– Grows SaaS Revenue 29% in Q3 2024 – Raises Full Year

2024 SaaS guidance – Seasoned NDR increases 900 bps

year-over-year to 101% – Closes acquisition of Infusion

Software, Inc., "Keap"

Headline of release should read: Thryv Accelerates SaaS

Revenue Growth and Achieves the "Rule of 40" in Third Quarter

2024

The updated release reads:

THRYV ACCELERATES SAAS REVENUE GROWTH AND

ACHIEVES THE "RULE OF 40" IN THIRD QUARTER 2024

– Grows SaaS Revenue 29% in Q3 2024 – Raises Full Year

2024 SaaS guidance – Seasoned NDR increases 900 bps

year-over-year to 101% – Closes acquisition of Infusion

Software, Inc., "Keap"

Thryv Holdings, Inc. (NASDAQ:THRY) (“Thryv” or the “Company”),

the provider of Thryv®, the leading small business software

platform, reported SaaS revenue growth of 29% year-over-year in the

third quarter of 2024.

“We had a strong third quarter - delivering SaaS revenue growth

of 29% year-over-year and record SaaS margins,” said Joe Walsh,

Thryv Chairman and CEO. “We reported 45% year-over-year growth in

SaaS clients as we are upgrading our marketing service clients to

our SaaS platform and have continued to execute on our

transformation strategy. In addition, we achieved a significant

milestone that further validates our business model and reached the

'Rule of 40' this quarter.

“With our recent acquisition of Keap, Thryv will be offering an

expanded, integrated set of marketing and sales solutions, and a

strong global partner channel, to our 100,000-plus SaaS clients,”

said Walsh.

“In the third quarter, we beat our SaaS Revenue and Adjusted

EBITDA guidance and are raising our full year SaaS guidance,”

stated Paul Rouse, Chief Financial Officer. “Our Seasoned NDR

increased to 101%, as we continue to increase paid centers per

client, which grew 12% this quarter, demonstrating the success of

our land-and-expand strategy.”

Third Quarter 2024 Highlights:

- Total SaaS revenue was $87.1 million, a 29% increase

year-over-year

- Total Marketing Services revenue was $92.8 million, a 20%

decrease year-over-year

- Consolidated total revenue was $179.9 million, a decrease of 2%

year-over-year

- Consolidated net loss was $96.1 million, or $(2.65) per diluted

share; which includes a non-cash charge of $83.1 million, or

$(2.29) per diluted share, related to a goodwill impairment for our

Marketing Services segment; compared to net loss of $27.0 million,

or $(0.78) per diluted share, for the third quarter of 2023

- Consolidated Adjusted EBITDA was $19.6 million, representing an

Adjusted EBITDA margin of 10.9%

- Total SaaS Adjusted EBITDA was $10.3 million, representing an

Adjusted EBITDA margin of 11.8%

- Total Marketing Services Adjusted EBITDA was $9.3 million,

representing an Adjusted EBITDA margin of 10.0%

- Consolidated Gross Profit was $112.0 million

- Consolidated Adjusted Gross Profit2 was $116.8 million

- SaaS Gross Profit was $60.6 million

- SaaS Adjusted Gross Profit was $62.9 million, representing an

Adjusted Gross Profit Margin of 72.2%

SaaS Metrics

- Total SaaS clients increased 45% year-over-year to 96 thousand

for the third quarter of 2024

- Seasoned Net Dollar Retention3 was 101% for the third quarter

of 2024, an increase of 900 bps year-over-year

- SaaS monthly Average Revenue per Unit (“ARPU”)4 was $307 for

the third quarter of 2024

- ThryvPay total payment volume was $82 million, an increase of

30% year-over-year

Outlook

Based on information available as of November 7, 2024, Thryv is

issuing guidance5 for the fourth quarter of 2024 and full year 2024

as indicated below:

4th Quarter

Full Year

(in millions)

2024

2024

SaaS Revenue

$90.0 - $92.0

$329.5 - $331.5

SaaS Adjusted EBITDA

$9.5 - $10.5

$33.5 - $34.5

4th Quarter

Full Year

(in millions)

2024

2024

Marketing Services Revenue

$81.0 - $83.0

$479.0 - $481.0

Marketing Services Adjusted EBITDA

$16.0 - $19.0

$125.0 - $128.0

For the fourth quarter of 2024, the Company's recent acquisition

of Keap is expected to contribute SaaS revenue in the range of

$11.0 to $12.0 million, which relates to November and December and

is not included in the guidance issued above. Keap's SaaS Adjusted

EBITDA is expected to be de minimus for the fourth quarter of 2024

and is also not included in the guidance issued above.

Earnings Conference Call Information

Thryv will host a conference call on Thursday, November 7, 2024

at 8:30 a.m. (Eastern Time) to discuss the Company's third quarter

2024 results.

For analysts to register for this conference call, please use

this link. After registering, a confirmation email will be sent,

including dial-in details and a unique code for entry. We recommend

registering a day in advance or at a minimum thirty minutes prior

to the start of the call. To listen to the webcast, please use this

link or visit Thryv's Investor Relations website at

investor.thryv.com. A live webcast will also be available on the

Investor Relations section of the Company's website at

investor.thryv.com.

If you are unable to participate in the conference call, a

replay will be available at this link.

Thryv Holdings, Inc. and Subsidiaries Consolidated

Statements of Operations and Comprehensive (Loss)

Three Months Ended

Nine Months Ended

September 30,

September 30,

(in thousands, except share and per share

data)

2024

2023

2024

2023

Revenue

$

179,852

$

183,822

$

637,560

$

680,798

Cost of services

67,871

80,178

223,350

262,261

Gross profit

111,981

103,644

414,210

418,537

Operating expenses:

Sales and marketing

66,484

74,755

201,984

226,781

General and administrative

50,972

48,267

155,229

149,642

Impairment charges

83,094

—

83,094

—

Total operating expenses

200,550

123,022

440,307

376,423

Operating (loss) income

(88,569

)

(19,378

)

(26,097

)

42,114

Other income (expense):

Interest expense

(8,194

)

(15,131

)

(31,554

)

(47,911

)

Interest expense, related party

(3,320

)

—

(5,494

)

—

Other components of net periodic pension

cost

(1,581

)

(1,902

)

(4,743

)

(3,888

)

Other income (expense)

218

(876

)

(7,571

)

(1,242

)

(Loss) before income tax benefit

(expense)

(101,446

)

(37,287

)

(75,459

)

(10,927

)

Income tax benefit (expense)

5,375

10,241

(6,640

)

9,173

Net (loss)

$

(96,071

)

$

(27,046

)

$

(82,099

)

$

(1,754

)

Other comprehensive income (loss):

Foreign currency translation adjustment,

net of tax

1,330

(1,842

)

1,132

(4,332

)

Comprehensive (loss)

$

(94,741

)

$

(28,888

)

$

(80,967

)

$

(6,086

)

Net (loss) per common share:

Basic

$

(2.65

)

$

(0.78

)

$

(2.28

)

$

(0.05

)

Diluted

$

(2.65

)

$

(0.78

)

$

(2.28

)

$

(0.05

)

Weighted-average shares used in

computing basic and diluted net (loss) per common share:

Basic

36,308,992

34,848,899

35,983,826

34,619,794

Diluted

36,308,992

34,848,899

35,983,826

34,619,794

Thryv Holdings, Inc. and Subsidiaries Consolidated

Balance Sheets

(in thousands, except share data)

September 30, 2024

December 31, 2023

Assets

Current assets

Cash and cash equivalents

$

12,453

$

18,216

Accounts receivable, net of allowance of

$18,890 in 2024 and $14,926 in 2023

176,364

205,503

Contract assets, net of allowance of $33

in 2024 and $35 in 2023

9,068

2,909

Taxes receivable

2,706

3,085

Prepaid expenses

18,383

17,771

Deferred costs

10,184

16,722

Other current assets

1,780

2,662

Total current assets

230,938

266,868

Fixed assets and capitalized software,

net

37,142

38,599

Goodwill

218,884

302,400

Intangible assets, net

3,453

18,788

Deferred tax assets

139,769

128,051

Other assets

24,567

28,464

Total assets

$

654,753

$

783,170

Liabilities and Stockholders'

Equity

Current liabilities

Accounts payable

$

6,946

$

10,348

Accrued liabilities

98,439

105,903

Current portion of unrecognized tax

benefits

25,623

23,979

Contract liabilities

32,534

44,558

Current portion of Term Loan

35,783

70,000

Current portion of Term Loan, related

party

16,717

—

Other current liabilities

5,906

8,402

Total current liabilities

221,948

263,190

Term Loan, net

157,794

230,052

Term Loan, net, related party

75,610

—

ABL Facility

21,900

48,845

Pension obligations, net

73,723

69,388

Other liabilities

9,246

18,995

Total long-term liabilities

338,273

367,280

Commitments and contingencies

Stockholders' equity

Common stock - $0.01 par value,

250,000,000 shares authorized; 63,840,032 shares issued and

36,322,417 shares outstanding at September 30, 2024; and 62,660,783

shares issued and 35,302,746 shares outstanding at December 31,

2023

638

627

Additional paid-in capital

1,177,078

1,151,259

Treasury stock - 27,517,615 shares at

September 30, 2024 and 27,358,037 shares at December 31, 2023

(488,824

)

(485,793

)

Accumulated other comprehensive loss

(14,059

)

(15,191

)

Accumulated deficit

(580,301

)

(498,202

)

Total stockholders' equity

94,532

152,700

Total liabilities and stockholders'

equity

$

654,753

$

783,170

Thryv Holdings, Inc. and Subsidiaries Consolidated

Statements of Cash Flows

Nine Months Ended September

30,

(in thousands)

2024

2023

Cash Flows from Operating

Activities

Net (loss)

$

(82,099

)

$

(1,754

)

Adjustments to reconcile net (loss) to net

cash provided by operating activities:

Depreciation and amortization

41,144

46,940

Amortization of deferred commissions

14,251

10,304

Amortization of debt issuance costs

3,151

4,080

Deferred income taxes

(11,823

)

808

Provision for credit losses and service

credits

16,496

15,594

Stock-based compensation expense

17,653

16,653

Other components of net periodic pension

cost

4,743

3,888

Impairment charges

83,094

—

Loss on foreign currency exchange

rates

933

164

Non-cash loss from the remeasurement of

the indemnification asset

—

10,734

Loss on early extinguishment of debt

6,638

—

Other

(3,167

)

—

Changes in working capital items,

excluding acquisitions:

Accounts receivable

18,161

59,238

Contract assets

(6,160

)

1,111

Prepaid expenses and other assets

(7,079

)

23,489

Accounts payable and accrued

liabilities

(14,108

)

(63,469

)

Other liabilities

(18,188

)

(24,132

)

Net cash provided by operating

activities

63,640

103,648

Cash Flows from Investing

Activities

Additions to fixed assets and capitalized

software

(24,730

)

(22,920

)

Acquisition of a business, net of cash

acquired

—

(8,897

)

Other

—

(215

)

Net cash used in investing activities

(24,730

)

(32,032

)

Cash Flows from Financing

Activities

Proceeds from Term Loan

234,256

—

Proceeds from Term Loan, related party

109,444

—

Payments of Term Loan

(345,151

)

(95,000

)

Payments of Term Loan, related party

(16,717

)

—

Proceeds from ABL Facility

247,579

697,234

Payments of ABL Facility

(274,524

)

(694,395

)

Debt issuance costs

(5,480

)

—

Purchase of treasury stock

(499

)

—

Proceeds from exercises of stock

warrants

—

15,899

Other

5,646

4,124

Net cash used in financing activities

(45,446

)

(72,138

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(120

)

(707

)

(Decrease) in cash, cash equivalents and

restricted cash

(6,656

)

(1,229

)

Cash, cash equivalents and restricted

cash, beginning of period

20,530

18,180

Cash, cash equivalents and restricted

cash, end of period

$

13,874

$

16,951

Supplemental Information

Cash paid for interest

$

35,299

$

44,029

Cash paid for income taxes, net

$

14,960

$

7,605

Non-cash investing and financing

activities

Repurchase of Treasury stock as a result

of the settlement of the indemnification asset

$

—

$

15,760

Segment Information

During first quarter of 2024, the Company changed the internal

reporting provided to the chief operating decision maker (“CODM”).

As a result, the Company reevaluated its segment reporting and

determined that Thryv U.S. Marketing Services and Thryv

International Marketing Services should be reflected as a single

reportable segment, and that Thryv U.S. SaaS and Thryv

International SaaS should be reflected as a single reportable

segment. As such, beginning on January 1, 2024, the results of our

Marketing Services and SaaS businesses are presented as two

reportable segments. Comparative prior periods have been recast to

reflect the current presentation.

The following tables summarize the operating results of the

Company's reportable segments:

Three Months Ended September

30,

Change

(in thousands)

2024

2023

Amount

%

Revenue

Marketing Services

$

92,797

$

116,462

$

(23,665

)

(20.3

)%

SaaS

87,055

67,360

19,695

29.2

%

Total Revenue

$

179,852

$

183,822

$

(3,970

)

(2.2

)%

Segment Gross Profit

Marketing Services

$

51,374

$

60,776

$

(9,402

)

(15.5

)%

SaaS

60,607

42,868

17,739

41.4

%

Consolidated Segment Gross

Profit

$

111,981

$

103,644

$

8,337

8.0

%

Segment EBITDA

Marketing Services

$

9,309

$

7,835

$

1,474

18.8

%

SaaS

10,314

(504

)

10,818

NM

Consolidated Adjusted EBITDA

$

19,623

$

7,331

$

12,292

167.7

%

Nine Months Ended September

30,

Change

(in thousands)

2024

2023

Amount

%

Revenue

Marketing Services

$

398,389

$

491,051

$

(92,662

)

(18.9

)%

SaaS

239,171

189,747

49,424

26.0

%

Total Revenue

$

637,560

$

680,798

$

(43,238

)

(6.4

)%

Segment Gross Profit

Marketing Services

$

252,219

$

299,305

$

(47,086

)

(15.7

)%

SaaS

161,991

119,232

42,759

35.9

%

Consolidated Segment Gross

Profit

$

414,210

$

418,537

$

(4,327

)

(1.0

)%

Segment EBITDA

Marketing Services

$

109,137

$

129,717

$

(20,580

)

(15.9

)%

SaaS

23,914

5,522

18,392

NM

Consolidated Adjusted EBITDA

$

133,051

$

135,239

$

(2,188

)

(1.6

)%

Non-GAAP Measures

Our results included in this press release include Adjusted

EBITDA, Adjusted EBITDA Margin and Adjusted Gross Profit, which are

not presented in accordance with U.S. generally accepted accounting

principles (“GAAP”). These non-GAAP measures are presented for

supplemental informational purposes only and are not intended to be

considered in isolation or as a substitute for, or superior to,

financial information prepared and presented in accordance with

GAAP. Please refer to the supplemental information presented in the

tables below for a reconciliation of Adjusted EBITDA to Net income

(loss) and Adjusted Gross Profit to Gross profit. Both Net income

(loss) and Gross profit are the most comparable GAAP financial

measure to Adjusted EBITDA and Adjusted Gross Profit, respectively.

Adjusted EBITDA margin is defined as Adjusted EBITDA divided by

revenue.

We believe that these non-GAAP financial measures provide useful

information about our financial performance, enhance the overall

understanding of our past performance and allow for greater

transparency with respect to important metrics used by our

management for financial and operational decision-making. We

believe that these measures provide additional tools for investors

to use in comparing our core financial performance over multiple

periods with other companies in our industry. However, it is

important to note that the particular items we exclude from, or

include in, our non-GAAP financial measures may differ from the

items excluded from, or included in, similar non-GAAP financial

measures used by other companies in the same industry.

The following is a reconciliation of Adjusted EBITDA to its most

directly comparable GAAP measure, Net (loss):

Three Months Ended September

30,

Nine Months Ended September

30,

(in thousands)

2024

2023

2024

2023

Reconciliation of Adjusted

EBITDA

Net (loss)

$

(96,071

)

$

(27,046

)

$

(82,099

)

$

(1,754

)

Interest expense

11,514

15,131

37,048

47,911

Depreciation and amortization expense

12,519

15,842

41,144

46,940

Stock-based compensation expense (1)

6,011

5,462

17,653

16,653

Restructuring and integration expenses

(2)

4,861

3,584

17,679

12,845

Income tax (benefit) expense

(5,375

)

(10,241

)

6,640

(9,173

)

Transaction costs (3)

1,706

—

1,706

373

Other components of net periodic pension

cost (4)

1,581

1,902

4,743

3,888

Loss on early extinguishment of debt

(5)

—

—

6,638

—

Non-cash loss from remeasurement of

indemnification asset (6)

—

—

—

10,734

Impairment charges

83,094

—

83,094

—

Other (7)

(217

)

2,697

(1,195

)

6,822

Adjusted EBITDA

$

19,623

$

7,331

$

133,051

$

135,239

(1)

We record stock-based compensation expense

related to the amortization of grant date fair value of the

Company’s stock-based compensation awards.

(2)

For the three and nine months ended

September 30, 2024 and 2023, expenses relate to periodic efforts to

enhance efficiencies and reduce costs, and include severance

benefits, and costs associated with abandoned facilities and system

consolidation.

(3)

Expenses related to the Keap acquisition

during the three and nine months ended September 30, 2024, and the

Yellow acquisition during the nine months ended September 30,

2023.

(4)

Other components of net periodic pension

cost is from our non-contributory defined benefit pension plans

that are currently frozen and incur no additional service costs.

The most significant component of Other components of net periodic

pension cost relates to periodic mark-to-market pension

remeasurement.

(5)

In connection with the debt refinancing

completed on May 1, 2024, we recorded a Loss on early

extinguishment of debt related to the write-off of certain

unamortized debt issuance costs on our prior Term Loan and prior

ABL Facility.

(6)

In connection with the YP acquisition, the

seller indemnified us for future potential losses associated with

certain federal and state tax positions taken in tax returns filed

by the seller prior to the acquisition date.

(7)

Other primarily represents foreign

exchange-related expense (income).

The following tables set forth reconciliations of Adjusted Gross

Profit and Adjusted Gross Margin, to their most directly comparable

GAAP measures, Gross profit and Gross margin:

Three Months Ended September

30, 2024

(in thousands)

Marketing Services

SaaS

Total

Reconciliation of Adjusted Gross

Profit

Gross profit

$

51,374

$

60,607

$

111,981

Plus:

Depreciation and amortization expense

2,508

2,189

4,697

Stock-based compensation expense

69

92

161

Adjusted Gross Profit

$

53,951

$

62,888

$

116,839

Gross Margin

55.4

%

69.6

%

62.3

%

Adjusted Gross Margin

58.1

%

72.2

%

65.0

%

Three Months Ended September

30, 2023

(in thousands)

Marketing Services

SaaS

Total

Reconciliation of Adjusted Gross

Profit

Gross profit

$

60,776

$

42,868

$

103,644

Plus:

Depreciation and amortization expense

4,885

1,901

6,786

Stock-based compensation expense

103

71

174

Adjusted Gross Profit

$

65,764

$

44,840

$

110,604

Gross Margin

52.2

%

63.6

%

56.4

%

Adjusted Gross Margin

56.5

%

66.6

%

60.2

%

Nine Months Ended September

30, 2024

(in thousands)

Marketing Services

SaaS

Total

Reconciliation of Adjusted Gross

Profit

Gross profit

$

252,219

$

161,991

$

414,210

Plus:

Depreciation and amortization expense

10,569

5,770

16,339

Stock-based compensation expense

280

228

508

Adjusted Gross Profit

$

263,068

$

167,989

$

431,057

Gross Margin

63.3

%

67.7

%

65.0

%

Adjusted Gross Margin

66.0

%

70.2

%

67.6

%

Nine Months Ended September

30, 2023

(in thousands)

Marketing Services

SaaS

Total

Reconciliation of Adjusted Gross

Profit

Gross profit

$

299,305

$

119,232

$

418,537

Plus:

Depreciation and amortization expense

16,790

4,603

21,393

Stock-based compensation expense

325

171

496

Adjusted Gross Profit

$

316,420

$

124,006

$

440,426

Gross Margin

61.0

%

62.8

%

61.5

%

Adjusted Gross Margin

64.4

%

65.4

%

64.7

%

Supplemental Financial Information

The following supplemental financial information provides

Revenue, Adjusted EBITDA and Adjusted EBITDA Margin by (i)

Marketing Services businesses and (ii) SaaS businesses. Total SaaS

Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial

measures. Total Marketing Services Adjusted EBITDA and Adjusted

EBITDA margin are also non-GAAP financial measures. These non-GAAP

financial measures are presented for supplemental informational

purposes only and are not intended to be considered in isolation or

as a substitute for, or superior to, financial information prepared

and presented in accordance with GAAP. Please refer to the

supplemental information presented in the tables below for a

reconciliation of these non-GAAP financial measures to the

corresponding segment financial measures presented in accordance

with GAAP.

We believe that these non-GAAP financial measures provide useful

information about our global SaaS and Marketing Services financial

performance, enhance the overall understanding of our global SaaS

and Marketing Services past financial performance and allow for

greater transparency with respect to important metrics used by our

management for financial and operational decision-making. We

believe that these measures provide additional tools for investors

to use in comparing our core financial performance over multiple

periods.

Three Months Ended September

30, 2024

(in thousands)

Marketing Services

SaaS

Total

Revenue

$

92,797

$

87,055

$

179,852

Net (Loss)

(96,071

)

Net (Loss) Margin

(53.4

)%

Adjusted EBITDA

9,309

10,314

19,623

Adjusted EBITDA Margin

10.0

%

11.8

%

10.9

%

Three Months Ended September

30, 2023

(in thousands)

Marketing Services

SaaS

Total

Revenue

$

116,462

$

67,360

$

183,822

Net (Loss)

(27,046

)

Net (Loss) Margin

(14.7

)%

Adjusted EBITDA

7,835

(504

)

7,331

Adjusted EBITDA Margin

6.7

%

(0.7

)%

4.0

%

Nine Months Ended September

30, 2024

(in thousands)

Marketing Services

SaaS

Total

Revenue

$

398,389

$

239,171

$

637,560

Net (Loss)

(82,099

)

Net (Loss) Margin

(12.9

)%

Adjusted EBITDA

109,137

23,914

133,051

Adjusted EBITDA Margin

27.4

%

10.0

%

20.9

%

Nine Months Ended September

30, 2023

(in thousands)

Marketing Services

SaaS

Total

Revenue

$

491,051

$

189,747

$

680,798

Net (Loss)

(1,754

)

Net (Loss) Margin

(0.3

)%

Adjusted EBITDA

129,717

5,522

135,239

Adjusted EBITDA Margin

26.4

%

2.9

%

19.9

%

Forward-Looking Statements

Certain statements contained herein are not historical facts,

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 and involve a

number of risks and uncertainties. Statements that include the

words “may”, “will”, “could”, “should”, “would”, “believe”,

“anticipate”, “forecast”, “estimate”, “expect”, “preliminary”,

“intend”, “plan”, “target”, “project”, “outlook”, “future”,

“forward”, “guidance” and similar statements of a future or

forward-looking nature identify forward-looking statements. These

statements are not guarantees of future performance. These

forward-looking statements are based on our current expectations

and beliefs concerning future developments and their potential

effect on us. While management believes that these forward-looking

statements are reasonable as and when made, there can be no

assurance that future developments affecting us will be those that

we anticipate. Accordingly, there are or will be important factors

that could cause our actual results to differ materially from those

indicated in these statements. We believe that these factors

include, but are not limited to, the risks related to the

following: the Company’s ability to maintain adequate liquidity to

fund operations; the Company’s future operating and financial

performance; the Company’s ability to consummate acquisitions, or,

if consummated, to successfully integrate acquired businesses into

the Company’s operations, the Company’s ability to recognize the

benefits of acquisitions, or the failure of an acquired company to

achieve its plans and objectives; limitations on our operating and

strategic flexibility and the ability to operate our business,

finance our capital needs or expand business strategies under the

terms of our credit facilities; our ability to retain existing

business and obtain and retain new business; general economic or

business conditions affecting the markets we serve; declining use

of print yellow page directories by consumers; our ability to

collect trade receivables from clients to whom we extend credit;

credit risk associated with our reliance on small and medium sized

businesses as clients; our ability to attract and retain key

managers; increased competition in our markets; our ability to

obtain future financing due to changes in the lending markets or

our financial position; our ability to maintain agreements with

major Internet search and local media companies; reduced

advertising spending and increased contract cancellations by our

clients, which causes reduced revenue; and our ability to

anticipate or respond effectively to changes in technology and

consumer preferences as well as the risks and uncertainties set

forth in the Company's most recent Annual Report on Form 10-K filed

with the Securities and Exchange Commission. All subsequent written

and oral forward-looking statements attributable to us or persons

acting on our behalf are expressly qualified in their entirety by

such cautionary statements.

If one or more events related to these or other risks or

uncertainties materialize, or if our underlying assumptions prove

to be incorrect, actual results may differ materially from what we

anticipate. For these reasons, we caution you against relying on

forward-looking statements. All forward-looking statements included

in this press release are expressly qualified in their entirety by

the foregoing cautionary statements. These forward-looking

statements speak only as of the date hereof and, other than as

required by law, we undertake no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

About Thryv

Thryv Holdings, Inc. (NASDAQ:THRY) is the provider of the

leading do-it-all small business software platform that empowers

small businesses to modernize how they work. It offers small

business owners everything they need to communicate effectively,

manage their day-to-day operations, and grow — all in one place —

giving up to 20 hours back in their week. Thryv's customizable

platform features three centers: Thryv Command Center, a freemium

central communications hub, Business CenterTM and Marketing

CenterTM. Approximately 300,000 businesses globally use Thryv to

connect with local customers and take care of everything they do,

start to finish. For more information, visit thryv.com.

1 Rule of 40 is defined as year-over-year revenue growth plus

Adj. EBITDA Margin.

2 Defined as Gross profit adjusted to exclude the impact of

depreciation and amortization expense and stock-based compensation

expense.

3 Seasoned Net Dollar Retention is defined as net dollar

retention excluding clients acquired over the previous 12

months.

4 Defined as total client billings for a particular month

divided by the number of clients that have one or more

revenue-generating solutions in that same month.

5 These statements are forward-looking and actual results may

materially differ. Refer to the “Forward-Looking Statements”

section below for information on the factors that could cause our

actual results to materially differ from these forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107017112/en/

Media Contact: Julie Murphy Thryv, Inc. 617.967.5426

julie.murphy@thryv.com

Investor Contact: Cameron Lessard Thryv, Inc.

214.773.7022 cameron.lessard@thryv.com

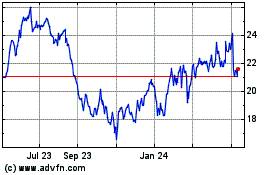

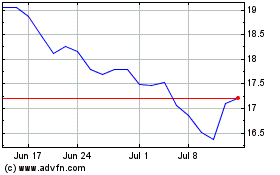

Thryv (NASDAQ:THRY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Thryv (NASDAQ:THRY)

Historical Stock Chart

From Dec 2023 to Dec 2024