PetVivo Holdings, Inc. (Nasdaq: PETV), an emerging biomedical

device company focused on the commercialization of innovative

medical therapeutics for animals, announces financial results for

the three months ended September 30, 2023 (“second quarter of

2024”).

Key highlights from the second quarter of 2024

and through November 14, 2023, include the following:

- Released clinical study results

which demonstrate the benefit and tolerability of an

intra-articular injection of Spryng™ into the stifle joint for dogs

with suspected cruciate ligament rupture (similar to ACL tear in

humans);

- Raised $2.35 million from the sale

of the Company’s common stock in a convertible note offering and a

registered direct offering in the second quarter of 2024;

- Entered into an At-The-Market Sales

Agreement (“ATM Sales Agreement”) with ThinkEquity, LLC for the

sale of shares of the Company’s common stock with an aggregate

offering price of up to $2.5 million.

Subsequent to September 30, 2023, the Company

raised an aggregate of $870,000 in gross proceeds from sales under

its ATM Sales Agreement.

Management Commentary

“We are excited about the progress the Company

has made this past quarter, including the recent release to the

veterinary community of beneficial clinical trial results related

to PetVivo’s innovative medical device, Spryng™ with OsteoCushion™

Technology,” said John Lai, Chief Executive Officer of PetVivo

Holdings, Inc. “The clinical trial data and corresponding results,

provided by Ethos Veterinary Health, a nationally renowned operator

of 145 world-class specialty veterinary hospitals, indicated

significant improvement in the thirty-nine dogs injected with

Spryng. All primary and secondary clinical endpoints related to

pain, lameness and quality of life were achieved. This clinical

trial demonstrates that Spryng™ is a reasonable, non-invasive

alternative for patients with cranial cruciate disease (“CCD”) when

patient and/or owner factors preclude surgical intervention.”

Second Quarter Financial Results

For The Three Months Ended September 30,

2023 Compared to The Three Months Ended September 30,

2022

Total Revenues. Revenues were

$207,366 and $223,280 for three months ended September 30, 2023 and

2022, respectively. Revenues in the three months ended September

30, 2023 consist of sales of our Spryng™ product to MWI Veterinary

Supply Co. (“our Distributor”) of $143,606 and to veterinary

clinics in the amount of $63,760. In the three months ended

September 30, 2022, our revenues of $223,280 consisted of sales of

our Spryng™ product to our Distributor of $118,264 and to

veterinary clinics in the amount of $105,016.

Cost of Sales. Cost of sales

was $140,913 and $148,149 for the three months ended September 30,

2023 and 2022, respectively. Cost of sales includes product costs

related to the sale of our Spryng™ product and labor and overhead

costs.

Operating Expenses. Operating

expenses were $3,010,796 and $2,194,689 for the three months ended

September 30, 2023 and 2022, respectively. Operating expenses

consisted of general and administrative, sales and marketing, and

research and development expenses. The increase is primarily due to

increased general and administrative expenses and sales and

marketing expenses related to the sale of our Spryng™ product.

Operating Loss. As a result of

the foregoing, our operating loss was $2,944,343 and $2,119,568 for

the three months ended September 30, 2023 and 2022, respectively.

The increase was related to costs to support the launch of

Spryng™.

Other (Expense) Income. Other

expense was $716,810 for the three months ended September 30, 2023

as compared to other income of $7,979 for the three months ended

September 30, 2022. Other expense in 2023 consisted of a loss on

extinguishment of debt of $534,366, a settlement to a former

employee and interest expense. Other income in 2022 consisted of

net interest income.

Net Loss. Our net loss for the

three months ended September 30, 2023 was $3,661,153 or ($0.28) per

share as compared to a net loss of $2,111,589 or ($0.21) per share

for the three months ended September 30, 2022. The increase was

related to the costs to support the launch of Spryng™ and loss on

extinguishment of debt. The weighted average number of shares

outstanding was 12,987,641 and 10,053,463 for the three months

ended September 30, 2023 and 2022, respectively.

Year to Date Financial

Results

Revenues. Revenues were

$324,549 for six the months ended September 30, 2023 compared to

revenues of $281,454 in the six months ended September 30, 2022.

Revenues in the six months ended September 30, 2023 consisted of

sales of our Spryng™ product to our Distributor of $177,395 and to

veterinary clinics in the amount of $147,154. In the six months

ended September 30, 2022, our revenues of $281,454 consisted of

sales of our Spryng™ product to our Distributor of $118,264 and to

veterinary clinics in the amount of $163,190.

Cost of Sales. Cost of sales

was $223,183 and $201,179 for the six months ended September 30,

2023 and 2022, respectively. Cost of sales includes product costs

related to the sale of products and labor and overhead costs.

Operating Expenses. Operating

expenses were $5,939,287 and $4,165,936 for the six months ended

September 30, 2023 and 2022, respectively. Operating expenses

consisted of general and administrative, sales and marketing, and

research and development expenses. The increase is primarily due to

increased general and administrative expenses and sales and

marketing expenses related to the sale of our Spryng™ product.

Operating Loss. As a result of

the foregoing, our operating loss was $5,837,920 and $4,085,661 for

the six months ended September 30, 2023 and 2022, respectively. The

increase in our operating loss, was related to the costs to support

the launch of Spryng™, stock issued for services and stock

compensation.

Other (Expense) Income. Other

expense was $716,810 for the six months ended September 30, 2023 as

compared to other income of $8,644 for the six months ended

September 30, 2022. Other expense in 2023 consisted of a loss on

extinguishment of debt of $534,366, a settlement to a former

employee and interest expense. Other income in 2022 consisted of

interest income.

Net Loss. Our net loss for the

six months ended September 30, 2023 was $6,554,730 or ($0.53) per

share as compared to a net loss of $4,077,017 or ($0.41) per share

for the six months ended September 30, 2022. The weighted average

number of shares outstanding was 12,325,973 and 10,021,090 for the

six months ended September 30, 2023 and 2022, respectively.

Balance Sheet and Inventory

As of September 30, 2023, our current assets

were $2,015,826, including $55,254 in cash and cash equivalents.

Our working capital as of September 30, 2023 was $100,517.

Conference Call and Webcast

A live webcast of the conference call and

related earnings release materials can be accessed on the Company’s

Investor Relations website at:

https://audience.mysequire.com/webinar-view?webinar_id=13014345-4054-48e0-b0d9-f0b425d9e51c

A replay of the webcast will be available

through the same link following the conference call. Participants

can also access the call using the dial-in details below:

Date: November 14, 2023Time: 4:00 p.m. CT (5:00

pm ET)Dial-in number: +1 669 444 9171Conference ID:

88693059825Passcode: 802278

About PetVivo Holdings,

Inc.

PetVivo Holdings, Inc. (the “Company”) is in the

business of licensing and commercializing its proprietary medical

devices and biomaterials for the treatment and/or management of

afflictions and diseases in animals, initially for dogs and horses.

The Company began commercialization of its lead product Spryng™

with OsteoCushion™ Technology, a veterinarian-administered,

intraarticular injection for the management of lameness and other

joint afflictions such as osteoarthritis in dogs and horses in

September 2021. The Company has a pipeline of additional products

for the treatment of animals in various stages of development. A

portfolio of twenty patents protects the Company’s biomaterials,

products, production processes and methods of use.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. Forward-looking statements include

all statements that do not relate solely to historical or current

facts, including without limitation the Company’s proposed

development and commercial timelines, and can be identified by the

use of words such as “may,” “will,” “expect,” “project,”

“estimate,” “anticipate,” “plan,” “believe,” “potential,” “should,”

“continue” or the negative versions of those words or other

comparable words. Forward-looking statements are not guarantees of

future actions or performance. These forward-looking statements are

based on information currently available to the Company and its

current plans or expectations and are subject to a number of

uncertainties and risks that could significantly affect current

plans. Risks concerning the Company’s business are described in

detail in the Company’s Annual Report on Form 10-K for the year

ended March 31, 2023, and other periodic and current reports filed

with the Securities and Exchange Commission. The Company is under

no obligation to, and expressly disclaims any such obligation to,

update or alter its forward-looking statements, whether as a result

of new information, future events, or otherwise.

Disclosure Information

The Company uses and intends to continue to use

its Investor Relations website as a means of disclosing material

nonpublic information, and for complying with its disclosure

obligations under Regulation FD. Accordingly, investors should

monitor the Company’s Investor Relations website, in addition to

following the Company’s press releases, SEC filings, public

conference calls, presentations, and webcasts.

Contact:John Lai, CEOPetVivo Holdings,

Inc.Email: info1@petvivo.com(952) 405-6216

(Tables to follow)

PETVIVO HOLDINGS,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(UNAUDITED)

| |

|

September 30,

2023(Unaudited) |

|

|

March 31, 2023 |

|

| |

|

|

|

|

|

|

| Assets: |

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

55,254 |

|

|

$ |

475,314 |

|

|

Accounts receivable |

|

|

155,888 |

|

|

|

86,689 |

|

|

Inventory |

|

|

434,080 |

|

|

|

370,283 |

|

|

Prepaid expenses and other assets |

|

|

1,370,604 |

|

|

|

491,694 |

|

|

Total Current Assets |

|

|

2,015,826 |

|

|

|

1,423,980 |

|

| |

|

|

|

|

|

|

|

|

| Property and Equipment,

net |

|

|

665,381 |

|

|

|

630,852 |

|

| |

|

|

|

|

|

|

|

|

| Other Assets: |

|

|

|

|

|

|

|

|

|

Operating lease right-of-use asset |

|

|

1,318,666 |

|

|

|

317,981 |

|

|

Patents and trademarks, net |

|

|

34,374 |

|

|

|

38,649 |

|

|

Security deposit |

|

|

27,490 |

|

|

|

27,490 |

|

|

Total Other Assets |

|

|

1,380,530 |

|

|

|

384,120 |

|

|

Total Assets |

|

$ |

4,061,737 |

|

|

$ |

2,438,952 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’

Equity: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

912,040 |

|

|

$ |

588,713 |

|

|

Accrued expenses |

|

|

818,357 |

|

|

|

779,882 |

|

|

Operating lease liability – short term |

|

|

177,773 |

|

|

|

78,149 |

|

|

Note payable and accrued interest |

|

|

7,139 |

|

|

|

6,936 |

|

|

Total Current Liabilities |

|

|

1,915,309 |

|

|

|

1,453,680 |

|

| Non-Current Liabilities |

|

|

|

|

|

|

|

|

|

Note payable and accrued interest (net of current portion) |

|

|

16,856 |

|

|

|

20,415 |

|

|

Operating lease liability (net of current portion) |

|

|

1,140,893 |

|

|

|

239,832 |

|

|

Total Non-Current Liabilities |

|

|

1,157,749 |

|

|

|

260,247 |

|

|

Total Liabilities |

|

|

3,073,058 |

|

|

|

1,713,927 |

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| Preferred Stock, par value

$0.001, 20,000,000 shares authorized, no shares issued and

outstanding at September 30, 2023 and March 31, 2023 |

|

|

- |

|

|

|

- |

|

| Common Stock, par value

$0.001, 250,000,000 shares authorized, 13,841,731 and 10,950,220

issued and outstanding at September 30, 2023 and March 31, 2023,

respectively |

|

|

13,842 |

|

|

|

10,950 |

|

|

Common Stock to be Issued |

|

|

- |

|

|

|

137,500 |

|

|

Additional Paid-In Capital |

|

|

79,373,596 |

|

|

|

72,420,604 |

|

|

Accumulated Deficit |

|

|

(78,398,759 |

) |

|

|

(71,844,029 |

) |

|

Total Stockholders’ Equity |

|

|

988,679 |

|

|

|

725,025 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

4,061,737 |

|

|

$ |

2,438,952 |

|

PETVIVO HOLDINGS,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED)

|

|

|

Three Months Ended September

30, |

|

|

Six Months Ended September

30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenues |

|

$ |

207,366 |

|

|

$ |

223,280 |

|

|

$ |

324,549 |

|

|

$ |

281,454 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

Sales |

|

|

140,913 |

|

|

|

148,159 |

|

|

|

223,182 |

|

|

|

201,179 |

|

|

Gross Profit |

|

|

66,453 |

|

|

|

75,121 |

|

|

|

101,367 |

|

|

|

80,275 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and Marketing |

|

|

1,078,725 |

|

|

|

867,985 |

|

|

|

2,020,611 |

|

|

|

1,524,554 |

|

|

Research and Development |

|

|

240,281 |

|

|

|

140,384 |

|

|

|

464,088 |

|

|

|

212,040 |

|

|

General and Administrative |

|

|

1,691,790 |

|

|

|

1,186,320 |

|

|

|

3,454,588 |

|

|

|

2,429,342 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Operating Expenses |

|

|

3,010,796 |

|

|

|

2,194,689 |

|

|

|

5,939,287 |

|

|

|

4,165,936 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Loss |

|

|

(2,944,343 |

) |

|

|

(2,119,568 |

) |

|

|

(5,837,920 |

) |

|

|

(4,085,661 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (Expense)

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on Extinguishment of Debt |

|

|

(534,366 |

) |

|

|

- |

|

|

|

(534,366 |

) |

|

|

- |

|

|

Settlement Expense |

|

|

(180,000 |

) |

|

|

- |

|

|

|

(180,000 |

) |

|

|

- |

|

|

Interest (Expense) Income |

|

|

(2,444 |

) |

|

|

7,979 |

|

|

|

(2,444 |

) |

|

|

8,644 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Other (Expense) Income |

|

|

(716,810 |

) |

|

|

7,979 |

|

|

|

(716,810 |

) |

|

|

8,644 |

|

| |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Loss before taxes |

|

|

(3,661,153 |

) |

|

|

(2,111,589 |

) |

|

|

(6,554,730 |

) |

|

|

(4,077,017 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Provision |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss |

|

$ |

(3,661,153 |

) |

|

$ |

(2,111,589 |

) |

|

$ |

(6,554,730 |

) |

|

$ |

(4,077,017 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

$ |

(0.28 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.53 |

) |

|

$ |

(0.41 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

12,987,641 |

|

|

|

10,053,463 |

|

|

|

12,325,973 |

|

|

|

10,021,090 |

|

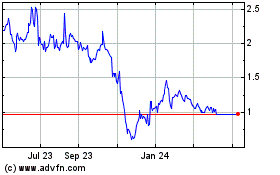

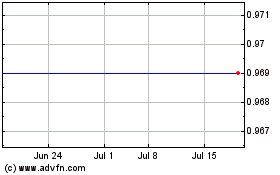

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Nov 2024 to Dec 2024

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Dec 2023 to Dec 2024