0001762322

false

0001762322

2023-07-21

2023-07-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

July 25, 2023 (July 21, 2023)

SHIFT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38839 |

|

82-5325852 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 290 Division Street, Suite 400, San Francisco, CA |

|

94103 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(855) 575-6739

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13a-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

SFT |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) if the Exchange Act.

Item 5.02 Departure of Directors or Principal

Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

Clementz Transition and Separation Agreement

As previously announced on June 14, 2023, Shift

Technologies, Inc. (the “Company”) implemented an executive leadership succession plan in connection with the transition

of Jeff Clementz from the Company as its Chief Executive Officer, effective June 9, 2023 (the “Transition Effective Date”).

Mr. Clementz also resigned from the Board of Directors (the “Board”) of the Company on the Transition Effective Date.

In order to ensure an orderly transition of responsibilities, Mr. Clementz continued to be employed in a non-executive capacity with the

Company through July 1, 2023 (the “Separation Date”).

In connection with his transition from employment

with the Company, the Company and Mr. Clementz entered into a Transition and Separation Agreement (the “Agreement”)

on July 21, 2023 that reflects the terms of his transition and the benefits he is eligible to receive. The Agreement becomes effective

and enforceable on July 29, 2023 (the “Effective Date”) unless revoked in writing by Mr. Clementz prior to the Effective

Date. Pursuant to the Agreement, and in lieu of all severance benefits otherwise provided for under Mr. Clementz’s prior employment

agreement with the Company, Mr. Clementz will be entitled to receive the following benefits: (i) a cash payment equal to $400,000, payable

in a single lump sum within thirty (30) days following the Effective Date, (ii) payment of his 2023 annual bonus (if any), prorated for

the number of days employed by the Company in 2023 and determined based on actual performance (with any personal goals considered to be

fulfilled), and payable at such time that annual bonuses are otherwise generally paid to employees of the Company and (iii) payment of

COBRA premiums for eighteen (18) months following the Separation Date (to the extent Mr. Clementz elects COBRA continuation coverage),

less amounts equal to the amount active employees pay for such coverage during such time period, and subject to reduction or elimination

if Mr. Clementz becomes entitled to duplicative benefits through other employment. The Agreement also provides that Mr. Clementz will

make himself available to members of the Company’s senior management team through August 31, 2023 (the “Transition Period”).

In addition, the Agreement contains a general

waiver and release of claims by Mr. Clementz in favor of the Company. Mr. Clementz will be subject to certain restrictive covenants following

his termination of employment with the Company, including during the Transition Period.

Mr. Clementz’s transition is not the result

of any disagreements over the Company’s business, operations, or strategic direction.

The foregoing description of the Agreement is

not complete and is qualified in its entirety by reference to the full text of such Agreement, a copy of which is filed hereto as Exhibit

10.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SHIFT TECHNOLOGIES, INC. |

| |

|

| Dated: July 25, 2023 |

/s/ Oded Shein |

| |

Name: |

Oded Shein |

| |

Title: |

Chief Financial Officer |

2

Exhibit 10.1

SHIFT

TECHNOLOGIES, INC.

TRANSITION

AND SEPARATION AGREEMENT

This Transition and Separation

Agreement (the “Agreement”) is entered into by and between Shift Technologies, Inc., a Delaware corporation (the “Company”)

and Jeff Clementz (the “Employee”) (the Company and Employee collectively referred to herein as the “Parties”)

as of the last date set forth on the signature page hereto.

1. Separation

Date. The Parties hereby acknowledge and agree that Employee’s employment by the Company terminated effective July 1, 2023 (the

“Separation Date”). The Separation Date shall be deemed to be the date of separation from service and the date that

employment ends for purposes of that certain Employment Agreement dated September 27, 2021, as amended on February 24, 2022, May 12, 2022

and August 8, 2022 (the “Employment Agreement”) and any applicable Company plans or programs in which Employee participated

(including, for the avoidance of doubt, the Shift Technologies, Inc. Severance Plan for Key Management Employees (the “Severance

Plan”)).

Employee further acknowledges

that Employee stepped down as Chief Executive Officer of the Company effective June 9, 2023, and continued in the employ of the Company

in a non-executive capacity through the Separation Date. The Company continued to pay Employee’s base salary (at an annual rate

of $530,000) through the Separation Date.

2. Accrued

Obligations and Vested Benefits. Employee is entitled to receive the following accrued obligations at his separation from service:

(a) all base salary earned, accrued and owing, but not yet paid, (b) any vacation earned but not yet taken, (c) reimbursement for business

expenses in accordance with Company policy, and (d) any benefits accrued and due in accordance with the terms of any applicable benefit

plans or programs of the Company.

3. Separation

Payments and Benefits. Provided that Employee timely signs and does not timely revoke this Agreement (in accordance with Section 21

and 22 herein), and complies with the terms and conditions of this Agreement, the Company shall provide Employee with the following separation

payments and benefits (less federal, state and local tax withholdings and any other deductions required by law or previously authorized

by Employee), in full satisfaction of all termination obligations the Company may have to Employee under any agreement, plan or arrangement,

including without limitation the Employment Agreement and Severance Plan, (the “Separation Benefits”):

(a) In

full satisfaction of the provisions of Section 8(c) of the Employment Agreement and the provisions of the Severance Plan:

(i) Lump

Sum Severance Amount. The Company shall pay Employee an amount in cash equal to $400,000 to be paid to Employee in a single lump sum

payment within thirty (30) days following the Effective Date (as defined below);

(ii) 2023

Prorated Annual Bonus. Employee shall be eligible for the 2023 annual bonus that would have been payable to him under the Employment

Agreement, prorated based on a fraction (i) the numerator of which is the number of days between January 1, 2023 and the Separation

Date, and (ii) the denominator of which is 365. The actual amount of the bonus (if any) shall be determined by the Board (determined based

on actual performance of Company goals, without negative discretion, and provided that any personal goals shall be considered to be fulfilled),

and shall be paid at the same time as such bonuses are otherwise generally paid to other employees of the Company, but no later than March

15, 2024; and

(iii) Health

Plan Continuation Coverage. If Employee timely and properly elects health continuation coverage pursuant to Employee’s benefit

continuation rights under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”), the Company

shall take appropriate steps so as to charge Employee his COBRA continuation premium at the amount paid by active employees for comparable

coverage rather than the full permissible COBRA premium amount that may otherwise be charged for COBRA continuation coverage (and the

Company shall pay the remaining amount of such COBRA premium amount). This reduced COBRA premium shall be applicable for a period that

ends on the eighteen (18) month anniversary of the Separation Date, or the date Employee becomes entitled to duplicative benefits by virtue

of Employee’s subsequent or other employment, whichever occurs first. Employee agrees to promptly advise the Company if Employee

becomes eligible for such duplicative benefits. If the payment by the Company of any portion of the COBRA premium would violate the nondiscrimination

rules or cause the reimbursement of claims to be taxable under the Patient Protection and Affordable Care Act of 2010, together with the

Health Care and Education Reconciliation Act of 2010 (collectively, the “Act”) or Section 105(h) of the Code (as defined

below), the Company-paid portion of the premium will be treated as taxable payments and be subject to imputed income tax treatment to

the extent necessary to eliminate any discriminatory treatment or taxation under the Act or Section 105(h) of the Code.

(b) Unvested

Equity Awards. For avoidance of doubt, and solely for purposes of clarity, as provided under the Shift Technologies, Inc. 2020 Omnibus

Equity Compensation Plan (the “Plan”), Employee’s outstanding equity awards held by Employee under the Plan shall

be forfeited and cancelled for no consideration as of the Separation Date.

(c) Employee

acknowledges and agrees that, unless he executes this Agreement, he will not otherwise be entitled to receive the consideration set forth

in this Section 3. Employee further acknowledges and agrees that the consideration set forth or referenced in Section 3 constitutes full

satisfaction and accord for any and all compensation and benefits due and owing to him pursuant to any plan, agreement or other arrangements

relating to his employment with the Company and termination thereof.

4. Directorship;

Post-Termination Cooperation.

(a) The

Parties hereby acknowledge and agree that Employee resigned from his position as a director of the Board effective as of June 9, 2023.

(b) From

the Separation Date until August 31, 2023 (the “Transition Period”), Employee agrees to make himself available to the

senior management of the Company to answer questions regarding any matter, project, initiative or effort with which Employee was involved

while employed with the Company.

5. Post-Separation

Covenants; Dispute Resolution. The Company and Employee acknowledge and agree that the post-separation covenants and dispute resolution

provisions set forth in the Employment Agreement (including, without limitation, Sections 14(c), 15 and 16 of the Employment Agreement)

are incorporated into this Agreement by reference and shall remain in full force and effect following the Separation Date in accordance

with their respective terms. In the event of material breach by Employee of this Agreement, Employee acknowledges and agrees that: (a)

the Company shall have the right to terminate any remaining unpaid Separation Benefits and file a lawsuit against Employee to recover

ninety-five percent (95%) of the Separation Benefits, as such amount is not deemed earned absent Employee’s compliance with this

Agreement; and (b) the remaining five percent (5%) of the Separation Benefits shall constitute full and complete consideration sufficient

to support enforcement of this Agreement against Employee, including, but not limited to, enforcement of Employee’s release of claims

set forth below.

6. Release.

In consideration of the Separation Benefits and the Company’s promises in this Agreement:

(a) Employee

hereby RELEASES the Company, its past and present parents, subsidiaries, affiliates, predecessors, successors, assigns, related companies,

entities or divisions, its or their past and present employee benefit plans, trustees, fiduciaries and administrators, and any and all

of its and their respective past and present officers, directors, partners, agents, representatives, attorneys and employees (all collectively

included in the term “Company” for purposes of this release), from any and all claims, demands or causes of action which Employee,

or Employee’s heirs, executors, administrators, agents, attorneys, representatives or assigns (all collectively included in the

term “Employee” for purposes of this release), have, had or may have against the Company, based on any events or circumstances

arising or occurring prior to and including the date of Employee’s execution of this Agreement to the fullest extent permitted by

law, regardless of whether such claims are now known or are later discovered, including but not limited to any claims relating to Employee’s

employment or termination of employment by the Company, any rights of continued employment, reinstatement or reemployment by the Company,

and any costs or attorneys’ fees incurred by Employee, PROVIDED, HOWEVER, Employee is not waiving, releasing or giving up any rights

Employee may have as a shareholder of the Company that may not be waived under applicable law, to vested benefits under any pension or

savings plan, to continued benefits in accordance with COBRA, to unemployment insurance, to any claims or rights Employee may have to

indemnification, to enforce the terms of this Agreement, or any other right which cannot be waived as a matter of law. In the event any

claim or suit is filed on Employee’s behalf against the Company by any person or entity, Employee waives any and all rights to receive

monetary damages or injunctive relief in favor of Employee from or against the Company.

(b) Employee

agrees and acknowledges: that this Agreement is intended to be a general release that extinguishes all claims by Employee against the

Company; that Employee is waiving any claims arising under Title VII of the Civil Rights Act of 1964, the Civil Rights Act of 1991, 42

U.S.C. §1981, the Americans With Disabilities Act, the Age Discrimination in Employment Act, the Older Worker Benefit Protection

Act, the Employee Retirement Income Security Act of 1974, the Family and Medical Leave Act, the Equal Pay Act, the Worker Adjustment and

Retraining Notification Act, the Uniformed Services Employment and Reemployment Rights Act, the Genetic Information Nondiscrimination

Act, the Fair Credit Reporting Act, the California Fair Employment and Housing Act, the Unruh Civil Rights Act, the California Government

Code, the California Business and Professions Code, the California Family Rights Act, the California Pregnancy Disability Leave Law, the

California Equal Pay Law, the California Crime Victim Leave Law, the California Healthy Family Act, the California Plant Closing Law,

and all other federal, state and local statutes, ordinances and common law, including but not limited to any claims based on public policy,

breach of contract, either expressed or implied, equitable claims, defamation, retaliation, whistleblowing, negligence, invasion of privacy,

infliction of emotional distress, slander, libel, estoppel, fraud, misrepresentation, and other torts (including intentional torts) and

wrongful discharge, and claims for discretionary bonuses and other discretionary payments to the fullest extent permitted by law; that

Employee is waiving all claims against the Company, known or unknown, arising or occurring prior to and including the date of Employee’s

execution of this Agreement; that the consideration that Employee will receive in exchange for Employee’s waiver of the claims specified

herein exceeds anything of value to which Employee is already entitled; that Employee was hereby advised in writing to consult with an

attorney and that Employee had at least twenty-one (21) calendar days to consider this Agreement; that Employee has entered into this

Agreement knowingly and voluntarily with full understanding of its terms and after having had the opportunity to seek and receive advice

from counsel of Employee’s choosing; and that Employee has had a reasonable period of time within which to consider this Agreement.

Employee represents that Employee has not assigned any claim against the Company to any person or entity; that Employee has no right to

any future employment by the Company; that Employee has received all compensation, benefits, remuneration, accruals, contributions, reimbursements,

bonuses, vacation pay, and other payments, leave and time off due; and that Employee has not suffered any injury that resulted, in whole

or in part, from Employee’s work at the Company that would entitle Employee to payments or benefits under any state worker’s

compensation law and the termination of Employee’s employment by the Company is not related to any such injury.

(c) Employee

expressly waives the benefit of any statute or rule of law which, if applied to this Agreement, would otherwise preclude from its binding

effect any claim against the Company (as defined in Paragraph 6(a) above) not now known by Employee to exist, including any benefit under

Section 1542 of the California Civil Code which states as follows:

A

general release does not extend to claims that the creditor or releasing party does not know or suspect to exist in his or her favor at

the time of executing the release and that, if known by him or her, would have materially affected his or her settlement with the debtor

or released party.

7. Permitted

Conduct. Employee understands that nothing contained in this Agreement limits: (a) Employee’s ability to file a charge

or complaint with the Equal Employment Opportunity Commission, the National Labor Relations Board, the Occupational Safety and Health

Administration, the Securities and Exchange Commission, law enforcement, or any other federal, state or local governmental agency or commission

(“Government Agencies”); (b) Employee’s right to disclose information about or testify regarding alleged

criminal conduct or unlawful acts in the workplace, including but not limited to discrimination, harassment, retaliation or any other

unlawful or potentially unlawful conduct; or (c) Employee’s ability to file or disclose any facts necessary to receive unemployment

insurance, Medicaid, or other public benefits to which Employee is entitled. Employee further understands that this Agreement does

not limit Employee’s ability to initiate, testify, assist, comply with a subpoena from, or communicate with any Government Agencies

or otherwise participate in any investigation or proceeding that may be conducted by any Government Agency, including providing documents

or other information, without notice to the Company and that nothing herein precludes Employee from requesting or receiving confidential

legal advice; provided, however, that Employee may not disclose Company information that is protected by the attorney-client privilege,

except as expressly authorized by law. This Agreement does not limit Employee’s right to receive an award for information provided

to any Government Agencies.

8. Defend

Trade Secrets Act of 2016. The Company provides notice to Employee pursuant to the Defend Trade Secrets Act of 2016 that:

(a) An

individual will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret

that (1) is made (i) in confidence to a federal, state, or local government official, either directly or indirectly, or to an

attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (2) is made in a complaint

or other document filed in a lawsuit or other proceeding, if such filing is made under seal; and

(b) An

individual who files a lawsuit for retaliation by an employer for reporting a suspected violation of law may disclose the trade secret

to the attorney of the individual and use the trade secret information in the court proceeding, if the individual (1) files any document

containing the trade secret under seal; and (2) does not disclose the trade secret, except pursuant to court order.

9. Cooperation.

Following the Separation Date, Employee agrees to cooperate fully with the Company in the defense, prosecution or conduct of any claims,

actions, investigations, or reviews now in existence or which may be initiated in the future against, involving or on behalf of the Company

which relate to events or occurrences that transpired while Employee was employed by the Company (“Matters”). For the

avoidance of doubt, this includes Employee’s cooperation in connection with such Matters, which will include, but not be limited

to, being available for telephone conferences with outside counsel and/or personnel of the Company, and being available for interviews

as reasonably requested. The Company will reimburse Employee for all reasonable out-of-pocket expenses incurred by Employee in connection

with such cooperation.

10. No

Unlawful Conduct. Employee represents and warrants that Employee has not engaged in any unlawful or fraudulent conduct in connection

with Employee’s employment or duties with the Company; that Employee is not aware of the Company’s violation of any applicable

law, rule, regulation and/or binding legal guidance; and that Employee is not aware of the Company’s material non-compliance with

any applicable accounting or professional responsibility rule, practice and/or principle.

11. Confidentiality;

Non-Disparagement.

(a) Employee

agrees to keep the terms of this Agreement confidential and not to disclose the terms of this Agreement to anyone other than Employee’s

immediate family or legal, tax or financial advisors or as otherwise required by law, and agrees to take all steps necessary to assure

confidentiality by those recipients of this information. With reference to Section 162(q) of the Internal Revenue Code of 1986, as amended,

and the corresponding regulations and guidance promulgated thereunder (the “Code”), nothing contained in this Agreement

shall be interpreted or construed as requiring non-disclosure with respect to factual information relating to allegations of sexual harassment

or sexual abuse.

(b) Employee

agrees not to make, or cause or attempt to cause any other person to make any statement, written or oral, or convey any information about

the Company (directly or indirectly) or attempt to cause any other person or entity to make any statement, written or oral (including,

but not limited to, statements made in person, by phone, email, text message, online, on social media, or otherwise) which is false, disparaging,

or defamatory towards the Company, as the Company is defined in Section 6(a) of this Agreement.

(c) Employee

specifically acknowledges and reaffirms Employee’s ongoing obligations to the Company (1) not to use for any purpose or disclose

any confidential or proprietary information of the Company or a third party to which Employee had access or created during: (i) the period

of Employee’s employment with the Company, (ii) during the Transition Period, or (iii) during his service as a director of the Board,

(2) to return after the cessation of his services to the Company any and all materials containing such confidential or proprietary information

to the Company, and (3) to comply with the obligations set forth in the Employment Agreement and this Agreement.

12. No

Admission of Liability. This Agreement does not constitute and will not be construed as an admission by the Company that it has violated

any law, interfered with any rights, breached any obligation or otherwise engaged in any improper or illegal conduct with respect to Employee,

and the Company expressly denies that it has engaged in any such conduct.

13. Amendment;

Entire Agreement. This Agreement constitutes the entire agreement between the Parties on the subject matter hereof, and, other than

as specifically set forth in this Agreement, supersedes and replaces all prior negotiations and agreements, whether written or oral. This

Agreement may be modified only by a written instrument signed by the Parties hereto. The Parties acknowledge and agree that Employee remains

subject to all employment and post-employment obligations set forth in the Employment Agreement; provided, however, for the avoidance

of doubt, that the foregoing shall not be construed as resulting in the duplication of any compensation or severance benefits payable

to Employee.

14. Execution.

This Agreement may be executed in one or more counterparts, each of which will be deemed an original, but all of which constitute one

and the same Agreement, and the Parties agree that signatures delivered by hand delivery, U.S. mail, fax, and e-mail/pdf are valid.

15. Withholding.

The Company may withhold from any and all amounts payable under this Agreement or otherwise such federal, state, and local taxes as may

be required to be withheld pursuant to any applicable law or regulation.

16. Section

409A of the Internal Revenue Code. Although the Company does not guarantee the tax treatment of any payment under this Agreement,

this Agreement and any payments made hereunder are intended to comply with or be exempt from Section 409A of the Code, and, accordingly,

to the maximum extent permitted, this Agreement shall be interpreted in a manner consistent therewith. Any payment under this Agreement

may only be made upon an event and in a manner permitted by Section 409A of the Code, and such payments are intended to be exempt from

Section 409A of the Code under the “short-term deferral” exception, to the maximum extent applicable. Notwithstanding anything

herein to the contrary, if, at the time of Employee’s termination of employment with the Company, Employee is a “specified

employee” (as such term is defined in Section 409A of the Code) and it is necessary to postpone the commencement of any payments

or benefits otherwise payable under this Agreement as a result of such termination of employment to prevent any accelerated or additional

tax under Section 409A of the Code, then the Company will postpone the commencement of the payment of any such payments or benefits hereunder

(without any reduction in such payments or benefits ultimately paid or provided to Employee) that are not otherwise paid within the “short-term

deferral exception” under Treas. Reg. §1.409A-1(b)(4), and the “separation pay exception” under Treas. Reg. §1.409A-1(b)(9)(iii),

until the first payroll date that occurs after the date that is six months following Employee’s “separation of service”

(as such term is defined in Section 409A of the Code) with the Company. If any payments are postponed due to such requirements, such postponed

amounts will be paid in a lump sum to Employee on the first payroll date that occurs after the date that is six months following Employee’s

separation of service with the Company. If Employee dies during the postponement period prior to the payment of postponed amount, the

amounts withheld on account of Section 409A of the Code shall be paid to the personal representative of Employee’s estate within

sixty (60) days after the date of Employee’s death.

For purposes of Section 409A

of the Code, Employee’s right to receive any installment payments pursuant to this Agreement shall be treated as a right to receive

a series of separate and distinct payments. In no event may Employee, directly or indirectly, designate the calendar year of a payment.

All reimbursements and in-kind benefits provided under this Agreement shall be made or provided in accordance with the requirements of

Section 409A of the Code. In no event may Employee, directly or indirectly, designate the calendar year of a payment.

The Company reserves the right

to amend the provisions of this Agreement at any time and in any manner without Employee’s consent but with notice to Employee solely

to comply with the requirements of Section 409A of the Code and to avoid the imposition of additional tax, interest or income inclusion

under Section 409A of the Code on any payment to be made hereunder. Notwithstanding the foregoing, in no event shall the Company be liable

for any additional tax, interest, income inclusion or other penalty that may be imposed on Employee by Section 409A of the Code or for

damages for failing to comply with Section 409A of the Code.

17. Severability.

If any provision, section, subsection or other portion of this Agreement is determined by any court of competent jurisdiction to be invalid,

illegal or unenforceable in whole or in part, and such determination becomes final, such provision or portion will be deemed to be severed

or limited, but only to the extent required to render the remaining provisions and portion of this Agreement enforceable. This Agreement

as thus amended will be enforced so as to give effect to the intention of the Parties insofar as that is possible. In addition, the Parties

hereby expressly empower a court of competent jurisdiction to modify any term or provision of this Agreement to the extent necessary to

comply with existing law and to enforce this Agreement as modified.

18. Voluntary

Agreement. Employee hereby agrees and acknowledges that Employee has carefully read this Agreement, fully understands what this Agreement

means, and is signing this Agreement knowingly and voluntarily, that no other promises or agreements have been made to Employee other

than those set forth in this Agreement, and that Employee has not relied on any statement by anyone associated with the Company that is

not contained in this Agreement in deciding to sign this Agreement.

19. Governing

Law and Dispute Resolution. This Agreement will be governed by the laws of the State of California. The Parties agree that all disputes

arising under this Agreement will be subject to the Employment Agreement.

20. Return

of Company Property. Employee must return to the Company within 10 days after Employee’s termination of employment all Company

property previously provided to Employee, including, but not limited to, any Company owned computer, personal digital assistant, mobile

phone, credit cards, keys, key fobs, computer accessories, and Company documents and materials (however stored). Notwithstanding the foregoing,

Employee will be permitted to keep certain Company-provided property following his termination of employment, which items include one

(1) iPad and one (1) computer (each of which shall be cleared of all confidential or proprietary information of the Company upon the termination

of Employee’s employment and prior to the transfer of such property to Employee). For the avoidance of doubt, subject to the provisions

of this Section 20, Company property remains subject to applicable Company policies, as may be amended from time to time.

21. Acceptance.

Employee may accept this Agreement by delivering an executed copy of the Agreement to the Company within twenty-one (21) calendar days

after Employee’s receipt of this Agreement. The Parties agree that any changes to the Agreement, whether material or non-material,

will not extend the 21-day consideration period.

22. Revocation.

Employee may revoke this Agreement within seven (7) calendar days after it is executed and delivered by Employee to the Company by delivering

a written notice of revocation to the Company no later than the close of business on the 7th calendar day after this Agreement was signed

by Employee. This Agreement will become effective and enforceable on the 8th calendar day after Employee signs and delivers the Agreement

to the Company (the “Effective Date”), provided Employee has not timely revoked this Agreement. If Employee fails to

timely accept the Agreement or timely revokes this Agreement, the Parties will have no obligations under this Agreement.

23.

Attorneys’ Fees. The Company shall reimburse Employee for his reasonable legal fees incurred in connection with review of

and revisions to this Agreement, in an amount not to exceed Seven Thousand Five Hundred dollars ($7,500).

[Signature Page Follows]

WHEREFORE, the Parties have executed this Agreement on the date or dates set forth below.

| |

JEFF CLEMENTZ: |

| |

|

| |

Name: |

/s/ Jeff Clementz |

| |

Date: |

7/21/2023 |

| |

|

| |

|

| |

SHIFT TECHNOLOGIES, INC. |

| |

|

| |

By: |

/s/ Oded Shein |

| |

Name: |

Oded Shein |

| |

Title: |

CFO |

| |

Date: |

7/21/2023 |

8

v3.23.2

Cover

|

Jul. 21, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 21, 2023

|

| Entity File Number |

001-38839

|

| Entity Registrant Name |

SHIFT TECHNOLOGIES, INC.

|

| Entity Central Index Key |

0001762322

|

| Entity Tax Identification Number |

82-5325852

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

290 Division Street

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94103

|

| City Area Code |

855

|

| Local Phone Number |

575-6739

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

SFT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

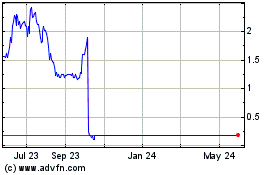

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Feb 2024 to Feb 2025