0001559053FALSE00015590532024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________________

FORM 8-K

_______________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

_______________________________________________________

PROTHENA CORPORATION PUBLIC LIMITED COMPANY

(Exact name of registrant as specified in its charter)

_______________________________________________________

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Ireland | | 001-35676 | | 98-1111119 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

|

| 77 Sir John Rogerson's Quay, Block C | |

| Grand Canal Docklands | |

| Dublin 2, | D02 VK60, | Ireland | |

| (Address of principal executive offices, including Zip Code) |

Registrant’s telephone number, including area code: 011-353-1-236-2500

___________________________________________________

(Former Name or Former Address, if Changed Since Last Report.)

___________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Ordinary Shares, par value $0.01 per share | PRTA | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

The information in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. It may only be incorporated by reference in another filing under the Exchange Act or the Securities Act of 1933, as amended, if such subsequent filing specifically incorporate by reference the information furnished pursuant to Item 2.02 (including Exhibit 99.1) of this Current Report.

On August 8, 2024, Prothena Corporation plc issued a press release announcing its financial results for the second quarter ended June 30, 2024. A copy of that press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| Date: | August 8, 2024 | PROTHENA CORPORATION PLC |

| | | | |

| | By: | | /s/ Tran B. Nguyen |

| | Name: | | Tran B. Nguyen |

| | Title: | | Chief Financial Officer and Chief Strategy Officer |

Exhibit 99.1

PRESS RELEASE

Prothena Reports Second Quarter 2024 Financial Results and Business Highlights

•Net cash provided by operating and investing activities was $15.8 million in the second quarter and net cash used by operating and investing activities was $57.3 million for the first six months of 2024; quarter-end cash and restricted cash position was $565.0 million

•Revised year-end cash guidance to be approximately $468 million in cash, cash equivalents and restricted cash, representing an increase of $63 million from prior guidance of $405 million

•Bristol Myers Squibb obtained the exclusive global license for PRX019 for $80 million, a potential treatment of neurodegenerative disease with an undisclosed target; Prothena to initiate a Phase 1 clinical trial by YE 2024

•Partner Bristol Myers Squibb presented a poster for BMS-986446 at AAIC 2024 of the clinical trial design for the ongoing Phase 2 TargetTau-1 clinical trial to treat Alzheimer’s disease

•Presented poster for PRX012 at AAIC 2024 of the clinical trial design for the ongoing Phase 1 ASCENT clinical trial to treat Alzheimer’s disease; program update expected in 2024

•Highlighted poster for birtamimab at ISA 2024 of additional efficacy analysis from the VITAL Phase 3 clinical trial to treat AL amyloidosis; ongoing global confirmatory Phase 3 AFFIRM-AL clinical trial with topline results expected between 4Q 2024 and 2Q 2025

DUBLIN, Ireland, August 8, 2024-- Prothena Corporation plc (NASDAQ:PRTA), a late-stage clinical biotechnology company with a robust pipeline of investigational therapeutics built on protein dysregulation expertise, today reported financial results for the second quarter and first six months of 2024 and provided business highlights.

“We continue to meaningfully advance our programs and move towards becoming a fully integrated commercial company, which will enable Prothena to deliver transformative medicines for people living with devastating diseases caused by protein dysregulation. We recently announced that our collaboration with Bristol Myers Squibb generated a clinical development program with their exclusive global license of PRX019 for $80 million. In addition, this quarter we continued to enroll our ongoing global clinical trials for our wholly-owned PRX012 and birtamimab programs as planned,” said Gene Kinney, Ph.D., President and Chief Executive Officer, Prothena. “Within the next 12 months we expect to announce topline results from four ongoing clinical programs: the Phase 1 ASCENT program for Alzheimer’s disease with PRX012, the confirmatory Phase 3 AFFIRM-AL clinical trial for AL amyloidosis with birtamimab, the Phase 2b PADOVA clinical trial for Parkinson’s disease with prasinzumab in collaboration with Roche and the Phase 2 clinical trial for ATTR-cardiomyopathy with coramitug in collaboration with Novo Nordisk.”

Second Quarter, Recent Business Highlights and Upcoming Milestones

Neurodegenerative Diseases Portfolio

Alzheimer’s Disease

PRX012, a wholly-owned potential best-in-class, next-generation antibody delivered subcutaneously for the treatment of Alzheimer’s disease that targets a key epitope at the N-terminus of amyloid beta (Aβ) with high binding potency. The U.S. Food and Drug Administration (FDA) has granted Fast Track designation for PRX012 for the treatment of Alzheimer’s disease.

•Poster presentation at AAIC 2024 highlighted the clinical trial design of the ongoing Phase 1 ASCENT program for PRX012

•Initial Phase 1 single ascending dose and multiple dose data supports once-monthly subcutaneous administration and ongoing evaluation in multiple dose cohorts

•Phase 1 clinical trial continues as planned and expect to update in 2024

BMS-986446 (formerly PRX005), a potential best-in-class antibody for the treatment of Alzheimer’s disease that specifically targets a key epitope within the microtubule binding region (MTBR) of tau, a protein implicated in the causal pathophysiology of Alzheimer’s disease.

•Poster presentation by partner Bristol Myers Squibb at AAIC 2024 highlighted the design of the ongoing Phase 2 TargetTau-1 clinical trial for BMS-986446

•Bristol Myers Squibb continues to enroll the ongoing Phase 2 clinical trial in approximately 475 patients with early Alzheimer’s disease for BMS-986446 (NCT06268886)

•Bristol Myers Squibb is responsible for all development, manufacturing, and commercialization of BMS-986446

PRX123, a wholly-owned potential first-in-class dual Aβ/tau vaccine designed for the treatment and prevention of Alzheimer’s disease, is a dual-target vaccine targeting key epitopes within the N-terminus of Aβ and MTBR-tau designed to promote amyloid clearance and block the transmission of pathogenic tau. The FDA cleared the investigational new drug (IND) application and granted Fast Track designation for PRX123 for the treatment of Alzheimer’s disease.

•Phase 1 timeline update expected in 2024

Parkinson’s Disease

Prasinezumab, a potential first-in-class antibody for the treatment of Parkinson’s disease that is designed to target key epitopes within the C-terminus of alpha-synuclein, and is the focus of a worldwide collaboration with Roche

•Topline results from Phase 2b PADOVA clinical trial in patients with early Parkinson’s disease, which has completed enrollment of 586 patients, expected in 2H 2024 (NCT04777331)

Neurodegenerative Diseases

PRX019, a potential treatment of neurodegenerative diseases with an undisclosed target.

•Bristol Myers Squibb obtained the exclusive global license for PRX019 for $80 million

•As part of the PRX019 global license with Bristol Myers Squibb, Prothena will be eligible to receive additional development, regulatory, and sales milestone payments of up to $617.5 million and tiered royalties on net sales

•Prothena will initiate a Phase 1 clinical trial for PRX019 by year-end 2024

Rare Peripheral Amyloid Diseases Portfolio

AL Amyloidosis

Birtamimab, a wholly-owned potential best-in-class anti-amyloid antibody for the treatment of AL amyloidosis designed to directly neutralize soluble toxic light chain aggregates and promote clearance of amyloid that causes organ dysfunction and failure. Among patients with AL amyloidosis, a rare, progressive, and fatal disease, newly diagnosed individuals with advanced disease (e.g., Mayo Stage IV) are at the highest risk for early death. Birtamimab has been granted Fast Track designation by the FDA for the treatment of patients with Mayo Stage IV AL amyloidosis to reduce the risk of mortality and has been granted Orphan Drug Designation by both the FDA and European Medicines Agency. A significant survival benefit was observed in the post hoc analysis of birtamimab-treated patients categorized as Mayo Stage IV at baseline in the previous Phase 3 VITAL clinical trial (Blood 2023).

•Longitudinal Health-Related Quality of Life data (SF-36v2) across domains from the VITAL Phase 3 clinical trial for birtamimab was presented at the International Society of Amyloidosis (ISA) 2024 meeting

•The ongoing confirmatory Phase 3 AFFIRM-AL clinical trial in patients with Mayo Stage IV AL amyloidosis is being conducted under a Special Protocol Assessment (SPA) agreement with the FDA with a primary endpoint of all-cause mortality (time-to-event) at a significance level of 0.10

•Topline results from confirmatory AFFIRM-AL Phase 3 clinical trial expected between 4Q 2024 and 2Q 2025 (NCT04973137)

ATTR Amyloidosis

Coramitug (formerly PRX004), a potential first-in-class amyloid depleter antibody for the treatment of ATTR cardiomyopathy designed to deplete the pathogenic, non-native forms of the transthyretin (TTR) protein and is being developed by Novo Nordisk as part of their up to $1.2 billion acquisition of Prothena’s ATTR amyloidosis business and pipeline

•Ongoing Phase 2 clinical trial in patients with ATTR cardiomyopathy is being conducted by Novo Nordisk

•Phase 2 clinical trial has completed enrollment of approximately 99 patients with topline data expected in 1H 2025 (NCT05442047)

Second Quarter and First Six Months of 2024 Financial Results

For the second quarter and first six months of 2024, Prothena reported net income of $66.9 million and net loss of $5.4 million, respectively, as compared to a net loss of $54.6 million and $101.5 million for the second quarter and first six months of 2023, respectively. Net income per share on a diluted basis was $1.22 for the second quarter of 2024 and net loss per share for the first six months of 2024 was $0.10, as compared to net loss per share of $1.03 and $1.92 for the second quarter and first six months of 2023, respectively.

Prothena reported total revenue of $132.0 million and $132.1 million for the second quarter and first six months of 2024, respectively, as compared to total revenue of $4.0 million and $6.2 million for the second quarter and first six months of 2023, respectively. Total revenue for the second quarter and first six months of 2024 was primarily from collaboration revenue from Bristol Myers Squibb as compared to total revenue for the second quarter and first six months of 2023 that also was primarily from collaboration revenue from Bristol Myers Squibb.

Research and development (R&D) expenses totaled $57.5 million and $121.6 million for the second quarter and first six months of 2024, respectively, as compared to $56.0 million and $100.8 million for the second quarter and first six months of 2023, respectively. The increase in R&D expenses for the second quarter and first six months of 2024 compared to the same periods in the prior year was primarily due to higher clinical trial expenses and higher personnel related expenses; offset in part by lower manufacturing expenses. R&D expenses included non-cash share-based compensation expense of $5.6 million and $11.1 million for the second quarter and first six months of 2024, respectively, as compared to $4.9 million and $9.2 million for the second quarter and first six months of 2023, respectively.

General and administrative (G&A) expenses totaled $16.1 million and $33.6 million for the second quarter and first six months of 2024, respectively, as compared to $14.5 million and $28.3 million for the second quarter and first six months of 2023, respectively. The increase in G&A expenses for the second quarter and first six months of 2024 compared to the same periods in the prior year was primarily related to higher personnel related and consulting expenses. G&A expenses included non-cash share-based compensation expense of $6.4 million and $13.3 million for the second quarter and first six months of 2024, respectively, as compared to $5.2 million and $9.7 million for the second quarter and first six months of 2023, respectively.

Total non-cash share-based compensation expense was $12.0 million and $24.4 million for the second quarter and first six months of 2024, respectively, as compared to $10.1 million and $18.9 million for the second quarter and first six months of 2023, respectively.

As of June 30, 2024, Prothena had $565.0 million in cash, cash equivalents and restricted cash, and no debt.

As of August 1, 2024, Prothena had approximately 53.8 million ordinary shares outstanding.

2024 Financial Guidance

The Company is updating it projected full year 2024 net cash used in operating and investing actives, and expects it to be $148 to $160 million (versus prior guidance $208 to $225 million) and expects to end the year with approximately $468 million (midpoint) in cash, cash equivalents and restricted cash, representing an increase of $63 million from prior guidance of $405 million (midpoint). This increase in cash position is primarily driven by Bristol Myers Squibb obtaining the $80 million exclusive worldwide rights for PRX019, offset by increased spend on our clinical stage programs including PRX019. The updated estimated full year 2024 net cash used from operating and investing activities is primarily driven by an updated estimated net loss of $120 to $135 million (versus prior guidance of $229 to $255 million), which includes an estimated $48 million of non-cash share-based compensation expense.

About Prothena

Prothena Corporation plc is a late-stage clinical biotechnology company with expertise in protein dysregulation and a pipeline of investigational therapeutics with the potential to change the course of devastating neurodegenerative and rare peripheral amyloid diseases. Fueled by its deep scientific expertise built over decades of research, Prothena is advancing a pipeline of therapeutic candidates for a number of indications and novel targets for which its ability to integrate scientific insights around neurological dysfunction and the biology of misfolded proteins can be leveraged. Prothena’s pipeline includes both wholly-owned and partnered programs being developed for the potential treatment of diseases including AL amyloidosis, ATTR amyloidosis, Alzheimer’s disease, Parkinson’s disease and a number of other neurodegenerative diseases. For more information, please visit the Company’s website at www.prothena.com and follow the Company on Twitter @ProthenaCorp.

Forward-Looking Statements

This press release contains forward-looking statements. These statements relate to, among other things, the sufficiency of our cash position to fund advancement of a broad pipeline and completion of our ongoing clinical trials; the continued advancement of our discovery, preclinical, and clinical pipeline, and expected milestones in 2024, 2025, and beyond; the treatment potential, designs, proposed mechanisms of action, and potential administration of PRX012, BMS-986446/PRX005, PRX123, prasinezumab, PRX019, birtamimab, and coramitug/PRX004; plans for ongoing and future clinical studies of PRX012, BMS-986446/PRX005, PRX123, prasinezumab, PRX019, birtamimab, and coramitug/PRX004; the expected timing of reporting data from clinical studies, including any updates regarding our ongoing Phase 1 clinical trial evaluating PRX012 in 2024 and topline study results for our Phase 3 AFFIRM-AL clinical trial between 4Q 2024 and 2Q 2025; amounts we might receive under our collaboration with BMS; our anticipated net cash burn from operating and investing activities for 2024 and expected cash balance at the end of 2024; and our estimated net loss and non-cash share-based compensation expense for 2024. These statements are based on estimates, projections and assumptions that may prove not to be accurate, and actual results could differ materially from those anticipated due to known and unknown risks, uncertainties and other factors, including but not limited to those described in the “Risk Factors” sections of our Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (SEC) on August 8, 2024, and discussions of potential risks, uncertainties, and other important factors in our subsequent filings with the SEC. We undertake no obligation to update publicly any forward-looking statements contained in this press release as a result of new information, future events, or changes in our expectations.

PROTHENA CORPORATION PLC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited - amounts in thousands except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Collaboration revenue | | $ | 132,014 | | | $ | 4,019 | | | $ | 132,014 | | | $ | 6,138 | |

| Revenue from license and intellectual property | | — | | | — | | | 50 | | | 50 | |

| Total revenue | | 132,014 | | | 4,019 | | | 132,064 | | | 6,188 | |

| Operating expenses: | | | | | | | | |

| Research and development | | 57,510 | | | 56,011 | | | 121,624 | | | 100,767 | |

| General and administrative | | 16,127 | | | 14,512 | | | 33,591 | | | 28,250 | |

| Total operating expenses | | 73,637 | | | 70,523 | | | 155,215 | | | 129,017 | |

Income (loss) from operations | | 58,377 | | | (66,504) | | | (23,151) | | | (122,829) | |

Total other income, net | | 6,470 | | | 7,603 | | | 13,558 | | | 14,152 | |

Income (loss) before income taxes | | 64,847 | | | (58,901) | | | (9,593) | | | (108,677) | |

Benefit from income taxes | | (2,039) | | | (4,306) | | | (4,240) | | | (7,218) | |

Net income (loss) | | $ | 66,886 | | | $ | (54,595) | | | $ | (5,353) | | | $ | (101,459) | |

| Basic net income (loss) per ordinary share | | $ | 1.24 | | | $ | (1.03) | | | $ | (0.10) | | | $ | (1.92) | |

| Diluted net income (loss) per ordinary share | | $ | 1.22 | | | $ | (1.03) | | | $ | (0.10) | | | $ | (1.92) | |

| Shares used to compute basic net income (loss) per share | | 53,767 | | | 53,121 | | | 53,740 | | | 52,812 | |

| Shares used to compute diluted net income (loss) per share | | 55,043 | | | 53,121 | | | 53,740 | | | 52,812 | |

PROTHENA CORPORATION PLC

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited - amounts in thousands)

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| Assets | | | |

| Cash and cash equivalents | $ | 564,124 | | | $ | 618,830 | |

Restricted cash, current | — | | | 1,352 | |

| Prepaid expenses and other current assets | 21,854 | | | 19,100 | |

| Total current assets | 585,978 | | | 639,282 | |

| Property and equipment, net | 3,486 | | | 3,836 | |

| Operating lease right-of-use assets | 12,066 | | | 12,162 | |

| Restricted cash, non-current | 860 | | | 860 | |

| Other non-current assets | 43,175 | | | 40,242 | |

| Total non-current assets | 59,587 | | | 57,100 | |

| Total assets | $ | 645,565 | | | $ | 696,382 | |

| Liabilities and Shareholders’ Equity | | | |

| Accrued research and development | 15,927 | | | 14,724 | |

Deferred revenue, current | 8,025 | | | — | |

| Lease liability, current | 2,579 | | | 1,114 | |

| Other current liabilities | 20,213 | | | 41,053 | |

| Total current liabilities | 46,744 | | | 56,891 | |

Deferred revenue, non-current | 7,366 | | | 67,405 | |

| Lease liability, non-current | 9,538 | | | 10,721 | |

| Total non-current liabilities | 16,904 | | | 78,126 | |

| Total liabilities | 63,648 | | | 135,017 | |

| Total shareholders’ equity | 581,917 | | | 561,365 | |

| Total liabilities and shareholders’ equity | $ | 645,565 | | | $ | 696,382 | |

Contacts:

Investors

Mark Johnson, CFA, Vice President, Investor Relations

650-417-1974, mark.johnson@prothena.com

Media

Michael Bachner, Senior Director, Corporate Communications

609-664-7308, michael.bachner@prothena.com

v3.24.2.u1

Cover Page

|

Aug. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity Registrant Name |

PROTHENA CORPORATION PUBLIC LIMITED COMPANY

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity File Number |

001-35676

|

| Entity Tax Identification Number |

98-1111119

|

| Entity Address, Address Line One |

77 Sir John Rogerson's Quay, Block C

|

| Entity Address, Address Line Two |

Grand Canal Docklands

|

| Entity Address, City or Town |

Dublin 2,

|

| Entity Address, Postal Zip Code |

D02 VK60,

|

| Entity Address, Country |

IE

|

| Country Region |

353

|

| City Area Code |

1

|

| Local Phone Number |

236-2500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary Shares, par value $0.01 per share

|

| Trading Symbol |

PRTA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001559053

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

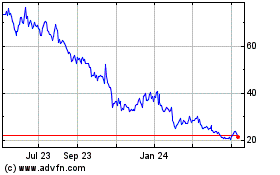

Prothena (NASDAQ:PRTA)

Historical Stock Chart

From Oct 2024 to Nov 2024

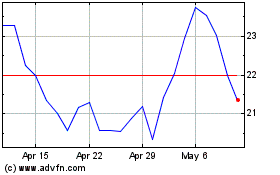

Prothena (NASDAQ:PRTA)

Historical Stock Chart

From Nov 2023 to Nov 2024