Form 8-K - Current report

February 06 2024 - 9:35AM

Edgar (US Regulatory)

false

0001069533

0001069533

2024-02-05

2024-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): February 5, 2024

RGC RESOURCES, INC.

(Exact name of Registrant as specified in its charter)

|

Virginia

|

000-26591

|

54-1909697

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

519 Kimball Ave., N.E. Roanoke, Virginia

|

24016

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: 540-777-4427

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading

Symbol

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $5 Par Value

|

RGCO

|

NASDAQ Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 if the Securities Exchange Act of 1934.

| |

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

ITEM 2.02.

|

RESULTS OF OPERATIONS AND FINANCIAL CONDITION

|

On February 5, 2024, RGC Resources, Inc. issued a press release announcing the results for the first quarter ending December 31, 2023. A copy of this press release is attached hereto as Exhibit 99.1 and is hereby incorporated by reference.

The press release attached hereto as Exhibit 99.1 is also incorporated into this Item 8.01 by reference and therefore deemed "filed" for purposes of the Securities Exchange Act of 1934, as amended.

|

ITEM 9.01.

|

FINANCIAL STATEMENTS AND EXHIBITS

|

| |

99.1

|

|

| |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RGC RESOURCES, INC.

|

|

| |

|

|

|

|

Date: February 6, 2024

|

By:

|

/s/ Timothy J. Mulvaney

|

|

| |

|

Timothy J. Mulvaney |

|

| |

|

Vice President, Treasurer and Chief Financial Officer |

|

Exhibit 99.1

NEWS RELEASE

RGC RESOURCES, INC.

|

Release Date:

|

February 5, 2024

|

|

Contact:

|

Timothy J. Mulvaney |

| |

Vice President, Treasurer and CFO |

|

Telephone:

|

540-777-3997

|

RGC RESOURCES, INC. REPORTS

FIRST QUARTER EARNINGS

ROANOKE, Va. (February 5, 2024)--RGC Resources, Inc. (NASDAQ: RGCO) announced consolidated Company earnings of $5,019,992, or $0.50 per share, for the first quarter ended December 31, 2023, compared to $3,256,405, or $0.33 per share, for the fiscal quarter ended December 31, 2022. The increase over the quarter a year ago included nearly $1.5 million in earnings from the Company’s investment in the Mountain Valley Pipeline, LLC (“MVP”) as well as improved utility margins.

Roanoke Gas continued to make investments in utility infrastructure to improve system reliability and deliver gas to new customers to drive earnings. CEO Paul Nester stated, “Higher utility margins were welcomed in the quarter particularly in light of inflationary pressures that will temper performance in the coming quarters. Good weather enabling strong construction progress of the MVP during the quarter was gratifying, and we eagerly await for the completion of the pipeline.” Nester further commented, “Roanoke Gas is experiencing increasing costs and has filed for relief through a rate application with the State Corporation Commission.”

RGC Resources, Inc. provides energy and related products and services to customers in Virginia through its operating subsidiaries Roanoke Gas Company and RGC Midstream, LLC.

Utility margins is a non-GAAP measure defined as utility revenues less cost of gas. Management considers this non-GAAP measure to provide useful information to both management and investors for purpose of such comparability and in evaluating operating performance, but it should be considered in addition to results prepared in accordance with GAAP and should not be considered a substitute for, or superior to, GAAP results.

The statements in this release that are not historical facts constitute “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. In order to comply with the terms of the safe harbor, the Company notes that a variety of factors could cause the Company’s actual results and experience to differ materially from any expectations expressed in the Company’s forward-looking statements, regarding inflation, customer growth, infrastructure investment and margins. These risks and uncertainties include gas prices and supply, geopolitical considerations, expectations regarding the MVP construction and operation, and regulatory and legal challenges along with risks included under Item 1-A in the Company’s fiscal 2023 Form 10-K. Forward-looking statements reflect the Company’s current expectations only as of the date they are made. The Company assumes no duty to update these statements should expectations change or actual results differ from current expectations except as required by applicable laws and regulations.

Past performance is not necessarily a predictor of future results.

Summary financial statements for the first quarter are as follows:

RGC Resources, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(Unaudited)

| |

|

Three Months Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

Operating revenues

|

|

$ |

24,419,352 |

|

|

$ |

33,282,335 |

|

|

Operating expenses

|

|

|

17,767,315 |

|

|

|

27,737,850 |

|

|

Operating income

|

|

|

6,652,037 |

|

|

|

5,544,485 |

|

|

Equity in earnings of unconsolidated affiliate

|

|

|

1,467,835 |

|

|

|

1,232 |

|

|

Other income, net

|

|

|

120,786 |

|

|

|

74,606 |

|

|

Interest expense

|

|

|

1,636,273 |

|

|

|

1,369,164 |

|

|

Income before income taxes

|

|

|

6,604,385 |

|

|

|

4,251,159 |

|

|

Income tax expense

|

|

|

1,584,393 |

|

|

|

994,754 |

|

| |

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

5,019,992 |

|

|

$ |

3,256,405 |

|

| |

|

|

|

|

|

|

|

|

|

Net earnings per share of common stock:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.50 |

|

|

$ |

0.33 |

|

|

Diluted

|

|

$ |

0.50 |

|

|

$ |

0.33 |

|

| |

|

|

|

|

|

|

|

|

|

Cash dividends per common share

|

|

$ |

0.2000 |

|

|

$ |

0.1975 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

10,029,243 |

|

|

|

9,830,206 |

|

|

Diluted

|

|

|

10,031,354 |

|

|

|

9,837,188 |

|

Condensed Consolidated Balance Sheets

(Unaudited)

| |

|

December 31,

|

|

|

Assets

|

|

2023

|

|

|

2022

|

|

|

Current assets

|

|

$ |

34,769,875 |

|

|

$ |

47,845,073 |

|

|

Utility property, net

|

|

|

250,343,833 |

|

|

|

234,849,715 |

|

|

Other non-current assets

|

|

|

29,589,527 |

|

|

|

25,257,374 |

|

| |

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$ |

314,703,235 |

|

|

$ |

307,952,162 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

$ |

64,196,722 |

|

|

$ |

60,164,437 |

|

|

Long-term debt, net

|

|

|

102,461,196 |

|

|

|

113,288,995 |

|

|

Deferred credits and other non-current liabilities

|

|

|

44,500,714 |

|

|

|

39,608,723 |

|

|

Total Liabilities

|

|

|

211,158,632 |

|

|

|

213,062,155 |

|

|

Stockholders’ Equity

|

|

|

103,544,603 |

|

|

|

94,890,007 |

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Equity

|

|

$ |

314,703,235 |

|

|

$ |

307,952,162 |

|

v3.24.0.1

Document And Entity Information

|

Feb. 05, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

RGC RESOURCES, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 05, 2024

|

| Entity, Incorporation, State or Country Code |

VA

|

| Entity, File Number |

000-26591

|

| Entity, Tax Identification Number |

54-1909697

|

| Entity, Address, Address Line One |

519 Kimball Ave.

|

| Entity, Address, City or Town |

Roanoke

|

| Entity, Address, State or Province |

VA

|

| Entity, Address, Postal Zip Code |

24016

|

| City Area Code |

540

|

| Local Phone Number |

777-4427

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $5 Par Value

|

| Trading Symbol |

RGCO

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001069533

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

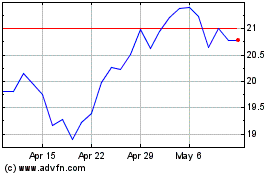

RGC Resources (NASDAQ:RGCO)

Historical Stock Chart

From Apr 2024 to May 2024

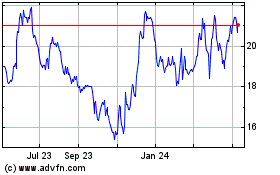

RGC Resources (NASDAQ:RGCO)

Historical Stock Chart

From May 2023 to May 2024