0001675634false--08-31Q12024500000000.000103583337500000000.000153976875073830100000000125012500000800000.060000.00700000.040000.003700000.03800000.0P3Y00016756342023-09-012023-11-300001675634us-gaap:SubsequentEventMember2024-01-050001675634pixy:VensureLitigationMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpixy:OverallBusinessMember2021-09-070001675634pixy:OlenCommercialRealtyCorpMember2023-08-310001675634pixy:OlenCommercialRealtyCorpMember2023-11-300001675634pixy:OlenCommercialRealtyCorpMember2023-09-012023-11-300001675634pixy:DelawareChanceryCourtMember2023-09-012023-11-300001675634pixy:RobertAngueiraMember2023-09-012023-11-300001675634pixy:RobertAngueiraMember2023-08-310001675634pixy:RobertAngueiraMember2023-11-300001675634pixy:RobertAngueiraMember2023-12-012023-12-140001675634pixy:WashingtonDeptMember2023-08-310001675634pixy:WashingtonDeptMember2023-11-300001675634pixy:WashingtonDeptMember2023-04-012023-04-250001675634pixy:FoundryASVRFSawgrassLLCMember2023-09-012023-11-300001675634pixy:FoundryASVRFSawgrassLLCMember2023-10-012023-10-160001675634pixy:GoldenWestWingsLLCMember2023-09-012023-11-300001675634pixy:SunzLitigationMember2023-08-310001675634pixy:SunzLitigationMember2023-11-300001675634pixy:SunzLitigationMember2021-03-012021-03-190001675634pixy:JohnStephenHolmesBankruptcyLitigationMember2022-11-012022-11-080001675634pixy:JohnStephenHolmesMemberpixy:PreferredStocksMember2021-10-012021-10-220001675634pixy:EmployeeRetentionTaxCreditClaimsMember2023-11-300001675634pixy:EverestLitigatonMember2023-09-012023-11-300001675634pixy:EverestLitigatonMember2020-12-012020-12-180001675634pixy:RobertAngueiraUSChapterSevenTrusteeVShiftpixyIncShiftpixyInvestmentsMember2023-12-012023-12-1400016756342022-06-130001675634pixy:IrvineFacilityMember2022-05-012022-05-020001675634pixy:SunriseFacilityMember2021-06-012021-06-070001675634pixy:ShiftPixyLabsFacilityMember2020-09-282020-10-010001675634pixy:SecondIrvineFacilityMember2023-09-012023-11-300001675634pixy:MiamiVerifoneFacilityMember2021-06-070001675634pixy:ShiftPixyLabsFacilityMember2023-09-012023-11-300001675634pixy:SunriseFacilityMember2023-09-012023-11-300001675634pixy:MiamiOfficeSpaceFacilityMember2021-09-012022-08-310001675634pixy:MiamiVerifoneFacilityMember2023-09-012023-11-300001675634pixy:IrvineFacilityMember2023-09-012023-11-300001675634pixy:MiamiOfficeSpaceFacilityMember2023-08-310001675634pixy:MiamiOfficeSpaceFacilityMember2023-11-300001675634pixy:MiamiOfficeSpaceFacilityMember2023-09-012023-11-300001675634pixy:DirectorsMember2023-11-300001675634pixy:DirectorsMember2023-08-310001675634pixy:DirectorsMember2022-09-012022-11-300001675634pixy:ScottAbsherMember2022-09-012022-11-300001675634pixy:ScottAbsherMember2023-09-012023-11-300001675634pixy:AmandaMurphyMember2023-08-310001675634pixy:AmandaMurphyMember2023-11-300001675634pixy:ScottAbsherMember2023-11-300001675634pixy:ScottAbsherMember2023-08-310001675634pixy:DirectorsMember2023-09-012023-11-300001675634pixy:DirectorsMember2022-09-012023-08-310001675634pixy:AmandaMurphyMember2022-09-012022-11-300001675634pixy:AmandaMurphyMember2023-09-012023-11-300001675634pixy:ConnieAbsherElizabethEastvoldAndHannahAbsherMember2022-09-012022-11-300001675634pixy:ConnieAbsherElizabethEastvoldAndHannahAbsherMember2023-09-012023-11-300001675634pixy:JasonAbsherMember2022-09-012022-11-300001675634pixy:JasonAbsherMember2023-09-012023-11-300001675634pixy:PhilEastvoldMember2022-09-012022-11-300001675634pixy:PhilEastvoldMember2023-09-012023-11-300001675634pixy:DavidMayMember2022-09-012022-11-300001675634pixy:DavidMayMember2023-09-012023-11-300001675634pixy:MarkAbsherMember2023-09-012023-11-300001675634pixy:MarkAbsherMember2022-09-012022-11-300001675634pixy:GrantedPriorToJuly12020Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-09-012023-11-300001675634pixy:OptionsGrantedOnOrAfterJuly12020Memberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-09-012023-11-300001675634pixy:GrantedPriorToJuly12020Memberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-09-012023-11-300001675634pixy:MarchSixTwoZeroTwentyThreeMember2023-03-060001675634pixy:MarchSixTwoZeroTwentyThreeMember2023-03-050001675634pixy:RelatedPartiesMember2022-09-012022-11-300001675634pixy:RelatedPartiesMember2023-09-012023-11-300001675634pixy:RelatedPartiesMember2023-08-310001675634pixy:RelatedPartiesMember2023-11-300001675634pixy:ExercisePriceRangeThreeMember2023-09-012023-11-300001675634pixy:ExercisePriceRangeThreeMember2023-11-300001675634pixy:ExercisePriceRangeTwoMember2023-09-012023-11-300001675634pixy:ExercisePriceRangeTwoMember2023-11-300001675634pixy:ExercisePriceRangeOneMember2023-09-012023-11-300001675634pixy:ExercisePriceRangeOneMember2023-11-300001675634srt:MaximumMemberpixy:ExercisePriceRangeThreeMember2023-09-012023-11-300001675634srt:MinimumMemberpixy:ExercisePriceRangeThreeMember2023-09-012023-11-300001675634srt:MaximumMemberpixy:ExercisePriceRangeTwoOneMember2023-09-012023-11-300001675634srt:MinimumMemberpixy:ExercisePriceRangeTwoMember2023-09-012023-11-300001675634srt:MaximumMemberpixy:ExercisePriceRangeOneMember2023-09-012023-11-300001675634srt:MinimumMemberpixy:ExercisePriceRangeOneMember2023-09-012023-11-3000016756342022-09-200001675634pixy:JanuaryTwoZeroTwoTwoCommonWarrantsMember2022-01-280001675634pixy:JanuaryTwoZeroTwoTwoCommonWarrantsMember2021-09-030001675634pixy:CommonStockWarrantsMemberus-gaap:PrivatePlacementMember2022-09-200001675634pixy:CommonShareUnitsMember2022-09-012022-09-2000016756342022-08-092022-09-020001675634pixy:ScottWAbsherMembersrt:ChiefExecutiveOfficerMemberpixy:CommonShareUnitsMember2020-06-012020-06-050001675634pixy:ScottWAbsherMembersrt:ChiefExecutiveOfficerMember2020-01-042020-06-0400016756342022-09-012022-09-2000016756342023-10-0500016756342023-10-012023-10-0500016756342022-01-012022-01-280001675634pixy:ScottWAbsherMembersrt:ChiefExecutiveOfficerMemberpixy:CommonShareUnitsMember2023-10-012023-10-170001675634pixy:ScottWAbsherMembersrt:ChiefExecutiveOfficerMemberpixy:CommonShareUnitsMember2023-08-012023-08-210001675634pixy:ScottWAbsherMembersrt:ChiefExecutiveOfficerMemberpixy:CommonShareUnitsMember2023-08-210001675634pixy:ScottWAbsherMembersrt:ChiefExecutiveOfficerMemberpixy:CommonShareUnitsMember2022-08-282022-09-030001675634pixy:ScottWAbsherMembersrt:ChiefExecutiveOfficerMemberus-gaap:ConvertiblePreferredStockMember2022-08-282022-09-0300016756342023-01-012023-01-310001675634pixy:CEOMember2023-08-012023-08-210001675634pixy:October2023WarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:October2023WarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:AmendedMarch2019NotesWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:May2020CommonWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:October2020CommonWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:October2020CommonWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:AmendedMarch2019NotesWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:May2020CommonWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:October2020UnderwriterWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:October2020UnderwriterWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:May2020UnderwriterWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:May2020UnderwriterWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:March2019ServicesWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:March2019ServicesWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:March2020CommonWarrantMemberus-gaap:WarrantMember2023-11-300001675634pixy:March2020CommonWarrantMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:March2020ExchangeWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:March2020ExchangeWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:May2021UnderwriterWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:May2021UnderwriterWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:September2021UnderwriterWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:September2021UnderwriterWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:July2023CommonWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:October2023CommonWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:September2022UnderwriterWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:July2022CommonWarrantsMemberus-gaap:WarrantMember2023-09-012023-11-300001675634pixy:July2022CommonWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:September2022UnderwriterWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:July2023CommonWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:October2023CommonWarrantsMemberus-gaap:WarrantMember2023-11-300001675634pixy:SunzInsuranceSolutionsLLCMember2023-11-300001675634pixy:OtherCurrentLiabilitiesOtherMember2023-08-310001675634pixy:OtherCurrentLiabilitiesBusinessTaxMember2023-08-310001675634pixy:OtherCurrentLiabilitiesBusinessTaxMember2023-11-300001675634pixy:OtherCurrentLiabilitiesFinancedInsurancePoliciesMember2023-08-310001675634pixy:OtherCurrentLiabilitiesFinancedInsurancePoliciesMember2023-11-300001675634pixy:OtherCurrentLiabilitiesDueIHCMember2023-08-310001675634pixy:OtherCurrentLiabilitiesDueIHCMember2023-11-300001675634pixy:OtherCurrentLiabilitiesERTCOwedClientsMember2023-08-310001675634pixy:OtherCurrentLiabilitiesERTCOwedClientsMember2023-11-300001675634pixy:OtherCurrentLiabilitiesOtherMember2023-11-300001675634pixy:OtherCurrentLiabilitiesWorkersCompensationMember2023-08-310001675634pixy:OtherCurrentLiabilitiesWorkersCompensationMember2023-11-300001675634pixy:OtherCurrentLiabilitiesSharesOwedDirectorsForServicesMember2023-08-310001675634pixy:OtherCurrentLiabilitiesSharesOwedDirectorsForServicesMember2023-11-300001675634pixy:OtherCurrentLiabilitiesLegalSettlementMember2023-08-310001675634pixy:OtherCurrentLiabilitiesLegalSettlementMember2023-11-300001675634pixy:OtherCurrentLiabilitiesOperatingLeaseLiabilityMember2023-08-310001675634pixy:OtherCurrentLiabilitiesOperatingLeaseLiabilityMember2023-11-300001675634pixy:OtherCurrentLiabilitiesContingentLeaseLiabilityMember2023-08-310001675634us-gaap:AccountsPayableMember2023-11-300001675634us-gaap:AccountsPayableMember2023-08-310001675634pixy:OtherCurrentLiabilitiesContingentLeaseLiabilityMember2023-11-300001675634pixy:EquipmentsMember2023-08-310001675634us-gaap:LeaseholdImprovementsMember2023-08-310001675634us-gaap:LeaseholdImprovementsMember2023-11-300001675634us-gaap:FurnitureAndFixturesMember2023-08-310001675634pixy:EquipmentsMember2023-11-300001675634us-gaap:FurnitureAndFixturesMember2023-11-300001675634us-gaap:AccountsReceivableMember2023-11-300001675634us-gaap:AccountsReceivableMember2023-08-310001675634pixy:IndustrialHumanCapitalIncMember2023-09-012023-11-300001675634us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpixy:PEOBusinessMember2020-01-030001675634us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpixy:PEOBusinessMember2023-09-012023-11-300001675634us-gaap:StockCompensationPlanMember2023-09-012023-11-300001675634pixy:WarrantOptionMember2022-09-012022-11-300001675634pixy:WarrantOptionMember2023-09-012023-11-300001675634pixy:EmployeeStockOptionTwoMember2022-09-012022-11-300001675634pixy:EmployeeStockOptionTwoMember2023-09-012023-11-300001675634pixy:ClientThreeMemberpixy:GrossRevenuesMemberus-gaap:CustomerConcentrationRiskMember2022-09-012022-11-300001675634pixy:ClientThreeMemberpixy:GrossRevenuesMemberus-gaap:CustomerConcentrationRiskMember2023-09-012023-11-300001675634pixy:ClientTwoMemberpixy:GrossRevenuesMemberus-gaap:CustomerConcentrationRiskMember2022-09-012022-11-300001675634pixy:ClientTwoMemberpixy:GrossRevenuesMemberus-gaap:CustomerConcentrationRiskMember2023-09-012023-11-300001675634pixy:ClientOneMemberpixy:GrossRevenuesMemberus-gaap:CustomerConcentrationRiskMember2022-09-012022-11-300001675634pixy:ClientOneMemberpixy:GrossRevenuesMemberus-gaap:CustomerConcentrationRiskMember2023-09-012023-11-300001675634pixy:ClientTwoMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2022-09-012023-08-310001675634pixy:ClientTwoMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-09-012023-11-300001675634pixy:ClientOneMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2022-09-012023-08-310001675634pixy:ClientOneMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-09-012023-11-300001675634pixy:NewYorkMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:GeographicConcentrationRiskMember2022-09-012022-11-300001675634pixy:NewMexicoMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:GeographicConcentrationRiskMember2022-09-012022-11-300001675634pixy:WashingtonMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:GeographicConcentrationRiskMember2022-09-012022-11-300001675634pixy:NewYorkMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:GeographicConcentrationRiskMember2023-09-012023-11-300001675634pixy:NewMexicoMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:GeographicConcentrationRiskMember2023-09-012023-11-300001675634pixy:WashingtonMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:GeographicConcentrationRiskMember2023-09-012023-11-300001675634us-gaap:CaliforniaFranchiseTaxBoardMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:GeographicConcentrationRiskMember2022-09-012022-11-300001675634us-gaap:CaliforniaFranchiseTaxBoardMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:GeographicConcentrationRiskMember2023-09-012023-11-300001675634pixy:StaffingServicesMember2023-09-012023-11-300001675634pixy:StaffingServicesMember2022-09-012022-11-300001675634pixy:HumanCapitalManagementServicesMember2023-09-012023-11-300001675634pixy:HumanCapitalManagementServicesMember2022-09-012022-11-3000016756342022-11-300001675634us-gaap:RetainedEarningsMember2023-11-300001675634us-gaap:AdditionalPaidInCapitalMember2023-11-300001675634us-gaap:CommonStockMember2023-11-300001675634pixy:PreferredStockSeriesAIssuedMember2023-11-300001675634us-gaap:RetainedEarningsMember2023-09-012023-11-300001675634us-gaap:AdditionalPaidInCapitalMember2023-09-012023-11-300001675634us-gaap:CommonStockMember2023-09-012023-11-300001675634pixy:PreferredStockSeriesAIssuedMember2023-09-012023-11-300001675634us-gaap:RetainedEarningsMember2023-08-310001675634us-gaap:AdditionalPaidInCapitalMember2023-08-310001675634us-gaap:CommonStockMember2023-08-310001675634pixy:PreferredStockSeriesAIssuedMember2023-08-3100016756342022-09-300001675634us-gaap:NoncontrollingInterestMember2022-09-300001675634pixy:TotalStockholdersDeficitShoftPixyIncMember2022-09-300001675634us-gaap:RetainedEarningsMember2022-09-300001675634us-gaap:AdditionalPaidInCapitalMember2022-09-300001675634us-gaap:CommonStockMember2022-09-300001675634pixy:PreferredStockSeriesAIssuedMember2022-09-3000016756342022-09-012022-09-300001675634us-gaap:NoncontrollingInterestMember2022-09-012022-09-300001675634pixy:TotalStockholdersDeficitShoftPixyIncMember2022-09-012022-09-300001675634us-gaap:RetainedEarningsMember2022-09-012022-09-300001675634us-gaap:AdditionalPaidInCapitalMember2022-09-012022-09-300001675634us-gaap:CommonStockMember2022-09-012022-09-300001675634pixy:PreferredStockSeriesAIssuedMember2022-09-012022-09-3000016756342022-08-310001675634us-gaap:NoncontrollingInterestMember2022-08-310001675634pixy:TotalStockholdersDeficitShoftPixyIncMember2022-08-310001675634us-gaap:RetainedEarningsMember2022-08-310001675634us-gaap:AdditionalPaidInCapitalMember2022-08-310001675634us-gaap:CommonStockMember2022-08-310001675634pixy:PreferredStockSeriesAIssuedMember2022-08-3100016756342022-09-012022-11-3000016756342023-08-3100016756342023-11-3000016756342024-01-19iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureutr:sqft

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended November 30, 2023

☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT |

For the transition period from _______ to _______

SEC File No. 001-37954

SHIFTPIXY, INC. |

(Exact name of registrant as specified in its charter) |

Wyoming | | 47-4211438 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

4101 NW 25th Street, Miami, FL | | 33131 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number: (888) 798-9100

N/A

(Former name, former address and former three months, if changed since last report)

Securities registered under Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

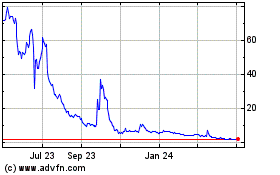

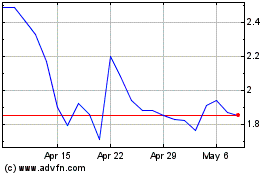

Common Stock, par value $0.0001 per share | | PIXY | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

Emerging growth company | ☒ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of the registrant’s only class of common stock issued and outstanding as of January 19, 2024, was 5,397,698.

TABLE OF CONTENTS

PART I — FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

Condensed Consolidated Balance Sheets

| | November 30, 2023 | | | August 31, 2023 | |

| | (Unaudited) | | | | |

ASSETS | |

Current assets | | | | | | |

Cash | | $ | 1,493,000 | | | $ | 75,000 | |

Accounts receivable, net | | | 390,000 | | | | 590,000 | |

Unbilled accounts receivable | | | 1,683,000 | | | | 1,784,000 | |

Prepaid expenses | | | 636,000 | | | | 839,000 | |

Other current assets | | | 532,000 | | | | 532,000 | |

Total current assets | | | 4,734,000 | | | | 3,820,000 | |

| | | | | | | | |

Fixed assets, net | | | 1,469,000 | | | | 1,622,000 | |

Right-of-use asset, net | | | 779,000 | | | | 866,000 | |

Deposits and other assets | | | 192,000 | | | | 192,000 | |

Total assets | | $ | 7,174,000 | | | $ | 6,500,000 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

| | | | | | | | |

Current liabilities | | | | | | | | |

Accounts payable and other accrued liabilities | | $ | 24,360,000 | | | $ | 17,911,000 | |

Payroll tax related liabilities | | | 31,814,000 | | | | 29,595,000 | |

Payroll related liabilities | | | 2,924,000 | | | | 2,940,000 | |

Accrued workers’ compensation costs discounted operations | | | — | | | | 4,389,000 | |

Total current liabilities | | | 59,098,000 | | | | 54,835,000 | |

Non-current liabilities | | | | | | | | |

Operating lease liability, non-current | | | 2,558,000 | | | | 2,790,000 | |

Total liabilities | | | 61,656,000 | | | | 57,625,000 | |

Commitments and contingencies (See Notes 10 and 11) | | | | | | | | |

Stockholders’ deficit | | | | | | | | |

Convertible preferred stock series A, 50,000,000 authorized shares; $0.0001 par value: 0 shares and 358,333 shares issued and outstanding as of November 30, 2023 and August 31, 2023, respectively | | | — | | | | — | |

Common stock, 750,000,000 authorized shares; $0.0001 par value; and 5,397,687 shares and 507,383 issued and outstanding as of November 30, 2023 and August 31, 2023, respectively | | | — | | | | — | |

Additional paid-in capital | | | 177,417,000 | | | | 175,226,000 | |

Accumulated deficit | | | (231,899,000 | ) | | | (226,351,000 | ) |

Total stockholders’ deficit | | | (54,482,000 | ) | | | (51,125,000 | ) |

Total liabilities and stockholders’ deficit | | $ | 7,174,000 | | | $ | 6,500,000 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ShiftPixy, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| | For the Three Months Ended | |

| | November 30, 2023 | | | November 30, 2022 | |

Revenues | | $ | 3,774,000 | | | $ | 5,266,000 | |

Cost of revenue | | | 3,324,000 | | | | 4,845,000 | |

Gross profit | | | 450,000 | | | | 421,000 | |

| | | | | | | | |

Operating expenses: | | | | | | | | |

Salaries, wages, and payroll taxes | | | 2,896,000 | | | | 3,069,000 | |

Professional fees | | | 814,000 | | | | 1,195,000 | |

Software development | | | — | | | | 60,000 | |

Depreciation and amortization | | | 141,000 | | | | 149,000 | |

General and administrative | | | 4,629,000 | | | | 1,171,000 | |

Total operating expenses | | | 8,480,000 | | | | 5,644,000 | |

| | | | | | | | |

Operating loss | | | (8,030,000 | ) | | | (5,223,000 | ) |

| | | | | | | | |

Other (expense) income: | | | | | | | | |

Gain from legal settlement | | | 2,500,000 | | | | — | |

Other | | | (18,000 | ) | | | — | |

Total other (expense) income | | | 2,482,000 | | | | — | |

| | | | | | | | |

Loss from continuing operations | | | (5,548,000 | ) | | | (5,223,000 | ) |

| | | | | | | | |

Loss from discontinued operations, net of tax | | | — | | | | (200,000 | ) |

| | | | | | | | |

Net loss | | | (5,548,000 | ) | | | (5,423,000 | ) |

| | | | | | | | |

Preferred stocks series A preferential dividend | | | (67,444,000 | ) | | | (127,145,000 | ) |

| | | | | | | | |

Net loss attributable to ShiftPixy, Inc. shareholders | | $ | (72,992,000 | ) | | $ | (132,568,000 | ) |

| | | | | | | | |

Net loss per share, Basic and diluted | | | | | | | | |

Continuing operations | | $ | (25.13 | ) | | $ | (33.21 | ) |

Discounting operations | | | — | | | | (0.50 | ) |

Net loss per common share – Basic and diluted | | $ | (25.13 | ) | | $ | (333.72 | ) |

| | | | | | | | |

Weighted average common shares outstanding – Basic and diluted | | | 2,904,021 | | | | 397,249 | |

The accompanying notes are an integral part of these condensed consolidated financial statement.

ShiftPixy, Inc.

Condensed Consolidated Statements of Stockholders' Deficit

For the Three Months Ended November 30, 2023 and For the Three Months Ended November 30, 2022

(Unaudited)

| | Preferred Stock Series A Issued | | | Common Stock Issued | | | Additional Paid-In | | | Accumulated | | | Total Stockholders’ Deficit ShiftPixy, | | | Noncontrolling | | | Total Stockholders' | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Inc. | | | interest | | | Deficit | |

Balance, September 1, 2022 | | | 358,333 | | | $ | — | | | | 21,390 | | | $ | — | | | $ | 151,737,000 | | | $ | (192,725,000 | ) | | $ | (40,988,000 | ) | | $ | 9,494,000 | | | $ | (31,494,000 | ) |

Fair market value increase of preferred stock | | | | | | | — | | | | — | | | | — | | | | 127,145,000 | | | | — | | | | 127,145,000 | | | | — | | | | 127,145,000 | |

Preferential dividend of preferred stock series A | | | — | | | | — | | | | — | | | | — | | | | (127,145,000 | ) | | | — | | | | (127,145,000 | ) | | | — | | | | (127,145,000 | ) |

Common stock issued for private placement, net of offering expenses | | | — | | | | — | | | | 17,361 | | | | — | | | | 4,387,000 | | | | | | | | 4,387,000 | | | | | | | | 4,387,000 | |

Common stock issued on exercised prefunded warrants | | | — | | | | — | | | | 5,175 | | | | | | | | 1,000 | | | | — | | | | 1,000 | | | | — | | | | 1,000 | |

Common stock issued in connection with conversion of preferred shares series A Stock | | | (358,333 | ) | | | — | | | | 358,333 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Stock-based compensation expense | | | — | | | | — | | | | — | | | | — | | | | 255,000 | | | | — | | | | 255,000 | | | | — | | | | 255,000 | |

Warrant modification expense | | | — | | | | — | | | | — | | | | — | | | | 106,000 | | | | — | | | | 106,000 | | | | — | | | | 106,000 | |

Additional Shares issued due to reverse stock split | | | — | | | | — | | | | 708 | | | | — | | | | | | | | | | | | — | | | | — | | | | — | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (5,423,000 | ) | | | (5,423,000 | ) | | | | | | | (5,423,000 | ) |

Balance, November 30, 2022 | | | — | | | $ | — | | | | 402,967 | | | $ | — | | | $ | 156,486,000 | | | $ | (198,148,000 | ) | | $ | (41,662,000 | ) | | $ | 9,494,000 | | | $ | (32,168,000 | ) |

| | Preferred Stock Series A Issued | | | Common Stock Issued | | | Additional Paid-In | | | Accumulated | | | Total Stockholders’ Deficit ShiftPixy, | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Inc. | |

Balance, September 1, 2023 | | | — | | | $ | — | | | | 507,383 | | | $ | — | | | $ | 175,226,000 | | | $ | (226,351,000 | ) | | $ | (51,125,000 | ) |

Fair market value increase of preferred stock series A | | | — | | | | — | | | | — | | | | — | | | | 67,444,000 | ) | | | — | | | | 67,444,000 | |

Preferential dividend of preferred stock Series A | | | — | | | | — | | | | — | | | | — | | | | (67,444,000 | ) | | | — | | | | (67,444,000 | ) |

Common stock issued for private placement, including the exercise of prefunded warrant net of offering cost | | | — | | | | — | | | | 94,375 | | | | — | | | | 2,016,000 | | | | — | | | | 2,016,000 | |

Preferred stock series A issued upon the exercise of preferred stock option | | | 4,744,234 | | | | | | | | — | | | | | | | | — | | | | — | | | | — | |

Common stock issued on conversion of preferred shares. | | | (4,744,234 | ) | | | — | | | | 4,744,234 | | | | — | | | | — | | | | — | | | | — | |

Stock-based compensation expense | | | — | | | | — | | | | — | | | | — | | | | 175,000 | | | | — | | | | 175,000 | |

Additional Shares issued due to reverse stock split | | | — | | | | — | | | | 51,706 | | | | — | | | | — | | | | — | | | | — | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (5,548,000 | ) | | | (5,548,000 | ) |

Balance, November 30, 2023 | | | — | | | $ | — | | | | 5,397,698 | | | $ | — | | | $ | 177,417,000 | | | $ | (231,899,000 | ) | | $ | (54,482,000 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ShiftPixy, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | For the Three Months Ended | |

| | November 30, 2023 | | | November 30, 2022 | |

OPERATING ACTIVITIES | | | | | | |

Net loss | | $ | (5,548,000 | ) | | $ | (5,423,000 | ) |

Loss from discontinued operations | | | — | | | | (200,000 | ) |

Net loss from continuing operations | | | (5,548,000 | ) | | | (5,223,000 | ) |

Adjustments to reconcile net loss from continuing operations to net cash used in continuing operating activities: | | | | | | | | |

Depreciation and amortization | | | 141,000 | | | | 149,000 | |

Stock-based compensation | | | 175,000 | | | | 255,000 | |

Warrant modification expense | | | — | | | | 106,000 | |

Amortization of operating lease | | | 87,000 | | | | 23,000 | |

Stock-based compensation for shares to be issued for services | | | 38,000 | | | | — | |

Bad debts | | | 57,000 | | | | — | |

Loss from sale of fixed assets | | | 7,000 | | | | — | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts receivable | | | 143,000 | | | | 41,000 | |

Unbilled accounts receivable | | | 101,000 | | | | (601,000 | ) |

Prepaid expenses and other current assets | | | 203,000 | | | | 115,000 | |

Deposits and other assets | | | - | | | | (1,000 | ) |

Accounts payable and other accrued liabilities | | | 1,790,000 | | | | (1,317,000 | ) |

Payroll tax liabilities | | | 2,219,000 | | | | 2,245,000 | |

Payroll related liabilities | | | (16,000 | ) | | | 466,000 | |

Total Adjustments | | | 4,945,000 | | | | 1,481,000 | |

Net cash used in continuing operating activities | | | (603,000 | ) | | | (3,742,000 | ) |

| | | | | | | | |

INVESTING ACTIVITIES | | | | | | | | |

Purchase of fixed assets | | | — | | | | (400,000 | ) |

Proceeds from the sale of fixed assts | | | 5,000 | | | | | |

Net cash provided by (used in) investing activities | | | 5,000 | | | | (400,000 | ) |

| | | | | | | | |

FINANCING ACTIVITIES | | | | | | | | |

Proceeds from prefunded warrant exercises | | | - | | | | 1,000 | |

Proceeds from private placement prefunded warrants, net of offering costs | | | 2,016,000 | | | | 4,387,000 | |

Net cash provided by financing activities | | | 2,016,000 | | | | 4,388,000 | |

Net increase in cash | | | 1,418,000 | | | | 246,000 | |

Cash - Beginning of Period | | | 75,000 | | | | 618,000 | |

Cash -End of Period | | $ | 1,493,000 | | | $ | 864,000 | |

Supplemental Disclosure of Cash Flows Information: | | | | | | | | |

Cash paid for interest | | $ | 21,900 | | | $ | — | |

Cash paid for income taxes | | | — | | | | — | |

Non-cash Investing and Financing Activities: | | | | | | | | |

Increase in marketable securities in trust account and Class A mandatory redeemable common shares | | $ | — | | | $ | 801,000 | |

Transfer of preferred shares to common shares | | $ | — | | | $ | 1,000 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

ShiftPixy, Inc.

Notes to the Condensed Consolidated Financial Statements

(Unaudited)

Note 1: Nature of Operations

ShiftPixy, Inc. (the “Company”) was incorporated on June 3, 2015, in the State of Wyoming. The Company is a specialized Human Capital service provider that provides solutions for large, contingent, part-time workforce demands, primarily in the restaurant and hospitality service trades. The Company’s historic focus has been on the quick service restaurant industry in Southern California, but the Company has expanded into other geographic areas and industries that employ temporary or part-time labor sources, notably including the healthcare industry.

The Company functions as an employment administrative services (“EAS”) provider primarily through its wholly owned subsidiary, ReThink Human Capital Management, Inc. (“HCM”), as well as a staffing provider through another of its wholly owned subsidiaries, ShiftPixy Staffing, Inc. (“Staffing”). These subsidiaries provide a variety of services to our clients typically as a co-employer through HCM and a direct employer through Staffing, including the following: administrative services, payroll processing, human resources consulting, and workers’ compensation administration and coverage (as permitted and/or required by state law). The Company has built a human resources information systems (“HRIS”) platform to assist in client acquisition that simplifies the onboarding of new clients into the Company’s closed proprietary operating and processing information system (the “ShiftPixy Ecosystem”).

In January 2020, the Company sold the assets of Shift Human Capital Management Inc. (“SHCM”), a wholly owned subsidiary of the Company, pursuant to which the Company assigned the majority of the Company’s billable clients at the time of the sale to a third party for cash. The continuing impact of this transaction on the Company’s condensed financial statements is described in Note 2.

Effective October 14, 2023, the Company filed articles of amendment to the Company’s articles of incorporation to effect a one-for-twenty four (1:24) reverse split of the Company’s issued and outstanding shares of common stock. The reverse split became effective on Nasdaq October 16, 2023. All references to common stock, warrants and options except for the conditional preferred stock option granted in August 2023, to purchase common stock, including per share data and related information contained in the condensed consolidated financial statements have been retroactively adjusted to reflect the effect of the reverse stock split for all periods presented.

Note 2: Summary of Significant Accounting Policies

Basis of Presentation

The accompanying condensed consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and the rules of the Securities and Exchange Commission (“SEC”) applicable to interim reports of companies filing as a small reporting company. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for fair presentation have been included. The results of condensed operations for the three months ended November 30, 2023, are not necessarily indicative of the results that may be expected for the full year ending August 31, 2024. For further information, refer to the condensed consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended August 31, 2023 (“Fiscal 2023”), filed with the SEC on December 14, 2023.

Principles of Consolidation

The condensed consolidated financial statements include the accounts of ShiftPixy, Inc., and its wholly owned subsidiaries. The condensed consolidated financial statements previously included the accounts of Industrial Human Capital, Inc. (“IHC”), which was a special purpose acquisition company, or “SPAC,” for which our wholly owned subsidiary, ShiftPixy Investments, Inc., served as the financial sponsor (as described below), and which SPAC was deemed to be controlled by the Company a result of the Company’s 15% equity ownership stake, the overlap of three of our executive officers for a period of time as executive officers of IHC, and significant influence that the Company exercised over the funding and acquisition of new operations for an initial business combination (“IBC”). that was a A Variable Interest Entity, All intercompany balances have been eliminated in consolidation until February 7, 2023, at which time it was deconosolidated. As of February 7, 2023, IHC was not a part of the Company’s operations, and consolidation. IHC was dissolved on November 14, 2022, and the Trustee released all the redemption funds from the Trust Account, 4, to IHC shareholders on December 1, 2022, effectively liquidating the Trust. On February 7, 2023, three creditors of IHC filed an involuntary petition for liquidation under Chapter 7 against IHC in the US Bankruptcy Court for the Southern District of Florida. Pursuant to ASC 810-10-15, consolidation is precluded where control does not rest for a non-controlling interest in legal reorganization or bankruptcy. In addition, IHC did not meet the criteria of a Variable Interest Entity (“VIE”). See Note 11 for litigation with IHC.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires the Company to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates include:

| · | Continuation as a going concern; management assumes that the Company will continue as a going concern, which contemplates continuity of operations, realization of assets and liquidation of all liabilities in the normal course of business |

| · | Liability for legal contingencies |

| · | Payroll tax and associated penalties and interest |

| · | Impairment of long-lived assets |

These significant accounting estimates or assumptions bear the risk of change due to the fact that there are uncertainties to these estimates or assumptions that are difficult to measure of value.

Management regularly reviews the key factors and assumptions to develop the estimates utilizing currently available information, changes in facts and circumstances, historical experience, and reasonable assumptions. After such valuation, if deemed appropriate, those estimates are adjusted accordingly.

Liquidity, Capital Resources and Going Concern

As of November 30, 2023, the Company had cash of $1.5 million and a working capital deficit of $54.4 million. During the three months ended November 30, 2023, the Company used approximately $0.6 million of cash from operations and incurred recurring losses, resulting in an accumulated deficit of $231.9 million. As of November 30, 2023, the Company is delinquent with respect to remitting payroll tax payments to the IRS, states and local jurisdictions. The Company has retained tax counsel and has been in near constant communication with the IRS regarding processing its Employee Retention Tax Credits (“ERTCs”). As of September 14, 2023, the IRS has a moratorium on processing new ERTC claims and many of the Company’s clients are seeking refunds. Recently, the Company has filed ERTC claims for its clients and has not received any acceptance from the IRS. Some clients have filed suits against the Company, demanding that the Company take action to file for additional ERTCs for certain tax periods.

· | ShiftPixy has received notices of $11.9 million as of August 31, 2023 and notices relating to liens from the IRS claiming it owes approximately $9.0 million for unpaid payroll tax liabilities, including penalties and interest. The balances reported on such notices do not represent the full payroll tax liability of ShiftPixy as of November 30, 2023 and August 31, 2023, respectively. ShiftPixy expects its payroll tax liabilities, penalties and interest to increase in the future. Moreover, the IRS has threatened to take enforced collection against ShiftPixy, Inc. and ShiftPixy, potentially in addition to other subsidiaries. ShiftPixy has taken steps to preserve so-called “collection due process rights” and present collection alternatives to the proposed enforced collection actions(s). Specifically: |

| |

· | ShiftPixy had a collection due process hearing with the IRS Independent Office of Appeals on October 24, 2023. On October 24 and November 6, 2023, ShiftPixy requested that the IRS Independent Office of Appeals (“Appeals”), among other things, abate additions to tax and related interest for the failure to make required deposits and the failure to timely pay required tax. That request is pending before Appeals; and |

| |

· | On October 27, 2023, the IRS issued to ShiftPixy a Letter 1058, Final Notice, Notice of Intent to Levy and Notice of Your Right to a Hearing, with respect to ShiftPixy's (a) Form 941 liabilities for the tax periods ending March 31, June 30, September 30, and December 31, 2022, and (b) Form 940 liabilities for the tax period ending December 31, 2022 (such liabilities, “ShiftPixy’s Liability That Are Subject to Enforced Collection”). On November 26, 2023, ShiftPixy timely filed a Form 12153, Request for a Collection Due Process or Equivalent Hearing, with respect to ShiftPixy's Liability That Are Subject to Enforced Collection. That Form 12153 requested, among other things, an abatement of additions to tax and related interest for the failure to make required deposits and the failure to timely pay required tax that are included within ShiftPixy’s Liability That Are Subject to Enforced Collection. That request is pending before the IRS Independent Office of Appeals. . |

| |

On December 12, 2023, the Company received a lien from the IRS. The IRS can levy the Company’s bank accounts. On January 12, 2024, ShiftPixy filed Form 12153 , Request for a Collection Due Process or Equivalent Hearing, with respect to ShiftPixy's Liability That Are Subject to Enforced Collection |

Notwithstanding the above-described requests for a collection due process hearing, the IRS can determine the collectability of tax. The IRS can, with limited notice, levy the Company’s bank accounts and subject it to enforced collection if ShiftPixy cannot obtain a resolution of the payroll tax issues, the United States Tax Court can (and will be asked to) review Appeals’ determination. There is no assurance that the IRS will abate penalties and interest currently assessed against ShiftPixy. If ShiftPixy is not successful getting the outstanding penalties, and or interest abated, including working out a payment plan with the IRS, it may cause ShiftPixy to file for bankruptcy protection in the near future.

The Company has taken aggressive steps to reduce its overhead expenses. The Company has plans and expectations for the next twelve months include raising additional capital which may help fund the Company’s operations and seeking acquisitions targets funded by debt or stock by Company’s in staffing services as the key driver towards its success.

The Company expects to engage in additional sales of its securities during the next twelve months either through registered public offerings or private placements, the proceeds of which the Company intends to use to fund its operations. If these sources do not provide the capital necessary to fund the Company’s operations during the next twelve months, it may need to curtail certain aspects of its operations or expansion activities, consider the sale of additional assets at distressed prices, or consider other means of financing. The Company is also seeking acquisition targets funded by debt and stock, for growth, a recurring revenue base, significant gross profit conversion, margin expansion opportunities, a light industrial sector focus, a blue-chip client base, cyclical tailwinds, and a tenured management team willing and able to execute a comprehensive integration plan. The Company can give no assurance that it will be successful in implementing its business plan and obtaining financing on advantageous terms, or that any such additional financing will be available. These condensed consolidated financial statements do not include any adjustments for this uncertainty. See Note 11, Contingencies for litigation with IHC. If the Company is not successful with outstanding litigation, this could have a material cash flows requirement and a negative impact on ShiftPixy’s operations and working capital.

Under the existing accounting guidance, management must evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date the condensed consolidated financial statements are issued. This evaluation initially does not take into consideration the potential mitigating effect of management’s plans that have not been fully implemented as of the date the consolidated financial statements are issued. When substantial doubt is determined to exist, management evaluates whether the mitigating effect of its plans sufficiently alleviates substantial doubt about the Company’s ability to continue as a going concern. The mitigating effect of management’s plans; however, is only considered if both (1) it is probable that the plans will be effectively implemented within one year after the date the condensed consolidated financial statements are issued, and (2) it is probable that the plans, when implemented, may mitigate the relevant conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern within one year after the date the condensed consolidated financial statements are issued. Therefore, management has concluded that there is substantial doubt about the Company’s ability to continue as a going concern for the next twelve months from the date of the issuance of the condensed consolidated financial statements.

Historically, the Company’s principal source of financing has come through the sale of the Company’s common stock, including in certain instances, warrants and the issuance of convertible notes.

Revenue and Direct Cost Recognition

The Company’s revenues are primarily disaggregated into fees for providing staffing solutions and EAS/HCM services. The Company enters into contracts with its clients for Staffing based on a stated rate and price in the contract. Contracts generally have a term of 12 months, are cancellable at any time by either party with 30 days’ written notice. Revenue is (i) persuasive evidence of an arrangement exists; (ii) the services have been rendered to the customer; (iii) the sales price is fixed or determinable; and (iv) collectability is reasonably assured. The performance obligations in the agreements are generally combined into one performance obligation, as they are considered a series of distinct services, and are satisfied over time because the client simultaneously receives and consumes the benefits provided as the Company performs the services. The Company does not have significant financing components or significant payment terms for its clients and consequently has no material credit losses. The Company uses the output method based on a stated rate and price over the payroll processed to recognize revenue, as the value to the client of the goods or services transferred to date appropriately depicts the Company’s performance towards complete satisfaction of the performance obligation.

Staffing Solutions

The Company records gross billings as revenues for its staffing solutions clients. The Company is primarily responsible for fulfilling the staffing solutions services and has discretion in establishing price. The Company includes payroll costs in revenues with a corresponding increase to cost of revenues for payroll costs associated with these services. As a result, the Company is the principal in this arrangement for revenue recognition purposes.

EAS Solutions / HCM

Employment administrative service or EAS solutions “EAS” and Human Capital Management “HCM” revenues are primarily derived from the Company’s gross billings, which are based on (i) the payroll cost of the Company’s worksite employees (“WSEs”) and (ii) an administrative fee and (iii) if eligible, WSE can elect certain pass-through benefits.

Gross billings are invoiced to each EAS and HCM client, concurrently with each periodic payroll. Revenues are offset by payroll cost component and pass through costs which are presented on a net basis for revenue recognition. WSEs perform their services at the client's worksite. The Company assumes responsibility for processing and remitting payroll to the WSE and payroll related obligations, it does not assume employment-related responsibilities such as determining the amount of the payroll and related payroll obligations. Revenues that have been recognized but not invoiced are included in unbilled accounts receivable on the Company’s condensed consolidated balance sheets were $1.7 million and $1.8 million, as of November 30, 2023 and August 31, 2023, respectively. Payments received by clients in advance of the due date of an invoice are recorded as liability. As of November 30, 2023 and August 31, 2023. the Company recorded a liability for advance payments of $0.4 million and $0.2 million, respectively, is included in accounts payable and other liabilities on the condensed balance sheets.

Disaggregation of Revenue

The Company’s primary revenue streams include HCM / EAS and staffing services. The Company’s disaggregated revenues for the three months ended November 30, 2023 and November 30, 2022, respectively, were as follows (in millions):

| | For the Three Months Ended | |

Revenue (in thousands): | | November 30, 2023 | | | November 30, 2022 | |

| | | | | | |

HCM / EAS (1) | | $ | 0.6 | | | $ | 1.5 | |

Staffing | | | 3.2 | | | | 3.8 | |

Total | | $ | 3.8 | | | $ | 5.3 | |

(1) HCM / EAS revenue is presented net, gross less worksite employees’ payroll cost. Gross billings for the three months ended November 30, 2023 was $7.9 million, less worksite employee cost of $7.3 million. Gross billings for the three months November 30, 2022 was $11.7 million, less worksite employees payroll cost of $10.2 million.

The following states represents more than 10% of total revenues for the three months ended November 30, 2023 and November 30, 2022, respectively, as follows:

| | For the Three Months Ended | |

States: | | November 30, 2023 | | | November 30, 2022 | |

California | | | 26.2 | % | | | 48.8 | % |

Washington | | | 16.5 | % | | | 12.2 | % |

New Mexico | | | 23.6 | % | | | 10.2 | % |

New York | | | 12.9 | % | | | 0.4 | % |

Discontinued Operations and Workers’ Compensation

On January 3, 2020, the Company entered into an asset purchase agreement with Shiftable HR Acquisition, LLC, a wholly owned subsidiary of Vensure, pursuant which was the assigned client contracts was significant to its revenues for the three months ended November 30, 2019, including 100% of the Company’s existing professional employer organization or PEO business. In connection with this transaction, the Company had a Note Receivable to be paid over four years. Prior to Fiscal Year 2023, the Company determined that it was probable that all contractually required payments would not be collected and recorded a reserve on the collectability. For the full amount receivable. Up until November 15, 2023, the company was in litigation with Vensure regarding the aforementioned note receivable. On November 15, 2023, the Company won an arbitration cause for $2.5 million, resulting in a gain during the three month ended November 30, 2023.

The Company had retained workers’ compensation reserves and workers’ compensation related liabilities for former WSEs of clients transferred to Shiftable HR Acquisition LLC in connection with the Vensure Asset Sale, under the Company’s former workers compensation programs “Everest, and Sunz Insurance Solutions, LLC (“Sunz”), which calculated the final policy premium based on the Company’s loss experience during the term of the policy and the stipulated formula set forth in the policy.

The Vensure Asset Sale had previously met the criteria of discontinued operations set forth in ASC 205 and as such the retained workers’ compensation asset and liabilities were presented as a discontinued operation.

Subsequent to the Vensure Asset sale, the Company entered into litigation with both Everest and Sunz, see Note 11 Contingencies and Note 12 Subsequent Events. As of November 30, 2023, the Company has now settled its’ litigation with both Everest and Sunz.

As a result of the settlement wit Everest and Sunz, the Company recorded $0.1 million out of discontinued operations to continued operations $0.1 million for the three months ended November 30, 2023. In addition, the Company recorded $2.1 million for the Sunz litigation for the three months ended November 30, 2023.

Incremental Cost of Obtaining a Contract

Pursuant to the “practical expedients” provided under Accounting Standards Update “ASC” No 2014-09, the Company expenses sales commissions when incurred because the terms of its contracts are cancellable by either party upon 30-day notice. These costs are recorded in commissions in the Company’s unaudited condensed Consolidated Statements of Operations.

Segment Reporting

The Company operates as one reportable segment under Accounting Standards Codification “ASC” 280, Segment Reporting. The chief operating decision maker regularly reviews the financial information of the Company at a consolidated level in deciding how to allocate resources and in assessing performance.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less when purchased as cash equivalents. The Company had no cash equivalent as of November 30, 2023 and August 31, 2023.

Concentration of Credit Risk

The Company maintains cash with a commercial bank, which is insured by the Federal Deposit Insurance Corporation (“FDIC”). At various times, the Company has deposits in this financial institution in excess of the amount insured by the FDIC. The Company has not experienced any losses related to these balances and believes its credit risk to be minimal. As of November 30, 2023, and August 31, 2022, there was $1.9 million and $0.0 million, respectively, of cash on deposit in excess of the amounts insured by the FDIC.

The following represents clients who have ten percent of total accounts receivable as of November 30, 2023, and August 31, 2023, respectively.

| | As of | |

| | November 30, 2023 | | | August 31, 2023 | |

Client 1 | | | 50.8 | % | | | 64.5 | % |

Client 2 | | | 38.4 | % | | | 23.6 | % |

The following represents clients who have ten percent of gross revenues for the three months ended November 30, 2023, and November 30, 2022, respectively.

| | November 30, 2023 | | | November 30, 2022 | |

Client 1 | | | 18.6 | % | | | 0 | % |

Client 2 | | | 15.5 | % | | | 10.6 | % |

Client 3 | | | 11.7 | % | | | 7.7 | % |

Discontinued Operations and Workers’ Compensation

On January 3, 2020, the Company entered into an asset purchase agreement with Shiftable HR Acquisition, LLC, a wholly owned subsidiary of Vensure, pursuant which was the assigned client contracts was significant to its revenues for the three months ended November 30, 2019, including 100% of the Company’s existing professional employer organization or PEO business. In connection with this transaction, the Company had a Note Receivable to be paid over four years. Prior to Fiscal Year 2023, the Company determined that it was probable that all contractually required payments would not be collected and recorded a reserve on the collectability. For the full amount receivable. Up until November 15, 2023, the company was in litigation with Vensure regarding the aforementioned note receivable. On November 15, 2023, the Company won an arbitration cause for $2.5 million, resulting in a gain during the three-month period ended November 30, 2023.

The Company had retained workers’ compensation reserves and workers’ compensation related liabilities for former WSEs of clients transferred to Shiftable HR Acquisition LLC in connection with the Vensure Asset Sale, under the Company’s former workers compensation programs “Everest, and Sunz Insurance Solutions, LLC (“Sunz”), which calculated the final policy premium based on the Company’s loss experience during the term of the policy and the stipulated formula set forth in the policy.

The Vensure Asset Sale had previously met the criteria of discontinued operations set forth in ASC 205 and as such the retained workers’ compensation asset and liabilities were presented as a discontinued operation.

Subsequent to the Vensure Asset sale, the Company entered into litigation with both Everest and Sunz, see Note 11 Contingencies and Note 12 Subsequent Events. As of November 30, 2023, the Company has now settled its’ litigation with both Everest and Sunz.

As a result of the settlement wit Everest and Sunz, the Company recorded $0.1 million out of discontinued operations to continued operations $0.1 million for the three months ended November 30, 2023. In addition, the Company recorded $2.1 million for the Sunz litigation for the three months ended November 30, 2023.

Fair Value of Financial Instruments

Accounting Standard Codification “ASC” 820, Fair Value Measurement, requires entities to disclose the fair value of financial instruments, both assets and liabilities recognized and not recognized on the balance sheet, for which it is practical to estimate fair value. ASC 820 defines fair value of a financial instrument as the amount at which the instrument could be exchanged in a current transaction between willing parties. As of November 30, 2023 and August 31, 2022, the carrying value of certain financial instruments (cash, accounts receivable and payable) approximated fair value due to the short-term nature of the instruments. Notes Receivable is valued at the Company’s estimate of expected collections.

The Company measures fair value under a framework that utilizes a hierarchy prioritizing the inputs to relevant valuation techniques. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of inputs used in measuring fair value are:

| · | Level 1: Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Company has the ability to access. |

| | |

| · | Level 2: Inputs to the valuation methodology include |

| · | Quoted prices for similar assets or liabilities in active markets |

| | |

| · | Quoted prices for identical or similar assets or liabilities in inactive markets |

| | |

| · | Inputs other than quoted prices that are observable for the asset or liability |

| | |

| · | Inputs that are derived principally from or corroborated by observable market data by correlation or other means; and |

| | |

| · | If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability |

| · | Level 3: Inputs to the valuation methodology are unobservable and significant to the fair value measurement |

When the Company changes its valuation inputs for measuring financial assets and liabilities at fair value, either due to changes in current market conditions or other factors, it could be required to transfer those assets or liabilities to another level in the hierarchy based on the new inputs used. The Company recognizes these transfers at the end of the reporting period that the transfers occur. The development and determination of the unobservable inputs for Level 3 fair value measurements and the fair value calculations are the responsibility of the Company’s chief financial officer and are approved by the chief executive officer. There were no transfers out of Level 3 for the three months ended November 30, 2023 and August 31, 2023, respectively.

Level 1 assets consisted of cash as of November 30, and August 31, 2023, respectively. The Company did not have any Level 2 or 3 assets or liabilities as of November 30, 2023 and August 31, 2023.

Advertising Costs

The Company expenses all advertising as incurred. Advertising expense for the three months ended November 30, 2023 and November 30, 2022 was $0.8 million and $0.7 million, respectively. Advertising expense includes salaries and external costs.

Income Taxes

The Company accounts for income taxes pursuant to ASC 740, Income Taxes. Under ASC 740, deferred income taxes are provided on a liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss carryforwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The provision for income taxes represents the tax expense for the period, if any, and the change during the period in deferred tax assets and liabilities. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment. ASC 740 also provides criteria for the recognition, measurement, presentation and disclosure of uncertain tax positions. Under ASC 740, the impact of an uncertain tax position on the income tax return may only be recognized at the largest amount that is more-likely-than-not to be sustained upon audit by the relevant taxing authority. A full valuation allowance was recorded as of November 30, 2023 and August 31, 2023, respectively.

Stock-Based Compensation

The Company has one stock-based compensation plan under which the Company may issue awards, as described in Note 8, Stock Based Compensation, below. The Company accounts for the Plan under the recognition and measurement principles of ASC 718, Compensation-Stock Compensation, which requires all stock-based payments to employees, including grants of employee stock options, to be recognized in the condensed consolidated statements of operations at their fair values.

The grant date fair value is determined using the Black-Scholes-Merton (“Black-Scholes”) pricing model. For all employee stock options, the Company recognizes expense on an accelerated basis over the employee’s requisite service period (generally the vesting period of the equity grant).

The Company’s option pricing model requires the input of highly subjective assumptions, including the expected stock price volatility and expected term. The expected volatility is based on the historical volatility of the Company’s common stock since the Company’s initial public offering. Any changes in these highly subjective assumptions significantly impact stock-based compensation expense.

The Company elects to account for forfeitures as they occur. As such, compensation cost previously recognized for an unvested award that is forfeited because of the failure to satisfy a service condition is revised in the period of forfeiture.

Net Loss Per Share

Basic net loss per common share is computed by dividing net loss attributable to common shareholders by the weighted-average number of shares of common stock outstanding including convertible preferred shares series A, and the option for preferred series A during the reporting period. The preferred series A are considered common stock since the exercise or conversion price to common stock is par value. Diluted net loss per share is computed similar to basic loss per share except that the denominator is increased to include additional common stock equivalents available upon exercise of stock options, warrants, shares of common stock to be issued to directors for services provided and the option for using the treasury stock method. Dilutive common stock equivalents include the dilutive effect of in-the-money stock equivalents, which are calculated based on the average share price for each period using the treasury stock method, excluding any common stock equivalents if their effect would be anti-dilutive. In periods in which a net loss has been incurred, all potentially dilutive common stock shares are considered anti-dilutive and thus are excluded from the calculation.

The following potentially dilutive securities were not included in the calculation of diluted net loss per share attributable to common shareholder of ShiftPixy, Inc. Because their effect would be antidilutive for the periods presented:

| | For the Three Months Ended November 30, 2023 | | | For the Three Months Ended November 30, 2022 | |

Options | | | 295 | | | | 442 | |

Shares to be issued for services to the board of directors | | | 1,208 | | | | - | |

Warrants | | | 232,679 | | | | 52,198 | |

Total potentially dilutive shares | | | 234,182 | | | | 52,640 | |

New Accounting Pronouncements Not Yet Adopted

In November 2023, the Financial Account Standard Board “FASB” issued Accounting Standards Update “ASU” 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which modifies the disclosure and presentation requirements of reportable segments. The amendments in the update require the disclosure of significant segment expenses that are regularly provided to the chief operating decision maker “CODM” and included within each reported measure of segment profit and loss. The amendments also require disclosure of all other segment items by reportable segment and a description of its composition. Additionally, the amendments require disclosure of the title and position of the CODM and an explanation of how the CODM uses the reported measure(s) of segment profit or loss in assessing segment performance and deciding how to allocate resources. This update is effective for annual periods beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, Early adoption is permitted. The Company is currently evaluating the impact that this guidance will have on the presentation of its condensed consolidated financial statements and accompanying notes.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which expands disclosures in an entity’s income tax rate reconciliation table and disclosures regarding cash taxes paid both in the U.S. and foreign jurisdictions. The update will be effective for annual periods beginning after December 15, 2025. The Company is currently evaluating the impact that this guidance will have on the presentation of its condensed consolidated financial statements and accompanying notes.

Reclassification

The Company reclassified certain expenses to conform to the current year's presentation, for penalties and interest expense that are included with salaries, wages and payroll taxes which was previously included in general and administrative expenses and other income (expenses). Accrued workers compensation has been reclassified to accounts payable and other accounts payable. The resulting changes from the condensed balance sheets reclassified certain items from the condensed statements of cash flows for the three months ended November 30, 2022.

Note 3: Accounts Receivable, Unbilled Receivable and Advanced Payments

The Company’s accounts receivable represents outstanding gross billings to clients, net of an allowance for estimated credit losses. The Company in some instances may require our clients to prefund payroll and related liabilities before payroll is processed or due for payment. If a client fails to fund payroll or misses the funding cut-off, at our sole discretion, ShiftPixy may pay the payroll and the resulting amounts due to us are recognized as accounts receivable. When client payment is received in advance of the Company’s performance under the contract, such amount is recorded as client deposits. We establish an allowance for credit losses based on the credit quality of clients, current economic conditions, the age of the accounts receivable balances, historical experience, and other factors that may affect clients’ ability to pay, and charge-off amounts against the allowance when they are deemed uncollectible. The allowance for credit losses was $0.2 million and $0.2 million as of November 30, 2023 and August 31, 2023, respectively.

The Company recognized unbilled revenue when work site employee payroll and payroll tax liabilities in the period in which the WSEs perform work. When clients'' pay periods cross reporting periods, we accrue the portion of the unpaid WSE payroll where we assume, under state regulations, the obligation for the payment of wages and the corresponding payroll tax liabilities associated with the work performed prior to period-end. These estimated payroll and payroll tax liabilities are recorded in accrued wages. The associated receivables, including estimated revenues, offset by advance collections from clients and an allowance for credit losses, are recorded as unbilled revenue. As of November 30, 2023 and August 31, 2023, advance collections included in unbilled revenue were $1.7 million and $1.8 million, respectively.

Payments received by clients in advance of the due date of an invoice are recorded as liability. As of November 30, 2023 and August 31, 2023. the Company recorded a liability for advance payments of $0.4 million and $0.2 million, respectively, is included in accounts payable and other liabilities on the condensed balance sheets.

Note 4: Fixed Assets

Fixed assets consisted of the following as of November 30, 2023, and August 31, 2023.

| | November 30, 2023 | | | August 31, 2023 | |

Equipment | | $ | 2,140,000 | | | $ | 2,182,000 | |

Furniture & fixtures | | | 614,000 | | | | 614,000 | |

Leasehold improvements | | | 604,000 | | | | 604,000 | |

| | | 3,358,000 | | | | 3,400,000 | |

Accumulated depreciation & amortization | | | (1,889,000 | ) | | | (1,778,000 | ) |

Fixed assets, net | | $ | 1,469,000 | | | $ | 1,622,000 | |

Depreciation and amortization expense for the three months ended November 30, 2023 and November 30, 2022 were $0.1 million and $0.1 million respectively.

Note 5: Accounts Payable and Other Current Liabilities

Accounts payable and other current liabilities consisted of the following as of November 30, 2023, and August 31, 2023:

| | November 30, 2023 | | | August 31, 2023 | |

Accounts payable (1) | | $ | 9,321,000 | | | $ | 6,527,000 | |

Contingent lease liability | | | 3,761,000 | | | | 3,761,000 | |

Operating lease liability | | | 895,000 | | | | 874,000 | |

Legal settlement | | | 5,790,000 | | | | 1,610,000 | |

Shares owed to directors for services | | | 794,000 | | | | 756,000 | |

Workers compensation | | | 24,000 | | | | 1,219,000 | |

ERTC owed to clients | | | 1,089,000 | | | | 1,089,000 | |

Due to IHC | | | 600,000 | | | | 600,000 | |

Financed insurance policies | | | 244,000 | | | | 335,000 | |

Business tax | | | 788,000 | | | | 150,000 | |

Other | | | 1,054,000 | | | | 990,000 | |

Total | | $ | 24,360,000 | | | $ | 17,911,000 | |

(1) | Includes $3.5 million of Sunz litigation settlement as of November 30, 2023. |

Note 6: Payroll Tax And Related Liabilities

Accrued payroll liabilities consisted of the following as of November 30, 2023, and August 31, 2023:

| | November 30, 2023 | | | August 31, 2023 | |

Payroll taxes liabilities | | $ | 23,692,000 | | | $ | 22,840,000 | |

Payroll related liabilities | | | 212,000 | | | | 237,000 | |

Accrued penalties and interest | | | 7,910,000 | | | | 6,518,000 | |

Total | | $ | 31,814,000 | | | $ | 29,595,000 | |

Payroll tax liabilities and payroll tax accrual are associated with the Company’s WSEs as well as its corporate employees. The Company has recorded approximately $7.9 million and $6.5 million in interest and penalties on approximately $23.7 and $22.8 million on delinquent outstanding payroll taxes to the IRS and states and local authorities as of November 30, 2023 and August 23, 2023, respectively. In addition, the Company has received notices from the IRS and has approximately $11.8 million for unpaid tax liabilities including penalties and interest. The IRS can levy the Company’s bank accounts and is subject to enforcement collections. ShiftPixy has requested for a collection due process or equivalent hearing, that are subject to enforced collection. ShiftPixy has also filed for an abatement of additions to tax and related interest for the failure to make required deposits and the failure to timely pay required tax that are subject to enforced collection. That request is pending before the IRS Independent Office of Appeals.

Note 7: Stockholders’ Deficit

Preferred Stock Series A

On September 1, 2022, Mr. Absher converted 358,333 preferred shares series A to 358,333 shares of the Company’s common stock. All of the 358,333 preferred shares series A were converted into common shares on September 1, 2022, after the Company's reverse stock split had taken effect. Accordingly, no preferred stock series A shares are issued and outstanding as of August 31, 2023.

On August 21, 2023, holders of an aggregate of 358,672 (representing 70.7%) of the Company’s outstanding shares of common stock, approved by written consent (a) a 1-for-24 (or such other ratio as may be determined by the Board) reverse split of the Company’s common stock, and, separately, (b) the Company’s grant to the its founder and CEO of the Option Agreement providing to him a conditional right to receive 4,744,234 shares of the Company’s preferred stock series A. This was approved by the shareholders.

Mr. Absher exercised the option agreement and on October 17, 2023, converted 4,744,234 shares of preferred stock series A to common stock.

Upon the conversion of the preferred stocks series A s to common stock, the Company has recorded a preferential dividend on preferred series A of $67.4 million. This was based upon the incremental value of the stock that was held prior to the reverse stock split and the date of preferred stock conversion to common stock. In addition, this had no effect on stockholders' deficit.

There are no preferred stock series A and options to issue preferred stock series A as of November 30, 2023.

Common Stock and Warrants

On September 23, 2022, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with a large institutional investor (the “Purchaser”) pursuant to which the Company sold to the Purchaser an aggregate of 17,361 shares of its common stock together with warrants (the “Warrants”) to purchase up to 34,772 shares of common stock (collectively, the “Offering”). Each share of common stock and two accompanying Warrants were sold together at a combined offering price of $288.00. The Warrants are exercisable for a period of seven years commencing upon issuance at an exercise price of $288.00, subject to adjustment. The private placement closed on September 23, 2022. The net proceeds to the Company from the Offering were $4.4 million.

In connection with the Purchase Agreement, the Company and the purchaser entered into Amendment No. 1 to Warrants (the “Warrant Amendment”). Pursuant to the Warrant Amendment, the exercise price of (i) 1,051 warrants issued on September 3, 2021, and (ii) 4,124 warrants issued on January 28, 2022, was reduced to $0.01. As a result of the warrant modification due to the change in the exercise price, for the three months ended November 30, 2022, the Company recorded an expense of $0.1 million. The incremental change in the fair market values was based upon the Black- Scholes option pricing model with the following inputs. The risk-free interest of 3.7%, expected volatility of 149.4%, dividend yield of 0% and expected term of 6.7 to 6.8 years.

A.G.P./Alliance Global Partners (the “Placement Agent” or "AGP") acted as the exclusive placement agent in connection with the Offering pursuant to the terms of a Placement Agent Agreement, dated September 20, 2022, between the Company and the Placement Agent (the “Placement Agent Agreement”). Pursuant to the Placement Agent Agreement, the Company paid the Placement Agent a fee equal to 7.0% of the aggregate gross proceeds from the Offering. In addition to the cash fee, the Company issued to the Placement Agent warrants to purchase up to 868 shares of common stock (5% of the number of shares sold in the Offering (the “Placement Agent Warrants”). The Placement Agent Warrants are exercisable for a period commencing six months from issuance, will expire four years from the effectiveness of a registration statement for the resale of the underlying shares, and have an initial exercise price of $316.80 per share.

October 5, 2023, the Company entered into a securities purchase agreement for a private placement with an institutional investor, The transaction closed on October 10, 2023 and the Company issued and sold to the investor (i) in a registered direct offering, 56,250 shares of common stock at a price of $26.40 per share, and pre-funded warrants to purchase up to 38,125 shares of common stock at a price of $26.3976 per pre-funded warrant, and (ii) in a concurrent private placement, common stock purchase warrants (the “Private Placement Warrants”), exercisable for an aggregate of up to 94,375 shares of common stock. The pre-funded warrants had an exercise price of $0.0024 and were exercised. The Private Placement Warrants are exercisable for a period of five-year years commencing six months from issuance. On October 16, 2023, the Company entered into an amendment to common stock purchase with the holder of the Private Placement Warrants. Pursuant to the amendment, the exercise price of the Private Placement Warrants was increased from $26.40 to $30.504. The net proceeds of this offering were $2.0 million. The Company reviewed the accounting for the modification and determined that no adjustment was needed for the three months ended November 30, 2023.

The following table summarizes the changes in the Company’s issued and outstanding common stock and prefunded warrants from August 31, 2023, to November 30, 2023:

| | Number of shares | | | Weighted average remaining life (years) | | | Weighted average exercise price $ | |

Warrants outstanding, August 31, 2023 | | | 138,309 | | | | 5.6 | | | $ | 208.78 | |

Issued | | | 94,375 | | | | 5.4 | | | | 30.50 | |

Forfeited | | | (5 | ) | | | — | | | | — | |

Warrants outstanding, November 30, 2023 | | | 232,679 | | | | 5.3 | | | $ | 131.47 | |

Warrants exercisable, November 30, 2023 | | | 138,304 | | | | 5.3 | | | $ | 157.06 | |

The following tables summarize the Company’s issued and outstanding warrants outstanding as of November 30, 2023:

| | Warrants Outstanding | | | Weighted Average Life of Outstanding Warrants (In years) | | | Exercise Price | |