The Donerail Group LP (together with its affiliates,

“Donerail”), one of the largest shareholders of Turtle Beach

Corporation (the “Company”, “Turtle Beach”, or “HEAR”), owning more

than 4% of the outstanding shares of the Company, released the

following letter today sharing its perspectives on its

investment.

In its letter, Donerail disclosed its significant concern

regarding the Company’s rejection of Donerail’s attractive offer to

purchase the entirety of the Company and detailed its unwavering

commitment to continue to work to maximize value for all

shareholders.

The full text of Donerail’s open letter to the Company

follows:

July 19, 2021

Juergen StarkTurtle Beach Corporation11011 Via Frontera Suite

A/B San Diego, CA 92127

cc: Board of Directors

Dear Juergen and Members of the Board of Directors,

As you know, The Donerail Group LP, together

with its affiliates (“Donerail” or “we”), is one of the largest

shareholders of Turtle Beach Corporation (the “Company”, “Turtle

Beach”, or “HEAR”). Over the last five months, we have appreciated

the more than dozen meetings that we have had with you, your

management team, your representatives and members of the Board of

Directors (the “Board”), and we have more conviction than ever that

Turtle Beach is meaningfully undervalued at today’s share

price.

At Donerail, engagement with management teams

and boards is a highly critical component of our investment

strategy, and we very much endeavor to build constructive dialogue

with the management teams and boards of the companies in which we

choose to invest. While Donerail is a relatively new investment

manager, our principals have had a long history of success working

with management teams to help create value for all shareholders. In

our experience, we have found that providing our thoughts and

advice privately to management teams and boards can oftentimes lead

to superior outcomes for shareholders, as doing so outside of the

public domain generally minimizes distraction for the company, its

employees and its customers. As such, private engagement will

always be our prevailing preference, and to date, we have refrained

from sharing our thoughts on HEAR publicly.

With that being said, recent engagement with the

Board and its representatives has left us with a heightened level

of concern regarding the Company’s strategy for creating value and,

as a top shareholder, we feel compelled to raise our concerns with

other shareholders and share this letter publicly.

Over the past five months, we have actively

engaged with you regarding a multitude of value-creation and

governance-enhancing topics. While those discussions have

admittedly had their fair share of friction, we were pleased to see

your responsiveness in our request to increase the diversity and

skill set of your Board, and we applauded you for the appointment

of Yie-Hsin Hung, an accomplished and talented executive, as a

start. Further, we commended you for heeding our concerns regarding

the lackluster acquisition history of this management team, and we

were pleased to see you increase the Company’s buyback

authorization in lieu of acquiring additional risk-enhancing

assets. As we have expressed to you, greater diversity in the

boardroom and mindful capital allocation are paramount interests of

ours.

Rather than begin the debate on the efficacy of

your historical capital allocation initiatives or certain of your

corporate governance decisions, our most pressing and immediate

concern is principally related to your quizzical and confounding

unilateral rejection of our highly attractive acquisition proposal

for the Company that we sent on April 27, 2021.

As our conviction in the power of the Turtle

Beach brand grew, we decided the best path forward for us was not

to simply remain a top shareholder, but rather, to pursue an

acquisition for the whole company. Consequently, we sent you an

acquisition proposal for Turtle Beach (the “Proposal”) that

detailed our initial offer to purchase the entirety of the Company,

detailed our ability to finance the transaction, highlighted our

view that we would not need a financing contingency as part of a

transaction, and articulated that “upon completion of an expedited

confirmatory due diligence process”, we would “be able to

meaningfully increase our offer” if, based on our diligence, we

found evidence of additional value inherent in the Company that

would warrant a higher premium.

It should be noted our incredible excitement for

this opportunity led us to making an unsolicited overture: simply

put, following our significant research, we have come to believe

Turtle Beach to be one of the preeminent brands in gaming

peripherals today, and the market-leadership that the brand has in

console headsets is both remarkable and enviable. Through our

industry research, it has become quite clear that the quality of

personnel at the Company includes some of the brightest and most

impressive talent in the industry who, under appropriate leadership

and strategy, can drive significant value for equity holders well

into the future.

Over the past eight weeks, we have worked in

good faith to provide comprehensive details regarding the

prospective financing package for our Proposal, as you requested.

While we found certain of your requests to be significantly time

consuming and surprising given the strength of our financing

package and partners, we were nonetheless pleased to learn that on

July 9, 2021, the Board had limited financing concerns and

confirmed the credibility of our prospective financing package.

Typically, such approval would support entering into an NDA that

would allow us to proceed with our due diligence and begin

negotiating a transaction.

In the same meeting, however, we were informed

that our initial offer was not deemed sufficiently high enough to

warrant further engagement. We found this news to be perplexing.

While it may not make sense to detail the specific price of our

initial offer in this public letter, it should be noted that our

offer represented both i) a significant premium to the Company’s

closing share price on July 8, 2021, the day prior to our most

recent meeting; and ii) a significant premium to any 30-day VWAP in

the past 7 years of the Company.

As shareholders, we have questions on the back

of such a rebuttal.

Indeed, we believe that the Company’s shares are

materially undervalued and that Turtle Beach’s leading and

strategic position in console headsets is durable, stands to grow

meaningfully over time, and will generate significant amounts of

cash flow. And while there clearly appears to be a debate to be had

regarding the most optimal and value-maximizing strategic plan that

leadership of Turtle Beach could take to drive shareholder returns

in the future, to refuse to enter into substantive discussions with

us, make a counteroffer to us, or otherwise engage with us on the

back of our all-cash offer – at such an attractive price –

naturally heightens our concern that this Board may simply be

entrenched.

To be sure, as public shareholders, there is an

appropriate and significant degree of opacity that inherently

exists in the information available to us. Perhaps you, as a Board,

are entertaining multiple value-creating strategic options that are

significantly more attractive on a risk-and-time-weighted basis

than what our all-cash offer – or any increase to our offer – can

provide. If that is the case, as one of your largest shareholders,

we would encourage you to pursue any such option with vigor.

Our growing fear, however, is that while you

have heeded certain advice that we have offered in the past, you

are now outright refusing to assess certain value-creating actions

that would enrich shareholders simply because such actions may

involve replacing you as executives and board members. Such

entrenchment would be intolerable to us, if that is in fact the

case.

Indeed, while we are flummoxed by your outright

refusal to engage with us as a bona fide buyer of the Company, we

are unwavering in our commitment to ensure maximum shareholder

value is realized for all shareholders.

William Z. WyattManaging Partner The Donerail Group LP

About Donerail

The Donerail Group LP is a Los Angeles-based investment adviser

that employs a value-oriented investment lens focusing on special

situations and event-driven investments.

Investor Contact:

Wes Calvert, (310) 564-9992

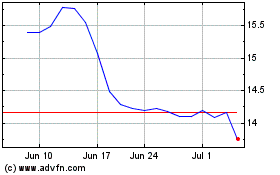

Turtle Beach (NASDAQ:HEAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

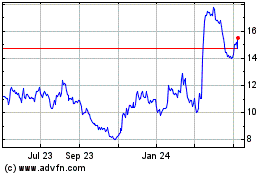

Turtle Beach (NASDAQ:HEAR)

Historical Stock Chart

From Apr 2023 to Apr 2024