- The steep re-ramp of Auto Insurance carrier spending has

begun

- Auto Insurance revenue is expected to continue to ramp in

coming quarters

- Continued total company revenue growth, further margin

expansion expected in FYQ4

- Strong growth & margin expansion expected in fiscal year

2025 which begins July 1

QuinStreet, Inc. (Nasdaq: QNST), a leader in performance

marketplaces and technologies for the financial services and home

services industries, today announced financial results for the

fiscal third quarter ended March 31, 2024.

For the fiscal third quarter, the Company reported revenue of

$168.6 million.

GAAP net loss for the fiscal third quarter was $(7.0) million,

or $(0.13) per diluted share. Adjusted net income for the fiscal

third quarter was $3.4 million, or $0.06 per diluted share.

Adjusted EBITDA for the fiscal third quarter was $7.9

million.

The Company closed the fiscal third quarter with $39.6 million

in cash and cash equivalents and no bank debt.

“The steep re-ramp of Auto Insurance carrier spending has

begun,” commented Doug Valenti, CEO of QuinStreet. “Revenue in our

Auto Insurance client vertical inflected strongly in January and

scaled further during the quarter. Total Company revenue grew about

40% sequentially in fiscal Q3. Adjusted EBITDA jumped to almost $8

million dollars in the quarter. We expect the ramp of Auto

Insurance revenue to continue in coming quarters, driving growth in

total Company revenue and further margin expansion.

“Turning to our outlook for the current quarter, or fiscal Q4,

we expect revenue to be between $180 and $190 million, a quarterly

revenue record for QuinStreet, implying year-over-year growth of

over 40% at the midpoint of the range. We expect adjusted EBITDA to

be between $10 and $11 million, implying year-over-year growth of

over 400%. Our fiscal year 2025 begins this July 1. The annual run

rate of our fiscal Q4 revenue outlook already implies growth of 20%

or more over full fiscal year 2024.”

Conference Call Today at 2:00 p.m.

PT

The Company will host a conference call and corresponding live

webcast at 2:00 p.m. PT. To access the conference call dial +1

800-717-1738 (domestic) or +1 646-307-1865 (international). A

replay of the conference call will be available beginning

approximately two hours after the completion of the call by dialing

+1 844-512-2921 (domestic) or +1 412-317-6671 (international) and

using passcode #1148246. The webcast of the conference call will be

available live and via replay on the investor relations section of

the Company's website at http://investor.quinstreet.com.

About QuinStreet

QuinStreet, Inc. (Nasdaq: QNST) is a leader in performance

marketplaces and technologies for the financial services and home

services industries. QuinStreet is a pioneer in delivering online

marketplace solutions to match searchers with brands in digital

media, and is committed to providing consumers with the information

and tools they need to research, find and select the products and

brands that meet their needs.

Non-GAAP Financial Measures and

Definitions of Client Verticals

This release and the accompanying tables include a discussion of

adjusted EBITDA, adjusted net (loss) income, adjusted diluted net

(loss) income per share and free cash flow and normalized free cash

flow, all of which are non-GAAP financial measures that are

provided as a complement to results provided in accordance with

accounting principles generally accepted in the United States of

America ("GAAP"). The term "adjusted EBITDA" refers to a financial

measure that we define as net loss less provision for (benefit

from) income taxes, depreciation expense, amortization expense,

stock-based compensation expense, interest and other (income)

expense, net, acquisition and divestiture costs, contingent

consideration adjustment, litigation settlement expense, tax

settlement expense, and restructuring costs. The term "adjusted net

(loss) income" refers to a financial measure that we define as net

loss adjusted for amortization expense, stock-based compensation

expense, acquisition and divestiture costs, contingent

consideration adjustment, litigation settlement expense, tax

settlement expense, tax valuation allowance, restructuring costs

and impairment of investment, net of estimated taxes. The term

"adjusted diluted net (loss) income per share" refers to a

financial measure that we define as adjusted net (loss) income

divided by weighted average diluted shares outstanding. The term

“free cash flow” refers to a financial measure that we define as

net cash provided by operating activities, less capital

expenditures and internal software development costs. The term

“normalized free cash flow” refers to free cash flow less changes

in operating assets and liabilities. These non-GAAP measures should

be considered in addition to results prepared in accordance with

GAAP, but should not be considered a substitute for, or superior

to, GAAP results. In addition, our definition of adjusted EBITDA,

adjusted net income, adjusted diluted net income per share and free

cash flow and normalized free cash flow may not be comparable to

the definitions as reported by other companies.

We believe adjusted EBITDA, adjusted net (loss) income and

adjusted diluted net (loss) income per share are relevant and

useful information because they provide us and investors with

additional measurements to analyze the Company's operating

performance.

Adjusted EBITDA is useful to us and investors because (i) we

seek to manage our business to a level of adjusted EBITDA as a

percentage of net revenue, (ii) it is used internally by us for

planning purposes, including preparation of internal budgets; to

allocate resources; to evaluate the effectiveness of operational

strategies and capital expenditures as well as the capacity to

service debt, (iii) it is a key basis upon which we assess our

operating performance, (iv) it is one of the primary metrics

investors use in evaluating Internet marketing companies, (v) it is

a factor in determining compensation, (vi) it is an element of

certain financial covenants under our historical borrowing

arrangements, and (vii) it is a factor that assists investors in

the analysis of ongoing operating trends. In addition, we believe

adjusted EBITDA and similar measures are widely used by investors,

securities analysts, ratings agencies and other interested parties

in our industry as a measure of financial performance, debt-service

capabilities and as a metric for analyzing company valuations.

We use adjusted EBITDA as a key performance measure because we

believe it facilitates operating performance comparisons from

period to period by excluding potential differences caused by

variations in capital structures (affecting interest expense), tax

positions (such as the impact of changes in effective tax rates or

fluctuations in permanent differences or discrete quarterly items),

non-recurring charges, certain other items that we do not believe

are indicative of core operating activities (such as litigation

settlement expense, tax settlement expense, acquisition and

divestiture costs, contingent consideration adjustment,

restructuring costs and other income and expense) and the non-cash

impact of depreciation expense, amortization expense and

stock-based compensation expense.

With respect to our adjusted EBITDA guidance, the Company is not

able to provide a quantitative reconciliation to the most directly

comparable GAAP financial measure without unreasonable efforts due

to the high variability, complexity and low visibility with respect

to certain items such as taxes, and income and expense from changes

in fair value of contingent consideration from acquisitions. We

expect the variability of these items to have a potentially

unpredictable and potentially significant impact on future GAAP

financial results, and, as such, we also believe that any

reconciliations provided would imply a degree of precision that

would be confusing or misleading to investors.

Adjusted net (loss) income and adjusted diluted net (loss)

income per share are useful to us and investors because they

present an additional measurement of our financial performance,

taking into account depreciation, which we believe is an ongoing

cost of doing business, but excluding the impact of certain

non-cash expenses (stock-based compensation, amortization of

intangible assets, and contingent consideration adjustment),

non-recurring charges and certain other items that we do not

believe are indicative of core operating activities. We believe

that analysts and investors use adjusted net income and adjusted

diluted net income per share as supplemental measures to evaluate

the overall operating performance of companies in our industry.

Free cash flow is useful to investors and us because it

represents the cash that our business generates from operations,

before taking into account cash movements that are non-operational,

and is a metric commonly used in our industry to understand the

underlying cash generating capacity of a company’s financial model.

Normalized free cash flow is useful as it removes the fluctuations

in operating assets and liabilities that occur in any given quarter

due to the timing of payments and cash receipts and therefore helps

investors understand the underlying cash flow of the business as a

quarterly metric and the cash flow generation potential of the

business model. We believe that analysts and investors use free

cash flow multiples as a metric for analyzing company valuations in

our industry.

We intend to provide these non-GAAP financial measures as part

of our future earnings discussions and, therefore, the inclusion of

these non-GAAP financial measures will provide consistency in our

financial reporting. A reconciliation of these non-GAAP measures to

GAAP is provided in the accompanying tables.

Legal Notice Regarding Forward Looking

Statements

This press release and its attachments contain forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934 that involve risks and uncertainties. Words

such as "estimate", "will”, "believe", “expect”, "intend",

“outlook”, "potential", “promises” and similar expressions are

intended to identify forward-looking statements. These

forward-looking statements include the statements in quotations

from management in this press release, as well as any statements

regarding the Company's anticipated financial results, growth and

strategic and operational plans and results of analyses on

impairment charges. The Company's actual results may differ

materially from those anticipated in these forward-looking

statements. Factors that may contribute to such differences

include, but are not limited to: the Company’s ability to maintain

and increase client marketing spend; the Company's ability, whether

within or outside the Company’s control, to maintain and increase

the number of visitors to its websites and to convert those

visitors and those to its third-party publishers' websites into

client prospects in a cost-effective manner; the Company's exposure

to data privacy and security risks; the impact of changes in

industry standards and government regulation including, but not

limited to investigation enforcement activities or regulatory

activity by the Federal Trade Commission, the Federal

Communications Commission, the Consumer Finance Protection Bureau

and other state and federal regulatory agencies; the impact of

changes in our business, our industry, and the current economic and

regulatory climate on the Company’s quarterly and annual results of

operations; the Company's ability to compete effectively against

others in the online marketing and media industry both for client

budget and access to third-party media; the Company’s ability to

protect our intellectual property rights; and the impact from risks

relating to counterparties on the Company's business. More

information about potential factors that could affect the Company's

business and financial results are contained in the Company's

annual report on Form 10-K and quarterly reports on Form 10-Q as

filed with the Securities and Exchange Commission ("SEC").

Additional information will also be set forth in the Company's

annual report on Form 10-Q for the fiscal year ended March 31,

2024, which will be filed with the SEC. The Company does not intend

and undertakes no duty to release publicly any updates or revisions

to any forward-looking statements contained herein.

QUINSTREET, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

March 31,

June 30,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

39,602

$

73,677

Accounts receivable, net

99,639

67,748

Prepaid expenses and other assets

7,525

9,779

Total current assets

146,766

151,204

Property and equipment, net

20,633

16,749

Operating lease right-of-use assets

10,923

3,536

Goodwill

125,056

121,141

Other intangible assets, net

40,881

38,700

Other assets, noncurrent

4,992

5,825

Total assets

$

349,251

$

337,155

Liabilities and Stockholders'

Equity

Current liabilities:

Accounts payable

$

40,621

$

37,926

Accrued liabilities

58,425

44,010

Deferred revenue

185

9

Other liabilities

9,883

7,875

Total current liabilities

109,114

89,820

Operating lease liabilities,

noncurrent

8,260

1,261

Other liabilities, noncurrent

16,913

16,273

Total liabilities

134,287

107,354

Stockholders' equity:

Common stock

55

54

Additional paid-in capital

343,424

329,093

Accumulated other comprehensive loss

(268

)

(266

)

Accumulated deficit

(128,247

)

(99,080

)

Total stockholders' equity

214,964

229,801

Total liabilities and stockholders'

equity

$

349,251

$

337,155

QUINSTREET, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

Nine Months Ended

March 31,

March 31,

2024

2023

2024

2023

Net revenue

$

168,587

$

172,671

$

415,193

$

450,312

Cost of revenue (1)

154,276

155,633

386,380

412,388

Gross profit

14,311

17,038

28,813

37,924

Operating expenses: (1)

Product development

7,549

7,832

22,457

21,832

Sales and marketing

3,626

3,385

10,076

9,651

General and administrative

8,468

7,230

22,906

21,919

Operating loss

(5,332

)

(1,409

)

(26,626

)

(15,478

)

Interest income

49

46

381

65

Interest expense

(293

)

(187

)

(515

)

(626

)

Other expense

(2,028

)

(12

)

(1,961

)

(44

)

Loss before income taxes

(7,604

)

(1,562

)

(28,721

)

(16,083

)

Benefit from (provision for) income

taxes

556

1,083

(446

)

3,108

Net loss

$

(7,048

)

$

(479

)

$

(29,167

)

$

(12,975

)

Net loss per share:

Basic

$

(0.13

)

$

(0.01

)

$

(0.53

)

$

(0.24

)

Diluted

$

(0.13

)

$

(0.01

)

$

(0.53

)

$

(0.24

)

Weighted-average shares used in computing

net loss per share:

Basic

55,065

53,950

54,764

53,668

Diluted

55,065

53,950

54,764

53,668

(1) Cost of revenue and operating expenses

include stock-based compensation expense as follows:

Cost of revenue

$

2,203

$

2,006

$

6,483

$

6,238

Product development

789

695

2,399

2,225

Sales and marketing

794

660

2,157

1,970

General and administrative

2,948

1,947

7,038

5,622

QUINSTREET, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

March 31,

March 31,

2024

2023

2024

2023

Cash Flows from Operating

Activities

Net loss

$

(7,048

)

$

(479

)

$

(29,167

)

$

(12,975

)

Adjustments to reconcile net loss to net

cash (used in) provided by operating activities:

Depreciation and amortization

6,225

4,972

17,276

14,004

Impairment of investment

2,000

—

2,000

—

Provision for sales returns and doubtful

accounts receivable

326

169

708

898

Stock-based compensation

6,721

5,308

18,063

16,055

Non-cash lease expense

51

(280

)

(559

)

(822

)

Deferred income taxes

(559

)

(981

)

187

(3,260

)

Other adjustments, net

150

(6

)

(266

)

(147

)

Changes in assets and liabilities:

Accounts receivable

(25,237

)

(34,363

)

(32,599

)

(25,075

)

Prepaid expenses and other assets

296

(3,238

)

2,481

(3,826

)

Accounts payable

7,023

3,113

2,297

(1,562

)

Accrued liabilities

13,980

16,465

14,886

10,920

Deferred revenue

185

(10

)

176

(341

)

Net cash (used in) provided by operating

activities

4,113

(9,330

)

(4,517

)

(6,131

)

Cash Flows from Investing

Activities

Capital expenditures

(1,211

)

(485

)

(4,173

)

(2,038

)

Internal software development costs

(2,488

)

(3,031

)

(8,903

)

(8,496

)

Acquisitions, net of cash acquired

(4,510

)

—

(4,510

)

—

Other investing activities

(1,500

)

—

(1,500

)

(120

)

Net cash used in investing activities

(9,709

)

(3,516

)

(19,086

)

(10,654

)

Cash Flows from Financing

Activities

Proceeds from exercise of stock options

and issuance of common stock under employee stock purchase plan

1,595

1,409

3,296

3,206

Payment of withholding taxes related to

release of restricted stock, net of share settlement

(1,571

)

(1,518

)

(4,920

)

(4,744

)

Post-closing payments and contingent

consideration related to acquisitions

(344

)

(3,184

)

(6,573

)

(10,408

)

Repurchase of common stock

—

—

(2,288

)

(4,731

)

Net cash used in financing activities

(320

)

(3,293

)

(10,485

)

(16,677

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(2

)

(2

)

13

(14

)

Net decrease in cash, cash equivalents and

restricted cash

(5,918

)

(16,141

)

(34,075

)

(33,476

)

Cash, cash equivalents and restricted cash

at beginning of period

45,535

79,118

73,692

96,453

Cash, cash equivalents and restricted cash

at end of period

$

39,617

$

62,977

$

39,617

$

62,977

Reconciliation of cash, cash

equivalents, and restricted cash to the condensed consolidated

balance sheets

Cash and cash equivalents

$

39,602

$

62,962

$

39,602

$

62,962

Restricted cash included in other assets,

noncurrent

15

15

15

15

Total cash, cash equivalents and

restricted cash

$

39,617

$

62,977

$

39,617

$

62,977

QUINSTREET, INC.

RECONCILIATION OF NET LOSS

TO

ADJUSTED NET INCOME

(LOSS)

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

Nine Months Ended

March 31,

March 31,

2024

2023

2024

2023

Net loss

$

(7,048

)

$

(479

)

$

(29,167

)

$

(12,975

)

Amortization of intangible assets

2,678

2,808

7,834

8,454

Stock-based compensation

6,734

5,308

18,077

16,055

Acquisition and divestiture costs

30

—

30

32

Litigation settlement expense

—

6

—

6

Tax settlement expense

—

—

—

39

Restructuring costs

277

102

578

183

Impairment of investment

2,000

—

2,000

—

Tax impact of non-GAAP items

(1,235

)

(1,597

)

410

(4,012

)

Adjusted net income (loss)

$

3,436

$

6,148

$

(238

)

$

7,782

Adjusted diluted net income (loss) per

share

$

0.06

$

0.11

$

(0.00

)

$

0.14

Weighted average shares used in computing

adjusted diluted net income (loss) per share

56,733

55,680

54,764

54,952

QUINSTREET, INC.

RECONCILIATION OF NET LOSS

TO

ADJUSTED EBITDA

(In thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

March 31,

March 31,

2024

2023

2024

2023

Net loss

$

(7,048

)

$

(479

)

$

(29,167

)

$

(12,975

)

Interest and other expense, net

2,272

153

2,095

605

Benefit from (provision for) income

taxes

(556

)

(1,083

)

446

(3,108

)

Depreciation and amortization

6,225

4,972

17,276

14,004

Stock-based compensation

6,734

5,308

18,077

16,055

Acquisition and divestiture costs

30

—

30

32

Litigation settlement expense

—

6

—

6

Tax settlement expense

—

—

—

39

Restructuring costs

277

102

578

183

Adjusted EBITDA

$

7,934

$

8,979

$

9,335

$

14,841

QUINSTREET, INC.

RECONCILIATION OF CASH (USED

IN) PROVIDED BY

OPERATING ACTIVITIES TO FREE

CASH FLOW

AND NORMALIZED FREE CASH

FLOW

(In thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

March 31,

March 31,

2024

2023

2024

2023

Net cash (used in) provided by operating

activities

$

4,113

$

(9,330

)

$

(4,517

)

$

(6,131

)

Capital expenditures

(1,211

)

(485

)

(4,173

)

(2,038

)

Internal software development costs

(2,488

)

(3,031

)

(8,903

)

(8,496

)

Free cash flow

414

(12,846

)

(17,593

)

(16,665

)

Changes in operating assets and

liabilities

3,754

18,032

12,758

19,884

Normalized free cash flow

$

4,168

$

5,186

$

(4,835

)

$

3,219

QUINSTREET, INC.

DISAGGREGATION OF

REVENUE

(In thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

March 31,

March 31,

2024

2023

2024

2023

Net revenue:

Financial Services

$

112,250

$

120,219

$

255,708

$

304,520

Home Services

53,908

50,289

152,636

139,997

Other Revenue

2,429

2,163

6,849

5,795

Total net revenue

$

168,587

$

172,671

$

415,193

$

450,312

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240508534355/en/

Investor Contact: Robert

Amparo (347) 223-1682 ramparo@quinstreet.com

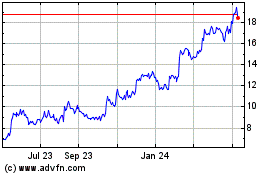

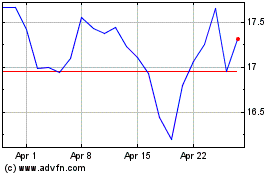

QuinStreet (NASDAQ:QNST)

Historical Stock Chart

From Oct 2024 to Nov 2024

QuinStreet (NASDAQ:QNST)

Historical Stock Chart

From Nov 2023 to Nov 2024