Rockwell Medical, Inc. (Nasdaq: RMTI), a biopharmaceutical company

dedicated to transforming the treatment of iron deficiency and

anemia management and improving outcomes for patients around the

world, today reported financial results and a business update for

the three months ended March 31, 2021.

“We continued to drive our business forward in

the first quarter,” said Russell Ellison, M.D., M.Sc., President

and Chief Executive Officer of Rockwell Medical. “We believe our

Home Infusion FPC program remains on track for a pre-IND meeting

with the FDA expected in the third quarter of this year, with

multiple upcoming milestones, including our current expectation

that the subsequent initiation of our Phase 2 clinical trial of FPC

for the treatment of iron deficiency anemia in adult patients in

the home infusion setting will commence in the second half of 2021.

We also received marketing approval of Triferic AVNU in Canada, the

first international regulatory approval for our intravenous

therapy, and continued to generate solid revenue from concentrates,

our base business, ending the quarter in a strong cash

position.”

First Quarter 2021

Operational Highlights

Dialysis Business

- Revenue from hemodialysis concentrates was approximately $15.2

million.

- Revenue from Triferic was approximately $283,000. Rockwell

Medical continues to generate data in clinics showing the benefits

of Triferic in real world protocols.

- The Company announced in April that

Triferic AVNU (ferric pyrophosphate citrate injection) received a

Notice of Compliance (marketing approval) from Health Canada for

the replacement of iron to maintain hemoglobin in adult patients

with hemodialysis-dependent chronic kidney disease. Rockwell

Medical expects Triferic AVNU to become commercially available in

Canada during 2022.

Home Infusion Program

- As previously announced, the U.S.

Food and Drug Administration (FDA) accepted the Company’s proposed

development strategy to pursue an approval via the 505(b)(1)

pathway as a novel new drug application (NDA) for FPC for treatment

of iron deficiency anemia (IDA) in adult patients in the home

infusion setting. Subject to a successful outcome of Rockwell

Medical’s pre-investigational new drug meeting with the FDA, the

Company plans to initiate a Phase 2 clinical trial in the second

half of 2021.

- In April, the Company presented

data from a clinical feasibility study reviewing the practice

patterns of iron deficiency anemia (IDA) in home parenteral

nutrition patients at the National Home Infusion Association’s

(NHIA) 2021 Annual Conference. The study found that although

approximately half of the patients in the home infusion setting

suffer from IDA, and oral iron is indicated as a first-line

therapy, many patients may not tolerate it, or may have

unsatisfactory results with this option. The study results support

the Company’s initial assumptions that management of IDA in the

home infusion population is suboptimal and remains an unmet

clinical need.

Pipeline Development

- Rockwell Medical continues to

explore the use of its FPC platform for the treatment of

hospitalized patients with acute heart failure. Management

currently believes that FPC may deliver rapidly bioavailable iron

to the heart and improve cardiac energetics. This effect could help

patients recover faster, resulting in shorter hospital stays and

fewer 30-day re-admissions. The Company expects to have a meeting

with the FDA in the second half of 2021.

First Quarter 2021 Selected Financial

Highlights

The following discussion and analysis should be

read in conjunction with our audited condensed consolidated

financial statements and related notes on Form 10-K for the year

ended December 31, 2020, and Form 10-Q for the quarter ended March

31, 2021.

Revenues were $15.5 million for the three months

ended March 31, 2021, compared to $15.9 million for the three

months ended March 31, 2020. Triferic revenue was $0.3 million for

the three months ended March 31, 2021.

Cost of sales was $15.1 million for the three

months ended March 31, 2021, resulting in gross profit of $0.4

million, compared to $14.7 million for the three months ended March

31, 2020, resulting in gross profit of $1.1 million.

Research and product development expenses were

$1.8 million for each of the three months ended March 31, 2021 and

2020. The Company is continuing to invest in its medical and

scientific programs to support the continued data and phase 4

clinical programs for Triferic in dialysis and the advancement of

our FPC technology platform.

Selling and marketing expenses were $1.9 million

during the three months ended March 31, 2021, compared with $2.1

million during the three months ended March 31, 2020. The decrease

of $0.2 million is primarily due to a decrease in marketing costs

related to Triferic (dialysate) partially offset by a slight

increase in costs associated with the launch of Triferic AVNU.

General and administrative expenses were $3.9

million during the three months ended March 31, 2021, compared

with $5.3 million during the three months ended March 31, 2020. The

decrease of $1.4 million is due primarily to a decrease in stock

compensation of $1.2 million, relating to a decrease in incentive

compensation from forfeited equity awards and the change in

probability relating to performance award achievement; a decrease

in legal costs of $0.2 million, relating to previous litigation

that has since been resolved; and a decrease in insurance costs of

$0.1 million, relating to reduced premiums; partially offset by an

increase of $0.1 million for increased headcount and severance pay

related to our former President and Chief Executive Officer.

Net loss was $7.8 million, or $(0.08) basic and

diluted net loss per share for the three months ended March 31,

2021, compared to net loss of $8.0 million, or $(0.12) basic and

diluted net loss per share for the three months ended March 31,

2020.

Cash, cash equivalents, and investments

available-for-sale totaled $46.1 million as of March 31, 2021,

compared to $58.7 million on December 31, 2020. Working capital was

$48.0 million as of March 31, 2021, compared to $56.7 million as of

December 31, 2020.

The Company has a debt facility of $35.0 million

of which the first tranche of $22.5 million was funded in March

2020 and is classified as long-term debt on the balance sheet. The

Company may be eligible to draw on a third tranche of $7.5 million

upon the achievement of certain additional milestones, including

the achievement of certain Triferic sales thresholds.

As of March 31, 2021, there were 93,599,519

shares of common stock outstanding.

First Quarter 2021 Business Update

Conference Call and Webcast

Rockwell Medical's management team will host a

conference call and audio webcast today, May 17, 2021, at 4:30 p.m.

ET to discuss Q1 2021 financial results and provide a business

update.

To access the conference call, please dial (877)

383-7438 (local) or (678) 894-3975 (international) at least 10

minutes prior to the start time and refer to conference ID 7870946.

A live webcast of the call will be available under "Events &

Presentations" in the Investor section of the Company's website,

https://ir.rockwellmed.com/. An archived webcast will be available

on the Company's website approximately two hours after the event

and will be available for 30 days.

About Triferic Dialysate and Triferic

AVNU

Triferic Dialysate and Triferic AVNU are the

only FDA-approved therapies in the U.S. indicated to replace iron

and maintain hemoglobin in hemodialysis patients during each

dialysis treatment. Triferic Dialysate and Triferic AVNU have a

unique and differentiated mechanism of action, which has the

potential to benefit patients and health care economics. Triferic

Dialysate and Triferic AVNU represent a potential innovative

medical advancement in hemodialysis patient iron management – with

the potential to become the future standard of care.

Triferic Dialysate and Triferic AVNU both

deliver approximately 5-7 mg iron with every hemodialysis treatment

to replace the ongoing losses to maintain hemoglobin without

increasing iron stores. Both formulations donate iron immediately

and completely to transferrin (carrier of iron in the body), which

is then transported to the bone marrow to be incorporated into

hemoglobin. Because of this unique mechanism of action, there is no

increase in ferritin (a measure of stored iron). Triferic and

Triferic AVNU address a significant medical need in treating

functional iron deficiency in end-stage kidney disease

patients.

The safety profile of Triferic is similar to

placebo in controlled clinical trials in patients with end-stage

kidney disease. Since approval, there have been no safety related

changes to the product labeling.

IMPORTANT SAFETY INFORMATION FOR

TRIFERIC AND TRIFERIC AVNU

INDICATION

TRIFERIC and TRIFERIC AVNU are indicated for the

replacement of iron to maintain hemoglobin in adult patients with

hemodialysis-dependent chronic kidney disease (HDD-CKD).

Limitations of Use

TRIFERIC and TRIFERIC AVNU are not intended for

use in patients receiving peritoneal dialysis. TRIFERIC and

TRIFERIC AVNU have not been studied in patients receiving home

hemodialysis.

Warnings and Precautions

Serious hypersensitivity reactions, including

anaphylactic-type reactions, some of which have been

life-threatening and fatal, have been reported in patients

receiving parenteral iron products. Patients may present with

shock, clinically significant hypotension, loss of consciousness,

and/or collapse. Monitor patients for signs and symptoms of

hypersensitivity during and after hemodialysis until clinically

stable. Personnel and therapies should be immediately available for

the treatment of serious hypersensitivity reactions.

Hypersensitivity reactions have been reported in 1 (0.3%) of 292

patients receiving TRIFERIC in two randomized clinical trials.

Iron status should be determined on pre-dialysis

blood samples. Post-dialysis serum iron parameters may overestimate

serum iron and transferrin saturation.

Adverse Reactions

Most common adverse reactions (incidence ≥3% and

at least 1% greater than placebo) in controlled clinical studies

include: headache, peripheral edema, asthenia, AV fistula

thrombosis, urinary tract infection, AV fistula site hemorrhage,

pyrexia, fatigue, procedural hypotension, muscle spasms, pain in

extremity, back pain, and dyspnea.

To report an Adverse Events (AE) or Product

Quality Control (PQC) please call the Medical Information

Department at (855) 333-4315 or e-mail at

rockwell.pharmacovigilance@propharmagroup.com.

For full Safety and Prescribing Information

please visit www.Triferic.com and www.Trifericavnu.com.

About Rockwell Medical

Rockwell Medical is a commercial-stage

biopharmaceutical company developing and commercializing its

next-generation parenteral iron technology platform, Ferric

Pyrophosphate Citrate (FPC), which has the potential to lead to

transformative treatments for iron deficiency in multiple disease

states, reduce healthcare costs and improve patients’ lives. The

Company has two FDA-approved therapies indicated for patients

undergoing hemodialysis, which are the first two products developed

from the FPC platform. Rockwell Medical is also advancing its FPC

platform by developing FPC for the treatment of iron deficiency

anemia in patients outside of dialysis, who are receiving

intravenous medications in the home infusion setting. In addition,

Rockwell Medical is one of two major suppliers of life-saving

hemodialysis concentrate products to kidney dialysis clinics in the

United States. For more information, visit www.RockwellMed.com.

Forward-Looking Statements

Certain statements in this press release may

constitute “forward-looking statements” within the meaning of the

federal securities laws, including, but not limited to, the

development plans and timing for Rockwell Medical’s FPC pipeline

candidates, the timing and outcome of meetings with the FDA, the

timing and outcome of foreign clinical trials and regulatory

approval, the timing for the commencement of our clinical trial of

FPC for treatment of IDA in adult patients in the home infusion

setting, the benefits of Triferic and the timing for a commercial

launch of Triferic AVNU in Canada. Words such as, “may,” “might,”

“will,” “should,” “believe,” “expect,” “anticipate,” “estimate,”

“continue,” “could,” “can,” “would,” “develop,” “plan,”

“potential,” “predict,” “forecast,” “project,” “intend” and similar

expressions, or statements regarding intent, belief, or current

expectations, are forward looking statements. While Rockwell

Medical believes these forward-looking statements are reasonable,

undue reliance should not be placed on any such forward-looking

statements, which are based on information available to us on the

date of this release. These forward-looking statements are based

upon current estimates and assumptions and are subject to various

risks and uncertainties (including, without limitation, those set

forth in Rockwell Medical’s SEC filings), many of which are beyond

our control and subject to change. Actual results could be

materially different. Risks and uncertainties include, but are not

limited to: the continuance of the COVID-19 pandemic (including,

applicable federal state or local orders) on business, labor

availability and operating results, including our supply chain,

dialysis concentrates business and the Company’s commercialization

of both pharmaceutical and medical device products; the challenges

inherent in new product development, other new indications and

therapeutics areas for our products; the success of our

commercialization of Triferic (dialysate) and Triferic AVNU; the

success and timing of international clinical trials for Triferic

Dialysate; the success and timing of international regulatory and

reimbursement approval for Triferic (dialysate) and Triferic AVNU;

the success of our commercial launch of Triferic AVNU in the United

States; the success and timing of the development of our FPC

pipeline candidates, the risk that topline clinical data and real

world data results may not demonstrate efficacy or may not be

predictive of future results; expected financial performance,

including cash flows, revenues, growth, margins, funding, liquidity

and capital resources; and those risks more fully discussed in the

“Risk Factors” section of our Annual Report on Form 10-K for the

year ended December 31, 2020, as such description may be amended or

updated in any future reports we file with the SEC. Rockwell

Medical expressly disclaims any obligation to update our

forward-looking statements, except as may be required by law.

Triferic® is a registered trademark of Rockwell

Medical, Inc. Triferic AVNU is pending with the U.S. Patent and

Trademark Office. All other product names, logos, and brands are

property of their respective owners in the United States and/or

other countries. All company, product and service names used on

this website are for identification purposes only. Use of these

names, logos, and brands does not imply endorsement.

Financial Tables Follow

ROCKWELL MEDICAL, INC. AND

SUBSIDIARIESCondensed Consolidated Balance

Sheets(Dollars in

Thousands)(Unaudited)

| |

March

31, |

|

December

31, |

| |

2021 |

|

|

2020 |

|

| |

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Cash and Cash Equivalents |

$ |

35,675 |

|

|

$ |

48,682 |

|

| Investments

Available-for -Sale |

|

10,464 |

|

|

|

9,997 |

|

| Accounts

Receivable, net of a reserve |

|

6,597 |

|

|

|

4,171 |

|

|

Inventory |

|

4,117 |

|

|

|

3,913 |

|

| Prepaid and

Other Current Assets |

|

2,389 |

|

|

|

2,706 |

|

|

Total Current Assets |

|

59,242 |

|

|

|

69,469 |

|

| Property and

Equipment, net |

|

2,472 |

|

|

|

2,642 |

|

| Inventory,

Non-Current |

|

1,325 |

|

|

|

1,176 |

|

| Right of Use

Assets, net |

|

4,860 |

|

|

|

2,911 |

|

|

Goodwill |

|

921 |

|

|

|

921 |

|

| Other

Non-current Assets |

|

629 |

|

|

|

629 |

|

|

Total Assets |

$ |

69,449 |

|

|

$ |

77,748 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

| Accounts

Payable |

$ |

3,307 |

|

|

$ |

4,155 |

|

| Accrued

Liabilities |

|

4,032 |

|

|

|

5,013 |

|

| Lease

Liability - Current |

|

1,417 |

|

|

|

1,167 |

|

| Deferred

License Revenue |

|

2,170 |

|

|

|

2,175 |

|

| Customer

Deposits |

|

135 |

|

|

|

152 |

|

| Other

Current Liability - Related Party |

|

171 |

|

|

|

131 |

|

|

Total Current Liabilities |

|

11,232 |

|

|

|

12,793 |

|

|

|

|

|

|

|

|

| Lease

Liability - Long Term |

|

3,522 |

|

|

|

1,821 |

|

| Term Loan,

Net of Issuance Costs |

|

21,041 |

|

|

|

20,949 |

|

| Deferred

License Revenue |

|

7,476 |

|

|

|

8,015 |

|

|

Total Liabilities |

|

43,271 |

|

|

|

43,578 |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

| Preferred

Shares, $0.0001 par value, 2,000,000 shares authorized, no shares

issued and outstanding at March 31, 2021 and December 31, 2020 |

|

— |

|

|

|

— |

|

| Common

Stock, $0.0001 par value,170,000,000 shares authorized, 93,599,519

and 93,573,165 shares issued and outstanding at March 31, 2021 and

December 31,2020, respectively |

|

9 |

|

|

|

9 |

|

| Additional

Paid-in Capital |

|

371,274 |

|

|

|

371,510 |

|

| Accumulated

Deficit |

|

(345,158 |

) |

|

|

(337,406 |

) |

| Accumulated

Other Comprehensive Income |

|

53 |

|

|

|

57 |

|

|

Total Stockholders’ Equity |

|

26,178 |

|

|

|

34,170 |

|

|

Total Liabilities And Stockholders’ Equity |

$ |

69,449 |

|

|

$ |

77,748 |

|

| |

|

|

|

|

|

ROCKWELL MEDICAL, INC. AND

SUBSIDIARIESCondensed Consolidated Statements of

Operations(Dollars in Thousands, except per share

amounts)(Unaudited)

| |

|

Three Months Ended March 31, 2021 |

|

Three Months Ended March 31, 2020 |

| |

|

|

|

|

|

|

|

Net Sales |

|

$ |

15,473 |

|

|

$ |

15,857 |

|

| Cost of

Sales |

|

|

15,072 |

|

|

|

14,744 |

|

|

Gross Profit |

|

|

401 |

|

|

|

1,113 |

|

| Research and

Product Development |

|

|

1,809 |

|

|

|

1,822 |

|

| Selling and

Marketing |

|

|

1,851 |

|

|

|

2,073 |

|

| General and

Administrative |

|

|

3,923 |

|

|

|

5,273 |

|

|

Operating Loss |

|

|

(7,182 |

) |

|

|

(8,055 |

) |

|

|

|

|

|

|

|

|

|

Other (Expense) Income |

|

|

|

|

|

|

| Realized

Gain on Investments |

|

|

— |

|

|

|

2 |

|

| Interest

Expense |

|

|

(581 |

) |

|

|

(102 |

) |

| Interest

Income |

|

|

11 |

|

|

|

171 |

|

|

Total Other (Expense) Income |

|

|

(570 |

) |

|

|

71 |

|

| |

|

|

|

|

|

|

|

Net Loss |

|

$ |

(7,752 |

) |

|

$ |

(7,984 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Net Loss per Share |

|

$ |

(0.08 |

) |

|

$ |

(0.12 |

) |

| |

|

|

|

|

|

|

|

Basic and Diluted Weighted Average Shares

Outstanding |

|

|

93,591,053 |

|

|

|

67,518,240 |

|

| |

|

|

|

|

|

|

CONTACTS

Investors:Argot

Partners212.600.1902Rockwell@argotpartners.com

Media:David RosenArgot

Partners212.600.1902david.rosen@argotpartners.com

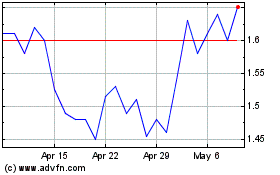

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Sep 2023 to Sep 2024