MFRI, Inc. (NASDAQ NM: MFRI) � Today MFRI

announced record sales and earnings for the quarter ended April 30,

2009. Net sales were $68.0 million, up 2.4% from $66.0

million in the corresponding quarter of the prior year. Net

income rose to $6.0 million or $0.88 earnings per share, versus net

income of $423 thousand or $0.06 per share, for the prior-year�s

quarter.

SALES -- Net sales for the first quarter compared to

prior-year�s quarter for the piping systems business increased by

$2.0 million, the filtration products business decreased by $2.5

million, and the industrial process cooling equipment business

decreased by $4.0 million. The HVAC business, included in corporate

and other, increased sales by $6.2 million as work continued on

projects. Net sales increased primarily due to the growing success

of the piping systems business in the United Arab Emirates

(�U.A.E.�), progress on the crude oil pipeline project in India and

the growth in field work on buildings in the heating, ventilation

and air conditioning (�HVAC�) backlog.

GROSS PROFIT -- Gross profit for the quarter increased to

27.7% of sales from 16.9% in the prior year. Due to the increased

net sales, first quarter 2009 gross profit of $18.7 million was

68.1% higher than 2008 first quarter gross profit of $11.1

million.

INDIA PIPELINE PROJECT -- As previously announced, the

piping systems business is performing the insulating and jacketing

services for a 600 kilometer (370 mile), 600 millimeter (24 inch)

diameter heat-traced crude oil pipeline. This work is being

performed at a facility in Mundra, India. As of April 30, 2009, the

Company had successfully completed over 95% of the production on

this contract.

EXPENSES -- General and administrative expenses increased

from 9.5% of sales in the first quarter of 2008 to 13.0% of sales

in the corresponding quarter of 2009. This was primarily due to

higher profit based incentive compensation, staff and recruiting

fees, and additional stock compensation expense.

NET INCOME -- Net income for the quarter was up

significantly versus the prior-year�s quarter due to the excellent

performance of the piping systems business unit in Fujairah U.A.E.,

continued production on the India pipeline project and profits from

the HVAC business. The income tax accrual is less than the

statutory U. S. federal income tax rate mainly due to the impact of

tax free foreign income in the U.A.E.

BACKLOG -- The Company�s backlog on April 30, 2009 was

$99.6 million, down $8.3 million or 7.6% from the January 31, 2009

year end and down $88.0 million or 46.9% from April 30, 2008. Part

of the backlog decline was due to the progress on specific projects

such as HVAC for new buildings and the heated oil pipeline in

India. Due to current customer financing constraints, there are

currently very few opportunities to obtain new HVAC business at

this time. Also, the Company would not expect new orders for a

project similar to the one in India to be replaced in the 2009

backlog. Additionally, the difficult worldwide economic environment

has caused some orders to be postponed or cancelled and has reduced

the opportunities to obtain new work. As a favorable sign, quoting

activity has been maintained at a reasonably high level but

decision making by customers is slow, which management believes is

probably due to general financial constraints and caution on

expenditures.

David Unger, CEO said, �Our global expansion strategy of

manufacturing our products in foreign countries to serve their

local markets has resulted in higher sales and earnings for our

Company. We continue to seek markets around the world where we can

grow our volume and profitability. This also helps us to provide

expanded economic opportunities for our people. When the current

economic recession ends, we expect the mix of domestic and global

sales will continue to support our Company�s growth.�

Brad Mautner, President and COO said, �The unusually

strong first quarter profitability was driven by the piping systems

business. A year ago, the project in India was not in production

and Perma Pipe Middle East had built a substantial order book and

was actively scaling up production. During this past quarter,

customer delivery requirements and efficient execution in India and

the U.A.E. led to strong shipments and increased margins. Likewise

the HVAC business is now executing their backlog and contributing

to our profitability. Within the filtration and process cooling

businesses, the world was very different a year ago. Demand

weakened in the second half of 2008 and continues declining into

2009. Not expecting a quick recovery, we are aggressively pursuing

sales opportunities and continue to adjust costs, expenses and

inventory levels to better match the depressed demand in these

markets.�

MFRI, Inc. is a multi-line company engaged in the

following businesses: pre-insulated specialty piping systems for

oil and gas gathering, district heating and cooling and other

applications; custom-designed industrial filtration products to

remove particulates from dry gas streams; industrial process

cooling equipment to remove heat from molding, printing and other

industrial processes; and installation of heating, ventilation and

air conditioning for large buildings.

Form 10-Q for the period ended April 30, 2009 will be

accessible at http://www.sec.gov/. For more information visit the

Company's website www.mfri.com or contact the company directly.

Statements and other information contained in this announcement

which can be identified by the use of forward-looking terminology

such as "anticipate," "may," "will," "expect," "continue,"

"remain," "intend," "aim," "should," "prospects," "could,"

"future," "potential," believes," "plans," "likely," and

"probable," or the negative thereof or other variations thereon or

comparable terminology, constitute "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934 as

amended and are subject to the safe harbors created thereby. These

statements should be considered as subject to the many risks and

uncertainties that exist in the Company's operations and business

environment. Such risks and uncertainties include, but are not

limited to, economic conditions, market demand and pricing,

competitive and cost factors, raw material availability and prices,

global interest rates, currency exchange rates, labor relations and

other risk factors.

MFRI, INC. AND SUBSIDIARIES

Condensed Statements of Operations and Related Data

(In $000�s except per share data)

Three Months Ended

April 30,

2009 �

2008 Net sales: Piping Systems

$ 32,627

$ 30,677 Filtration Products 23,305 25,817 Industrial

Process Cooling Equipment 5,053 9,067 Corporate and Other (1) 6,594

420 Totals 67,579 65,981 Gross profit: Piping Systems 14,148 5,460

Filtration Products 2,646 3,269 Industrial Process Cooling

Equipment 1,051 2,392 Corporate and Other (1) 882 22 Totals 18,727

11,143 Income (loss) from operations: Piping Systems 9,952 2,932

Filtration Products (285) 253 Industrial Process Cooling Equipment

(495) (40) Corporate and Other (1) (2,300) (2,010) Totals 6,872

1,135 � Income from joint venture 0 99 � Interest expense � net 688

623 � Income before income taxes 6,184 611 � Income tax expense 178

188 � � Net income

$ 6,006

$ 423 � � Weighted average

number of common shares outstanding - basic 6,816 6,787 Earnings

per share - basic net income

$ 0.88

$ 0.06 � Weighted

average number of common shares outstanding - diluted 6,852 6,888

Earnings per share - diluted net income

$ 0.88

$ 0.06

� Backlog (In thousands): 4/30/09 1/31/09 Piping Systems $ 56,742 $

52,385 Filtration Products 29,432 35,549 Industrial Process Cooling

Equipment 3,895 3,835 Corporate and Other (1) � 9,550 � 16,051

Total Backlog $ 99,619 $ 107,820

1) Corporate and Other includes activity for the installation of

heating, ventilation and air conditioning systems.

See the Company�s Form 10-Q for notes to financial

statements.

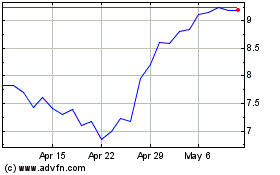

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Sep 2024 to Oct 2024

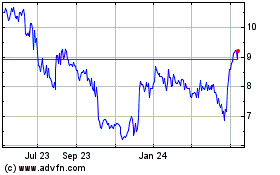

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Oct 2023 to Oct 2024