UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Rush Enterprises, Inc.

(Exact name of registrant as specified in its charter)

|

Texas

|

74-1733016

|

|

(State or other jurisdiction

of incorporation or organization)

|

(I.R.S Employer Identification No.)

|

|

555 IH 35 South, Suite 500

New Braunfels, Texas

|

78130

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Rush Enterprises, Inc. Amended and Restated 2007 Long-Term Incentive Plan

Rush Enterprises, Inc. Amended and Restated 2004 Employee Stock Purchase Plan

(Full title of the plan)

Michael Goldstone

Senior Vice President, General Counsel and Corporate Secretary

Rush Enterprises, Inc.

555 IH 35 South, Suite 500

New Braunfels, Texas 78130

(830) 302-5200

Copies to:

Daryl L. Lansdale, Jr.

Norton Rose Fulbright US LLP

111 W. Houston Street, Suite 1800

San Antonio, TX 78205

(210) 224-5575

(Name, address, and telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☒

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☐

|

| |

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

REGISTRATION OF ADDITIONAL SHARES

Rush Enterprises, Inc. (the “Company”) is filing this registration statement on Form S-8 (this “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”) to register (i) 1,800,000 additional shares of Class A Common Stock and 1,800,000 additional shares of Class B Common Stock that may be issued under the Rush Enterprises, Inc. Amended and Restated 2007 Long-Term Incentive Plan (the “2007 LTIP”) and (ii) 600,000 additional shares of Class A Common Stock that may be issued under the Rush Enterprises, Inc. Amended and Restated 2004 Employee Stock Purchase Plan (the “2004 ESPP”). Pursuant to General Instruction E of Form S-8, (i) with respect to the 2007 LTIP, the contents of the Company’s prior registration statements on Form S-8, filed with the Securities and Exchange Commission (the “Commission”) on July 24, 2007 (Registration No. 333-144821), July 21, 2010 (Registration No. 333-168231), August 12, 2014 (Registration No. 333-198080), August 10, 2017 (Registration No. 333-219878), and August 7, 2020 (Registration No. 333-242488), and (ii) with respect to the 2004 ESPP, the contents of the Company’s prior registration statements on Form S-8, filed with the Commission on December 17, 2004 (Registration No. 333-121355) and August 7, 2020 (Registration No. 333-242488), are incorporated by reference into this Registration Statement, except to the extent supplemented, amended and superseded by the information set forth herein. On July 25, 2023, the Board of Directors of the Company declared a 3-for-2 stock split of the Company’s Class A common stock and Class B common stock, which was effected in the form of a stock dividend. On August 28, 2023, the Company distributed one additional share of stock for every two shares of Class A common stock, par value $0.01 per share, and Class B common stock, par value $0.01 per share, held by shareholders of record as of August 7, 2023. All share data in this Registration Statement have been adjusted and restated to reflect the stock split as if it occurred on the first day of the earliest period presented.

There are 15,000,000 shares of Class A Common Stock reserved for issuance under the 2007 LTIP, of which 13,200,000 shares of Class A Common Stock are registered under prior registration statements and 1,800,000 shares of Class A Common Stock are registered under this Registration Statement. There are 6,600,000 shares of Class B Common Stock reserved for issuance under the 2007 LTIP, of which 4,800,000 shares of Class B Common Stock are registered under prior registration statements and 1,800,000 shares of Class B Common Stock are registered under this Registration Statement. There are 3,300,000 shares of Class A Common Stock reserved for issuance under the 2004 ESPP, of which 2,700,000 shares are registered under prior registration statements and 600,000 shares are registered under this Registration Statement.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

Except to the extent that information is deemed furnished and not filed pursuant to securities laws and regulations, the following documents, which have been previously filed with the Commission, or are being filed with this Registration Statement, are incorporated by reference into this Registration Statement:

(a) The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed on February 23, 2023;

(b) The Company’s Quarterly Reports on Form 10-Q for the fiscal quarter ended March 31, 2023, filed on May 10, 2023;

(c) The Company's Quarterly Reports on Form 10-Q for the fiscal quarter ended June 30, 2023, filed on August 9, 2023;

(d) The Company's Quarterly Reports on Form 10-Q for the fiscal quarter ended September 30, 2023, filed on November 9, 2023;

(e) The Company’s Current Reports on Form 8-K filed on March 6, 2023, April 6, 2023, April 25, 2023, May 22, 2023, May 24, 2023, June 6, 2023, June 29, 2023, July 25, 2023, October 10, 2023, October 24, 2023, November 6, 2023 and November 13, 2023 (except, in each case, any information, including exhibits, furnished to the Commission pursuant to Items 2.02 and 7.01);

(f) The Company’s Definitive Proxy Statement on Schedule 14A filed on April 17, 2023, incorporated by reference into Part III of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022;

(g) The description of the Company’s Class A Common Stock contained in Exhibit 4.5 to this Registration Statement; and

(h) The description of the Company’s Class B Common Stock contained in Exhibit 4.5 to this Registration Statement.

Except to the extent that information is deemed furnished and not filed pursuant to securities laws and regulations, all documents filed by the Company with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended, after the date of this Registration Statement and prior to the filing of a post-effective amendment that (i) indicates that all securities offered under this Registration Statement have been sold, or (ii) deregisters all securities then remaining unsold under this Registration Statement, shall be deemed to be incorporated by reference into this Registration Statement and to be a part of this Registration Statement from the date of filing of such documents. In no event, however, will any information that we disclose under Item 2.02 or Item 7.01 (and any related exhibits) of any Current Report on Form 8-K that we may from time to time furnish to the Commission be incorporated by reference into, or otherwise become a part of, this Registration Statement.

For purposes of this Registration Statement, any statement contained in a document incorporated or deemed to be incorporated herein by reference shall be deemed to be modified or superseded to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated herein by reference modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 8. Exhibits.

|

Exhibit No.

|

|

Description

|

| |

|

|

|

4.1*

|

|

Restated Articles of Incorporation of Rush Enterprises, Inc. (incorporated herein by reference to Exhibit 3.1 of the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2008, File No. 000-20797)

|

| |

|

|

|

4.2*

|

|

Certificate of Amendment to the Restated Articles of Incorporation of Rush Enterprises, Inc. (incorporated herein by reference to Exhibit 3.2 of the Company's Quarterly Report on Form 10-Q (File No. 000-20797) for the quarter ended June 30, 2023)

|

| |

|

|

|

4.3*

|

|

Rush Enterprises, Inc. Amended and Restated Bylaws (incorporated herein by reference to Exhibit 3.1 of the Company’s Current Report on Form 8-K filed May 21, 2013, File No. 000-20797)

|

| |

|

|

|

4.4*

|

|

First Amendment to Amended and Restated Bylaws of Rush Enterprises, Inc. (incorporated herein by reference to Exhibit 3.1 of the Company's Current Report on Form 8-K filed May 24, 2021, File No. 000-20797)

|

| |

|

|

| 4.5 |

|

Description of Registrant’s Securities Registered Pursuant to Section 12 of the Securities Act of 1934 |

| |

|

|

|

5.1

|

|

Opinion of Norton Rose Fulbright US LLP

|

| |

|

|

|

23.1

|

|

Consent of Norton Rose Fulbright US LLP (contained in Exhibit 5.1)

|

| |

|

|

|

23.2

|

|

Consent of Ernst & Young LLP

|

| |

|

|

|

24.1

|

|

Power of Attorney (included on the signature page hereto)

|

| |

|

|

|

99.1*

|

|

Rush Enterprises, Inc. Amended and Restated 2007 Long-Term Incentive Plan (incorporated herein by reference to Exhibit 10.1 of the Company’s Current Report on Form 8-K filed May 22, 2023, File No. 000-20797)

|

| |

|

|

|

99.2*

|

|

Rush Enterprises, Inc. Amended and Restated 2004 Employee Stock Purchase Plan (incorporated herein by reference to Exhibit 10.2 of the Company’s Current Report on Form 8-K filed May 22, 2023, File No. 000-20797)

|

| |

|

|

|

107

|

|

Filing Fee Table

|

* Incorporated by reference

SIGNATURES

Pursuant to the requirements of the Securities Act, the Company certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New Braunfels, State of Texas, on November 30, 2023.

| |

Rush Enterprises, Inc.

|

|

| |

|

|

|

| |

By:

|

/s/ Michael Goldstone

|

|

| |

|

Michael Goldstone

|

|

| |

|

Senior Vice President, General Counsel and Corporate Secretary

|

|

POWER OF ATTORNEY

Each person whose signature appears below hereby appoints W.M. “RUSTY” RUSH and MICHAEL GOLDSTONE, and each of them, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution or re-substitution, for such person and in such person’s name, place and stead, in any and all capacities, to sign on such person’s behalf, any and all amendments, including post-effective amendments to this Registration Statement on Form S-8, and to sign any and all additional registration statements relating to the same, with all exhibits thereto, and other documents in connection therewith, with the Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as such person might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or either of them, or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and on the date indicated.

|

/s/ W.M. “Rusty” Rush

W.M. “Rusty” Rush

|

President,

Chief Executive Officer and Chairman of the Board

(Principal Executive Officer)

|

November 30, 2023

|

| |

|

|

|

/s/ Steven L. Keller

Steven L. Keller

|

Chief Financial Officer and Treasurer

(Principal Financial and Accounting

Officer)

|

November 30, 2023

|

| |

|

|

|

/s/ Thomas A. Akin

Thomas A. Akin

|

Director

|

November 30, 2023

|

| |

|

|

|

/s/ Raymond J. Chess

Raymond J. Chess

|

Director

|

November 30, 2023

|

| |

|

|

|

/s/ William H. Cary

William H. Cary

|

Director

|

November 30, 2023

|

| |

|

|

|

/s/ Dr. Kennon H. Guglielmo

Dr. Kennon H. Guglielmo

|

Director

|

November 30, 2023

|

| |

|

|

|

/s/ Elaine Mendoza

Elaine Mendoza

|

Director

|

November 30, 2023

|

| |

|

|

|

/s/ Troy A. Clarke

Troy A. Clarke

|

Director

|

November 30, 2023

|

| |

|

|

|

/s/ Amy Boerger

Amy Boerger

|

Director

|

November 30, 2023

|

| |

|

|

|

/s/ Michael J. McRoberts

Michael J. McRoberts

|

Chief Operating Officer and Director

|

November 30, 2023

|

Exhibit 4.5

DESCRIPTION OF THE REGISTRANT’S SECURITIES REGISTERED PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

Description of Common Stock

Rush Enterprises, Inc. (“Rush,” the “Corporation,” “we,” “us” or “our”) has two classes of securities registered under Section 12 of the Securities Exchange Act of 1934, as amended: (i) Class A Common Stock; and (ii) Class B Common Stock. The following description of our Class A Common Stock and Class B Common Stock is only a summary and is qualified in its entirety by reference to our Restated Articles of Incorporation, as amended by the Certificate of Amendment to the Restated Articles of Incorporation (the “Articles”), our Amended and Restated Bylaws, as amended by the First Amendment thereto (the “Bylaws”) and applicable provisions of the Texas Business Organizations Code (“TBOC”).

Authorized Capital Stock

The total number of shares of all classes of stock which we are authorized to issue is 141,000,000 shares, divided into the following: (i) 1,000,000 shares of preferred stock, par value $.01 per share (“Preferred Stock”), (ii) 105,000,000 shares of Class A Common Stock, par value $.01 per share and (iii) 35,000,000 shares of Class B Common Stock, par value $.01 per share. The issued and outstanding shares of Class A Common Stock and Class B Common Stock are fully paid and non-assessable.

Voting Rights

Subject to any preferential rights of any series of Preferred Stock: (i) the holders of Class A Common Stock are entitled to one-twentieth (1/20th) of one vote per share on all proposals presented to the shareholders; and (ii) the holders of Class B Common Stock are entitled to one vote per share on all proposals presented to the shareholders. The holders of Class A Common Stock and Class B Common Stock will vote together as a single class on all matters presented to the shareholders for approval, except as might otherwise be required by Texas law. There is no cumulative voting with respect to the election of directors or upon any other matter. Neither the Class A Common Stock nor the Class B Common Stock is convertible into shares of another class of common stock or any other security.

Dividends and Other Distribution Rights

Subject to any preferential rights of any series of Preferred Stock, dividends may be paid on Class A Common Stock and Class B Common Stock as and when declared by our board of directors out of any funds of the Corporation legally available for the payment thereof. Each share of Class A Common Stock and Class B Common Stock will be equal in respect to dividends and other distributions declared on the common stock of the Corporation, except that: (i) if declared, a dividend or distribution in shares of Class A Common Stock will be paid in Class A Common Stock; and (ii) if declared, a dividend or distribution in shares of Class B Common Stock will be paid in Class B Common Stock. The number of shares so paid as a dividend or distribution on each share of Class A Common Stock or Class B Common Stock shall be equal, although the class of the shares so paid shall differ depending on whether the recipient of the dividend is a holder of a share of Class A Common Stock or Class B Common Stock.

Liquidation Rights

Subject to any preferential rights of any series of Preferred Stock, in the event of any liquidation, dissolution or winding-up of the Corporation, the holders of Class A Common Stock and Class B Common Stock will share ratably with respect to any assets legally available for distribution to the Corporation’s shareholders.

Other Rights

There are no sinking fund or redemption provisions associated with the Preferred Stock, Class A Common Stock or Class B Common Stock. There are no preemptive rights associated with the Preferred Stock, Class A Common Stock or Class B Common Stock.

Certain Anti-Takeover Provisions of our Articles and Bylaws

Certain provisions of our Articles and Bylaws could have the effect of delaying, deferring or preventing a change in control of the Corporation. For example, the Articles and Bylaws include certain provisions that: (i) authorize our board of directors to issue shares of Preferred Stock without further vote or action by the holders of Class A Common Stock or Class B Common Stock; (ii) establish advance notice procedures and other requirements for shareholders to submit nominations of candidates for election to our board of directors and other shareholder proposals; (iii) limit the ability of shareholders to call special meetings; (iv) provide that the number of directors on the board of directors shall be determined by the board of directors; and (v) provide vacancies on the board of directors may be filly by a majority of the remaining directors though less than a quorum. The Corporation does not have a super-majority voting standard or a staggered board of the directors.

Listing

Our securities are traded on The NASDAQ Global Select MarketSM under the trading symbols: (i) RUSHA; and (ii) RUSHB.

Exhibit 5.1

November 30, 2023

Rush Enterprises, Inc.

555 IH 35 South

New Braunfels, Texas 78130

| |

Re:

|

Registration Statement on Form S-8

|

Ladies and Gentlemen:

We have acted as counsel to Rush Enterprises, Inc., a Texas corporation (the “Company”), in connection with the registration under the Securities Act of 1933, as amended (the “Securities Act”), of (i) 1,800,000 additional shares of the Company’s Class A Common Stock, and 1,800,000 additional shares of the Company’s Class B Common Stock that may be issued under the Rush Enterprises, Inc. Amended and Restated 2007 Long-Term Incentive Plan (the “2007 LTIP”), and (ii) 600,000 additional shares of Class A Common Stock that may be issued under the Rush Enterprises, Inc. Amended and Restated 2004 Employee Stock Purchase Plan (the “2004 ESPP”), each plan as described in the Company's Registration Statement on Form S-8 (as may subsequently be amended, the “Registration Statement”) filed with the Securities and Exchange Commission of even date herewith (all shares in (i) and (ii) collectively, the “Shares”).

In connection with the foregoing, we have examined the 2007 LTIP and the 2004 ESPP and originals or copies of certain corporate records of the Company, certificates and other communications of public officials, certificates of officers of the Company and such other documents as we have deemed relevant or necessary for the purpose of rendering the opinions expressed herein. As to questions of fact material to those opinions, we have, to the extent we deemed appropriate, relied on certificates of officers of the Company and on certificates and other communications of public officials. We have assumed that the persons identified to us as officers of the Company are actually serving as such and that any certificates representing the Shares will be properly executed by one or more such persons. We have assumed the effectiveness of the Registration Statement pursuant to the Securities Act. We have assumed the genuineness of all signatures on, and the authenticity of, all documents submitted to us as originals, the conformity to authentic original documents of all documents submitted to us as copies thereof, the due authorization, execution and delivery by the parties thereto other than the Company of all documents examined by us, that the Company will receive any required consideration for such Shares and the legal capacity of each individual who signed any of those documents.

Based upon the foregoing, we are of the opinion that the Shares have been duly authorized and, when issued and sold in the manner referred to in the 2007 LTIP and the 2004 ESPP and pursuant to the agreements that accompany the 2007 LTIP and the 2004 ESPP, will be validly issued, fully paid and non-assessable.

The opinions expressed herein are limited exclusively to applicable federal laws of the United States of America and applicable provisions of, respectively, the Texas Constitution, the Texas Business Organizations Code and reported judicial interpretations of such law, in each case as currently in effect, and we are expressing no opinion as to the effect of the laws of any other jurisdiction.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement and the reference to this firm wherever it appears in the Registration Statement. This consent is not to be construed as an admission that we are a party whose consent is required to be filed with the Registration Statement under the provisions of the Securities Act or the rules and regulations of the Securities and Exchange Commission promulgated thereunder.

Very truly yours,

/s/ NORTON ROSE FULBRIGHT US LLP

Norton Rose Fulbright US LLP

Exhibit 23.2

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the registration of an additional 1,800,000 shares of Rush Enterprises, Inc.’s Class A common stock and 1,800,000 shares of Class B common stock issuable pursuant to the Rush Enterprises, Inc. Amended and Restated 2007 Long-Term Incentive Plan and 600,000 additional shares of Class A common stock issuable pursuant to the Rush Enterprises, Inc. Amended and Restated 2004 Employee Stock Purchase Plan of our reports dated February 23, 2023, with respect to the consolidated financial statements of Rush Enterprises, Inc. and subsidiaries and the effectiveness of internal control over financial reporting of Rush Enterprises, Inc. and subsidiaries, included in its Annual Report (Form 10-K) for the year ended December 31, 2022, filed with the Securities and Exchange Commission.

/s/ Ernst &Young LLP

San Antonio, Texas

November 30, 2023

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Rush Enterprises, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Security Type

|

|

Security

Class Title

|

|

Fee

Calculation

or Carry

Forward

Rule

|

|

Amount

Registered(1)

|

|

Proposed

Maximum

Offering Price

Per Share

|

|

Maximum

Aggregate

Offering Price

|

|

Fee

Rate

|

|

Amount of

Registration

Fee

|

| Equity |

|

Class A Common Stock, $.01 par value per share Reserved for future issuance under the Amended and Restated 2007 Long-Term Incentive Plan and Amended and Restated 2004 Employee Stock Purchase

Plan

|

|

Rule 457(c) and Rule 457(h)

|

|

2,400,000(2)

|

|

$38.75(3)

|

|

$93,000,000

|

|

0.0001476 |

|

$13,726.80 |

| Equity |

|

Class B Common Stock, $.01 par value per share Reserved for future issuance under the Amended and Restated 2007 Long-Term Incentive Plan

|

|

Rule 457(c) and Rule 457(h)

|

|

1,800,000(4)

|

|

$43.65(5)

|

|

$78,570,000

|

|

0.0001476 |

|

$11,596.30 |

|

Total Offering Amounts

|

|

|

|

|

|

|

|

$171,549,000 |

|

|

|

|

Total Fees Previously Paid

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Fee Offsets

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Net Fee Due

|

|

|

|

|

|

|

|

|

|

$25,323.73

|

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the "Securities Act"), the registration statement on Form S-8 (the "Registration Statement") shall also cover any additional shares of common stock of Rush Enterprises, Inc. (the "Registrant") that become issuable in respect of the securities identified in the above table by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the Registrant's receipt of consideration that results in an increase in the number of the outstanding shares of the Registrant's common stock

|

| |

|

|

(2)

|

Represents 2,400,000 additional shares of the Registrant's Class A Common Stock that were authorized for issuance under the Registrant's Amended and Restated 2007 Long-Term Incentive and Amended and Restated 2004 Employee Stock Purchase Plans pursuant to shareholder approval at the 2023 annual meeting, as adjusted for the 3-for-2 stock split approved by the Board of Directors on July 25, 2023.

|

| |

|

|

(3)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act, based upon the average of the high ($39.06) and low ($38.43) prices of the registrant’s Class A Common Stock as reported on the Nasdaq Global Select Market on November 27, 2023.

|

| |

|

|

(4)

|

Represents 1,800,000 additional shares of the Registrant's Class B Common Stock that were authorized for issuance under the Registrant's Amended and Restated 2007 Long-Term Incentive Plan pursuant to shareholder approval at the 2023 annual meeting, as adjusted for the 3-for-2 stock split approved by the Board of Directors on July 25, 2023.

|

| |

|

|

(5)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act, based upon the average of the high ($43.99) and low ($43.30) prices of the registrant’s Class B Common Stock as reported on the Nasdaq Global Select Market on November 27, 2023.

|

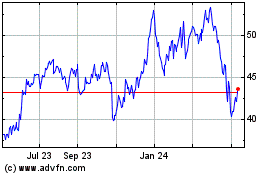

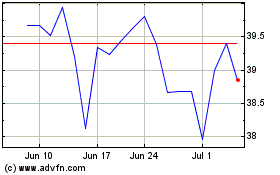

Rush Enterprises (NASDAQ:RUSHB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rush Enterprises (NASDAQ:RUSHB)

Historical Stock Chart

From Apr 2023 to Apr 2024