Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 14 2024 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF

1934

For the month of February 2024

Commission File Number 001-38737

TuanChe Limited

(Exact name of registrant as specified

in its charter)

9F, Ruihai Building, No. 21 Yangfangdian

Road

Haidian District

Beijing 100038, People’s Republic

of China

(86-10) 6399-8902

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F x

Form 40-F ¨

EXPLANATORY NOTE

The Form 6-K and the exhibit to the Form 6-K, including

any amendment and report filed for the purpose of updating such document, are incorporated by reference into the registration statement

on Form F-3 of TuanChe Limited (File No. 333-264942), and shall be a part thereof from the date on which the Form 6-K is furnished, to

the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

|

TuanChe Limited |

| |

|

|

| Date: |

February 14, 2024 |

|

By: |

/s/ Simon Li |

| |

|

|

Name: |

Simon Li |

| |

|

|

Title: |

Chief Financial Officer |

EXHIBIT INDEX

Exhibit 99.1

TuanChe Has Regained Compliance with Nasdaq's

Minimum Bid Price Requirement

BEIJING, Feb. 12, 2024 /PRNewswire/ -- TuanChe Limited ("TuanChe"

or the "Company") (NASDAQ: TC), a leading integrated automotive marketplace in China, today announced that it has received a

notification letter (the "Compliance Notice") from the Listing Qualifications Department of the Nasdaq Stock Market Inc. ("Nasdaq")

dated February 9, 2024, informing the Company that it has regained compliance with the Nasdaq Listing Rule 5550(a)(2) (the

"Minimum Bid Price Requirement").

As previously announced, TuanChe received a notification letter (the

"Deficiency Notice") from the Nasdaq dated February 17, 2023 indicating that the closing bid price for the Company's

American depositary shares (the "ADSs") was below the minimum bid price of $1.00 required for continued listing under

the Nasdaq Listing Rule 5550(a)(2) for 30 consecutive business days. According to the Deficiency Notice, if at any time during

the 180-day compliance period, the closing bid price of the Company's ADSs is at least $1.00 for a minimum of ten

consecutive business days, the Nasdaq will provide the Company written confirmation of compliance and the matter will be closed. According

to the Compliance Notice, the closing bid price of the Company's ADSs has been at $1.00 per ADS or greater for 10 consecutive business

days from January 26 through February 8, 2024. Accordingly, the Company has regained compliance with the Minimum Bid Price Requirement,

and the matter is closed.

About TuanChe

Founded in 2010, TuanChe Limited (NASDAQ: TC) is a leading integrated

automotive marketplace in China. TuanChe offers services to connect automotive consumers with various industry players such as automakers,

dealers and other automotive service providers. TuanChe provides automotive marketing and transaction related services by integrating

its online platforms with offline sales events. Through its integrated marketing solutions, TuanChe turns individual and isolated automobile

purchase transactions into large-scale collective purchase activities by creating an interactive many-to-many environment. Furthermore,

leveraging its proprietary data analytics and advanced digital marketing system, TuanChe's online marketing service platform helps industry

customers increase the efficiency and effectiveness of their advertising placements.

For more information, please contact ir@tuanche.com.

Safe Harbor Statement

This announcement contains forward-looking statements within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform

Act of 1995. These forward-looking statements include, without limitation, the Company's business plans and development and business outlook,

which can be identified by terminology such as "may," "will," "expect," "anticipate," "aim,"

"estimate," "intend," "plan," "believe," "potential," "continue," "is/are

likely to" or other similar expressions. Such statements are based upon management's current expectations and current market and

operating conditions, and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult

to predict and many of which are beyond the Company's control. Further information regarding these and other risks, uncertainties or factors

is included in the Company's filings with the U.S. Securities and Exchange Commission. The Company does not undertake any obligation to

update any forward-looking statement as a result of new information, future events or otherwise, except as required under law.

For investor and media inquiries, please contact:

TuanChe Limited

Investor Relations

Tel: +86 (10) 6397-6232

Email: ir@tuanche.com

Piacente Financial

Communications

Brandi Piacente

Tel: +1 (212) 481-2050

Email: tuanche@tpg-ir.com

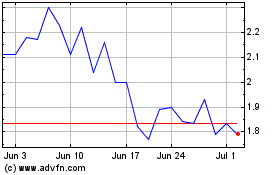

TuanChe (NASDAQ:TC)

Historical Stock Chart

From Jan 2025 to Feb 2025

TuanChe (NASDAQ:TC)

Historical Stock Chart

From Feb 2024 to Feb 2025