Qurate Retail, Inc. ("Qurate Retail") (Nasdaq: QRTEA, QRTEB,

QRTEP) today reported first quarter 2024 results(1).

“Our first quarter results demonstrate the continued momentum in

our turnaround. We expanded gross margins for the fourth

consecutive quarter, increased Adjusted OIBDA over 40% as reported

for the third consecutive quarter of growth, and improved free cash

flow year-over-year for the fifth consecutive quarter," said David

Rawlinson, President and CEO of Qurate Retail. “We are successfully

delivering on our transformation initiatives to reduce costs and

improve product margins while prioritizing enhanced merchandise,

brand launches and celebrity partnerships which are hallmarks of

the QVC and HSN brands. We are focused on achieving our stated

objectives throughout 2024 and positioning the business for

sustainable future growth.

“In April, we launched our Age of Possibility campaign, where we

brought together a group of Quintessential 50 ambassadors including

Billie Jean King, Patti LaBelle, Queen Latifah, Martha Stewart and

many other inspiring women to tell their stories and celebrate our

core customer of women over 50.”

First quarter 2024 operating results:

- Qurate Retail revenue decreased 4%(2) in both US Dollars and

constant currency(3)

- Qurate Retail grew Adjusted OIBDA(4) 25%(2) in constant

currency

- Qurate Retail reported diluted EPS of $0.00

- Adjusted diluted EPS(4) of $0.04

- QxH revenue decreased 4%

- QVC International revenue decreased 3%

- In constant currency, revenue decreased 1%

- Cornerstone revenue decreased 11%

Corporate headlines:

- Repaid remaining $423 million principal outstanding of QVC’s

4.85% senior secured notes due April 2024

Discussion of Results

Unless otherwise noted, the following discussion compares

financial information for the three months ended March 31, 2024 to

the same period in 2023.

FIRST

QUARTER 2024 FINANCIAL RESULTS

(amounts in millions)

1Q23

1Q24

% Change

% Change Constant Currency(a)

Revenue

QxH

$

1,601

$

1,539

(4

)%

QVC International

592

572

(3

)%

(1

)%

Cornerstone

259

231

(11

)%

Total Qurate Retail Revenue (excluding

Zulily)

2,452

2,342

(4

)%

(4

)%

Zulily(b)

192

—

NM

Total Qurate Retail Revenue (as

reported)

$

2,644

$

2,342

(11

)%

(11

)%

Operating Income (Loss)

QxH(c)

$

74

$

94

27

%

QVC International(d)

156

63

(60

)%

(57

)%

Cornerstone

(2

)

(3

)

(50

)%

Unallocated corporate cost

(9

)

(9

)

-

%

Total Qurate Retail Operating Income

(excluding Zulily)

219

145

(34

)%

(32

)%

Zulily(b)

(43

)

—

NM

Total Qurate Retail Operating Income

(as reported)

$

176

$

145

(18

)%

(15

)%

Adjusted OIBDA

QxH(c)

$

139

$

185

33

%

QVC International(d)

72

75

4

%

10

%

Cornerstone

4

6

50

%

Unallocated corporate cost

(5

)

(7

)

(40

)%

Total Qurate Retail Adjusted OIBDA

(excluding Zulily)

$

210

$

259

23

%

25

%

Zulily(b)

(31

)

—

NM

Total Qurate Retail Adjusted OIBDA (as

reported)

$

179

$

259

45

%

47

%

____________________

a)

For a definition of constant

currency financial metrics, see the accompanying schedules.

b)

Zulily, LLC (“Zulily”) was

divested on May 24, 2023.

c)

In the first quarter of 2023, QxH

incurred $21 million of net gains primarily related to Rocky Mount

fire related costs, net of recoveries and the sale of its Rocky

Mount fulfillment center. These are included in operating income

and excluded from Adjusted OIBDA. See Reconciling Schedule 2.

d)

In the first quarter of 2023, QVC

International recorded $113 million of gains related to the sale

leaseback of the UK and German fulfillment centers partially offset

by $17 million of restructuring charges. In the first quarter of

2024, QVC International recorded a $1 million gain related to the

sale leaseback of a German property. These are included in

operating income and excluded from Adjusted OIBDA. See Reconciling

Schedule 2.

FIRST

QUARTER 2024 NET INCOME AND ADJUSTED NET INCOME(4)

(amounts in millions)

1Q23

1Q24

Net income (loss)

$

20

$

(1

)

Adjusted net income (loss)(a)

$

(20

)

$

17

Basic weighted average shares outstanding

("WASO")

383

392

Potentially dilutive shares

1

1

Diluted WASO

384

393

GAAP EPS(b)

$

0.05

$

—

Adjusted EPS(a)

$

(0.05

)

$

0.04

____________________

a)

See Reconciling Schedule 3.

b)

Represents diluted net income per

share attributable to Series A and Series B common stockholders as

presented in Qurate Retail’s financial statements.

QxH

QxH revenue declined primarily due to a 4% decrease in units

shipped, partially offset by favorable returns and higher shipping

and handling revenue. QxH reported sales declines mainly in home

and apparel, partially offset by growth in accessories and

jewelry.

Operating income and Adjusted OIBDA margin(4) increased mainly

due to higher product margins and lower fulfillment (warehouse and

freight) and administrative expenses, partially offset by higher

marketing costs. Product margins increased primarily due to mix

shift to higher-margin products and lower supply chain costs.

Fulfillment favorability primarily reflected lower freight rates

and efficiencies from Project Athens initiatives. Administrative

expenses declined primarily due to lower costs for outside services

related to Project Athens. Marketing expenses increased largely due

to the normalization of the annual spend compared to the prior

year.

QVC International

US Dollar denominated results were negatively impacted by

exchange rate fluctuations due to the US Dollar strengthening 11%

against the Japanese Yen, which was partially offset by the US

Dollar weakening 5% against the British Pound and 1% against the

Euro. The financial metrics presented in this press release also

provide a comparison of the percentage change in QVC

International’s results in constant currency (where applicable) to

the comparable figures calculated in accordance with US GAAP for

the first quarter of 2024.

QVC International’s constant currency revenue declined slightly

as a 4% increase in units shipped was offset by a 5% decrease in

average selling price. QVC International reported constant currency

revenue growth in home, with declines in all other categories.

Operating income decreased primarily as a result of comparing

against $113 million of gains recognized in the prior year related

to the UK and German sale leaseback transactions.

Adjusted OIBDA margin increased mainly due to higher product

margins and lower administrative expenses. Product margins

increased primarily due to favorable returns, higher initial

margins and shipping and handling revenue. Lower administrative

expenses mainly reflected lower personnel expenses.

Cornerstone

Cornerstone revenue decreased due to continued softness in

certain categories in the home sector and for apparel at Garnet

Hill.

Operating income margin decreased primarily due to higher

depreciation related to the opening of six new retail stores and

the relocation of four stores in the past year.

Adjusted OIBDA margin increased primarily due to lower supply

chain costs, partially offset by deleverage of administrative costs

and marketing expenses.

FIRST

QUARTER 2024 SUPPLEMENTAL METRICS

(amounts in millions unless otherwise

noted)

1Q23

1Q24

% Change

% Change Constant Currency(a)

QxH

Cost of Goods Sold % of Revenue

69.0

%

65.4

%

(360

) bps

Operating Income Margin (%)(b)

4.6

%

6.1

%

150

bps

Adjusted OIBDA Margin (%)(b)

8.7

%

12.0

%

330

bps

Average Selling Price

$

53.90

$

53.60

(1

)%

Units Sold

(4

)%

Return Rate(c)

16.0

%

15.4

%

(60

) bps

eCommerce Revenue(d)

$

961

$

958

-

%

eCommerce % of Total Revenue

60.0

%

62.2

%

220

bps

Mobile % of eCommerce Revenue(e)

68.3

%

69.8

%

150

bps

LTM Total Customers(f)

8.5

8.0

(6

)%

QVC International

Cost of Goods Sold % of Revenue

64.7

%

64.0

%

(70

) bps

Operating Income Margin (%)(g)

26.4

%

11.0

%

(1,540

) bps

Adjusted OIBDA Margin (%)(g)

12.2

%

13.1

%

90

bps

Average Selling Price

(7

)%

(5

)%

Units Sold

4

%

Return Rate(c)

19.3

%

19.2

%

(10

) bps

eCommerce Revenue(d)

$

280

$

294

5

%

7

%

eCommerce % of Total Revenue

47.3

%

51.4

%

410

bps

Mobile % of eCommerce Revenue(e)

69.5

%

68.8

%

(70

) bps

LTM Total Customers(f)

4.3

4.1

(5

)%

Cornerstone

Cost of Goods Sold % of Revenue

63.8

%

59.7

%

(410

) bps

Operating Income Margin (%)

(0.8

)%

(1.3

)%

(50

) bps

Adjusted OIBDA Margin (%)

1.5

%

2.6

%

110

bps

eCommerce Revenue(d)

$

197

$

175

(11

)%

eCommerce % of Total Revenue

76.1

%

75.8

%

(30

) bps

____________________

a)

For a definition of constant

currency financial metrics, see the accompanying schedules.

b)

In the first quarter of 2023, QxH

incurred $21 million of net gains primarily related to Rocky Mount

fire related costs, net of recoveries and the sale of its Rocky

Mount fulfillment center. These are included in operating income

and excluded from Adjusted OIBDA. See Reconciling Schedule 2.

c)

Measured as returned sales over

gross shipped sales in US Dollars.

d)

Based on net revenue.

e)

Based on gross US Dollar

orders.

f)

LTM: Last twelve months.

g)

In the first quarter of 2023, QVC

International recorded $113 million of gains related to the sale

leaseback of the UK and German fulfillment centers partially offset

by $17 million of restructuring charges. In the first quarter of

2024, QVC International recorded a $1 million gain related to the

sale leaseback of a German property. These are included in

operating income and excluded from Adjusted OIBDA. See Reconciling

Schedule 2.

FOOTNOTES

1)

Qurate Retail will discuss these

headlines and other matters on Qurate Retail’s earnings conference

call that will begin at 8:30 a.m. (E.T.) on May 8, 2024. For

information regarding how to access the call, please see “Important

Notice” later in this document.

2)

Adjusted for the divestiture of

Zulily on May 24, 2023.

3)

For a definition of constant

currency financial metrics, see the accompanying schedules.

Applicable reconciliations can be found in the financial tables at

the beginning of this press release.

4)

For definitions and applicable

reconciliations of Adjusted OIBDA, Adjusted OIBDA margin, adjusted

net income and adjusted diluted EPS, see the accompanying

schedules.

NOTES

Cash and Debt

The following presentation is provided to separately identify

cash and debt information.

(amounts in millions)

12/31/2023

3/31/2024

Cash and cash equivalents

(GAAP)

$

1,121

$

1,102

Debt:

QVC senior secured notes(a)

$

3,509

$

3,086

QVC senior secured bank credit

facility

857

1,295

Total Qurate Retail Group Debt

$

4,366

$

4,381

Senior notes(a)

792

792

Senior exchangeable debentures(b)

781

780

Corporate Level Debentures

1,573

1,572

Total Qurate Retail, Inc. Debt

$

5,939

$

5,953

Unamortized discount, fair market value

adjustment and deferred loan costs

(599

)

(462

)

Total Qurate Retail, Inc. Debt

(GAAP)

$

5,340

$

5,491

Other Financial Obligations:

Preferred stock(c)

$

1,270

$

1,272

QVC, Inc. leverage(d)

2.4x

2.5x

____________________

a)

Face amount of Senior Notes and

Debentures with no reduction for the unamortized discount.

b)

Face amount of Senior

Exchangeable Debentures with no adjustment for the fair market

value adjustment.

c)

Preferred Stock has an 8% coupon,

$100 per share initial liquidation preference plus accrued and

unpaid dividends and is non-voting. It is subject to mandatory

redemption on March 15, 2031. The Preferred Stock is considered a

liability for GAAP purposes, and is recorded net of capitalized

costs.

d)

As defined in QVC’s credit

agreement. A portion of expected cost savings are included in

Adjusted EBITDA for purposes of the covenant calculations under

QVC’s bank credit facility.

Cash at Qurate Retail decreased $19 million in the first quarter

as cash from operations and net borrowings were primarily offset by

capital expenditures during the period. Total debt at Qurate

Retail, Inc. increased $14 million in the first quarter as

additional borrowings under QVC’s bank credit facility more than

offset debt repayment. Qurate Retail redeemed the remaining $423

million principal outstanding of QVC’s 4.85% senior secured notes

due April 2024 in the first quarter.

QVC’s bank credit facility has $1.3 billion drawn as of March

31, 2024 with incremental availability of $1.9 billion, net of

letters of credit. QVC’s leverage ratio, as defined by the QVC

revolving credit facility, was 2.5x at quarter-end. Pursuant to the

terms of QVC’s revolving credit facility, a portion of expected

cost savings are included in operating income for purposes of QVC’s

leverage ratio for covenant calculations. QVC’s leverage ratio

increased slightly from December 31, 2023 due to certain add backs

no longer impacting the calculation, though these add backs were

largely offset by growth in Adjusted OIBDA.

As of March 31, 2024, QVC’s consolidated leverage ratio (as

calculated under QVC’s senior secured notes) was greater than 3.5x

and as a result QVC is restricted in its ability to make unlimited

dividends or other restricted payments. Dividends made by QVC to

service the principal and interest of indebtedness of its parent

entities, as well as payments made by QVC to Qurate Retail under an

intercompany tax sharing agreement in respect of certain tax

obligations of QVC and its subsidiaries, are permitted under the

bond indenture and credit agreement.

Qurate Retail is in compliance with all debt covenants as of

March 31, 2024.

Important Notice: Qurate Retail, Inc. (Nasdaq: QRTEA,

QRTEB, QRTEP) will discuss Qurate Retail’s earnings release on a

conference call which will begin at 8:30 a.m. (E.T.) on May 8,

2024. The call can be accessed by dialing (877) 704-4234 or (215)

268-9904, passcode 13742823, at least 10 minutes prior to the start

time. The call will also be broadcast live across the Internet and

archived on our website. To access the webcast go to

https://www.qurateretail.com/investors/news-events/ir-calendar.

Links to this press release and replays of the call will also be

available on Qurate Retail’s website.

This press release includes certain forward-looking statements,

including statements about business strategies and initiatives

(including Project Athens) and their expected benefits, market

potential, future financial performance and prospects and other

matters that are not historical facts. These forward-looking

statements involve many risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

by such statements, including, without limitation, possible changes

in market acceptance of new products or services, competitive

issues, regulatory matters affecting our businesses, continued

access to capital on terms acceptable to Qurate Retail, changes in

law and government regulations, the availability of investment

opportunities, general market conditions (including as a result of

future public health crises), issues impacting the global supply

chain and labor market and use of social media and influencers.

These forward-looking statements speak only as of the date of this

press release, and Qurate Retail expressly disclaims any obligation

or undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein to reflect any change in

Qurate Retail's expectations with regard thereto or any change in

events, conditions or circumstances on which any such statement is

based. Please refer to the publicly filed documents of Qurate

Retail, including the most recent Forms 10-K and 10-Q, for

additional information about Qurate Retail and about the risks and

uncertainties related to Qurate Retail's business which may affect

the statements made in this press release.

NON-GAAP FINANCIAL MEASURES

To provide investors with additional information regarding our

financial results, this press release includes a presentation of

Adjusted OIBDA, which is a non-GAAP financial measure, for Qurate

Retail, QVC (and certain of its subsidiaries), Zulily (through May

23, 2023) and Cornerstone together with a reconciliation to that

entity or such businesses’ operating income, as determined under

GAAP. Qurate Retail defines Adjusted OIBDA as operating income

(loss) plus depreciation and amortization, stock-based

compensation, and where applicable, separately identified

impairments, litigation settlements, restructuring, penalties,

acquisition-related costs, fire related costs, net (including Rocky

Mount inventory losses), and (gains) losses on sale leaseback

transactions. Further, this press release includes Adjusted OIBDA

margin, which is also a non-GAAP financial measure. Qurate Retail

defines Adjusted OIBDA margin as Adjusted OIBDA divided by

revenue.

Qurate Retail believes Adjusted OIBDA is an important indicator

of the operational strength and performance of its businesses by

identifying those items that are not directly a reflection of each

business’s performance or indicative of ongoing business trends. In

addition, this measure allows management to view operating results

and perform analytical comparisons and benchmarking between

businesses and identify strategies to improve performance. Because

Adjusted OIBDA is used as a measure of operating performance,

Qurate Retail views operating income as the most directly

comparable GAAP measure. Adjusted OIBDA is not meant to replace or

supersede operating income or any other GAAP measure, but rather to

supplement such GAAP measures in order to present investors with

the same information that Qurate Retail's management considers in

assessing the results of operations and performance of its assets.

Please see the attached schedules for applicable

reconciliations.

In addition, this press release includes references to adjusted

net income and adjusted earnings per share, which are non-GAAP

financial measures, for Qurate Retail. Qurate Retail defines

adjusted net income as net income, excluding the impact of

acquisition accounting amortization (net of deferred tax benefit),

mark-to-market adjustments on certain public debt and equity

securities, (gain) loss on sale of fixed assets and other one-time

adjustments. Qurate Retail defines adjusted earnings per share as

diluted earnings per share plus the diluted per share effects of

certain adjustments, net of tax.

Qurate Retail believes adjusted net income and adjusted earnings

per share are important indicators of financial performance due to

the impact of purchase accounting amortization, mark-to-market

adjustments and other one-time items identified in Schedule 3

below. Because adjusted net income and adjusted earnings per share

are used as measures of overall financial performance, Qurate

Retail views net income and diluted earnings per share,

respectively, as the most directly comparable GAAP measures.

Adjusted net income and adjusted earnings per share are not meant

to replace or supersede net income, diluted earnings per share or

any other GAAP measure, but rather to supplement such GAAP measures

in order to present investors with a supplemental metric of

financial performance. Please see the attached schedules for a

reconciliation of adjusted net income to net income (loss) and

adjusted earnings per share to diluted earnings per share, in each

case, calculated in accordance with GAAP for Qurate Retail

(Schedule 3).

This press release also references certain financial metrics on

a constant currency basis, which is a non-GAAP measure, for Qurate

Retail. Constant currency financial metrics, as presented herein,

are calculated by translating the current-year and prior-year

reported amounts into comparable amounts using a single foreign

exchange rate for each currency.

Qurate Retail believes constant currency financial metrics are

an important indicator of financial performance, in particular for

QVC, due to the translational impact of foreign currency

fluctuations relating to its subsidiaries in the UK, Germany, Italy

and Japan. We use constant currency financial metrics to provide a

framework to assess how our businesses performed excluding the

effects of foreign currency exchange fluctuations. Please see the

financial tables at the beginning of this press release for a

reconciliation of the impact of foreign currency fluctuations on

revenue, operating income, Adjusted OIBDA and average selling

price.

SCHEDULE 1

The following table provides a reconciliation of Qurate Retail’s

Adjusted OIBDA to its operating income (loss) calculated in

accordance with GAAP for the three months ended March 31, 2023,

June 30, 2023, September 30, 2023, December 31, 2023 and March 31,

2024, respectively.

CONSOLIDATED

OPERATING INCOME AND ADJUSTED OIBDA RECONCILIATION

(amounts in millions)

1Q23

2Q23

3Q23

4Q23

1Q24

Qurate Retail Operating Income

(Loss)

$

176

$

366

$

151

$

(103

)

$

145

Depreciation and amortization

100

104

105

98

99

Stock compensation expense

16

14

10

13

16

Restructuring, penalties and fire related

costs, net of (recoveries) (including Rocky Mount inventory

losses)(a)

—

(208

)

19

—

—

Impairment of intangible assets(b)

—

—

—

326

—

(Gains) losses on sale of assets and sale

leaseback transactions(c)

(113

)

(6

)

—

6

(1

)

Qurate Retail Adjusted OIBDA

$

179

$

270

$

285

$

340

$

259

____________________

a)

In the second quarter of 2023,

QxH recognized (i) a $209 million net gain on insurance proceeds

representing insurance proceeds received in excess of fire-related

costs and (ii) a $2 million gain on the sale of Rocky Mount in

February 2023 that was released from escrow. Additionally, in the

second quarter of 2023, Cornerstone recorded $2 million and Zulily

recorded $1 million of restructuring charges, both related to

workforce reductions. In the third quarter of 2023, QxH incurred

(i) a $2 million gain on the sale of Rocky Mount in February 2023

on proceeds released from escrow and (ii) $21 million of

restructuring, penalties and fire-related costs. These items are

included in operating income and excluded from Adjusted OIBDA.

b)

In the fourth quarter of 2023,

QxH recognized a $326 million non-cash impairment charge related to

goodwill.

c)

Includes gains related to the

sale leaseback of the UK and German fulfillment centers in the

first quarter of 2023, a gain on the sale of an intangible asset

primarily related to the sale of a channel positioning right in the

second quarter of 2023, a loss related to the sale leaseback of a

German property in the fourth quarter of 2023 and a gain related to

the sale leaseback of a German property in the first quarter of

2024.

SCHEDULE 2

The following table provides a reconciliation of Adjusted OIBDA

for QVC and Cornerstone to that entity or such businesses'

operating income (loss) calculated in accordance with GAAP for the

three months ended March 31, 2023, June 30, 2023, September 30,

2023, December 31, 2023 and March 31, 2024, respectively.

SUBSIDIARY ADJUSTED

OIBDA RECONCILIATION

(amounts in millions)

1Q23

2Q23

3Q23

4Q23

1Q24

QVC

Operating income (loss)

$

230

$

374

$

154

$

(113

)

$

157

Depreciation and amortization

89

94

98

91

92

Stock compensation

9

11

7

10

12

Restructuring, penalties and fire related

costs, net of (recoveries) (including Rocky Mount inventory

losses)

(4

)

(211

)

19

—

—

(Gains) losses on sale of assets and sale

leaseback transactions

(113

)

(6

)

—

6

(1

)

Impairment of intangible assets

—

—

—

326

—

Adjusted OIBDA

$

211

$

262

$

278

$

320

$

260

QxH Adjusted OIBDA

$

139

$

185

$

201

$

221

$

185

QVC International Adjusted

OIBDA

$

72

$

77

$

77

$

99

$

75

Cornerstone

Operating income (loss)

$

(2

)

$

15

$

4

$

18

$

(3

)

Depreciation and amortization

5

7

7

7

7

Stock compensation

1

1

—

2

2

Restructuring costs

—

2

—

—

—

Adjusted OIBDA

$

4

$

25

$

11

$

27

$

6

SCHEDULE 3

The following table provides a reconciliation of Qurate Retail’s

net income (loss) to its adjusted net income and diluted earnings

(loss) per share to adjusted earnings per share, in each case,

calculated in accordance with GAAP for the three months ended March

31, 2023, June 30, 2023, September 30, 2023, December 31, 2023 and

March 31, 2024, respectively.

ADJUSTED NET INCOME

AND ADJUSTED EPS RECONCILIATION

(amounts in millions)

1Q23

2Q23

3Q23

4Q23

1Q24

Qurate Retail Net Income (Loss)

(GAAP)

$

20

$

107

$

1

$

(273

)

$

(1

)

Purchase accounting amort., net of

deferred tax benefit(a)

17

15

14

14

14

Impairment of intangible assets, net of

tax impact

—

—

—

326

—

Restructuring, penalties and fire related

costs, net of (recoveries) and tax impact (including Rocky Mount

inventory losses)

—

(156

)

14

—

—

(Gains) losses on sale of intangible asset

and sale leaseback transactions, net of tax impact

(92

)

(5

)

—

6

(2

)

Mark-to-market adjustments, net(b)

35

26

11

14

6

Adjusted Net Income (Loss)

$

(20

)

$

(13

)

$

40

$

87

$

17

Diluted earnings (loss) per share

(GAAP)

$

0.05

$

0.28

$

—

$

(0.70

)

$

—

Total adjustments per share, net of

tax

(0.10

)

(0.31

)

0.10

0.92

0.04

Adjusted earnings (loss) per

share

$

(0.05

)

$

(0.03

)

$

0.10

$

0.22

$

0.04

____________________

a)

Add-back relates to non-cash,

non-tax deductible purchase accounting amortization from Qurate

Retail’s acquisitions of QVC, HSN, Zulily and Cornerstone, net of

book deferred tax benefit.

b)

Add-back includes realized and

unrealized gains/losses on financial instruments, net of tax.

QURATE RETAIL, INC.

CONDENSED CONSOLIDATED BALANCE

SHEET INFORMATION

(unaudited)

March 31,

December 31,

2024

2023

amounts in millions

Assets

Current assets:

Cash and cash equivalents

$

1,102

1,121

Trade and other receivables, net of

allowance for credit losses

980

1,308

Inventory, net

1,134

1,044

Other current assets

170

209

Total current assets

3,386

3,682

Property and equipment, net

496

512

Intangible assets not subject to

amortization

5,839

5,862

Intangible assets subject to amortization,

net

495

526

Operating lease right-of-use assets

629

635

Other assets, at cost, net of accumulated

amortization

136

151

Total assets

$

10,981

11,368

Liabilities and Equity

Current liabilities:

Accounts payable

789

895

Accrued liabilities

715

983

Current portion of debt

939

642

Other current liabilities

100

97

Total current liabilities

2,543

2,617

Long-term debt

4,552

4,698

Deferred income tax liabilities

1,504

1,531

Preferred stock

1,272

1,270

Operating lease liabilities

617

615

Other liabilities

142

148

Total liabilities

10,630

10,879

Equity

255

385

Non-controlling interests in equity of

subsidiaries

96

104

Total liabilities and equity

$

10,981

11,368

QURATE RETAIL, INC.

CONDENSED CONSOLIDATED

STATEMENT OF OPERATIONS INFORMATION

(unaudited)

Three months ended

March 31,

2024

2023

amounts in millions

Revenue:

Total revenue, net

$

2,342

2,644

Operating costs and expenses:

Cost of goods sold (exclusive of

depreciation shown separately below)

1,511

1,809

Operating expense

180

194

Selling, general and administrative,

including stock-based compensation

408

478

Depreciation and amortization

99

100

Gain on sale of assets and leaseback

transactions

(1

)

(113

)

2,197

2,468

Operating income (loss)

145

176

Other income (expense):

Interest expense

(117

)

(94

)

Dividend and interest income

12

11

Realized and unrealized gains (losses) on

financial instruments, net

(7

)

(32

)

Other, net

(2

)

4

(114

)

(111

)

Earnings (loss) before income taxes

31

65

Income tax (expense) benefit

(23

)

(32

)

Net earnings (loss)

8

33

Less net earnings (loss) attributable to

the noncontrolling interests

9

13

Net earnings (loss) attributable to Qurate

Retail, Inc. shareholders

$

(1

)

20

QURATE RETAIL, INC.

CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS INFORMATION

(unaudited)

Three months ended

March 31,

2024

2023

amounts in millions

CASH FLOWS FROM OPERATING ACTIVITIES:

Net earnings (loss)

$

8

33

Adjustments to reconcile net earnings

(loss) to net cash provided by operating activities:

Depreciation and amortization

99

100

Stock-based compensation

16

16

Realized and unrealized (gains) losses on

financial instruments, net

7

32

Gain on sale of assets and sale leaseback

transactions

(1

)

(113

)

Gain on insurance proceeds, net of fire

related costs

—

(17

)

Insurance proceeds received for operating

expenses and business interruption losses

—

37

Deferred income tax expense (benefit)

(2

)

(2

)

Other, net

4

9

Changes in operating assets and

liabilities

Decrease (increase) in accounts

receivable

313

294

Decrease (increase) in inventory

(94

)

25

Decrease (increase) in prepaid expenses

and other assets

45

48

(Decrease) increase in trade accounts

payable

(101

)

(167

)

(Decrease) increase in accrued and other

liabilities

(268

)

(279

)

Net cash provided (used) by operating

activities

26

16

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital expenditures

(40

)

(54

)

Expenditures for television distribution

rights

(2

)

(38

)

Cash proceeds from dispositions of

investments

6

1

Proceeds from sale of fixed assets

6

198

Insurance proceeds received for fixed

asset loss

—

18

Payments for settlements of financial

instruments

—

(179

)

Proceeds from settlements of financial

instruments

—

167

Other investing activities, net

(1

)

(1

)

Net cash provided (used) by investing

activities

(31

)

112

CASH FLOWS FROM FINANCING ACTIVITIES:

Borrowings of debt

1,570

677

Repayments of debt

(1,555

)

(803

)

Dividends paid to noncontrolling

interest

(11

)

(12

)

Dividends paid to common shareholders

(4

)

(7

)

Indemnification agreement settlement

—

24

Other financing activities, net

(2

)

(1

)

Net cash provided (used) by financing

activities

(2

)

(122

)

Effect of foreign currency exchange rates

on cash, cash equivalents and restricted cash

(12

)

4

Net increase (decrease) in cash, cash

equivalents and restricted cash

(19

)

10

Cash, cash equivalents and restricted cash

at beginning of period

1,136

1,285

Cash, cash equivalents and restricted cash

at end period

$

1,117

1,295

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507179583/en/

Shane Kleinstein 720-875-5432

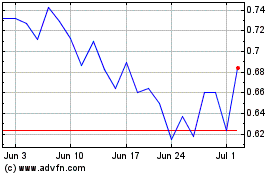

Qurate Retail (NASDAQ:QRTEA)

Historical Stock Chart

From May 2024 to Jun 2024

Qurate Retail (NASDAQ:QRTEA)

Historical Stock Chart

From Jun 2023 to Jun 2024