Portman Ridge Finance Corp NASDAQ false 0001372807 0001372807 2024-08-08 2024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

Portman Ridge Finance Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

814-00735 |

|

20-5951150 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 650 Madison Avenue, 23rd Floor New York, New York |

|

10022 |

| (Address of principal executive offices) |

|

(Zip Code) |

(Registrant’s telephone number, including area code): (212) 891-2880

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

PTMN |

|

The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 8, 2024, Portman Ridge Finance Corporation (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended June 30, 2024. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. Additionally, on August 9, 2024, the Company made available on its website, http://www.portmanridge.com/home, a supplemental investor presentation with respect to the earnings release. A copy of the investor presentation is being furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

The information disclosed under this Item 2.02, including Exhibits 99.1 and 99.2 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any filing made under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| PORTMAN RIDGE FINANCE CORPORATION |

|

|

| By: |

|

/s/ Brandon Satoren |

| Name: |

|

Brandon Satoren |

| Title: |

|

Chief Financial Officer |

Date: August 12, 2024

Exhibit 99.1

FOR IMMEDIATE RELEASE

Portman Ridge Finance Corporation

Announces Second Quarter 2024 Financial Results

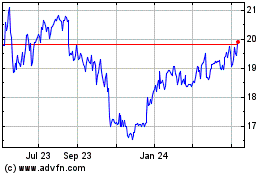

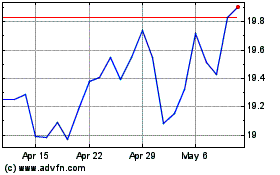

Reports Net Investment Income of $0.70 Per Share and Net Asset Value of $21.21 Per Share

Amends and Extends Existing Senior Secured Revolving Credit Facility; Upsizes Commitments to $200.0 Million from $115.0 Million, Reduces

Interest Rate Margin to 2.50% from 2.80%

Continued Share Repurchase Program: Total of 79,722 Shares for an Aggregate Cost of

Approximately $1.6 Million Repurchased During the Second Quarter; Accretive to NAV by $0.03 Per Share

Announces Third

Quarter 2024 Quarterly Distribution of $0.69 Per Share

NEW YORK, August 8, 2024 – Portman Ridge Finance

Corporation (Nasdaq: PTMN) (the “Company” or “Portman Ridge”) announced today its financial results for the second quarter ended June 30, 2024.

Second Quarter 2024 Highlights

| |

• |

|

Total investment income for the second quarter of 2024 was $16.3 million, as compared to

$16.5 million for the first quarter of 2024. |

| |

• |

|

Core investment income1, excluding the impact of

purchase price accounting, for the second quarter of 2024 was $16.2 million, as compared to $16.5 million for the first quarter of 2024. |

| |

• |

|

Net investment income (“NII”) for the second quarter of 2024 was $6.5 million ($0.70 per

share) as compared to $6.2 million ($0.67 per share) in the first quarter of 2024. |

| |

• |

|

Net asset value (“NAV”), as of June 30, 2024, was $196.4 million ($21.21 per share),

as compared to NAV of $210.6 million ($22.57 per share) as of March 31, 2024. |

| |

• |

|

Total shares repurchased in open market transactions under the Renewed Stock Repurchase Program during the

quarter ended June 30, 2024, were 79,722 shares at an aggregate cost of approximately $1.6 million, which was accretive to NAV by $0.03 per share. |

| 1 |

Core investment income represents reported total investment income as determined in accordance with U.S.

generally accepted accounting principles, or U.S. GAAP, less the impact of purchase discount accretion in connection with the Garrison Capital Inc. (“GARS”) and Harvest Capital Credit Corporation (“HCAP”) mergers. Portman Ridge

believes presenting core investment income and the related per share amount is useful and appropriate supplemental disclosure for analyzing its financial performance due to the unique circumstance giving rise to the purchase accounting adjustment.

However, core investment income is a non-U.S. GAAP measure and should not be considered as a replacement for total investment income and other earnings measures presented in accordance with U.S. GAAP. Instead,

core investment income should be reviewed only in connection with such U.S. GAAP measures in analyzing Portman Ridge’s financial performance. |

Subsequent Events

| |

• |

|

On July 23, 2024, Great Lakes Portman Ridge Funding LLC, a wholly-owned subsidiary of the Company, entered

into a second amendment of its senior secured revolving credit facility (“Revolving Credit Facility”) with JPMorgan Chase Bank, National Association (“JPM”) as administrative agent. The second amendment, among other things,

(i) provided for a committed increase to the aggregate principal amount of the Revolving Credit Facility in an amount not to exceed $85,000,000, subject to the satisfaction of certain conditions, (ii) provided for a committed seven-day bridge advance in an aggregate principal amount of $18,250,000, subject to the satisfaction of certain conditions, (iii) reduced the applicable margin on the Revolving Credit Facility to 2.50% per

annum, (iv) extended the period in which the Company may request advances under the Revolving Credit Facility to August 29, 2026, (v) extended the stated maturity of the Revolving Credit Facility to August 29, 2027, (vi) extended the non-call period under the Revolving Credit Facility to April 29, 2025, and (vii) provided for certain fees to be paid to the administrative agent and the lenders in connection therewith.

|

| |

• |

|

On August 8, 2024, the Company declared a cash distribution of $0.69 per share of common stock. The

distribution is payable on August 30, 2024 to stockholders of record at the close of business on August 22, 2024. |

Management Commentary

Ted Goldthorpe,

Chief Executive Officer of Portman Ridge, stated, “We are pleased to report that Portman Ridge delivered net investment income of $0.70 per share, which is an increase of 4.5% from the previous quarter and exceeded the Company’s

quarterly distribution. Additionally, during the three months ended June 30, 2024, we repurchased 79,722 shares for an aggregate cost of approximately $1.6 million, which was accretive to NAV by $0.03. During the quarter, however, we

experienced challenges at certain select inherited portfolio companies, resulting in a decline in NAV and an increase in non-accruals. Despite the challenging quarter, we remain confident in the quality of the

portfolio and our ability to generate attractive and sustainable returns for shareholders over the long-term.

Subsequent to quarter end, we amended and

extended our Credit Facility with JPM. The new attractive terms, which reduced the applicable margin from 2.80% per annum to 2.50% per annum, have reduced our overall cost of capital, providing us with further financial flexibility. The new

revolving commitment from JPM, which increased by $85.0 million to $200.0 million, expands our ability to provide additional capital to our existing portfolio companies as well as provides us with greater flexibility to finance new

attractive investment opportunities as they arise.

As we enter the back half of 2024, we want to reiterate our commitment to our shareholders. With our

amended credit facility, robust pipeline, and strong balance sheet, we believe we are well positioned to continue executing our strategy and delivering positive returns to our shareholders.”

Selected Financial Highlights

| |

• |

|

Total investment income for the quarter ended June 30, 2024, was $16.3 million, of which

$13.9 million was attributable to interest income, inclusive of payment-in-kind income, from the Debt Securities Portfolio. This compares to total investment income

of $19.6 million for the quarter ended June 30, 2023, of which $15.5 million was attributable to interest income, inclusive of payment-in-kind income,

from the Debt Securities Portfolio. |

| |

• |

|

Core investment income for the second quarter of 2024, excluding the impact of purchase discount

accretion, was $16.2 million, a decrease of $3.0 million as compared to core investment income of $19.2 million for the second quarter of 2023. |

| |

• |

|

Net investment income (“NII”) for the second quarter of 2024 was $6.5 million ($0.70 per

share) as compared to $7.9 million ($0.83 per share) for the same period the prior year. |

| |

• |

|

Non-accruals on debt investments, as of June 30, 2024, were

nine debt investments representing 0.5% and 4.5% of the Company’s investment portfolio at fair value and amortized cost, respectively. This compares to seven debt investments representing 0.5% and 3.2% of the Company’s investment portfolio

at fair value and amortized cost, respectively, as of March 31, 2024. Two non-accrual debt investments were sold subsequent to the quarter ended June 30, 2024. |

| |

• |

|

Total investments at fair value as of June 30, 2024, was $444.4 million and consisted of

investments in 92 portfolio companies. The debt investment portfolio at fair value as of June 30, 2024 was $358.9 million, which excludes CLO Funds and Joint Ventures, and was comprised of 75 different portfolio companies across 28

different industries with an average par balance per entity of approximately $2.6 million. This compares to total investments of $471.3 million at fair value as of March 31, 2024 and consisted of investments in 94 portfolio companies.

The debt investment portfolio at fair value as of March 31, 2024 was $386.1 million, which excludes CLO Funds and Joint Ventures, and was comprised of 79 different portfolio companies across 27 different industries with an average par

balance per entity of approximately $3.1 million. |

| |

• |

|

Weighted average contractual interest rate on our interest earning Debt Securities Portfolio as of

June 30, 2024 was approximately 12.4%. |

| |

• |

|

Par value of outstanding borrowings, as of June 30, 2024, was $285.1 million compared to

$291.7 million as of March 31, 2024, with an asset coverage ratio of total assets to total borrowings of 169% and 171%, respectively. On a net basis, leverage as of June 30, 2024 was

1.3x2 compared to net leverage of 1.2x2 as of March 31, 2024. |

| 2 |

Net leverage is calculated as the ratio between (A) debt, excluding unamortized debt issuance costs, less

available cash and cash equivalents, and restricted cash and (B) NAV. Portman Ridge believes presenting a net leverage ratio is useful and appropriate supplemental disclosure because it reflects the Company’s financial condition net of

$36.6 million and $39.6 million of cash and cash equivalents and restricted cash as of June 30, 2024 and March 31, 2024, respectively. However, the net leverage ratio is a non-U.S. GAAP

measure and should not be considered as a replacement for the regulatory asset coverage ratio and other similar information presented in accordance with U.S. GAAP. Instead, the net leverage ratio should be reviewed only in connection with such U.S.

GAAP measures in analyzing Portman Ridge’s financial condition. |

Results of Operations

Operating results for the three months ended June 30, 2024, and June 30, 2023, were as follows:

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended June 30, |

|

| ($ in thousands) |

|

2024 |

|

|

2023 |

|

| Total investment income |

|

$ |

16,337 |

|

|

$ |

19,626 |

|

|

|

|

|

|

|

|

|

|

| Total expenses |

|

|

9,860 |

|

|

|

11,711 |

|

|

|

|

|

|

|

|

|

|

| Net Investment Income |

|

|

6,477 |

|

|

|

7,915 |

|

|

|

|

|

|

|

|

|

|

| Net realized gain (loss) on investments |

|

|

(6,922 |

) |

|

|

(6,471 |

) |

|

|

|

|

|

|

|

|

|

| Net change in unrealized gain (loss) on investments |

|

|

(5,966 |

) |

|

|

(4,176 |

) |

|

|

|

|

|

|

|

|

|

| Tax (provision) benefit on realized and unrealized gains (losses) on investments |

|

$ |

78 |

|

|

$ |

(164 |

) |

|

|

|

|

|

|

|

|

|

| Net realized and unrealized appreciation (depreciation) on investments, net of taxes |

|

$ |

(12,810 |

) |

|

$ |

(10,811 |

) |

|

|

|

|

|

|

|

|

|

| Net realized gain (loss) on extinguishment of debt |

|

$ |

(39 |

) |

|

$ |

(218 |

) |

|

|

|

|

|

|

|

|

|

| Net Increase (Decrease) in Net Assets Resulting from Operations |

|

$ |

(6,372 |

) |

|

$ |

(3,114 |

) |

|

|

|

|

|

|

|

|

|

| Net Increase (Decrease) In Net Assets Resulting from Operations per Common Share: |

|

|

|

|

|

|

|

|

| Basic and Diluted: |

|

$ |

(0.69 |

) |

|

$ |

(0.33 |

) |

| Net Investment Income Per Common Share: |

|

|

|

|

|

|

|

|

| Basic and Diluted: |

|

$ |

0.70 |

|

|

$ |

0.83 |

|

| Weighted Average Shares of Common Stock Outstanding — Basic and Diluted |

|

|

9,293,687 |

|

|

|

9,541,722 |

|

Investment Income

The

composition of our investment income for the three months ended June 30, 2024, and June 30, 2023, was as follows:

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

Ended June 30, |

|

| ($ in thousands) |

|

2024 |

|

|

2023 |

|

| Interest income, excluding CLO income and purchase discount accretion |

|

$ |

11,589 |

|

|

$ |

14,156 |

|

| Purchase discount accretion |

|

|

112 |

|

|

|

427 |

|

| PIK Income |

|

|

2,201 |

|

|

|

966 |

|

| CLO Income |

|

|

524 |

|

|

|

829 |

|

| JV Income |

|

|

1,800 |

|

|

|

2,329 |

|

| Fees and other income |

|

|

111 |

|

|

|

919 |

|

|

|

|

|

|

|

|

|

|

| Investment Income |

|

$ |

16,337 |

|

|

$ |

19,626 |

|

|

|

|

|

|

|

|

|

|

| Less : Purchase discount accretion |

|

$ |

(112 |

) |

|

$ |

(427 |

) |

|

|

|

|

|

|

|

|

|

| Core Investment Income |

|

$ |

16,225 |

|

|

$ |

19,199 |

|

|

|

|

|

|

|

|

|

|

Fair Value of Investments

The composition of our investment portfolio as of June 30, 2024 and December 31, 2023, at cost and fair value was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

|

June 30, 2024

(Unaudited) |

|

|

December 31, 2023 |

|

| Security Type |

|

Cost/Amortized

Cost |

|

|

Fair Value |

|

|

Fair Value

Percentage

of Total

Portfolio |

|

|

Cost/Amortized

Cost |

|

|

Fair Value |

|

|

Fair Value

Percentage

of Total

Portfolio |

|

| First Lien Debt |

|

$ |

343,264 |

|

|

$ |

320,815 |

|

|

|

72.1 |

% |

|

$ |

351,858 |

|

|

$ |

336,599 |

|

|

|

71.9 |

% |

| Second Lien Debt |

|

|

48,750 |

|

|

|

36,386 |

|

|

|

8.2 |

% |

|

|

50,814 |

|

|

|

41,254 |

|

|

|

8.8 |

% |

| Subordinated Debt |

|

|

8,055 |

|

|

|

1,693 |

|

|

|

0.4 |

% |

|

|

7,990 |

|

|

|

1,224 |

|

|

|

0.3 |

% |

| Collateralized Loan Obligations |

|

|

8,423 |

|

|

|

7,354 |

|

|

|

1.7 |

% |

|

|

9,103 |

|

|

|

8,968 |

|

|

|

1.9 |

% |

| Joint Ventures |

|

|

65,775 |

|

|

|

54,292 |

|

|

|

12.2 |

% |

|

|

71,415 |

|

|

|

59,287 |

|

|

|

12.7 |

% |

| Equity |

|

|

30,594 |

|

|

|

23,830 |

|

|

|

5.4 |

% |

|

|

31,280 |

|

|

|

20,533 |

|

|

|

4.4 |

% |

| Asset Manager Affiliates(1) |

|

|

17,791 |

|

|

|

— |

|

|

|

— |

|

|

|

17,791 |

|

|

|

— |

|

|

|

— |

|

| Derivatives |

|

|

31 |

|

|

|

— |

|

|

|

— |

|

|

|

31 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

522,683 |

|

|

$ |

444,370 |

|

|

|

100.0 |

% |

|

$ |

540,282 |

|

|

$ |

467,865 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 |

Represents the equity investment in the Asset Manager Affiliates. |

Liquidity and Capital Resources

As of June 30, 2024, the Company had $285.1 million (par value) of borrowings outstanding at a current weighted average interest rate of 6.9%, of

which $108.0 million par value had a fixed rate and $177.1 million par value had a floating rate. This balance was comprised of $92.0 million of outstanding borrowings under the Revolving Credit Facility, $85.1 million of 2018-2 Secured Notes, and $108.0 million of 4.875% Notes due 2026.

As of June 30, 2024, and December 31,

2023, the fair value of investments and cash were as follows:

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

|

|

|

|

|

|

| Security Type |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

| Cash and cash equivalents |

|

$ |

9,813 |

|

|

$ |

26,912 |

|

| Restricted Cash |

|

|

26,826 |

|

|

|

44,652 |

|

| First Lien Debt |

|

|

320,815 |

|

|

|

336,599 |

|

| Second Lien Debt |

|

|

36,386 |

|

|

|

41,254 |

|

| Subordinated Debt |

|

|

1,693 |

|

|

|

1,224 |

|

| Equity |

|

|

23,830 |

|

|

|

20,533 |

|

| Collateralized Loan Obligations |

|

|

7,354 |

|

|

|

8,968 |

|

| Asset Management Affiliates |

|

|

— |

|

|

|

— |

|

| Joint Ventures |

|

|

54,292 |

|

|

|

59,287 |

|

| Derivatives |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

481,009 |

|

|

$ |

539,429 |

|

|

|

|

|

|

|

|

|

|

As of June 30, 2024, the Company had unrestricted cash of $9.8 million and restricted cash of $26.8 million.

This compares to unrestricted cash of $20.8 million and restricted cash of $18.8 million as of March 31, 2024. As of June 30, 2024, the Company had $23.0 million of available borrowing capacity under the Revolving Credit

Facility, and no remaining borrowing capacity under the 2018-2 Secured Notes.

Interest Rate Risk

The Company’s investment income is affected by fluctuations in various interest rates, including SOFR and prime rates.

As of June 30, 2024, approximately 88.1% of our Debt Securities Portfolio at par value were either floating rate with a spread to an interest rate index

such as SOFR or the PRIME rate. 81.6% of these floating rate loans contain SOFR floors ranging between 0.50% and 3.25%. We generally expect that future portfolio investments will predominately be floating rate investments.

In periods of rising or lowering interest rates, the cost of the portion of debt associated with the 4.875% Notes Due 2026 would remain the same, given that

this debt is at a fixed rate, while the interest rate on borrowings under the Revolving Credit Facility would fluctuate with changes in interest rates.

Generally, the Company would expect that an increase in the base rate index for floating rate investment assets would increase gross investment income and a

decrease in the base rate index for such assets would decrease gross investment income (in either case, such increase/decrease may be limited by interest rate floors/minimums for certain investment assets).

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Impact on net investment income from

a change in interest rates at: |

|

| ($ in thousands) |

|

1% |

|

|

2% |

|

|

3% |

|

| Increase in interest rate |

|

$ |

1,764 |

|

|

$ |

3,528 |

|

|

$ |

5,292 |

|

| Decrease in interest rate

|

|

$ |

(1,764 |

) |

|

$ |

(3,528 |

) |

|

$ |

(5,252 |

) |

Conference Call and Webcast

We will hold a conference call on Friday, August 9, 2024, at 10:00 am Eastern Time to discuss our second quarter 2024 financial results. To access the

call, stockholders, prospective stockholders and analysts should dial (646) 307-1963 approximately 10 minutes prior to the start of the conference call and use the conference ID 9474953.

A live audio webcast of the conference call can be accessed via the Internet, on a listen-only basis on the Company’s website www.portmanridge.com

in the Investor Relations section under Events and Presentations. The webcast can also be accessed by clicking the following link: https://edge.media-server.com/mmc/p/zqckbjgv. The online archive of the webcast will be available on the

Company’s website shortly after the call.

About Portman Ridge Finance Corporation

Portman Ridge Finance Corporation (Nasdaq: PTMN) is a publicly traded, externally managed investment company that has elected to be regulated as a business

development company under the Investment Company Act of 1940. Portman Ridge’s middle market investment business originates, structures, finances and manages a portfolio of term loans, mezzanine investments and selected equity securities in

middle market companies. Portman Ridge’s investment activities are managed by its investment adviser, Sierra Crest Investment Management LLC, an affiliate of BC Partners Advisors L.P.

Portman Ridge’s filings with the Securities and Exchange Commission (the “SEC”), earnings releases, press releases and other financial,

operational and governance information are available on the Company’s website at www.portmanridge.com.

About BC Partners Advisors L.P. and

BC Partners Credit

BC Partners is a leading international investment firm in private equity, private credit and real estate strategies. Established in

1986, BC Partners has played an active role in developing the European buyout market for three decades. Today, BC Partners executives operate across markets as an integrated team through the firm’s offices in North America and Europe. For more

information, please visit https://www.bcpartners.com/.

BC Partners Credit was launched in February 2017 and has pursued a strategy focused on

identifying attractive credit opportunities in any market environment and across sectors, leveraging the deal sourcing and infrastructure made available from BC Partners.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements. The matters discussed in this press release, as well as in future oral and written statements by

management of Portman Ridge Finance Corporation, that are forward-looking statements are based on current management expectations that involve substantial risks and uncertainties which could cause actual results to differ materially from the results

expressed in, or implied by, these forward-looking statements.

Forward-looking statements relate to future events or our future financial performance and include, but are

not limited to, projected financial performance, expected development of the business, plans and expectations about future investments and the future liquidity of the Company. We generally identify forward-looking statements by terminology such as

“may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “outlook”, “contemplates,”

“believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words. Forward-looking statements are based upon current plans, estimates and

expectations that are subject to risks, uncertainties, and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove to be incorrect, actual results may vary materially from those indicated

or anticipated by such forward-looking statements.

Important assumptions include our ability to originate new investments, and achieve certain margins

and levels of profitability, the availability of additional capital, and the ability to maintain certain debt to asset ratios. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this press

release should not be regarded as a representation that such plans, estimates, expectations or objectives will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include,

among others, (1) uncertainty of the expected financial performance of the Company; (2) expected synergies and savings associated with merger transactions effectuated by the Company; (3) the ability of the Company and/or its adviser

to implement its business strategy; (4) evolving legal, regulatory and tax regimes; (5) changes in general economic and/or industry specific conditions, including but not limited to the impact of inflation; (6) the impact of increased

competition; (7) business prospects and the prospects of the Company’s portfolio companies; (8) contractual arrangements with third parties; (9) any future financings by the Company; (10) the ability of Sierra Crest

Investment Management LLC to attract and retain highly talented professionals; (11) the Company’s ability to fund any unfunded commitments; (12) any future distributions by the Company; (13) changes in regional or national

economic conditions and their impact on the industries in which we invest; and (14) other changes in the conditions of the industries in which we invest and other factors enumerated in our filings with the SEC. The forward-looking statements

should be read in conjunction with the risks and uncertainties discussed in the Company’s filings with the SEC, including the Company’s most recent Form 10-K and other SEC filings. We do not

undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required to be reported under the rules and regulations of the SEC.

Contacts:

Portman Ridge Finance Corporation

650 Madison Avenue, 3rd

floor

New York, NY 10022

info@portmanridge.com

Brandon Satoren

Chief Financial Officer

Brandon.Satoren@bcpartners.com

(212) 891-2880

The Equity Group Inc.

Lena Cati

lcati@equityny.com

(212) 836-9611

Val

Ferraro

vferraro@equityny.com

(212) 836-9633

PORTMAN RIDGE FINANCE CORPORATION

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

| |

|

June 30, 2024

(Unaudited) |

|

|

December 31, 2023 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Investments at fair value: |

|

|

|

|

|

|

|

|

|

Non-controlled/non-affiliated

investments (amortized cost: 2024 - $409,486; 2023 - $426,630) |

|

$ |

370,359 |

|

|

$ |

398,325 |

|

| Non-controlled affiliated investments (amortized cost:

2024 - $62,769; 2023 - $55,611) |

|

|

60,464 |

|

|

|

55,222 |

|

| Controlled affiliated investments (cost: 2024 - $50,428; 2023 - $58,041) |

|

|

13,547 |

|

|

|

14,318 |

|

|

|

|

|

|

|

|

|

|

| Total Investments at Fair Value (cost: 2024 - $522,683; 2023 - $540,282) |

|

$ |

444,370 |

|

|

$ |

467,865 |

|

| Cash and cash equivalents |

|

|

9,813 |

|

|

|

26,912 |

|

| Restricted cash |

|

|

26,826 |

|

|

|

44,652 |

|

| Interest receivable |

|

|

4,659 |

|

|

|

5,162 |

|

| Receivable for unsettled trades |

|

|

— |

|

|

|

573 |

|

| Due from affiliates |

|

|

1,544 |

|

|

|

1,534 |

|

| Other assets |

|

|

1,599 |

|

|

|

2,541 |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

488,811 |

|

|

$ |

549,239 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

| 2018-2 Secured Notes (net of discount of: 2024 - $414;

2023 - $712) |

|

$ |

84,656 |

|

|

$ |

124,971 |

|

| 4.875% Notes Due 2026 (net of discount of: 2024 - $974; 2023 - $1,225; net of deferred financing

costs of: 2024 - $430; 2023 - $561) |

|

|

106,596 |

|

|

|

106,214 |

|

| Great Lakes Portman Ridge Funding LLC Revolving Credit Facility (net of deferred financing costs

of: 2024 - $609; 2023 - $775) |

|

|

91,391 |

|

|

|

91,225 |

|

| Payable for unsettled trades |

|

|

37 |

|

|

|

520 |

|

| Accounts payable, accrued expenses and other liabilities |

|

|

2,700 |

|

|

|

4,252 |

|

| Accrued interest payable |

|

|

3,537 |

|

|

|

3,928 |

|

| Due to affiliates |

|

|

411 |

|

|

|

458 |

|

| Management and incentive fees payable |

|

|

3,054 |

|

|

|

4,153 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

$ |

292,382 |

|

|

$ |

335,721 |

|

| COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

| NET ASSETS |

|

|

|

|

|

|

|

|

| Common stock, par value $0.01 per share, 20,000,000 common shares authorized; 9,951,485 issued,

and 9,260,495 outstanding at June 30, 2024, and 9,943,385 issued, and 9,383,132 outstanding at December 31, 2023 |

|

$ |

93 |

|

|

$ |

94 |

|

| Capital in excess of par value |

|

|

715,488 |

|

|

|

717,835 |

|

| Total distributable (loss) earnings |

|

|

(519,152 |

) |

|

|

(504,411 |

) |

|

|

|

|

|

|

|

|

|

| Total Net Assets |

|

$ |

196,429 |

|

|

$ |

213,518 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Net Assets |

|

$ |

488,811 |

|

|

$ |

549,239 |

|

|

|

|

|

|

|

|

|

|

| Net Asset Value Per Common Share |

|

$ |

21.21 |

|

|

$ |

22.76 |

|

|

|

|

|

|

|

|

|

|

PORTMAN RIDGE FINANCE CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended

June 30, |

|

|

For the Six Months Ended

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| INVESTMENT INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlled/non-affiliated

investments |

|

$ |

11,913 |

|

|

$ |

14,786 |

|

|

$ |

24,534 |

|

|

$ |

29,632 |

|

| Non-controlled affiliated investments |

|

|

312 |

|

|

|

626 |

|

|

|

407 |

|

|

|

1,475 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest income |

|

$ |

12,225 |

|

|

$ |

15,412 |

|

|

$ |

24,941 |

|

|

$ |

31,107 |

|

| Payment-in-kind

income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlled/non-affiliated

investments(1) |

|

$ |

2,018 |

|

|

$ |

859 |

|

|

$ |

3,912 |

|

|

$ |

2,386 |

|

| Non-controlled affiliated investments |

|

|

183 |

|

|

|

107 |

|

|

|

295 |

|

|

|

180 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

payment-in-kind income |

|

$ |

2,201 |

|

|

$ |

966 |

|

|

$ |

4,207 |

|

|

$ |

2,566 |

|

| Dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-controlled affiliated investments |

|

$ |

1,800 |

|

|

$ |

1,864 |

|

|

$ |

3,453 |

|

|

$ |

3,248 |

|

| Controlled affiliated investments |

|

|

— |

|

|

|

465 |

|

|

|

— |

|

|

|

1,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total dividend income |

|

$ |

1,800 |

|

|

$ |

2,329 |

|

|

$ |

3,453 |

|

|

$ |

4,788 |

|

| Fees and other income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlled/non-affiliated

investments |

|

$ |

111 |

|

|

$ |

905 |

|

|

$ |

262 |

|

|

$ |

1,478 |

|

| Non-controlled affiliated investments |

|

|

— |

|

|

|

14 |

|

|

|

— |

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total fees and other income |

|

$ |

111 |

|

|

$ |

919 |

|

|

$ |

262 |

|

|

$ |

1,492 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total investment income |

|

$ |

16,337 |

|

|

$ |

19,626 |

|

|

$ |

32,863 |

|

|

$ |

39,953 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Management fees |

|

$ |

1,680 |

|

|

$ |

1,869 |

|

|

$ |

3,409 |

|

|

$ |

3,822 |

|

| Performance-based incentive fees |

|

|

1,374 |

|

|

|

1,680 |

|

|

|

2,608 |

|

|

|

3,488 |

|

| Interest and amortization of debt issuance costs |

|

|

5,365 |

|

|

|

6,372 |

|

|

|

11,091 |

|

|

|

12,704 |

|

| Professional fees |

|

|

631 |

|

|

|

699 |

|

|

|

1,397 |

|

|

|

1,302 |

|

| Administrative services expense |

|

|

361 |

|

|

|

659 |

|

|

|

717 |

|

|

|

1,330 |

|

| Other general and administrative expenses |

|

|

449 |

|

|

|

432 |

|

|

|

939 |

|

|

|

863 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total expenses |

|

$ |

9,860 |

|

|

$ |

11,711 |

|

|

$ |

20,161 |

|

|

$ |

23,509 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INVESTMENT INCOME |

|

$ |

6,477 |

|

|

$ |

7,915 |

|

|

$ |

12,702 |

|

|

$ |

16,444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net realized gains (losses) from investment transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlled/non-affiliated

investments |

|

$ |

(694 |

) |

|

$ |

(5,267 |

) |

|

$ |

(2,335 |

) |

|

$ |

(8,352 |

) |

| Non-controlled affiliated investments |

|

|

— |

|

|

|

(1,124 |

) |

|

|

— |

|

|

|

(1,124 |

) |

| Controlled affiliated investments |

|

|

(6,228 |

) |

|

|

(80 |

) |

|

|

(6,644 |

) |

|

|

(80 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net realized gain (loss) on investments |

|

$ |

(6,922 |

) |

|

$ |

(6,471 |

) |

|

$ |

(8,979 |

) |

|

$ |

(9,556 |

) |

| Net change in unrealized appreciation (depreciation) on: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlled/non-affiliated

investments |

|

$ |

(10,163 |

) |

|

$ |

(5,478 |

) |

|

$ |

(10,822 |

) |

|

$ |

(8,535 |

) |

| Non-controlled affiliated investments |

|

|

(2,055 |

) |

|

|

766 |

|

|

|

(1,915 |

) |

|

|

455 |

|

| Controlled affiliated investments |

|

|

6,252 |

|

|

|

536 |

|

|

|

6,842 |

|

|

|

(2,056 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net change in unrealized gain (loss) on investments |

|

$ |

(5,966 |

) |

|

$ |

(4,176 |

) |

|

$ |

(5,895 |

) |

|

$ |

(10,136 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax (provision) benefit on realized and unrealized gains (losses) on investments |

|

$ |

78 |

|

|

$ |

(164 |

) |

|

$ |

537 |

|

|

$ |

407 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net realized and unrealized appreciation (depreciation) on investments, net of taxes |

|

$ |

(12,810 |

) |

|

$ |

(10,811 |

) |

|

$ |

(14,337 |

) |

|

$ |

(19,285 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net realized gain (loss) on extinguishment of debt |

|

$ |

(39 |

) |

|

$ |

(218 |

) |

|

$ |

(252 |

) |

|

$ |

(218 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS |

|

$ |

(6,372 |

) |

|

$ |

(3,114 |

) |

|

$ |

(1,887 |

) |

|

$ |

(3,059 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Increase (Decrease) In Net Assets Resulting from Operations per Common Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted: |

|

$ |

(0.69 |

) |

|

$ |

(0.33 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.32 |

) |

| Net Investment Income Per Common Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted: |

|

$ |

0.70 |

|

|

$ |

0.83 |

|

|

$ |

1.36 |

|

|

$ |

1.72 |

|

| Weighted Average Shares of Common Stock Outstanding—Basic and Diluted |

|

|

9,293,687 |

|

|

|

9,541,722 |

|

|

|

9,319,272 |

|

|

|

9,548,424 |

|

| (1) |

During the six months ended June 30, 2024, the Company received $0.1 million of non-recurring fee income that was paid in-kind and included in this financial statement line item. During the six months ended June 30, 2023, the Company received

$0.3 million of non-recurring fee income that was paid in-kind and included in this financial statement line item. |

Exhibit 99.2 Q2 2024 Earnings Presentation August 9, 2024

Important Information Cautionary Statement Regarding Forward-Looking

Statements This presentation contains forward-looking statements. The matters discussed in this presentation, as well as in future oral and written statements by management of Portman Ridge Finance Corporation (“PTMN”, “Portman

Ridge” or the “Company”), that are forward-looking statements are based on current management expectations that involve substantial risks and uncertainties which could cause actual results to differ materially from the results

expressed in, or implied by, these forward-looking statements. Forward-looking statements relate to future events or our future financial performance and include, but are not limited to, projected financial performance, expected development of the

business, plans and expectations about future investments, our contractual arrangements and relationships with third parties, the ability of our portfolio companies to achieve their objectives, the ability of the Company’s investment adviser

to attract and retain highly talented professionals, our ability to maintain our qualification as a regulated investment company and as a business development company, our compliance with covenants under our borrowing arrangements, and the future

liquidity of the Company. We generally identify forward-looking statements by terminology such as may, will, should, expects, plans, anticipates, could, intends, target, projects, “outlook”, contemplates, believes, estimates, predicts,

potential or continue or the negative of these terms or other similar words. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these

risks or uncertainties materialize, or should underlying assumptions prove to be incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Forward-looking statements are subject to change

at any time based upon economic, market or other conditions, including with respect to the impact of the COVID-19 pandemic and its effects on the Company and its portfolio companies’ results of operations and financial condition. More

information on these risks and other potential factors that could affect the Company’s financial results, including important factors that could cause actual results to differ materially from plans, estimates or expectations included herein,

is included in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of

Operations” sections of the Company’s most recently filed quarterly report on Form 10-Q and annual report on Form 10-K, as well as in subsequent filings. In light of these and other uncertainties, the inclusion of a projection or

forward-looking statement in this presentation should not be regarded as a representation by us that our plans and objectives will be achieved. We do not undertake to publicly update or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as required to be reported under the rules and regulations of the SEC. 2

First Quarter Highlights Second Quarter 2024 Highlights ▪ Total

investment income for the quarter ended June 30, 2024, was $16.3 million, of which 13.9 million was attributable to interest income, inclusive of payment-in-kind income, from the Debt Securities Portfolio. This compares to total investment income of

$19.6 million for the quarter ended June 30, 2023, of which $15.5 million was attributable to interest income, inclusive of payment-in-kind income, from the Debt Securities Portfolio. (1) ▪ Core investment income for the second quarter,

excluding the impact of purchase price accounting, was $16.2 million, a decrease of $3.0 million as compared to core investment income of $19.2 million for the second quarter of 2023. ▪ Net investment income ( NII ) for the second quarter of

2024 was $6.5 million ($0.70 per share) as compared to $7.9 million ($0.83 per share) for the same period the prior year, and $6.2 million, or $0.67 per share for the quarter ended March 31, 2024. ▪ Net asset value (“NAV”) as of

June 30, 2024, was $196.4 million ($21.21 per share) as compared to $210.6 million ($22.57 per share) as of March 31, 2024. ▪ Total shares repurchased in open market transactions under the Renewed Stock Repurchase Program during the quarter

ended June 30, 2024, were 79,722 at an aggregate cost of approximately $1.6 million, which was accretive to NAV by $0.03 per share. ▪ Total investments at fair value as of June 30, 2024, was $444.4 million; the debt investment portfolio at

fair value as of June 30, 2024 was $358.9 million, which excludes CLO Funds and Joint Ventures, and was comprised of 75 different portfolio companies across 28 different industries with an average par balance per entity of approximately $2.6

million. This compares to total investments of $471.3 million at fair value as of March 31, 2024 and consisted of investments in 94 portfolio companies. The debt investment portfolio at fair value as of March 31, 2024 was $386.1 million, which

excludes CLO Funds and Joint Ventures, and was comprised of 79 different portfolio companies across 27 different industries with an average par balance per entity of approximately $3.1 million. ▪ Weighted average contractual interest rate on

our interest earning Debt Securities Portfolio for the quarter ended June 30, 2024, was approximately 12.4%. ▪ Non-accruals on debt investments, as of June 30, 2024, were nine debt investments as compared to seven debt investments on

non-accrual status as of March 31, 2024. As of June 30, 2024, debt investments on non-accrual status represented 0.5% and 4.5% of the Company’s investment portfolio at fair value and amortized cost, respectively. This compares to debt

investments on non-accrual status representing 0.5% and 3.2% of the Company’s investment portfolio at fair value and amortized cost, respectively, as of March 31, 2024. ▪ Par value of outstanding borrowings, as of June 30, 2024, was

$285.1 million compared to $291.7 million as of March 31,2024, with an asset coverage ratio of total assets to total (2) (2) borrowings of 169% and 171% respectively. On a net basis, leverage as of June 30, 2024, was 1.3x compared to net leverage of

1.2x as of March 31, 2024. ▪ Amended and extended Senior Secured Credit Facility with JPMorgan Chase Bank, National Association (“JMP”). Under the terms of the amendment, commitments to the aggregate principal amount of the Credit

Facility increased by $85.0 million, to a total of $200.0 million and the applicable margin was reduced from 2.80% per annum to 2.50% per annum. Additionally, the reinvestment period was extended from April 29, 2025, to August 29, 2026, and the

maturity date was extended from April 29, 2026, to August 29, 2027. Furthermore, the Company’s existing 2018-2 Secured Notes will be refinanced under the terms of this amendment. ▪ Declared stockholder distribution of $0.69 per share for

the third quarter of 2024, payable on August 30, 2024, to stockholders of record at the close of business on August 22, 2024. (1) Core investment income represents reported total investment income as determined in accordance with U.S. generally

accepted accounting principles, or U.S. GAAP, less the impact of purchase price discount accounting in connection with the Garrison Capital Inc. (“GARS”) and Harvest Capital Credit Corporation (“HCAP”) mergers. Portman Ridge

believes presenting core investment income and the related per share amount is useful and appropriate supplemental disclosure for analyzing its financial performance due to the unique circumstance giving rise to the purchase accounting adjustment.

However, core investment income is a non-U.S. GAAP measure and should not be considered as a replacement for total investment income and other earnings measures presented in accordance with U.S. GAAP. Instead, core investment income should be

reviewed only in connection 3 with such U.S. GAAP measures in analyzing Portman Ridge’s financial performance. (2) Net leverage is calculated as the ratio between (A) debt, excluding unamortized debt issuance costs, less available cash and

cash equivalents, and restricted cash and (B) NAV. Portman Ridge believes presenting a net leverage ratio is useful and appropriate supplemental disclosure because it reflects the Company’s financial condition net of $36.6 million and $39.6

million of cash and cash equivalents and restricted cash as of June 30, 2024 and March 31, 2024, respectively. However, the net leverage ratio is a non-U.S. GAAP measure and should not be considered as a replacement for the regulatory asset coverage

ratio and other similar information presented in accordance with U.S. GAAP. Instead, the net leverage ratio should be reviewed only in connection with such U.S. GAAP measures in analyzing Portman Ridge’s financial condition.

Financial Highlights ($ in thousands) Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2

2024 Interest from investments in debt excluding accretion $14,156 $13,174 $13,196 $12,088 $11,589 Purchase discount accounting 427 238 67 73 112 PIK Investment Income 966 2,421 2,081 2,006 2,201 CLO Income 829 502 119 555 524 JV Income 2,329 2,073

2,087 1,653 1,800 Service Fees 919 166 238 151 111 Investment Income $19,626 $18,574 $17,788 $16,526 $16,337 Less: Purchase discount accounting ($427) ($238) ($67) ($73) ($112) (1) $19,199 $18,336 $17,721 $16,453 $16,225 Core investment income

Expenses: Management fees $1,869 $1,844 $1,786 $1,729 $1,680 Performance-based incentive fees 1,680 1,519 2,367 1,234 1,374 Interest and amortization of debt issuance costs 6,372 6,343 6,259 5,725 5,365 Professional fees 699 640 687 766 631

Administrative services expense 659 617 430 356 361 Other general and administrative expenses 432 445 405 490 449 Total expenses $11,711 $11,408 $11,934 $10,300 $9,860 Less: Expense reimbursement - - (5,309) - - Net Expenses $11,711 $11,408 $6,625

$10,300 $9,860 Net investment income $7,915 $7,166 $11,163 $6,226 $6,477 Excluding impact of expense reimbursement — — 4,371 — — (2) $7,563 $6,928 $6,792 $6,153 $6,384 Core net investment income Net realized gain (loss) on

investments (6,471) (1,636) (15,574) (2,057) (6,922) Net change in unrealized gain (loss) on investments ( 4,176) 1 ,708 1 1,750 71 (5,966) Tax (provision) benefit on realized and unrealized gains (losses) on investments (164) 264 (257) 459 78 Net

realized gain (loss) on extinguishment of debt (218) (57) ( 87) ( 213) (39) Net increase/(decrease) in Core net assets resulting from operations ($3,466) $7,207 $2,611 $4,413 ($6,465) Per Share Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Core Net

Investment Income $0.79 $0.73 $0.72 $0.66 $0.69 Net Realized and Unrealized Gain / (Loss) on Investments ($1.12) $0.01 ($0.41) ($0.21) ($1.39) Net Core Earnings ($0.36) $0.76 $0.28 $0.47 ($0.70) Distributions Declared $0.69 $0.69 $0.69 $0.69 $0.69

Net Asset Value $22.54 $22.65 $22.76 $22.57 $21.21 (1) Core investment income represents reported total investment income as determined in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, less the impact of purchase price

discount accounting in connection with the GARS and HCAP mergers. Portman Ridge believes presenting core investment income and the related per share amount is useful and appropriate supplemental disclosure for analyzing its financial performance due

to the unique circumstance giving rise to the purchase accounting adjustment. However, core investment income is a non-U.S. GAAP measure and should not be considered as a replacement for total investment income and other earnings measures presented

in accordance with U.S. GAAP. Instead, core investment income should be reviewed only in connection with such U.S. GAAP measures in analyzing Portman Ridge’s financial performance. (2) Core net investment income represents reported total net

investment income as determined in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, less the impact of purchase price discount accounting in connection with the GARS and HCAP mergers, while also considering the impact of

accretion from these mergers on expenses, such as incentive fees. Portman Ridge believes presenting core net investment income and the related per share amount is useful and appropriate supplemental disclosure for analyzing its financial performance

due to the unique circumstance giving rise to the purchase accounting adjustment and the reimbursement. However, core net investment income is a non-U.S. GAAP 4 measure and should not be considered as a replacement for total net investment income

and other earnings measures presented in accordance with U.S. GAAP. Instead, core net investment income should be reviewed only in connection with such U.S. GAAP measures in analyzing Portman Ridge’s financial performance. See slide 7 for a

presentation of Reported net investment income in comparison to Core net investment income and a reconciliation thereof.

Rising Rates ▪ As of June 30, 2024, substantially all of our

floating rate assets were on SOFR contract. ▪ If all floating rate assets as of 6/30/24 were reset to current 3-month benchmark rates (5.28%), we would expect to generate an incremental ~$103k of quarterly income. Blended Contracted SOFR at

Month End 6.00% 5.50% 5.28% 5.25% 5.23% 5.18% 5.16% 5.17% 4.86% 5.00% 4.70% 4.55% 4.36% 4.50% 3.99% 4.00% 3.44% 3.50% 3.03% 3.00% 2.50% 2.15% 1.94% 1.92% 2.00% 1.50% 1.00% 0.50% 0.00% 6/30 7/31 8/31 9/30 10/31 11/30 12/31 1/31 2/28 3/31 6/30 9/30

12/31 3/31 6/30 3m (1) SOFR (7/24/24) (1) 3-month SOFR per Bloomberg as of July 24, 2024. 5

Limited Repayment Activity ▪ Over the last three years, Portman

has experienced an average of $1.1 million in income related to repayment / prepayment activity as compared to the current quarter of $0.3 million. Paydown Income by Quarter ($ in 000s) 5,000 4,500 4,000 3,500 3,000 2,500 2,000 1,500 Quarterly

Average: $1,135 1,000 50% of Average: $567 500 281 -- Mar-20 Jun-20 Sep-20 Dec-20 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Jun-22 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 6

Core Earning Analysis ($ in ‘000s except per share) Q2 2023 Q3

2023 Q4 2023 Q1 2024 Q2 2024 Interest Income: Non-controlled/non-affiliated investments 14,786 13,283 12,760 12,621 11,913 Non-controlled affiliated investments 626 631 622 95 312 Total interest income 15,412 13,914 13,382 12,716 12,225

Payment-in-kind income: Non-controlled/non-affiliated investments 859 2,308 1,968 1,894 2,018 Non-controlled affiliated investments 107 113 113 112 183 Controlled affiliated investments - - - - - Total payment-in-kind income 966 2,421 2,081 2,006

2,201 Dividend income: Non-controlled affiliated investments 1,864 1,429 2,087 1,653 1,800 Controlled affiliated investments 465 644 - - - Total dividend income 2,329 2,073 2,087 1,653 1,800 Fees and other income: Non-controlled/non-affiliated

investments 905 166 238 151 111 Non-controlled affiliated investments 14 - - - - Total fees and other income 919 166 238 151 111 Reported Investment Income $19,626 $18,574 $17,788 $16,526 $16,337 Less: Purchase discount accouting (427) (238) (67)

(73) (112) Core Investment Income $19,199 $18,336 $17,721 $16,453 $16,225 Reported Net Investment Income $7,915 $7,166 $11,163 $6,226 $6,477 NII Per Share $0.83 $0.75 $1.17 $0.67 $0.70 Core (1) Net Investment Income $7,563 $6,928 $6,779 $6,162

$6,384 NII Per Share $0.79 $0.73 $0.71 $0.64 $0.69 (1) Core net investment income represents reported total net investment income as determined in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, less the impact of

purchase price discount accounting in connection with the GARS and HCAP mergers, while also considering the impact of accretion from these mergers on expenses. Portman Ridge believes presenting core net investment income and the related per share

amount is useful and appropriate supplemental 7 disclosure for analyzing its financial performance due to the unique circumstance giving rise to the purchase accounting adjustment. However, core net investment income is a non-U.S. GAAP measure and

should not be considered as a replacement for total net investment income and other earnings measures presented in accordance with U.S. GAAP. Instead, core net investment income should be reviewed only in connection with such U.S. GAAP measures in

analyzing Portman Ridge’s financial performance.

Net Asset Value Rollforward ($ in ‘000s) Q2 2023 Q3 2023 Q4 2023

Q1 2024 Q2 2024 NAV, Beginning of Period $225,106 $215,013 $214,755 $213,518 $210,607 (1) Net realized gains (losses) from investment transactions (6,471) (1,636) (15,574) (2,057) (6,922) (1) Net change in unrealized appreciation (depreciation) on

investments (4,176) 1,708 11,750 71 (5,966) Net Investment Income 7,915 7,166 11,163 6,226 6,477 Net decrease in net assets resulting from stockholder distributions (6,579) (6,554) (6,518) (6,444) (6,411) Realized gains (losses) on extinguishments

of debt (218) (57) (87) (213) (39) Tax (provision) benefit on realized and unrealized gains (losses) on investments (164) 264 (257) 459 78 Stock repurchases (553) (1,222) (1,789) (953) (1,553) Distribution reinvestment plan 153 73 75 — 158

NAV, End of Period $215,013 $214,755 $213,518 $210,607 $196,429 Leverage and Asset Coverage Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Gross Leverage 1.6x 1.5x 1.5x 1.4x 1.5x (2) 1.4x 1.3x 1.2x 1.2x 1.3x Net Leverage Asset Coverage 163% 166% 165% 171%

169% (1) Excluding gains from merger activity. (2) Net leverage is calculated as the ratio between (A) debt, excluding unamortized debt issuance costs, less available cash and cash equivalents, and restricted cash and (B) NAV. Portman Ridge believes

presenting a net leverage ratio is useful and appropriate supplemental disclosure because it reflects the Company’s financial condition net of $36.6 million, $39.6 million, $71.2 million $33.7 million, and $35.4 million, of cash and cash

equivalents and restricted cash as of June 30, 2024, March 31, 2024, December 31, 2023, September 30, 2023, and June 30, 2023, respectively. However, the net leverage ratio is a non-U.S. GAAP measure and should not be considered as a replacement for

the regulatory asset coverage ratio and other similar 8 information presented in accordance with U.S. GAAP. Instead, the net leverage ratio should be reviewed only in connection with such U.S. GAAP measures in analyzing Portman Ridge’s

financial condition.

(1) Current Portfolio Profile (2) Diversified Portfolio of Assets

Diversification by Borrower 5.8% Top 5 Borrowers, 18.7% 4.9% 75 Debt + Equity Portfolio Investee Companies 3.4% 3.3% $2.6mm / 1% Average Debt Position Size Remainder 3.1% 38.2% U.S Centric Investments: Nearly 100% US-Based Companies Focus on

Non-Cyclical Industries with High FCF Generation Next 6-10 Investments 13.6% Credit quality has been stable to improving during the rotation period Next 11-25 Investments 27.7% (2) (2) Industry Diversification Asset Mix Other, 20.6% High Tech

Industries, 15.9% Aerospace and Defense, 3.0% Second Lien Debt 9.5% Beverage, Food and Tobacco, 3.1% Services: Business, First Lien Debt Equity Securities 13.8% 83.9% Machinery (Non- 6.2% Agrclt/Constr/Electr), 3.2% Subordinated Healthcare &

Debt Pharmaceuticals, Media: Broadcasting 0.4% 13.4% & Subscription, 3.5% Finance, 5.0% Consumer goods: Banking, Finance, Insurance & Real Estate, 12.9% Durable, 5.8% (1) As of June 30, 2024. Figures shown do not include, CLO Funds, F3C JV

or Series A-Great Lakes Funding II LLC, and derivatives. 9 (2) Shown as % of debt and equity investments at fair market value.

(1)(2) Portfolio Trends ($ in ‘000s) Q2 2023 Q3 2023 Q4 2023 Q1

2024 Q2 2024 Portfolio Sourcing (at Fair Value): BC Partners $357,971 $366,509 $357,645 $365,041 $348,856 Legacy KCAP $30,718 $24,719 $26,274 $23,865 $23,333 Legacy OHAI $6,715 $6,289 $1,188 $0 $0 Legacy GARS $91,842 $82,738 $69,488 $68,895 $60,790

(3) $22,854 $20,166 $13,271 $13,454 $11,391 Legacy HCAP Portfolio Summary: Total portfolio, at fair value $510,100 $500,419 $467,865 $471,255 $444,370 (4) 85 / 183 83 / 175 80 / 174 79 / 187 75/196 Total number of debt portfolio companies / Total

number of investments Weighted Avg EBITDA of debt portfolio companies $99,545 $107,118 $108,229 $111,355 $104,439 Average size of debt portfolio company investment, at fair value $2,879 $3,294 $3,165 $2,818 $2,602 Weighted avg first lien / total

leverage ratio (net) of debt portfolio 4.9x / 5.5x 5.0x / 5.8x 5.0x/5.7x 5.0x/5.7x 5.0x/5.8x Portfolio Yields and Spreads: (5) 11.3% 12.2% 12.3% 12.1% 12.4% Weighted average yield on debt investments at par value Average Spread to SOFR 675 bps 744

bps 750 bps 743 bps 752 bps Portfolio Activity: Beginning balance $539,122 $510,100 $500,419 $467,865 $471,255 Purchases / draws 15,257 18,301 18,061 39,080 16,220 Exits / repayments / amortization (36,296) (29,912) (48,148) (35,440) (32,096) Gains

/ (losses) / accretion (7,983) 1,930 (2,467) (250) (11,009) Ending Balance $510,100 $500,419 $467,865 $471,255 $444,370 (1) For comparability purposes, portfolio trends metrics exclude short-term investments and derivatives. (2) Excludes select

investments where the metric is not applicable, appropriate, data is unavailable for the underlying statistic analyzed 10 (3) Includes assets purchased from affiliate of HCAP’s former manager in a separate transaction. (4) CLO holdings and

Joint Ventures are excluded from investment count. (5) Excluding non-accrual and partial non-accrual investments and excluding CLO holdings and Joint Ventures.

Credit Quality ▪ As of June 30, 2024, nine of the

Company’s debt investments were on non-accrual status and represented 0.5% and 4.5% of the Company’s investment portfolio at fair value and amortized cost, respectively ($ in ‘000s) Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 (1)

Investments Credit Quality – Internal Rating Performing 95.1% 93.5% 93.7% 93.7% 96.4% Underperforming 4.9% 6.5% 6.3% 6.3% 3.6% Investments on Non-Accrual Status Number of Non-Accrual Investments 7 8 7 7 9 Non-Accrual Investments at Cost

$15,618 $21,318 $17,260 $17,130 $23,333 Non-Accrual Investments as a % of Total Cost 2.6% 3.6% 3.2% 3.2% 4.5% Non-Accrual Investments at Fair Value $3,904 $8,212 $6,106 $2,152 $2,024 Non-Accrual Investments as a % of Total Fair Value 0.8% 1.6% 1.3%

0.5% 0.5% (1) Based on fair market value as of the end of the respective period. 11

(1) Portfolio Composition Investment Portfolio ($ in ‘000s) Q2

2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 First Lien Debt $368,186 $357,451 $336,599 $345,978 $320,815 Second Lien Debt 44,863 49,825 41,254 38,925 36,386 Subordinated Debt 1,495 1,298 1,224 1,211 1,693 Equity Securities 20,013 19,189 20,533 23,428

23,830 Collateralized Loan Obligations 12,996 10,425 8,968 8,549 7,354 Joint Ventures 62,547 62,231 59,287 53,164 54,292 Ending Balance $510,100 $500,419 $467,865 $471,255 $444,370 Investment Portfolio (% of total) Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2

2024 First Lien Debt 72.2% 71.4% 71.9% 73.3% 72.1% Second Lien Debt 8.8% 10.0% 8.8% 8.3% 8.2% Subordinated Debt 0.3% 0.3% 0.3% 0.3% 0.4% Equity Securities 3.9% 3.8% 4.4% 5.0% 5.4% Collateralized Loan Obligations 2.5% 2.1% 1.9% 1.8% 1.7% Joint

Ventures 12.3% 12.4% 12.7% 11.3% 12.2% Total 100.0% 100.0% 100.0% 100.0% 100.0% (1) At Fair Value at the end of the respective period. Does not include activity in short-term investments and derivatives. 12

M&A Value Realization ▪ BC Partners Advisors L.P.

(“BCPAL”) is an affiliate of Portman’s investment advisor, Sierra Crest Investment Management (“Sierra Crest”), and employees of BCPAL operate Sierra Crest pursuant to a servicing agreement between the entities.

Portman’s track record demonstrates BC Partners’ ability to efficiently realize the value of legacy portfolios acquired while rotating into BC Partners’ sourced assets. OHAI GARS HCAP $319,591 $316,452 $67,143 $57,827 81% of

$60,550 $53,540 Portfolio FMV at 86% of 100% of transaction Portfolio Portfolio has been FMV at FMV at $260,136 realized transaction transaction $45,871 $67,143 has been has been realized realized $59,456 – $7,669 At Closing 6/30/24 At Closing

6/30/24 At Closing 6/30/24 Still Held Realized Still Held Realized Still Held Realized 13

Appendix

Balance Sheet June 30, 2024 December 31, 2023 (in thousands, except

share and per share amounts) (Unaudited) ASSETS Investments at fair value: Non-controlled/non-affiliated investments (amortized cost: 2024 - $409,486; 2023 - $426,630) $ 370,359 $ 398,325 Non-controlled affiliated investments (amortized cost: 2024 -

$62,769; 2023 - $55,611) 60,464 55,222 Controlled affiliated investments (cost: 2024 - $50,428; 2023 - $58,041) 13,547 14,318 Total Investments at Fair Value (cost: 2024 - $522,683; 2023 - $540,282) $ 444,370 $ 467,865 Cash and cash equivalents

9,813 26,912 Restricted cash 26,826 44,652 Interest receivable 4,659 5,162 Receivable for unsettled trades — 573 Due from affiliates 1,544 1,534 Other assets 1,599 2,541 Total Assets $ 488,811 $ 549,239 LIABILITIES 2018-2 Secured Notes (net of

discount of: 2024 - $414; 2023 - $712) $ 84,656 $ 124,971 4.875% Notes Due 2026 (net of discount of: 2024 - $974; 2023 - $1,225; net of deferred financing costs of: 2024 - $430; 2023 - $561) 106,596 106,214 Great Lakes Portman Ridge Funding LLC

Revolving Credit Facility (net of deferred financing costs of: 2024 - $609; 2023 - $775) 91,391 91,225 Payable for unsettled trades 37 520 Accounts payable, accrued expenses and other liabilities 2,700 4,252 Accrued interest payable 3,537 3,928 Due