false

0000944075

0000944075

2023-10-27

2023-10-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of

The Securities

Exchange Act of 1934

October

27, 2023

Date

of Report

(Date

of earliest event reported)

SOCKET

MOBILE, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-13810 |

|

94-3155066 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

40675

Encyclopedia Circle

Fremont,

CA 94538

(Address

of principal executive offices, including zip code)

(510)

933-3000

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

[

] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[

] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[

] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[

] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

stock, $0.001 Par Value per Share |

SCKT |

NASDAQ |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

2.02 Results of Operations and Financial Condition

On

October 27, 2023, Socket Mobile, Inc. issued a press release reporting its results for the three and nine months ended September 30, 2023. The

full text of the press release is furnished as Exhibit 99.1.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

| Exhibit

No. |

|

Description |

| |

|

|

| 99.1 |

|

Text

of press release, dated October 27, 2023, titled "Socket Mobile Reports Third Quarter and Nine-Month 2023 Results". |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

SOCKET

MOBILE, INC. |

| |

|

|

| |

By: |

/s/

Lynn Zhao |

|

| |

|

Name:

Lynn Zhao

Vice

President, Finance and Administration

and

Chief Financial Officer |

Date:

October 27, 2023

Exhibit

99.1

Socket

Mobile Reports Third Quarter and Nine-Month 2023 Results

FREMONT,

Calif., – October 27, 2023 – Socket Mobile, Inc. (NASDAQ: SCKT), a leading provider of data capture and delivery solutions

for enhanced workplace productivity, today reported financial results that are determined in accordance with generally accepted accounting

principles in the United States (“GAAP”) for the three and nine months ended September 30, 2023.

Third

Quarter 2023 Financial Highlights:

| • | Revenue

decreased 14% to $3.2 million, compared to $3.7 million in the prior-year quarter, and decreased

by 37% sequentially compared to $5.1 million in Q2 2023. |

| • | Gross

margin declined to 44.2%, compared to 44.4% in the prior-year quarter and 51.8% in the preceding

quarter. The decrease in gross margins was primarily due to the allocation of manufacturing

overhead costs across lower shipments during the quarter ended September 30, 2023. |

| • | Operating

expenses for the third quarter of 2023 totaled $2.8 million, an increase of 8.2% compared

to operating expenses of $2.6 million in the prior-year quarter, and a decrease of 4.3% sequentially

in the preceding quarter. |

| • | Operating

loss was $1.4 million compared to an operating loss of $947,000 for the prior-year quarter,

and operating loss of $292,000 in the preceding quarter. |

| • | The

cash balance was $3.1 million as of September 30, 2023, compared to $3.4 million as of June

30, 2023, and $3.6 million as of December 31, 2022. |

“In

Q3, our distribution partners reduced their inventories by 50% in response to ongoing market uncertainty and elevated interest rates,

significantly impacting our Q3 revenue. Sales to resellers and end-users were substantially higher than the reported revenue, which is

calculated based on sales to distributors with a reserve for estimated product returns. We believe that sales to resellers and end-users

provide a more accurate picture of the underlying demand in our business. Throughout the quarter, we maintained a focus on managing

liquidity and expenses while continuing to invest in critical projects,” said Kevin Mills, president, and chief executive officer.

“We

launched several new products in Q3. The XtremeScan product line, comprised of XtremeScan Case XC100, XtremeScan XS930, and

XtremeScan Grip XG930, is designed for iPhone series 15, 14, 13 and 12. This product family is engineered to withstand harsh

industrial conditions, offering robust scanning capabilities with superior durability and support. The launch of the XtremeScan

series represents a significant milestone in our commitment to delivering high-quality data capture solutions for our customers in

industrial and manufacturing markets.

“We’ve

also introduced the C860, an advanced camera-based subscription solution. It’s designed for users with more demanding scanning

needs, those working in challenging conditions, or those dealing with poorly printed or damaged barcodes. The C860 is a follow-on to

our free camera-based scanner, the C820, launched in Q2. There are no licensing fees for App providers, enabling them to service a wide

range of customers with various data capture requirements by integrating CaptureSDK into their applications. This approach enables developers

to service price-sensitive end-users with the free C820 and address performance-sensitive needs with the C860. The monthly subscription

fee is $5.99, available for purchase via the Apple Store or Google Play,” continued Mills.

“Our

CaptureSDK was upgraded in Q3 and is fully compatible with iOS 17. It supports our complete range of barcode scanners and NFC readers/writers

across the entire Socket Mobile product line, ensuring that iOS and Android application developers can fully meet their data capture

requirements and maximize performance for their end-users. Socket Mobile CaptureSDK has been integrated into thousands of applications

across various industries.

“During

Q3, our team remained focused on delivering these critical products, which we believe will enable Socket Mobile to return to growth and

profitability” concluded Mills.

Conference

Call

The

management of Socket Mobile will hold a conference call today at 2 P.M. Pacific (5 P.M. Eastern) to discuss the quarterly results and

outlook for the future. The dial-in number to access the live conference call is (800) 237-1091 toll-free from within the U.S.

or (848) 488-9280 (toll).

About

Socket Mobile, Inc.

Socket

Mobile is a leading provider of data capture and delivery solutions for enhanced productivity in workforce mobilization. Socket Mobile’s

revenue is primarily driven by the deployment of third-party barcode enabled mobile applications that integrate Socket Mobile’s

cordless barcode scanners and contactless reader/writers. Mobile Applications servicing the specialty retailer, field service, digital

ID, transportation, and manufacturing markets are the primary revenue drivers. Socket Mobile has a network of thousands of developers

who use its software developer tools to add sophisticated data capture to their mobile applications. Socket Mobile is headquartered in

Fremont, Calif. and can be reached at +1-510-933-3000 or www.socketmobile.com. Follow

Socket Mobile on LinkedIn, Twitter, and keep up with our latest News and Updates.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, but are not limited to, statements regarding

new mobile computer and data collection products, including details on the timing, distribution, and market acceptance of the products,

and statements predicting trends, sales, market conditions, and opportunities in the markets in which we sell our products. Such statements

involve risks and uncertainties, and actual results could differ materially from the results anticipated in such forward-looking statements

as a result of a number of factors, including, but not limited to, the risk that our new products may be delayed or not rollout as predicted,

if ever, due to technological, market, or financial factors, including the availability of necessary working capital, the risk that market

acceptance and sales opportunities may not happen as anticipated, the risk that our application partners and current distribution channels

may choose not to distribute the new products or may not be successful in doing so, the risk that acceptance of our new products in vertical

application markets may not happen as anticipated, and other risks described in our most recent Form 10-K and 10-Q reports filed with

the Securities and Exchange Commission.

| Socket

Mobile Investor Contact: |

| Lynn

Zhao |

| Chief

Financial Officer |

| 510-933-3016 |

| lynn@socketmobile.com |

Socket

is a registered trademark of Socket Mobile. All other trademarks and trade names contained herein may be those of their respective owners.

©

2023, Socket Mobile, Inc. All rights reserved.

–

Financial tables to follow –

Socket

Mobile, Inc.

Condensed

Summary Statements of Operations (Unaudited)

(Amounts

in thousands except per share)

| | |

Three months ended Sept 30, | |

Nine months ended Sept 30, |

| | |

2023 | |

2022 | |

2023 | |

2022 |

| Revenue | |

$ | 3,206 | | |

$ | 3,728 | | |

$ | 12,635 | | |

$ | 16,067 | |

| Cost of revenue | |

| 1,788 | | |

| 2,073 | | |

| 6,493 | | |

| 8,249 | |

| Gross margin | |

| 1,418 | | |

| 1,655 | | |

| 6,142 | | |

| 7,818 | |

| Gross margin percent | |

| 44.2 | % | |

| 44.4 | % | |

| 48.6 | % | |

| 48.7 | % |

Research & development

| |

| 1,207 | | |

| 1,096 | | |

| 3,643 | | |

| 3,271 | |

| Sales & marketing | |

| 1,002 | | |

| 865 | | |

| 3,014 | | |

| 2,729 | |

| General & administrative | |

| 608 | | |

| 641 | | |

| 2,131 | | |

| 2,112 | |

| Total operating expenses | |

| 2,817 | | |

| 2,602 | | |

| 8,788 | | |

| 8,112 | |

| Operating income (loss) | |

| (1,399 | ) | |

| (947 | ) | |

| (2,646 | ) | |

| (294 | ) |

| Interest expense, net | |

| (76 | ) | |

| (43 | ) | |

| (170 | ) | |

| (134 | ) |

| Income tax benefit (expense) | |

| 150 | | |

| 116 | | |

| (16 | ) | |

| — | |

| Net loss | |

$ | (1,325 | ) | |

$ | (874 | ) | |

$ | (2,832 | ) | |

$ | (428 | ) |

| Net loss per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.16 | ) | |

$ | (0.11 | ) | |

$ | (0.34 | ) | |

$ | (0.05 | ) |

| Fully diluted | |

$ | (0.16 | ) | |

$ | (0.11 | ) | |

$ | (0.34 | ) | |

$ | (0.05 | ) |

Weighted average shares outstanding:

Basic

Fully diluted | |

| 7,320 7,320 | | |

| 7,153 7,153 | | |

| 7,197 7,197 | | |

| 7,202 7,202 | |

Socket

Mobile, Inc.

Condensed

Summary Balance Sheets

(Amounts

in Thousands)

| | |

(Unaudited)

September 30, 2023 | |

December 31, 2022* |

| Cash | |

$ | 3,094 | | |

$ | 3,624 | |

| Accounts receivable | |

| 1,560 | | |

| 2,660 | |

| Inventories | |

| 5,528 | | |

| 5,602 | |

| Deferred costs on shipments to distributors | |

| 247 | | |

| 266 | |

| Other current assets | |

| 617 | | |

| 617 | |

| Property, equipment and computer software, net | |

| 2,558 | | |

| 1,657 | |

| Deferred tax assets | |

| 8,652 | | |

| 8,668 | |

| Intangible assets, net | |

| 1,591 | | |

| 1,694 | |

| Operating leases right-of-use assets | |

| 3,208 | | |

| 3,560 | |

| Other long-term assets | |

| 251 | | |

| 250 | |

| Total assets | |

$ | 27,306 | | |

$ | 28,598 | |

| Accounts payable and accrued liabilities | |

$ | 1,911 | | |

$ | 2,407 | |

| Bank non-formula loan | |

| — | | |

| 125 | |

| Subordinated convertible notes payable, net of discount | |

| 150 | | |

| 147 | |

| Subordinated convertible notes payable, net of discount-related party | |

| 2,834 | | |

| 1,231 | |

| Deferred revenue on shipments to distributors | |

| 596 | | |

| 595 | |

| Deferred service revenue | |

| 33 | | |

| 34 | |

| Operating lease liabilities | |

| 3,407 | | |

| 3,737 | |

| Total liabilities | |

| 8,931 | | |

| 8,276 | |

| Common stock | |

| 68,258 | | |

| 67,165 | |

| Accumulated deficit | |

| (48,845 | ) | |

| (46,013 | ) |

| Treasury stock | |

| (1,038 | ) | |

| (830 | ) |

| Total equity | |

| 18,375 | | |

| 20,322 | |

| Total liabilities and equity | |

$ | 27,306 | | |

$ | 28,598 | |

*Derived

from audited financial statements.

#

# #

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

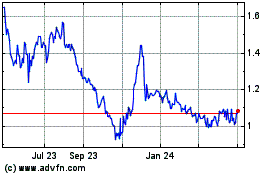

Socket Mobile (NASDAQ:SCKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

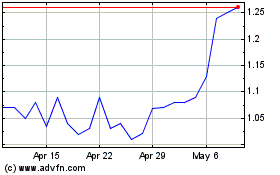

Socket Mobile (NASDAQ:SCKT)

Historical Stock Chart

From Apr 2023 to Apr 2024