Form 8-K - Current report

December 21 2023 - 9:13AM

Edgar (US Regulatory)

0000350894FALSE00003508942023-12-212023-12-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________

FORM 8-K

________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

December 21, 2023

Date of report (Date of earliest event reported)

________________________________________

________________________________________

SEI INVESTMENTS COMPANY

(Exact name of registrant as specified in charter)

________________________________________

| | | | | | | | | | | | | | |

| Pennsylvania | | 0-10200 | | 23-1707341 |

(State or Other Jurisdiction of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

1 Freedom Valley Drive

Oaks, Pennsylvania 19456

(Address of Principal Executive Offices and Zip Code)

(610) 676-1000

(Registrants’ Telephone Number, Including Area Code)

________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | SEIC | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Information.

On Thursday, December 21, 2023, SEI Investments Company (the “Company”) announced the acquisition of Altigo, a cloud-based technology platform that provides inventory, e-subscription, and reporting capabilities for alternative investments. The acquisition is not a significant acquisition of assets or otherwise material to the operations or financial results of the Company. A copy of the press release is furnished as Exhibit 99.1 and incorporated into this Item 7.01 by reference.

As provided in General Instruction B.2 to Form 8-K, the information furnished pursuant to Item 7.01 and Exhibit 99.1 hereof shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing with the Securities and Exchange Commission, except as shall be expressly provided by specific reference in such filing.

This Current Report on Form 8-K may contain forward looking statements within the meaning or the rules and regulations of the Securities and Exchange Commission. In some cases you can identify forward-looking statements by terminology such as ‘‘may’’, ‘‘will’’, ‘‘expect’’, ‘‘believe’’ and ‘‘continue’’ or ‘‘appear.’’ You should not place undue reliance on our forward-looking statements as they are based on the current beliefs and expectations of our management and subject to significant risks and uncertainties many of which are beyond our control or are subject to change. Although we believe the assumptions upon which we base our forward-looking statements are reasonable, they could be inaccurate. Some of the risks and important factors that could cause actual results to differ from those described in our forward-looking statements can be found in the “Risk Factors” sections of our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission.

Item 9.01. Financial Statements and Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| SEI INVESTMENTS COMPANY |

| |

| Date: | December 21, 2023 | By: | /s/ Dennis J. McGonigle |

| | Dennis J. McGonigle

Chief Financial Officer |

© 2023 SEI 1 Company Contact: Media Contact: Leslie Wojcik Kerry Mullen SEI Vested +1 610-676-4191 +1 917-765-8720 lwojcik@seic.com kerry@fullyvested.com Pages: 2 FOR IMMEDIATE RELEASE SEI Acquires Altigo SEI to Leverage Unique Industry Position to Meet Market Demand and Streamline Investment Process for Alternatives OAKS, Pa., Dec. 21, 2023 – SEI® (NASDAQ:SEIC) today announced the acquisition of Altigo, a cloud- based technology platform that provides inventory, e-subscription, and reporting capabilities for alternative investments. With 35% of investors aged 25 to 44 years indicating an increased demand for alts1 and global alternative assets expected to hit $23 trillion by 20272, fund sponsors are seeking efficient access to private clients, and SEI believes those investors want access to a variety of high- quality alternative investment products. SEI expects the acquisition of Altigo to drive growth and expand its strategic opportunity in the alternatives space. Ryan Hicke, SEI CEO, said: “We sit at the center of the financial services industry, which positions us to connect all components of the ecosystem in a way that others can’t. Our client footprint across financial intermediaries and fund sponsors—combined with the breadth of our capabilities across technology, operations, and asset management—gives us opportunities to transform private fund investing and widen access to alternative investment products for investors.” As part of the transaction, SEI will welcome Altigo team members who collectively bring technical, sales, client service, and marketing expertise. The company intends to provide the distribution of and access to a selection of alternative investment products in a Software-as-a-Service model to its existing investment manager, advisor, and banking clients in the first half of 2024. SEI is a market leader in supporting sponsor firms’ operational and information needs, and the integration of Altigo with SEI’s capabilities across intermediary wealth channels will enable the delivery of a broader, end-to-end solution. Kevin Crowe, Senior Vice President at SEI, added: “Investor expectations for a personalized wealth management experience continue to drive the demand for investment flexibility, and alternatives can play an important role in a diversified Press release.

© 2023 SEI 2 portfolio that meets an investor’s financial goals—but access to alternative investments is largely exclusive. Financial intermediaries often seek guidance on how to source and utilize these products, the process to invest in these products can be complicated and slow, and ongoing management is typically manual. This platform is built on the idea that investing in alternative securities could be made much more efficient and manageable using online technology tools and digital workflows. “By leveraging our unmatched position to connect fund sponsors to intermediaries and intermediaries to investment options that cater to their clients’ goals, we believe we can enable distribution beyond today’s access points, empower financial professionals to make faster, more confident investment decisions for their clients, and drive future growth.” 1 Prequin, “2022 Global Alternatives Report”; 2 Prequin, “Future of Alts in 2027” About SEI® SEI (NASDAQ:SEIC) delivers technology and investment solutions that connect the financial services industry. With capabilities across investment processing, operations, and asset management, SEI works with corporations, financial institutions and professionals, and ultra-high-net-worth families to help drive growth, make confident decisions, and protect futures. As of Sept. 30, 2023, SEI manages, advises, or administers approximately $1.3 trillion in assets. For more information, visit seic.com. This release contains forward-looking statements within the meaning or the rules and regulations of the Securities and Exchange Commission. In some cases you can identify forward-looking statements by terminology, such as “may,” “will,” “expect,” “believe,” and “continue” or “appear.” Our forward-looking statements include our current expectations as to: investor desire for access to a variety of high-quality alternative investment products, our ability to transform private fund investing and widen access to alternative investment products for investors, the solutions we will offer and the timing of such offerings, the drivers of investor demands for flexibility, the degree to which investing in alternative securities could be made much more efficient and manageable using online technology tools and digital workflows, and our ability to enable distribution beyond today’s access points and empower financial professionals to make faster, more confident investment decisions for their clients and drive future growth. You should not place undue reliance on our forward-looking statements, as they are based on the current beliefs and expectations of our management and subject to significant risks and uncertainties, many of which are beyond our control or are subject to change. Although we believe the assumptions upon which we base our forward-looking statements are reasonable, they could be inaccurate. Some of the risks and important factors that could cause actual results to differ from those described in our forward-looking statements can be found in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended Dec. 31, 2022, filed with the Securities and Exchange Commission. ###

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

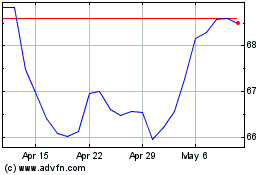

SEI Investments (NASDAQ:SEIC)

Historical Stock Chart

From Apr 2024 to May 2024

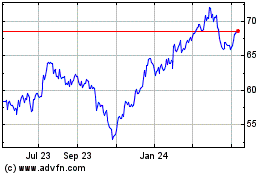

SEI Investments (NASDAQ:SEIC)

Historical Stock Chart

From May 2023 to May 2024