Penn National Board Authorizes New $750 Million Buyback Program

February 03 2022 - 8:08AM

Dow Jones News

By Michael Dabaie

Penn National Gaming Inc. said its board authorized a new

share-buyback program.

The provider of retail and online gambling, live racing and

sports betting entertainment said its board authorized a new $750

million share-repurchase program, which matures on Jan. 31,

2025.

Penn National said the program reflects its confidence in its

long-term prospects. It also said the program enables the company

to make both opportunistic share repurchases and offset dilution

from stock-based compensation and other equity grants.

Penn National said that it ended 2021 with total liquidity of

$2.5 billion, including $1.9 billion in cash, which "positions us

well to be opportunistic in an extremely dynamic marketplace."

Traditional net debt as of year-end was $886.2 million, an

increase of $841.0 million from $45.2 million as of Sept. 30,

mainly due to a cash payment of about $922.8 million for the

acquisition of theScore, the company said.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

February 03, 2022 07:53 ET (12:53 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

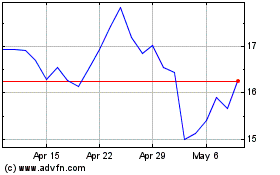

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Jun 2024 to Jul 2024

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Jul 2023 to Jul 2024