Quipt Home Medical Corp. (the “

Company”)

(NASDAQ:QIPT; TSXV:QIPT), a U.S. based leader in the home medical

equipment industry, focused on end-to-end respiratory care, today

announced its third quarter fiscal 2022 financial results and

operational highlights. These results pertain to the three-month

period ended June 30, 2022 and are reported in U.S. Dollars.

Financial

Highlights:

- Revenue for Q3 2022 was $36.7 million compared to $26.2 million

for Q3 2021, representing a 40% increase in revenue year-over-year.

Compared to Q2 2022, the Company experienced very strong sequential

organic growth of 2%.

- As of June 30, 2022, the Company’s backlog decreased to

approximately 6,000 patients in the queue to be set up on sleep

devices. The Company remains optimistic that sleep device

allocations will increase through the remainder of 2022, which will

continue to relieve some of the backlog, generating a lift in

revenue from this impacted segment of the business.

- Revenue for the nine months ended June 30, 2022, increased to

$99.8 million, or 36.2% compared to the nine months ended June 30,

2021.

- Recurring Revenue as of Q3 2022 was 77% of total revenue.

- Adjusted EBITDA for Q3 2022 was $7.7 million (21% margin),

compared to Adjusted EBITDA for Q3 2021 of $5.3 million (20.2%

margin), representing a 44% increase year-over-year.

- Adjusted EBITDA for the nine months ended June 30, 2022,

increased to $20.8 million, or 30.4% compared to the nine months

ended June 30, 2021, and represented 20.8% of revenue.

- Cash flow from operations for the nine months ending June 2022

was $19.4 million, compared to $11.2 million in the corresponding

period ending June 2021.

- The Company reported $18.5 million of cash on hand as at June

30, 2022.

Operational

Highlights:

- Through the Company’s continued use of technology and

centralized intake processes, respiratory resupply set-ups and/or

deliveries increased to 62,815 for the three months ended June 30,

2022, compared to 40,580 for the same period ended June 30, 2021,

an increase of 55%.

- The Company’s customer base increased 38% year over year from

64,578 unique patients served in Q3 2021 to 89,085 unique patients

in Q3 2022.

- Compared to 133,704 unique set-ups/deliveries in Q3 2022, the

Company completed 95,192 unique set-ups/deliveries in Q3 2021, an

increase of 40%.

- On April 26, 2022, the Company announced the execution of a

national insurance contract with the largest health insurer in the

United States, which has expanded patient accessibility across the

country. The Company continues to work towards additional national

contracts with large health insurers in the United States.

- The Company’s product mix has reached 80% respiratory as of

June 30, 2022.

- The Company has recently accelerated its hiring of experienced

sales personnel to expand its sales reach across the United States.

The Company anticipates this will be a key driver of future organic

growth.

- The Company continues to experience robust demand for

respiratory equipment, such as Oxygen Concentrators, Ventilators,

as well as the CPAP resupply and other supplies business.

- Effective after the U.S. market open on June 27, 2022., Quipt

joined the Russell Microcap Index.

- The Company operates out of 94 locations in nineteen states

across the United States, completing hundreds of thousands of

deliveries each year to more than 200,000 active patients, with

over 21,600 referring physicians.

Acquisition Related

Updates:

- Since April 19, 2022, the Company has closed four acquisitions

adding locations across nine U.S. states including Arkansas,

Georgia, Massachusetts, Mississippi, North Carolina, Ohio, Texas,

California, and Louisiana. Louisiana represented the 19th state of

service, and the total geographical area represented over 5.5

million COPD patients, a key target group. The four acquisitions

added over 30,000 active patients, equate to an estimated

annualized revenue of $25 million and, post integration, an

estimated over $4.5 million of Adjusted EBITDA.

- The Company completed seven acquisitions during the nine months

ended June 30, 2022 and one subsequent to June 30, 2022.

Subsequent Events to the Three Months

Ended June 30, 2022:

- On July 26, 2022, the Company executed a supply contract with

Cardinal Health at-Home, a business unit of Cardinal Health, Inc.,

wherein Quipt has agreed to offer to sell, and Cardinal has agreed

to supply and distribute, disposable medical supplies nationwide.

The contract is extremely meaningful for Quipt as it provides us

the ability to produce meaningful cross selling opportunities,

including additional product lines to go after in the future.

Additionally, any new acquisitions, will benefit from being able to

immediately leverage the contract at new locations across the

country, providing further synergies with the expectation this

contract will give us stronger buying power for disposable medical

supplies.

- On August 9, 2022, the Company exercised its right under the

debenture indenture dated March 7, 2019, which governs all of the

Company’s 8.0% unsecured convertible debentures issued on March 7,

2019, to convert all of the principal amount outstanding of the

remaining debentures into common shares of the Company.

- On August 15, 2022, the Company received a commitment letter

from CIT Bank, a division of First-Citizens Bank & Trust

Company, wherein CIT would commit to provide 100% of the senior

secured credit facilities in the aggregate amount of up to

$80,000,000 (to be comprised of a term loan facility of $5,000,000,

a delayed draw term loan facility of $55,000,000 and a revolving

credit facility of $20,000,000). The senior credit facilities will

be evidenced by an Amended and Restated Credit and Guaranty

Agreement, which will amend and restate the Credit Agreement dated

September 18, 2020 (announced by the Company on September 21,

2020).

Management

Commentary:

“The robust financial and operating results in

the fiscal third quarter are reflective of the continued

operational excellence displayed throughout each facet of the

organization. Our team of hands-on operators have been able to

effectively integrate acquired assets, drive organic growth, and

maintain strength in our margins during a well above normal

inflationary period. We are very encouraged by the substantial

improvement on the labor side as it relates to hiring additional

talented team members as we have moved through the year, and we

have also seen continued progress on the supply chain in real time.

Moreover, we saw accelerating momentum across our respiratory

product mix as the quarter progressed, which has continued into

fiscal Q4.,” said CEO and Chairman Greg Crawford.

“There have been several exciting developments

over the course of 2022 as we continue building our scalable

healthcare platform and expand our continuum of care across the

country. During fiscal Q3, we executed a national contract with the

largest healthcare insurance provider in the United States which

was a major milestone, allowing for substantially expanded patient

accessibility and we are continuing to work with other major

insurance providers on new national contracts. Additionally, we

recently executed a supply contract with Cardinal Health for

medical supplies nationwide. This contract will provide us

additional buying power, and open new synergistic product verticals

in the future. These major contracts are examples of the ongoing

success we are having scaling our business into a national clinical

respiratory care company in the United States. On the acquisition

front, our pipeline remains deep with strategic opportunities

across all three tiers of our strategy, and we look forward to a

very active remainder of the year. The bullish regulatory

environment, momentum in our core business, and strong balance

sheet leave us extremely well positioned to seize the growth

opportunity ahead of us.”

Chief Financial Officer Hardik Mehta added, “Our

record fiscal third quarter results demonstrate our ability to

successfully operate the business through a challenging operating

environment. We are extremely enthused with our margin stability

which we fully expect to continue moving through fiscal Q4 and

beyond. We saw record revenue of $36.7 million, experienced 2%

organic growth over fiscal Q2 2022, had strong operating cash flow

and maintained a very healthy balance sheet. As of July, we had

reached approximately $160 million in run-rate revenue and are well

on our way to meeting our outlook. Last week, we announced a

commitment letter for up to $80 million of senior credit facilities

from CIT, which will give us substantially more financial

flexibility to continue executing on our growth strategy led by our

strategic three-tiered approach to acquisitions. As it relates to

acquisitions made in 2022, we are encouraged by the ongoing

integration process of and are well positioned to continue our

aggressive growth strategy led by strategic acquisitions in

favorable geographies. We are also continuing to drive meaningful

cost and revenue synergies, following our stringent acquisition

criteria and robust integration process. Furthermore, we see

potential expansionary opportunities into synergistic verticals of

service that would enhance our end-to-end product and service

offering and look forward to updating investors on all our

progress.”

The financial statements of the Company for the

three and nine months ended June 30, 2022 and 2021 and accompanying

Management Discussion & Analysis (MD&A) are available

at www.sedar.com.

ABOUT QUIPT HOME MEDICAL CORP.

The Company provides in-home monitoring and

disease management services focused on end-to-end respiratory

solutions for patients in the United States healthcare market. It

seeks to continue to expand its offerings to include the management

of several chronic disease states focusing on patients with heart

or pulmonary disease, sleep disorders, reduced mobility, and other

chronic health conditions. The primary business objective of the

Company is to create shareholder value by offering a broader range

of services to patients in need of in-home monitoring and chronic

disease management. The Company’s organic growth strategy is to

increase annual revenue per patient by offering multiple services

to the same patient, consolidating the patient’s services, and

making life easier for the patient.

Reader Advisories

Readers are cautioned that the financial

information regarding recent acquisitions disclosed herein is

unaudited and derived as a result of the Company’s due diligence,

including a review of the acquisition’s bank statements and tax

returns.

There can be no assurance that any of the

potential acquisitions in the Company’s pipeline or in negotiations

will be completed as proposed or at all and no definitive

agreements have been executed. Completion of any transaction will

be subject to applicable director, shareholder and regulatory

approvals.

Unless otherwise specified, all dollar amounts

in this press release are expressed in U.S. dollars.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward-Looking Statements

Certain statements contained in this press

release constitute "forward-looking information" as such term is

defined in applicable Canadian securities legislation. The words

"may", "would", "could", "should", "potential", "will", "seek",

"intend", "plan", "anticipate", "believe", "estimate", "expect" and

similar expressions as they relate to the Company, including: the

Company being optimistic that sleep device allocations increasing

in the third half of 2022 will relieve some of the backlog,

generating a lift in revenue from this impacted segment of the

business; the Company anticipating that its acceleration of hiring

of experienced sales personnel to expand its sales reach across the

United States will be a key driver of future organic growth; the

Company expecting its margin stability to continue moving through

fiscal Q4 and beyond; anticipated annualized revenue and Adjusted

EBITDA of acquisitions post integration; and the Company’s outlook

for calendar 2022; are intended to identify forward-looking

information. All statements other than statements of historical

fact may be forward-looking information. Such statements reflect

the Company's current views and intentions with respect to future

events, and current information available to the Company, and are

subject to certain risks, uncertainties and assumptions, including,

without limitation: the Company’s ability to maintain/slightly

increase its collections ratios; the Company maintaining its gross

margins and maintaining its revenue growth; the Company maintaining

its selling, general and administrative expenses; acquisitions

achieving results at least as good as historical performances; the

financial information regarding acquisitions being verified when

included in the Company’s consolidated financial statements

prepared in accordance with generally accepted accounting

principles in Canada as set out in the CPA Canada Handbook -

Accounting under Part I, which incorporates International

Financial Reporting Standards as issued by the International

Accounting Standards Board; the Company successfully identified,

negotiating and completing additional acquisitions, including

accretive acquisitions; and the Company organically growing at a

rate of 10% and completing acquisitions that add at least $39 to

49 million in new revenue at approximately 20% Adjusted EBITDA in

order to meet 2022 outlook. Many factors could cause the actual

results, performance or achievements that may be expressed or

implied by such forward-looking information to vary from those

described herein should one or more of these risks or uncertainties

materialize. Examples of such risk factors include, without

limitation: credit; market (including equity, commodity, foreign

exchange and interest rate); liquidity; operational (including

technology and infrastructure); reputational; insurance; strategic;

regulatory; legal; environmental; capital adequacy; the general

business and economic conditions in the regions in which the

Company operates; the ability of the Company to execute on key

priorities, including the successful completion of acquisitions,

business retention, and strategic plans and to attract, develop and

retain key executives; difficulty integrating newly acquired

businesses; the ability to implement business strategies and pursue

business opportunities; low profit market segments; disruptions in

or attacks (including cyber-attacks) on the Company's information

technology, internet, network access or other voice or data

communications systems or services; the evolution of various types

of fraud or other criminal behavior to which the Company is

exposed; the failure of third parties to comply with their

obligations to the Company or its affiliates; the impact of new and

changes to, or application of, current laws and regulations;

decline of reimbursement rates; dependence on few payors; possible

new drug discoveries; a novel business model; dependence on key

suppliers; granting of permits and licenses in a highly regulated

business; the overall difficult litigation environment, including

in the U.S.; increased competition; changes in foreign currency

rates; increased funding costs and market volatility due to market

illiquidity and competition for funding; the availability of funds

and resources to pursue operations; critical accounting estimates

and changes to accounting standards, policies, and methods used by

the Company; and the occurrence of natural and unnatural

catastrophic events and claims resulting from such events; as well

as those risk factors discussed or referred to in the Company’s

disclosure documents filed with the securities regulatory

authorities in certain provinces of Canada and available at

www.sedar.com. Should any factor affect the Company in an

unexpected manner, or should assumptions underlying the

forward-looking information prove incorrect, the actual results or

events may differ materially from the results or events predicted.

Any such forward-looking information is expressly qualified in its

entirety by this cautionary statement. Moreover, the Company does

not assume responsibility for the accuracy or completeness of such

forward-looking information. The forward-looking information

included in this press release is made as of the date of this press

release and the Company undertakes no obligation to publicly update

or revise any forward-looking information, other than as required

by applicable law.

Non-GAAP Measures

This press release refers to “Adjusted EBITDA”

which is a non-GAAP and non-IFRS financial measure that does not

have a standardized meaning prescribed by GAAP or IFRS. The

Company’s presentation of this financial measure may not be

comparable to similarly titled measures used by other companies.

This financial measure is intended to provide additional

information to investors concerning the Company’s performance.

Adjusted EBITDA is defined as EBITDA excluding stock-based

compensation. Adjusted EBITDA is a Non-IFRS measure the Company

uses as an indicator of financial health and excludes several items

which may be useful in the consideration of the financial condition

of the Company, including interest expense, income taxes,

depreciation, amortization, stock-based compensation, goodwill

impairment and change in fair value of debentures and financial

derivatives. The following table shows our Non-IFRS measure

(Adjusted EBITDA) reconciled to our net income for the indicated

periods:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three |

|

Three |

|

Nine |

|

Nine |

|

| |

|

|

months |

|

months |

|

months |

|

months |

|

| |

|

|

ended June |

|

ended June |

|

ended June |

|

ended June |

|

| |

|

|

30, 2022 |

|

30, 2021 |

|

30, 2022 |

|

30, 2021 |

|

|

Net income (loss) |

|

|

$ |

163 |

|

|

$ |

6,329 |

|

|

$ |

3,069 |

|

|

$ |

(4,677 |

) |

|

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

|

5,363 |

|

|

|

4,768 |

|

|

|

15,835 |

|

|

|

12,389 |

|

|

| Interest expense, net |

|

|

|

522 |

|

|

|

479 |

|

|

|

1,507 |

|

|

|

1,480 |

|

|

| Provision (benefit) for income

taxes |

|

|

|

155 |

|

|

|

(535 |

) |

|

|

458 |

|

|

|

(1,941 |

) |

|

| EBITDA |

|

|

|

6,203 |

|

|

|

11,041 |

|

|

|

20,869 |

|

|

|

7,251 |

|

|

| Stock-based compensation |

|

|

|

1,325 |

|

|

|

1,597 |

|

|

|

4,596 |

|

|

|

1,624 |

|

|

| Acquisition-related costs |

|

|

|

391 |

|

|

|

92 |

|

|

|

692 |

|

|

|

164 |

|

|

| Gain (loss) on foreign

currency transactions |

|

|

|

(44 |

) |

|

|

36 |

|

|

|

82 |

|

|

|

170 |

|

|

| Other income from government

grant |

|

|

|

— |

|

|

|

— |

|

|

|

(4,254 |

) |

|

|

— |

|

|

| Change in fair value of

debentures and warrants |

|

|

|

(177 |

) |

|

|

(7,422 |

) |

|

|

(1,235 |

) |

|

|

6,704 |

|

|

| Adjusted EBITDA |

|

|

$ |

7,698 |

|

|

$ |

5,344 |

|

|

$ |

20,750 |

|

|

$ |

15,913 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Management uses this non-IFRS measure as a key

metric in the evaluation of the Company’s performance and the

consolidated financial results. The Company believes this non-IFRS

measure is useful to investors in their assessment of the operating

performance and the valuation of the Company. In addition, this

non-IFRS measure addresses questions the Company routinely receives

from analysts and investors and, in order to assure that all

investors have access to similar data, the Company has determined

that it is appropriate to make this data available to all

investors. However, non-IFRS financial measures are not prepared in

accordance with IFRS, and the information is not necessarily

comparable to other companies and should be considered as a

supplement to, not a substitute for, or superior to, the

corresponding measures calculated in accordance with IFRS.

For further information please visit our website

at www.Quipthomemedical.com, or contact:

Cole StevensVP of Corporate DevelopmentQuipt Home Medical

Corp.859-300-6455cole.stevens@myquipt.com

Gregory CrawfordChief Executive OfficerQuipt Home Medical

Corp.859-300-6455investorinfo@myquipt.com

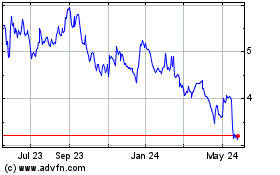

Quipt Home Medical (NASDAQ:QIPT)

Historical Stock Chart

From Nov 2024 to Dec 2024

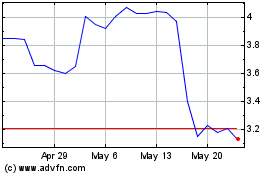

Quipt Home Medical (NASDAQ:QIPT)

Historical Stock Chart

From Dec 2023 to Dec 2024