Sportsman's Warehouse Holdings, Inc. (“Sportsman's Warehouse” or

the “Company”) (Nasdaq: SPWH) today announced third quarter

financial results for the thirteen and thirty-nine weeks ended

November 2, 2024.

“Despite a pressured consumer and complex

macroeconomic environment, we focused our efforts on driving sales

and achieved growth in our fishing, camping and gift bar categories

during the quarter,” said Paul Stone, Sportsman’s Warehouse

President and Chief Executive Officer. “We continue to make

progress on our business reset initiatives with a focus on improved

in-stocks, in-store and online customer experience and our Great

Gear | Great Service program.”

“To improve our holiday relevancy and drive

traffic during the season, we introduced an omni-channel marketing

campaign highlighting gear perfect for gifting or for treating

yourself, primarily centered around value,” continued Stone. “This

is a new approach to engaging our customers, which we coupled with

an upgraded store experience creating a fully integrated customer

experience. As we move through the balance of the holiday season

and navigate a pressured consumer environment, we’ll continue to

prioritize traffic-driving marketing and product pricing

initiatives, exceptional customer service and prudent inventory

management. Emphasizing the balance sheet and ending the year with

positive free cash flow remain our primary objectives.”

For the thirteen weeks ended November 2,

2024:

- Net sales were

$324.3 million, a decrease of 4.8%, compared to $340.6 million in

the third quarter of fiscal year 2023. The net sales decrease was

primarily due to the continued impact of consumer inflationary

pressures on discretionary spending, resulting in a decline in

store traffic and lower demand across most product categories,

particularly in ammunition, apparel and footwear. This decrease,

however, was partially offset by year-over-year sales growth in our

fishing, camping and optics and accessories departments.

- Same store sales

decreased 5.7% during the third quarter of fiscal year 2024,

compared to the third quarter of fiscal year 2023, primarily as a

result of the impact of consumer inflationary pressures and

recessionary concerns on discretionary spending.

- Gross profit was

$103.1 million, or 31.8% of net sales, compared to $103.2 million

or 30.3% of net sales in the third quarter of fiscal year 2023.

This 150 basis-point increase, as a percentage of net sales, was

primarily driven by improved product margins in our apparel and

footwear departments, partially offset by increased freight and

shrink.

- Selling, general,

and administrative (SG&A) expenses were $100.0 million, or

30.8% of net sales, compared to $100.1 million, or 29.4% of net

sales in the third quarter of fiscal year 2023.

- Net loss was $(0.4)

million, compared to a net loss of $(1.3) million in the third

quarter of fiscal year 2023. Adjusted net income was $1.4 million,

compared to adjusted net loss of $(0.2) million in the third

quarter of fiscal year 2023 (see “GAAP and Non-GAAP Financial

Measures”).

- Adjusted EBITDA was

$16.4 million, compared to $16.2 million in the third quarter of

fiscal year 2023 (see "GAAP and Non-GAAP Financial Measures").

- Diluted loss per

share was $(0.01), compared to diluted loss per share of $(0.04) in

the third quarter of fiscal year 2023. Adjusted diluted earnings

per share were $0.04, compared to adjusted diluted loss per share

of $(0.01) for the third quarter of fiscal year 2023 (see "GAAP and

Non-GAAP Financial Measures").

For the thirty-nine weeks ended November

2, 2024:

- Net sales were

$857.2 million, a decrease of 6.6%, compared to $917.6 million in

the first nine months of fiscal year 2023. This net sales decrease

was primarily driven by lower demand across most product categories

due to current consumer inflationary pressures on discretionary

spending. This decrease was partially offset by same store sales

growth in our fishing department and the opening of 1 new store

since October 28, 2023. Stores that have been open for less than 12

months and were not included in our same store sales, contributed

$30.8 million to net sales.

- Same store sales

decreased 9.4% compared to the first nine months of fiscal year

2023, primarily as a result of the same factors noted above that

impacted net sales.

- Gross profit was

$266.9 million or 31.1% of net sales, compared to $284.0 million or

31.0% of net sales for the first nine months of fiscal year 2023.

This increase, as a percentage of net sales, was primarily due to

higher overall product margins, versus last years apparel and

footwear clearance events which put pressure on our gross margin,

partially offset by increased shrink.

- SG&A expenses

decreased to $288.7 million or 33.6% of net sales, compared with

$301.5 million or 32.9% of net sales for the first nine months of

fiscal year 2023. This absolute dollar decrease primarily related

to our ongoing cost reduction efforts and decision to not open new

stores during fiscal year 2024, partially offset by increases in

rent and depreciation expenses. The increase as a percentage of net

sales was largely due to lower net sales.

- Net loss was

$(24.3) million, compared to net loss of $(20.3) million in the

first nine months of fiscal year 2023. Adjusted net loss was

$(21.7) million, compared to adjusted net loss of $(16.6) million

in the first nine months of fiscal year 2023 (see “GAAP and

Non-GAAP Financial Measures”).

- Adjusted EBITDA was

$15.1 million, compared to $19.3 million in the first nine months

of fiscal year 2023 (see "GAAP and Non-GAAP Financial

Measures").

- Diluted loss per

share was $(0.65), compared to diluted loss per share of $(0.54) in

the first nine months of fiscal year 2023. Adjusted diluted loss

per share was $(0.58), compared to adjusted diluted loss per share

of $(0.44) in the first nine months of fiscal year 2023 (see "GAAP

and Non-GAAP Financial Measures").

Balance sheet and capital allocation

highlights as of November 2,

2024:

- The Company ended

the third quarter with net debt of $151.3 million, comprised of

$130.0 million of borrowings outstanding under the Company’s

revolving credit facility, $24.0 million of net borrowings

outstanding under the Company’s term loan facility, and $2.7

million of cash and cash equivalents. Inventory at the end of the

third quarter was $438.1 million.

- Total liquidity was

$150.8 million as of the end of the third quarter of fiscal year

2024, comprised of $148.1 million of availability under the

Company’s revolving credit facility and term loan facility and $2.7

million of cash and cash equivalents.

Company Outlook:

“Given the current consumer environment and the

shift towards value and promotion-driven shopping, we intensified

our marketing and advertising campaigns to drive sales, which

placed additional pressure on our margins this quarter,” said Jeff

White, Chief Financial Officer of Sportsman’s Warehouse “To ensure

strong core product in-stocks and to bring fresh offerings to our

stores, we made strategic inventory investments aimed at improving

sales during the hunting and holiday seasons. As we progress

through the remainder of the year, we will remain disciplined in

managing our expenses, and will reduce total inventory levels to

generate positive free cash flow. Our mid and long-term objectives

will be centered on improving our topline with a focus on margins

and profitability.”

The Company is adjusting its guidance for fiscal

year 2024 and expects net sales to be in the range of $1.18 billion

to $1.20 billion, adjusted EBITDA to be in the range of $23 million

to $29 million and total inventory to be below $350 million. The

low end of the adjusted EBITDA range still assumes positive free

cash flow for the full year. The Company now expects capital

expenditures for 2024 to be in the range of $17 million to $20

million, primarily consisting of technology investments relating to

merchandising and store productivity. No new store openings for the

remainder of fiscal year 2024 are currently anticipated and we plan

to open one new store in fiscal year 2025.

The Company has not reconciled expected adjusted

EBITDA for fiscal year 2024 to GAAP net income because the Company

does not provide guidance for net (loss) income and is not able to

provide a reconciliation to net (loss) income without unreasonable

effort. The Company is not able to estimate net (loss) income

on a forward-looking basis without unreasonable efforts due to the

variability and complexity with respect to the charges excluded

from Adjusted EBITDA, including stock-based compensation

expense.

Conference Call Information

A conference call to discuss third quarter 2024

financial results is scheduled for December 10, 2024, at 5:00 PM

Eastern Time. The conference call will be held via webcast and may

be accessed via the Investor Relations section of the Company’s

website at www.sportsmans.com.

Non-GAAP Financial Measures

This press release includes the following

financial measures defined as non-GAAP financial measures by the

Securities and Exchange Commission (the “SEC”) and that are not

calculated in accordance with U.S. generally accepted accounting

principles (“GAAP”): adjusted net (loss) income, adjusted diluted

(loss) earnings per share and adjusted EBITDA. The Company defines

adjusted net (loss) income as net (loss) income plus expenses

incurred relating to director and officer transition costs, costs

related to the implementation of our cost reduction plan, costs

related to legal settlements and related fees and expenses, and

fees and expenses related to a settlement in the cancellation of a

contract related to our information technology systems. Net (loss)

income is the most comparable GAAP financial measure to adjusted

net (loss) income. The Company defines adjusted diluted (loss)

earnings per share as adjusted net (loss) income divided by diluted

weighted average shares outstanding. Diluted (loss) earnings per

share is the most comparable GAAP financial measure to adjusted

diluted (loss) earnings per share. The Company defines Adjusted

EBITDA as net (loss) income plus interest expense, income tax

(benefit) expense, depreciation and amortization, stock-based

compensation expense, director and officer transition costs, costs

related to the implementation of our cost reduction plan, a legal

settlement and related fees and expenses, and fees and expenses

related to a settlement in the cancellation of a contract related

to our information technology systems. Net (loss) income is the

most comparable GAAP financial measure to adjusted EBITDA. The

Company has reconciled these non-GAAP financial measures to the

most directly comparable GAAP financial measures under “GAAP and

Non-GAAP Financial Measures” in this release. As noted above, the

Company has not provided a reconciliation of fiscal year 2024

guidance for Adjusted EBITDA, in reliance on the unreasonable

efforts exception provided under Item 10(e)(1)(i)(B) of Regulation

S-K.

The Company believes that these non-GAAP

financial measures not only provide its management with comparable

financial data for internal financial analysis but also provide

meaningful supplemental information to investors and are frequently

used by analysts, investors and other interested parties in the

evaluation of companies in the Company’s industry. Specifically,

these non-GAAP financial measures allow investors to better

understand the performance of the Company’s business and facilitate

a more meaningful comparison of its diluted (loss) earnings per

share and actual results on a period-over-period basis. The Company

has provided this information as a means to evaluate the results of

its ongoing operations. Management uses this information as

additional measurement tools for purposes of business

decision-making, including evaluating store performance, developing

budgets and managing expenditures. Other companies in the Company’s

industry may calculate these items differently than the Company

does. Each of these measures is not a measure of performance under

GAAP and should not be considered as a substitute for the most

directly comparable financial measures prepared in accordance with

GAAP. Non-GAAP financial measures have limitations as analytical

tools, and investors should not consider them in isolation or as a

substitute for analysis of the Company’s results as reported under

GAAP. The Company’s management believes that these non-GAAP

financial measures allow investors to evaluate the Company’s

operating performance and compare its results of operations from

period to period on a consistent basis by excluding items that

management does not believe are indicative of the Company’s core

operating performance. The presentation of such measures, which may

include adjustments to exclude unusual or non-recurring items,

should not be construed as an inference that the Company’s future

results, cash flows or leverage will be unaffected by other unusual

or non-recurring items.

Forward-Looking

Statements

This press release includes forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 as contained in Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements in this release include, but are not

limited to, statements regarding our progress on our business reset

initiatives; our prioritization of traffic-driving marketing and

product pricing initiatives, exceptional customer service and

prudent inventory management; our emphasis on the balance sheet and

ending the year with positive free cash flow; our ability to manage

expenses, reduce total inventory levels to generate positive free

cash flow; and our guidance for net sales and Adjusted EBITDA for

fiscal year 2024. Investors can identify these statements by the

fact that they use words such as “aim,” “anticipate,” “assume,”

“believe,” “can have,” “could,” “due,” “estimate,” “expect,”

“goal,” “intend,” “likely,” “may,” “objective,” “plan,”

“positioned,” “potential,” “predict,” “should,” “target,” “will,”

“would” and similar terms and phrases. These forward-looking

statements are based on current expectations, estimates, forecasts

and projections about our business and the industry in which we

operate and our management’s beliefs and assumptions. We derive

many of our forward-looking statements from our own operating

budgets and forecasts, which are based upon many detailed

assumptions. While we believe that our assumptions are reasonable,

we caution that predicting the impact of known factors is very

difficult, and we cannot anticipate all factors that could affect

our actual results. The Company cannot assure investors that future

developments affecting the Company will be those that it has

anticipated. Actual results may differ materially from these

expectations due to many factors including, but not limited to:

current and future government regulations, in particular

regulations relating to the sale of firearms and ammunition, which

may impact the supply and demand for the Company’s products and

ability to conduct its business; the Company’s retail-based

business model which is impacted by general economic and market

conditions and economic, market and financial uncertainties that

may cause a decline in consumer spending; the Company’s

concentration of stores in the Western United States which makes

the Company susceptible to adverse conditions in this region, and

could affect the Company’s sales and cause the Company’s operating

results to suffer; the highly fragmented and competitive industry

in which the Company operates and the potential for increased

competition; changes in consumer demands, including regional

preferences, which we may not be able to identify and respond to in

a timely manner; the Company’s entrance into new markets or

operations in existing markets, including the Company’s plans to

open additional stores in future periods, which may not be

successful; the Company’s implementation of a plan to reduce

expenses in response to adverse macroeconomic conditions, including

an increased focus on financial discipline and rigor throughout the

Company’s organization; impact of general macroeconomic conditions,

such as labor shortages, inflation, elevated interest rates,

economic slowdowns, and recessions or market corrections; and other

factors that are set forth in the Company's filings with the SEC,

including under the caption “Risk Factors” in the Company’s Form

10-K for the fiscal year ended February 3, 2024, which was filed

with the SEC on April 4, 2024, and the Company’s other public

filings made with the SEC and available at www.sec.gov. If one or

more of these risks or uncertainties materialize, or if any of the

Company’s assumptions prove incorrect, the Company’s actual results

may vary in material respects from those projected in these

forward-looking statements. Any forward-looking statement made by

the Company in this release speaks only as of the date on which the

Company makes it. Factors or events that could cause the Company’s

actual results to differ may emerge from time to time, and it is

not possible for the Company to predict all of them. The Company

undertakes no obligation to publicly update any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as may be required by any

applicable securities laws.

About Sportsman's Warehouse Holdings,

Inc.

Sportsman’s Warehouse Holdings, Inc. is an

outdoor specialty retailer focused on meeting the needs of the

seasoned outdoor veteran, the first-time participant, and everyone

in between. We provide outstanding gear and exceptional service to

inspire outdoor memories.

For press releases and certain additional

information about the Company, visit the Investor Relations section

of the Company's website at www.sportsmans.com. Investor

Contact:

Riley TimmerVice President, Investor Relations Sportsman’s

Warehouse(801) 304-2816investors@sportsmans.com

|

SPORTSMAN’S WAREHOUSE HOLDINGS,

INC.Condensed Consolidated Statements of

Operations (Unaudited)(amounts in thousands,

except per share data) |

|

|

|

For the Thirteen Weeks Ended |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

November 2,2024 |

|

|

% of netsales |

|

October 28,2023 |

|

|

% of netsales |

|

YOYVariance |

|

|

Net sales |

$ |

324,261 |

|

|

|

100.0 |

% |

|

$ |

340,569 |

|

|

|

100.0 |

% |

|

$ |

(16,308 |

) |

| Cost of goods sold |

|

221,173 |

|

|

|

68.2 |

% |

|

|

237,384 |

|

|

|

69.7 |

% |

|

|

(16,211 |

) |

|

Gross profit |

|

103,088 |

|

|

|

31.8 |

% |

|

|

103,185 |

|

|

|

30.3 |

% |

|

|

(97 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

|

99,973 |

|

|

|

30.8 |

% |

|

|

100,113 |

|

|

|

29.4 |

% |

|

|

(140 |

) |

|

Income from operations |

|

3,115 |

|

|

|

1.0 |

% |

|

|

3,072 |

|

|

|

0.9 |

% |

|

|

43 |

|

| Interest expense |

|

3,317 |

|

|

|

1.1 |

% |

|

|

3,944 |

|

|

|

1.2 |

% |

|

|

(627 |

) |

| Other losses |

|

- |

|

|

|

0.0 |

% |

|

|

- |

|

|

|

0.0 |

% |

|

|

- |

|

|

Loss before income taxes |

|

(202 |

) |

|

|

(0.1 |

%) |

|

|

(872 |

) |

|

|

(0.3 |

%) |

|

|

670 |

|

| Income tax expense |

|

162 |

|

|

|

0.0 |

% |

|

|

459 |

|

|

|

0.1 |

% |

|

|

(297 |

) |

|

Net loss |

$ |

(364 |

) |

|

|

(0.1 |

%) |

|

$ |

(1,331 |

) |

|

|

(0.4 |

%) |

|

$ |

967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.01 |

) |

|

|

|

$ |

(0.04 |

) |

|

|

|

$ |

0.03 |

|

|

Diluted |

$ |

(0.01 |

) |

|

|

|

$ |

(0.04 |

) |

|

|

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

37,869 |

|

|

|

|

|

37,393 |

|

|

|

|

|

476 |

|

|

Diluted |

|

37,869 |

|

|

|

|

|

37,393 |

|

|

|

|

|

476 |

|

|

SPORTSMAN’S WAREHOUSE HOLDINGS,

INC.Condensed Consolidated Statements of

Operations (Unaudited)(amounts in thousands,

except per share data) |

|

|

|

For the Thirty-Nine Weeks Ended |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

November 2,2024 |

|

|

% of netsales |

|

October 28,2023 |

|

|

% of netsales |

|

YOYVariance |

|

|

Net sales |

$ |

857,235 |

|

|

|

100.0 |

% |

|

$ |

917,593 |

|

|

|

100.0 |

% |

|

$ |

(60,358 |

) |

| Cost of goods sold |

|

590,343 |

|

|

|

68.9 |

% |

|

|

633,547 |

|

|

|

69.0 |

% |

|

|

(43,204 |

) |

|

Gross profit |

|

266,892 |

|

|

|

31.1 |

% |

|

|

284,046 |

|

|

|

31.0 |

% |

|

|

(17,154 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

|

288,727 |

|

|

|

33.6 |

% |

|

|

301,450 |

|

|

|

32.9 |

% |

|

|

(12,723 |

) |

|

Loss from operations |

|

(21,835 |

) |

|

|

(2.5 |

%) |

|

|

(17,404 |

) |

|

|

(1.9 |

%) |

|

|

(4,431 |

) |

| Interest expense |

|

9,408 |

|

|

|

1.1 |

% |

|

|

9,518 |

|

|

|

1.0 |

% |

|

|

(110 |

) |

| Other losses |

|

457 |

|

|

|

0.1 |

% |

|

|

- |

|

|

|

0.0 |

% |

|

|

457 |

|

|

Loss before income taxes |

|

(31,700 |

) |

|

|

(3.7 |

%) |

|

|

(26,922 |

) |

|

|

(2.9 |

%) |

|

|

(4,778 |

) |

| Income tax benefit |

|

(7,364 |

) |

|

|

(0.9 |

%) |

|

|

(6,664 |

) |

|

|

(0.7 |

%) |

|

|

(700 |

) |

|

Net loss |

$ |

(24,336 |

) |

|

|

(2.8 |

%) |

|

$ |

(20,258 |

) |

|

|

(2.2 |

%) |

|

$ |

(4,078 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.65 |

) |

|

|

|

$ |

(0.54 |

) |

|

|

|

$ |

(0.11 |

) |

|

Diluted |

$ |

(0.65 |

) |

|

|

|

$ |

(0.54 |

) |

|

|

|

$ |

(0.11 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

37,729 |

|

|

|

|

|

37,500 |

|

|

|

|

|

229 |

|

|

Diluted |

|

37,729 |

|

|

|

|

|

37,500 |

|

|

|

|

|

229 |

|

|

SPORTSMAN’S WAREHOUSE HOLDINGS,

INC.Condensed Consolidated Balance Sheets

(Unaudited)(amounts in thousands, except par value

data) |

|

|

|

|

November 2, |

|

|

February 3, |

|

|

|

2024 |

|

|

2024 |

|

| Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

2,666 |

|

|

$ |

3,141 |

|

|

Accounts receivable, net |

|

1,447 |

|

|

|

2,119 |

|

|

Income tax receivable |

|

523 |

|

|

|

— |

|

|

Merchandise inventories |

|

438,136 |

|

|

|

354,710 |

|

|

Prepaid expenses and other |

|

19,745 |

|

|

|

20,078 |

|

|

Total current assets |

|

462,517 |

|

|

|

380,048 |

|

| Operating lease right of use

asset |

|

320,729 |

|

|

|

309,377 |

|

| Property and equipment, net |

|

175,181 |

|

|

|

194,452 |

|

| Goodwill |

|

1,496 |

|

|

|

1,496 |

|

| Deferred tax asset |

|

7,480 |

|

|

|

505 |

|

| Definite lived intangibles,

net |

|

282 |

|

|

|

327 |

|

|

Total assets |

$ |

967,685 |

|

|

$ |

886,205 |

|

| |

|

|

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

112,690 |

|

|

$ |

56,122 |

|

|

Accrued expenses |

|

95,094 |

|

|

|

83,665 |

|

|

Income taxes payable |

|

— |

|

|

|

126 |

|

|

Operating lease liability, current |

|

48,866 |

|

|

|

48,693 |

|

|

Revolving line of credit |

|

130,042 |

|

|

|

126,043 |

|

|

Total current liabilities |

|

386,692 |

|

|

|

314,649 |

|

| Long-term liabilities: |

|

|

|

|

|

|

Term loan, net |

|

23,969 |

|

|

|

— |

|

|

Operating lease liability, noncurrent |

|

313,454 |

|

|

|

307,000 |

|

|

Total long-term liabilities |

|

337,423 |

|

|

|

307,000 |

|

|

Total liabilities |

|

724,115 |

|

|

|

621,649 |

|

| |

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

Preferred stock, $.01 par value; 20,000 shares authorized; 0 shares

issued and outstanding |

|

— |

|

|

|

— |

|

|

Common stock, $.01 par value; 100,000 shares authorized; 37,957 and

37,529 shares issued and outstanding, respectively |

|

379 |

|

|

|

375 |

|

|

Additional paid-in capital |

|

85,144 |

|

|

|

81,798 |

|

|

Accumulated earnings |

|

158,047 |

|

|

|

182,383 |

|

|

Total stockholders' equity |

|

243,570 |

|

|

|

264,556 |

|

|

Total liabilities and stockholders' equity |

$ |

967,685 |

|

|

$ |

886,205 |

|

|

SPORTSMAN’S WAREHOUSE HOLDINGS,

INC.Condensed Consolidated Statements Cash Flows

(Unaudited)(amounts in thousands) |

|

|

|

|

Thirty-Nine Weeks Ended |

|

|

|

November 2, |

|

|

October 28, |

|

|

|

2024 |

|

|

2023 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

Net loss |

$ |

(24,336 |

) |

|

$ |

(20,258 |

) |

|

Adjustments to reconcile net income to net cash used in operating

activities: |

|

|

|

|

|

|

Depreciation of property and equipment |

|

30,491 |

|

|

|

28,367 |

|

|

Amortization of discount on debt and deferred financing fees |

|

217 |

|

|

|

114 |

|

|

Amortization of definite lived intangible |

|

45 |

|

|

|

45 |

|

|

Loss on asset dispositions |

|

501 |

|

|

|

— |

|

|

Noncash lease expense |

|

3,239 |

|

|

|

24,493 |

|

|

Deferred income taxes |

|

(6,975 |

) |

|

|

(6,664 |

) |

|

Stock-based compensation |

|

3,438 |

|

|

|

3,341 |

|

|

Change in operating assets and liabilities, net of amounts

acquired: |

|

|

|

|

|

|

Accounts receivable, net |

|

673 |

|

|

|

(1,051 |

) |

|

Operating lease liabilities |

|

(7,964 |

) |

|

|

(10,539 |

) |

|

Merchandise inventories |

|

(83,426 |

) |

|

|

(47,196 |

) |

|

Prepaid expenses and other |

|

220 |

|

|

|

(7,403 |

) |

|

Accounts payable |

|

56,128 |

|

|

|

26,081 |

|

|

Accrued expenses |

|

9,727 |

|

|

|

(4,413 |

) |

|

Income taxes payable and receivable |

|

(649 |

) |

|

|

(1,554 |

) |

|

Net cash used in operating activities |

|

(18,671 |

) |

|

|

(16,637 |

) |

| Cash flows from investing

activities: |

|

|

|

|

|

|

Purchase of property and equipment, net of amounts acquired |

|

(11,305 |

) |

|

|

(71,170 |

) |

|

Proceeds from sale of property and equipment |

|

55 |

|

|

|

— |

|

|

Net cash used in investing activities |

|

(11,250 |

) |

|

|

(71,170 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

Net borrowings on line of credit |

|

3,999 |

|

|

|

97,885 |

|

|

Borrowings on term loan |

|

25,000 |

|

|

|

— |

|

|

Increase (Decrease) in book overdraft |

|

1,670 |

|

|

|

(5,611 |

) |

|

Proceeds from issuance of common stock per employee stock purchase

plan |

|

208 |

|

|

|

456 |

|

|

Payments to acquire treasury stock |

|

— |

|

|

|

(2,748 |

) |

|

Payment of withholdings on restricted stock units |

|

(296 |

) |

|

|

(1,649 |

) |

|

Payment of deferred financing costs and discount on term loan |

|

(1,135 |

) |

|

|

— |

|

|

Net cash provided by financing activities |

|

29,446 |

|

|

|

88,333 |

|

| Net change in cash and cash

equivalents |

|

(475 |

) |

|

|

526 |

|

| Cash and cash equivalents at

beginning of period |

|

3,141 |

|

|

|

2,389 |

|

| Cash and cash equivalents at end

of period |

$ |

2,666 |

|

|

$ |

2,915 |

|

|

SPORTSMAN’S WAREHOUSE HOLDINGS, INC.GAAP

and Non-GAAP Financial Measures

(Unaudited)(amounts in thousands, except per share

data) |

|

| |

|

| The

following table presents the reconciliations of (i) GAAP net loss

to adjusted net loss and (ii) GAAP diluted loss per share to

adjusted diluted loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the Thirteen Weeks Ended |

|

|

For the Thirty-Nine Weeks Ended |

|

| |

November 2,2024 |

|

|

October 28,2023 |

|

|

November 2,2024 |

|

|

October 28,2023 |

|

| Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(364 |

) |

|

$ |

(1,331 |

) |

|

$ |

(24,336 |

) |

|

$ |

(20,258 |

) |

| Director and officer

transition costs (1) |

|

279 |

|

|

|

1,180 |

|

|

|

709 |

|

|

|

3,067 |

|

| Cancelled contract (2) |

|

205 |

|

|

|

- |

|

|

|

911 |

|

|

|

- |

|

| Cost reduction plan (3) |

|

- |

|

|

|

351 |

|

|

|

- |

|

|

|

1,216 |

|

| Legal settlement (4) |

|

1,750 |

|

|

|

- |

|

|

|

1,750 |

|

|

|

687 |

|

| Less tax benefit |

|

(519 |

) |

|

|

(398 |

) |

|

|

(783 |

) |

|

|

(1,292 |

) |

| Adjusted net loss |

$ |

1,351 |

|

|

$ |

(198 |

) |

|

$ |

(21,749 |

) |

|

$ |

(16,580 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted weighted average

shares outstanding |

|

37,869 |

|

|

|

37,393 |

|

|

|

37,729 |

|

|

|

37,500 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of loss

per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted loss per share: |

$ |

(0.01 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.65 |

) |

|

$ |

(0.54 |

) |

| Impact of adjustments to

numerator and denominator |

|

0.05 |

|

|

|

0.03 |

|

|

|

0.07 |

|

|

|

0.10 |

|

| Adjusted diluted loss per

share: |

$ |

0.04 |

|

|

$ |

(0.01 |

) |

|

$ |

(0.58 |

) |

|

$ |

(0.44 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Expenses

incurred relating to the departure of directors and officers and

the recruitment of directors and key members of our senior

management team. |

|

| (2) Represents fees

and expenses related to a settlement in the cancellation of a

contract related to our information technology systems. |

|

| (3) Severance

expenses paid as part of our cost reduction plan implemented during

the 13 weeks ended July 29, 2023. |

|

| (4) Represents costs

related to legal settlements and related fees and expenses. |

|

|

SPORTSMAN’S WAREHOUSE HOLDINGS, INC.GAAP

and Non-GAAP Financial Measures

(Unaudited)(amounts in thousands, except per share

data) |

|

| |

|

| The

following table presents the reconciliation of GAAP net loss to

adjusted EBITDA for the periods presented: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the Thirteen Weeks Ended |

|

|

For the Thirty-Nine Weeks Ended |

|

| |

November 2,2024 |

|

|

October 28,2023 |

|

|

November 2,2024 |

|

|

October 28,2023 |

|

|

Net loss |

$ |

(364 |

) |

|

$ |

(1,331 |

) |

|

$ |

(24,336 |

) |

|

$ |

(20,258 |

) |

| Interest expense |

|

3,317 |

|

|

|

3,944 |

|

|

|

9,408 |

|

|

|

9,518 |

|

| Income tax benefit |

|

162 |

|

|

|

459 |

|

|

|

(7,364 |

) |

|

|

(6,664 |

) |

| Depreciation and

amortization |

|

9,984 |

|

|

|

10,663 |

|

|

|

30,536 |

|

|

|

28,412 |

|

| Stock-based compensation

expense (1) |

|

1,047 |

|

|

|

965 |

|

|

|

3,438 |

|

|

|

3,341 |

|

| Director and officer

transition costs (2) |

|

279 |

|

|

|

1,180 |

|

|

|

709 |

|

|

|

3,067 |

|

| Cancelled contract (3) |

|

205 |

|

|

|

- |

|

|

|

911 |

|

|

|

- |

|

| Cost reduction plan (4) |

|

- |

|

|

|

351 |

|

|

|

- |

|

|

|

1,216 |

|

| Legal settlement (5) |

|

1,750 |

|

|

|

- |

|

|

|

1,750 |

|

|

|

687 |

|

| Adjusted EBITDA |

$ |

16,380 |

|

|

$ |

16,231 |

|

|

$ |

15,052 |

|

|

$ |

19,319 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Stock-based

compensation expense represents non-cash expenses related to equity

instruments granted to employees under our equity incentive plan

and employee stock purchase plan. |

|

| (2) Expenses

incurred relating to the departure of directors and officers and

the recruitment of directors and key members of our senior

management team. |

|

| (3) Represents

fees and expenses related to a settlement in the cancellation of a

contract related to our information technology systems. |

|

| (4) Severance

expenses paid as part of our cost reduction plan implemented during

the 13 weeks ended July 29, 2023. |

|

| (5) Represents

costs related to legal settlements and related fees and

expenses. |

|

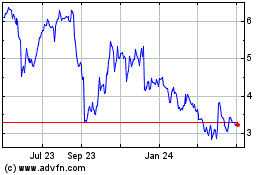

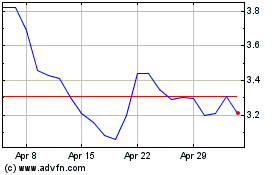

Sportsmans Warehouse (NASDAQ:SPWH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sportsmans Warehouse (NASDAQ:SPWH)

Historical Stock Chart

From Feb 2024 to Feb 2025