equity in income or loss of

affiliated company, income taxes, noncontrolling interests in income of subsidiaries, interest expense, impairment of long-lived

assets, other income or expense, gain or loss on retirement of debt, and income or loss from discontinued operations, net of tax.

Station operating income is not a measure of financial performance under U.S. generally accepted accounting principles (“GAAP”). Nevertheless

we believe station operating income is often a useful measure of a broadcasting company’s operating performance and is a

significant basis used by our management to measure the operating performance of our radio stations within the various markets

because station operating income provides helpful information about our results of operations apart from expenses associated with

our physical plant, income taxes, investments, debt financings, gain or loss on retirement of debt, corporate overhead, stock-based

compensation, impairment of long-lived assets and income or losses from asset sales. Station operating income is frequently

used as one of the bases for comparing businesses in our industry, although our measure of station operating income may not be

comparable to similarly titled measures of other companies. Station operating income does not purport to represent operating income

or cash flow from operating activities, as those terms are defined under generally accepted accounting principles, and should not

be considered as an alternative to those measurements as an indicator of our performance. Station operating income includes results

from all four of our reportable segments (Radio Broadcasting, Reach Media, Internet and Cable Television).

The term “station

operating income margin” is also used throughout this report. “Station operating income margin” consists

of station operating income as a percentage of net revenue. Station operating income margin is not a measure of financial performance

under GAAP. Nevertheless, we believe that station operating income margin is a useful measure of our performance because it provides

helpful information about our profitability as a percentage of our net revenue. Station operating income margin also includes results

from all four of our reportable segments (Radio Broadcasting, Reach Media, Internet and Cable Television).

Unless otherwise indicated:

|

|

•

|

we obtained total radio industry revenue levels from

the Radio Advertising Bureau (the “RAB”);

|

|

|

•

|

we obtained audience share and ranking information from

Arbitron Inc. (“Arbitron”); and

|

|

|

•

|

we derived historical market statistics and market revenue

share percentages from data published by Miller, Kaplan, Arase & Co., LLP (“Miller Kaplan”), a public accounting

firm that specializes in serving the broadcasting industry and BIA Financial Network, Inc. (“BIA”), a media and telecommunications

advisory services firm.

|

Cautionary Note Regarding Forward-Looking

Statements

This document,

and the documents incorporated by reference into this Annual Report on Form 10-K,

contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. These forward-looking statements do not relay historical facts, but rather reflect our current expectations

concerning future operations, results and events. All statements other than statements of historical fact are “forward-looking

statements” including any projections of earnings, revenues or other financial items; any statements of the plans, strategies

and objectives of management for future operations; any statements concerning proposed new services or developments; any statements

regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any

of the foregoing. You can identify some of these forward-looking statements by our use of words such as “anticipates,”

“expects,” “intends,” “plans,” “believes,” “seeks,” “likely,”

“may,” “estimates” and similar expressions. You can also identify a forward-looking statement

in that such statements discuss matters in a way that anticipates operations, results or events that have not already occurred

but rather will or may occur in future periods. We cannot guarantee that we will achieve any forward-looking plans,

intentions, results, operations or expectations. Because these statements apply to future events, they are subject to

risks and uncertainties, some of which are beyond our control that could cause actual results to differ materially from those forecasted

or anticipated in the forward-looking statements. These risks, uncertainties and factors include (in no particular order),

but are not limited to:

|

|

•

|

the effects of continued global economic weakness, credit and equity market volatility, high unemployment

and continued fluctuations in the U.S. and other world economies may have on our business and financial condition and the

business and financial conditions of our advertisers;

|

|

|

•

|

our high degree of leverage and potential inability to refinance certain portions of our debt or finance

other strategic transactions given fluctuations in market conditions;

|

|

|

•

|

continued fluctuations in the U.S. economy and the local economies of the markets in which we operate

could negatively impact our ability to meet our cash needs and our ability to maintain compliance with our debt covenants;

|

|

|

•

|

fluctuations in the demand for advertising across our various media given the current economic environment;

|

|

|

•

|

risks associated with the implementation and execution of our business diversification strategy;

|

|

|

•

|

increased competition in our markets and in the radio broadcasting and media industries;

|

|

|

•

|

changes in media audience ratings and measurement technologies and methodologies;

|

|

|

•

|

regulation by the Federal Communications Commission (“FCC”) relative to maintaining our

broadcasting licenses, enacting media ownership rules and enforcing of indecency rules;

|

|

|

•

|

changes in our key personnel and on-air talent;

|

|

|

•

|

increases in the costs of our programming, including on-air talent and content acquisitions costs;

|

|

|

•

|

financial losses that may be incurred due to impairment charges against our broadcasting licenses,

goodwill and other intangible assets, particularly in light of the current economic environment;

|

|

|

•

|

increased competition from new media and technologies;

|

|

|

•

|

the impact of our acquisitions, dispositions and similar transactions; and

|

|

|

•

|

other factors mentioned in our filings with the Securities and Exchange Commission (“SEC”)

including the factors discussed in detail in Item 1A, “Risk Factors,” contained in this report.

|

You should not place

undue reliance on these forward-looking statements, which reflect our views as of the date of this report. We undertake no obligation

to publicly update or revise any forward-looking statements because of new information, future events or otherwise.

PART I

ITEM 1. BUSINESS

Overview

Radio

One, Inc., a Delaware corporation, and its subsidiaries (collectively, “Radio One” or the “Company”) is

an urban-oriented, multi-media company that primarily targets African-American and urban consumers. Our core business is our radio

broadcasting franchise that is the largest radio broadcasting operation that targets African-American and/or urban listeners. As

of December 31, 2011, we owned and/or operated 54 broadcast stations located in 16 urban markets in the United States. While

our primary source of revenue is the sale of local and national advertising for broadcast on our radio stations, our operating

strategy is to operate the premier multi-media entertainment and information content provider targeting African-American and urban

consumers. Thus, we have diversified our revenue streams by making acquisitions and investments in other complementary media properties.

Our other media interests include our approximately 51.0% controlling ownership interest in TV One, LLC (“TV One”),

an African-American targeted cable television network; our 53.5% ownership interest in Reach Media, Inc. (“Reach Media”),

which operates the Tom Joyner Morning Show; our ownership of Interactive One, LLC (“Interactive One”), an online platform

serving the African-American community through social content, news, information, and entertainment, which operates a number of

branded sites, including News One, UrbanDaily and HelloBeautiful; and our ownership of Community Connect, LLC (formerly Community

Connect Inc.) (“CCI”), an online social networking company, which operates a number of branded websites, including

BlackPlanet, MiGente and Asian Avenue. Through our national multi-media presence, we provide advertisers with a unique

and powerful delivery mechanism to the African-American and urban audience. Recently, given changes in ratings methodologies and

economic and demographic shifts, we have reprogrammed certain of our stations in underperforming segments of certain markets. However,

our core franchise remains targeted toward the African-American and/or urban listener and consumer.

In December 2009,

the Company ceased publication of our urban-themed lifestyle periodical Giant Magazine. Further, as of June 2011, our

remaining Boston radio station was made the subject of an LMA whereby we

have made available,

for a fee, air time on this station to another party

. The remaining assets and liabilities of Giant Magazine as well as

stations sold or stations that we do not operate that are the subject of an LMA have been classified as discontinued operations

as of December 31, 2011 and

December 31, 2010,

and Giant Magazine’s and the

Boston station’s results from operations for the years ended December 31, 2011, 2010 and 2009, have been reclassified as discontinued

operations in the accompanying consolidated financial statements.

As

part of our consolidated financial statements, consistent with our financial reporting structure and how the Company currently

manages its businesses, we have provided selected financial information on the Company’s four reportable segments: (i) Radio

Broadcasting; (ii) Reach Media; (iii) Internet; and (iv) Cable Television.

Our Stations and Markets

The table below provides

information about our radio stations and the markets in which we owned or operated as of December 31, 2011.

|

|

|

Radio One

|

|

|

Market Data

|

|

|

|

|

|

|

|

Entire

Audience

Four

Book

|

|

|

Ranking

by Size

|

|

|

|

|

|

|

|

|

|

|

Average

|

|

|

of

|

|

|

Estimated Fall 2011

|

|

|

|

|

|

|

|

(Ending

|

|

|

African-

|

|

|

Metro

|

|

|

|

|

|

|

|

Fall

|

|

|

American

|

|

|

Population Persons

|

|

|

|

|

Number of

|

|

|

2011)

|

|

|

Population

|

|

|

12+

|

|

|

|

|

Stations (a)

|

|

|

Audience

|

|

|

Persons

|

|

|

|

|

|

African-

|

|

|

Market

|

|

FM

|

|

|

AM

|

|

|

Share (b)

|

|

|

12+ (c)

|

|

|

Total

|

|

|

American%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(millions)

|

|

|

|

|

|

Atlanta

|

|

|

4

|

|

|

|

-

|

|

|

|

15.2

|

|

|

|

2

|

|

|

|

4.3

|

|

|

|

32.9

|

%

|

|

Washington, DC

|

|

|

3

|

|

|

|

2

|

|

|

|

12.0

|

|

|

|

4

|

|

|

|

4.5

|

|

|

|

26.6

|

%

|

|

Philadelphia

|

|

|

3

|

|

|

|

-

|

|

|

|

8.6

|

|

|

|

5

|

|

|

|

4.5

|

|

|

|

20.4

|

%

|

|

Houston (1)

|

|

|

3

|

|

|

|

-

|

|

|

|

14.7

|

|

|

|

6

|

|

|

|

5.0

|

|

|

|

17.2

|

%

|

|

Detroit

|

|

|

3

|

|

|

|

1

|

|

|

|

10.4

|

|

|

|

7

|

|

|

|

3.7

|

|

|

|

21.9

|

%

|

|

Dallas

|

|

|

2

|

|

|

|

-

|

|

|

|

5.0

|

|

|

|

8

|

|

|

|

5.3

|

|

|

|

15.3

|

%

|

|

Baltimore

|

|

|

2

|

|

|

|

2

|

|

|

|

15.5

|

|

|

|

11

|

|

|

|

2.3

|

|

|

|

28.6

|

%

|

|

Charlotte

|

|

|

2

|

|

|

|

-

|

|

|

|

6.5

|

|

|

|

13

|

|

|

|

2.0

|

|

|

|

21.5

|

%

|

|

St. Louis

|

|

|

2

|

|

|

|

-

|

|

|

|

8.3

|

|

|

|

14

|

|

|

|

2.3

|

|

|

|

18.6

|

%

|

|

Cleveland

|

|

|

2

|

|

|

|

2

|

|

|

|

12.2

|

|

|

|

18

|

|

|

|

1.8

|

|

|

|

19.7

|

%

|

|

Raleigh-Durham

|

|

|

4

|

|

|

|

-

|

|

|

|

20.9

|

|

|

|

19

|

|

|

|

1.4

|

|

|

|

21.8

|

%

|

|

Richmond(2)

|

|

|

4

|

|

|

|

1

|

|

|

|

20.9

|

|

|

|

20

|

|

|

|

1.0

|

|

|

|

29.6

|

%

|

|

Boston (3)

|

|

|

-

|

|

|

|

1

|

|

|

|

-

|

|

|

|

21

|

|

|

|

4.0

|

|

|

|

7.2

|

%

|

|

Columbus

|

|

|

3

|

|

|

|

-

|

|

|

|

10.9

|

|

|

|

27

|

|

|

|

1.5

|

|

|

|

15.6

|

%

|

|

Indianapolis

|

|

|

3

|

|

|

|

1

|

|

|

|

16.1

|

|

|

|

29

|

|

|

|

1.4

|

|

|

|

15.5

|

%

|

|

Cincinnati

|

|

|

2

|

|

|

|

1

|

|

|

|

10.7

|

|

|

|

30

|

|

|

|

1.8

|

|

|

|

12.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

42

|

|

|

|

11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

In addition, in Houston, we operate a digital channel KMJQ-HD2.

|

|

|

(2)

|

Richmond is the only market in which we operate using the diary methodology of audience measurement.

|

|

|

(3)

|

Radio One retains ownership of a station in Boston; however, that station is the subject of an LMA

and is not operated by the Company. We do not subscribe to Arbitron for our Boston market.

|

|

|

(a)

|

WDNI-CD (formerly WDNI-LP), the low power television station that we acquired in Indianapolis in June

2000, is not included in this table.

|

|

|

(b)

|

Audience share data are for the 12+ demographic and derived from the Arbitron

Survey four book averages ending with the Fall 2011 Arbitron Survey.

|

|

|

(c)

|

Population estimates are from the Arbitron Radio Market Report, Fall 2011.

|

The African-American Market Opportunity

We believe that urban-oriented

media primarily targeting African-Americans continues as an attractive opportunity for the following reasons:

Steady African-American

Population Growth.

From 2000 to 2010, the African-American population grew by 11.9% compared to 7.7% for the white

population and 9.8% for the total population. (Source: “The Multicultural Economy 2010,” Selig Center for Economic

Growth, Terry College of Business, The University of Georgia, August 2010.) The African-American population is expected

to grow to approximately 42.4 million by the end of 2015, a 5.8% increase from 2010. African-Americans are expected to make up

12.9% of total population growth during the period from 2010 through 2015 (Source: U.S. Census Bureau, 2008 and 2009, “Projections

of the Population by Sex, Race, and Hispanic Origin for the United States: 2010 to 2050”). According to the U.S. Census,

the average African-American population is nearly five years younger than the total U.S. population average. As a result, urban

formats, in general, tend to skew younger than formats targeted to the general market population. As of December 2011,

the African-American population represents almost 13% of the total U.S. population. The African-American consumer market

represents an attractive customer segment in many states.

High African-American

Geographic Concentration.

An analysis of the African-American population shows a high degree of geographic concentration. A

recent study shows that while the five most populous U.S. markets are home to 21% of the overall U.S. population, 27% of the total

African-American population resides in those same markets. Expanding the analysis to the 20 most populous U.S. markets,

45% of the overall U.S. population resides within these markets, with 57% of the total African-American population residing within

them. (Source: “Markets Within Markets,” Cable Advertising Bureau (“CAB”) Race, Relevance and Revenue,

June 2007.) The practical implication of these findings is that a multi-media strategy within these pockets of geographic

concentration can have a proportionately much more meaningful reach towards the African-American population than towards non-African-American

U.S. populations. Indeed, the markets in which we operate radio stations are home to 27% of the total African-American population.

(Source: U.S. Census Bureau, 2008 and 2009, “Projections of the Population by Sex, Race, and Hispanic Origin for the United

States: 2010 to 2050”.)

Higher African-American

Income Growth.

The economic status of African-Americans improved at an above-average rate over the past two decades. African-American

buying power was estimated at $957 billion in 2010, up from $600 billion in 2000, and is expected to increase to over $1.2 trillion

by 2015. The 2000 to 2010 60% gain of African-Americans outweighed the 49% increase in white buying power and the 52% increase

in buying power of all races combined. Indeed, in 2009, the African-American market was larger than the entire economies (2008

GDP measured in U.S. dollars) of all but fourteen countries in the world. (Source: “The Multicultural Economy 2010,”

Selig Center for Economic Growth, Terry College of Business, The University of Georgia, August 2010.) In addition, African-American

consumers tend to have a different consumption profile than non-African-Americans. A report published by the CAB notes those

products and services for which African-American households spent more or a higher proportion of their money than non-African-Americans.

These products and services included apparel and accessories, appliances, consumer electronics, food, personal care products, telephone

service and transportation. Such findings imply that utilities, telecom firms, clothing and grocers would greatly benefit from

marketing directly to African-American consumers. This is particularly true in those states (including the District

of Columbia) where the percentage that African-American buying power represents of total buying power in that state is the largest,

such as the District of Columbia (28%), Maryland (22%), Georgia (21%), North Carolina (14%) and Virginia (13%). Indeed, in

2010, the African-American markets in Georgia, Maryland, North Carolina and Virginia were $66 billion, $57 billion, $44 billion

and $42 billion, respectively. (Source: “The Multicultural Economy 2010,” Selig Center for Economic Growth, Terry College

of Business, The University of Georgia, August 2010.)

Growing Influence

of African-American Culture.

We believe that there continues to be an ongoing “urbanization” of many

facets of American society as evidenced by the influence of African-American culture in the areas of politics, music, film, fashion,

sports and urban-oriented television shows and networks. We believe that many companies from a broad range of industries have embraced

this urbanization trend in their products as well as in their advertising messages. As noted in one recent study, “Moreover,

blacks are consumer trendsetters, which isn’t surprising given that 28.1% of them are under 18 compared to 22.5% of the white

population or 24.3% of the total population.” (Source: “The Multicultural Economy 2010,” Selig Center for Economic

Growth, Terry College of Business, The University of Georgia, August 2010.)

Growth in Advertising

Targeting the African-American Market.

We continue to believe that large corporate advertisers are becoming more

focused on reaching minority consumers in the United States. The African-American community is considered an emerging growth market

within a mature domestic market. During the recession, spending on African-American media declined 7.3%, according to figures by

The Nielsen Company. While the decline was consistent with the trend in overall advertising, the drop was not as severe as it was

for the general market. In February 2010, Nielsen reported that ad spending in general fell 9% in 2009, despite significant

increases in advertising spending for Cable TV. The decline in spending on African-American media was consistent with

decreased spending in network television and national magazines. Increased spending on cable television helped balance

out the losses. Advertisers spent 35% more on African-American cable in 2009 than in 2008. Radio continued to earn the

most revenue among African-American media in 2009. Advertisers spent $748 million on the medium last year. (Source: “Multicultural

Ad Spending Declines in 2009, but Less than Overall Ad Market,” NielsenWire, March 12, 2010.) We believe many large corporations

are expanding their commitment to ethnic advertising. The companies that successfully market to the African-American audience have

focused on building brand relationships. Advertisers are making an effort to fully understand African-American consumers, and to

relate to them with messages that are relevant to their community. These advertisers are accomplishing this by visibly and consistently

engaging the African-American consumer, involving themselves with the interests of the African-American consumer and increasing

African-American brand loyalty.

Significant and

Growing Internet Usage among African-Americans with Limited Targeted Online Content Offerings.

African-Americans

are becoming significant users of the internet. The same factors driving increases in African-American buying power, such as improvements

in education, income and employment, are also increasing African-American internet usage. One study estimates that 23.7 million

African-Americans will make up 11.2% of all U.S. internet users in 2013, up from 9.9% in 2008. (Source: “African

Americans Online,” eMarketer, March 2009.) This represents a 24% increase from 2008 versus a 15% increase for

the general population and an 11% increase among white internet users. According to another national study among more

than 7,000 African American adults, the internet represents 32% of daily media exposure for African-Americans and the average amount

of time spent online is 4 hours and 21 minutes per day, a figure that is 10% higher when compared to the average amount of time

spent online for all U.S. adults. (Source: “The Media Audit National Report 2010”.) Additionally, the growth of

internet penetration and high-speed internet penetration in African-American households is expected to remain above that of the

general population. We believe that there is no company that dominates the African-American market online, and the lack of any

such dominant presence provides us with a significant opportunity to build an online business that is highly scalable.

The Results of our

Black America Study (www.blackamericastudy.com).

In addition to relying on third-party research and our own experience,

from time to time we conduct or commission our own proprietary research. In early 2008, we released the groundbreaking

“Black America Study.” This national study, conducted by Yankelovich, a leader in consumer research for

over 50 years, is one of the largest segmentation research studies ever done of Blacks and African-Americans. This study

helps us to better understand the motivations of our core demographic by segmenting the large and growing African-American audience

so that we can highlight the diversity that exists in Black America. This enhanced understanding helps us identify new opportunities

to serve the African-American community and assists us in helping advertisers and marketers reach the African-American market more

effectively.

The study includes

insight into the feelings of African-Americans about their future, past and present, as well as, details on their relationship

with media, advertising and technology. The wealth of quantifiable information about our listeners, viewers, readers and visitors

provides valuable marketing and programming applications for us. This allows us to ensure that our content best reflects

our audience and, in turn, allows for companies, organizations and individuals to effectively reach this vital community.

Business Strategy

Radio Station Portfolio

Optimization.

Within our core radio business, our portfolio management strategy is to make select acquisitions of

radio stations, primarily in markets where we already have a presence, and to divest stations which are no longer strategic in

nature. Depending on market conditions, we may divest stations that do not have an urban format or stations located in smaller

markets or markets where the African-American population is smaller, on a relative basis, than other markets in which we operate.

Recently, given

market conditions

, changes in

ratings methodologies and economic and demographic shifts, we have reprogrammed some of our stations in underperforming segments

of certain markets. However, our core franchise remains targeted toward the African-American and/or urban listener and consumer.

Through our portfolio management strategy, we are continually looking for opportunities to upgrade the performance of existing

radio stations through reprogramming or by strengthening their signals to reach a larger number of potential listeners.

Investment in Complementary

Businesses.

We continue to invest in complementary businesses in the media and entertainment industry. The primary

focus of these investments will be on businesses that provide entertainment and information content to African-American and urban

consumers. Most recently, in April 2011, we increased

our ownership interests in TV One,

a cable television network targeting African-Americans,

to 50.9% giving us a controlling interest in the network, such that

we now consolidate it into our financial statements. Subsequent to April 2011, our ownership in TV One increased to approximately

51.0% after a redemption of certain management interests. In April 2008, we acquired CCI, an online social networking company that

hosted the website BlackPlanet. BlackPlanet has been integrated into our online operations, as part of Interactive One,

which now includes the largest social networking site primarily targeted at African-Americans. The consolidation of

both TV One and BlackPlanet into our operations is consistent with our operating strategy of becoming a multi-media entertainment

and information content provider to African-American consumers. We believe that our unique position as a diversified

media company focused on the African-American consumer provides us with a competitive advantage in these new businesses.

Top 50 African-American Radio Markets

in the United States

The table below notes

the top 50 African-American radio markets in the United States. The bold text indicates markets where we own and/or operate radio

stations. Population estimates are for 2011 and are based upon data provided by Arbitron.

|

Rank

|

|

|

Market

|

|

African-

American

Population

(Persons

12+)

|

|

|

African-

Americans

as a

Percentage

of the

Overall

Population

(Persons

12+)

|

|

|

|

|

|

|

|

(In

thousands)

|

|

|

|

|

|

|

1

|

|

|

New York, NY

|

|

|

2,591

|

|

|

|

16.6

|

%

|

|

|

2

|

|

|

Atlanta, GA

|

|

|

1,140

|

|

|

|

32.9

|

|

|

|

3

|

|

|

Chicago, IL

|

|

|

1,320

|

|

|

|

17.0

|

|

|

|

4

|

|

|

Washington, DC

|

|

|

1,191

|

|

|

|

26.6

|

|

|

|

5

|

|

|

Philadelphia, PA

|

|

|

915

|

|

|

|

20.4

|

|

|

|

6

|

|

|

Houston-Galveston, TX

|

|

|

856

|

|

|

|

17.2

|

|

|

|

7

|

|

|

Detroit, MI

|

|

|

818

|

|

|

|

21.9

|

|

|

|

8

|

|

|

Dallas-Ft. Worth, TX

|

|

|

807

|

|

|

|

15.3

|

|

|

|

9

|

|

|

Los Angeles, CA

|

|

|

757

|

|

|

|

7.1

|

|

|

|

10

|

|

|

Miami-Ft. Lauderdale-Hollywood, FL

|

|

|

725

|

|

|

|

20.1

|

|

|

|

11

|

|

|

Baltimore, MD

|

|

|

660

|

|

|

|

28.6

|

|

|

|

12

|

|

|

Memphis, TN

|

|

|

484

|

|

|

|

44.3

|

|

|

|

13

|

|

|

Charlotte-Gastonia-Rock Hill, NC

|

|

|

440

|

|

|

|

21.5

|

|

|

|

14

|

|

|

St. Louis, MO

|

|

|

430

|

|

|

|

18.6

|

|

|

|

15

|

|

|

Norfolk-Virginia Beach-Newport News, VA

|

|

|

424

|

|

|

|

31.4

|

|

|

|

16

|

|

|

San Francisco, CA

|

|

|

422

|

|

|

|

7.0

|

|

|

|

17

|

|

|

New Orleans, LA

|

|

|

364

|

|

|

|

30.7

|

|

|

|

18

|

|

|

Cleveland, OH

|

|

|

345

|

|

|

|

19.7

|

|

|

|

19

|

|

|

Raleigh-Durham, NC

|

|

|

298

|

|

|

|

21.8

|

|

|

|

20

|

|

|

Richmond, VA

|

|

|

290

|

|

|

|

29.6

|

|

|

|

21

|

|

|

Boston, MA

|

|

|

290

|

|

|

|

7.2

|

|

|

|

22

|

|

|

Tampa-St. Petersburg-Clearwater, FL

|

|

|

269

|

|

|

|

11.1

|

|

|

|

23

|

|

|

Greensboro-Winston-Salem-High Point, NC

|

|

|

260

|

|

|

|

21.4

|

|

|

|

24

|

|

|

Birmingham, AL

|

|

|

256

|

|

|

|

28.5

|

|

|

|

25

|

|

|

Orlando, FL

|

|

|

255

|

|

|

|

16.2

|

|

|

|

26

|

|

|

Jacksonville, FL

|

|

|

240

|

|

|

|

20.9

|

|

|

|

27

|

|

|

Columbus, OH

|

|

|

238

|

|

|

|

15.6

|

|

|

|

28

|

|

|

Milwaukee-Racine, WI

|

|

|

224

|

|

|

|

15.2

|

|

|

|

29

|

|

|

Indianapolis, IN

|

|

|

221

|

|

|

|

15.5

|

|

|

|

30

|

|

|

Cincinnati, OH

|

|

|

219

|

|

|

|

12.4

|

|

|

|

31

|

|

|

Nassau-Suffolk (Long Island), NY

|

|

|

217

|

|

|

|

9.0

|

|

|

|

32

|

|

|

Kansas City, KS

|

|

|

216

|

|

|

|

13.2

|

|

|

|

33

|

|

|

Minneapolis-St. Paul, MN

|

|

|

215

|

|

|

|

7.8

|

|

|

|

34

|

|

|

Seattle-Tacoma, WA

|

|

|

206

|

|

|

|

5.9

|

|

|

|

35

|

|

|

Nashville, TN

|

|

|

203

|

|

|

|

15.8

|

|

|

|

36

|

|

|

Baton Rouge, LA

|

|

|

197

|

|

|

|

33.4

|

|

|

|

37

|

|

|

Jackson, MS

|

|

|

189

|

|

|

|

47.1

|

|

|

|

38

|

|

|

West Palm Beach-Boca Raton, FL

|

|

|

188

|

|

|

|

16.3

|

|

|

|

39

|

|

|

Middlesex-Somerset-Union, NJ

|

|

|

182

|

|

|

|

12.9

|

|

|

|

40

|

|

|

Las Vegas, NV

|

|

|

180

|

|

|

|

10.9

|

|

|

|

41

|

|

|

Columbia, SC

|

|

|

179

|

|

|

|

32.2

|

|

|

|

42

|

|

|

Riverside-San Bernardino, CA

|

|

|

177

|

|

|

|

9.3

|

|

|

|

43

|

|

|

Hudson Valley, CA

|

|

|

174

|

|

|

|

12.0

|

|

|

|

44

|

|

|

Pittsburgh, PA

|

|

|

172

|

|

|

|

8.6

|

|

|

|

45

|

|

|

Phoenix, AZ

|

|

|

170

|

|

|

|

5.4

|

|

|

|

46

|

|

|

Augusta, GA

|

|

|

154

|

|

|

|

34.0

|

|

|

|

47

|

|

|

Charleston, SC

|

|

|

152

|

|

|

|

26.5

|

|

|

|

48

|

|

|

Greenville-Spartanburg, SC

|

|

|

148

|

|

|

|

16.7

|

|

|

|

49

|

|

|

Louisville, KY

|

|

|

146

|

|

|

|

14.7

|

|

|

|

50

|

|

|

Sacramento, CA

|

|

|

144

|

|

|

|

7.7

|

|

Multi-Media Operating Strategy

To maximize net revenue

and station operating income at our radio stations, we strive to achieve the largest audience share of African-American listeners

in each market, convert these audience share ratings to advertising revenue, and control operating expenses. Complementing our

core radio franchise are our cable and online media interests. Through our national presence across our various media, we provide

our customers with a multi-media advertising platform that is a unique and powerful delivery mechanism toward African-Americans

and other urban consumers. We believe that as we continue to diversify into other media, the strength and effectiveness of this

unique platform will become even more compelling. The success of our strategy relies on the following:

|

|

·

|

market research and targeted programming and marketing;

|

|

|

·

|

ownership and syndication of programming content;

|

|

|

·

|

clustering, programming segmentation and sales bundling;

|

|

|

·

|

strategic and coordinated sales, marketing and special event efforts;

|

|

|

·

|

strong management and performance-based incentives; and

|

|

|

·

|

significant community involvement.

|

Market Research and Targeted Programming

and Marketing

We use market

research to tailor the programming, marketing and promotion of our radio stations and the content of our complementary media to

maximize audience share. We also use our research to reinforce and refine our current programming and content, to identify unserved

or underserved markets or segments within the African-American population and to determine whether to acquire new media properties

or reprogram one of our existing media properties.

We also seek

to reinforce our targeted programming and content by creating a distinct and marketable identity for each of our media properties.

To achieve this objective, in addition to our significant community involvement (discussed below), we employ and promote distinct,

high-profile personalities across our media properties, many of whom have strong ties to the African-American community and the

local communities in which a broadcasting property is located.

Ownership and Syndication of Programming

Content

To diversify our revenue

base beyond the markets in which we physically operate, we seek to develop or acquire proprietary African-American targeted content.

We distribute this content in a variety of ways, utilizing our own network of multi-media distribution assets or through distribution

assets owned by others. If we distribute content through others, we are paid for providing this content or we receive advertising

inventory which we monetize through our adverting sales. To date, our programming content efforts have included our investment

in TV One and its related programming, our 53.5% ownership of Reach Media, the acquisition and development of our interactive brands

including BlackPlanet, NewsOne, TheUrbanDaily and HelloBeautiful and the development and distribution of several syndicated radio

shows, including the “Russ Parr Morning Show,” the “Yolanda Adams Morning Show,” the “Rickey Smiley

Morning Show,” “CoCo Brother Live,” CoCo Brother’s the “Spirit” program, Bishop T.D. Jakes’

“Empowering Moments,” the “Reverend Al Sharpton Show,” and the “Warren Ballentine Show.” In

addition to being broadcast on Radio One stations, our syndicated radio programming also is available on 198 non-Radio One stations

through the United States.

Clustering, Programming Segmentation

and Sales Bundling

We strive to build

clusters of radio stations in our markets, with each radio station targeting different demographic segments of the African-American

population. This clustering and programming segmentation strategy allows us to achieve greater penetration within the distinct

segments of our overall target market. In a similar fashion, we have multiple online brands including BlackPlanet, NewsOne, TheUrbanDaily

and HelloBeautiful. Each of these brands focuses upon a different segment of African-American online users. With

our radio station clusters and multiple online brands, we are able to direct advertisers to specific audiences within the urban

communities in which we are located or to bundle the radio stations and brands for advertising sales purposes when advantageous.

We believe there are

several potential benefits that result from operating multiple radio stations within the same market as well as operating multiple

online brands. First, each additional radio station in a market and online brand provides us with a larger percentage of the prime

advertising time available for sale within that market and among online users. Second, the more stations we program

and brands we operate, the greater the market share we can achieve in our target demographic groups through the use of segmented

programming and content delivery. Third, we are often able to consolidate sales, promotional, technical support and business functions

across stations and brands to produce substantial cost savings. Finally, the purchase of additional radio stations in

an existing market and the development of additional online brands allow us to take advantage of our market expertise and leverage

our existing relationships with advertisers.

Strategic and Coordinated Sales,

Marketing and Special Event Efforts

We have assembled an

effective, highly trained sales staff responsible for converting our broadcast and online audience shares into revenue. We

operate with a focused, sales-oriented culture, which rewards aggressive selling efforts through a commission and bonus compensation

structure. We hire and deploy large teams of sales professionals for each of our media properties or media clusters, and we provide

these teams with the resources necessary to compete effectively in the markets in which we operate. We utilize various sales strategies

to sell and market our properties on a stand-alone basis, in combination with other properties within a given market, and across

our various media properties, where appropriate.

We have created a national

platform of radio stations in some of the largest African-American consumer markets. This platform has the ability to reach approximately

20 million listeners weekly, more than that of any other radio broadcaster primarily targeting African-Americans. Given the high

degree of geographic concentration among the African-American population, national advertisers find advertising on our radio stations

an efficient and cost-effective way to reach this target audience. Through our corporate sales department, we bundle and sell our

platform of radio stations to national advertisers, thereby enhancing our revenue generating opportunities, expanding our base

of advertisers, creating greater demand for our advertising time inventory and increasing the capacity utilization of our inventory

and making our sales efforts more efficient. We have also created a dedicated online sales force as part of our interactive unit.

The unit’s national team focuses on helping marketers reach our online audience of approximately 4 million unique visitors

per month. Our leading advertising products, custom marketing solutions, and integrated inventory opportunities, provide

our advertising customers a unique vehicle to reach online African-American consumers at scale. To allow marketers to reach our

audience across all of our platforms (radio, television and online) in an efficient way, in 2008, we launched One Solution, a cross-platform/brand

sales and marketing effort which allows top tier advertisers to take full advantage of our complete suite of offerings through

a one-stop shop approach that has the potential to reach 82% of African-Americans in the United States.

In order to create

advertising loyalty, we strive to be the recognized expert in marketing to the African-American consumer in the markets in which

we operate. We believe that we have achieved this recognition by focusing on serving the African-American consumer and by creating

innovative advertising campaigns and promotional tie-ins with our advertising clients and sponsoring numerous entertainment events

each year. In these events, advertisers buy sponsorships, signage, booth space and/or broadcast promotions to sell a variety of

goods and services to African-American consumers. As we expand our presence in our existing markets and into new markets, we may

increase the number of events and the number of markets in which we host events based upon our evaluation of the financial viability

and economic benefits of the events.

Strong Management and Performance-Based

Incentives

We focus on hiring

and retaining highly motivated and talented individuals in each functional area of our organization who can effectively help us

implement our growth and operating strategies. Our management team is comprised of a diverse group of individuals who bring significant

expertise to their functional areas. To enhance the quality of our management in the areas of sales and programming, general managers,

sales managers and program directors have significant portions of their compensation tied to the achievement of certain performance

goals. General Managers’ compensation is based partially on increasing market share and achieving station operating income

benchmarks, which creates an incentive for management to focus on both sales growth and profitability. Additionally, sales managers

and sales personnel have incentive packages based on sales goals, and program directors and on-air talent have incentive packages

focused on maximizing ratings in specific target segments. Our One Solution sales approach seeks to drive incremental revenue and

value across all of our media properties and includes performance based incentives for our sales team.

Significant Community Involvement

We believe our active

involvement and significant relationships in the African-American community across each of our brands and in each of our markets

provide a competitive advantage in targeting African-American audiences and significantly improve the marketability of our advertising

to businesses that are targeting such communities. We believe that a media property’s image should reflect the lifestyle

and viewpoints of the target demographic group it serves. Due to our fundamental understanding of the African-American community,

we are well positioned to identify music and musical styles, as well as political and social trends and issues, early in their

evolution. This understanding is integrated into significant aspects of our operations across all of our media properties and enables

us to create enhanced awareness and name recognition in the marketplace. In addition, we believe our approach to community

involvement leads to increased effectiveness in developing and updating our programming formats and online brands and content which

in turn leads to greater listenership and users of our online properties, driving higher ratings and online traffic over the long-term.

Our Radio Station Portfolio

The following table

sets forth selected information about our portfolio of radio stations as of December 31, 2011. Market population data and revenue

rank data are from BIA Financials Investing in Radio Market Report, 2011 Fourth Edition. Audience share and audience rank data

are based on Arbitron Survey four book averages ending with the Fall 2011 Arbitron Survey unless otherwise noted. As used in this

table, “n/a” means not applicable or not available and (“t”) means tied with one or more radio stations.

We do not subscribe to Arbitron for our Boston market.

|

|

|

|

|

|

|

|

|

|

|

Four

Book Average

|

|

|

|

|

|

|

|

2011

|

|

|

|

|

|

|

|

|

|

Audience

Share

|

|

|

Audience

Rank

|

|

|

Audience

Share

|

|

|

Audience

Rank

|

|

|

|

|

Metro

|

|

|

Year

|

|

|

|

|

Target Age

|

|

in 12+

|

|

|

in 12+-

|

|

|

in Target

|

|

|

in Target

|

|

|

Market

|

|

Population

|

|

|

Acquired

|

|

|

Format

|

|

Demographic

|

|

Demographic

|

|

|

Demographic

|

|

|

Demographic

|

|

|

Demographic

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Atlanta

|

|

|

11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WPZE-FM

|

|

|

|

|

|

|

2004

|

|

|

Contemporary Inspirational

|

|

25-54

|

|

|

5.6

|

|

|

|

4

|

(t)

|

|

|

5.4

|

|

|

|

7

|

|

|

WHTA-FM

|

|

|

|

|

|

|

2002

|

|

|

Urban Contemporary

|

|

18-34

|

|

|

5.0

|

|

|

|

6

|

(t)

|

|

|

9.0

|

|

|

|

2

|

|

|

WAMJ-FM

|

|

|

|

|

|

|

1999

|

|

|

Urban AC

|

|

25-54

|

|

|

4.6

|

|

|

|

8

|

(t)

|

|

|

5.5

|

|

|

|

5

|

(t)

|

|

WUMJ-FM

|

|

|

|

|

|

|

1999

|

|

|

Urban AC

|

|

25-54

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Washington, DC

|

|

|

10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WKYS-FM

|

|

|

|

|

|

|

1995

|

|

|

Urban Contemporary

|

|

18-34

|

|

|

3.4

|

|

|

|

13

|

|

|

|

7.6

|

|

|

|

3

|

|

|

WMMJ-FM

|

|

|

|

|

|

|

1987

|

|

|

Urban AC

|

|

25-54

|

|

|

4.6

|

|

|

|

7

|

|

|

|

4.6

|

|

|

|

7

|

(t)

|

|

WPRS-FM

|

|

|

|

|

|

|

2008

|

|

|

Contemporary Inspirational

|

|

25-54

|

|

|

3.6

|

|

|

|

11

|

(t)

|

|

|

4.0

|

|

|

|

10

|

|

|

WOL-AM

|

|

|

|

|

|

|

1980

|

|

|

News/Talk

|

|

35-64

|

|

|

0.2

|

|

|

|

39

|

(t)

|

|

|

0.2

|

|

|

|

36

|

(t)

|

|

WYCB-AM

|

|

|

|

|

|

|

1998

|

|

|

Gospel

|

|

25-54

|

|

|

0.2

|

|

|

|

39

|

(t)

|

|

|

0.0

|

|

|

|

55

|

(t)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Philadelphia

|

|

|

9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WPPZ-FM

|

|

|

|

|

|

|

1997

|

|

|

Contemporary Inspirational

|

|

25-54

|

|

|

2.8

|

|

|

|

16

|

|

|

|

2.3

|

|

|

|

18

|

|

|

WPHI-FM

|

|

|

|

|

|

|

2000

|

|

|

Urban Contemporary

|

|

18-34

|

|

|

2.0

|

|

|

|

19

|

(t)

|

|

|

3.8

|

|

|

|

9

|

|

|

WRNB-FM

|

|

|

|

|

|

|

2004

|

|

|

Urban AC

|

|

25-54

|

|

|

3.8

|

|

|

|

10

|

|

|

|

4.3

|

|

|

|

7

|

(t)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Houston

|

|

|

8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KMJQ-FM

|

|

|

|

|

|

|

2000

|

|

|

Urban AC

|

|

25-54

|

|

|

5.6

|

|

|

|

3

|

|

|

|

5.8

|

|

|

|

4

|

|

|

KBXX-FM

|

|

|

|

|

|

|

2000

|

|

|

Urban Contemporary

|

|

18-34

|

|

|

6.7

|

|

|

|

2

|

|

|

|

11.8

|

|

|

|

1

|

|

|

KROI-FM

|

|

|

|

|

|

|

2004

|

|

|

News

|

|

25-54

|

|

|

**

|

|

|

|

**

|

|

|

|

**

|

|

|

|

**

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Detroit

|

|

|

13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WGPR-FM

|

|

|

|

|

|

|

2011

|

|

|

Urban Contemporary

|

|

18-34

|

|

|

2.6

|

|

|

|

18

|

|

|

|

5.1

|

|

|

|

8

|

|

|

WDMK-FM

|

|

|

|

|

|

|

1998

|

|

|

Urban AC

|

|

25-54

|

|

|

4.7

|

|

|

|

6

|

(t)

|

|

|

4.3

|

|

|

|

11

|

|

|

WPZR-FM

|

|

|

|

|

|

|

1998

|

|

|

Contemporary Inspirational

|

|

25-54

|

|

|

2.5

|

|

|

|

19

|

(t)

|

|

|

2.7

|

|

|

|

17

|

(t)

|

|

WCHB-AM

|

|

|

|

|

|

|

1998

|

|

|

News/Talk

|

|

35-64

|

|

|

0.6

|

|

|

|

28

|

(t)

|

|

|

0.6

|

|

|

|

28

|

(t)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dallas

|

|

|

7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KBFB-FM

|

|

|

|

|

|

|

2000

|

|

|

Urban Contemporary

|

|

18-34

|

|

|

2.7

|

|

|

|

14

|

(t)

|

|

|

4.3

|

|

|

|

7

|

|

|

KSOC-FM

|

|

|

|

|

|

|

2001

|

|

|

Urban AC

|

|

25-54

|

|

|

2.3

|

|

|

|

19

|

(t)

|

|

|

2.5

|

|

|

|

17

|

(t)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Baltimore

|

|

|

23

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WERQ-FM

|

|

|

|

|

|

|

1993

|

|

|

Urban Contemporary

|

|

18-34

|

|

|

6.2

|

|

|

|

4

|

|

|

|

12.1

|

|

|

|

1

|

|

|

WWIN-FM

|

|

|

|

|

|

|

1992

|

|

|

Urban AC

|

|

25-54

|

|

|

8.4

|

|

|

|

1

|

|

|

|

8.1

|

|

|

|

1

|

|

|

WOLB-AM

|

|

|

|

|

|

|

1993

|

|

|

News/Talk

|

|

35-64

|

|

|

0.3

|

|

|

|

42

|

(t)

|

|

|

0.3

|

|

|

|

43

|

(t)

|

|

WWIN-AM

|

|

|

|

|

|

|

1992

|

|

|

Gospel

|

|

35-64

|

|

|

0.6

|

|

|

|

33

|

(t)

|

|

|

0.7

|

|

|

|

30

|

(t)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Charlotte

|

|

|

26

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WQNC-FM

|

|

|

|

|

|

|

2000

|

|

|

Urban AC

|

|

25-54

|

|

|

2.6

|

|

|

|

16

|

|

|

|

2.8

|

|

|

|

14

|

(t)

|

|

WPZS-FM

|

|

|

|

|

|

|

2004

|

|

|

Contemporary Inspirational

|

|

25-54

|

|

|

3.9

|

|

|

|

13

|

|

|

|

3.3

|

|

|

|

13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|