As filed with the Securities

and Exchange Commission on February 16, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

T Stamp Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

813777260 |

| (State or other jurisdiction of |

(IRS Employer |

| incorporation or organization) |

Identification Number) |

3017 Bolling Way NE,

Floors 1 and 2,

Atlanta, Georgia, 30305,

USA

(404) 806-9906

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Gareth Genner

c/o T Stamp Inc.

3017 Bolling Way NE,

Floors 1 and 2,

Atlanta, Georgia, 30305,

USA

(404) 806-9906

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

With a copy to:

CrowdCheck Law LLP

700 12th Street NW,

Suite 700

Washington, DC 20005

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only

securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box. ¨

If any of

the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities

Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

x

If this form

is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this form

is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form

is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon

filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this form

is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

|

Accelerated filer ¨ |

| Non-accelerated filer x |

|

Smaller reporting company x |

| |

|

Emerging growth company x |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.¨

The registrant hereby

amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file

a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section

8(a) of the Securities Act, or until this registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to such Section 8(a), may determine.

The information contained in

this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed

with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and offers to buy

these securities are not being solicited in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY

16, 2024

PRELIMINARY PROSPECTUS

T Stamp Inc.

Up to 3,600,000 Shares of Class A Common Stock

This prospectus relates

to the resale from time to time of up to an aggregate of 3,600,000 shares of our Class A Common Stock, par value $0.01 per share (the

“Warrant Shares”) issuable upon the exercise of Class A Common Stock purchase warrants (the “Warrants”)

sold to a certain investor (the “Selling Stockholder”) in a private placement offering consummated on December

21, 2023. We are registering these Warrant Shares as required by the Warrant Exercise Agreement that we entered into with the Selling

Stockholder on December 21, 2023 (the “WEA”). The Selling Stockholder may offer and sell the Warrant Shares

in public or private transactions, or both. These sales may occur at fixed prices, at market prices prevailing at the time of sale, at

prices related to the prevailing market price, or at negotiated prices.

As provided by Rule 416

of the Securities Act of 1933, as amended, this prospectus also covers any additional shares of Class A Common Stock that may become issuable

upon any anti-dilution adjustment pursuant to the terms of the Warrants issued to the Selling Stockholder by reason of stock splits, stock

dividends, and other events described therein.

The Selling Stockholder

may sell all or a portion of Warrant Shares through underwriters, broker-dealers, or agents, who may receive compensation in the form

of discounts, concessions, or commissions from the Selling Stockholder, the purchasers of the Warrant Shares, or both. See “Plan

of Distribution” for a more complete description of the ways in which the Warrant Shares may be sold. We will not receive any of

the proceeds from the sale of any of the 3,600,000 Warrant Shares by the Selling Stockholder. However, upon exercise of the Warrants for

cash, the Selling Stockholder would pay us an exercise price of $1.34 per Warrant Share, subject to any adjustment pursuant to the terms

of the Warrants, or an aggregate of approximately $4,824,000 if the Warrants are exercised in full for cash. The Warrants are also exercisable

on a cashless basis under certain circumstances, and if the Warrants are exercised on a cashless basis, we would not receive any cash

payment from the Selling Stockholder upon any such exercise of the Warrants. We have agreed to bear the expenses (other than underwriting

discounts, commissions, or agent’s commissions and legal expenses of the Selling Stockholder) in connection with the registration

of the Warrant Shares being offered under this prospectus by the Selling Stockholder.

We will pay the expenses

of registering the Warrant Shares, but all selling and other expenses incurred by the Selling Stockholder will be paid by the Selling

Stockholder. See “Plan of Distribution.”

This prospectus provides you with a general description

of the securities that may be resold by the Selling Stockholder. In certain circumstances, we may provide a prospectus supplement that

will contain specific information about the terms of a particular offering by the Selling Stockholder. Such supplements may also add,

update or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement

before you invest in any of our securities.

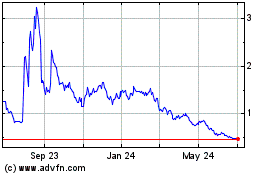

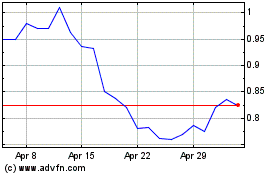

Our Class A Common Stock is listed on the Nasdaq

Capital Market under the symbol “IDAI.” On February 15, 2024, the last reported sale price of our Class A Common Stock on

the Nasdaq Capital Market was $1.54 per share.

As of February 15, 2024, the aggregate market

value of our outstanding Class A Common Stock held by non-affiliates was approximately $13,84 million based on 8,984,284 shares of Class

A Common Stock held by non-affiliates on such date, and based on the last reported sale price of our Class A Common Stock on the Nasdaq

Capital Market on such date of $1.54 per share. As of the date of this prospectus, we have sold $5,191,989 worth of securities on April 14, 2023 and $2,942,767

worth of securities on June 5, 2023 pursuant to General Instruction I.B.6 of Form S-3 during the prior 12-calendar month period ending

on, and including, the date of this prospectus.

We are an “emerging growth company,”

as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and are subject

to reduced public company reporting requirements.

INVESTING IN OUR SECURITIES INVOLVES A HIGH

DEGREE OF RISK. SEE “RISK FACTORS” ON PAGE 6 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS

SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus provides you with a general description

of the Class A Common Stock that may be resold by the Selling Stockholder, which is not meant to be a complete description of the Class

A Common Stock.

To the extent required by applicable law, each

time the Selling Stockholder sells securities, we will provide you with this prospectus and, to the extent required, a prospectus supplement

that will contain more information about the specific terms of the offering. We may also authorize one or more free writing prospectuses

to be provided to you that may contain material information relating to these offerings. The prospectus supplement may also add, update

or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information

in this prospectus and the applicable prospectus supplement, you should rely on the prospectus supplement. Before purchasing any securities,

you should carefully read both this prospectus and the applicable prospectus supplement, together with the additional information described

under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

We have not authorized anyone to provide you with

any information or to make any representations other than those contained in this prospectus, any applicable prospectus supplement or

any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for and can provide

no assurance as to the reliability of any other information that others may give you. You should assume that the information appearing

in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of the date on its respective cover, and

that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate

otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

Unless the context requires otherwise, references

in this prospectus to the “Company,” “T Stamp”, “Trust Stamp”,

“we,” “us” and “our” refer to T Stamp Inc., a Delaware corporation,

and its consolidated subsidiaries.

PROSPECTUS SUMMARY

This summary highlights selected information

appearing elsewhere in this prospectus or incorporated by reference in this prospectus and does not contain all of the information that

you need to consider in making your investment decision. You should carefully read the entire prospectus, the applicable prospectus supplement

and any related free writing prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors”

contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents

that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into

this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Overview

Trust Stamp was incorporated

under the laws of the State of Delaware on April 11, 2016 as “T Stamp Inc.” T Stamp Inc. and its subsidiaries (“Trust

Stamp”, “we”, or the “Company”) develop and market identity authentication software for enterprise and government

partners and peer-to-peer markets.

Trust Stamp develops

proprietary artificial intelligence-powered identity and trust solutions at the intersection of biometrics, privacy, and cybersecurity,

which enable organizations to protect themselves and their users, while empowering individuals to retain ownership of their identity data

and prevent fraudulent activity using their identity.

Trust Stamp tackles industry

challenges including data protection, regulatory compliance, and financial accessibility, with cutting edge technology including biometric

science, cryptography, artificial intelligence, and machine learning. Our core technology irreversibly transforms identity information

to create tokenized identifiers that enable probabilistic authentication without the need to store or share biometric images or traditional

templates. By retaining the usefulness of biometric-derived data while minimizing the risk, we allow businesses, NGOs, and government

agencies to adopt biometrics and other anti-fraud initiatives while protecting end-user personal information from hacks and leaks.

Trust Stamp’s key

sub-markets are identity authentication for the purpose of account opening, access and fraud detection, the creation of tokenized digital

identities to facilitate financial and societal inclusion, and in-community case management software for alternatives to detention and

other governmental uses.

As biometric solutions

proliferate, so does the need to protect biometric data. Stored biometric images and templates represent a growing and unquantified financial,

security and PR liability and are the subject of governmental, media and public scrutiny, since biometric data cannot be “changed”

once they are hacked, as they are directly linked to the user’s physical features and/or behaviors. Privacy concerns around biometric

technology have led to close attention from regulators, with multiple jurisdictions placing biometrics in a special or sensitive category

of personal data and demanding much stronger safeguards around collection and safekeeping.

To address this unprecedented

danger and the increased cross-industry need to establish trust quickly and securely in virtual environments, Trust Stamp has developed

its Irreversibly Transformed Identity Token, or IT2 TM, solutions, which replace biometric templates with a cryptographic hash that can

never be rebuilt into the original data and cannot be used to identify the subject outside the environment for which it is designed.

Trust Stamp’s data

transformation and comparison technology is vendor and modality agnostic, allowing organizations including other biometric services providers

to benefit from the increased protection, efficiency, and utility of our proprietary tokenization process. With online and offline functionality,

Trust Stamp technology is effective in even the most remote locations in the world.

Trust Stamp also offers

end-to-end solutions for multi-factor biometric authentication for account access and recovery, KYC/AML compliance, customer onboarding,

and more, which allow organizations to approve more genuine users, keep bad actors from accessing systems and services, and retain existing

users with a superior user experience.

Markets

Trust Stamp has evaluated

the market potential for its services in part by reviewing the following reports, articles, and data sources, none of which were commissioned

by the Company, and none of which are to be incorporated by reference:

Data security and

fraud

| · | In 2022, 4,145 publicly disclosed breaches exposed over 22 billion records

according to the “2021 Year End Report: Data Breach QuickView” published by Flashpoint. |

| · | The cumulative merchant losses to online payment fraud between 2023 and

2027 will exceed $343 billion globally according to a 2022 report titled “Fighting Online Payment Fraud in 2022 & Beyond”

published by Juniper Research. |

Trust Stamp addresses

this market with biometric identity verification and biometric authentication solutions — which offer Trust Stamp’s proprietary

irreversible identity token to perform biometric-based matching in a secure and tokenized domain, matching tokenized personally identifiable

information while implementing liveness detection.

Biometric authentication

| · | By 2027, the value of biometrically authenticated remote mobile payments

will reach $1.2 trillion globally, according to a 2022 report titled “Mobile Payment Biometrics” published by Juniper Research. |

| · | The global biometric system market size is valued at $41.1 billion per annum

in 2023, with a forecast compound growth of 20.4% from 2023 to 2030 with a 2030 revenue forecast of $150.6 billion according to the 2023

report titled “Biometric Technology Market Size, Share & Trends Analysis Report By Component, By Offering, By Authentication

Type, By Application, By End-use, By Region, And Segment Forecasts, 2023 — 2030” published by Grand View Research. |

Trust Stamp addresses

this market through its biometric authentication and liveness detection products — which offer Trust Stamp’s proprietary irreversible

identity token to perform biometric matching in a secure and tokenized domain. This permits biometric authentication without the risk

of storing pictures and biometric templates.

Financial and societal

inclusion

| · | As of 2021, 1.4 billion people were unbanked according to the “Global

Findex Database 2021” published by The World Bank. |

| · | 131 million small and medium-sized enterprises in emerging markets lack

access to finance, limiting their ability to grow and thrive (UNSGSA Financial Inclusion Webpage, Accessed March 2023) |

| · | The global market for Microfinance is estimated at $157 Billion in the year

2020, and is projected to reach $342 billion by 2026 according to the 2022 report titled “Microfinance - Global Market Trajectory

& Analytics” published by Global Industry Analysts, Inc. |

Trust Stamp’s biometric

authentication, liveness detection, and information tokenization enable individuals to verify and establish their identities using biometrics.

While individuals in this market lack traditional means of identity verification, Trust Stamp provides a means to authenticate identity

that preserves an individual’s privacy and control over that identity.

Alternatives to

Detention (“ATD”)

| · | The ATD market includes Federal, State, and Municipal agencies for both

criminal justice and immigration purposes. Trust Stamp addresses the ATD market with applications built on Trust Stamp’s privacy-preserving

solutions allowing individuals to comply with ATD requirements using ethical and humane technology methodologies. Trust Stamp has developed

innovative patented technologies for use in the ATD market encompassing biometrics, geolocation, and tokenization as well as a proprietary,

tamper-resistant, battery-free “Tap-In-Band” that can complement or replace biometric check-in requirements and provide a

lower-cost and more humane alternative to traditional “ankle bracelet” technology. |

In addition to its key

sub-markets, the Company is developing products and working with partners and industry organizations in other sectors that offer significant

market opportunities, in particular, the travel, healthcare, Metaverse platform and cryptographic key and account credential safekeeping

sectors. For example, the Company has developed a “crypto key vault” solution that leverages proven facial biometric authentication

and irreversible data transformation technology to protect private keys for digital assets while ensuring long-term data protection and

access credential availability.

Principal Products

and Services

Trust Stamp’s most

important technology is the Irreversibly Transformed Identity TokenTM (also known as the IT2 TM, Evergreen

HashTM, EgHashTM and MyHashTM) combined with a data architecture that

can use one or multiple sources of biometric or other identifying data. Once a “hash translation” algorithm is created, like-modality

hashes are comparable regardless of their origin. The IT2 protects against system and data redundancy, providing a lifelong “digital-DNA”

that can store (or pivot to) any type of KYC or relationship data with fields individually hashed or (salted and) encrypted, facilitating

selective data sharing. Products utilizing the IT2 are Trust Stamp’s primary products, accounting for the majority of its revenues

during the nine months ended September 30, 2023.

We adhere to the best

practices outlined in the National Institute of Standards and Technology (“NIST”) and International Organization for Standardization

(“ISO”) frameworks, and our policies and procedures in managing personally identifiable information (“PII”) are

in compliance with General Data Protection Regulation (“GDPR”) requirements wherever such requirements are applicable.

Key Customers

The Company’s initial

business consisted of developing proprietary privacy-first identity solutions and then implementing them through custom applications built

and maintained for a small number of key customers. In 2022, the Company added to its product offerings a modular and highly scalable

Software-as-a-Service (SaaS) model with low-code or no implementation (“the Orchestration Layer”). Although the Company remains

open to significant opportunities to deliver custom solutions, sales of Orchestration Layer products are the primary focus of the Company’s

sales and development initiatives. This strategic pivot in the Company’s go-to-market approach is expected to negatively impact

revenue in 2023 while substantially increasing potential revenue in 2024 and thereafter.

Historically, the Company

generated most of its income through two long-term partnerships, comprising a relationship with an S&P 500 bank with services provided

pursuant to a Master Software Agreement entered into in 2017, together with a relationship with Mastercard International (“Mastercard”)

with services provided under the terms of a ten-year technology services agreement entered into in March 2019 (the "TSA”).

Both of those relationships remain strong, and the Company anticipates future revenue growth from the two relationships.

Under the TSA, IT2 TM technology

is being implemented by Mastercard for Humanitarian & Development purposes as a core element of its Community Pass and Inclusive Identity

offerings. Use cases include not only financial services for individuals and businesses but also empowering people and communities to

meet basic needs, such as nutritious food, clean water, housing, education, and healthcare. Under the TSA, the Company is paid to develop

and host software solutions utilizing the IT2 and to support Mastercard’s implementations. In addition, the Company is paid

on a “per user per year” basis for all transactions utilizing its technology. In December of 2022, the Company entered into

a modification of the agreed pricing schedule with Mastercard to move from a per-use to a per-user-year model to broaden the range of

potential use cases. The TSA may be terminated by either party in the event of a material breach by the other party that remains uncured

within thirty days after notice is received of such a breach. Either party may terminate the TSA if the other party becomes, including,

but not limited to, insolvent, subject to bankruptcy, dissolved or liquidated. Unless the TSA is terminated, the TSA will automatically

renew for additional one year-periods unless either party provides ninety days written notice of intent not to renew. To date, the Company

has received guaranteed minimum annual payments on account of usage. Mastercard’s Community Pass program currently serves approximately

3.5 million users and is targeting 30 million users by 2027. Based upon information provided to us by Mastercard we anticipate user-based

revenue starting in 2024 and growing year-on-year thereafter.

In 2022, the Company

expanded its key customer base to include a relationship with Fidelity Information Services, LLC (“FIS”), a relationship focused

upon the implementation of our Orchestration Layer and underlying technologies in FIS’ Global KYC product offering.

The

Orchestration Layer is a low-code platform that is designed to be a one-stop shop for Trust Stamp services and provides easy integration

to our products; chargeable on a per-use basis. The Orchestration Layer utilizes the Company’s next-generation identity package,

offering rapid deployment across devices and platforms, with custom workflows that seamlessly orchestrate trust across the identity lifecycle

for a consistent user experience in processes for onboarding and KYC/AML, multi-factor authentication, account recovery, fraud prevention,

compliance, and more. The Orchestration Layer facilitates no-code and low-code implementations of the Company’s technology making

adoption and updating faster and cost-effective for a broader range of potential customers.

In the third quarter

of 2022, the Company acquired its first 2 new customers on the Orchestration Layer through its partnership with FIS, and in the fourth

quarter of 2022, 4 additional FIS customers onboarded. As of September 30, 2023, a total of 35 financial institutions with over $297 billion

in assets have been onboarded via FIS, bringing the total number of (FIS and non-FIS) customers either fully implemented or are currently

implementing the Orchestration Layer to 38. The first (non-FIS) client onboarded to the Orchestration Layer in the third quarter of 2022

has generated $180 thousand of revenue for the Company to date including $137 thousand

during the nine months ended September 30, 2023. Although each of the institutions onboarded via FIS pays a small onboarding fee, given

the typical time taken by a financial institution to test, implement and roll out any new technology, the Company does not anticipate

significant revenue from the new FIS customers until 2024.

Reinforced

by the product-market fit indicated by the FIS roll-out, the Company is building an internal direct sales force to offer the Orchestration

Layer to non-FIS institutions. A key criterion for the account executives recruited is possessing significant experience and a successful

track record in the identity solutions market. The Company anticipates contracted revenue from this initiative in 2023 and significant

banked revenue in 2024.

In Management's opinion,

we would be able to continue operations without our current customers, including our channel partnership with FIS. However, the unanticipated

loss of the Company’s current customers could have an adverse effect on the Company’s financial position.

Recent Developments

Private Placement,

Entry Into Warrant Exchange Agreement, and Issuance of the Warrants

On December 21,

2023, the Company entered into a warrant exercise agreement (the “WEA”) with the Selling Stockholder,

pursuant to which the Selling Stockholder agreed to exercise (the

“Exercise”) (i) a portion (106,670) of the warrants issued to the Selling Stockholder on June

5, 2023, which are exercisable for 1,279,700 shares of the Company’s Class A Common Stock, par value $0.01 per share

(“Class A Common Stock”) with a current exercise price of $2.30 per share (the “June 2023

Warrants”), (ii) all of the warrants issued to the Selling Stockholder on September 14, 2022, as amended on June 5,

2023, which are exercisable for 120,000 shares of Class A Common Stock, with a current exercise price of $2.30 per share (the

“September 2022 Warrants”), and (iii) all of the warrants issued to the Selling Stockholder on April 18,

2023, which are exercisable for 1,573,330 shares of Class A Common Stock, with a current exercise price of $3.30 per share (the

“April 2023 Warrants” and collectively with all of the June 2023 Warrants and the September 2022 Warrants,

the “Existing Warrants”). In consideration for the immediate

exercise of 1,800,000 of the Existing Warrants for cash, the Company agreed to reduce the exercise price of all of the Existing

Warrants, including any unexercised portion thereof, to $1.34 per share, which is equal to the most recent closing price of the

Company’s Class A Common Stock on The Nasdaq Stock Market prior to the execution of the WEA. As of December 31, 2023,

Armistice had submitted an Exercise Notice for 918,000 Existing Warrants and the shares of Class A Common Stock were issued to the

warrant holders. The remaining 882,000 Existing Warrants from this exercise are held in abeyance until the Company receives notice

from the holders that the remaining shares may be issued in compliance with the beneficial ownership limitation. In

addition, in consideration for such Exercise, the Selling Stockholder received new unregistered warrants to purchase up to an

aggregate of 3,600,000 shares of Class A Common Stock, equal to 200% of the shares of Class A Common Stock issued in connection with

the Exercise, with an exercise price of $1.34 per share (the “New Warrants”) in a private placement

pursuant to Section 4(a)(2) of the Securities Act of 1933 (the “Securities Act”). The New Warrants

have substantially the same terms as the June 2023 Warrants.

The Company agreed to

file a resale registration statement on Form S-3 with respect to the New Warrants and the shares of Class A Common Stock issuable upon

exercise of the New Warrants, which is the purpose of this registration statement.

The gross proceeds to

the Company from the Exercise were approximately $2.41 million, prior to deducting warrant inducement agent fees and estimated offering

expenses. The Company intends to use the remainder of the net proceeds for business growth, working capital, and general corporate purposes.

As of February 16,

2024, the Selling Stockholder has not exercised the New Warrants. All 3,600,000 of the New Warrants remain outstanding as of

February 16, 2024. (Note – the “New Warrants” referenced above are the “Warrants” referred to throughout

this prospectus, which may be exercised by the Selling Stockholder for the Warrant Shares that we are registering for resale from time

to time pursuant to this registration statement).

Corporate Information

Trust Stamp was incorporated under the laws of

the State of Delaware on April 11, 2016 as “T Stamp Inc.” Our principal executive offices are located at 3017 Bolling Way

NE, Floors 1 and 2, Atlanta, GA 30305, and our telephone number is (404) 806-9906. Our website address is www.truststamp.ai.

None of the information contained on, or that may be accessed through, our website is a prospectus or constitutes part of, or is otherwise

incorporated into this prospectus.

The Offering

| Issuer |

T Stamp Inc., a Delaware corporation |

| |

|

Securities Offered by

the Selling Stockholder

|

Up to 3,600,000 shares of Class A Common Stock issuable upon exercise of the Warrants |

|

Shares of Class A

Common Stock

Outstanding Prior to

this Offering

(as of

December 31, 2023):

|

9,198,089 (1) |

| |

|

|

Shares of Class A

Common Stock

Outstanding

Assuming Exercise of

All Warrants:

|

12,798,089 (2) |

| |

|

| Use of Proceeds |

We will not receive any proceeds from the sale of our Class A Common Stock offered by the Selling Stockholder under this prospectus. However, in the case of Warrants being exercised by the Selling Stockholder for cash, the Selling Stockholder would pay us an exercise price of $1.34 per share of Class A Common Stock, subject to any adjustment pursuant to the terms of the Warrants, or an aggregate of approximately $4,824,000 if the Warrants are exercised in full for cash. The Warrants are also exercisable on a cashless basis, and if the Warrants are exercised on a cashless basis, we would not receive any cash payment from the Selling Stockholder upon any such exercise of the Warrants. |

| |

|

| Risk Factors |

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus, and any other risk factors described in a prospectus supplement and in the documents incorporated herein and therein by reference, for a discussion of certain factors that you should carefully consider before deciding to invest in our securities. |

| |

|

Nasdaq Capital

Market Trading

Symbol |

IDAI |

| (1) | The above discussion is based

on 9,198,089 shares of Class A Common Stock outstanding as of December 31, 2023, but excludes up to 8,026,641 shares of Class A Common

Stock acquirable within 60 days of December 31, 2023 from the conversion, vesting, and/or exercise of outstanding restricted stock units,

stock options, warrants, and stock grants. As of December 31, 2023, the remaining 882,000 Existing Warrants held

in abeyance are included in the shares acquirable within 60 days. |

| (2) | Assumes 3,600,000 shares of Class

A Common Stock underlying the Warrants exercised by the Selling Stockholder. |

RISK FACTORS

Investing in our securities involves a high degree

of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described under

the heading “Risk Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and

discussed under the section entitled “Risk Factors” contained in our most recent Registration Statement on Form S-1 (File

No.: 333-274160), which is incorporated by reference into this prospectus in their entirety,

together with other information in this prospectus, the documents incorporated by reference and any free writing prospectus that we may

authorize for use in connection with this offering. The risks described in these documents are not the only ones we face, but those that

we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that

could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance,

and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our

business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our

securities to decline, resulting in a loss of all or part of your investment. Please also carefully read the section below entitled “Special

Note Regarding Forward-Looking Statements.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, each prospectus supplement and

the information incorporated by reference in this prospectus and each prospectus supplement contain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section

21E of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), that involve risks and uncertainties,

as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially and adversely

from those expressed or implied by such forward-looking statements. Forward-looking statements may include, but are not limited to, statements

relating to our outlook or expectations for earnings, revenues, expenses, asset quality or other future financial or business performance,

strategies, expectations or business prospects, or the impact of legal, regulatory or supervisory matters on our business, results of

operations, or financial condition. Specifically, forward-looking statements may include statements relating to our future business prospects,

revenue, income, and financial condition.

Forward-looking statements can be identified by

the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,”

“expect,” “anticipate,” “believe,” “seek,” “target,” or similar expressions.

Forward-looking statements reflect our judgment based on currently available information and involve a number of risks and uncertainties

that could cause actual results to differ materially from those described in the forward-looking statements.

Important factors could cause actual results to

differ materially from our expectations include, but are not limited to:

| |

· |

adverse economic conditions; |

| |

· |

general decreases in demand for our products and services; |

| |

· |

changes in timing of introducing new products into the market; |

| |

· |

intense competition (including entry of new competitors), including among competitors with substantially greater resources than us; |

| |

· |

revenues and net income lower than anticipated; |

| |

· |

becoming delisted from Nasdaq; |

| |

· |

the possible fluctuation and volatility of operating results and financial conditions; |

| |

· |

the impact of legal, regulatory, or supervisory matters on our business, results of operations, or financial condition; |

| |

· |

inability to carry out our marketing and sales plans; and |

| |

· |

the loss of key employees and executives. |

Forward-looking statements are based on

assumptions we have made in light of our industry experience and our perceptions of historical trends, current conditions, expected

future developments and other factors we believe are appropriate under the circumstances. You are cautioned that these statements

are not guarantees of performance or results. They involve risks, uncertainties (many of which are beyond our control) and

assumptions. Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that

many factors could affect our actual operating and financial performance and cause our performance to differ materially from the

performance anticipated in the forward-looking statements. We discuss in greater detail many of these risks in the applicable

prospectus supplement, in any free writing prospectuses we may authorize for use in connection with a specific offering, in our most

recent annual report on Form 10-K, as well as any amendments thereto, and in our subsequent filings with the SEC, which are

incorporated by reference into this prospectus in their entirety.

Unless required by law, we undertake no obligation

to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume

that actual events are bearing out as expressed or implied in such forward-looking statements. You should read this prospectus, any applicable

prospectus supplement, together with the documents we have filed with the SEC that are incorporated by reference and any free writing

prospectus that we may authorize for use in connection with this offering completely and with the understanding that our actual future

results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by

these cautionary statements.

USE OF PROCEEDS

We will not receive any proceeds from the sale

of the Warrant Shares covered by this prospectus and any accompanying prospectus supplement. All proceeds from the sale of the Warrant

Shares will be for the account of the Selling Stockholder. However, we will receive the proceeds of any cash exercise of the Warrants.

We intend to use the net proceeds from any cash exercise of the Warrants for general corporate purposes, which includes working capital,

business and product development, potential acquisitions, retirement of debt and other business opportunities. The timing and amount of

our actual expenditures will be based on many factors; therefore, unless otherwise indicated in the prospectus supplement, our management

will have broad discretion to allocate the net proceeds of our offerings.

We will bear all other costs, fees and expenses

incurred in effecting the registration of the offering and sale of the Warrant Shares covered by this prospectus and any accompanying

prospectus supplement, including, without limitation, all registration and filing fees, Nasdaq listing fees and fees and expenses of our

counsel and our accountants, in accordance with the terms of the WEA. The Selling Stockholder will pay any discounts, commissions, and

fees of underwriters, selling brokers, dealer managers or similar securities industry professionals incurred by the Selling Stockholder

in disposing of the Warrant Shares covered by this prospectus.

THE SELLING STOCKHOLDER

The shares of Class A

Common Stock (or Warrant Shares) being offered by the Selling Stockholder are those issuable to the Selling Stockholder upon exercise

of the Warrants. For additional information regarding the issuance of the Warrants, see “Recent Developments” further above

in this prospectus. We are registering the shares of Class A Common Stock issuable upon exercise of the Warrants in order to permit the

Selling Stockholder to offer the shares for resale from time to time.

In September 2022, April

2023, and June 2023, the Selling Stockholder and the Company engaged in transactions whereby, pursuant to the terms of Securities Purchase

Agreements dated September 11, 2022, April 14, 2023, and June 5, 2023, respectively, the Company sold the Selling Stockholder a number

of shares of Class A Common Stock and warrants to purchase shares of Class A Common Stock in various private placement transactions, and

subsequently filed registration statements on Form S-1 that were declared effective in January 2023 (File No. 333-267668), August 2023

(File No. 333-272343), and September 2023 (File No. 333-274160), respectively, to register for resale by the Selling Stockholder those

shares, as well as the shares issuable upon the exercise of the warrants sold to this investor in those transactions. Apart from these

previous transactions, and the transactions described in this prospectus relating to the WEA, the Selling Stockholder has not had any

material relationship with the Company within the past three years.

The table below lists

beneficial ownership information of the Selling Stockholder as of the date of this prospectus, as well as the expected beneficial ownership

of the Selling Stockholder after the conclusion of this offering.

In accordance with the

terms of the WEA with the Selling Stockholder, this prospectus generally covers the resale of the maximum number of shares of Class A

Common Stock issuable upon exercise of the Warrants, determined as if the outstanding Warrants were exercised in full as of the trading

day immediately preceding the date this registration statement was initially filed with the SEC, each as of the trading day immediately

preceding the applicable date of determination and all subject to adjustment as provided in the WEA, without regard to any limitations

on the exercise of the Warrants. The fourth column assumes the sale of all the shares offered by the Selling Stockholder pursuant to this

prospectus.

Under the terms of the Warrants, the Selling Stockholder

may not exercise Warrants to the extent such exercise would cause the Selling Stockholder, together with its affiliates and attribution

parties, to beneficially own a number of shares of Class A Common Stock which would exceed 4.99% (or, at the option of the Selling Stockholder

upon 61 days’ notice to the Company subject to the terms of such Warrants, up to 9.99%), as applicable, of our then outstanding

Class A Common Stock following such exercise, excluding for purposes of such determination shares of Class A Common Stock issuable upon

exercise of such Warrants which have not been exercised. The number of shares in the table do not reflect this limitation. The Selling

Stockholder may sell all, some or none of the Warrant Shares in this offering. See “Plan of Distribution.”

| | |

Number of shares of | | |

Maximum Number of shares | | |

Number of shares of | |

| Name of Selling | |

Class A Common Stock Owned | | |

of Class A Common Stock to be Sold | | |

Class A Common Stock | |

| Stockholder | |

Prior to Offering | | |

Pursuant to this prospectus | | |

Owned After Offering | |

| Armistice Capital, LLC | |

| 5,655,030 | (1) | |

| 3,600,000 | (2) | |

| 5,655,030 | (3) |

| (1) |

Consists of (i) 2,055,030 shares of Class A Common Stock underlying

certain other warrants held by Armistice Capital Master Fund Ltd.; and (iii) 3,600,000 shares of Class A Common Stock underlying the Warrants. |

| (2) |

The securities to be sold pursuant to this prospectus include 3,600,000 shares of Class A Common Stock that may be exercised pursuant to the Warrants, all of which are directly held by Armistice Capital Master Fund Ltd. (the “Master Fund”), a Cayman Islands exempted company, and may be deemed to be indirectly beneficially owned by Armistice Capital, LLC (the “Selling Stockholder”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of the Selling Stockholder. The Warrants are subject to a 4.99% beneficial ownership limitation, which limitations prohibit the Selling Stockholder from exercising any portion of the Warrants if, following such exercise, the Selling Stockholder’s ownership of our Class A Common Stock would exceed the applicable ownership limitation. This beneficial ownership limitation may be increased up to 9.99% at the option of the Selling Stockholder upon 61 days’ notice to the Company subject to the terms of such Warrants. The address of the Selling Stockholder is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

| (3) |

Assumes the sale of all shares offered by the Selling Stockholder pursuant to this prospectus. |

SECURITIES BEING REGISTERED AND DESCRIPTION

OF CAPITAL STOCK

We are registering for

resale by the Selling Stockholder from time to time of up to an aggregate of 3,600,000 shares of Class A Common Stock issuable upon the

exercise of the Warrants sold to the Selling Stockholder in a private placement offering consummated on December 21, 2023.

General

The authorized capital stock of the Company consists

of Common Stock, par value $0.01 per share. The total number of authorized shares of Common Stock of Trust Stamp is 50,000,000, all of

which are designated as Class A Common Stock.

The following summary description of our capital

stock is based on the provisions of our Third Amended & Restated Certificate of Incorporation, our amended and restated bylaws and

the applicable provisions of the Delaware General Corporation Law (the “DGCL”). This description is not complete

and is subject to, and qualified in its entirety by reference to our Third Amended & Restated Certificate of Incorporation (our “A&R

Certificate of Incorporation”) and our amended and restated bylaws (our “Bylaws”), each of which

is incorporated by reference as an exhibit to the registration statement of which this prospectus forms a part, and the DGCL. You should

read our A&R Certificate of Incorporation our Bylaws and the applicable provisions of the DGCL for a complete statement of the provisions

described below and for other provisions that may be important to you. For information on how to obtain copies of our A&R Certificate

of Incorporation and our Bylaws, see “Where You Can Find Additional Information.”

Common Stock

Pursuant to the Company’s A&R Certificate

of Incorporation, the Board of Directors of the Company has the right to designate shares of the Company’s Common Stock as either

Class A or Class B Common Stock. As of the date of this prospectus, all shares of Common Stock of the Company have been designated

as Class A Common Stock, and there is no issued (or designated) Class B Common Stock. The rights and preferences of each of

the Class A and Class B classes of Common Stock are summarized below.

Class A Common Stock

Voting Rights

Holders of shares of Class A Common Stock

are entitled to one vote for each on all matters submitted to a vote of the shareholders, including the election of directors.

Dividend Rights

Holders of each class of Common Stock are entitled

to receive dividends, as may be declared from time to time by the Board of Directors out of legally available funds as detailed in our

A&R Certificate of Incorporation. The Company has never declared or paid cash dividends on any of its capital stock and currently

does not anticipate paying any cash dividends after this offering or in the foreseeable future.

Liquidation Rights

In the event of a voluntary or involuntary liquidation,

dissolution, or winding up of the Company, the holders of Class A Common Stock are entitled to share ratably in the net assets legally

available for distribution to shareholders after the payment of all debts and other liabilities of the Company.

Exchange Rights

A holder of shares of Class A Common Stock

shares that is a bank, savings association, or a holding company (or an affiliate thereof) may at any time choose to exchange all or any

portion of shares of Class A Common Stock it holds for shares of Class B Common Stock. In the event of such an election, each

Class A share for which the holder makes such election shall be exchanged for a Class B share on a one-for-one basis without

the payment of any additional consideration. In the event of such an election, the Company will take all necessary corporate actions to

affect such exchange, the holder will surrender its certificate or certificates representing the shares of Class A Common Stock for

which it made such election, and such Shares of Class A Common Stock shall be cancelled.

Transfer Rights

There are no restrictions on the transfer of shares

of Class A Common Stock of the Company.

Class B Common Stock

The rights and preferences of the Company’s

Class B Common Stock are identical to those of the Class A Common Stock of the Company, except for as described below.

Voting Rights

Holders of shares of Class B Common Stock

have no voting rights with respect to such shares; provided that the holders of Class B Common Stock shall be entitled to vote (one

vote for each Class B share held) to the same extent that the holders of Shares of Class A Common Stock would be entitled to

vote on matters as to which non-voting equity interests are permitted to vote pursuant to 12 C.F.R. § 225.2(q)(2) (or a successor

provision thereto).

Transfer Rights

In the event a holder of shares of Class B

Common Stock transfers all or any portion of his or her shares of Class B Common Stock to a “Permitted Transferee” (as

defined below), such Permitted Transferee will be entitled to elect to exchange all or any portion of such Shares of Class B Common

Stock for Shares of Class A Common Stock on a one-for-one basis without the payment of any additional consideration. No fractional

shares may be so exchanged. In the event of such an election, the Company will take all necessary corporate actions to effect such exchange,

the holder will surrender its certificate or certificates representing the Shares of Class B Common Stock for which it made such

election, and such Shares of Class B Common Stock shall be cancelled. A “Permitted Transferee” is a person or entity

who acquires Shares of Class B Common Stock from a bank, savings association, or a holding company (or an affiliate thereof) in any

of the following transfers:

| |

(i) |

A widespread public distribution; |

| |

(ii) |

A private placement in which no one party acquires the right to purchase 2% or more of any class of voting securities of the Company |

| |

(iii) |

An assignment to a single party (e.g. a broker or investment banker) for the purpose of conducting widespread public distribution on behalf of a bank, savings association, or a holding company (or an affiliate thereof) and its transferees (other than transferees that are Permitted Transferees); or |

| |

(iv) |

To a party who would control more than 50% of the voting securities of the Company without giving effect to the Shares of Class B Common Stock transferred by a bank, savings association, or a holding company (or an affiliate thereof) and its transferees (other than transferees that are Permitted Transferees). |

Warrants

The Company has various warrants outstanding that

are exercisable for shares of its Class A Common Stock. See the Company’s Quarterly Report on Form 10-Q for

the quarter ended September 30, 2023 filed with the SEC on November 7, 2023, as well as the Current Report on Form 8-K filed by the Company

on December 21, 2023, for information on the outstanding warrants of the Company.

Anti-Takeover Effects of Our Certificate of Incorporation and Bylaws

Our A&R Certificate of Incorporation and Bylaws

contain certain provisions that could have the effect of delaying, deferring or discouraging another party from acquiring control of us.

These provisions, which are summarized below, could discourage takeovers, coercive or otherwise. These provisions are also designed, in

part, to encourage persons seeking to acquire control of us to negotiate first with our Board of Directors. We believe that the benefits

of increased protection of our potential ability to negotiate with an unfriendly or unsolicited acquirer outweigh the disadvantages of

discouraging a proposal to acquire us.

Authorized but Unissued Capital Stock

We have authorized but unissued shares of Common

Stock, and our Board of Directors may authorize the issuance of one or more series of preferred stock without stockholder approval. These

shares could be used by our Board of Directors to make it more difficult or to discourage an attempt to obtain control of us through a

merger, tender offer, proxy contest or otherwise.

Limits on Stockholder Action to Call a Special Meeting

Our Bylaws provide that special meetings of the

stockholders may be called only by our Board of Directors. A stockholder may not call a special meeting, which may delay the ability of

our stockholders to force consideration of a proposal or for holders controlling a majority of our capital stock to take any action, including

the removal of directors.

Our A&R Certificate of Incorporation authorizes our Board

of Directors to fill vacancies or newly created directorships.

If there is a vacancy on our Board of Directors,

the majority of the directors then in office may elect a successor to fill any vacancies or newly created directorships. This may also

discourage or deter a potential acquirer from conducting a solicitation of proxies to elect their own slate of directors or otherwise

attempt to obtain control of our Company.

Classified Board

of Directors

The A&R Certificate

of Incorporation provides for a classified board of directors of the Company, with the board divided into three classes. Class I will

hold office for a term expiring at the 2023 annual meeting of stockholders; Class II will hold office initially for a term expiring at

the 2024 annual meeting of stockholders; and Class III will hold office initially for a term expiring at the 2025 annual meeting of stockholders.

At each annual meeting following this initial classification and election, the successors to the class of directors whose terms expire

at that meeting would be elected for a term of office to expire at the third succeeding annual meeting after their election and until

their successors have been duly elected and qualified.

The Class I directors

were elected at the 2023 annual meeting for a term of office for a term expiring at the 2026 annual meeting.

PLAN OF DISTRIBUTION

The Selling Stockholder, which as used herein

includes certain donees, pledgees, transferees, or other successors-in-interest selling Warrant Shares or interests in Warrant Shares

received after the date of this prospectus from the Selling Stockholder as a gift, pledge, partnership distribution or other transfer,

may, from time to time, sell, transfer or otherwise dispose of any or all of their Warrant Shares on any stock exchange, market or trading

facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices

at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated

prices.

The Selling Stockholder may use any one or more

of the following methods when disposing of shares or interests therein:

| |

· |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

· |

block trades in which the broker-dealer will

attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the

transaction; |

| |

· |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

· |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

· |

privately negotiated transactions; |

| |

· |

short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC; |

| |

· |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

· |

broker-dealers may agree with the Selling Stockholder to sell a specified number of such shares at a stipulated price per share; |

| |

· |

a combination of any such methods of sale; and |

| |

· |

any other method permitted by applicable law. |

The Selling Stockholder may transfer the Warrant

Shares in other circumstances, in which case the transferees, pledgees, or other successors in interest will be the selling beneficial

owners for purposes of this prospectus.

In connection with the sale of our Class A Common

Stock or interests therein, the Selling Stockholder may enter into hedging transactions with broker-dealers or other financial institutions,

which may in turn engage in short sales of the Class A Common Stock in the course of hedging the positions they assume. The Selling Stockholder

may also sell shares of our Class A Common Stock short and deliver these securities to close out its short positions, or loan or pledge

the Class A Common Stock to broker-dealers that in turn may sell these securities. The Selling Stockholder may also enter into option

or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require

the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the Selling Stockholder

from the sale of the Warrant Shares offered by them will be the sale price of the Warrant Shares less discounts or commissions, if any.

The Selling Stockholder reserves the right to accept and, together with its agents from time to time, to reject, in whole or in part,

any proposed purchase of Warrant Shares to be made directly or through agents. We will not receive any of the proceeds from this offering.

The Selling Stockholder also may resell all or

a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act of 1933, provided that it

meets the criteria and conforms to the requirements of that rule.

The Selling Stockholder and any underwriters,

broker-dealers or agents that participate in the sale of the Class A Common Stock or interests therein may be “underwriters”

within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions, or profit they earn on any resale

of the shares may be underwriting discounts and commissions under the Securities Act. If any of the Selling Stockholder is an “underwriter”

within the meaning of Section 2(11) of the Securities Act, it will be subject to the prospectus delivery requirements of the Securities

Act.

To the extent required, the shares of our Class

A Common Stock to be sold, the names of the Selling Stockholder, the respective purchase prices and public offering prices, the names

of any agents, dealer, or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in

an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this

prospectus.

In order to comply with the securities laws of

some states, if applicable, the Warrant Shares may be sold in these jurisdictions only through registered or licensed brokers or dealers.

In addition, in some states the Warrant Shares may not be sold unless it has been registered or qualified for sale or an exemption from

registration or qualification requirements is available and is complied with.

We have advised the Selling Stockholder that the

anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of

the Selling Stockholder and their affiliates. In addition, to the extent applicable we will make copies of this prospectus (as it may

be supplemented or amended from time to time) available to the Selling Stockholder for the purpose of satisfying the prospectus delivery

requirements of the Securities Act. The Selling Stockholder may indemnify any broker-dealer that participates in transactions involving

the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

We have agreed to indemnify the Selling Stockholder

against liabilities, including liabilities under the Securities Act and the Exchange Act, relating to the registration of the shares offered

by this prospectus.

We have agreed with the Selling Stockholder to

keep the registration statement of which this prospectus constitutes a part effective at all times until no Selling Stockholder owns any

Warrants or Warrant Shares.

Our Class A Common Stock is listed on the Nasdaq

Capital Market under the symbol “IDAI.”

LEGAL MATTERS

The validity of the securities being offered hereby

will be passed upon for us by CrowdCheck Law, LLP. Additional legal matters may be passed upon for us or any underwriters, dealers or

agents, by counsel named in the applicable prospectus supplement.

EXPERTS

The consolidated financial

statements of T Stamp Inc. and its subsidiaries as of December 31, 2022 and for the fiscal year then ended, have been audited by Marcum

LLP, an independent registered public accounting firm, as set forth in their reports thereon, included in T Stamp Inc.’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022. The report of Marcum LLP includes an explanatory paragraph related to

the substantial doubt about the Company’s ability to continue as a going concern. Such consolidated financial statements have been

incorporated herein by reference in reliance upon such report given on the authority of such firms as experts in accounting and auditing.

The consolidated financial

statements of T Stamp Inc. and its subsidiaries as of December 31, 2021 and for the fiscal year then ended, have been audited by Cherry

Bekaert LLP, an independent registered public accounting firm, as set forth in their reports thereon, included in T Stamp Inc.’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022. The report of Cherry Bekaert LLP includes an “Emphasis Of Matter

Regarding Liquidity”. Such consolidated financial statements have been incorporated herein by reference in reliance upon such report

given on the authority of such firms as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements

and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

This prospectus and any prospectus supplement

are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement.

The full registration statement may be obtained from the SEC or us, as provided below. Other documents establishing the terms of the offered

securities are or may be filed as exhibits to the registration statement. Statements in this prospectus or any prospectus supplement about

these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should

refer to the actual documents for a more complete description of the relevant matters. You may obtain a copy of the registration statement

through the SEC’s website, as provided above.

We maintain a website at www.truststamp.ai.

None of the information contained on, or that may be accessed through, our website is a prospectus or constitutes part of, or is otherwise

incorporated into, this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC’s rules allow us to “incorporate

by reference” information into this prospectus, which means that we can disclose important information to you by referring you to

another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and

subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in

this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this

prospectus to the extent that a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies

or replaces that statement.

This prospectus and any accompanying prospectus

supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

| |

● |

our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 30, 2023; |

| |

● |

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023 filed with the SEC on May 15, 2023 June 30, 2023 filed with the SEC on August 14, 2023, and September 30, 2023, filed with the SEC on November 7, 2023. |

| |

● |

our Current Reports on Form 8-K and 8-K/A, filed with the SEC on January 25, 2023, February 8, 2023, March 22, 2023, March 30, 2023, April 7, 2023, April 11, 2023, April 12, 2023, April 18, 2023, April 20, 2023, May 8, 2023, May 15, 2023, June 5, 2023, July 7, 2023, August 14, 2023, September 20, 2023, October 23, 2023, November 7, 2023, December 21, 2023, and January 3, 2024. |

| |

● |

Description of our Class A Common Stock, and Risk Factors applicable to our Company, each of which is contained in our Registration Statement on Form S-1 filed with the SEC on August 23, 2023, including any amendment or report filed for the purpose of updating such description. |

All reports and other documents we subsequently

file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, but excluding any information

furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this

prospectus from the date of the filing of such reports and documents.

We will furnish without charge to each person,

including any beneficial owner, to whom a prospectus is delivered, upon written or oral request, a copy of any or all of the documents

incorporated by reference into this prospectus but not delivered with the prospectus, including exhibits that are specifically incorporated

by reference into such documents. You should direct any requests for documents to:

T Stamp Inc.

3017 Bolling Way NE, Floors 1 and 2, Atlanta, Georgia,

30305

Attention: Corporate Secretary

(404) 806-9906

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth an estimate of

the fees and expenses, other than the underwriting discounts and commissions, payable by the registrant in connection with the issuance

and distribution of the securities being registered. All the amounts shown are estimates, except for the SEC registration fee.

| |

|

Amount |

|

| SEC registration fee |

|

$ |

712.02 |

|

| Accounting fees and expenses |

|

|

10,000.00 |

* |

| Legal fees and expenses |

|

|

20,000.00 |

|

| Printing and miscellaneous fees and expenses |

|

|

2,500.00 |

|

| Total |

|

$ |

33,212.02 |

|

| * |

These fees are calculated based on the securities offered and the number of issuances and accordingly cannot be estimated at this time. |

Item 15. Indemnification of Directors and Officers

Our A&R Certificate of Incorporation contains

provisions limiting the liability of directors to the fullest extent permitted by Delaware law and provides that we will indemnify each

of our directors and officers to the fullest extent permitted under Delaware law. Our A&R Certificate of Incorporation and Bylaws

also provide our Board of Directors with the discretion to indemnify our employees and other agents when determined appropriate by the

Board. In addition, each employment agreement entered into between the Company and its officers and/or directors contains certain indemnification

provisions, which require us to indemnify them in certain circumstances.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers, or persons controlling our Company pursuant to the foregoing provision,

we have been informed that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act

and is therefore unenforceable.

Item 16. Exhibits

| Exhibit No. |

|

Exhibit Description |

| 3.1 |

|

Third Amended and Restated Certificate of Incorporation (incorporated by reference to the Company’s Form 8-K filed with the SEC on July 7, 2023). |

| 3.2 |

|

Amended and Restated Bylaws of the Company (incorporated by reference to Exhibit 3.2 to the Company's Current Report on Form 8-K filed with the SEC on December 12, 2022) |

| 4.1 |

|

Warrant issued to the Armistice Capital Master Fund Ltd. dated September 14, 2022 (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed with the SEC on September 15, 2022). |

| 4.2 |

|

Form of Warrant dated November 9, 2016 ($5,000 per share) (incorporated by reference to Exhibit 3.9 to the Company’s Form DOS filed with the SEC on December 30, 2019). |

| 4.3 |

|

Form of Warrant dated November 9, 2016 ($1,000,000) (incorporated by reference to Exhibit 3.10 to the Company’s Form DOS filed with the SEC on December 30, 2019). |

| 4.4 |

|

Form of Warrant dated September 30, 2016 (incorporated by reference to Exhibit 3.11 to the Company’s Form DOS filed with the SEC on December 30, 2019). |

| 4.5 |

|

Form of Warrant dated December 16, 2016 (incorporated by reference to Exhibit 3.12 to the Company’s Form DOS filed with the SEC on December 30, 2019). |

| 4.6 |

|

Warrant issued by the Company to Reach® Ventures 2017 LP (incorporated by reference to Exhibit 3.14 to the Company’s Form 1-A filed with the SEC on March 12. 2020). |

| 4.7 |

|

Warrant issued by the Company to Second Century Ventures, LLC (incorporated by reference to Exhibit 3.15 to the Company’s Form 1-A filed with the SEC on March 12. 2020). |

| 4.8 |

|

Form of Private Placement Warrant (incorporated by reference to Exhibit 4.2 to the Company’s Current Report on Form 8-K filed with the SEC on April 18, 2023). |

| 4.9 |

|

Form of Private Placement Warrant (incorporated by reference to Exhibit 4.2 to the Company’s Current Report on Form 8-K filed with the SEC on June 5, 2023). |

| 4.10 |

|

Form of New Warrant (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed with the SEC on December 21, 2023). |

| 5.1* |

|

Opinion of CrowdCheck Law, LLP |

| 10.1 |

|

Emergent Agreement dated June 11, 2020 (incorporated by reference to Exhibit 6.11 to the Company’s Form 1-SA for the six months ended June 30, 2020 filed with the SEC on September 28, 2020). |

| 10.2 |

|

Executive Employment Agreements of Gareth Genner and Andrew Gowasack, effective as of December 8, 2020 (incorporated by reference to Exhibit 6.13 to the Company’s Form 1-K for the year ended December 31, 2020 filed with the SEC on April 30, 2021). |

| 10.3 |

|

Malta Enterprise Letter dated July 8, 2020 sent to the Company (Repayable Advance of €800,000) (incorporated by reference to Exhibit 6.14 to the Company’s Form 1-A/A filed with the SEC on January 12, 2022). |

| 10.4 |

|

Purchase Order executed September 23, 2021 issued by U.S. Immigration and Customs Enforcement to the Company (as Contractor) (incorporated by reference to Exhibit 6.15 to the Company’s Form 1-A/A filed with the SEC on January 12, 2022). |

| 10.5 |

|

Letter of Appointment effective December 1, 2021 sent by the Company to Berta Pappenheim (as non-executive director appointee) (incorporated by reference to Exhibit 6.16 to the Company’s Form 1-A/A filed with the SEC on January 12, 2022). |

| 10.6 |

|

Letter of Appointment effective December 1, 2021 sent by the Company to Kristin Stafford (as non-executive director appointee) (incorporated by reference to Exhibit 6.17 to the Company’s Form 1-A/A filed with the SEC on January 12, 2022). |

| 10.7 |

|

Warrant Agency Agreement between the Company and Colonial Stock Transfer Company, Inc. dated August 20, 2021. (incorporated by reference to Exhibit 6.18 to the Company’s Form 1-A/A filed with the SEC on January 12, 2022). |

| 10.8 |

|

Mutual Channel Agreement dated November 15, 2020 between the Company and Vital4Data, Inc. (incorporated by reference to Exhibit 6.19 to the Company’s Form 1-A/A filed with the SEC on January 12, 2022). |

| 10.9 |

|