UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| x |

Soliciting Material under §240.14a-12 |

Sharecare, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

The following is an excerpt of the transcript

of an employee town hall held by Sharecare, Inc. (“Sharecare”) on August 14, 2024 and provided in recorded form

to employees on August 16, 2024:

Dawn

Whaley: Jeff, if you could, please give us an update on the Altaris deal.

Jeff

Arnold: Sure. It's very procedural at this stage. As you may have seen in our earnings release on Friday, the expiration of

the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 in connection with the transaction occurred for us

on Thursday, August 8th. So that's a big deal as part of this process; that's a milestone that we got over on the 8th and now the

expiration of the waiting period satisfies one of the key conditions necessary for the transaction to close. So, like I said, an important

milestone. Second, we're making progress towards the special meeting of stockholders to approve the transaction, which is a key item

for closing.

Dawn

Whaley: Right.

Jeff

Arnold: So, we're making progress through our steps to get to that shareholder vote. And as you may have seen, the preliminary

proxy statement for a special meeting of stockholders to vote on the transaction and the accompanying Schedule 13E-3, was filed on Monday,

August 5th. And so, because we filed that, obviously everybody on the call is welcome to go read it. And once finalized, there'll

be a definitive proxy statement that will set the date for the special meeting, which we expect to happen in the coming month.

And

then finally, I think I speak for all of us – Brent and Justin, Dawn, Jen, everybody – that we've enjoyed continuing

to get to know the Altaris team and we've developed a very collaborative relationship; but as we've said before, we continue to be an

independent company until closing. However, we expect that to happen before the end of this year. And as I said, you know, we're making

really good progress from a procedural standpoint; you know, moving the ball down the field to get to a closing, but if you have any

additional questions, you can always reach out to Jen or as you know, you can email PR@sharecare.com and we'll get back

to you with an answer.

Dawn

Whaley: Got it. Great. Thanks.

Important

Notice Regarding Forward-Looking Statements

This communication

contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that are based on

beliefs and assumptions and on information currently available. In some cases, you can identify forward-looking statements by the following

words: “outlook,” “target,” “reflect,” “on track,” “foresees,” “future,”

“may,” “deliver,” “will,” “shall,” “could,” “would,” “should,”

“expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,”

“predict,” “project,” “potential,” “continue,” “ongoing” or the negative of

these terms, other comparable terminology (although not all forward-looking statements contain these words), or by discussions of strategy,

plans, or intentions. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity,

performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

Although we believe that we have a reasonable basis for each forward-looking statement contained in this communication, we caution you

that these statements are based on a combination of facts and factors currently known by us and our projections of the future, about which

we cannot be certain.

Forward-looking

statements in this communication include, but are not limited to, statements regarding our long-term strategy and positioning, growth,

globalization and other strategic cost optimization initiatives and the corresponding benefits, including long-term growth, margin improvement

and cash flow improvements, and partnerships or other relationships with third parties or customers, in each case on our future growth

objectives and statements regarding our future results and outlook, including those under the caption “Financial Outlook.”

We cannot

assure you that the forward-looking statements in this communication will prove to be accurate. These forward-looking statements are subject

to a number of significant risks and uncertainties that could cause actual results to differ materially from expected results. For example,

the Company’s Financial Outlook assumes business currently under contract and satisfaction by our customers of their contractual

obligations under those agreements, which is not within the Company’s control. If a customer fails to satisfy its contractual obligations,

actual revenue and Adjusted EBITDA could be negatively impacted. Descriptions of some of the other factors that could cause actual results

to differ materially from these forward-looking statements are discussed in more detail in our filings with the U.S. Securities and Exchange

Commission (the "SEC"), including the Risk Factors section of the Company's Annual Report on Form 10-K for the year ended

December 31, 2023, filed with the SEC on March 30, 2023. Furthermore, if the forward-looking statements prove to be inaccurate,

the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these

statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time

frame, or at all. The forward-looking statements in this communication represent our views as of the date of this communication. We anticipate

that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements

at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore,

not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this communication.

Additional Information and Where to Find It

This communication

relates to the proposed transaction involving Sharecare. In connection with the proposed transaction, Sharecare filed and will file relevant

materials with the SEC, including Sharecare’s proxy statement on Schedule 14A (the “Proxy Statement”), filed with the

SEC on August 5, 2024. This communication is not a substitute for the Proxy Statement or for any other document that Sharecare may

file with the SEC and send to its stockholders in connection with the proposed transaction. The proposed transaction will be submitted

to Sharecare’s stockholders for their consideration. Before making any voting decision, Sharecare’s stockholders are urged

to read all relevant documents filed or to be filed with the SEC, including the Proxy Statement, as well as any amendments or supplements

to those documents, when they become available because they will contain important information about the proposed transaction.

Sharecare’s

stockholders will be able to obtain a free copy of the Proxy Statement, as well as other filings containing information about Sharecare,

without charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and the filings with the SEC that will be incorporated

by reference therein can also be obtained, without charge, by directing a request to Sharecare, Inc., 255 East Paces Ferry Road NE, Suite 700,

Atlanta, Georgia 30305, Attention: Investor Relations, investors@sharecare.com, or from Sharecare’s website www.sharecare.com.

Participants in the Solicitation

Sharecare

and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect

of the proposed transaction. Information regarding Sharecare’s directors and executive officers is available in Sharecare’s

proxy statement for the 2024 annual meeting of stockholders, which was filed with the SEC on April

29, 2024 (the “Annual Meeting Proxy Statement”). Please refer to the sections captioned “Executive Compensation,”

“Director Compensation” and “Stock Ownership” in the Annual Meeting Proxy Statement. To the extent holdings of

such participants in Sharecare’s securities have changed since the amounts described in the Annual Meeting Proxy Statement, such

changes have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed

with the SEC: Form 4, filed by Jeffrey T. Arnold on May

17, 2024; Form 4, filed by Dawn Whaley on May

17, 2024; Form 4, filed by Justin Ferrero on May

17, 2024; Form 4, filed by Carrie Ratliff on May

17, 2024; Form 4, filed by Michael Blalock on May

17, 2024; Form 4, filed by Colin Daniel on May

17, 2024; Form 4, filed by Jeffrey A. Allred on June

12, 2024; Form 4, filed by John Huston Chadwick on June

12, 2024; Form 4, filed by Kenneth R. Goulet on June

12, 2024; Form 4, filed by Brent D. Layton on June

12, 2024; Form 4, filed by Rajeev Ronanki on June

12, 2024; Form 4, filed by Rajeev Ronanki on June

18, 2024; Form 4, filed by Kenneth R. Goulet on June

18, 2024; Form 4, filed by Colin Daniel on June

18, 2024; Form 4, filed by Carrie Ratliff on June

18, 2024; Form 4, filed by Veronica Mallett on June

18, 2024; Form 4, filed by Jeffrey Sagansky on June

18, 2024; Form 4, filed by John Huston Chadwick on June

18, 2024; Form 4, filed by Justin Ferrero on June

18, 2024; Form 4, filed by Nicole Torraco on June 18, 2024; Form 4, filed by Alan G. Mnuchin on June

18, 2024; Form 4, filed by Michael Blalock on June 18, 2024; Form 4, filed by Sandro Galea on June

18, 2024; Form 4, filed by Dawn Whaley on June

18, 2024; Form 4, filed by Jeffrey A. Allred on June

18, 2024; Form 4, filed by Colin Daniel on July

15, 2024; Form 4, filed by Dawn Whaley on July

15, 2024; Form 4, filed by Justin Ferrero on July

15, 2024; Form 4, filed by Michael Blalock on July 15, 2024; Form 4, filed by Carrie Ratliff on July

15, 2024; Form 4, filed by Justin Ferrero on July

30, 2024; Form 4, filed by Brent D. Layton on July

30, 2024; Form 4, filed by Jeffrey T. Arnold on July

30, 2024; Form 4, filed by Colin Daniel on July

30, 2024; Form 4, filed by Michael Blalock on July

30, 2024; Form 4, filed by Carrie Ratliff on July

30, 2024; Form 4, filed by Dawn Whaley on July

30, 2024; Form 4, filed by Jeffrey T. Arnold on August

15, 2024; Form 4, filed by Dawn Whaley on August

15, 2024; Form 4, filed by Justin Ferrero on August

15, 2024; Form 4, filed by Colin Daniel on August

15, 2024; and Form 4, filed by Michael Blalock on August

15, 2024. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests,

by security holdings or otherwise, are or will be contained in the Proxy Statement, the Schedule 13E-3 and other relevant materials to

be filed with the SEC in connection with the proposed transaction when they become available. Free copies of the Proxy Statement, the

Schedule 13E-3 and such other materials may be obtained as described in the preceding paragraph.

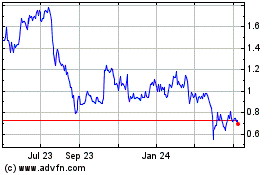

Sharecare (NASDAQ:SHCR)

Historical Stock Chart

From Nov 2024 to Dec 2024

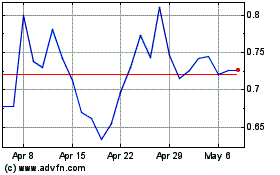

Sharecare (NASDAQ:SHCR)

Historical Stock Chart

From Dec 2023 to Dec 2024