Rhythm Pharmaceuticals Reports Second Quarter 2019 Financial Results

July 29 2019 - 4:01PM

Rhythm Pharmaceuticals, Inc. (Nasdaq:RYTM), a biopharmaceutical

company focused on the development and commercialization of

therapeutics for the treatment of rare genetic disorders of

obesity, today reported financial results and provided a business

update for the second quarter ended June 30, 2019.

“In recent months, we have made great strides toward achieving

our foundational goals of changing the treatment paradigm for rare

genetic disorders of obesity and delivering setmelanotide as the

first-approved therapy for people living with these conditions,”

said Keith Gottesdiener, M.D., Chief Executive Officer of Rhythm.

“We look forward to building on this momentum in the months ahead.

We are on track to announce topline data from our two pivotal

trials in POMC and LEPR deficiency obesity in the third quarter of

2019, and we are actively preparing for our first new drug

application.”

Dr. Gottesdiener continued, “We are making significant progress

across the Rhythm Engine. Our GO-ID genotyping study is enrolling

patients ahead of schedule, with several new sites coming online in

the second quarter. We are receiving additional sequencing

data through new collaborations with multiple biobanks, and our

recently launched Uncovering Rare Obesity program is supporting

patient identification and helping identify underlying genetic

causes of obesity. As we expand our efforts to educate physicians

and patient advocacy groups on these conditions and the potential

benefits of genetic sequencing, we are building a new community of

patients, families and health care providers focused on rare

genetic disorders of obesity in both the United States and

Europe.”

Second Quarter and Recent Business

Highlights:

- In July 2019, Rhythm announced the launch of Uncovering Rare

Obesity, a Rhythm-sponsored genetic testing program designed to

broaden access to genetic testing and to determine the underlying

genetic cause of severe obesity. This program may help identify

patients eligible for participation in Rhythm’s ongoing clinical

research programs.

- In July 2019, Rhythm announced that the European Medicines

Agency’s Committee for Orphan Medicinal Products issued a positive

opinion recommending setmelanotide for designation as an orphan

medicinal product for the treatment of patients with Bardet-Biedl

syndrome (BBS).

- Rhythm recently added two new members to its Board of

Directors. In July 2019, the Company announced the appointment of

Stuart Arbuckle, Executive Vice President and Chief Commercial

Officer of Vertex Pharmaceuticals, to the Board. In June 2019,

Jennifer Good, Co-founder, President and Chief Executive Officer of

Trevi Therapeutics, Inc., was elected to the Board at the Company’s

annual general meeting of stockholders. Neil Exter, a partner at

Third Rock Ventures and member of the Company’s Board of Directors

since April 2014, stepped down from the board as he did not seek

re-election.

Upcoming Milestones:

- Rhythm expects to announce topline data from its two pivotal

Phase 3 trials of setmelanotide in pro-opiomelanocortin (POMC) and

leptin receptor (LEPR) deficiency obesities in the third quarter of

2019. Pending positive results, the Company plans to submit one new

drug application (NDA) to the U.S. Food and Drug Administration

(FDA) for setmelanotide in patients with these indications at the

end of 2019 or early 2020.

- Rhythm remains on track to complete pivotal enrollment in its

combined Phase 3 trial evaluating setmelanotide in BBS and

Alström syndrome in the second half of 2019, with topline data

expected in 2020.

- Rhythm expects to provide an update on ongoing efforts to

increase patient identification in the fourth quarter of 2019.

- Rhythm expects to announce an expansion of its ongoing Phase 2

basket studies with additional MC4R pathway disorders in the fourth

quarter of 2019.

- Rhythm expects to announce additional data from its ongoing

Phase 2 basket study of setmelanotide in HET obesity in 2020.

- Rhythm expects to submit an investigational new drug (IND)

application for RM-853, its ghrelin o-acyltransferase (GOAT)

inhibitor for the treatment of Prader-Willi Syndrome, to the FDA in

2020.

Second Quarter 2019 Financial Results:

- Cash Position: As

of June 30, 2019, cash, cash equivalents and short-term

investments were $195.2 million, as compared to $252.1

million as of December 31, 2018. This decrease reflects

cash used to fund operating activities in the first half of

2019. Based on its current clinical

development plans, Rhythm expects that its existing cash and cash

equivalents and short-term investments will enable it to fund its

operations into the fourth quarter of 2020.

- R&D

Expenses: R&D expenses

were $35.3 million for the second quarter of 2019, as

compared to $8.6 million for the second quarter of 2018.

The increase was primarily due to an increase in setmelanotide

clinical trial activity of $12.5 million, primarily due to the

expansions of the GO-ID genotyping study and Phase 2 basket study

with new trial sites for both studies, as well as ongoing

enrollment in the Phase 3 study of setmelanotide in patients with

BBS and Alström syndrome. Additional drivers of the R&D

increase were: an increase of $4.6 million related to translational

research and genetic sequencing efforts designed to improve

identification of patients with MC4R pathway deficiencies; an

increase of $4.8 million primarily related to the purchases of

setmelanotide active pharmaceutical ingredient (API) for clinical

trials and commercial scale up and pre-IND work for RM-853; and an

increase of $2.3 million due to the hiring of additional personnel

related to community building and education efforts for physicians,

care providers and patients who are facing rare genetic disorders

of obesity.

- S,G&A

Expenses: S,G&A expenses

were $8.8 million for the second quarter of 2019, as

compared to $6.4 million for the second quarter of 2018.

The increase was primarily due to an increase of $1.9 million in

headcount-related expenses and an increase of $0.2 million in

efforts to drive disease awareness about rare genetic causes of

obesity and prepare for the potential commercial launch of

setmelanotide in the U.S.

- Net Loss: Net loss

was $42.8 million for the second quarter of 2019, or a

net loss per basic and diluted share of $1.24, as compared to

a net loss of $14.4 million for the second quarter of

2018, or a net loss per basic and diluted share of $0.52.

Year to Date Financial Results:

- R&D Expenses: R&D expenses

were $58.1 million for the six months ended June 30,

2019, as compared to $20.9 million for the six months ended

June 30, 2018. The increase was primarily due to an increase in

setmelanotide clinical trial activity of $19.8 million, primarily

due to the expansions of the GO-ID genotyping study and Phase 2

basket study, as well as ongoing enrollment in the Phase 3 study of

setmelanotide in patients with BBS and Alström syndrome.

Additional drivers of the R&D increase were: an increase of

$7.5 million related to translational research and genetic

sequencing efforts designed to improve identification of patients

with MC4R pathway deficiencies; an increase of $6.0 million

primarily related to purchases of setmelanotide API for clinical

trials and commercial scale up and pre-IND work for RM-853; and an

increase of $4.7 million in employee-related costs due to the

hiring of additional personnel; an increase of $1.8 million in

consulting and professional services associated with the creation

of Rhythm’s EU Medical Science Liaison field force and various

medical communication programs. The above increases were partially

offset by a decrease of $4.4 million due to the non-cash expense

related to the license acquired from Takeda for RM-853 in March

2018.

- S,G&A Expenses: S,G&A expenses

were $16.6 million for the six months ended June 30,

2019, as compared to $11.2 million for the six months ended

June 30, 2018. The increase was primarily due to an increase of

$3.7 million in headcount-related expenses and an increase of $1.5

million in efforts to drive disease awareness about rare genetic

causes of obesity and prepare for the potential commercial launch

of setmelanotide in the U.S.

- Net Loss: Net loss was $71.8

million for the six months ended June 30, 2019, or a net loss

per basic and diluted share of $2.08, as compared to a net

loss of $30.9 million for the six months ended June 30,

2018, or a net loss per basic and diluted share of $1.12.

About Rhythm Pharmaceuticals

Rhythm is a biopharmaceutical company focused on the development

and commercialization of therapies for the treatment of rare

genetic disorders of obesity. Rhythm is currently evaluating the

efficacy and safety of setmelanotide, the company’s first-in-class

MC4R agonist, in Phase 3 studies in patients with

Pro-opiomelanocortin (POMC) deficiency obesity, Leptin receptor

(LEPR) deficiency obesity, Bardet-Biedl syndrome, and Alström

syndrome. The company is leveraging the Rhythm Engine -- comprised

of its Phase 2 basket study, TEMPO Registry, GO-ID genotyping study

and Uncovering Rare Obesity program -- to improve the

understanding, diagnosis and potentially the treatment of rare

genetic disorders of obesity. For healthcare professionals,

visit www.UNcommonObesity.com for more information. For

patients and caregivers,

visit www.LEADforRareObesity.com for more information.

The company is based in Boston, MA.

Forward-Looking Statements

This press release contains certain statements that are

forward-looking within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and that involve risks

and uncertainties, including statements regarding Rhythm’s

anticipated timing for enrollment and design of clinical trials,

the timing for filing of a new drug application, its ongoing

efforts related to patient identification, the release of results

of clinical trials, and its sufficiency of cash. Statements using

word such as “expect”, “anticipate”, “believe”, “may”, “will” and

similar terms are also forward looking statements. Such

statements are subject to numerous risks and uncertainties,

including but not limited to, our ability to enroll patients in

clinical trials, the design and outcome of clinical trials, the

impact of competition, the ability to achieve or obtain necessary

regulatory approvals, risks associated with data analysis and

reporting, and expenses, and other risks as may be detailed from

time to time in our Annual Reports on Form 10-K and quarterly

reports on Form 10-Q and other reports we file with the

Securities and Exchange Commission. Except as required by law, we

undertake no obligations to make any revisions to the

forward-looking statements contained in this release or to update

them to reflect events or circumstances occurring after the date of

this release, whether as a result of new information, future

developments or otherwise.

Rhythm Pharmaceuticals,

Inc.Condensed Consolidated Statements of

Operations and Comprehensive Loss(in thousands,

except share and per share data)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended June 30, |

|

Six months ended June 30, |

| |

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

$ |

35,308 |

|

|

$ |

8,584 |

|

|

$ |

58,069 |

|

|

$ |

20,870 |

|

|

Selling, general, and administrative |

|

|

|

8,841 |

|

|

|

6,437 |

|

|

|

16,600 |

|

|

|

11,152 |

|

|

Total operating expenses |

|

|

|

44,149 |

|

|

|

15,021 |

|

|

|

74,669 |

|

|

|

32,022 |

|

| Loss from operations |

|

|

|

(44,149 |

) |

|

|

(15,021 |

) |

|

|

(74,669 |

) |

|

|

(32,022 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net |

|

|

|

1,353 |

|

|

|

609 |

|

|

|

2,899 |

|

|

|

1,151 |

|

|

Total other income: |

|

|

|

1,353 |

|

|

|

609 |

|

|

|

2,899 |

|

|

|

1,151 |

|

|

Net loss and comprehensive loss |

|

|

$ |

(42,796 |

) |

|

$ |

(14,412 |

) |

|

$ |

(71,770 |

) |

|

$ |

(30,871 |

) |

| Net loss attributable to

common stockholders |

|

|

$ |

(42,796 |

) |

|

$ |

(14,412 |

) |

|

$ |

(71,770 |

) |

|

$ |

(30,871 |

) |

| Net loss per share

attributable to common stockholders, basic and diluted |

|

|

$ |

(1.24 |

) |

|

$ |

(0.52 |

) |

|

$ |

(2.08 |

) |

|

$ |

(1.12 |

) |

| Weighted average common shares

outstanding, basic and diluted |

|

|

|

34,452,661 |

|

|

|

27,960,664 |

|

|

|

34,435,023 |

|

|

|

27,624,271 |

|

Rhythm Pharmaceuticals,

Inc.Condensed Consolidated Balance

Sheets(in thousands, except share and per share

data)

| |

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

June 30, |

|

December 31, |

| |

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

63,118 |

|

|

$ |

49,542 |

|

|

Short-term investments |

|

|

132,049 |

|

|

|

202,519 |

|

|

Prepaid expenses and other current assets |

|

|

8,334 |

|

|

|

6,628 |

|

|

Total current assets |

|

|

203,501 |

|

|

|

258,689 |

|

| Property and equipment,

net |

|

|

3,901 |

|

|

|

1,120 |

|

| Right-of-use asset |

|

|

3,085 |

|

|

|

— |

|

| Restricted cash |

|

|

401 |

|

|

|

401 |

|

|

Total assets |

|

$ |

210,888 |

|

|

$ |

260,210 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

6,565 |

|

|

$ |

7,640 |

|

|

Accrued expenses and other current liabilities |

|

|

19,146 |

|

|

|

5,942 |

|

|

Lease liability |

|

|

379 |

|

|

|

— |

|

|

Total current liabilities |

|

|

26,090 |

|

|

|

13,582 |

|

| Long-term liabilities: |

|

|

|

|

|

|

| Lease liability |

|

|

3,331 |

|

|

|

— |

|

| Deferred rent |

|

|

— |

|

|

|

372 |

|

|

Total liabilities |

|

|

29,421 |

|

|

|

13,954 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred Stock, $0.001 par value: 10,000,000 shares authorized; no

shares issued and outstanding at June 30, 2019 and

December 31, 2018, respectively |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value: 120,000,000 shares authorized;

34,497,542 and 34,410,725 shares issued and outstanding

June 30, 2019 and December 31, 2018,

respectively |

|

|

34 |

|

|

|

34 |

|

|

Additional paid-in capital |

|

|

437,805 |

|

|

|

430,824 |

|

|

Accumulated deficit |

|

|

(256,372 |

) |

|

|

(184,602 |

) |

|

Total stockholders’ equity |

|

|

181,467 |

|

|

|

246,256 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

210,888 |

|

|

$ |

260,210 |

|

Corporate Contact: David ConnollyHead of

Investor Relations and Corporate CommunicationsRhythm

Pharmaceuticals, Inc. 857-264-4280dconnolly@rhythmtx.com

Investor Contact:Hannah DeresiewiczStern

Investor Relations,

Inc.212-362-1200hannah.deresiewicz@sternir.com

Media Contact:Adam Daley Berry & Company

Public Relations212-253-8881adaley@berrypr.com

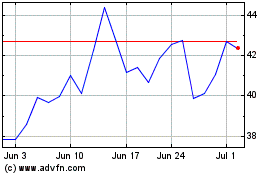

Rhythm Pharmaceuticals (NASDAQ:RYTM)

Historical Stock Chart

From Oct 2024 to Nov 2024

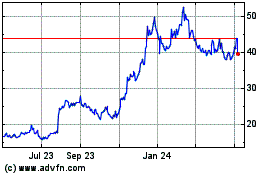

Rhythm Pharmaceuticals (NASDAQ:RYTM)

Historical Stock Chart

From Nov 2023 to Nov 2024