false

0001708055

0001708055

2024-10-03

2024-10-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

October 3, 2024

Date

of Report (Date of earliest event reported)

RIBBON COMMUNICATIONS INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

001-38267 |

|

82-1669692 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

6500 Chase Oaks Blvd., Suite 100, Plano, TX

75023

(Address of Principal Executive Offices) (Zip Code)

(978) 614-8100

(Registrant’s telephone number, including

area code)

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 |

|

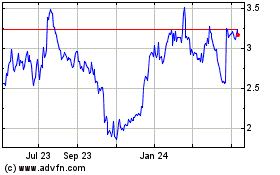

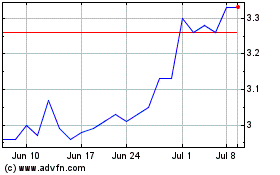

RBBN |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02. |

Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On October 3, 2024, Ribbon Communications Inc. (the “Company”)

announced the appointment of John Townsend as Executive Vice President, Chief Financial Officer of the Company, effective upon the earlier

of the filing of the Company’s Form 10-Q for the quarter ended September 30, 2024 and November 1, 2024 (the “Effective

Date”). As previously reported, Miguel Lopez, the Company’s current Executive Vice President, Chief Financial Officer, is

retiring from the Company following the filing of the Company’s Form 10-Q for the quarter ended September 30, 2024.

Mr. Townsend, age 61, was previously the Chief Financial Officer

of Digicel Group, a mobile phone network, business services and home entertainment provider operating in 26 markets, from September, 2022

to September, 2023. Prior to his time at Digicel Group, Mr. Townsend served in several positions for Verizon Communications, a global

communications and technology company, from 2013 through 2022, including most recently serving as the Chief Financial Officer of Verizon

Business from 2019 to 2022. Mr. Townsend’s career also includes time at Vodafone Group PLC, a British multinational telecommunications

company, where he served in various senior finance roles from 1993 to 2012, including six years as Chief Financial Officer of Verizon

Wireless, which at the time was jointly owned by Vodafone and Verizon. Mr. Townsend holds a B.A. in Economics (honors) and Business

Finance from Manchester University and is an Associate of the Institute of Chartered Accountants.

No family relationship exists between Mr. Townsend and any of

the Company’s directors or executive officers. There are no arrangements or understandings between Mr. Townsend and any other

person pursuant to which Mr. Townsend was selected as an officer of the Company, nor are there any transactions to which the Company

is or was a participant and in which Mr. Townsend had or will have a direct or indirect material interest subject to disclosure under Item

404(a) of Regulation S-K.

In connection with Mr. Townsend’s appointment, he has entered

into an employment agreement (the “Employment Agreement”) and a severance agreement (the “Severance Agreement”)

with the Company. Mr. Townsend has also entered into the Company’s standard indemnification agreement for directors and officers.

Pursuant to the Employment Agreement, Mr. Townsend will receive an annual base salary of $500,000 and will be eligible to participate

in the Company’s annual cash incentive program, with a target bonus opportunity equal to 75% of his then-applicable annual base

salary and a maximum bonus opportunity equal to 200% of his then-applicable annual base salary. Mr. Townsend will receive a one-time

relocation bonus of $50,000, after reduction for applicable income tax withholdings, and will be entitled to a monthly temporary housing

allowance of $4,500 for six months.

As an inducement for Mr. Townsend’s employment, the Company

has agreed to award Mr. Townend sign-on equity grants consisting of a $750,000 time-based vesting grant of restricted share units

(the “Sign On RSUs”), calculated based on the five-day average closing price per share of the Company’s common stock,

par value $0.0001 (the “Common Stock”), ending two days prior to the date of grant, and two performance-based vesting grants

of restricted share units (“PSUs”). Subject to Mr. Townend’s continued employment, $416,667 of the Sign On RSUs

are eligible to vest on October 15, 2025 and, upon vesting, will be settled in shares of Common Stock. The remaining Sign On RSUs

will vest in four equal semi-annual instalments thereafter and will be settled in shares of Common Stock. A grant of $750,000 PSUs (the

“Financial Performance PSUs”), calculated based on the five-day average closing price per share of the Common Stock ending

two days prior to the date of grant, will vest based on the achievement of both (i) annual financial goals established by the Compensation

Committee of the Company’s Board of Directors for the years ended December 31, 2025 through 2027 (60% weighting) and (ii) the

relative total shareholder return on the Common Stock for the period from October 15, 2025 through December 31, 2027 compared

to the relative shareholder return for the companies included in the Nasdaq Telecom Index over the same period (40% weighting), in both

cases subject to Mr. Townsend’s continued employment. The Financial Performance PSUs can vest up to 200% of the target amount

awarded. In addition, a grant of 314,583 PSUs (the “Stock Price PSUs”) will vest based on both (i) the achievement of

specified stock prices for the Common Stock and (ii) the passage of time through October 15, 2028, subject to Mr. Townsend’s

continued service with the Company. The Stock Price PSUs will also be settled in shares of Common Stock. Mr. Townend will not be

eligible for the annual grant of equity awards expected to be made to the Company’s executives in 2025.

Pursuant to the Severance Agreement, Mr. Townsend is entitled

to severance payments and benefits upon certain terminations of employment subject to his execution and non-revocation of a general waiver

and release of claims. Upon a termination of Mr. Townsend’s employment by the Company without Cause or by Mr. Townsend

for Good Reason (each as defined in the Severance Agreement), Mr. Townsend is entitled to (a) severance payments equal to (i) 100%

of his annual base salary for the “Severance Period”, payable in monthly installments following termination, (ii) a prorated

portion of the annual bonus for the fiscal year of termination based on actual Company performance and target individual performance (such

proration based on the number of days actually worked in such fiscal year) (the “Pro Rata Bonus”), and (b) a lump sum

payment of an amount equal to the sum of the Company’s share of health plan premium payments for Mr. Townsend and his dependents

for a period of 12 months following termination. The Severance Period is six months if the termination occurs within 24 months of Mr. Townsend’s

employment date and 12 months thereafter. In addition, upon such a termination, (A) Mr. Townsend’s equity awards that

are subject to vesting based solely upon Mr. Townsend’s continued service with the Company and would have vested during the

12-month period following the date of Mr. Townsend’s termination of employment shall vest and (B) (i) all awards

that are subject to vesting in whole or in part based on the achievement of performance objective(s) (other than the Stock Price

PSUs) (collectively, “Performance-Based Equity Awards”) with respect to any performance periods ending on or prior to the

date of termination shall remain eligible to vest based on actual performance through the end of the applicable performance period and

(ii) a pro-rated portion of Performance-Based Equity Awards with respect to any performance periods in which the date of termination

occurs shall remain eligible to vest based on performance through the end of the fiscal year in which the date of termination occurs based

on actual performance through the end of such fiscal year (such proration based on the number of days actually employed during such performance

period).

Notwithstanding the foregoing, to the extent a termination by the Company

without Cause or by Mr. Townsend for Good Reason occurs within 12 months following a Change in Control (as defined in the Severance

Agreement), Mr. Townsend is entitled to receive a cash lump sum payment equal to (a) 100% of (X) his annual base salary,

and (Y) his target annual bonus, (b) the Pro Rata Bonus, and (c) a lump sum payment of an amount equal to the sum of the

Company’s share of health plan premium payments for Mr. Townsend and his dependents for a period of 12 months following termination.

In addition, upon such a termination, the vesting of all of Mr. Townsend’s outstanding equity awards (other than the Stock

Price PSUs) will accelerate, with Performance-Based Equity Awards vesting as if target performance had been achieved, pursuant to the

Severance Agreement. Further, the Stock Price PSUs will be eligible to vest on or following a Change in Control (as defined in the Severance

Agreement) in accordance with the terms of the underlying award agreements.

The foregoing descriptions of the Employment Agreement and Severance

Agreement are qualified in their entirety by reference to the Employment Agreement and Severance Agreement, respectively, which are filed

as Exhibits 10.1 and 10.2 hereto and are incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: October 4, 2024 |

Ribbon Communications Inc. |

| |

|

| |

By: |

/s/ Patrick Macken |

| |

|

Name: Patrick W. Macken |

| |

|

Title: Executive Vice President, Chief Legal Officer and Secretary |

Exhibit 10.1

October 3, 2024

John Townsend

Via email

Dear John,

On behalf of Ribbon Communications Inc. (“Ribbon”)

and Ribbon Communications Operating Company, Inc. (“RCOC” and Ribbon and RCOC, together with its affiliates who may employ

you from time to time, the “Company”), I am pleased to provide you with this written offer of employment (this “Agreement”)

Your start date with the Company is October 14, 2024 (the “Start Date”). You will be appointed to the position of Chief

Financial Officer on November 1, 2024, or such earlier date as may be agreed between you and the Company.

This Agreement is entered into as of the date

set forth above and shall be effective as of the Start Date.

1. Compensation.

During your employment with the Company:

(a) Base Salary.

Your initial base salary will be at the annualized rate of $500,000 (your base salary, as may be adjusted from time to time, “Base

Salary”), less applicable local, state and federal withholdings, paid in accordance with the Company’s normal payroll practices.

Your Base Salary will be subject to review and adjustment by Ribbon’s Board of Directors (the “Board”) or Compensation

Committee of the Board (the “Committee”) in its sole discretion.

(b) Annual Bonus.

You will be eligible to receive an annual variable cash bonus based on achievement of certain corporate and/or individual objectives (“Annual

Bonus”). Subject to the achievement of such objectives for the applicable year, the target Annual Bonus shall equal seventy-five

percent (75%) of your Base Salary. The Annual Bonus for each fiscal year will be based on the achievement of objectives determined by

the Board or the Committee; provided that the Annual Bonus payable with respect to 2024 shall be pro-rated based upon the portion of the

year beginning on the Start Date and ending on December 31, 2024 and shall be paid to you regardless of the level of achievement

actually realized by the Company in 2024 (i.e. you will receive a pro-rated 2024 Annual Bonus as if the Company achieved its target

level of performance for 2024). Your Annual Bonus, if any, shall be paid as soon as reasonably practicable following Ribbon’s public

disclosure of its financial results for the applicable bonus period and the Board’s or Committee’s approval of the bonus under

the then-applicable Ribbon bonus plan, subject to your continued employment with the Company through the date of such payment (except

as otherwise set forth in any written agreement by and between the Company and you).

(c) Relocation.

Your primary work location will be the Company’s offices in Plano, Texas. You agree to relocate your primary residence within six

(6) months following the Start Date to the Dallas, Texas metropolitan area (the date of your actual relocation, the “Relocation

Date”). In connection with such relocation, you will be entitled to: 1) a monthly Temporary Housing Allowance of $4,500.00, less

applicable withholdings and deductions, for six (6) months between the Relocation Date and the six month anniversary of such date;

and 2) a one-time cash allowance payment in an amount such that, after reduction for applicable income tax withholdings, you receive $50,000

(the “Relocation Allowance”) to support your relocation and assist with moving-related expenses, to be paid on the first payroll

date after the Start Date. In the event that your employment is terminated by the Company for Cause or as a result of your resignation

for any reason, in each case, prior to the first (1st) anniversary of the Relocation Date or you fail to timely relocate in

accordance with this Section 1(c), you will be required to reimburse the Company for the Relocation Allowance within thirty (30)

days following your termination of employment or the date of such failure, as applicable. Any amounts that may be owed to the Company

pursuant to this Section 1(c) may, to the extent permitted by law, be withheld from any other payments owed to you from the

Company. For purposes of this Section 1(c), “Cause” and “Good Reason” shall have the meanings set forth in

the Severance Agreement (as defined below).

(e) Equity Awards.

Subject to your commencement of employment on the Start Date and approval by the Committee:

| (i) | You will, October 15, 2024 (the “Grant Date”), be granted restricted stock units (the

“Sign On RSUs”) that, upon vesting, will be settled in shares of common stock of Ribbon with a value (as of the Grant Date)

equal to $250,000.00, calculated consistent with such grants made to similarly situated employees of the Company. Subject to your active

and continuous employment with the Company through the applicable vesting date, the Sign On RSUs will vest on the first anniversary of

the Grant Date. Notwithstanding the foregoing, your grant will be subject to, and you will be required to, enter into a restricted share

unit agreement in the Company’s applicable form in connection with the grant of the Sign On RSUs. |

| (ii) | You will, on the Grant Date, be granted restricted stock units (the “RSUs”) that, upon vesting,

will be settled in shares of common stock of Ribbon with a value (as of the Grant Date) equal to $500,000.00, calculated consistent with

such grants made to similarly situated employees of the Company. Subject to your active and continuous employment with the Company through

the applicable vesting date, the RSUs will vest as follows: (A) 1/3rd of your RSUs on the first anniversary of the Grant

Date (the “Initial Vesting Date”); and (B) the remaining 2/3rd of your RSUs vesting in four (4) equal

installments on each six (6) month anniversary of the Initial Vesting Date. Notwithstanding the foregoing, your grant will be subject

to, and you will be required to, enter into a restricted share unit agreement in the Company’s applicable form in connection with

the grant of the RSUs |

| (iii) | You will, on the Grant Date, be granted performance share units (the “PSUs”) that, upon vesting,

will be settled in shares of common stock of Ribbon with a value (as of the Grant Date) equal to $1.5 million, calculated consistent with

such grants made to similarly situated employees of the Company (the “Share Price PSUs”). Notwithstanding the foregoing, your

grant of the Share Price PSUs will be subject to, and you will be required to, enter into a performance share unit agreement in the Company’s

applicable form in connection with the grant of the PSUs in substantially the form attached hereto as Attachment 3. |

| (iv) | You will, on the Grant Date, be granted PSUs that, upon vesting, will be settled in shares of common stock

of Ribbon with a value (as of the Grant Date) equal to $750,000 (the “Target Amount”), calculated consistent with such grants

made to similarly situated employees of the Company (the “2025 PSUs”). Subject to your active and continuous employment with

the Company through the applicable vesting date, the 2025 PSUs will vest as follows: (A) 60% of the Target Amount will vest based

on the achievement of three separate annual corporate financial metric(s) (the “Financial Metric PSUs”) established by

the Compensation Committee of the Company’s Board of Directors for each of the fiscal years ending on December 31, 2025, December 31,

2026 and December 31, 2027, which Financial Metric PSUs can vest between 0% and 150% of the number of shares subject to the Financial

Metric PSUs as of the Grant Date; and (B) the remaining 40% will vest based on the calculation of the Company’s relative Total

Shareholder Return (“rTSR”) compared to the rTSR for the companies included in the peer index identified in the award agreement

for the 2025 PSUs for the period from the Grant Date through December 31, 2027 (the “TSR PSUs”). The TSR PSUs can vest

between 0% and 200% of the number of shares subject to the TSR PSUs as of the Grant Date. Notwithstanding the foregoing, your grant of

the 2025 PSUs will be subject to, and you will be required to, enter into a performance share unit agreement in the Company’s applicable

form in connection with the grant of the PSUs in substantially the form attached hereto as Attachment 4. |

| (v) | Except as set forth herein, you shall not be entitled to any other equity awards from the Company during

the fiscal years ending December 31, 2024 and December 31,2025. Following the fiscal year ending December 31, 2025, subject

to Board or Committee approval, you will be eligible to receive annual equity incentive awards under the Plan at such times, in such amounts

and forms, and on such terms as are determined by the Board or Committee, taking into account your role and responsibilities. You will

be required to enter into equity award agreement(s) in the Company’s then-applicable form in connection with the grant of any

future awards described in this Section 1(e)(v). |

2. Benefits.

During your employment with the Company, you will be entitled to the following benefits:

(a) You

will be entitled to vacation consistent with Company policy and limitations, under which you will initially accrue four (4) weeks

of vacation per year beginning on the Start Date;

(b) You

will be entitled to participate as an employee of the Company in all health and welfare benefit plans and receive fringe benefits and

perquisites generally provided to similarly situated employees of the Company in accordance with applicable Company plan, policy or program,

which currently include group health, life and dental insurance, and a 401(k) plan. Notwithstanding the foregoing, the Company

retains the right to change, add or cease any particular compensation or benefit for its employees in its sole discretion; and

(c) The

Company will reimburse you for all reasonable travel, business development, meals, entertainment and other expenses incurred by you in

connection with the performance of your duties and obligations on behalf of the Company. You will comply with such limitations and

reporting requirements with respect to expenses as may be established by the Company from time to time and will promptly provide all appropriate

and requested documentation in connection with such expenses.

3. Employment

Relationship. The Company’s obligations under this Agreement are contingent upon your satisfactory completion of our pre-employment

reference check and background check investigation and your verification of your identity and employment eligibility. No provision of

this Agreement shall be construed to create an express or implied employment contract for a specific period of time. Employment at the

Company is considered “at will” and either you or the Company may terminate the employment relationship at any time and for

any reason, subject to compliance with the Severance Agreement. As a full-time employee of the Company, you will be expected to devote

your full business time and energies to the business and affairs of the Company. As the Company’s organization evolves, its reporting

structure may change and you may be assigned such other management duties and responsibilities as the Company may determine, in addition

to performing duties and responsibilities reflected above.

4. Termination

and Eligibility for Severance. The parties acknowledge and agree that they will enter into a severance agreement in substantially

the form attached hereto as Attachment 1 (the “Severance Agreement”) on the Start Date. Except as set forth in the

Severance Agreement, you will not be entitled to any severance or other termination payments or benefits from the Company or any of its

affiliates. Notwithstanding the foregoing or anything set forth in the Severance Agreement, in the event termination is the result of

your retirement on or after attaining age 65 and at least 5 years continuous services with the Company, you will be entitled to

pro rata vesting of equity awards subject to performance-based vesting and have a vesting date after your retirement date with the terms

of such pro rata vesting set forth in the award agreement(s) for such equity award(s), if any.

5. Previous

Employment. By accepting employment with the Company, you represent the following: (a) any notice period you are required to

give or to serve with a previous employer has expired and that by entering into or performing any of your duties for the Company, you

will not be in breach of any other obligation binding on you; (b) you will not use or disclose any confidential information in breach

of any agreement you may have with a previous employer or any other person; and (c) you are not currently party to or bound by the

terms of any non-competition, non-solicitation, confidentiality or non-disclosure agreement or other agreement with a previous employer

or any other party which could impair or interfere in any manner with your ability to fully satisfy your obligations and duties hereunder.

6. Confidentiality.

The Company considers the protection of its confidential information and proprietary materials to be very important. Therefore, as a condition

of your employment, you and the Company will become parties to the Confidentiality, Non-Competition and Assignment of Inventions Agreement,

as set forth in Attachment 2 hereto. This attached agreement must be signed and returned to the Company as soon as practicable

following the Start Date.

7. Indemnity.

As an executive of the Company, the Company will provide you with an Indemnity Agreement on the Company’s standard form.

8. General.

| (a) | This Agreement, together with the agreements referenced herein, will constitute our entire agreement as

to your employment by the Company and will supersede any prior agreements or understandings, whether in writing or oral. |

| (b) | This Agreement and your employment are contingent upon the Company’s standard onboarding processes,

which may include background and reference checks and satisfactory proof of your right to work in the United States. You agree to provide

any documentation or information at the Company’s reasonable request to facilitate these processes (if any). |

| (c) | This Agreement may be executed in more than one counterpart, each of which shall be deemed to be an original,

and all such counterparts together shall constitute one and the same instrument. |

| (d) | The provisions of this Agreement are severable and if any one or more provisions may be determined to

be illegal or otherwise unenforceable, in whole or in part, the remaining provisions of this Agreement shall nevertheless be binding and

enforceable. Except as modified hereby, this Agreement shall remain unmodified and in full force and effect. |

| (e) | This Agreement is personal in nature and neither of the parties hereto shall, without the written consent

of the other, assign or otherwise transfer this Agreement or its obligations, duties and rights under this Agreement; provided, however,

that in the event of the merger, consolidation, transfer or sale of all or substantially all of the assets of the Company, the Company

may assign its rights and obligations hereunder and, in the event of such assignment, this Agreement shall, subject to the provisions

hereof, be binding upon and inure to the benefit of such successor and such successor shall be solely obligated to discharge and perform

all of the promises, covenants, duties and obligations of the Company hereunder. |

| (f) | All notices shall be in writing and shall be delivered personally (including by courier), by overnight

receipted courier service (such as UPS or Federal Express) or sent by certified, registered or express mail, postage prepaid, to the Company

at the following address: Ribbon Communications Legal Department, 6500 Chase Oaks Blvd, Suite 100, Plano Texas 75023, and to you

at the most current address we have in your employment file. Any such notice shall be deemed given when so delivered personally or, if

by certified, registered or express mail, postage prepaid mailed, forty-eight (48) hours after the date of deposit in the mail. Any party

may, by notice given in accordance with this paragraph to the other party, designate another address or person for receipt of notices

hereunder. |

| i. | Any controversy, dispute or claim arising out of or relating to this Agreement or the breach hereof which

cannot be settled by mutual agreement will be finally settled by binding arbitration in the county where you performed your principal

work duties for the Company, under the jurisdiction of the American Arbitration Association or other mutually agreeable alternative arbitration

dispute resolution service, before a single arbitrator appointed in accordance with the arbitration rules of the American Arbitration

Association or other selected service, modified only as herein expressly provided. You acknowledge receipt of the applicable AAA

Employment Arbitration Rules and Mediation Procedures which may be found at the AAA website here https://www.adr.org/Rules. The arbitrator

may enter a default decision against any party who fails to participate in the arbitration proceedings. |

| ii. | The Federal Arbitration Act, 9 U.S.C. §§ 1 et seq. shall govern the interpretation and enforcement

of this arbitration clause. The decision of the arbitrator on the points in dispute will be final, non-appealable and binding, and judgment

on the award may be entered in any court having jurisdiction thereof. |

| iii. | The fees and expenses of the arbitration will be borne as provided in the AAA Costs of Arbitration section,

and each party will bear the fees and expenses of its own attorney, unless the arbitrator finds that a statutory award of attorneys’

fees and/or costs is appropriate. |

| iv. | The parties waive their rights to a class or collective action. The parties agree that claims may not

be joined, consolidated, or heard together with claims of any other current or former employee of the Company or other third party. |

| v. | The parties agree that this Section 8(g) has been included to resolve any disputes between them

with respect to this Agreement or your employment, and that this Section 8(g) will be grounds for dismissal of any court action

commenced by either party with respect to this Agreement, other than post-arbitration actions seeking to enforce an arbitration award

or actions seeking an injunction or temporary restraining order and other than claims for unemployment insurance benefits or workers compensation

benefits or other claims which by law cannot be subject to a mandatory arbitration agreement. In the event that any court determines

that this arbitration procedure is not binding, or otherwise allows any litigation regarding a dispute, claim, or controversy covered

by this Agreement to proceed, the parties hereto hereby waive, to the maximum extent allowed by law, any and all right to a class or collection

action or a trial by jury in or with respect to such litigation. |

| vi. | The parties will keep confidential, and will not disclose to any person, except as may be required by

law or the rules and regulations of the Securities and Exchange Commission or other government agencies, the existence of any controversy

hereunder, the referral of any such controversy to arbitration or the status or resolution thereof; notwithstanding the foregoing, nothing

herein shall restrict you from communicating with a government agency or engaging in protected concerted activity that cannot be waived

by such an agreement not to disclose. |

| (h) | This Agreement shall be governed by and interpreted in accordance with the laws of the State of Delaware,

without regard to the conflict of laws provisions thereof or of any other jurisdiction. |

| (i) | The Company is an equal opportunity employer. |

9. Acceptance. You

may accept the terms and conditions described herein by confirming your acceptance in writing. Please send your countersignature

to this Agreement to the Company, or via e-mail to me and cc Petrena Ferguson, which execution will evidence your agreement with the terms

and conditions set forth herein.

Sincerely,

| /s/ Bruce McClelland |

|

| Bruce McClelland |

|

On behalf of Ribbon Communications Inc. and Ribbon Communications

Operating Company, Inc.

Accepted as of the first date set forth above by:

| /s/ John Townsend |

|

| John Townsend |

|

Signature Page to Employment Letter

Attachment 1

Severance Agreement

[see attached]

Attachment 2

Confidentiality, Non-Competition, Non-Solicitation

And Assignment of Inventions Agreement

[see attached]

Attachment 3

Form of Share Price PSU Award Agreement

[see attached]

Attachment 4

Form of 2025 PSU Award Agreement

[see attached]

Exhibit 10.2

Attachment 1

Severance Agreement

THIS SEVERANCE AGREEMENT (the “Severance

Agreement” or “Agreement”) is entered into as of October 3, 2024, and effective as of the Start Date

(as defined in the Employment Letter), between Ribbon Communications Inc. (“Ribbon”), Ribbon Communications Operating

Company, a wholly owned subsidiary of Ribbon Communications Inc., (“RCOC”, and together with Ribbon, the “Company”)

John Townsend (“Executive” or “you”).

| 1. | Definitions. The following capitalized terms used herein shall have the following meanings: |

(a) “Annual

Bonus” means the annual variable cash compensation you are eligible to receive as determined from time to time by the Company,

whether acting through Ribbon’s Board of Directors (the “Board”), a committee thereof or otherwise, based on

the achievement of certain Ribbon Entity and/or individual performance objectives.

(b) “Base

Pay” means your annual base compensation, as determined from time to time by the Company, whether acting through the Board,

a committee thereof or otherwise, regardless of whether all or any portion thereof may be deferred under any deferred compensation plan

or program of the Company.

(c) “Cause”

means termination of your employment by the Company upon the occurrence of any of the following: (i) your commission of bribery in

violation of the Code of Conduct (or similar policy) of the Company or other Ribbon Entity employing you at the relevant time and/or local

law and regulation including, without limitation, the UK Bribery Act, (ii) your engaging in acts in the course of your employment

with any Ribbon Entity that constitute theft, fraud or embezzlement, (iii) your intentional or negligent misconduct which materially

and adversely affects any Ribbon Entity and which is not cured (to the extent curable) within thirty (30) days following your receipt

of written notice of such misconduct, (iv) your unauthorized disclosure of proprietary information of a confidential nature relating

to any Ribbon Entity, which unauthorized disclosure has a material and adverse effect on any Ribbon Entity, (v) your material violation

of any Ribbon Entity policy, agreement or procedure which is not cured (to the extent curable) within thirty (30) days following receipt

of written notice of such violation, (vi) your excessive absenteeism, (vii) your material neglect of duty, (viii) your

failure to devote substantially all of your working time to the business of the Ribbon Entities or to otherwise perform the duties of

your position to the satisfaction of the Board (or your direct supervisor) which is not cured (to the extent curable) within thirty (30)

days following receipt of written notice of such failure, (ix) your insubordination or failure to perform and carry out any directive

of the Board (or your direct supervisor), (x) your abuse of alcohol, or unlawful use (including being under the influence) or possession

of illegal drugs, at the premises of any Ribbon Entity or otherwise while performing (or holding yourself out as performing) services

for or on behalf of any Ribbon Entity, (xi) your commission of any act that has resulted in (or could reasonably be expected to result

in) conviction of a felony or crime involving moral turpitude or pleading “no contest” to a felony charge or other criminal

charge involving moral turpitude, (xii) your failure to cooperate with any of the Ribbon Entities and/or their professional advisors

in any investigation (whether internal or external) or any formal legal or investigative proceeding, or (xiii) your engagement in

any conduct, including any violation of applicable law, that may reasonably result in material and adverse injury to the business or reputation

of any Ribbon Entity.

(d) “Change

in Control” shall have the meaning set forth in the Incentive Award Plan. Notwithstanding the foregoing, if a Change in Control

constitutes a payment or benefit event with respect to any payment or benefit hereunder that provides for the deferral of compensation

that is subject to Section 409A, to the extent required to avoid the imposition of additional taxes under Section 409A, such

transaction or event will not be deemed a Change in Control unless the transaction qualifies as a “change in control event”

within the meaning of Section 409A.

(e) “Change

in Control Protection Period” means the period beginning on the date of the consummation of the Change in Control and ending

on the first anniversary of such Change in Control.

(f) “Code”

means the Internal Revenue Code of 1986, as amended.

(g) “Date

of Termination” means the date of termination of your employment for any reason.

(h) “Disability”

means an illness (mental or physical) or incapacity, which results in you being unable to perform your duties as an employee of the

Company for a period of one hundred eighty (180) days, whether or not consecutive, in any twelve (12) month period.

(i) “Employment

Letter” means that certain Employment Letter Agreement by and between you and the Company, dated September 24, 2024.

(j) “Equity

Awards” means all stock options, restricted stock units, performance stock units and such other equity-based awards granted

pursuant to the Incentive Award Plan. For the avoidance of doubt, “Equity Awards” shall not include any cash or cash-based

awards granted pursuant to the Incentive Award Plan.

(k) “Good

Reason” means the occurrence of one or more of the following conditions without your prior written consent: (A) a material

reduction in your then-effective Base Pay or target Annual Bonus, (B) the relocation of your primary place of employment to a location

more than 30 miles from your then-present work location, (C) a material diminution in your authority, duties or responsibilities

for the Ribbon Entities, or (D) any material breach of any written agreement by and between any Ribbon Entity and you; provided that,

you shall not have Good Reason unless and until (x) you give the Company written notice describing the occurrence of Good Reason

within 30 days after such occurrence first occurs, (y) such occurrence is not corrected by the Company within 30 days after the Company’s

receipt of such notice, and (z) you terminate employment no later than 30 days after the expiration of such 30-day correction period.

(l) “Incentive

Award Plan” means Ribbon Communications Inc. 2019 Incentive Award Plan, as may be amended from time to time (or any successor

equity incentive plan of Ribbon).

(m) “Restrictive

Covenants Agreement” shall mean the Confidentiality, Non-Competition, Non-Solicitation and Assignment of Inventions Agreement

dated October 3, 2024, as referenced in Section 6 of the Employment Letter.

(n) “Ribbon

Entities” means Ribbon Communications Inc. and its direct and indirect subsidiaries.

(o) “Section 409A”

has the meaning set forth in Section 7 of this Agreement.

(p) “Severance

Period" means (i) six (6) months beginning on the Date of Termination, if the Date of Termination is prior to the 18

month anniversary of your Start Date; and (ii) 12 months beginning on the Date of Termination, if the Date of Termination is on or

after the two (2) year anniversary of your Start Date.

| 2. | Term of Agreement. The term of this Agreement will commence as of the Effective Date and shall

continue in effect until the earlier of (a) the third anniversary of the Effective Date; and (b) the date on which all payments

or benefits required to be made or provided hereunder have been made or provided in their entirety (the “Initial Term”).

Notwithstanding the foregoing, (i) on the third anniversary of the Effective Date and on each subsequent anniversary thereafter,

this Agreement shall automatically renew and extend for a period of twelve (12) additional months (each such twelve (12)-month period,

collectively with the Initial Term, the “Term”) unless written notice of non-renewal is delivered from either party

to the other not less than six (6) months prior to the applicable date on which extension of the then-existing Term would occur,

and (ii) in no event will the Term end prior to the first anniversary of the date of consummation a Change in Control. |

| 3. | Termination and Eligibility for Severance. |

| (a) | Accrued Benefits. Upon any termination of your employment, you will be paid (i) any and all

earned and unpaid portion of your Base Pay through the Date of Termination; (ii) any accrued but unused vacation pay owed to you

in accordance with Company practices up to and including the Date of Termination; and (iii) any allowable and unreimbursed business

expenses incurred through the Date of Termination that are supported by appropriate documentation in accordance with the Company’s

applicable expense reimbursement policies. Hereafter, items (i) through (iii) in this Section 3 are referred to as “Accrued

Benefits.'' If termination of your employment is for any reason other than (A) by the Company without Cause (other than due to

death or Disability) or (B) by you for Good Reason, you will be entitled to receive only the Accrued Benefits. |

(b) Severance

Payment. Subject to Sections 3(c), 6 and 7 of the Agreement:

(i) If

the Company terminates your employment without Cause (other than as a result of your death or Disability) or if you terminate your employment

with Good Reason, in each case, outside of the Change in Control Protection Period, then, in addition to the Accrued Benefits, the Company

will provide you the following severance and related post-termination benefits:

(1) The

Company shall, during the Severance Period, pay to you an amount equal to (A) your Base Pay as in effect immediately prior to the

Date of Termination (or, in the case of termination by you with Good Reason due to material reduction in Base Pay, your Base Pay in effect

immediately prior to such reduction) (the “Non-CIC Severance Payment”), and (B) an amount equal to the Annual

Bonus you would have received, if any, had you remained employed through the end of the fiscal year in which the Date of Termination occurs,

prorated based on the number of days you worked during such fiscal year and calculated based on actual achievement of the Ribbon Entity

performance targets relating to such Annual Bonus (and assuming any individual, personal performance targets are achieved at target) (the

“Pro Rata Bonus”);

(2) The

Company shall pay you an amount equal to the aggregate sum of the Company's share of medical, dental and vision insurance premiums for

you and your dependents for the Severance Period (as if you had remained employed and based on coverage as of immediately prior to termination).

For the avoidance of doubt, if immediately prior to the termination of your employment you were required to contribute towards the cost

of premiums as a condition of receiving such insurance, the payment hereunder will not cover any such contributions. The cash payment

provided for in this Section 3(b)(i)(2) or Section 3(b)(ii)(2), as applicable, is referred to herein as the “Continued

Benefit Payment”;

(3) Unless

otherwise explicitly set forth in the award agreement for the applicable Equity Award, each outstanding unvested Equity Award held by

you immediately prior to the Date of Termination that is subject to vesting based solely upon your continuous service with the Company

(collectively, “Time-Based Equity Awards”) that would have vested during the Severance Period had you remained employed

shall remain outstanding and on the Severance Commencement Date, (I) to the extent you have timely executed and not revoked the Release

Agreement (as defined below), such Time-Based Equity Awards shall automatically vest and become exercisable (as applicable) or (II) to

the extent you have not timely executed or have revoked the Release Agreement, such Time-Based Equity Awards will be forfeited for no

consideration; and

(4) Unless

otherwise explicitly set forth in the award agreement for the applicable Equity Award, each outstanding unvested Equity Award held by

you immediately prior to the Date of Termination that is subject to vesting in whole or in part based on achievement of performance objective(s) (collectively,

“Performance-Based Equity Awards”) and is eligible to vest based on achievement of such performance objective(s) for

performance periods ending prior to the Date of Termination or in which the Date of Termination occurs shall remain outstanding and on

the Severance Commencement Date, (I) to the extent you have timely executed and not revoked the Release Agreement, (x) the portion

of such unvested Performance-Based Equity Award that is eligible to vest based on achievement of performance objective(s) for performance

periods ending prior to the Date of Termination shall remain eligible to vest and be settled (as applicable) in accordance with its terms

based on actual performance, without regard for any requirement of continued employment, and (y) a prorated amount of the portion

of such unvested Performance-Based Equity Award that is eligible to vest based on achievement of performance objective(s) for the

applicable performance periods in which the Date of Termination occurs shall remain eligible to vest through the end of the fiscal year

in which the Date of Termination occurs and be settled (as applicable) in accordance with its terms as if the last day of such fiscal

year was the last day of the applicable performance period(s), based on performance targets established by the Company and actual performance

through the end of such fiscal year, without regard for any requirement of continued employment, or (II) to the extent you have not

timely executed or have revoked the Release Agreement, such Performance-Based Equity Awards will be forfeited for no consideration. The

Company shall prorate the portion of each unvested Performance-Based Equity Award described in subsection (y) above based on the

number of days of your employment during the performance period as compared to the total number of days in such performance period, with

such prorated portion of such Performance-Based Equity Awards eligible to vest and become exercisable at the end of the fiscal year in

which the Date of Termination occurs, based on the actual level of achievement of such performance objective(s) as of end of the

applicable fiscal year (with the applicable performance objective(s) prorated for any shortened performance period). Any such determination

by the Company shall be final and binding on all persons (including, without limitation, you). Notwithstanding anything to the contrary

herein, settlement upon vesting (if any) of such Performance-Based Equity Awards described in subsection (ii) shall occur no later

than March 15 of the calendar year immediately following the calendar year of the Date of Termination (or otherwise in compliance

with Section 409A as required by their terms). For the avoidance of doubt, any Performance-Based Equity Award with respect to which

performance vesting conditions have been determined to be fully satisfied prior to or as of the Date of Termination (or, which, in connection

with a Change in Control or otherwise, was converted into an Equity Award solely subject to time-based vesting) shall be deemed to be

a Time-Based Equity Award for purposes of this Severance Agreement.

(5) Subject

to the provisions of Sections 3(c) and 7, (I) the Non-CIC Severance Payment shall be paid in equal installments during the Severance

Period in accordance with the Company’s normal payroll practices beginning on the first payroll date following the 60th day following

the Date of Termination (such payroll date, the “Severance Commencement Date”), and with the first installment including

any amounts that would have been paid had the Release Agreement been effective and irrevocable on the Date of Termination, (II) the

Pro Rata Bonus shall be paid at the same time as annual bonus payments are made to similarly situated employees of the Company for the

applicable year, but in no event shall be paid earlier than January 1 or later than December 31 of the calendar year following

the year of termination, and (III) the Continued Benefit Payment shall be paid in lump sum on the Severance Commencement Date, in

each case, less applicable federal, state and other applicable withholdings.

(ii) If

the Company terminates your employment without Cause (other than as a result of your death or Disability) or if you terminate your employment

with Good Reason, in each case, during the Change in Control Protection Period, then, in addition to the Accrued Benefits, the Company

will provide you the following severance and related post-termination benefits:

(1) The

Company shall pay to you a cash lump sum payment in an amount equal to (A) the sum of twelve (12) months of your Base Pay as in effect

immediately prior to the Date of Termination and your target Annual Bonus for the calendar year in which the Date of Termination occurs

(or in the case of termination by you with Good Reason due to material reduction in Base Pay and/or target Annual Bonus, your Base Pay

and/or target Annual Bonus in effect immediately prior to such reduction, as applicable) (the “CIC Severance Payment”),

and (B) the Pro Rata Bonus;

(2) The

Company shall pay you an amount equal to the aggregate sum of the Company’s share of medical, dental and vision insurance premiums

for you and your dependents for the period commencing on the Date of Termination and ending on the first anniversary thereof (as if you

had remained employed and based on coverage as of immediately prior to termination). For the avoidance of doubt, if immediately prior

to the termination of your employment you were required to contribute towards the cost of premiums as a condition of receiving such insurance,

the payment hereunder will not cover any such contributions; and

(3) Unless

otherwise explicitly set forth in the award agreement for the applicable Equity Award, any unvested Equity Awards outstanding immediately

prior to the Date of Termination shall automatically become fully vested and exercisable (as applicable) as of the Date of Termination;

provided that any Performance-Based Equity Award shall vest assuming a target level of achievement for each applicable performance objective(s).

(4) Subject

to the provisions of Sections 3(c) and 7, (I) the CIC Severance Payment shall be made in a lump sum on the Severance Commencement

Date, (II) the Pro Rata Bonus shall be paid at the same time as annual bonus payments are made to similarly situated employees of

the Company for the applicable year, but in no event shall be paid earlier than January 1 or later than December 31 of the calendar

year following the year of termination, and (III) the Continued Benefit Payment shall be paid in lump sum on the Severance Commencement

Date, in each case, less applicable federal, state and other applicable withholdings.

(c) Release.

Any amounts payable pursuant to Section 3(b)(i) or Section 3(b)(ii), as applicable (collectively, the “Severance

Benefits”), shall be in lieu of notice or any other severance benefits to which you might otherwise be entitled from any Ribbon

Entity. Notwithstanding anything to the contrary herein, the Company’s provision of the Severance Benefits will be contingent upon

your timely execution and non-revocation of a general waiver and release of claims agreement in a form to be provided by the Company (a

“Release Agreement”), subject to the terms set forth herein. You will have twenty-one (21) days (or, in the event that

your termination of employment is “in connection with an exit incentive or other employment termination program” (as such

phrase is defined in the Age Discrimination in Employment Act of 1967, as amended), forty-five (45) days) following your receipt of the

Release Agreement to consider whether or not to accept it. If the Release Agreement is signed and delivered by you to the Company, you

will have seven (7) days from the date of delivery to revoke your acceptance of such agreement (the “Revocation Period”).

If you do not timely execute or if you subsequently revoke the Release Agreement, you shall be required to pay to the Company, immediately

upon demand therefor, the amount of any payments or benefits you received in connection with any portion of Equity Awards that was eligible

to vest pursuant to Section 3(b) (including, without limitation, proceeds received or realized by you from the sale or surrender

of any shares underlying such Equity Awards in connection with applicable tax withholding).

(d) The

provisions of this Section 3 shall supersede in their entirety any severance payment provisions in any severance plan, severance

policy, severance program or other severance arrangement maintained by the Company or any of its affiliates (or any of their respective

predecessors). The Company shall have no further obligation to you in the event of termination of your employment for any reason at any

time, other than those obligations specifically set forth in this Section 3.

4. Resignation

from Board, Officer and Other Positions. Unless otherwise determined by the Board, in the event that your employment is terminated

for any reason (whether during or after the Term), you shall be deemed, effective as of the date of such termination, to resign (a) if

a director, from the Board or similar board of directors of any direct or indirect parent, subsidiary or affiliate of the Company and

(b) from any position with the Company or any direct or indirect parent, subsidiary or affiliate of the Company, including as an

officer of the Company or any of its direct or indirect parents, subsidiaries or affiliates.

5. Mitigation.

You shall not be required to mitigate the amount of any payment or benefit provided for in Section 3 by seeking other employment

or otherwise, nor shall the amount of any payment or benefit provided for in Section 3 be reduced by any compensation earned by you

as the result of employment by another employer or by retirement benefits after the Date of Termination or otherwise, subject to Section 6;

provided, however, that any loans, advances or other amounts owed by you to the Company may be offset by the Company and

its affiliates against amounts payable to you under Section 3 to the greatest extent permitted by applicable law.

6. Restrictive

Covenants and Other Conditions. You acknowledge and agree that you are a party to that certain Restrictive Covenant Agreement, and

such agreement remains in full force and effect. In the event of (a) your material breach of the Restrictive Covenant Agreement,

(b) your engagement in any act or omission after the Date of Termination that would have constituted “Cause” under subsections

(ii) through (iv), (xii) or (xiii) of the definition thereof (without regard for any cure periods therein) for termination

of your employment had you remained employed after the Date of Termination, or (c) the Company’s determination in good faith

that facts or circumstances existed on the Date of Termination that, if known by the Company on the Date of Termination, would have constituted

Cause, the Company shall be entitled to cease all payments and benefits pursuant to Section 3(b), all Equity Awards that vested pursuant

to Section 3(b) and any shares of Company stock you received with respect thereto shall immediately be forfeited, without payment

therefor, and you shall be required to pay to the Company, immediately upon demand therefor, the amount of any proceeds realized by you

from the sale of any such shares.

7. Section 409A

Tax Implications. Any payments or benefits required to be provided under this Agreement that is subject to Section 409A of the

Code shall be provided only after the date of your “separation from service” with the Company as defined under Section 409A

of the Code and the regulations and guidance issued thereunder (collectively, “Section 409A”). The following rules shall

apply with respect to distribution of the payments and benefits, if any, to be provided to you under this Agreement:

(a) To

the extent applicable, this Agreement shall be interpreted in accordance with Section 409A. Each installment of the payments and

benefits provided hereunder shall be treated as a separate “payment” for purposes of Section 409A. If and to the extent

(i) any portion of any payment, compensation or other benefit provided to you pursuant to this Agreement in connection with your

termination of employment constitutes “nonqualified deferred compensation” within the meaning of Section 409A and (ii) you

are a specified employee as defined in Section 409A(a)(2)(B)(i) of the Code, in each case as determined by the Company in accordance

with its procedures, by which determinations you agree that you are bound, such portion of the payment, compensation or other benefit

shall not be paid until the first business day that is six (6) months plus one (1) day or more after the date of “separation

from service” (as determined under Section 409A) (the “New Payment Date”), except such earlier date as Section 409A

may then permit. The aggregate of any payments that otherwise would have been paid to you during the period between the date of separation

from service and the New Payment Date shall be paid to you in a lump sum on such New Payment Date, and any remaining payments will be

paid on their original schedule.

(b) The

Company and its employees, agents and representatives make no representations or warranty and shall have no liability to you or any other

person if any provisions of or payments, compensation or other benefits under this Agreement are determined to constitute nonqualified

deferred compensation subject to Section 409A but do not satisfy the conditions of that section. Notwithstanding any provision of

this Agreement to the contrary, in the event that following the Effective Date the Board determines that this Agreement may be subject

to Section 409A, the Board may (but is not obligated to), without your consent, adopt such amendments to this Agreement or adopt

other policies and procedures (including amendments, policies and procedures with retroactive effect), or take any other actions, that

the Board determines are necessary or appropriate to (i) exempt this Agreement from Section 409A and/or preserve the intended

tax treatment of the benefits provided with respect to this Agreement or (ii) comply with the requirements of Section 409A and

thereby avoid the application of any penalty taxes under Section 409A.

8. Section 280G.

If any payment or benefit you would receive or retain under this Severance Agreement, when combined with any other payment or benefit

you receive or retain in connection with a “change in control event” within the meaning of Section 280G of the Code and

the regulations and guidance thereunder (“Section 280G”), would (a) constitute a “parachute payment”

within the meaning of Section 280G of the Code, and (b) but for this Section 8, be subject to the excise tax imposed by

Section 4999 of the Code (the “Excise Tax”), then such Payment shall be either payable in full or in such lesser

amount as would result in no portion of the Payment being subject to the Excise Tax, whichever of the foregoing amounts, taking into account

the applicable federal, state and local employment taxes, income taxes, and the Excise Tax, results in your receipt, on an after-tax basis,

of the greater amount of the Payment notwithstanding that all or some portion of the Payment may be subject to the Excise Tax. All determinations

required to be made under this Section 8, including whether and to what extent the Payment shall be reduced and the assumptions to

be utilized in arriving at such determination, shall be made by a nationally recognized certified public accounting firm or consulting

firm experience in matters regarding Section 280G of the Code as may be designated by the Company (the “280G Advisor”).

The 280G Advisor shall provide detailed supporting calculations both to you and the Company at such time as is requested by the Company.

All fees and expenses of the 280G Advisor shall be borne solely by the Company. Any final determination by the 280G Advisor shall be binding

upon you and the Company. For purposes of making the calculations required by this Section 8, the 280G Advisor may make reasonable

assumptions and approximations concerning applicable taxes and may rely on reasonable, good-faith interpretations concerning the application

of Sections 280G and 4999 of the Code.

9. Withholding.

The Company shall be entitled to withhold from any amounts payable under this Agreement any federal, state, local or foreign withholding

or other taxes or charges that the Company is required to withhold. The Company shall be entitled to rely on an opinion or advice of counsel

if any questions as to the amount or requirement of withholding arise.

| (a) | This Agreement, together with any written employment agreement or offer letter to which you may be a party

and any agreements referenced herein, will constitute our entire agreement as to your employment by the Company and will supersede any

prior agreements or understandings, whether in writing or oral, with respect to the subject matter hereof, other than with respect to

any agreements between you and the Company with respect to confidential information, intellectual property, non-competition, non-solicitation,

non-disparagement, nondisclosure of proprietary information, inventions and injunctive relief, including, without limitation, the Restrictive

Covenant Agreement. |

| (b) | This Agreement may be executed in more than one counterpart, each of which shall be deemed to be an original,

and all such counterparts together shall constitute one and the same instrument. |

| (c) | The provisions of this Agreement are severable and if any one or more provisions may be determined to

be illegal or otherwise unenforceable, in whole or in part, the remaining provisions of this Agreement shall nevertheless be binding and

enforceable and except to the extent necessary to reform or delete such illegal or unenforceable provision, this Agreement shall remain

unmodified and in full force and effect. |

| (d) | This Agreement is personal in nature and neither of the parties hereto shall, without the written consent

of the other, assign or otherwise transfer this Agreement or its obligations, duties and rights under this Agreement; provided, however,

that in the event of the merger, consolidation, transfer or sale of all or substantially all of the assets of the Company, the Company

may assign its rights and obligations hereunder and, in the event of such assignment, this Agreement shall, subject to the provisions

hereof, be binding upon and inure to the benefit of such successor and such successor shall be solely obligated to discharge and perform

all of the promises, covenants, duties and obligations of the Company hereunder. |

| (e) | All notices shall be in writing and shall be delivered personally (including by courier), by overnight

receipted courier service (such as UPS or Federal Express) or sent by certified, registered or express mail, postage prepaid, to the Company

at the following address: Ribbon Communications Legal Department, 6500 Chase Oaks Blvd, Ste 100, Plano, Texas 75073, Attn: Head of Legal,

and to you at the most current address we have in your employment file. Any such notice shall be deemed given when so delivered personally

or, if by certified, registered or express mail, postage prepaid mailed, forty-eight (48) hours after the date of deposit in the mail.

Any party may, by notice given in accordance with this paragraph to the other party, designate another address or person for receipt of

notices hereunder. |

| (i) | Any controversy, dispute or claim arising out of or relating to this Agreement or the breach hereof which

cannot be settled by mutual agreement will be finally settled by binding arbitration in the county where you performed your principal

work duties for the Company, under the jurisdiction of the American Arbitration Association or other mutually agreeable alternative arbitration

dispute resolution service, before a single arbitrator appointed in accordance with the arbitration rules of the American Arbitration

Association or other selected service, modified only as herein expressly provided. You acknowledge receipt of the applicable AAA Employment

Arbitration Rules and Mediation Procedures which may be found at the AAA website here https://www.adr.org/Rules. The arbitrator may

enter a default decision against any party who fails to participate in the arbitration proceedings. |

| ii. | The Federal Arbitration Act, 9 U.S.C. §§ 1 et seq. shall govern the interpretation and enforcement

of this arbitration clause. The decision of the arbitrator on the points in dispute will be final, non-appealable and binding, and judgment

on the award may be entered in any court having jurisdiction thereof. |

| iii. | The fees and expenses of the arbitration will be borne as provided in the AAA Costs of Arbitration section,

and each party will bear the fees and expenses of its own attorney, unless the arbitrator finds that a statutory award of attorneys’

fees and/or costs is appropriate. |

| iv. | The parties waive their rights to a class or collective action. The parties agree that claims may not

be joined, consolidated, or heard together with claims of any other current or former employee of the Company or other third party. |

| v. | The parties agree that this Section 10(f) has been included to resolve any disputes between

them with respect to this Agreement or your employment, and that this Section 10(f) will be grounds for dismissal of any court

action commenced by either party with respect to this Agreement, other than post-arbitration actions seeking to enforce an arbitration

award or actions seeking an injunction or temporary restraining order and other than claims for unemployment insurance benefits or workers

compensation benefits or other claims which by law cannot be subject to a mandatory arbitration agreement. In the event that any court

determines that this arbitration procedure is not binding, or otherwise allows any litigation regarding a dispute, claim, or controversy

covered by this Agreement to proceed, the parties hereto hereby waive, to the maximum extent allowed by law, any and all right to a class

or collection action or a trial by jury in or with respect to such litigation. |

| vi. | The parties will keep confidential, and will not disclose to any person, except as may be required by

law or the rules and regulations of the Securities and Exchange Commission or other government agencies, the existence of any controversy

hereunder, the referral of any such controversy to arbitration or the status or resolution thereof; notwithstanding the foregoing, nothing

herein shall restrict you from communicating with a government agency or engaging in protected concerted activity that cannot be waived

by such an agreement not to disclose. |

| (g) | This Agreement shall be governed by and interpreted in accordance with the laws of the State of Delaware,

without regard to the conflict of laws provisions thereof or of any other jurisdiction. |

11. Acceptance.

You may accept the terms and conditions described herein by confirming your acceptance in writing. Please send your countersignature to

this Agreement to the Company, or via e-mail to me, which execution will evidence your agreement with the terms and conditions set forth

herein.

* * * * *

IN WITNESS WHEREOF, each of the parties has executed

this Severance Agreement, in the case of the Company by its duly authorized officer, as of the day and year first above written.

| EXECUTIVE: |

|

| |

|

|

| /s/ John Townsend |

|

| John Townsend |

|

| |

|

|

| COMPANY: |

|

| |

|

|

| By: |

/s/ Bruce McClelland |

|

| |

Name: Bruce McClelland |

|

| |

Title: President, Chief Executive Officer and Director |

|

Signature Page to Severance Agreement

Exhibit 10.3

Ribbon Communications Inc.

Restricted Stock Unit Award Agreement (Share

Price-Based Vesting – Inducement Grant)

THIS RESTRICTED STOCK UNIT AWARD AGREEMENT (the

“Agreement”), is made effective as of October 15, 2024 (the “Grant Date”), between Ribbon Communications

Inc., a Delaware corporation (the “Company”), and John Townsend (the “Participant”).

RECITALS

WHEREAS, the Board has determined that it is in the best interests

of the Company and its stockholders to, as an inducement material to the decision by the Participant to accept employment with the Company,

grant to the Participant the Restricted Stock Units (as defined below) described herein pursuant to the terms set forth below; and

WHEREAS, the award of the Restricted Stock Units pursuant to this Agreement

(this “Award”) is being made and granted as a stand-alone award and not granted under the Ribbon Amended and Restated 2019

Incentive Award Plan, as amended (the “Plan”).

NOW THEREFORE, in consideration of the mutual covenants hereinafter

set forth, the parties agree as follows:

1. Award

of Restricted Stock Units.

(a) Subject

to the terms and conditions of the Plan and this Agreement and in consideration of employment services rendered and to be rendered by

the Participant to the Company, the Company hereby grants to the Participant 314,583 restricted stock units (the “Restricted Stock

Units” or “PSUs”). Each Restricted Stock Unit entitles the Participant to such number of shares of Common Stock, subject

to continued employment, upon vesting as is determined pursuant to Section 2 hereof.

(b) This

Award is being made and granted as a stand-alone award, separate and apart from, and outside of, the Plan, and shall not constitute an

award granted under or pursuant to the Plan. Notwithstanding the foregoing, the terms, conditions and definitions set forth in the Plan

(other than Section 11(i) of the Plan) shall apply to the Agreement and the Restricted Stock Units awarded hereunder as if the

Restricted Stock Units had been granted under the Plan, and the Agreement shall be subject to such terms, conditions and definitions,

which are hereby incorporated into this Agreement by reference (and any references to the Plan in this Agreement shall solely be interpreted

to be references to the substance of the provisions of the Plan so incorporated, but shall not in any way imply or indicate that this

Award was granted under the Plan). For the avoidance of doubt, the Restricted Stock Units awarded under this Agreement shall not be counted

for purposes of calculating the aggregate number of shares of Common Stock that may be issued or transferred pursuant to awards under

the Plan as set forth in Section 4(a) of the Plan. In the event of any inconsistency between the Plan and this Agreement, the

terms of this Agreement shall control.

(c) This

Award is intended to constitute an “employment inducement grant” under NASDAQ Listing Rule 5635(c)(4), and consequently

is intended to be exempt from the NASDAQ rules regarding shareholder approval of stock option and stock purchase plans. This Agreement

and the terms and conditions of the PSUs shall be interpreted in accordance and consistent with such exemption.

| 2. | Vesting of Restricted Stock Units. |

(a) Upon

the vesting of the Award, as described in this Section and Schedule 1 attached hereto, the Company shall deliver for each

Restricted Stock Unit that vests, the number of shares of Common Stock as is determined pursuant to Schedule 1. The Common Stock

shall be delivered as soon as practicable following the Vesting Date (as defined in Schedule 1), but in any case within 30 days

after such date.

(b) Subject

to Section 2(c) and Section 3, the Restricted Stock Units shall vest in accordance with the terms set forth in Schedule

1 attached hereto.

(c) Notwithstanding

Section 2(b), upon the Participant’s termination of employment, the Award shall become subject to the acceleration of vesting

to the extent provided in Schedule 1 attached hereto or under the terms of the Participant’s Severance Agreement, subject

to any terms and conditions set forth in the Plan or imposed by the Board (including in Schedule 1 hereto). In this Agreement,

“Severance Agreement” as of any date means the severance agreement between Participant and the Company or one of its subsidiaries,

as in effect on such date.

3. Termination

of Employment. Subject to Section 2(c) and notwithstanding any other provision of the Plan to the contrary, upon the Participant’s

Date of Termination (as defined in the Severance Agreement), the Award, to the extent not yet vested, shall immediately and automatically

terminate and be forfeited without consideration, and subject to the Company’s compliance with applicable minimum requirements of

applicable employment standards legislation, the Participant waives any claim to damages (whether at common law or otherwise) in respect

thereof; provided, however, that the Board may, in its sole and absolute discretion agree to accelerate the vesting of the

Award, upon termination of employment or otherwise, for any reason or no reason, but shall have no obligation to do so.

4. No

Assignment. Except as expressly permitted under the Plan, this Agreement may not be assigned by the Participant by operation of law

or otherwise.

5. No

Rights to Continued Employment. The granting of this Award evidenced hereby and this Agreement shall impose no obligation on the Company

or any of its affiliates to continue the employment or service of the Participant and shall not lessen or affect any right that the Company

or any of its affiliates may have to terminate the service of such Participant.

6. Governing

Law. This Agreement will be governed by and interpreted and construed in accordance with the internal laws of the State of Delaware

(without reference to principles of conflicts or choice of law) as to all matters, including, but not limited to, matters of validity,

construction, effect, performance and metrics.

7. Tax

Obligations. As a condition to the granting of the Award and the vesting and settlement thereof, the Participant acknowledges and

agrees that he/she is responsible for the payment of income and employment taxes (and any other taxes required to be withheld) payable

in connection with the vesting and settlement of an Award. Accordingly, the Participant agrees to remit to the Company or any applicable

subsidiary an amount sufficient to pay such taxes. Such payment shall be made to the Company or the applicable subsidiary of the Company

in a form that is reasonably acceptable to the Company, as the Company may determine in its sole discretion. Notwithstanding the foregoing,

the Company may retain and withhold from delivery at the time of vesting or settlement that number of shares of Common Stock having a

fair market value equal to the taxes owed by the Participant, which retained shares shall fund the payment of such taxes by the Company