0001675634false00016756342022-09-012023-08-31iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

As filed with the Securities and Exchange Commission on December 21, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SHIFTPIXY, INC. |

(Exact name of registrant as specified in its charter) |

Wyoming | | 7361 | | 47-4211438 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

4101 NW 25th Street

Miami, FL 33142

(888) 798-9100

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Scott Absher

Chief Executive Officer 4101 NW 25th Street

Miami, FL 33142

(888) 798-9100

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Gregory Sichenzia, Esq.

Jeff Cahlon, Esq.

Sichenzia Ross Ference Carmel LLP

1185 Avenue of the Americas, 31st Floor

New York, New York 10036

Tel: (212) 930-9700

From time to time after this registration statement becomes effective.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED DECEMBER 21, 2023 |

ShiftPixy, Inc.

94,375 Shares of Common Stock

Pursuant to this prospectus, the selling stockholder identified herein is offering on a resale basis 94,375 shares of common stock issuable upon exercise of warrants (the “Private Placement Warrants”) issued pursuant to a securities purchase agreement, dated October 5, 2023 (the “Purchase Agreement”). The Private Placement Warrants were issued upon closing of the Purchase Agreement on October 10, 2023, are exercisable for a period of five years commencing April 10, 2024 (six months from issuance) and have an exercise price of $30.504 per share.

We will not receive any of the proceeds from the sale by the selling stockholder of the common stock. Upon any exercise of the Private Placement Warrants by payment of cash, however, we will receive the exercise price of the Private Placement Warrants.

The selling stockholder may sell or otherwise dispose of the common stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholder may sell or otherwise dispose of the common stock covered by this prospectus in the section entitled “Plan of Distribution“ on page 7. Discounts, concessions, commissions and similar selling expenses attributable to the sale of common stock covered by this prospectus will be borne by the selling stockholder. We will pay all expenses (other than discounts, concessions, commissions and similar selling expenses) relating to the registration of the common stock with the Securities and Exchange Commission, or the SEC.

Our common stock is listed on The Nasdaq Capital Market (“Nasdaq”), under the symbol “PIXY.” On December 20, 2023, the last reported sale price of our common stock was $6.24 per share.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus to read about factors you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 21, 2023

TABLE OF CONTENTS

PROSPECTUS SUMMARY This summary highlights selected information included elsewhere in or incorporated by reference in this prospectus and does not contain all the information that you should consider before investing in our securities. You should read the entire prospectus carefully, especially “Risk Factors” and the financial statements and related notes and other information incorporated by reference into this prospectus, before deciding whether to participate in the offering described in this prospectus. In this prospectus, unless expressly noted or the content indicates otherwise, the words “we,” “us,” “our,” “ShiftPixy,” “Company” and similar references mean ShiftPixy, Inc. and its subsidiaries. Company Overview We are a human capital management platform. We provide payroll and related employment tax processing, human resources and employment compliance, employment related insurance, and employment administrative services solutions for our business clients (“clients” or “operators”) and shift work or “gig” opportunities for worksite employees. As consideration for providing these services, we receive administrative or processing fees as a percentage of a client’s gross payroll. The level of our administrative fees is dependent on the services provided to our clients, which ranges from basic payroll processing to a full suite of human resources information systems technology. Our primary operating business metric is gross billings, consisting of our clients’ fully burdened payroll costs, which includes, in addition to payroll, workers’ compensation insurance premiums, employer taxes, and benefits costs. About this Offering On October 5, 2023, the Company entered into a securities purchase agreement (the “Purchase Agreement”) with an institutional investor, pursuant to which the Company issued and sold to the investor (i) in a registered direct offering, 56,250 shares of common stock at a price of $26.40 per share, and pre-funded warrants to purchase up to 38,125 shares of common stock at a price of $26.3976 per pre-funded warrant, and (ii) in a concurrent private placement, common stock purchase warrants (the “Private Placement Warrants”), exercisable for an aggregate of up to 94,375 shares of common stock. The pre-funded warrants have an exercise price of $0.0024, are exercisable upon issuance and will remain exercisable until all the pre-funded warrants are exercised in full. The Private Placement Warrants are exercisable for a period of five year years commencing six months from issuance. On October 16, 2023, the Company entered into an amendment to common stock purchase with the holder of the Private Placement Warrants. Pursuant to the amendment, the exercise price of the Private Placement Warrants was increased from $26.40 to $30.504. The registered direct offering and concurrent private placement closed on October 10, 2023. The securities issued in the registered direct offering were offered and sold pursuant to the Company’s shelf registration statement on Form S-3 (File No. 333-269477), initially filed by the Company with the SEC under the Securities Act of 1933, as amended (the “Securities Act”), on January 31, 2023, and declared effective on February 13, 2023. The Private Placement Warrants (and the shares of common stock issuable upon the exercise of the Private Placement Warrants) were not registered under the Securities Act and were offered and sold pursuant to an exemption from the registration requirements of the Securities Act provided under Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation D promulgated under the Securities Act. Pursuant to the terms of the Purchase Agreement, the Company is required within 90 days of the closing to file a registration statement registering the resale of the shares of common stock issuable upon the exercise of the Private Placement Warrants. The Company is required to use commercially reasonable efforts to cause such registration to become effective within 30 days (60 days in the event the registration statement is reviewed by the SEC) of the filing of such registration statement, and to keep the registration statement effective as specified in the Purchase Agreement. This prospectus includes the resale of 94,375 shares of common stock issuable upon exercise of the Private Placement Warrants. Recent Developments IHC Bankruptcy Litigation On December 14, 2023, the Company received notice of an adversarial proceeding in a bankruptcy case, captioned Robert Angueira, as US Chapter 7 Trustee v. Shiftpixy, Inc, Shiftpixy Investments, Inc. The case is related to Industrial Human Capital, “IHC”, a company that was an attempted SPAC in 2022. IHC was unable to finish the listing requirements and all money was returned to the investors. Because some creditors were unpaid after the IHC was closed due to insolvency, some IHC creditors filed an involuntary bankruptcy in the Southern District of Florida. The Chapter 7 Bankruptcy Trustee, correctly, asserted a claim against a transfer of $600,000 to the Company from IHC as a partial repayment of money owed related to the sponsorship IHC SPAC, and the Company is working to make arrangements for payment to the Trustee. In relation to the recent filing by the Chapter 7 Trustee, the Trustee asserts, amongst other things, that some officers and directors of the Company acted inappropriately in transferring those funds and subsequent to the filing of the involuntary bankruptcy. These claims forced the Company to put ShiftPixy’s D&O carrier on notice and the Company is waiting for their decision on the matter(s). The Chapter 7 Trustee claims to be entitled to the $117 million dollars from the investors, shareholders, officers, and directors and Shiftpixy, Inc, for a bankruptcy estate with claims totaling $1.8 million ($382,000 of which are claims by Shiftpixy). Given the early stage of the litigation, it is too early to assess whether an unfavorable outcome for the Company is either probable or remote. |

RISK FACTORS

Investing in our securities involves risk. You should carefully consider the specific risks incorporated by reference in this prospectus, together with all the other information contained or incorporated by reference in this prospectus. In particular, you should consider the risks, uncertainties and assumptions discussed under the caption “Risk Factors” and elsewhere included in our annual report on Form 10-K for the year ended August 31, 2023, which are incorporated by reference in this prospectus and may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The market or trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment. In addition, please read the section of this prospectus captioned “Cautionary Note Regarding Forward-Looking Statements,” in which we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated by reference in this prospectus.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

All statements in this prospectus and the documents incorporated by reference that are not historical facts should be considered “Forward Looking Statements” within the meaning of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Some of the forward-looking statements can be identified by the use words such as “believe,” “expect,” “may,” “estimates,” “should,” “seek,” “approximately,” “intend,” “plan,” “estimate,” “project,” “continue” or “anticipates” or similar expressions or words, or the negatives of those expressions or words. These statements may be made directly in this prospectus and they may also be incorporated by reference in this prospectus from other documents filed with the SEC, and include, but are not limited to, statements about future financial and operating results and performance, statements about our plans, objectives, expectations and intentions with respect to future operations, products and services, and other statements that are not historical facts. These forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements.

USE OF PROCEEDS

We will not receive any of the proceeds from any sale or other disposition of the shares of common stock covered by this prospectus. All proceeds from the sale of the shares will be paid directly to the selling stockholder. We will receive proceeds upon the cash exercise of the Private Placement Warrants, however. Assuming full cash exercise of the Private Placement Warrants, we would receive gross proceeds of approximately $2.9 million. We currently intend to use any net proceeds from Private Placement Warrant exercises for general corporate purposes, including working capital.

To the extent the resale of the shares of common stock underlying Private Placement Warrants is registered under the Securities Act and there is a prospectus available for such registered resale, holders of Private Placement Warrants are required to pay the exercise price for the Private Placement Warrants in cash. If no such registration statement and prospectus are available following April 10, 2024, the Private Placement Warrants may be exercised through cashless exercise, where the holder of the Private Placement Warrants receives fewer shares upon exercise of its Private Placement Warrants but does not pay the Company any cash to exercise the Private Placement Warrants.

SELLING STOCKHOLDER

The shares of common stock being offered by the selling stockholder consist of 94,375 shares underlying the Private Placement Warrants issued under the Purchase Agreement. We are registering the shares of common stock in order to permit the selling stockholder to offer the shares for resale from time to time. The selling stockholder has not had had any material relationship with us within the past three years. The selling stockholder is a not a broker-dealer or an affiliate of a broker-dealer.

The table below lists the selling stockholder and other information regarding the beneficial ownership of the shares of common stock by the selling stockholder. The second column lists the number of shares of common stock beneficially owned by the selling stockholder, based on its ownership of the shares of common stock and warrants, as of December 14, 2023, assuming exercise of any warrants held by the selling stockholder on that date, without regard to any limitations on exercises.

The third column lists the shares of common stock being offered by this prospectus by the selling stockholder. The fourth column assumes the sale of all of the shares offered by the selling stockholder pursuant to this prospectus.

Under the terms of the Private Placement Warrants, the selling stockholder may not exercise the Private Placement Warrants to the extent such exercise would cause such selling stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99% of our then outstanding common stock following such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise of the Private Placement Warrants which have not been exercised. The number of shares in the second column does not reflect this limitation. The selling stockholder may sell all, some or none of its shares in this offering. See “Plan of Distribution.”

Selling Stockholder | Number of shares beneficially owned prior to offering(1) | Number of shares offered | Number of shares beneficially owned after offering(2) | Percentage of shares beneficially owned after offering(3) |

Armistice Capital, LLC(4) | 217,159(5) | 94,375 | 122,784 | 2.3% |

(1) Under applicable SEC rules, a person is deemed to beneficially own securities which the person has the right to acquire within 60 days through the exercise of any option or warrant or through the conversion of a convertible security. Also under applicable SEC rules, a person is deemed to be the “beneficial owner” of a security with regard to which the person directly or indirectly, has or shares (a) voting power, which includes the power to vote or direct the voting of the security, or (b) investment power, which includes the power to dispose, or direct the disposition, of the security, in each case, irrespective of the person’s economic interest in the security. To our knowledge, subject to community property laws where applicable, the selling stockholder named in the table has sole voting and investment power with respect to the common stock shown as beneficially owned by such selling stockholder, except as otherwise indicated in the footnotes to the table.

(2) Represents the amount of shares that will be held by the selling stockholder after completion of this offering based on the assumptions that (a) all common stock registered for resale by the registration statement of which this prospectus is part will be sold and (b) no other shares of common stock are acquired or sold by the selling stockholder prior to completion of this offering. However, the selling stockholder may sell all, some or none of such shares offered pursuant to this prospectus and may sell other shares of common stock that they may own pursuant to another registration statement under the Securities Act or sell some or all of their shares pursuant to an exemption from the registration provisions of the Securities Act, including under Rule 144.

(3) Based on 5,397,698 shares of common stock outstanding as of December 14, 2023, and assumes that following the offering all of the Private Placement Warrants will have been exercised (such that 5,492,073 shares of common stock will be outstanding), and all of the shares offered by the selling stockholder hereunder will have been sold.

(4) The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”), and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The warrants are subject to a beneficial ownership limitation of 4.99%, which such limitation restricts the selling stockholder from exercising that portion of the warrants that would result in the selling stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022.

(5) Includes 94,375 shares issuable upon exercise of Private Placement Warrants and 122,784 shares issuable upon exercise of other warrants held by the selling stockholder.

PLAN OF DISTRIBUTION

The selling stockholder of the securities and any of its pledgees, assignees and successors-in-interest may, from time to time, sell any or all of its securities covered hereby on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholder may use any one or more of the following methods when selling securities:

| ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● | block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ● | an exchange distribution in accordance with the rules of the applicable exchange; |

| ● | privately negotiated transactions; |

| ● | settlement of short sales; |

| ● | in transactions through broker-dealers that agree with the selling stockholder to sell a specified number of such securities at a stipulated price per security; |

| ● | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| ● | a combination of any such methods of sale; or |

| ● | any other method permitted pursuant to applicable law. |

The selling stockholder may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

In connection with the sale of the securities or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling stockholder may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholder and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. The selling stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify the selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus effective until the earlier of (i) when all Private Placement Warrants are sold, and underlying shares are issued or sold, as the case may be, under the registration statement or pursuant to Rule 144 under the Securities Act, (ii) the underlying shares may be sold without volume or manner-of-sale restrictions pursuant to Rule 144 under the Securities Act, and (iii) the three (3) year anniversary of the date of the closing date under the Purchase Agreement. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the selling stockholder or any other person. We will make copies of this prospectus available to the selling stockholder and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

The validity of the shares of common stock offered in this prospectus has been passed upon for us by Bailey, Stock, Harmon, Cottam, Lopez LLP, Cheyenne, Wyoming.

EXPERTS

The consolidated financial statements of ShiftPixy, Inc. as of August 31, 2023 and for each of the two years in the period ended August 31, 2023 appearing in our Annual Report on Form 10-K for the year ended August 31, 2023, have been audited by Marcum LLP, an independent registered public accountant, as set forth in its report thereon included therein, which include an explanatory paragraph as to the Company’s ability to continue as a going concern and an emphasis of matter paragraph related to the risks and uncertainties related to the Company’s outstanding payroll tax liabilities and which are incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” information that we file with them. Incorporation by reference allows us to disclose important information to you by referring you to those other documents. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We filed a registration statement on Form S-1 under the Securities Act with the SEC with respect to the securities being offered pursuant to this prospectus. This prospectus omits certain information contained in the registration statement, as permitted by the SEC. You should refer to the registration statement, including the exhibits and schedules attached to the registration statement and the information incorporated by reference, for further information about us and the securities being offered pursuant to this prospectus. Statements in this prospectus regarding the provisions of certain documents filed with, or incorporated by reference in, the registration statement are not necessarily complete, and each statement is qualified in all respects by that reference. Copies of all or any part of the registration statement, including the documents incorporated by reference or the exhibits, may be obtained upon payment of the prescribed rates at the offices of the SEC listed below in “Where You Can Find More Information.” The documents we are incorporating by reference into this prospectus are:

| · | Our Annual Report on Form 10-K for the fiscal year ended August 31, 2023, filed with the SEC on December 14, 2023; |

| · | Our Current Reports on Form 8-K filed on September 18, 2023, September 26, 2023, September 29, 2023, October 10, 2023, October 12, 2023, October 18, 2023, and October 31, 2023; and |

| · | The description of our common stock contained in our Registration Statement on Form 8-A, registering our common stock under Section 12(b) under the Exchange Act, filed with the SEC on June 28, 2017. |

All documents subsequently filed by us with the SEC under Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (other than current reports on Form 8-K furnished pursuant to Item 2.02 or Item 7.01 of Form 8-K, including any exhibits included with such information, unless otherwise indicated therein) prior to the termination or completion of the offering made pursuant to this prospectus are also incorporated herein by reference and will automatically update and supersede information contained or incorporated by reference in this prospectus.

You may request a copy of these filings, at no cost, by writing or telephoning us at the following address: ShiftPixy, Inc., Attention: Corporate Secretary, 4101 NW 25th Street, Miami, FL 33142, phone number (888) 798-9100.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-1 under the Securities Act with respect to the securities offered hereby. This prospectus, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules filed therewith. For further information about us and our securities offered hereby, we refer you to the registration statement and the exhibits and schedules filed therewith. Statements contained in this prospectus regarding the contents of any contract or any other document that is filed as an exhibit to the registration statement are not necessarily complete, and each such statement is qualified in all respects by reference to the full text of such contract or other document filed as an exhibit to the registration statement. The SEC maintains a website that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. The address is http://www.sec.gov.

We are subject to the reporting requirements of the Exchange Act, and file annual, quarterly and current reports, proxy statements and other information with the SEC. You can read our SEC filings, including the registration statement, over the Internet at the SEC’s website. We also maintain a website at http://www.shiftpixy.com, at which you may access these materials free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed through, our website is not part of this prospectus. You may also request a copy of these filings, at no cost, by writing or telephoning us at: 4101 NW 25th Street, Miami, FL 33142, (888) 798-9100.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13. Other Expenses of Issuance and Distribution

The following table provides information regarding the various expenses (other than placement agent fees) payable by us in connection with the issuance and distribution of the securities being registered hereby. All amounts shown are estimates except the SEC registration fee.

Securities and Exchange Commission Registration Fee | | $ | 81 | |

Legal Fees and Expenses | | | 290,000 | |

Accounting Fees and Expenses | | | 15,000 | |

Miscellaneous | | | 5,000 | |

Total | | $ | 310,081 | |

Item 14. Indemnification of Directors and Officers

Sections 17-16-851 through -856 of the Wyoming Statutes (the “Applicable Statutes”) provide that directors and officers of Wyoming corporations may, under certain circumstances, be indemnified against expenses (including attorneys’ fees) and other liabilities actually and reasonably incurred by them as a result of any suit brought against them in their capacity as a director or officer, if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, if they had no reasonable cause to believe their conduct was unlawful. The Applicable Statutes also provide that directors and officers may also be indemnified against expenses (including attorneys’ fees) incurred by them in connection with a derivative suit if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification may be made without court approval if such person was adjudged liable to the corporation.

Further, Article V of our articles of incorporation, as amended, also provides as follows regarding our indemnification of our directors, officers, employees and agents:

“[t]o the fullest extent permitted by the Wyoming Business Corporation Act or any other applicable law as now in effect or as it may hereafter be amended, no person who is or was a director of the Corporation shall be personally liable to the Corporation or its shareholders for monetary damages for breach of fiduciary duty as a director, except for liability for (A) the amount of financial benefit received by a director to which he or she is not entitled; (B) an intentional infliction of harm on the Corporation or the Shareholders; (C) a violation of Section 17-16-833 of the Wyoming Business Corporation Act; or (D) an intentional violation of criminal law. If the Wyoming Business Corporation Act is amended after the effective date of this Amendment to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent permitted by the Wyoming Business Corporation Act, as so amended.

The Corporation shall indemnify to the fullest extent permitted by the Wyoming Business Corporation Act, as the same may be amended and supplemented from time to time, any and all persons whom it shall have power to indemnify under the Wyoming Business Corporation Act. The indemnification provided for herein shall not be exclusive of any other rights to which those seeking indemnification may be entitled as a matter of law under any Bylaw, agreement, vote of shareholders or disinterested directors of the Corporation, or otherwise, both as to action in such indemnified person’s official capacity and as to action in another capacity while serving as a director, officer, employee, or agent of the Corporation, and shall continue as to a person who has ceased to be a director, officer, employee, or agent of the Corporation, and shall inure to the benefit of the heirs, executors and administrators of such person.

Any repeal or modification of this Article V or amendment to the Wyoming Business Corporation Act shall not adversely affect any right or protection of a director, officer, agent, or other person existing at the time of or increase the liability of any director, officer, agent, or other person of the Corporation with respect to any acts or omissions of such director, officer, or agent occurring prior to, such repeal, modification, or amendment.

The Corporation shall have the power to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the Corporation or is or was serving at the request of the Corporation as a director, officer, employee or agent to another corporation, partnership, joint venture, trust or other enterprise, against any liability asserted against such person and incurred by such person in any such capacity or arising out of his status as such, whether or not the Corporation would have the power to indemnify him against liability under the provisions of this Article V.”

Further, Article XIV of our Bylaws also provides as follows regarding our indemnification of our directors, officers, employees and agents:

“The corporation shall indemnify any person acting on its behalf in accord with the law of Wyoming. The indemnification provided hereby shall not be deemed exclusive of any other right to which anyone seeking indemnification thereunder may be entitled under any bylaw, agreement, or otherwise, both as to action in his official capacity and as to action in another capacity while holding such office. The corporation may purchase and maintain insurance on the behalf of any Director, officer, agent, employee or former Director or officer or other person, against any liability asserted against them and incurred by him.”

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed hereby in the Securities Act and we will be governed by the final adjudication of such issue.

Item 15. Recent Sales of Unregistered Securities

In the three years preceding the filing of this registration statement, the Registrant has sold the following securities that were not registered under the Securities Act:

On July 14, 2022, the board of directors of the Company approved the issuance to the Company’s founder and principal shareholder, Scott Absher, of 12,500,000 shares of the Company’s Preferred Class A Stock (“Preferred Shares”), in exchange for (a) the surrender by Mr. Absher of his options to acquire Preferred Shares, which options provide for exercise upon certain triggering events, as detailed in our prior filings, and (b) the tender of payment by Mr. Absher of the sum of $5,000, representing four times the par value for such Preferred Shares.

On July 19, 2022, Mr. Absher converted 8,000,000 Preferred Shares to 333,333 shares of the Company’s common stock, par value $0.0001 per share.

On August 12, 2022, the Company entered into an agreement with Mr. Absher whereby he waived claims to certain unpaid compensation due to him through July 31, 2022, totaling $820,793.24, in exchange for an option to receive 4,100,000 Preferred Shares.

On September 20, 2022, the Company entered into a securities purchase agreement with a large institutional investor pursuant to which the Company sold to the purchaser an aggregate of 17,361 shares of its common stock together with warrants to purchase up to 34,722 shares of common stock. Each share of common stock and two accompanying warrants were sold together at a combined offering price of $288.00. The warrants are exercisable for a period of seven years commencing upon issuance at an exercise price of $288.00, subject to adjustment. In connection with the purchase agreement, the Company and the purchaser entered into amendment No. 1 to warrants (the “Warrant Amendment”). Pursuant to the Warrant Amendment, the exercise price of (i) 1,051 warrants issued on September 3, 2021, and (ii) 4,124 warrants issued on January 28, 2022, was reduced to $0.24.

A.G.P./Alliance Global Partners (“AGP”) acted as the exclusive placement agent in connection with the offering pursuant to the terms of a placement agent agreement, dated September 20, 2022, between the Company and AGP. Pursuant to the placement agent agreement, the Company paid AGP a fee equal to 7.0% of the aggregate gross proceeds from the offering. In addition to the cash fee, the Company issued to AGP warrants to purchase up to 868 shares of common stock (5% of the number of shares sold in the offering. The placement agent warrants are exercisable for a period commencing six months from issuance, will expire four years from the effectiveness of a registration statement for the resale of the underlying shares, and have an initial exercise price of $316.80 per share.

On May 17, 2021, we issued warrants to purchase up to an aggregate of 2,062 shares of our common stock, with an exercise price of $5,820 (the “Existing Warrants”). The Existing Warrants were immediately exercisable and expire on June 15, 2026. On January 26, 2022, we entered into a Warrant Exercise Agreement (“the Exercise Agreement”) with the holder of the Existing Warrants (the “Exercising Holder”). Pursuant to the Exercise Agreement, the Exercising Holder and the Company agreed that, subject to any applicable beneficial ownership limitations, the Exercising Holder would cash exercise up to 2,062 of its Existing Warrants (the “Investor Warrants”) into shares of our common stock underlying such Existing Warrants (the “Exercised Shares”). To induce the Exercising Holder to exercise the Investor Warrants, the Exercise Agreement (i) amended the Investor Warrants to reduce their exercise price per share to $2,880 and (ii) provided for the issuance of a new warrant to purchase up to an aggregate of approximately 4,124 shares of our common stock (the “January 2022 Common Warrant”), with such January 2022 Common Warrant being issued on the basis of two January 2022 Common Warrant shares for each share of the Existing Warrant that was exercised for cash. The January 2022 Common Warrant is exercisable commencing on July 28, 2022, terminates on July 28, 2027, and has an exercise price per share of $3,720. The Exercise Agreement generated aggregate proceeds to the Company of approximately $5.9 million, prior to the deduction of $0.5 million of costs consisting of placement agent commissions and offering expenses payable by the Company. As a result of the warrant modification, which reduced the exercise price of the Existing Warrants, as well as the issuance of the January 2022 Common Warrants, the Company recorded approximately (i) $0.64 million for the increased fair value of the modified warrants; and (ii) $12.6 million as the fair value of the January 2022 Common Warrants on the date of issuance. We recorded approximately $5.5 million as issuance costs that offset the $5.5 million of additional paid-in capital the received for the cash exercise of the Existing Warrants at the reduced exercise price, while the remaining $7.7 million was recorded as a deemed dividend on the unaudited condensed consolidated statements of operations, resulting in a reduction of income available to common shareholders in our basic earnings per share calculation.

On September 3, 2021, the Company issued warrants to purchase up to 3,135 shares of common stock, with an exercise price per share of $3,828 (the “September 2021 Warrants”), pursuant to a securities purchase agreement, and on January 28, 2022, the Company issued warrants to purchase up to 4,124 shares of common stock, with an exercise price of $3,720 (the “January 2022 Common Warrants”), pursuant to a warrant exercise agreement. The September 2021 Warrants were immediately exercisable and had an expiration date of May 3, 2027. The January 2022 Common Warrants are exercisable commencing July 28, 2022, and had an expiration date of July 28, 2027.

On July 18, 2022, the Company entered into a warrant exercise agreement (the “Exercise Agreement”) with the holder of the September 2021 Warrants and January 2022 Warrants (the “Exercising Holder”). Pursuant to the Exercise Agreement, the Exercising Holder and the Company agreed that the Exercising Holder would exercise for cash 2,083 of its September 2021 Warrants (the “Investor Warrants”). In order to induce the Exercising Holder to exercise the Investor Warrants, the Exercise Agreement (i) amended the September 2021 Warrants and January 2022 Warrants to (a) reduce the exercise price per share of the September 2021 Warrants and January 2022 Warrants to $624, (b) extended the expiration date of the September 2021 Warrants to May 3, 2029, and (c) extended the expiration date of the January 2022 Warrants to July 28, 2029 and (ii) provides for the issuance by the Company to the Exercising Holder of new warrants to purchase up to 14,517 shares of common stock (the “New Warrants”) (equal to 200% of the sum of the September 2021 Warrants and January 2022 Warrants). The New Warrants are exercisable for a period of seven years commencing upon issuance and have an exercise price per share of $624.

On May 13, 2021, the Company entered into a securities purchase agreement with a large institutional investor pursuant to which the Company sold to the investor an aggregate of (i) 967 shares of its common stock, together with warrants to purchase up to 967 shares of common stock, and (ii) 1,095 pre-funded warrants with each pre-funded warrant exercisable for one share of common stock, together with warrants to purchase up to 1,095 shares of common stock. Each share of common stock and accompanying warrant were sold together at a combined offering price of $5,820, and each pre-funded warrant and accompanying warrant were sold together at a combined offering price of $5,819.76. The pre-funded warrants are immediately exercisable, at a nominal exercise price of $0.24, and may be exercised at any time until all of the pre-funded warrants are exercised in full. The warrants had an initial exercise price of $5,820 per share, are exercisable upon issuance and will expire five years from the date of an effective registration statement covering the shares underlying the warrants.

AGP acted as the exclusive placement agent in connection with the offering pursuant to the terms of a placement agent agreement, dated May 13, 2021, between the Company and AGP. Pursuant to the placement agent agreement, the Company agreed to pay AGP a fee equal to 7.0% of the aggregate gross proceeds from the offering. In addition to the cash fee, the Company agreed to issue to AGP warrants to purchase an aggregate of up to five percent (5%) of the aggregate number of shares and shares of common stock issuable upon exercise of the pre-funded warrants sold in the offering. The placement agent warrants are exercisable for a period commencing six months from issuance and expiring four years from the effective of a registration statement for the resale of the underlying shares, and have an initial exercise price of $6,402 per share.

On October 5, 2023, the Company entered into a securities purchase agreement (the “Purchase Agreement”) with an institutional investor, pursuant to which the Company issue and sold to the investor (i) in a registered direct offering, 56,250 shares of common stock at a price of $26.40 per share, and pre-funded warrants to purchase up to 38,125 shares of common stock at a price of $26.3976 per share and an exercise price of $0.0024 per share, and (ii) in a concurrent private placement, warrants exercisable for an aggregate of up to 94,375 shares of common stock, at an initial exercise price of $26.40 per share. On October 16, 2023, the warrants were amended to increase the exercise price to $30.504.

In connection with the foregoing, we relied upon the exemption from registration provided by Section 4(a)(2) under the Securities Act of 1933, as amended, for transactions not involving a public offering.

Item 16. Exhibits and Financial Statement Schedules.

(a) Exhibits.

3.1 | | Amended and Restated Articles of Incorporation of ShiftPixy, Inc., dated March 20, 2020 (incorporated by reference from Exhibit 3.1 to our Current Report on Form 8-K, filed with the SEC on March 26, 2020) |

| | |

3.2 | | Articles of Amendment to Amended and Restated Articles of Incorporation of ShiftPixy, Inc., dated May 7, 2021 (incorporated by reference from Exhibit 3.1 to our Current Report on Form 8-K, filed with the SEC on May 17, 2021) |

| | |

3.3 | | Articles of Amendment to Amended and Restated Articles of Incorporation of ShiftPixy, Inc, dated August 2, 2022 (incorporated by reference from Exhibit 3.1 to our Current Report on Form 8-K, filed with the SEC on August 31, 2022) |

| | |

3.4 | | Articles of Correction to Articles of Amendment to Amended and Restated Articles of Incorporation of ShiftPixy, Inc, dated August 15, 2022 (incorporated by reference from Exhibit 3.1.1 to our Current Report on Form 8-K, filed with the SEC on August 31, 2022) |

| | |

3.5 | | Articles of Amendment (incorporated by reference to 8-K filed September 26, 2023) |

| | |

3.6 | | Articles of Correction (incorporated by reference to 8-K filed October 12, 2023) |

| | |

3.7 | | Bylaws of ShiftPixy, Inc., as amended through July 15, 2022 (incorporated by reference from Exhibit 10.2 to our Form 8-K, filed with the SEC on July 19, 2022) |

| | |

4.1 | | Amended Principal Shareholder Option for Preferred Stock (incorporated by reference as Exhibit 3.5 to our 1-A/A, filed with the SEC on October 18, 2016) |

| | |

5.1* | | Opinion of Bailey, Stock, Harmon, Cottam, Lopez LLP |

| | |

10.1 | | Stock Option and Stock Issuance Plan (incorporated by reference as Exhibit 3.8 to our 1-A POS, filed with the SEC on April 4, 2017) |

10.2 | | Offer Letter to Scott W. Absher, dated March 23, 2016 (incorporated by reference from Exhibit 10.27 to our registration statement on Form S-1, filed with the SEC on March 30, 2020) |

| | |

10.3 | | Scott W. Absher Surrender of ShiftPixy’s Preferred Options (incorporated by reference from Exhibit 10.1 our Form 8K filed with the SEC on July 19, 2022) |

| | |

10.4 | | Form of Warrant (incorporated by reference from Exhibit 4.1 to our Current Report on Form 8-K, filed with the SEC on May 17, 2021) |

| | |

10.5 | | Form of Pre-Funded Warrant (incorporated by reference from Exhibit 4.2 to our Current Report on Form 8-K, the SEC on May 17, 2021) |

| | |

10.6 | | Form of Warrant (incorporated by reference from Exhibit 4.1 to our Current Report on Form 8-K, filed with the SEC on September 2, 2021) |

| | |

10.7 | | Form of Pre-Funded Warrant (incorporated by reference as Exhibit 4.2 to our Current Report on Form 8-K, filed with the SEC on September 2, 2021) |

| | |

10.8 | | Form of Warrants (incorporated by reference from Exhibit 4.1 to our Current Report on Form 8-K, filed with the SEC on January 27, 2022). |

10.9 | | Form of Warrant (incorporated by reference from Exhibit 10.1 to our Current Report on Form 8-K, filed with the SEC on July 19, 2022). |

| | |

10.10 | | Amendment No. 1 to Common Stock Purchase Warrant (incorporated by reference form Exhibit 10.1 to our Current Report on Form 8-K, filed with the SEC on July 26, 2022). |

| | |

10.11 | | Form of Warrant (incorporated by reference from Exhibit 10.2 to our Current Report on Form 8-K, filed with SEC on September 23, 2022). |

| | |

10.12 | | Amendment No. 1 to Warrants (incorporated by reference from Exhibit 10.4 to our Current Report on Form 8-K, filed with SEC on September 23, 2022). |

| | |

10.13 | | Form of Placement Agent Warrant (incorporated by reference from Exhibit 10.6 to our Current Report on Form 8-K, filed with SEC on September 23, 2022). |

| | |

10.14 | | Form of Pre-Funded Warrant (incorporated by reference to 8-K filed July 14, 2023) |

| | |

10.15 | | Form of Common Warrant (incorporated by reference to 8-K filed July 14, 2023) |

| | |

10.16 | | Warrant Amendment (incorporated by reference to 8-K filed July 14, 2023) |

| | |

10.17 | | Form of Option Agreement (incorporated by reference to 8-K filed August 22, 2023) |

| | |

10.18 | | Financial Advisory Agreement (incorporated by reference to 8-K filed October 10, 2023) |

| | |

10.19 | | Form of Securities Purchase Agreement (incorporated by reference to 8-K filed October 10, 2023) |

| | |

10.20 | | Form of Pre-funded Warrant (incorporated by reference to 8-K filed October 10, 2023) |

| | |

10.21 | | Form of Private Placement Warrant (incorporate by reference to 8-K filed October 10, 2023) |

| | |

10.22 | | Amendment No. 1 to Common Stock Purchase Warrant (incorporated by reference to 8-K filed October 18, 2023) |

| | |

21.1 | | List of Subsidiaries of ShiftPixy, Inc. (incorporated by reference to 10-K filed December 14, 2023) |

| | |

23.1* | | Consent of Marcum LLP |

| | |

23.2* | | Consent of Bailey, Stock, Harmon, Cottam, Lopez LLP (included in Exhibit 5.1) |

| | |

107* | | Filing Fees |

* Filed herewith

(b) Financial statement schedules

Schedules not listed above have been omitted because the information required to be set forth therein is not applicable or is shown in the financial statements or notes thereto.

Item 17. Undertakings

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

provided, however, that paragraphs (1)(i), (1)(ii) and (1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Registration Statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; and

(5) The undersigned hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act of 1934 that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(6) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that, in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer, or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Miami, State of Florida, on December 21, 2023.

| ShiftPixy, Inc. | |

| | |

| By: | /s/ Scott W. Absher | |

| Name: | Scott W. Absher | |

| Title: | Chief Executive Officer | |

| | (Principal Executive Officer) | |

Each person whose signature appears below constitutes and appoints Scott W. Absher, his true and lawful attorney-in-fact and agent, with full power of substitution and re-substitution for him and in his name, place and stead, and in any and all capacities, to sign for him and in him name in the capacities indicated below any and all amendments (including post-effective amendments) to this registration statement (or any other registration statement for the same offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933, as amended), and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent, full power and authority to do and perform each and every act and thing requisite or necessary to be done in and about the premises, as full to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

SIGNATURE | | TITLE | | DATE |

| | | | |

/s/ Scott W. Absher | | Chief Executive Officer and Director (Principal Executive Officer) | | December 21, 2023 |

Scott W. Absher | | | | |

| | | | |

/s/ Douglas Beck | | Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) | | December 21, 2023 |

Douglas Beck | | | | |

| | | | |

/s/ Christopher Sebes | | Director | | December 21, 2023 |

Christopher Sebes | | | | |

| | | | |

/s/ Whitney J. White | | Director | | December 21, 2023 |

Whitney J. White | | | | |

| | | | |

/s/ Amanda Murphy | | Director | | December 21, 2023 |

Amanda Murphy | | | | |

nullnullnull

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

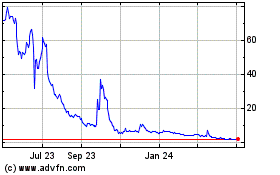

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Nov 2024 to Dec 2024

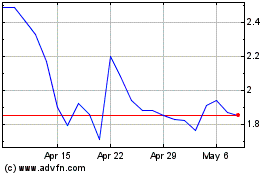

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Dec 2023 to Dec 2024