Filed Pursuant to Rule 424(b)(3)

Registration No. 333-275117

PROSPECTUS SUPPLEMENT NO. 6

(to Prospectus dated March 29, 2024)

Scilex Holding Company

Up to 13,474,683 Shares of Common Stock

This prospectus supplement supplements the prospectus dated March 29, 2024 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-275117) for which Post-Effective Amendment No. 1 was filed with the Securities and Exchange Commission on March 27, 2024 and declared effective by the Securities and Exchange Commission on March 29, 2024. This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission on August 13, 2024 (the “Quarterly Report”). Accordingly, we have attached the Quarterly Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the resale from time to time by the selling stockholders named in the Prospectus (including their permitted transferees, donees, pledgees and other successors-in-interest) (collectively, the “Selling Stockholders”) of up to an aggregate of 13,474,683 shares (the “Resale Shares”) of our common stock, par value $0.0001 per share (“Common Stock”), consisting of:

(i) up to 474,683 shares of Common Stock (the “HB Shares”), of which 161,392 shares of Common Stock are held by Cove Lane Onshore Fund, LLC (“Cove Lane”) and 313,291 shares of Common Stock are held by HBC Investments LLC (“HBC”), in each case issued on September 25, 2023, pursuant to the Settlement Agreement (as defined and described below); and

(ii) up to 13,000,000 shares of Common Stock issuable upon exercise of warrants to purchase Common Stock, having an exercise price of $0.01 per share (such shares issuable upon exercise, the “Penny Warrant Shares” and such warrants, the “Penny Warrants”), issued to Oramed Pharmaceuticals Inc. (“Oramed”) pursuant to the Scilex Oramed SPA (as defined and described below).

On September 21, 2023, we entered into, and consummated the transactions contemplated by that certain Securities Purchase Agreement, dated as of such date, between us and Oramed (the “Scilex-Oramed SPA”). Pursuant to the Scilex-Oramed SPA, among other things, on September 21, 2023, we (i) issued to Oramed (A) a senior secured promissory note due 18 months from the date of issuance in the principal amount of $101,875,000 (the “Oramed Note”), (B) a warrant to purchase up to an aggregate of 4,500,000 shares of Common Stock (the “Closing Penny Warrant”), with an exercise price of $0.01 per share and restrictions on exercisability (as more fully described elsewhere in the Prospectus), and (C) warrants to purchase up to an aggregate of 8,500,000 shares of Common Stock (the “Subsequent Penny Warrants” and together with the Closing Penny Warrant, the “Penny Warrants”), each with an exercise price of $0.01 per share and each with restrictions on exercisability (as more fully described elsewhere in the Prospectus), and (ii) caused certain outstanding warrants to purchase up to an aggregate of 4,000,000 shares of Common Stock, with an exercise price of $11.50 per share, that we acquired from Sorrento pursuant to the Sorrento SPA (as defined and described elsewhere in the Prospectus) to be transferred to Oramed (the “Transferred Warrants”). See the section in the Prospectus titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Developments—Transactions with Oramed Pharmaceuticals Inc. and Sorrento Therapeutics, Inc.” for additional information regarding the Scilex-Oramed SPA and transactions related thereto.

On September 15, 2023, we entered into that certain Settlement Agreement (the “Settlement Agreement”) with Cove Lane, HBC and Hudson Bay Capital Management LP (“Hudson Bay” and collectively with Cove Lane and HBC, the “Hudson Bay Parties” and each a “Hudson Bay Party”) in connection with a previously contemplated financing with the Hudson Bay Parties. The HB Shares were issued to Cove Lane and HBC pursuant to the Settlement Agreement. See the section in the Prospectus titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Developments—Settlement Agreement” for additional information.

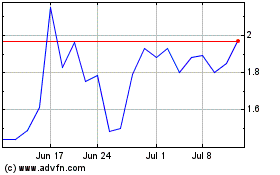

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “SCLX”. On August 12, 2024, the last reported sales price per share of our Common Stock was $1.32.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

See the section entitled “Risk Factors” beginning on page 17 of the Prospectus as well as risks and uncertainties described under similar headings in any amendments or supplements to the Prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the Prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is August 13, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended: June 30, 2024

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-39852

Scilex Holding Company

(Exact Name of Registrant as Specified in Its Charter)

|

|

Delaware |

92-1062542 |

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

960 San Antonio Road Palo Alto, CA |

94303 |

(Address of Principal Executive Offices) |

(Zip Code) |

(650) 516-4310

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of exchange on which registered |

Common Stock, par value $0.0001 per share |

|

SCLX |

|

The Nasdaq Stock Market LLC |

Warrants to purchase one share of common stock, each at an exercise price of $11.50 per share |

|

SCLXW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

As of August 9, 2024, the registrant had 191,790,520 shares of common stock, par value $0.0001, outstanding.

SCILEX HOLDING COMPANY

TABLE OF CONTENTS

SCILEX HOLDING COMPANY

In this Quarterly Report on Form 10-Q, unless the context requires otherwise, references to the “Company”, “Scilex”, “we”, “us”, “our”, and similar terms refer to Scilex Holding Company, a Delaware corporation formerly known as Vickers Vantage Corp. I (“Vickers”), and its consolidated subsidiaries. References to “Legacy Scilex” refer to the private Delaware corporation that is now our wholly owned subsidiary and named Scilex, Inc. (formerly known as “Scilex Holding Company”).

On November 10, 2022, we consummated the previously announced business combination pursuant to the Agreement and Plan of Merger, dated as of March 17, 2022 (as amended by Amendment No. 1 to Agreement and Plan of Merger, dated September 12, 2022, together, the “Merger Agreement”), by and among Vickers, Vantage Merger Sub Inc. (“Merger Sub”), a wholly owned subsidiary of Vickers, and Legacy Scilex. Pursuant to the terms of the Merger Agreement, the business combination (herein referred to as the “Business Combination” or “reverse recapitalization” for accounting purposes) between Vickers and Legacy Scilex was effected through the merger of Merger Sub with and into Legacy Scilex with Legacy Scilex surviving as Vickers’s wholly owned subsidiary. In connection with the Business Combination, Vickers changed its name from Vickers Vantage Corp. I to Scilex Holding Company.

Unless otherwise noted or the context requires otherwise, references to our “Common Stock” refer to our common stock, par value $0.0001 per share.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Quarterly Report on Form 10-Q may constitute “forward-looking statements” for purposes of federal securities laws. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements appear in a number of places in this Quarterly Report on Form 10-Q including, without limitation, in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “contemplate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “will,” “would” and other similar words and expressions (including the negative of any of the foregoing), but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements are based on information available as of the date of this Quarterly Report on Form 10-Q and our management’s current expectations, forecasts and assumptions, and involve a number of judgments, known and unknown risks and uncertainties and other factors, many of which are outside the control of the Company and our directors, officers and affiliates. There can be no assurance that future developments will be those that have been anticipated. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date.

These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 12, 2024 (the “Annual Report on Form 10-K”), as updated by the risk factors described under the heading “Risk Factors” in Part II - Item 1A of this Quarterly Report on Form 10-Q.

Forward-looking statements in this Quarterly Report on Form 10-Q may include, but are not limited to, statements about:

•our ability to maintain the listing of our Common Stock on the Nasdaq Capital Market;

•our public securities’ liquidity and trading;

•our ability to raise financing in the future;

•our future use of equity or debt financings to execute our business strategy;

•our ability to use cash on hand to meet current and future financial obligations, including funding our operations, debt service requirements and capital expenditures;

•the outcome of any legal proceedings that may be instituted against us;

•our ability to attract and retain qualified directors, officers, employees and key personnel;

•our ability to compete effectively in a highly competitive market;

•the competition from larger biotechnology companies that have greater resources, technology, relationships and/or expertise;

•the ability to protect and enhance our corporate reputation and brand;

•the impact from future regulatory, judicial and legislative changes in our industry;

•our ability to obtain and maintain regulatory approval of any of our product candidates;

•our ability to research, discover and develop additional product candidates;

•our ability to grow and manage growth profitably;

•our ability to obtain and maintain intellectual property protection and not infringe on the rights of others;

•our ability to execute our business plans and strategy;

•our ability to prevent, respond to, and recover from a cybersecurity incident;

•the effect of global economic and political developments, including the conflicts in Ukraine and Israel;

•the impact of COVID-19 and other similar disruptions in the future; and

•other factors detailed under the section titled “Risk Factors” in the Annual Report on Form 10-K, as updated by the risk factors described in the section of this Quarterly Report on Form 10-Q titled “Risk Factors.”

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by our management prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Some of these risks and uncertainties may in the future be amplified by COVID-19 (or other similar disruptions), and there may be additional risks that we consider immaterial or which are unknown. It is not possible to predict or identify all such risks. We do not undertake any obligation to update, add or to otherwise correct any forward-looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

SCILEX HOLDING COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for par value and share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

|

December 31,

2023 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,888 |

|

|

$ |

3,921 |

|

Accounts receivable, net |

|

|

38,004 |

|

|

|

34,597 |

|

Inventory |

|

|

3,073 |

|

|

|

4,214 |

|

Prepaid expenses and other |

|

|

2,453 |

|

|

|

4,049 |

|

Total current assets |

|

|

50,418 |

|

|

|

46,781 |

|

Property and equipment, net |

|

|

714 |

|

|

|

722 |

|

Operating lease right-of-use asset |

|

|

2,578 |

|

|

|

2,943 |

|

Intangibles, net |

|

|

34,456 |

|

|

|

36,485 |

|

Goodwill |

|

|

13,481 |

|

|

|

13,481 |

|

Other long-term assets |

|

|

2,897 |

|

|

|

897 |

|

Total assets |

|

$ |

104,544 |

|

|

$ |

101,309 |

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

41,787 |

|

|

$ |

40,954 |

|

Accrued payroll |

|

|

4,073 |

|

|

|

2,681 |

|

Accrued rebates and fees |

|

|

125,063 |

|

|

|

89,658 |

|

Accrued expenses |

|

|

7,988 |

|

|

|

7,408 |

|

Current portion of deferred consideration |

|

|

469 |

|

|

|

491 |

|

Debt, current |

|

|

75,370 |

|

|

|

108,429 |

|

Current portion of operating lease liabilities |

|

|

701 |

|

|

|

759 |

|

Total current liabilities |

|

|

255,451 |

|

|

|

250,380 |

|

Long-term portion of deferred consideration |

|

|

2,667 |

|

|

|

2,895 |

|

Debt, net of issuance costs |

|

|

29,033 |

|

|

|

17,038 |

|

Derivative liabilities |

|

|

30,005 |

|

|

|

1,518 |

|

Operating lease liabilities |

|

|

1,893 |

|

|

|

2,237 |

|

Other long-term liabilities |

|

|

187 |

|

|

|

179 |

|

Total liabilities |

|

$ |

319,236 |

|

|

$ |

274,247 |

|

Commitments and contingencies (See Note 11) |

|

|

|

|

|

|

Stockholders’ deficit: |

|

|

|

|

|

|

Preferred stock, $0.0001 par value, 45,000,000 shares authorized; 29,057,097 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively |

|

|

— |

|

|

|

— |

|

Common stock, $0.0001 par value, 740,000,000 shares authorized; 181,473,622 shares issued and 121,405,037 shares outstanding as of June 30, 2024; 160,084,250 shares issued and 100,015,665 shares outstanding as of December 31, 2023 |

|

|

18 |

|

|

|

16 |

|

Additional paid-in capital |

|

|

426,165 |

|

|

|

407,813 |

|

Accumulated other comprehensive income |

|

|

1,851 |

|

|

|

— |

|

Accumulated deficit |

|

|

(552,204 |

) |

|

|

(490,245 |

) |

Treasury stock, at cost; 60,068,585 shares as of each of June 30, 2024 and December 31, 2023 |

|

|

(90,522 |

) |

|

|

(90,522 |

) |

Total stockholders’ deficit |

|

|

(214,692 |

) |

|

|

(172,938 |

) |

Total liabilities and stockholders’ deficit |

|

$ |

104,544 |

|

|

$ |

101,309 |

|

See accompanying notes to unaudited condensed consolidated financial statements

SCILEX HOLDING COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except for net loss per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net revenue |

|

$ |

16,370 |

|

|

$ |

12,582 |

|

|

$ |

27,254 |

|

|

$ |

23,164 |

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

4,390 |

|

|

|

4,177 |

|

|

|

8,230 |

|

|

|

7,768 |

|

Research and development |

|

|

2,004 |

|

|

|

3,204 |

|

|

|

5,112 |

|

|

|

5,940 |

|

Selling, general and administrative |

|

|

24,598 |

|

|

|

26,989 |

|

|

|

53,876 |

|

|

|

55,690 |

|

Intangible amortization |

|

|

1,001 |

|

|

|

1,026 |

|

|

|

2,028 |

|

|

|

2,053 |

|

Legal settlements |

|

|

— |

|

|

|

— |

|

|

|

(6,891 |

) |

|

|

— |

|

Total operating costs and expenses |

|

|

31,993 |

|

|

|

35,396 |

|

|

|

62,355 |

|

|

|

71,451 |

|

Loss from operations |

|

|

(15,623 |

) |

|

|

(22,814 |

) |

|

|

(35,101 |

) |

|

|

(48,287 |

) |

Other expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Loss on derivative liability |

|

|

15,284 |

|

|

|

82 |

|

|

|

15,741 |

|

|

|

5,335 |

|

Change in fair value of debt and liability instruments |

|

|

6,099 |

|

|

|

3,748 |

|

|

|

10,004 |

|

|

|

3,748 |

|

Interest expense, net |

|

|

571 |

|

|

|

5 |

|

|

|

1,102 |

|

|

|

4 |

|

Loss on foreign currency exchange |

|

|

5 |

|

|

|

3 |

|

|

|

11 |

|

|

|

23 |

|

Total other expense |

|

|

21,959 |

|

|

|

3,838 |

|

|

|

26,858 |

|

|

|

9,110 |

|

Loss before income taxes |

|

|

(37,582 |

) |

|

|

(26,652 |

) |

|

|

(61,959 |

) |

|

|

(57,397 |

) |

Income tax expense (benefit) |

|

|

— |

|

|

|

(3 |

) |

|

|

— |

|

|

|

5 |

|

Net loss |

|

$ |

(37,582 |

) |

|

$ |

(26,649 |

) |

|

$ |

(61,959 |

) |

|

$ |

(57,402 |

) |

Net loss per share attributable to common stockholders — basic and diluted |

|

$ |

(0.31 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.56 |

) |

|

$ |

(0.40 |

) |

Weighted average number of shares during the period — basic and diluted |

|

|

120,188 |

|

|

|

142,626 |

|

|

|

111,449 |

|

|

|

142,146 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(37,582 |

) |

|

|

(26,649 |

) |

|

|

(61,959 |

) |

|

|

(57,402 |

) |

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

Changes in fair value attributable to instrument-specific credit risk |

|

|

1,851 |

|

|

|

— |

|

|

|

1,851 |

|

|

|

— |

|

Total other comprehensive income |

|

|

1,851 |

|

|

|

— |

|

|

|

1,851 |

|

|

|

— |

|

Comprehensive loss |

|

$ |

(35,731 |

) |

|

$ |

(26,649 |

) |

|

$ |

(60,108 |

) |

|

$ |

(57,402 |

) |

See accompanying notes to unaudited condensed consolidated financial statements

SCILEX HOLDING COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock |

|

|

Common Stock |

|

|

Additional |

|

|

Accumulated Other |

|

|

Accumulated |

|

|

Treasury Stock |

|

|

Stockholders’ |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Paid-in Capital |

|

|

Comprehensive Income |

|

|

Deficit |

|

|

Shares |

|

|

Amount |

|

|

Deficit |

|

Balance, December 31, 2023 |

|

29,057 |

|

|

$ |

— |

|

|

|

160,084 |

|

|

$ |

16 |

|

|

$ |

407,813 |

|

|

|

|

|

$ |

(490,245 |

) |

|

|

60,069 |

|

|

$ |

(90,522 |

) |

|

$ |

(172,938 |

) |

Shares issued under Standby Equity Purchase Agreements and under ATM Sales Agreement |

|

— |

|

|

|

— |

|

|

|

189 |

|

|

|

— |

|

|

|

156 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

156 |

|

Shares issued under Bought Deal Offering |

|

— |

|

|

|

— |

|

|

|

5,882 |

|

|

|

1 |

|

|

|

3,768 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,769 |

|

Stock options exercised |

|

— |

|

|

|

— |

|

|

|

35 |

|

|

|

— |

|

|

|

46 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

46 |

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,558 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,558 |

|

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(24,377 |

) |

|

|

— |

|

|

|

— |

|

|

|

(24,377 |

) |

Balance, March 31, 2024 |

|

29,057 |

|

|

|

— |

|

|

|

166,190 |

|

|

|

17 |

|

|

|

415,341 |

|

|

|

— |

|

|

|

(514,622 |

) |

|

|

60,069 |

|

|

|

(90,522 |

) |

|

|

(189,786 |

) |

Shares issued under Registered Direct Offering |

|

— |

|

|

|

— |

|

|

|

15,000 |

|

|

|

1 |

|

|

|

5,918 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,919 |

|

Placement Agent Warrants issued in connection with Registered Direct Offering and Representative Warrants issued in connection with Bought Deal Offering |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

956 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

956 |

|

Shares issued under ESPP |

|

— |

|

|

|

— |

|

|

|

167 |

|

|

|

— |

|

|

|

154 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

154 |

|

Stock options exercised |

|

— |

|

|

|

— |

|

|

|

67 |

|

|

|

— |

|

|

|

99 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

99 |

|

Issuance of common stock upon warrants exercise |

|

— |

|

|

|

— |

|

|

|

50 |

|

|

|

— |

|

|

|

84 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

84 |

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,613 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,613 |

|

Other comprehensive income |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,851 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,851 |

|

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(37,582 |

) |

|

|

— |

|

|

|

— |

|

|

|

(37,582 |

) |

Balance, June 30, 2024 |

|

29,057 |

|

|

$ |

— |

|

|

|

181,474 |

|

|

$ |

18 |

|

|

$ |

426,165 |

|

|

$ |

1,851 |

|

|

$ |

(552,204 |

) |

|

|

60,069 |

|

|

$ |

(90,522 |

) |

|

$ |

(214,692 |

) |

SCILEX HOLDING COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock |

|

|

Common Stock |

|

|

Additional |

|

|

Accumulated |

|

|

Treasury Stock |

|

|

Stockholders’ |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Paid-in Capital |

|

|

Deficit |

|

|

Shares |

|

|

Amount |

|

|

Deficit |

|

Balance, December 31, 2022 |

|

29,057 |

|

|

$ |

3 |

|

|

|

141,349 |

|

|

$ |

14 |

|

|

$ |

412,136 |

|

|

$ |

(375,914 |

) |

|

|

— |

|

|

$ |

— |

|

|

$ |

36,239 |

|

Shares issued under Standby Equity Purchase Agreements |

|

— |

|

|

|

— |

|

|

|

462 |

|

|

|

— |

|

|

|

1,869 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,869 |

|

Retainer shares issued |

|

— |

|

|

|

— |

|

|

|

4,000 |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,720 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,720 |

|

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(30,753 |

) |

|

|

— |

|

|

|

— |

|

|

|

(30,753 |

) |

Balance, March 31, 2023 |

|

29,057 |

|

|

|

3 |

|

|

|

145,811 |

|

|

|

15 |

|

|

|

417,725 |

|

|

|

(406,667 |

) |

|

|

— |

|

|

|

— |

|

|

|

11,076 |

|

Shares issued under Standby Equity Purchase Agreements |

|

— |

|

|

|

— |

|

|

|

2,084 |

|

|

|

— |

|

|

|

13,925 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,925 |

|

Stock options exercised |

|

— |

|

|

|

— |

|

|

|

128 |

|

|

|

— |

|

|

|

222 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

222 |

|

Conversion of Convertible Debentures into common stock |

|

— |

|

|

|

— |

|

|

|

632 |

|

|

|

— |

|

|

|

7,735 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7,735 |

|

Issuance of common stock upon warrants exercise |

|

— |

|

|

|

— |

|

|

|

45 |

|

|

|

— |

|

|

|

521 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

521 |

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,587 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,587 |

|

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(26,649 |

) |

|

|

— |

|

|

|

— |

|

|

|

(26,649 |

) |

Balance, June 30, 2023 |

|

29,057 |

|

|

$ |

3 |

|

|

|

148,700 |

|

|

$ |

15 |

|

|

$ |

443,715 |

|

|

$ |

(433,316 |

) |

|

|

— |

|

|

$ |

— |

|

|

$ |

10,417 |

|

See accompanying notes to unaudited condensed consolidated financial statements

SCILEX HOLDING COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

|

2024 |

|

|

2023 |

|

Operating activities |

|

|

|

|

|

Net loss |

$ |

(61,959 |

) |

|

$ |

(57,402 |

) |

Adjustments to reconcile net loss to net cash proceeds from (used for) operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

2,037 |

|

|

|

2,073 |

|

Amortization of debt issuance costs and debt discount |

|

63 |

|

|

|

1 |

|

Non-cash operating lease cost |

|

365 |

|

|

|

156 |

|

Stock-based compensation |

|

7,171 |

|

|

|

7,307 |

|

Loss on derivative liability |

|

15,741 |

|

|

|

5,335 |

|

Allocated expenses for warrant issuance cost |

|

2,526 |

|

|

|

— |

|

Change in fair value of debt and liability instruments |

|

10,004 |

|

|

|

3,748 |

|

Other |

|

53 |

|

|

|

(20 |

) |

Changes in operating assets and liabilities: |

|

|

|

|

|

Accounts receivables, net |

|

(3,407 |

) |

|

|

(6,332 |

) |

Inventory |

|

1,138 |

|

|

|

(1,732 |

) |

Prepaid expenses and other |

|

474 |

|

|

|

(9 |

) |

Other long-term assets |

|

(30 |

) |

|

|

804 |

|

Accounts payable |

|

653 |

|

|

|

4,334 |

|

Accrued payroll |

|

1,392 |

|

|

|

1,398 |

|

Accrued expenses |

|

470 |

|

|

|

1,525 |

|

Accrued rebates and fees |

|

35,405 |

|

|

|

16,886 |

|

Other liabilities |

|

(402 |

) |

|

|

705 |

|

Other long-term liabilities |

|

8 |

|

|

|

6 |

|

Net cash proceeds from (used for) operating activities |

|

11,702 |

|

|

|

(21,217 |

) |

Investing activities |

|

|

|

|

|

Acquisition consideration paid in cash for Romeg intangible asset acquisition |

|

(300 |

) |

|

|

— |

|

Purchase of property, plant and equipment |

|

— |

|

|

|

(8 |

) |

Net cash used for investing activities |

|

(300 |

) |

|

|

(8 |

) |

Financing activities |

|

|

|

|

|

Proceeds from issuance of shares under Standby Equity Purchase Agreements and ATM Sales Agreement |

|

156 |

|

|

|

16,166 |

|

Proceeds from issuance of Convertible Debentures |

|

— |

|

|

|

24,000 |

|

Proceeds from issuance of Revolving Facility |

|

65,470 |

|

|

|

17,538 |

|

Proceeds from issuance of FSF Deposit |

|

10,000 |

|

|

|

— |

|

Repayment of Revolving Facility |

|

(65,265 |

) |

|

|

(1,243 |

) |

Repayment of Oramed Note |

|

(35,000 |

) |

|

|

— |

|

Transaction costs paid related to the Business Combination |

|

— |

|

|

|

(1,372 |

) |

Repayment of Convertible Debentures |

|

(4,375 |

) |

|

|

(1,285 |

) |

Payments of debt issuance costs |

|

— |

|

|

|

(380 |

) |

Proceeds from issuance of shares under Bought Deal Offering and Registered Direct Offering |

|

25,000 |

|

|

|

— |

|

Payments of Bought Deal Offering and Registered Direct Offering issuance costs |

|

(2,834 |

) |

|

|

— |

|

Proceeds from stock options and warrants exercised |

|

383 |

|

|

|

743 |

|

Net cash (used for) proceeds from financing activities |

|

(6,465 |

) |

|

|

54,167 |

|

Net change in cash, cash equivalents and restricted cash |

|

4,937 |

|

|

|

32,942 |

|

Cash, cash equivalents and restricted cash at beginning of period |

|

4,729 |

|

|

|

2,184 |

|

Cash, cash equivalents and restricted cash at end of period |

$ |

9,666 |

|

|

$ |

35,126 |

|

Supplemental disclosure: |

|

|

|

|

|

Non-cash investing and financing activities |

|

|

|

|

|

Issuance of shares to B. Riley pursuant to B. Riley Purchase Agreement |

$ |

— |

|

|

$ |

1,869 |

|

Issuance costs related to Bought Deal Offering and Registered Direct Offering included in accrued expenses and account payables |

$ |

1,440 |

|

|

$ |

— |

|

Conversion of Convertible Debentures into common stock |

$ |

— |

|

|

$ |

7,735 |

|

Right-of-use assets obtained in exchange for operating lease liabilities with lease modification |

$ |

— |

|

|

$ |

2,523 |

|

See accompanying notes to unaudited condensed consolidated financial statements

SCILEX HOLDING COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Nature of Operations and Basis of Presentation

Organization and Principal Activities

Scilex Holding Company (“Scilex” and together with its wholly owned subsidiaries, the “Company”) is an innovative revenue-generating company focused on acquiring, developing and commercializing non-opioid pain management products for the treatment of acute and chronic pain. The Company was originally formed in 2019 and currently has five wholly owned subsidiaries: Scilex Inc. (“Legacy Scilex”), Scilex Pharmaceuticals Inc. (“Scilex Pharma”), Semnur Pharmaceuticals, Inc. (“Semnur”), SCLX DRE Holdings LLC and SCLX Stock Acquisition JV LLC. The business combination with Vickers (the “Business Combination”) was closed in November 2022.

The Company launched its first commercial product in October 2018, ZTlido (lidocaine topical system) 1.8% (“ZTlido”), a prescription lidocaine topical system that is designed with novel technology to address the limitations of current prescription lidocaine therapies by providing significantly improved adhesion and continuous pain relief throughout the 12-hour administration period. In June 2022, the Company in-licensed the exclusive right to commercialize GLOPERBA (colchicine USP) oral solution (“GLOPERBA”), a U.S. Food and Drug Administration (“FDA”)-approved prophylactic treatment for painful gout flares in adults, in the United States of America (“U.S.” or the “United States”). In February 2023, the Company acquired the rights related to ELYXYB (celecoxib oral solution) (“ELYXYB”) and the commercialization thereof in the U.S. and Canada. ELYXYB is a first-line treatment and the only FDA-approved, ready-to-use oral solution for the acute treatment of migraine, with or without aura, in adults. The Company launched ELYXYB in the U.S. in April 2023 and commercialized GLOPERBA in the U.S. in June 2024.

The Company is currently developing three product candidates, SP-102 (10 mg, dexamethasone sodium phosphate viscous gel), a novel, viscous gel formulation of a widely used corticosteroid for epidural injections to treat lumbosacral radicular pain, or sciatica for which the Company has completed a Phase 3 study (“SP-102” or “SEMDEXA”), SP-103 (lidocaine topical system) 5.4% (“SP-103”), a next-generation, triple-strength formulation of ZTlido, for the treatment of chronic neck pain and for which the Company completed a Phase 2 trial in acute low back pain (“LBP”) in the third quarter of 2023, and SP-104 (4.5 mg, low-dose naltrexone hydrochloride delayed-burst release low dose naltrexone hydrochloride capsules) (“SP-104”), a novel low-dose delayed-release naltrexone hydrochloride being developed for the treatment of fibromyalgia, for which Phase 1 trials were completed in the second quarter of 2022. Since inception, the Company has devoted substantially all of its efforts to the development of SP-102, SP-103 and SP-104, and the commercialization of ZTlido. In 2024, the Company is also devoting its efforts on the commercialization of GLOPERBA and ELYXYB.

Sorrento Chapter 11 Filing

On February 13, 2023, Sorrento Therapeutics, Inc. (“Sorrento”), the Company’s then-controlling stockholder, and Sorrento’s wholly-owned direct subsidiary, Scintilla Pharmaceuticals, Inc. (“Scintilla” and together with Sorrento, the “Debtors”), commenced voluntary proceedings under Chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”). The Debtors’ Chapter 11 proceedings are jointly administered under the caption In re Sorrento Therapeutics, Inc., et al., Case Number 23-90085 (DRJ) (the “Chapter 11 Cases”). While the Company was majority-owned by Sorrento, the Company was not a debtor in the Chapter 11 Cases. Pursuant to that certain Stock Purchase Agreement that we entered into with Sorrento on September 21, 2023 (the “Sorrento SPA”), we repurchased shares of our Common Stock and Series A Preferred Stock from Sorrento. As a result, Sorrento no longer holds a majority of the voting power of the Company’s outstanding capital stock entitled to vote. As of June 30, 2024, the Company had a $3.2 million receivable from Sorrento, which was fully reserved. The Company evaluates the collectability of this receivable on a quarterly basis.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and applicable rules and regulations of the

Securities and Exchange Commission (“SEC”) regarding interim financial reporting of the Company and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated.

These unaudited interim condensed consolidated financial statements have been prepared on the same basis as the annual consolidated financial statements and, in the opinion of management, include all adjustments of a normal recurring nature necessary to present fairly, in all material respects, the Company’s consolidated financial position, results of operations and cash flows. These unaudited condensed consolidated financial statements should be read in conjunction with the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 as filed with the SEC on March 12, 2024 (the “Annual Report on Form 10-K”). The interim results for the six months ended June 30, 2024 are not necessarily indicative of the results to be expected for the year ending December 31, 2024 or for any future periods.

Use of Estimates

The preparation of these unaudited condensed consolidated financial statements in conformity with GAAP requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of these unaudited condensed consolidated financial statements and the reported amounts of expenses during the reporting period. Management believes that these estimates are reasonable; however, actual results may differ from these estimates.

Customer Concentration Risk

The Company had four customers during the three and six months ended June 30, 2024, each of which individually generated 10% or more of the Company’s total revenue. These customers accounted for 87% and 86% of the Company’s revenue for the three and six months ended June 30, 2024, respectively and individually ranging from 16% to 27% and 11% to 28%, respectively. As of June 30, 2024, these customers represented 94% of the Company’s outstanding accounts receivable, individually ranging between 17% to 27%. Additionally, during the three and six months ended June 30, 2024 and 2023, the Company purchased ZTlido inventory from its sole supplier, Itochu Chemical Frontier Corporation (“Itochu”). In November 2023 and February 2024, respectively, the Company started purchasing ELYXYB and GLOPERBA inventories from its sole suppliers, Contract Pharmaceuticals Ltd Canada (CPL) and Ferndale Laboratories, Inc., respectively. This exposes the Company to concentration of customer and supplier risk. The Company monitors the financial condition of its customers, limits its credit exposure by setting credit limits, and has not experienced any credit losses during the six months ended June 30, 2024 and 2023.

Significant Accounting Policies

There have been no significant changes to the accounting policies during the three and six months ended June 30, 2024, as compared to the significant accounting policies described in Note 1 of the Notes to Consolidated Financial Statements in the Company’s audited consolidated financial statements included in the Annual Report on Form 10-K.

Fair Value Measurements

Financial assets and liabilities are recorded at fair value on a recurring basis in the condensed consolidated balance sheets. The carrying values of the Company’s financial assets and liabilities, including cash and cash equivalents, restricted cash, prepaid and other current assets, accounts payable and accrued expenses approximate to their fair value due to the short-term nature of these instruments. The valuation of the derivative warrant liability for Private Warrants, Firm Warrants and RDO Common Warrants (each as defined below) is outlined in Note 4, utilizing the Black-Scholes option pricing model. The Company has chosen the fair value option for the Convertible Debentures, Oramed Note and FSF Deposit (each as defined below), with the valuation methodologies detailed in Note 7. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the reporting date. Assets and liabilities recorded at fair value are categorized based

upon the level of judgment associated with the inputs used to measure their fair value. Hierarchical levels are directly related to the amount of subjectivity with the inputs to the valuation of these assets or liabilities as follows:

Level 1 - Observable inputs such as unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date;

Level 2 - Inputs (other than quoted prices included in Level 1) that are either directly or indirectly observable inputs for similar assets or liabilities. These include quoted prices for identical or similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active; and

Level 3 - Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

Cash, Cash Equivalents and Restricted Cash

The Company considers all highly liquid investments that are readily convertible into cash without penalty and with original maturities of three months or less at the date of purchase to be cash equivalents. The carrying amounts reported in the unaudited condensed consolidated balance sheets for cash and cash equivalents are valued at cost, which approximate their fair value.

Restricted cash for the periods presented consist of deposits placed in a segregated bank account as required under the terms of the Credit and Security Agreement, dated as of June 27, 2023, between Scilex Pharma and eCapital Healthcare Corp., which is discussed further in Note 7. Restricted cash is recorded as other long-term assets within the Company’s unaudited condensed consolidated balance sheet.

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the unaudited condensed consolidated balance sheets that together reflect the same amounts shown in the unaudited condensed consolidated statements of cash flows (in thousands):

|

|

|

|

|

|

|

|

|

As of June 30,

2024 |

|

|

As of December 31,

2023 |

|

Cash and cash equivalents |

$ |

6,888 |

|

|

$ |

3,921 |

|

Restricted cash |

|

2,778 |

|

|

|

808 |

|

Total cash, cash equivalents, and restricted cash |

$ |

9,666 |

|

|

$ |

4,729 |

|

Convertible Debentures, the Oramed Note and FSF Deposit

The Company has elected the fair value option to account for the Convertible Debentures (as defined in Note 2 “Liquidity and Going Concern” below) that were issued in March and April 2023, as discussed further in Note 7. The Company has also elected the fair value option to account for the Oramed Note (as defined in Note 4 “Fair Value Measurements” below) and for the FSF Deposit (as defined in Note 2 “Liquidity and Going Concern” below) that was issued in June 2024, as discussed further in Note 7. The Company recorded the Convertible Debentures, the Oramed Note and FSF Deposit at fair value upon issuance with changes in fair value recorded as change in fair value of debt and liability instruments in the unaudited condensed consolidated statements of operations, with the exception of changes in fair value due to instrument-specific credit risk, if any, which are recorded as a component of other comprehensive income. Interest expense related to these financial instruments is included in the changes in fair value. As a result of applying the fair value option, direct costs and fees related to the Convertible Debentures, the Oramed Note and FSF Deposit were expensed as incurred. As of June 30, 2024 and December 31, 2023, the weighted-average interest rates for the short-term loans, including the Convertible Debentures, the Oramed Note and FSF Deposit were 13.56% and 13.55%, respectively.

Treasury Stock

The Company uses the cost method to account for repurchases of its stock. In the computation of net (loss) income per share, treasury shares are not included as part of the outstanding shares.

2. Liquidity and Going Concern

The accompanying unaudited condensed consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. Management has assessed the Company’s ability to continue as a going concern for at least one year after the issuance date of the accompanying unaudited condensed consolidated financial statements.

On November 17, 2022, the Company entered into a standby equity purchase agreement (the “Original Purchase Agreement”) with YA II PN, Ltd., a Cayman Islands exempt limited partnership (“Yorkville”). On February 8, 2023, the Company entered into an amended and restated standby equity purchase agreement with Yorkville (the “A&R Yorkville Purchase Agreement”), amending, restating and superseding the Original Purchase Agreement. On, and effective as of, March 25, 2024, the Company and Yorkville mutually agreed to terminate the Amended and Restated Standby Equity Purchase Agreement.

On January 8, 2023, the Company entered into a standby equity purchase agreement (the “B. Riley Purchase Agreement” and together with A&R Yorkville Purchase Agreement, the “Standby Equity Purchase Agreements”) with B. Riley Principal Capital II, LLC (“B. Riley”). Pursuant to each of the Standby Equity Purchase Agreements, the Company had the right, but not the obligation, to sell to each of Yorkville and B. Riley up to $500.0 million of shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) at its request any time during the 36 months following the date on which the registration statement related to each such purchase agreement was initially declared effective by the SEC, subject to certain conditions, which are discussed further in Note 9. As consideration for Yorkville’s and B. Riley’s respective commitment to purchase shares of Common Stock at the Company’s direction, the Company issued 250,000 commitment shares to each of Yorkville (the “Yorkville Commitment Shares”) and B. Riley (the “B. Riley Commitment Shares”). On, and effective as of, February 16, 2024, the Company and B. Riley mutually agreed to terminate the B. Riley Purchase Agreement.

On March 21, 2023, the Company entered into a securities purchase agreement with Yorkville (the “Yorkville SPA”), pursuant to which the Company would issue and sell to Yorkville convertible debentures in an aggregate principal amount of up to $25.0 million (the “Convertible Debentures”). Convertible Debentures in the principal amount of $25.0 million (for net cash proceeds of $24.0 million) were issued and sold pursuant to the Yorkville SPA, which is discussed further in Note 7. The Company fully repaid the Convertible Debentures in March 2024.

On June 27, 2023, Scilex Pharma entered into a Credit and Security Agreement (the “eCapital Credit Agreement”) with eCapital Healthcare Corp. (the “Lender”), pursuant to which the Lender shall make available loans (the “Revolving Facility”) in an aggregate principal amount of up to $30.0 million (the “Facility Cap”). The proceeds of the Revolving Facility will be used for (i) transaction fees incurred in connection with the eCapital Credit Agreement, (ii) working capital needs of Scilex Pharma and (iii) other uses not prohibited under the eCapital Credit Agreement. As of June 30, 2024, the Company has an outstanding balance of $17.3 million under the Revolving Facility. See Note 7 for additional discussion of the terms of the eCapital Credit Agreement.

On December 22, 2023, the Company entered into a Sales Agreement (the “ATM Sales Agreement”) with B. Riley Securities, Inc., Cantor Fitzgerald & Co. and H.C. Wainwright & Co., LLC (the “Sales Agents”). Pursuant to the ATM Sales Agreement, the Company may offer and sell (the “Offering”) shares of Common Stock up to $170.0 million (the “ATM Shares”), through or to the Sales Agents as part of the Offering. The Company has no obligation to sell any shares of Common Stock under the ATM Sales Agreement and may suspend offers thereunder at any time. The Offering will terminate upon (i) the election of the Sales Agents upon the occurrence of certain adverse events, (ii) three business days’ advance notice from the Company to the Sales Agents or a Sales Agent to the Company, or (iii) the sale of all $170.0 million of shares of Common Stock thereunder. As of June 30, 2024, the Company sold 92,295 shares of Common Stock pursuant to the ATM Sales Agreement for net proceeds of approximately $0.1 million.

On June 11, 2024, the Company entered into that certain Commitment Side Letter (the “Commitment Letter”) with FSF 33433 LLC (“FSF Lender”), pursuant to which FSF Lender committed to provide the Company a loan (the “FSF Loan”) in the aggregate amount of $100.0 million (the “Commitment Amount”). The Commitment Amount shall be payable as follows: (i) $85.0 million no later than the date that is 70 days following the date on which the Company receives the Deposit (as defined below) (the “Outside Date” and the funding of the initial $85.0 million, the “Initial Closing”) and (ii) the remaining $15.0 million within 60 days following the Initial Closing (the funding of the second $15.0 million, the “Second Closing”). Pursuant to the Commitment Letter, FSF Lender is required to provide the Company a non-refundable deposit in immediately available funds in the aggregate principal amount of $10.0 million

(the “FSF Deposit” and the date on which such funds are fully received, the “Deposit Date”), which amount will be creditable towards the $85.0 million required to be funded by FSF Lender at the Initial Closing. The Company received the FSF Deposit on June 18, 2024 and issued to FSF Lender a warrant to purchase up to an aggregate of 3,250,000 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) (subject to adjustment for any stock dividend, stock split, reverse stock split or similar transaction) (the “Deposit Warrant”), with an exercise price of $1.20 per share. The Deposit Warrant is immediately exercisable and will expire five years from the date of issuance.

As of June 30, 2024, the Company’s negative working capital was $205.0 million, including cash and cash equivalents of approximately $6.9 million. During the six months ended June 30, 2024, the Company had operating losses of $35.1 million and cash flows received from operations of $11.7 million. The Company had an accumulated deficit of $552.2 million as of June 30, 2024.

The Company has plans to obtain additional resources to fund its currently planned operations and expenditures and to service its debt obligations (whether under the Oramed Note, the FSF Loan or otherwise) for at least twelve months from the issuance of these unaudited condensed consolidated financial statements through a combination of equity offerings, debt financings, collaborations, government contracts or other strategic transactions. The Company’s plans are also dependent upon the success of future sales of ZTlido, ELYXYB and GLOPERBA, which is still in the early stages of commercialization.

Although the Company believes such plans, if executed, should provide the Company with financing to meet its needs, successful completion of such plans is dependent on factors outside the Company’s control. As a result, management has concluded that the aforementioned conditions, among other things, raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date the unaudited condensed consolidated financial statements are issued.

3. Acquisitions

SP-104 Acquisition

In May 2022, the Company acquired the Delayed Burst Release Low Dose Naltrexone asset and intellectual property rights for the treatment of chronic pain, fibromyalgia and chronic post-COVID syndrome (collectively, the “SP-104 Assets”). Pursuant to the acquisition provisions, the Company is obligated to pay Aardvark Therapeutics, Inc. (“Aardvark”) (i) $3.0 million upon initial approval by the FDA of a new drug application for the SP-104 Assets (which amount may be paid in shares of Common Stock or cash, in the Company’s sole discretion) (the “Development Milestone Payment”) and (ii) $20.0 million in cash, upon achievement of certain net sales by the Company of a commercial product that uses the SP-104 Assets (the “Sales Milestone Payment”). The Company will also pay Aardvark certain royalties in the single digits based on percentages of annual net sales by the Company of a commercial product that uses the SP-104 Assets.

The Sales Milestone Payment and sale volume-based future royalties were determined to meet a scope exception for derivative accounting and will not be recognized until the contingencies are realized. The Development Milestone Payment represents a liability, which will be measured at fair value for each reporting period. As of June 30, 2024 and December 31, 2023, the contingent consideration associated with Development Milestone Payment was $0.2 million, recorded in the other long-term liabilities.

GLOPERBA License Agreement

In June 2022, the Company entered into a license agreement (the “Romeg License Agreement”) with RxOmeg Therapeutics, LLC (a/k/a Romeg Therapeutics, Inc.) (“Romeg”). Pursuant to the Romeg License Agreement, among other things, Romeg granted the Company (a) a transferable license, with the right to sublicense, to (i) commercialize the pharmaceutical product comprising liquid formulations of colchicine for the prophylactic treatment of gout in adult humans (the “Initial Licensed Product” or “GLOPERBA”) in the United States (including its territories) (the “GLOPERBA Territory”), (ii) develop other products comprising the Initial Licensed Product as an active pharmaceutical ingredient (the “Licensed Products”) and commercialize any such products and (iii) manufacture Licensed Products anywhere in the world, solely for commercialization in the GLOPERBA Territory; and (b) an exclusive, transferable license, with a right to sublicense, to use the trademark GLOPERBA and logos, designs,

translations, and modifications thereof in connection with the commercialization of the Initial Licensed Product solely in the GLOPERBA Territory. The Initial Licensed Product, GLOPERBA, was approved and made available in the United States in 2020.

As consideration for the license under the Romeg License Agreement, the Company paid Romeg an up-front license fee of $2.0 million, and has agreed to pay Romeg (a) upon the Company’s achievement of certain net sales milestones, certain milestone payments in the aggregate amount of up to $13.0 million, (b) certain royalties in the mid-single digit to low-double digit percentages based on annual net sales of the Licensed Products by the Company during the applicable royalty term under the Romeg License Agreement, and (c) minimum quarterly royalty payments totaling $7.1 million commencing on the first year anniversary of the effective date of the Romeg License Agreement and ending on the later of (i) the expiration of the last-to-expire of the licensed patents covering the Licensed Products in the GLOPERBA Territory or (ii) the tenth anniversary of the effective date of the Romeg License Agreement.

In connection with the Romeg License Agreement, the Company recorded an intangible asset for acquired licenses of $5.7 million, which is comprised of the upfront license fee of $2.0 million and deferred consideration of $3.7 million that is the present value of the future minimum royalty payments and immaterial transaction costs. No contingent consideration was recognized as a liability or included in the fair value of the assets as of June 30, 2024 or December 31, 2023.

ELYXYB Acquisition

On February 12, 2023, the Company entered into an asset purchase agreement (the “ELYXYB APA”) with BioDelivery Sciences International, Inc. (“BDSI”) and Collegium Pharmaceutical, Inc. (“Collegium”, and together with BDSI, the “Sellers”) to acquire the rights to certain patents, trademarks, regulatory approvals, data, contracts, and other rights related to ELYXYB and its commercialization in the United States and Canada (the “ELYXYB Territory”).

As consideration for the acquisition, the Company assumed various rights and obligations under the asset purchase agreement between BDSI and Dr. Reddy’s Laboratories Limited, a company incorporated under the laws of India (“DRL”), dated August 3, 2021 (the “DRL APA”), including an irrevocable, royalty-free, exclusive license to know-how and patents of DRL related to ELYXYB that is necessary or used to exploit ELYXYB in the ELYXYB Territory. No cash consideration was or will be payable to the Sellers for such acquisition; however, the obligations under the DRL APA that were assumed by the Company include contingent sales and regulatory milestone payments and sales royalties. The Company is also obligated to make quarterly royalty payments to DRL on net sales of ELYXYB in the ELYXYB Territory. In April 2023, the Company launched ELYXYB in the U.S. As of June 30, 2024 and December 31, 2023, the Company had ending balances of accrued royalty payables of $0.1 million and $5.0 thousand, respectively. As of June 30, 2024, no sales or regulatory milestone payments had been accrued as there were no potential milestones yet considered probable of achievement.

4. Fair Value Measurements

The following table presents the Company’s financial assets and liabilities that are measured at fair value on a recurring basis and the level of inputs used in such measurements (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

|

Balance |

|

Quoted Prices

in Active

Markets

(Level 1) |

|

|

Significant

Other

Observable

Inputs (Level 2) |

|

|

Significant Unobservable Inputs (Level 3) |

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

Oramed Note |

|

$ |

75,370 |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

75,370 |

|

FSF Deposit |

|

|

11,727 |

|

|

— |

|

|

|

— |

|

|

|

11,727 |

|

Derivative liabilities |

|

|

30,005 |

|

|

— |

|

|

|

— |

|

|

|

30,005 |

|

Other long-term liabilities |

|

|

187 |

|

|

— |

|

|

|

— |

|

|

|

187 |

|

Total liabilities measured at fair value |

|

$ |

117,289 |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

117,289 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

|

|

Balance |

|

|

Quoted Prices

in Active

Markets

(Level 1) |

|

|

Significant

Other

Observable

Inputs (Level 2) |

|

|

Significant

Unobservable

Inputs (Level 3) |

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Oramed Note |

|

$ |

104,089 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

104,089 |

|

Convertible Debentures |

|

|

4,340 |

|

|

|

— |

|

|

|

— |

|

|

|

4,340 |

|

Derivative liabilities |

|

|

1,518 |

|

|

|

— |

|

|

|

— |

|

|

|

1,518 |

|

Other long-term liabilities |

|

|

179 |

|

|

|

— |

|

|

|

— |

|

|

|

179 |

|

Total liabilities measured at fair value |

|

$ |

110,126 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

110,126 |

|

The Oramed Note

In September 2023, the Company issued a senior secured promissory note to Oramed Pharmaceuticals Inc. (“Oramed”) in the principal amount of $101.9 million (the “Oramed Note”) (see Note 7). The Company elected the fair value option to account for the Oramed Note with any changes in the fair value of the note recorded in the unaudited condensed consolidated statements of operations, with the exception of changes in fair value due to instrument-specific credit risk, if any, which are recorded as a component of other comprehensive income. The Company uses a discounted cash flow model to determine the fair value of the Oramed Note based on Level 3 inputs. This methodology discounts the interest and principal payments using a risk-adjusted discount rate. The fair value as of June 30, 2024 was determined to be $75.4 million by applying a discount rate of 30.27%. For the three and six months ended June 30, 2024, the Company recorded $4.3 million and $8.1 million in change in fair value of the Oramed Note in the unaudited condensed consolidated statements of operations, respectively. The change in fair value due to instrument-specific credit risk recorded as a component of other comprehensive income was $1.9 million during the three and six months ended June 30, 2024.

FSF Deposit

In June 2024, the Company received the FSF Deposit in the aggregate principal amount of $10.0 million from FSF Lender (see Note 2 and Note 7). The Company elected the fair value option to account for the FSF Deposit with any changes in the fair value of the deposit recorded in the unaudited condensed consolidated statements of operations. The Company uses a probability weighted expected return model coupled with a Monte Carlo simulation and a discounted cash flow analysis to determine the fair value of the FSF Deposit based on Level 3 inputs. The fair value as of June 30, 2024 was determined to be $11.7 million by applying a discount rate of 35.66%. For each of the three and six months ended June 30, 2024, the Company recorded $1.7 million in change in fair value of the FSF Deposit.

Convertible Debentures