Altaris completes acquisition of Sharecare

October 22 2024 - 9:00AM

Sharecare, the health tech company that helps to improve care

quality, drive better outcomes, and lower costs across the

healthcare ecosystem, today announced the completion of its

acquisition by Altaris, LLC (collectively with its managed funds,

“Altaris”), an investment firm exclusively focused on the

healthcare industry, for $1.43 per share in cash. The transaction

was announced on June 21, 2024, and received approval from

stockholders on October 17, 2024. As a result of the acquisition,

Sharecare’s common stock ceased trading and will no longer be

listed on the Nasdaq stock market.

“Sharecare’s Board of Directors and shareholders determined that

this transaction with Altaris was in the best interests of our

company and our clients, and delivered significant, immediate, and

certain value to our stockholders,” said Jeff Arnold, Sharecare’s

founder and executive chairman of the Board of Directors. “With

Altaris, Sharecare has gained the support of an experienced,

growth-oriented investor that believes in the company’s vision,

strategic growth plan, and management team, and shares a commitment

to maximizing the value of Sharecare’s full potential across our

three channels.”

Through Sharecare’s flexible, data-driven platform and

comprehensive solutions – including benefits navigation,

evidence-based coaching and digital therapeutics,

wellness programs, home care resources, health information

management, and more – the company helps people easily

and efficiently manage their healthcare and improve their

well-being. Across its three business channels, Sharecare

enables employers, commercial and government health plans, and

managed care organizations, as well as providers and life

sciences companies to drive personalized and value-based care

at scale.

“This take-private transaction provides Sharecare with the

operational flexibility to focus on profitable growth and positions

us to help our customers better address their and their

populations’ needs through continued innovation,” said Brent

Layton, CEO of Sharecare. “We are enthusiastic about this next

phase of Sharecare’s evolution, and our team is laser focused on

continuing to deliver exceptional service to our existing and

future clients, including developing and deploying best-in-class

solutions that make healthcare more personalized, accessible, and

affordable for everyone.”

As part of the transaction, Arnold rolled over the majority of

his equity holdings and certain affiliates of Claritas Capital, LLC

(“Claritas”) rolled over all of their equity holdings. Arnold and

Claritas will continue to be significant shareholders in Sharecare

going forward.

Sharecare’s leadership team will remain in place and will

continue to be focused on delivering measurable results for

customers and driving sustainable growth for the company. Sharecare

will maintain its headquarters in Atlanta and continue to operate

under its existing brand as a standalone company under Altaris’

ownership.

Advisors Houlihan Lokey and MTS Health Partners

acted as financial advisors to the Special Committee, and Wachtell,

Lipton, Rosen & Katz served as legal advisor to the Special

Committee. Kirkland & Ellis LLP acted as legal advisor to

Altaris. King & Spalding LLC acted as legal advisor to Jeff

Arnold. RBC Capital Markets, LLC acted as financial advisor to

Claritas, and Ropes & Gray LLP served as legal advisor to

Claritas.

About SharecareSharecare is a digital

healthcare company that delivers software

and tech-enabled services to stakeholders across the

healthcare ecosystem to help improve care quality, drive better

outcomes, and lower costs. Through its data-driven AI

insights, evidence-based resources, and comprehensive platform –

including benefits navigation, care management, home care

resources, health information management, and more –

Sharecare helps people easily and efficiently manage

their healthcare and improve their well-being. Across its

three business channels, Sharecare enables health plan sponsors,

health systems and physician practices, and leading

pharmaceutical brands to drive personalized and

value-based care at scale. To learn more,

visit www.sharecare.com.

About Altaris Altaris is an investment firm

with an exclusive focus on acquiring and building companies in the

healthcare industry. Since inception in 2003, Altaris has invested

in more than 50 companies across a range of healthcare subsectors,

with a consistent goal of delivering value to the healthcare system

and generating attractive financial returns for investors. Altaris

is headquartered in New York City and manages $10 billion of equity

capital. For more information, please visit www.altariscap.com.

Contacts:Investor relations:

investors@sharecare.comMedia relations: Jen Martin Hall,

jen@sharecare.com

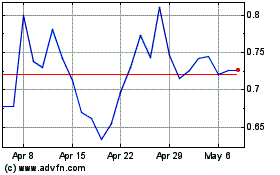

Sharecare (NASDAQ:SHCR)

Historical Stock Chart

From Nov 2024 to Dec 2024

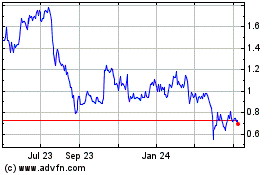

Sharecare (NASDAQ:SHCR)

Historical Stock Chart

From Dec 2023 to Dec 2024