UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

PROFIRE ENERGY, INC.

(Name of Subject Company (Issuer))

COMBUSTION MERGER SUB, INC.

(Offeror)

A wholly owned subsidiary of

CECO ENVIRONMENTAL CORP.

(Parent of Offeror)

(Names of Filing Persons (identifying status as Offeror, Issuer or Other Person)

COMMON STOCK, PAR VALUE $0.001 PER SHARE

(Title of Class of Securities)

74316X101

(CUSIP Number of Class of Securities)

Lynn Watkins-Asiyanbi

CECO Environmental Corp.

5080 Spectrum Drive, Suite 800E

Addison, Texas 75001

(214) 357-6181

(Name, address, and telephone numbers of person authorized to receive notices and communications on behalf of filing persons)

Copies to:

Clyde W. Tinnen

Foley & Lardner LLP

777 E. Wisconsin Avenue

Milwaukee, Wisconsin 53202

(414) 271-2400

☐

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

☒

third-party tender offer subject to Rule 14d-1.

☐

issuer tender offer subject to Rule 13e-4.

☐

going-private transaction subject to Rule 13e-3.

☐

amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

☐

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

This Tender Offer Statement on Schedule TO (together with any amendments and supplements hereto, this “Schedule TO”) is being filed by CECO Environmental Corp., a Delaware corporation (“Parent”) and Combustion Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Purchaser”). This Schedule TO relates to the tender offer by Purchaser for all of the issued and outstanding shares of common stock, par value $0.001 per share (the “Shares”), of Profire Energy, Inc., a Nevada corporation (“PFIE”), at a price of $2.55 per Share, net to the seller in cash without interest and less any required withholding taxes (the “Offer Price”), upon the terms and subject to the conditions set forth in the offer to purchase, dated December 3, 2024 (together with any amendments or supplements thereto, the “Offer to Purchase”), a copy of which is attached as Exhibit (a)(1)(A), and in the related letter of transmittal (together with any amendments or supplements thereto, the “Letter of Transmittal”), a copy of which is attached as Exhibit (a)(1)(B), and the related notice of guaranteed delivery (together with any amendments or supplements thereto, the “Notice of Guaranteed Delivery” and, together with the Offer to Purchase and the Letter of Transmittal, the “Offer”), a copy of which is attached hereto as Exhibit (a)(1)(C).

All the information set forth in the Offer to Purchase is incorporated by reference herein in response to Items 1 through 9 and Item 11 in this Schedule TO, and is supplemented by the information specifically provided in this Schedule TO.

Item 1. Summary Term Sheet.

The information set forth in the Offer to Purchase under the caption SUMMARY TERM SHEET is incorporated herein by reference.

Item 2. Subject Company Information.

(a) Name and Address. The name, address, and telephone number of the subject company’s principal executive offices are as follows:

Profire Energy, Inc., 321 South 1250 West, Suite 1, Lindon, Utah, 84042, (801) 796-5127

(b) Securities. This Schedule TO relates to the Offer by Purchaser to purchase all outstanding Shares. According to PFIE, as of the close of business on November 25, 2024, there were 46,199,725 Shares of common stock of PFIE issued and outstanding.

(c) Trading Market and Price. The information set forth under the caption THE TENDER OFFER — Section 6 (“Price Range of Shares; Dividends”) of the Offer to Purchase is incorporated herein by reference.

Item 3. Identity and Background of Filing Person.

(a) – (c) This Schedule TO is filed by Purchaser and Parent. The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 8 (“Certain Information Concerning Parent and Purchaser”) and Schedule I attached thereto.

Item 4. Terms of the Transaction.

(a) Material Terms. The information set forth in the Offer to Purchase is incorporated herein by reference, including the following sections incorporated herein by reference:

SUMMARY TERM SHEET

INTRODUCTION

THE TENDER OFFER — Section 1 (“Terms of the Offer”)

THE TENDER OFFER — Section 2 (“Acceptance for Payment and Payment for Shares”)

THE TENDER OFFER — Section 3 (“Procedures for Accepting the Offer and Tendering Shares”)

THE TENDER OFFER — Section 4 (“Withdrawal Rights”)

THE TENDER OFFER — Section 5 (“Material United States Federal Income Tax Consequences”)

THE TENDER OFFER — Section 10 (“Background of the Offer; Past Contacts or Negotiations with PFIE”)

THE TENDER OFFER — Section 11 (“The Merger Agreement; Other Agreements”)

THE TENDER OFFER — Section 12 (“Purpose of the Offer; Plans for PFIE”)

THE TENDER OFFER — Section 13 (“Certain Effects of the Offer”)

THE TENDER OFFER — Section 15 (“Certain Conditions of the Offer”)

THE TENDER OFFER — Section 19 (“Miscellaneous”)

Subsections (a)(1)(ix), (x) and (xi) and (a)(2)(vi) are not applicable.

Item 5. Past Contacts, Transactions, Negotiations and Agreements.

(a), (b) The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

INTRODUCTION

THE TENDER OFFER — Section 8 (“Certain Information Concerning Parent and Purchaser”) and Schedule I attached thereto

THE TENDER OFFER — Section 10 (“Background of the Offer; Past Contacts or Negotiations with PFIE”)

THE TENDER OFFER — Section 11 (“The Merger Agreement; Other Agreements”)

THE TENDER OFFER — Section 12 (“Purpose of the Offer; Plans for PFIE”)

Item 6. Purposes of the Transaction and Plans or Proposals.

(a) The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

INTRODUCTION

THE TENDER OFFER — Section 12 (“Purpose of the Offer; Plans for PFIE”)

(c) (1) – (7) The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

INTRODUCTION

THE TENDER OFFER — Section 10 (“Background of the Offer; Past Contacts or Negotiations with PFIE”)

THE TENDER OFFER — Section 11 (“The Merger Agreement; Other Agreements”)

THE TENDER OFFER — Section 12 (“Purpose of the Offer; Plans for PFIE”)

THE TENDER OFFER — Section 13 (“Certain Effects of the Offer”)

THE TENDER OFFER — Section 14 (“Dividends and Distributions”)

Item 7. Source and Amount of Funds or Other Consideration.

(a), (b), (d) The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 9 (“Source and Amount of Funds”)

Item 8. Interest in Securities of the Subject Company.

(a), (b) The information set forth in the Offer to Purchase under the following caption is incorporated herein by reference:

THE TENDER OFFER — Section 8 (“Certain Information Concerning Parent and Purchaser”) and Schedule I attached thereto

Item 9. Persons/Assets, Retained, Employed, Compensated or Used.

(a) The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 3 (“Procedures for Accepting the Offer and Tendering Shares”)

THE TENDER OFFER — Section 10 (“Background of the Offer; Past Contacts or Negotiations with PFIE”)

THE TENDER OFFER — Section 18 (“Fees and Expenses”)

Item 10. Financial Statements.

(a) Not applicable.

(b) Not applicable.

Item 11. Additional Information.

(a) The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

SUMMARY TERM SHEET

THE TENDER OFFER — Section 10 (“Background of the Offer; Past Contacts or Negotiations with PFIE”)

THE TENDER OFFER — Section 11 (“The Merger Agreement; Other Agreements”)

THE TENDER OFFER — Section 12 (“Purpose of the Offer; Plans for PFIE”)

THE TENDER OFFER — Section 13 (“Certain Effects of the Offer”)

THE TENDER OFFER — Section 15 (“Certain Conditions of the Offer”)

THE TENDER OFFER — Section 16 (“Certain Legal Matters; Regulatory Approvals”)

(c) The information set forth in the Offer to Purchase and the Letter of Transmittal is incorporated herein by reference.

Item 12. Exhibits.

| |

Exhibit No.

|

|

|

Description

|

|

| |

(a)(1)(A)

|

|

|

|

|

| |

(a)(1)(B)

|

|

|

|

|

| |

(a)(1)(C)

|

|

|

|

|

| |

(a)(1)(D)

|

|

|

|

|

| |

(a)(1)(E)

|

|

|

|

|

| |

(a)(1)(F)

|

|

|

|

|

| |

(a)(5)(A)

|

|

|

Joint Press Release issued by Profire Energy, Inc. and CECO Environmental Corp., dated October 29, 2024 (incorporated by reference to Exhibit 99.1 to the Current Report on Form 8-K filed with the SEC by Profire Energy, Inc. on October 29, 2024).

|

|

| |

(a)(5)(B)

|

|

|

|

|

| |

(d)(1)

|

|

|

Agreement and Plan of Merger, dated October 28, 2024, by and among CECO Environmental Corp., Combustion Merger Sub, Inc. and Profire Energy, Inc. (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed with the SEC by Profire Energy, Inc. on October 29, 2024).

|

|

| |

(d)(2)

|

|

|

|

|

| |

(d)(3)

|

|

|

|

|

| |

(d)(4)

|

|

|

Tender and Support Agreement, dated October 28, 2024, by and among CECO Environmental Corp., Combustion Merger Sub, Inc., Brenton W. Hatch and Hatch Family Holding Company, LLC.

|

|

| |

(d)(5)

|

|

|

|

|

| |

(d)(6)

|

|

|

|

|

| |

(g)

|

|

|

None.

|

|

| |

(h)

|

|

|

None.

|

|

| |

107

|

|

|

|

|

Item 13. Information Required by Schedule 13E-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

COMBUSTION MERGER SUB, INC.

| |

By

|

|

|

/s/ Todd Gleason

|

|

|

|

|

| |

Name:

|

|

|

Todd Gleason

|

|

|

|

|

| |

Title:

|

|

|

Chief Executive Officer

|

|

|

|

|

| |

Date:

|

|

|

December 3, 2024

|

|

|

|

|

CECO ENVIRONMENTAL CORP.

| |

By

|

|

|

/s/ Todd Gleason

|

|

|

|

|

| |

Name:

|

|

|

Todd Gleason

|

|

|

|

|

| |

Title:

|

|

|

Chief Executive Officer

|

|

|

|

|

| |

Date:

|

|

|

December 3, 2024

|

|

|

|

|

Exhibit (a)(1)(A)

Offer to Purchase for Cash

All Outstanding Shares of

Common Stock

of

PROFIRE ENERGY, INC.

at

$2.55 Net Per Share, in Cash

by

Combustion Merger Sub, Inc.,

a wholly owned subsidiary of

CECO Environmental Corp.

| |

|

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT ONE MINUTE AFTER 11:59 P.M., NEW YORK CITY TIME, ON DECEMBER 31, 2024, UNLESS THE OFFER IS EXTENDED OR EARLIER TERMINATED.

|

|

|

The Offer (as defined below) is being made pursuant to the Agreement and Plan of Merger, dated as of October 28, 2024 (together with any amendments or supplements thereto, the “Merger Agreement”), by and among CECO Environmental Corp., a Delaware corporation (“Parent”), Combustion Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Parent (“Purchaser”), and Profire Energy, Inc., a Nevada corporation (“PFIE”). Purchaser is offering to purchase all of the issued and outstanding shares of PFIE’s common stock, par value $0.001 per share (the “Shares”), at a price of $2.55 per Share, net to the seller, in cash, without interest and less any required withholding taxes (the “Offer Price”), upon the terms and subject to the conditions set forth in this offer to purchase (together with any amendments or supplements hereto, this “Offer to Purchase”) and the related letter of transmittal (together with any amendments or supplements thereto, the “Letter of Transmittal”) and the related notice of guaranteed delivery (together with any amendments or supplements thereto, the “Notice of Guaranteed Delivery” and, together with this Offer to Purchase and the Letter of Transmittal, the “Offer”). Pursuant to the Merger Agreement, following the consummation of the Offer (the date and time of Purchaser’s acceptance of Shares tendered for payment, the “Acceptance Time”) and the satisfaction or waiver of the applicable conditions set forth in the Merger Agreement, Purchaser will merge with and into PFIE without a vote of the stockholders of PFIE in accordance with Section 92A.133 of the Nevada Revised Statutes (the “NRS”) and Section 252 of the General Corporation Law of the State of Delaware (the “DGCL”) (the “Merger”), with PFIE continuing as the surviving corporation in the Merger (the “Surviving Corporation”). As a result of the Merger, each Share issued and outstanding immediately prior to the Effective Time (defined below) of the Merger (other than (i) Shares owned directly or indirectly by Parent or its subsidiaries, including Purchaser, if any, (ii) Shares held by PFIE as treasury shares immediately prior to the Effective Time and (iii) shares owned by a wholly owned subsidiary of PFIE ((i), (ii) and (iii), collectively “Company Owned Shares”), which Company Owned Shares shall be cancelled without any payment made with respect thereto) will, at the Effective Time, be cancelled and automatically converted into the right to receive an amount in cash equal to the Offer Price, without interest and less any required withholding taxes (the “Merger Consideration”). As a result of the Merger, PFIE will cease to be a publicly traded company and will become a wholly owned subsidiary of Parent. The Offer, the Merger and the other transactions contemplated by the Merger Agreement are collectively referred to in this Offer to Purchase as the “Transactions.”

On October 28, 2024, the board of directors of PFIE (the “PFIE Board”) unanimously (i) determined that the Merger Agreement and the Transactions are fair to and in the best interests of PFIE and its stockholders, (ii) declared it advisable to enter into the Merger Agreement and approved the execution, delivery and performance of the Merger Agreement, (iii) approved and declared advisable the Transactions,

(iv) resolved to recommend that the stockholders of PFIE accept the Offer and tender their Shares to Purchaser pursuant to the Offer and (v) resolved that the Merger shall be governed by and effected pursuant to Section 92A.133 of the NRS and Section 252 of the DGCL and that the Merger shall be consummated as soon as practicable following the Offer Closing.

There is no financing condition to the Offer. The Offer is subject to the satisfaction of the Minimum Tender Condition (as defined below) and other conditions described in Section 15 — “Certain Conditions of the Offer.” If the number of Shares tendered in the Offer is insufficient to cause the Minimum Tender Condition to be satisfied or if any of the other conditions of the Offer is not satisfied upon expiration of the Offer (taking into account any extensions thereof as permitted by the Merger Agreement), then (i) neither the Offer nor the Merger will be consummated and (ii) PFIE’s stockholders will not receive the Offer Price pursuant to the Offer or any Merger Consideration pursuant to the Merger. A summary of the principal terms of the Offer appears starting on page 5 of this Offer to Purchase under the heading “Summary Term Sheet.” You should read this Offer to Purchase and the other documents to which this Offer to Purchase refers carefully before deciding whether to tender your Shares.

The Information Agent for the Offer is:

D.F. King & Co., Inc.

48 Wall Street, 22nd Floor

New York, New York 10005

Banks and Brokers may call: (212) 269-5550

Stockholders may call toll free: (866) 342-4881

Email: PFIE@dfking.com

December 3, 2024

IMPORTANT

If you desire to tender all or any portion of your Shares to Purchaser pursuant to the Offer, you must (a) follow the procedures described in Section 3 — “Procedures for Accepting the Offer and Tendering Shares” below or (b) if your Shares are held by a broker, dealer, commercial bank, trust company or other nominee, contact such nominee and request that they effect the transaction for you and tender your Shares.

Beneficial owners of Shares holding their Shares through nominees should be aware that their broker, dealer, commercial bank, trust company or other nominee may establish its own earlier deadline for participation in the Offer. Accordingly, beneficial owners holding Shares through a broker, dealer, commercial bank, trust company or other nominee and who wish to participate in the Offer should contact such nominee as soon as possible in order to determine the times by which such owner must take action in order to participate in the Offer.

* * * *

Questions and requests for assistance regarding the Offer or any of the terms thereof may be directed to D.F. King & Co., Inc. (“D.F. King”), acting as information agent for the Offer (the “Information Agent”), at the address and telephone number set forth for the Information Agent on the back cover of this Offer to Purchase, which will be furnished promptly at Purchaser’s expense. Additionally, copies of this Offer to Purchase, the related Letter of Transmittal and any other material related to the Offer may be obtained at the website maintained by the SEC at www.sec.gov. Requests for additional copies of this Offer to Purchase, the Letter of Transmittal and other tender offer materials may also be directed to the Information Agent. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Offer. Brokers, dealers, commercial banks, trust companies or other nominees will, upon request, be reimbursed by Purchaser for customary mailing and handling expenses incurred by them in forwarding the Offer materials to their customers.

This Offer to Purchase and the Letter of Transmittal contain important information, and you should read both carefully and in their entirety before making a decision with respect to the Offer.

This transaction has not been approved or disapproved by the U.S. Securities and Exchange Commission (the “SEC”) or any state securities commission nor has the SEC or any state securities commission passed upon the fairness or merits of this transaction or upon the accuracy or adequacy of the information contained in this Offer to Purchase or the Letter of Transmittal. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

|

31 |

|

|

|

|

|

|

|

|

49 |

|

|

|

|

|

|

|

|

51 |

|

|

|

|

|

|

|

|

51 |

|

|

|

|

|

|

|

|

51 |

|

|

|

|

|

|

|

|

52 |

|

|

|

|

|

|

|

|

54 |

|

|

|

|

|

|

|

|

54 |

|

|

|

|

|

|

|

|

54 |

|

|

|

|

|

|

|

|

56

|

|

|

SUMMARY TERM SHEET

Combustion Merger Sub, Inc. (“Purchaser”), a Delaware corporation and wholly owned subsidiary of CECO Environmental Corp., a Delaware corporation (“Parent”), is offering to purchase (i) all of the issued and outstanding shares of common stock, par value $0.001 per share (the “Shares”), of Profire Energy, Inc., a Nevada corporation (“PFIE”), at a price per share of $2.55, net to the seller, in cash, without interest and less any required withholding taxes, as further described herein, upon the terms and subject to the conditions set forth in this Offer to Purchase and the Letter of Transmittal.

The following are some questions you, as a stockholder of PFIE, may have and answers to those questions. This summary term sheet highlights selected information from this Offer to Purchase and may not contain all of the information that is important to you and is qualified in its entirety by the more detailed descriptions and explanations contained in this Offer to Purchase and the Letter of Transmittal. We have included cross-references in this summary term sheet to other sections of this Offer to Purchase where you will find more complete descriptions of the topics mentioned below. The information concerning PFIE contained herein and elsewhere in this Offer to Purchase has been provided to Parent and Purchaser by PFIE or has been taken from or is based upon publicly available documents or records of PFIE on file with the SEC or other public sources at the time of the Offer (as defined in the “Introduction” to this Offer to Purchase). Parent and Purchaser have not independently verified the accuracy and completeness of such information. Parent and Purchaser have no knowledge that would indicate that any statements contained herein relating to PFIE provided to Parent and Purchaser or taken from or based upon such documents and records filed with the SEC are untrue or incomplete in any material respect. To better understand the Offer and for a complete description of the legal terms of the Offer, you should read this Offer to Purchase and the Letter of Transmittal carefully and in their entirety. Questions or requests for assistance may be directed to the Information Agent at the address and telephone numbers available on the back cover of this Offer to Purchase. Unless the context indicates otherwise, in this Offer to Purchase, we use the terms “us,” “we” and “our” to refer to Purchaser and where appropriate, Parent and Purchaser, collectively.

| |

Securities Sought

|

|

|

All of the issued and outstanding shares of common stock, par value $0.001 per share (the “Shares”), of Profire Energy, Inc., a Nevada corporation (“PFIE”).

|

|

| |

Price Offered Per Share

|

|

|

$2.55, per Share, net to the seller, in cash, without interest and less any required withholding taxes (the “Offer Price”).

|

|

| |

Scheduled Expiration of Offer

|

|

|

One minute after 11:59 P.M., New York City time, on December 31, 2024 (“Offer Expiration Time”), unless the Offer is extended or terminated (the Offer Expiration Time, as it may be extended is referred to as the “Expiration Date”). See Section 1 — “Terms of the Offer.”

|

|

| |

Purchaser

|

|

|

Combustion Merger Sub, Inc. (“Purchaser”), a Delaware corporation and wholly owned subsidiary of CECO Environmental Corp. (“Parent”), a Delaware corporation.

|

|

| |

PFIE’s Board of Directors’ Recommendation

|

|

|

The board of directors of PFIE (the “PFIE Board”) unanimously recommends that the stockholders of PFIE tender their Shares in the Offer.

|

|

Who is offering to buy my Shares?

Purchaser is offering to purchase all of the issued and outstanding Shares. Purchaser is a Delaware corporation and wholly owned subsidiary of Parent which was formed for the sole purpose of making the Offer and completing the process by which PFIE will become a subsidiary of Parent through the merger of Purchaser with and into PFIE (the “Merger”), with PFIE being the surviving corporation. See the “Introduction,” Section 8 — “Certain Information Concerning Parent and Purchaser” and Schedule I — “Directors and Executive Officers of Purchaser Entities.”

How many Shares are you offering to purchase in the Offer?

We are making an offer to purchase all of the issued and outstanding Shares on the terms and subject to the conditions set forth in this Offer to Purchase and the Letter of Transmittal. See the “Introduction” and Section 1 — “Terms of the Offer.”

How much are you offering to pay and what is the form of payment? Will I have to pay any fees or commissions?

We are offering to pay $2.55 per Share, net to you, in cash, without interest and less any required withholding taxes. If you are the record owner of your Shares and you directly tender your Shares to us in the Offer, you will not pay brokerage fees, commissions or similar expenses. If you own your Shares through a broker or other nominee, and your broker or nominee tenders your Shares on your behalf, your broker or nominee may charge you a fee for doing so. You should consult with your broker or nominee to determine whether any charges will apply. See the “Introduction,” Section 1 — “Terms of the Offer,” and Section 2 — “Acceptance for Payment and Payment for Shares.”

Is there an agreement governing the Offer?

Yes. The Merger Agreement entered into by Parent, Purchaser and PFIE on October 28, 2024 provides, among other things, for the terms and conditions of the Offer and the Merger. See Section 11 — “The Merger Agreement; Other Agreements” and Section 15 — “Certain Conditions of the Offer.”

What are the most significant conditions of the Offer?

Our obligation to purchase Shares tendered in the Offer is subject to the satisfaction or waiver of the following conditions set forth in the Merger Agreement (the “Offer Conditions”), including, among other things:

(i)

the number of Shares validly tendered and not validly withdrawn prior to the Offer Expiration Time (other than Shares tendered by guaranteed delivery that have not yet been “received,” as such term is used in Section 92A.133(4)(g) of the NRS, by the depositary for the Offer), when added to any Shares already owned by Purchaser, equals a majority of the voting power of the then issued and outstanding Shares (the “Minimum Tender Condition”);

(ii)

the accuracy of PFIE’s representations and warranties contained in the Merger Agreement (subject to certain customary materiality qualifiers) (as described in Section 11 — “The Merger Agreement; Other Agreements”);

(iii)

the Merger Agreement has not been terminated in accordance with its terms;

(iv)

PFIE will have complied with and performed in all material respects its covenants, agreements and obligations required to be complied or performed by it on or prior to the Offer Expiration Time;

(v)

no event has occurred that, individually or in the aggregate, has had or would be reasonably likely to have a material adverse effect on PFIE; and

(vi)

there is no order or other legal restraint that is in effect and has the effect of making the consummation of the Offer or the Merger illegal or prohibiting the consummation of the Offer or the Merger.

See Section 15 — “Certain Conditions of the Offer.”

Do you have the financial resources to pay for all of the issued and outstanding Shares that you are offering to purchase in the Offer and to consummate the Merger and the other transactions contemplated by the Merger Agreement?

Purchaser estimates that it will need up to approximately $125 million to purchase all of the issued and outstanding Shares in the Offer, to provide funding for the consideration to be paid in the Merger and to pay related fees and expenses at the Closing of the Transactions (the “Transaction Uses”). The Offer and the

Merger are not conditioned upon Parent’s or Purchaser’s ability to finance the purchase of Shares pursuant to the Offer and pay for the Shares acquired in the Merger.

See Section 9 — “Source and Amount of Funds.”

Is your financial condition relevant to my decision to tender my Shares in the Offer?

We do not think that our financial condition is relevant to your decision whether to tender Shares and accept the Offer because:

•

the consideration offered in the Offer consists solely of cash;

•

the Offer is being made for all issued and outstanding Shares;

•

if we consummate the Offer, subject to the satisfaction or waiver of certain conditions, we have agreed to acquire all remaining Shares for the same cash price in the Merger;

•

the Offer is not subject to any financing condition; and

•

we have all of the financial resources sufficient to finance the Offer and the Merger.

See Section 9 — “Source and Amount of Funds.”

Why are you making the Offer?

We are making the Offer because we want to acquire all of the equity interests in PFIE. If the Offer is consummated, as promptly as practicable after consummation of the Offer, Purchaser will merge with and into PFIE, with PFIE as the Surviving Corporation. See Section 12 — “Purpose of the Offer; Plans for PFIE.”

What does the PFIE Board think about the Offer?

We are making the Offer pursuant to the Merger Agreement, which has been unanimously approved by the PFIE Board. The PFIE Board has unanimously:

•

determined that the Merger Agreement and the Transactions, including the Offer and the Merger, are fair to and in the best interests of PFIE and PFIE’s stockholders;

•

adopted and approved and declared advisable the Merger Agreement and the Transactions; and recommended, by resolution, that the stockholders of PFIE accept the Offer and tender their Shares to Purchaser pursuant to the Offer.

A more complete description of PFIE’s reasons for authorizing and approving the Merger Agreement and the Transactions, including the Offer and the Merger, will be set forth in PFIE’s Solicitation/Recommendation Statement on Schedule 14D-9 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which will be subsequently filed by PFIE with the SEC and mailed to PFIE’s stockholders after the mailing of this Offer to Purchase. See the “Introduction” and Section 10 — “Background of the Offer; Past Contacts or Negotiations with PFIE.”

Has the PFIE Board received a fairness opinion in connection with the Offer and the Merger?

Yes. Stephens Inc. (“Stephens”), the financial advisor to PFIE, delivered an oral opinion to the PFIE Board, which was subsequently confirmed by delivery of a written opinion dated October 28, 2024, to the effect that, as of that date, the consideration to be received by the common stockholders of PFIE (solely in their capacity as such) in the proposed acquisition was fair to them from a financial point of view, based upon and subject to the qualifications, assumptions and other matters considered by Stephens in connection with the preparation of its opinion. The full text of Stephens’s written opinion, which describes the assumptions, qualifications and limitations stated in such written opinion, will be included as an annex to the Schedule 14D-9. Stephens’s opinion was provided for the benefit of the PFIE Board in connection with, and for the purpose of, its evaluation of the Offer Price in the Transaction and addresses only the fairness, from a financial point of view, to holders of Shares of the consideration to be received pursuant to the Merger Agreement. Stockholders are urged to read the full text of that opinion carefully and in its entirety.

How long do I have to decide whether to tender my Shares in the Offer?

If you desire to tender all or any portion of your Shares to Purchaser pursuant to the Offer, you must comply with the procedures described in this Offer to Purchase and the Letter of Transmittal, as applicable, by the Offer Expiration Time. If you cannot deliver everything that is required in order to make a valid tender prior to the Offer Expiration Time, you may be able to use a guaranteed delivery procedure, which is described in this Offer to Purchase. The term “Offer Expiration Time” means one minute after 11:59 P.M., New York City time, on December 31, 2024, unless, in accordance with the Merger Agreement, the Offer has been extended, in which event the term “Offer Expiration Time” means such later time and date to which the Offer has been extended. Notwithstanding the foregoing, Purchaser and Parent will not be required to extend the Offer beyond the earlier of (i) 11:59 P.M. New York City time on March 31, 2025, or (ii) the valid termination of the Merger Agreement.

If you hold Shares registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you should be aware that such institutions may establish their own earlier deadline for tendering Shares in the Offer.

Accordingly, if you hold Shares registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you should contact such institution as soon as possible in order to determine the times by which you must take action in order to tender Shares in the Offer.

Can the Offer be extended and under what circumstances?

Yes. We have agreed in the Merger Agreement that, subject to our rights and PFIE’s rights to terminate the Merger Agreement in accordance with its terms or terminate the Offer under certain circumstances:

•

we will extend the Offer for any minimum period required by any rule or regulation of the SEC or its staff, any rule or regulation of the Nasdaq Capital Market (“Nasdaq”) or any other applicable law, in each case, applicable to the Offer; and

•

if, as of any then-scheduled Offer Expiration Time, any Offer Condition is not satisfied and has not been waived, we will extend the Offer for up to three (3) periods of time of ten (10) business days per extension (or such longer period as Parent and PFIE may mutually agree), to permit such Offer Condition to be satisfied.

Notwithstanding the foregoing, in no event shall Purchaser be required to extend the Offer beyond the earlier to occur of (A) the valid termination of the Merger Agreement in compliance with Section 8 thereof and (B) the Outside Date.

If we extend the time period of the Offer, this extension will extend the time that you will have to tender your Shares. See Section 1 — “Terms of the Offer” for more details on our ability to extend the Offer.

How will I be notified if the Offer is extended?

If we extend the Offer, we will inform the Depositary and Paying Agent (as defined below) of that fact and will make a public announcement of the extension not later than 9:00 A.M., New York City time, on the next business day after the day on which the Offer was scheduled to expire. See Section 1 — “Terms of the Offer.”

How do I tender my Shares?

If you wish to accept the Offer and:

•

you hold your Shares through a broker, dealer, commercial bank, trust company or other nominee, you should contact your broker, dealer, commercial bank, trust company or other nominee and give instructions that your Shares be tendered in accordance with the procedures described in this Offer to Purchase and the Letter of Transmittal;

•

you are a record holder (i.e., a stock certificate has been issued to you and registered in your name or your Shares are registered in “book entry” form in your name with PFIE’s transfer agent), you

must deliver the stock certificate(s) representing your Shares (or follow the procedures described in this Offer to Purchase for book-entry transfer), together with a duly completed and validly executed Letter of Transmittal (or, with respect to Eligible Institutions (as defined below), a manually executed facsimile thereof) or an Agent’s Message (as defined in Section 3 — “Procedures for Accepting the Offer and Tendering Shares” below) in connection with a book-entry delivery of Shares, and any other documents required by the Letter of Transmittal, to the Depositary and Paying Agent. These materials must reach the Depositary and Paying Agent before the Offer expires; or

•

you are a record holder but your stock certificate is not available or you cannot deliver it to the Depositary and Paying Agent before the Offer expires, you may be able to tender your Shares using guaranteed delivery procedures. See Section 3 — “Procedures for Accepting the Offer and Tendering Shares” for further details.

In any case, the Depositary and Paying Agent must receive all required documents before the Offer Expiration Time. See the Letter of Transmittal and Section 3 — “Procedures for Accepting the Offer and Tendering Shares” for more information.

May I withdraw Shares I previously tendered in the Offer? Until what time may I withdraw tendered Shares?

Yes. You may withdraw previously tendered Shares any time prior to the Offer Expiration Time and, if not previously accepted for payment, at any time after February 1, 2025, which is the date that is 60 days after the date of the commencement of the Offer, pursuant to SEC regulations, by following the procedures for withdrawing your Shares. To withdraw your Shares, you must deliver a written notice of withdrawal, or a facsimile of one, with the required information to the Depositary and Paying Agent for the Offer, while you have the right to withdraw your Shares. If you tendered your Shares by giving instructions to a broker, dealer, commercial bank, trust company or other nominee, you must instruct your broker, dealer, commercial bank, trust company or other nominee prior to the Offer Expiration Time to arrange for the withdrawal of your Shares. See Section 4 — “Withdrawal Rights.”

Do I have to vote to approve the Offer or the Merger?

No vote of PFIE stockholders is required to approve the Offer or the Merger. You only need to tender your Shares if you choose to do so. Following the completion of the Offer, if the Minimum Tender Condition has been satisfied, and the other Offer Conditions are satisfied or waived, we will be able to consummate the Merger pursuant to Section 92A.133 of the Nevada Revised Statutes (the “NRS”) without a vote of the stockholders of PFIE. See Section 12 — “Purpose of the Offer; Plans for PFIE.”

If the Offer is successfully completed, will PFIE continue as a public company?

No. If the Minimum Tender Condition has been satisfied, and the other Offer Conditions are satisfied or waived, we expect to consummate the Merger in accordance with Section 92A.133 of the NRS and the other applicable provisions of the NRS, and no vote of the PFIE stockholders will be required to approve the Merger Agreement or to consummate the Merger. If the Merger takes place, PFIE will no longer be publicly owned. We do not expect there to be a significant period of time between the consummation of the Offer and the consummation of the Merger. If you decide not to tender your Shares in the Offer and the Merger occurs as described above, your Shares will be converted in the Merger into the right to receive the same amount of cash per Share as if you had tendered your Shares in the Offer. Upon consummation of the Merger, the Shares will no longer be eligible to be traded on Nasdaq or any other securities exchange, there will not be a public trading market for the common stock of PFIE, and PFIE will no longer be required to make filings with the SEC or otherwise comply with the rules of the SEC relating to publicly-held companies. See Section 13 — “Certain Effects of the Offer.”

If you do not consummate the Offer, will you nevertheless consummate the Merger?

No. Neither we nor PFIE is under any obligation to pursue or consummate the Merger if the Offer is not consummated.

Do I have dissenter’s or appraisal rights in connection with the Offer and the Merger?

No. There are no dissenter’s rights or appraisal rights available as a result of or in connection with the Offer. Pursuant to Section 92A.390 of the NRS, there are no dissenter’s rights or appraisal rights available as a result of or in connection with the Merger, if consummated. See Section 17 — “No Dissenter’s or Appraisal Rights.”

If I decide not to tender, how will the Offer affect my Shares?

If you decide not to tender your Shares pursuant to the Offer and the Merger occurs as described herein, you will receive as a result of the Merger the right to receive the same amount of cash per Share as if you had tendered your Shares pursuant to the Offer, less any required withholding taxes and without interest.

If the Minimum Tender Condition and the other Offer Conditions are satisfied, we are obligated under the Merger Agreement to cause the Merger to occur.

Because the Merger will be effected pursuant to Section 92A.133 of the NRS, assuming the requirements of that statutory provision are met, no vote by the stockholders of PFIE will be required in connection with the consummation of the Merger. We do not expect there to be significant time between the consummation of the Offer and the consummation of the Merger. See Section 12 — “Purpose of the Offer; Plans for PFIE.”

If the number of Shares tendered in the Offer is insufficient to cause the Minimum Tender Condition to be satisfied upon expiration of the Offer (taking into account any extensions thereof and any Shares subject to a valid notice of guaranteed delivery), then (i) neither the Offer nor the Merger will be consummated and (ii) PFIE’s stockholders will not receive the Offer Price or Merger Consideration pursuant to the Offer or Merger, as applicable.

Will there be a subsequent offering period?

No. As required by Section 92A.133 of the NRS, we expect the Merger to occur as promptly as practicable following the date and time of Purchaser’s acceptance of Shares tendered for payment (the “Acceptance Time”) without a subsequent offering period.

What is the market value of my Shares as of a recent date?

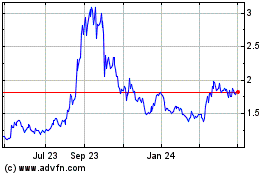

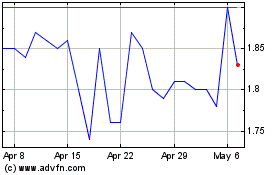

On October 25, 2024, the last full trading day before Parent and PFIE entered into the Merger Agreement, the closing price of the Shares reported on Nasdaq was $1.74 per Share; therefore, the Offer Price of $2.55 per Share represents a premium of (i) approximately 46.5% over such price and (ii) approximately 60.3% to the volume-weighted average price of the Shares on Nasdaq over the thirty trading day period ended on October 25, 2024 . On November 25, 2024, the closing price of the Shares reported on Nasdaq was $2.52 per Share.

Have any stockholders already agreed to tender their Shares in the Offer or to otherwise support the Offer?

Yes. In connection with the execution of the Merger Agreement, Brenton Hatch (and certain of his affiliates), the Chairman of the PFIE Board, Ryan Oviatt, the Co-Chief Executive Officer and Chief Financial Officer of PFIE, and Cameron Tidball, the Co-Chief Executive Officer of PFIE (the “Supporting Stockholders”) have each entered into tender and support agreements with Parent and Purchaser (as they may be amended, restated, supplemented or otherwise modified from time to time, the “Support Agreements” and each, a “Support Agreement”), pursuant to which the Supporting Stockholders have agreed to tender all of the Shares owned or controlled by the Supporting Stockholders pursuant to the Offer and subject to the terms and conditions of such Support Agreements.

By entering into the Support Agreements, the Stockholders also agreed to other customary terms and conditions, including certain restrictions on transferring their Shares and issuing public statements or press releases. Each of the Stockholders’ respective obligations under the Support Agreements will automatically terminate upon the earliest to occur of (i) the termination of the Merger Agreement in accordance with it terms, (ii) the time of the acceptance for payment of Shares pursuant to and subject to the Offer Conditions

upon the Offer Expiration Time (the “Offer Closing”), provided, that, each Stockholder has tendered all of its Shares and complied with the covenants in the Support Agreement, (iii) the making of a Company Adverse Recommendation Change in accordance with the Merger Agreement, (iv) the entry of Parent or Purchaser, without the prior written consent of the Stockholders, into any amendment or modification of the Merger Agreement that decreases the Offer Price or changes the form of Merger Consideration and (v) the termination of the Support Agreement by written notice from Parent and Purchaser.

PFIE has informed us that, as of November 25, 2024, the executive officers and directors of PFIE beneficially owned, directly or indirectly, in the aggregate, 12,032,731 Shares (excluding any PFIE RSU (as defined below)), and that, to the best of PFIE’s knowledge, after reasonable inquiry, each executive officer and director of PFIE who owns Shares presently intends to tender in the Offer all Shares that he or she owns of record or beneficially. The foregoing does not include any shares over which, or with respect to which, any such executive officer or director acts in a fiduciary or representative capacity or is subject to the instructions of a third party with respect to such tender.

See Section 11 — “The Merger Agreement; Other Agreements — Support Agreements.”

If I tender my Shares, when and how will I get paid?

If the Offer Conditions are satisfied or, to the extent permitted, waived, and we consummate the Offer and accept your Shares for payment, we will pay you an amount equal to the number of Shares you tendered multiplied by $2.55 in cash without interest and less any required withholding taxes, promptly following the Acceptance Time. See Section 1 — “Terms of the Offer” and Section 2 — “Acceptance for Payment and Payment of Shares.”

What will happen to my restricted stock units in the Offer and the Merger?

The Offer is made only for Shares and is not being made for any outstanding restricted stock units granted under the 2014 Equity Incentive Plan or the 2023 Equity Incentive Plan, each as amended, or otherwise (each, a “PFIE RSU”). Pursuant to the Merger Agreement, as of the Effective Time, each PFIE RSU that is then outstanding and unvested as of the Effective Time will be canceled and converted into the right to receive an amount in cash, without interest, equal to the product of (a) the number of Shares then underlying such PFIE RSU (calculated based on the achievement of any applicable performance metrics at the maximum level) multiplied by (b) the Merger Consideration. See Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement.”

What are the material United States federal income tax consequences of the Offer and the Merger to a United States Holder?

If you are a United States Holder (as defined in Section 5 — “Material United States Federal Income Tax Consequences”), the receipt of cash by you in exchange for your Shares pursuant to the Offer or the Merger will be a taxable transaction for United States federal income tax purposes. In general, if you are a United States Holder and you hold your Shares as a capital asset, you will recognize capital gain or loss equal to the difference between the amount of cash you receive and your adjusted tax basis in such Shares exchanged therefor. Such gain or loss will generally be treated as a long-term capital gain or loss if you have held your Shares for more than one year at the time of the exchange. If you are a non-United States Holder (as defined in Section 5 — “Material United States Federal Income Tax Consequences”), you generally will not be subject to United States federal income tax with respect to the exchange of Shares for cash pursuant to the Offer or the Merger unless you have certain connections to the United States. See Section 5 — “Material United States Federal Income Tax Consequences” for a summary of the material United States federal income tax consequences of tendering Shares pursuant to the Offer or exchanging Shares in the Merger.

You are urged to consult your tax advisors to determine the tax consequences to you of the Offer and the Merger in light of your particular circumstances, including the application and effect of any state, local or non-United States tax laws.

Who should I talk to if I have additional questions about the Offer?

Stockholders, banks and brokers may call D.F. King & Co., Inc. (“D.F. King”) toll-free at (866) 342-4881. D.F. King is acting as the Information Agent for the Offer. See the back cover of this Offer to Purchase.

INTRODUCTION

Combustion Merger Sub, Inc., a Delaware corporation (“Purchaser”) and a wholly owned subsidiary of CECO Environmental Corp., a Delaware corporation (“Parent” and, together with Purchaser, the “Buyer Parties”), hereby offers to purchase for cash all issued and outstanding shares of common stock, par value $0.001 per share (the “Shares”), of Profire Energy, Inc., a Nevada corporation (“PFIE”), at a price of $2.55 per Share, net to the seller, in cash without interest and less any required withholding taxes (the “Offer Price”), upon the terms and subject to the conditions set forth in this offer to purchase (this “Offer to Purchase”) and in the related letter of transmittal (the “Letter of Transmittal”) and the related notice of guaranteed delivery (the “Notice of Guaranteed Delivery”) (which three documents, together with other related materials and any amendments or supplements hereto or thereto, collectively constitute the “Offer”). PFIE has informed us that, as of November 25, 2024, the executive officers and directors of PFIE beneficially owned, directly or indirectly, in the aggregate, 12,032,731 Shares (excluding any shares issuable upon the settlement of PFIE restricted stock units), and that, to the best of PFIE’s knowledge, after reasonable inquiry, each executive officer and director of PFIE who owns Shares presently intends to tender in the Offer all Shares that he or she owns of record or beneficially. The foregoing does not include any shares over which, or with respect to which, any such executive officer or director acts in a fiduciary or representative capacity or is subject to the instructions of a third party with respect to such tender. The Supporting Stockholders have entered into Support Agreements to tender their Shares in the Offer in connection with the execution of the Merger Agreement. The Offer and withdrawal rights will expire at one minute after 11:59 P.M., New York City time, on December 31, 2024 (the “Offer Expiration Time”), unless the Offer is extended in accordance with the terms of the Merger Agreement.

The Offer is being made pursuant to the Agreement and Plan of Merger, dated as of October 28, 2024, among Parent, Purchaser and PFIE (together with any amendments or supplements thereto, the “Merger Agreement”). The Merger Agreement provides that as promptly as practicable after the consummation of the Offer, Purchaser will merge with and into PFIE (the “Merger”) in accordance with the provisions of Section 92A.133 of the Nevada Revised Statutes (the “NRS”) and Section 252 of the DGCL, with PFIE continuing as the surviving corporation (the “Surviving Corporation”) in the Merger. Because the Merger will be effected pursuant to Section 92A.133 of the NRS, assuming the requirements of that statutory provision are met, no PFIE stockholder vote will be required to approve the Merger Agreement and consummate the Merger. As a result of the Merger, the Shares will cease to be publicly traded. Under the terms of the Merger Agreement, after the completion of the Offer and the satisfaction or waiver of certain conditions, the Merger will be consummated by executing and filing the articles of merger (the “Articles of Merger”) with the Nevada Secretary of State in accordance with the relevant provisions of the NRS and a certificate of merger (the “Certificate of Merger”) with the Secretary of State of the State of Delaware in accordance with the relevant provisions of the DGCL. The Merger shall become effective upon the filing of the Articles of Merger with the Nevada Secretary of State or at such later effective date and time permitted under the NRS as may be agreed in writing by Parent, Purchaser and PFIE and specified in the Articles of Merger (the “Effective Time”). At the Effective Time, each Share issued and outstanding immediately prior to the Effective Time (other than (i) Shares owned directly or indirectly by Parent or its subsidiaries, including Purchaser, if any, (ii) Shares held by PFIE as treasury shares or otherwise immediately prior to the Effective Time and (iii) shares owned by a wholly owned subsidiary of PFIE ((i), (ii) and (iii), collectively “Company Owned Shares”), which Company Owned Shares shall be cancelled without any payment made with respect thereto) will be cancelled and automatically converted into the right to receive an amount in cash equal to the Offer Price (the “Merger Consideration”), without interest and less any required withholding taxes. Under no circumstances will interest on the Offer Price or Merger Consideration for Shares be paid to the stockholders of PFIE, regardless of any delay in payment for such Shares. The Merger Agreement is more fully described in Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement,” which also contains a discussion of the treatment of equity awards of PFIE.

Tendering stockholders who are record owners of their Shares and tender directly to the Depositary and Paying Agent (as defined below) will not be obligated to pay brokerage fees or commissions or, except

as otherwise provided in the instructions to the Letter of Transmittal, stock transfer taxes with respect to the purchase of Shares by Purchaser pursuant to the Offer. Stockholders who hold their Shares through a broker or bank should consult such institution as to whether it charges any brokerage or other service fees. Parent or Purchaser will pay all charges and expenses of Colonial Stock Transfer Company, Inc., acting as the depositary and paying agent for the Offer (the “Depositary and Paying Agent”), and D.F. King & Co., Inc. (“D.F. King”), acting as the information agent for the Offer, incurred in connection with the Offer. See Section 18 — “Fees and Expenses.”

On October 28, 2024, the board of directors of PFIE (the “PFIE Board”) unanimously (i) determined that the Merger Agreement and the Transactions are fair to and in the best interests of PFIE and its stockholders, (ii) declared it advisable to enter into the Merger Agreement and approved the execution, delivery and performance of the Merger Agreement, (iii) approved and declared advisable the Transactions, (iv) resolved to recommend that the stockholders of PFIE accept the Offer and tender their Shares to Purchaser pursuant to the Offer and (v) resolved that the Merger shall be governed by and effected pursuant to Section 92A.133 of the NRS and Section 252 of the DGCL and that the Merger shall be consummated as soon as practicable following the Offer Closing. A more complete description of the PFIE Board’s reasons for authorizing and approving the Merger Agreement and the Transactions, including the Offer and the Merger, will be set forth in PFIE’s Solicitation/Recommendation Statement on Schedule 14D-9 (together with any supplements thereto, “Schedule 14D-9”) under the Exchange Act. The Schedule 14D-9 will be mailed to PFIE’s stockholders in connection with the Offer as promptly as practicable after the mailing of this Offer to Purchase, the Letter of Transmittal and other related materials.

The Offer is not subject to any financing condition. These and other conditions to the Offer are described in Section 15 — “Certain Conditions of the Offer.”

Section 92A.133 of the NRS provides that, subject to certain statutory requirements, if following consummation of a tender offer for a publicly traded Nevada corporation, the stock irrevocably accepted for purchase pursuant to such tender offer and received by the depositary prior to the expiration of such tender offer, plus the stock otherwise owned by the corporation consummating the tender offer equals at least that percentage of the voting power of the stock, and of each class or series thereof, of the target corporation that would otherwise be required to approve a merger agreement under the NRS and the target corporation’s articles of incorporation, and each outstanding share of each class or series of stock that is the subject of such tender offer and is not irrevocably accepted for purchase in the offer is to be converted in such merger into the right to receive the same amount and kind of consideration to be paid for shares of such class or series of stock irrevocably accepted for purchase in the tender offer, the corporation consummating the tender offer may effect a merger with the target Nevada corporation without a vote of the stockholders of the target Nevada corporation. Accordingly, if the number of Shares validly tendered in accordance with the terms of the Offer and not validly withdrawn prior to the Offer Expiration Time, together with any Shares beneficially owned by Purchaser or its “affiliates” (as defined in Section 92A.133(4)(a) of the NRS), immediately after giving effect to the acceptance for payment of Shares in the Offer, equals at least a majority of the then issued and outstanding Shares, and the other Offer Conditions are satisfied or waived, no vote of the PFIE stockholders will be required to approve or effectuate the Merger, and Purchaser will not seek the approval of PFIE’s remaining public stockholders before effecting the Merger. Section 92A.133 of the NRS also requires that the Merger Agreement provide that a merger pursuant to that provision be effected as soon as practicable after the tender offer. Therefore, PFIE, Parent and Purchaser have agreed to take all necessary action to cause the Merger to become effective as promptly as practicable following the acceptance for payment of all Shares validly tendered and not validly withdrawn pursuant to the Offer. See Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement.”

There are no dissenter’s rights or appraisal rights available as a result of or in connection with the Offer. Pursuant to Section 92A.390 of the NRS, there are no dissenter’s rights or appraisal rights available as a result of or in connection with the Merger, if consummated. See Section 17 — “No Dissenter’s or Appraisal Rights.”

Stephens Inc. (“Stephens”), the financial advisor to PFIE, delivered an oral opinion to the PFIE Board, which was subsequently confirmed by delivery of a written opinion dated October 28, 2024, to the effect that, as of that date, the consideration to be received by the common stockholders of PFIE (solely in their capacity as such) in the proposed acquisition was fair to them from a financial point of view, based upon

and subject to the qualifications, assumptions and other matters considered by Stephens in connection with the preparation of its opinion. The full text of Stephens’s written opinion, which describes the assumptions, qualifications and limitations stated in such written opinion, will be included as an annex to Schedule 14D-9. Stephens’s opinion was provided for the benefit of the PFIE Board in connection with, and for the purpose of, its evaluation of the Offer Price in the Transaction and addresses only the fairness, from a financial point of view, to holders of Shares of the consideration to be received pursuant to the Merger Agreement. Stockholders are urged to read the full text of that opinion carefully and in its entirety.

The material United States federal income tax consequences for stockholders of PFIE that exchange Shares for cash pursuant to the Offer or the Merger are summarized in Section 5 — “Material United States Federal Income Tax Consequences.”

Parent and Purchaser have retained D.F. King to be the “Information Agent” and Colonial Stock Transfer Company, Inc. to be the “Depositary and Paying Agent” in connection with the Offer. Parent or Purchaser will pay all charges and expenses of Colonial Stock Transfer Company, Inc., as Depositary and Paying Agent, and D.F. King, as Information Agent, incurred in connection with the Offer. See Section 18 — “Fees and Expenses.”

Questions and requests for assistance may be directed to the Information Agent at its address and telephone numbers set forth on the back cover of this Offer to Purchase. Requests for copies of this Offer to Purchase and the related Letter of Transmittal may be directed to the Information Agent. Such copies will be furnished promptly at Purchaser’s expense. Stockholders may also contact brokers, dealers, commercial banks or trust companies for assistance concerning the Offer.

This Offer to Purchase, the Letter of Transmittal and the other documents referred to in this Offer to Purchase contain important information that should be read carefully before any decision is made with respect to the Offer.

THE TENDER OFFER

1.

Terms of the Offer.

Upon the terms and subject to the satisfaction or, to the extent permitted, waiver of the Offer Conditions (as defined in Section 15 — “Certain Conditions of the Offer”) (including, if the Offer is extended or amended, the terms and conditions of such extension or amendment), Purchaser will accept for payment and pay for all Shares validly tendered prior to the Offer Expiration Time and not validly withdrawn as permitted under Section 4 — “Withdrawal Rights” (the date and time of Purchaser’s acceptance of Shares tendered for payment, the “Acceptance Time”). The term “Offer Expiration Time” means one minute after 11:59 P.M., New York City time, on December 31, 2024, unless, in accordance with the Merger Agreement, the Offer has been extended, in which event the term “Offer Expiration Time” means such later time and date to which the Offer has been extended. Notwithstanding the foregoing, Purchaser and Parent will not be required to extend the Offer beyond the earlier of (i) 11:59 P.M. New York City time on March 31, 2025, or (ii) the valid termination of the Merger Agreement.

The Offer is conditioned upon the satisfaction of the Minimum Tender Condition and the other Offer Conditions set forth in Section 15 — “Certain Conditions of the Offer.” Purchaser may, subject to the terms and conditions of the Merger Agreement, terminate the Offer without purchasing any Shares if the Offer Conditions described in Section 15 — “Certain Conditions of the Offer” are not satisfied or waived. See Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement — Termination.”

Subject to the applicable rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) and the provisions of the Merger Agreement, Parent and Purchaser expressly reserve the right to increase the Offer Price and amend, modify or waive any Offer Condition (other than the Minimum Tender Condition) or to make any other changes in the terms and conditions of the Offer. However, pursuant to the Merger Agreement, Purchaser and Parent have agreed that (i) Purchaser shall not decrease the Offer Price and (ii) no change may be made to the Offer that (a) changes the form of consideration to be delivered by Purchaser pursuant to the Offer, (b) reduces the number of Shares sought to be purchased by Purchaser in the Offer, (c) amends or modifies any of the Offer Conditions in a manner that is adverse to the holders of the Shares, or imposes conditions or requirements to the Offer in addition to the Offer Conditions, (d) amends, modifies or waives the Minimum Tender Condition or (e) extends or otherwise changes the Expiration Date in a manner other than pursuant to and in accordance with the Merger Agreement.

The Merger Agreement provides, among other things, that the Offer Price will be adjusted appropriately to reflect the effect of any stock split, reverse stock split, stock dividend (including any dividend or distribution of securities convertible into the Shares), reorganization, recapitalization, reclassification, combination, merger, issuer tender offer, exchange of shares or other like change with respect to the Shares occurring on or after the date of the Merger Agreement and prior to the Acceptance Time.

Pursuant to the Merger Agreement, the Offer may be extended beyond the initial Offer Expiration Time, but in no event will the Offer be extended beyond the earlier of the valid termination of the Merger Agreement and the Outside Date without the prior written consent of PFIE. The Merger Agreement provides that Purchaser will (a) extend the Offer for any minimum period required by any rule or regulation of the SEC or its staff, any rule or regulation of Nasdaq or any other applicable law, in each case, applicable to the Offer; (b) if, as of any then-scheduled Offer Expiration Time, any Offer Condition (other than those conditions that by their nature are to be satisfied at the Offer Expiration Time) is not satisfied and has not been waived, extend the Offer for up to three (3) periods of time of ten business days each (or such longer period as PFIE and Parent may agree) to permit such Offer Conditions to be satisfied.

During any extension of the initial offer period, all Shares previously validly tendered and not validly withdrawn will remain subject to the Offer and subject to withdrawal rights. See Section 4 — “Withdrawal Rights.”

If, subject to the terms of the Merger Agreement, Purchaser makes a material change in the terms of the Offer or the information concerning the Offer, or if it waives a material condition of the Offer, Purchaser will disseminate additional tender offer materials and extend the Offer, if and to the extent required by Rules 14d-4(d), 14d-6(c) and 14e-1 under the Exchange Act, or otherwise. The minimum period during which

an Offer must remain open following material changes in the terms of the Offer, other than a change in price, percentage of securities sought, or inclusion of or changes to a dealer’s soliciting fee, will depend upon the facts and circumstances, including the materiality, of the changes. In the SEC’s view, an offer to purchase should remain open for a minimum of five business days from the date the material change is first published, sent or given to stockholders and, if material changes are made with respect to information that approaches the significance of price and share levels, a minimum of ten business days may be required to allow for adequate dissemination and investor response. Accordingly, if prior to the Offer Expiration Time, Purchaser decreases the number of Shares being sought or changes the consideration offered pursuant to the Offer, and if the Offer is scheduled to expire at any time earlier than the tenth business day from the date that notice of such increase or change is first published, sent or given to stockholders, the Offer will be extended at least until the expiration of such tenth business day.

Purchaser expressly reserves the right, in its sole discretion, subject to the terms and conditions of the Merger Agreement and the applicable rules and regulations of the SEC, not to accept for payment any Shares if, at the expiration of the Offer, any of the Offer Conditions set forth in Section 15 — “Certain Conditions of the Offer” have not been satisfied or waived. Under certain circumstances, Parent and Purchaser may terminate the Merger Agreement and the Offer, but Parent and Purchaser are prohibited (without PFIE’s consent) from terminating the Offer prior to any then-scheduled Offer Expiration Time, unless the Merger Agreement has been terminated in accordance with its terms.

Purchaser expressly reserves the right, in its sole discretion, subject to the terms and conditions of the Merger Agreement and the applicable rules and regulations of the SEC, to delay acceptance of Shares and to delay payment for Shares in order to comply in whole or in part with any applicable law. See Section 15 — “Certain Conditions of the Offer” and Section 16 — “Certain Legal Matters; Regulatory Approvals.” The reservation by Purchaser of the right to delay the acceptance of or payment for Shares is subject to the provisions of Rule 14e-1(c) under the Exchange Act, which requires Purchaser to pay the consideration offered or to return Shares deposited by or on behalf of tendering stockholders promptly after the termination or withdrawal of the Offer.

Any extension of the Offer, waiver, amendment of the Offer, delay in acceptance for payment or payment or termination of the Offer will be followed, as promptly as practicable, by public announcement thereof, the announcement in the case of an extension to be issued not later than 9:00 A.M., New York City time, on the next business day after the previously scheduled Offer Expiration Time in accordance with the public announcement requirements of Rules 14d-4(d), 14d-6(c) and l4e-1(d) under the Exchange Act.

Under no circumstances will interest be paid on the Offer Price for the Shares, regardless of any extension of the Offer or any delay in making payment for the Shares.

As promptly as practicable following the consummation of the Offer, Purchaser will consummate the Merger in accordance with Section 92A.133 of the NRS, which provides that no vote of the stockholders of PFIE is required to approve the Merger Agreement or consummate the Merger.

PFIE has provided Purchaser its list of stockholders with security position listings for the purpose of dissemination of the Offer to holders of Shares. The Offer to Purchase and the related Letter of Transmittal will be mailed to record holders of Shares whose names appear on PFIE’s stockholder list and will be furnished to brokers, dealers, commercial banks, trust companies or other nominees whose names, or the names of whose nominees, appear on the stockholder list or, if applicable, who are listed as participants in a clearing agency’s security position listing, for subsequent transmittal to beneficial owners of Shares.

2.

Acceptance for Payment and Payment for Shares.

Upon the terms and subject to the conditions of the Offer (including, if the Offer is extended or amended, the terms and conditions of any such extension or amendment), including the satisfaction or, to the extent permitted, earlier waiver of the Offer Conditions set forth in Section 15 — “Certain Conditions of the Offer,” Purchaser will, and Parent will cause Purchaser to, accept for payment and will pay or cause the Depositary and Paying Agent to pay for all Shares validly tendered and not validly withdrawn prior to the Offer Expiration Time pursuant to the Offer. Subject to the terms and conditions of the Merger Agreement and the applicable rules of the SEC, Purchaser expressly reserves the right to delay acceptance for payment of,

or payment for, Shares, in order to comply with applicable law. See Section 15 — “Certain Conditions of the Offer” and Section 16 — “Certain Legal Matters; Regulatory Approvals.”

In all cases, payment for Shares tendered and accepted for payment pursuant to the Offer will be made only after timely receipt by the Depositary and Paying Agent of (i) certificates representing those Shares or confirmation of the book-entry transfer of those Shares into the Depositary and Paying Agent’s account at The Depository Trust Company (“DTC”) pursuant to the procedures set forth in Section 3 — “Procedures for Accepting the Offer and Tendering Shares,” (ii) the Letter of Transmittal (or, with respect to a recognized Medallion Program approved by The Securities Transfer Association, Inc., including the Security Transfer Agents Medallion Program, the New York Stock Exchange Medallion Signature Program and the Stock Exchanges Medallion Program (each, an “Eligible Institution”), a manually executed facsimile thereof or an Agent’s Message (as defined in Section 3 — “Procedures for Accepting the Offer and Tendering Shares” below)), properly completed and duly executed, with any required signature guarantees and (iii) any other documents required by the Letter of Transmittal. See Section 3 — “Procedures for Accepting the Offer and Tendering Shares.” Accordingly, tendering stockholders may be paid, at different times, depending upon when certificates or book-entry transfer confirmations with respect to their Shares are actually received by the Depositary and Paying Agent.

For purposes of the Offer, Purchaser will be deemed to have accepted for payment and thereby purchased Shares validly tendered and not validly withdrawn if and when Purchaser gives written notice to the Depositary and Paying Agent of its acceptance for payment of those Shares pursuant to the Offer. Payment for Shares accepted for payment pursuant to the Offer will be made by deposit of the purchase price therefor with the Depositary and Paying Agent, which will act as agent for the tendering stockholders for purposes of receiving payments from Purchaser and transmitting those payments to the tendering stockholders. If Purchaser extends the Offer, is delayed in its acceptance for payment of Shares or is unable to accept Shares for payment pursuant to the Offer for any reason, then, without prejudice to its rights under the Offer and the Merger Agreement, but subject to PFIE’s rights under the Merger Agreement (other than in a situation in which the Offer is withdrawn or terminated or the Merger Agreement is terminated), the Depositary and Paying Agent may retain tendered Shares on Purchaser’s behalf, and such Shares may not be withdrawn except to the extent that tendering stockholders are entitled to withdrawal rights as described herein under Section 4 — “Withdrawal Rights” and as otherwise required by Rule 14e-1(c) under the Exchange Act. Under no circumstances will interest be paid on the Offer Price for Shares, regardless of any extension of the Offer or any delay in payment for Shares.

If any tendered Shares are not accepted for payment pursuant to the terms and conditions of the Offer for any reason, or if certificates are submitted for more Shares than are tendered, certificates for those unpurchased Shares will be returned (or new certificates for such Shares not tendered will be sent), without expense to the tendering stockholder (or, in the case of Shares tendered by book-entry transfer into the Depositary and Paying Agent’s account at DTC pursuant to the procedures set forth in Section 3 — “Procedures for Accepting the Offer and Tendering Shares” those Shares will be credited to an account maintained with DTC) promptly following expiration or termination of the Offer.

If, prior to the Offer Expiration Time, Purchaser increases the consideration offered to holders of Shares pursuant to the Offer, that increased consideration will be paid to holders of all Shares that are tendered pursuant to the Offer, whether or not those Shares were tendered prior to that increase in consideration.

3.

Procedures for Accepting the Offer and Tendering Shares.

Valid Tenders. Except as set forth below, to validly tender Shares pursuant to the Offer, either (i) a properly completed and duly executed Letter of Transmittal (or, with respect to Eligible Institutions, a manually executed facsimile thereof) in accordance with the instructions of the Letter of Transmittal, with any required signature guarantees, or an Agent’s Message (as defined below) in connection with a book-entry delivery of Shares, and any other documents required by the Letter of Transmittal, must be received by the Depositary and Paying Agent at one of its addresses set forth on the back cover of this Offer to Purchase prior to the Offer Expiration Time and either (a) certificates representing Shares tendered must be delivered to the Depositary and Paying Agent or (b) those Shares must be properly delivered pursuant to the procedures for book-entry transfer described below and a confirmation of that delivery received by

the Depositary and Paying Agent (which confirmation must include an Agent’s Message if the tendering stockholder has not delivered a Letter of Transmittal), in each case, prior to the Offer Expiration Time; or (ii) the tendering stockholder must comply with the guaranteed delivery procedures described below.