Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 31 2023 - 7:24AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of July 2023

Commission

File Number 001-35722

TAOPING

INC.

(Translation

of registrant’s name into English)

21st

Floor, Everbright Bank Building

Zhuzilin, Futian District

Shenzhen, Guangdong, 518040

People’s Republic of China

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form

40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date:

July 31, 2023 |

TAOPING

INC. |

| |

|

|

| |

By: |

/s/

Jianghuai Lin |

| |

|

Jianghuai

Lin |

| |

|

Chief

Executive Officer |

EXHIBIT

INDEX

Exhibit

99.1

Taoping

Announces 1-for -10 Reverse Stock Split

SHENZHEN,

China, July 31, 2023 - Taoping Inc. (Nasdaq: TAOP, the “Company” or “Taoping”), today announced that the board

of directors of the Company approved a one-for-ten reverse stock split of the Company’s issued and outstanding ordinary shares,

no par value (the “Ordinary Shares”). Beginning August 1, 2023, the Company’s Ordinary Shares will be trading on a

split-adjusted basis under the same symbol “TAOP” but with new CUSIP number, G8675V 127.

As

a result of the share consolidation, each ten Ordinary Shares outstanding will automatically combine and convert to one issued and outstanding

Ordinary Share without any action on the part of shareholders who hold their shares in brokerage accounts or “street name”.

Shareholders holding certificates of Ordinary Shares are expected to receive instructions from the Company’s transfer agent, Transhare

Corporation, regarding procedures for exchanging share certificates. All outstanding options, warrants and other rights to purchase the

Company’s Ordinary Shares will be adjusted proportionately as a result of the reverse stock split. No fractional shares will be

issued as a result of the reverse stock split, and instead, all such fractional shares resulting from the reverse stock split will be

rounded up to the nearest whole share.

The

reverse stock split is intended to increase the per share trading price of the Ordinary Shares to satisfy the $1.00 minimum bid price

requirement for continued listing on the NASDAQ Stock Market. Following the reverse stock split the Company will have approximately 1.86

million Ordinary Shares issued and outstanding, exclusive of shares issuable under outstanding options and warrants. The reverse stock

split will not affect the number of total authorized Ordinary Shares of the Company.

About

Taoping Inc.

Taoping

Inc. (Nasdaq: TAOP) has a long history of successfully leveraging technology in the development of innovative solutions to help customers

in both the private and public sectors to more effectively communicate and market to their desired targets. The Company has built a far-reaching

city partner ecosystem and comprehensive portfolio of high-value, high-traffic areas for its products, which are aligned together with

Taoping’s smart cloud platform, cloud services and solutions, new media and artificial intelligence. For more information about

Taoping, please visit www.taop.com. You can also follow us via LinkedIn, Twitter or YouTube.

Safe

Harbor Statement

This

press release contains “forward-looking statements” that involve substantial risks and uncertainties. All statements other

than statements of historical facts contained in this press release, such as statements regarding our estimated future results of operations

and financial position, our strategy and plans, and our objectives or goals, are forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. We have attempted to

identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,”

“could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Our

actual results may differ materially or perhaps significantly from those discussed herein, or implied by, these forward-looking statements.

There are a significant number of factors that could cause actual results to differ materially from statements made in this press release,

including: our potential inability to achieve or sustain profitability or reasonably predict our future results due to our limited operating

history of providing smart cloud services, the effects of the global Covid-19 pandemic, the emergence of additional competing technologies,

changes in domestic and foreign laws, regulations and taxes, uncertainties related to China’s legal system and economic, political

and social events in China, the volatility of the securities markets; and other risks including, but not limited to, those that we discussed

or referred to in the Company’s disclosure documents filed with the U.S. Securities and Exchange Commission (the “SEC”)

available on the SEC’s website at www.sec.gov, including the Company’s most recent Annual Report on Form 20-F as well

as in our other reports filed or furnished from time to time with the SEC. The forward-looking statements included in this press release

are made as of the date of this press release and the Company undertakes no obligation to publicly update or revise any forward-looking

statements, other than as required by applicable law.

For

further information, please contact:

Taoping

Inc.

Xue

Jiang

IR@taop.com

www.taop.com |

Global

IR Partners

David

Pasquale

TAOP@globalirpartners.com

New

York Office: +1-914-337-8801 |

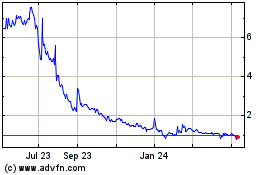

Taoping Inc BVI (NASDAQ:TAOP)

Historical Stock Chart

From Dec 2024 to Jan 2025

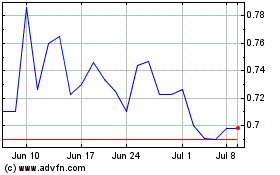

Taoping Inc BVI (NASDAQ:TAOP)

Historical Stock Chart

From Jan 2024 to Jan 2025