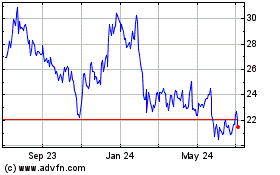

Peapack-Gladstone Financial Corporation (

NASDAQ Global

Select Market: PGC) (the "Company") announces its third

quarter 2024 financial results.

This earnings release should be read in

conjunction with the Company’s Q3 2024 Investor Update, a copy of

which is available on our website at

www.pgbank.com and via a current report on

Form 8-K on the website of the Securities and Exchange Commission

at www.sec.gov.

During the third quarter of 2024, deposits grew

$279 million, to $5.9 billion, which represents an annualized

growth rate of 20%. Nearly half of the deposit growth during the

quarter was attributed to an increase in noninterest-bearing demand

deposit balances which grew $130 million to $1.1 billion. Strong

core relationship growth throughout 2024 has allowed the Company to

repay all outstanding short-term borrowings and strengthen its

liquidity position. The Company also saw an increase in loan

demand during the third quarter. Outstanding loan balances

increased by $51 million to $5.3 billion as of September 30,

2024.

The Company recorded net income of $7.6 million

and diluted earnings per share (“EPS”) of $0.43 for the quarter

ended September 30, 2024 compared to net income of $7.5 million and

EPS of $0.42 for the quarter ended June 30, 2024.

Net interest income increased $2.6 million, or

8%, on a linked quarter basis to $37.7 million during the third

quarter of 2024 compared to $35.0 million in the second

quarter. The growth in net interest income was driven by

continued improvement in the net interest margin. The net interest

margin increased to 2.34% for the quarter ended September 30, 2024

compared to 2.25% for the quarter ended June 30, 2024 and 2.20% for

the quarter ended March 31, 2024.

Douglas L. Kennedy, President and CEO said, “Our

expansion into the metro New York market, leading with our ‘Single

Point of Contact’ private banking strategy, continues to deliver

results ahead of plan. Our third quarter results reflect this

success through strong core deposit growth, continued improvement

in net interest income and enhanced liquidity profile. Our New York

Commercial Private Banking initiative is currently managing over

$730 million in customer relationship deposits, which includes 31%

in noninterest-bearing demand deposits. We expect that our

expansion will become accretive to earnings in early 2025."

Mr. Kennedy also noted, “During the third

quarter of 2024, Moody's reaffirmed our investment grade ratings

with a stable outlook after a thorough analysis of our business

model and balance sheet. We are fully aware of the headwinds

created by the current interest rate environment, and we are

confident in our ability to manage through any of these issues that

may arise as we execute our private banking strategy, which over

time will deliver shareholder value."

The following are select highlights for the

period ended September 30, 2024:

Wealth Management:

- AUM/AUA in our Wealth Management Division totaled a record

$12.1 billion at September 30, 2024 compared to $10.9 billion at

December 31, 2023.

- Gross new business inflows for Q3 2024 totaled $140 million

($130 million managed).

- Wealth Management fee income was $15.2 million in Q3 2024,

which amounted to 27% of total revenue for the quarter.

Commercial Banking and Balance Sheet

Management:

- Year-to-date total deposits have increased by $661 million, to

$5.9 billion at September 30, 2024 compared to $5.3 billion at

December 31, 2023. The Company intentionally allowed $121 million

in high cost, non-core relationship deposits to roll off during the

first nine months of 2024. Excluding this deposit run-off, core

relationship deposits have grown by $782 million during 2024.

- The Company has repaid $404 million in short-term borrowings as

of September 30, 2024.

- Total loans declined $116 million to $5.3 billion at September

30, 2024 from $5.4 billion at December 31, 2023. However,

outstanding loans increased by $51 million during the three-month

period ended September 30, 2024 after experiencing contraction

during the first six months of 2024.

- Commercial and industrial lending (“C&I”) drove a majority

of the growth during the third quarter. C&I balances represent

42% of the total loan portfolio at September 30, 2024. A strong

pipeline of new business has been built heading into Q4.

- Fee income on unused commercial lines of credit totaled

$845,000 for Q3 2024.

- The net interest margin ("NIM") was 2.34% in Q3 2024, an

increase of 9 basis points compared to 2.25% at Q2 2024.

- Noninterest-bearing demand deposits increased by $130 million

during the third quarter of 2024 and represented 18% of total

deposits as of September 30, 2024.

Capital Management:

- Tangible book value per share increased 6% to $32.00 per share

at September 30, 2024 compared to $30.31 at December 31, 2023. Book

value per share increased 5% to $34.57 per share at September 30,

2024 compared to $32.90 at December 31, 2023.

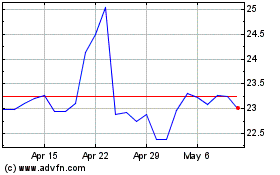

- During the third quarter, the Company repurchased 100,000

shares of common stock at a total cost of $2.6 million, or an

average cost of $25.92 per share. During the first nine months of

2024, the Company repurchased 300,000 shares of common stock at a

cost of $7.2 million. For the full year 2023, the Company

repurchased 455,341 shares at a cost of $12.5 million.

- At September 30, 2024, the Tier 1 Leverage Ratio stood at

10.99% for Peapack-Gladstone Bank (the "Bank") and 9.33% for the

Company. The Common Equity Tier 1 Ratio (to Risk-Weighted Assets)

was 13.75% for the Bank and 11.67% for the Company at September 30,

2024. These ratios remain significantly above well capitalized

standards, as capital continues to benefit from net income

generation.

SUMMARY INCOME STATEMENT

DETAILS:

The following tables summarize specified

financial details for the periods shown.

Nine Months Ended September 30, 2024 Year

Compared to Nine Months Ended September 30, 2023

|

|

|

Nine Months Ended |

|

|

Nine Months Ended |

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

Increase/ |

|

| (Dollars in millions,

except per share data) (unaudited) |

|

2024 |

|

|

2023 |

|

|

|

(Decrease) |

|

| Net interest income |

|

$ |

107.10 |

|

|

$ |

119.41 |

|

|

|

$ |

(12.31 |

) |

|

|

(10 |

)% |

| Wealth management fee income |

|

|

45.98 |

|

|

|

41.99 |

|

|

|

|

3.99 |

|

|

|

10 |

|

| Capital markets activity |

|

|

2.30 |

|

|

|

2.45 |

|

|

|

|

(0.15 |

) |

|

|

(6 |

) |

| Other income |

|

|

10.91 |

|

|

|

11.55 |

|

|

|

|

(0.64 |

) |

|

|

(6 |

) |

| Total other income |

|

|

59.19 |

|

|

|

55.99 |

|

|

|

|

3.20 |

|

|

|

6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenue |

|

|

166.29 |

|

|

|

175.40 |

|

|

|

|

(9.11 |

) |

|

|

(5 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

127.82 |

|

|

|

110.68 |

|

|

|

|

17.14 |

|

|

|

15 |

|

| Pretax income before provision

for credit losses |

|

|

38.47 |

|

|

|

64.72 |

|

|

|

|

(26.25 |

) |

|

|

(41 |

) |

| Provision for credit losses |

|

|

5.76 |

|

|

|

9.06 |

|

|

|

|

(3.30 |

) |

|

|

(36 |

) |

| Pretax income |

|

|

32.71 |

|

|

|

55.66 |

|

|

|

|

(22.95 |

) |

|

|

(41 |

) |

| Income tax expense |

|

|

8.96 |

|

|

|

15.40 |

|

|

|

|

(6.44 |

) |

|

|

(42 |

) |

| Net income |

|

$ |

23.75 |

|

|

$ |

40.26 |

|

|

|

$ |

(16.51 |

) |

|

|

(41 |

)% |

| Diluted EPS |

|

$ |

1.34 |

|

|

$ |

2.23 |

|

|

|

$ |

(0.89 |

) |

|

|

(40 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

0.49 |

% |

|

|

0.84 |

% |

|

|

|

(0.35 |

) |

|

|

|

| Return on average equity |

|

|

5.42 |

% |

|

|

9.66 |

% |

|

|

|

(4.24 |

) |

|

|

|

September 2024 Quarter Compared to Prior

Year Quarter

| |

|

Three Months Ended |

|

|

|

Three Months Ended |

|

|

|

|

|

|

|

| |

|

September 30, |

|

|

|

September 30, |

|

|

Increase/ |

|

| (Dollars in millions,

except per share data) (unaudited) |

|

2024 |

|

|

|

2023 |

|

|

(Decrease) |

|

| Net interest income |

|

$ |

37.68 |

|

|

|

$ |

36.52 |

|

|

$ |

1.16 |

|

|

|

3 |

% |

| Wealth management fee income |

|

|

15.15 |

|

|

|

|

13.98 |

|

|

|

1.17 |

|

|

|

8 |

|

| Capital markets activity |

|

|

0.44 |

|

|

|

|

0.61 |

|

|

|

(0.17 |

) |

|

|

(28 |

) |

| Other income |

|

|

3.35 |

|

|

|

|

4.76 |

|

|

|

(1.41 |

) |

|

|

(30 |

) |

| Total other income |

|

|

18.94 |

|

|

|

|

19.35 |

|

|

|

(0.41 |

) |

|

|

(2 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenue |

|

|

56.62 |

|

|

|

|

55.87 |

|

|

|

0.75 |

|

|

|

1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

44.65 |

|

|

|

|

37.41 |

|

|

|

7.24 |

|

|

|

19 |

|

| Pretax income before provision

for credit losses |

|

|

11.97 |

|

|

|

|

18.46 |

|

|

|

(6.49 |

) |

|

|

(35 |

) |

| Provision for credit losses |

|

|

1.22 |

|

|

|

|

5.86 |

|

|

|

(4.64 |

) |

|

|

(79 |

) |

| Pretax income |

|

|

10.75 |

|

|

|

|

12.60 |

|

|

|

(1.85 |

) |

|

|

(15 |

) |

| Income tax expense |

|

|

3.16 |

|

|

|

|

3.84 |

|

|

|

(0.68 |

) |

|

|

(18 |

) |

| Net income |

|

$ |

7.59 |

|

|

|

$ |

8.76 |

|

|

$ |

(1.17 |

) |

|

|

(13 |

)% |

| Diluted EPS |

|

$ |

0.43 |

|

|

|

$ |

0.49 |

|

|

$ |

(0.06 |

) |

|

|

(12 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets

annualized |

|

|

0.46 |

% |

|

|

|

0.54 |

% |

|

|

(0.08 |

) |

|

|

|

| Return on average equity

annualized |

|

|

5.12 |

% |

|

|

|

6.20 |

% |

|

|

(1.08 |

) |

|

|

|

September 2024 Quarter Compared to Linked

Quarter

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

June 30, |

|

|

|

Increase/ |

|

| (Dollars in millions,

except per share data) (unaudited) |

|

2024 |

|

|

2024 |

|

|

|

(Decrease) |

|

| Net interest income |

|

$ |

37.68 |

|

|

$ |

35.04 |

|

|

|

$ |

2.64 |

|

|

|

8 |

% |

| Wealth management fee income |

|

|

15.15 |

|

|

|

16.42 |

|

|

|

|

(1.27 |

) |

|

|

(8 |

) |

| Capital markets activity |

|

|

0.44 |

|

|

|

0.59 |

|

|

|

|

(0.15 |

) |

|

|

(25 |

) |

| Other income |

|

|

3.35 |

|

|

|

4.55 |

|

|

|

|

(1.20 |

) |

|

|

(26 |

) |

| Total other income |

|

|

18.94 |

|

|

|

21.56 |

|

|

|

|

(2.62 |

) |

|

|

(12 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenue |

|

|

56.62 |

|

|

|

56.60 |

|

|

|

|

0.02 |

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

44.65 |

|

|

|

43.13 |

|

|

|

|

1.52 |

|

|

|

4 |

|

| Pretax income before provision

for credit losses |

|

|

11.97 |

|

|

|

13.47 |

|

|

|

|

(1.50 |

) |

|

|

(11 |

) |

| Provision for credit losses |

|

|

1.22 |

|

|

|

3.91 |

|

|

|

|

(2.69 |

) |

|

|

(69 |

) |

| Pretax income |

|

|

10.75 |

|

|

|

9.56 |

|

|

|

|

1.19 |

|

|

|

12 |

|

| Income tax expense |

|

|

3.16 |

|

|

|

2.03 |

|

|

|

|

1.13 |

|

|

|

56 |

|

| Net income |

|

$ |

7.59 |

|

|

$ |

7.53 |

|

|

|

$ |

0.06 |

|

|

|

1 |

% |

| Diluted EPS |

|

$ |

0.43 |

|

|

$ |

0.42 |

|

|

|

$ |

0.01 |

|

|

|

2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets

annualized |

|

|

0.46 |

% |

|

|

0.47 |

% |

|

|

|

(0.01 |

) |

|

|

|

| Return on average equity

annualized |

|

|

5.12 |

% |

|

|

5.22 |

% |

|

|

|

(0.10 |

) |

|

|

|

SUPPLEMENTAL QUARTERLY

DETAILS:

Wealth Management

AUM/AUA in the Bank’s Wealth Management Division

reached a record high of $12.1 billion at September 30, 2024

compared to $10.9 billion at December 31, 2023. For the

September 2024 quarter, the Wealth Management Team generated $15.2

million in fee income, compared to $16.4 million for the June 30,

2024 quarter and $14.0 million for the September 2023 quarter. The

equity markets continued to improve during 2024, contributing to

the increase in AUM/AUA along with gross new business inflows of

$547 million.

John Babcock, President of the Bank's Wealth

Management Division, noted, “Q3 2024 saw continued strong client

inflows totaling new accounts and client additions of $140 million

($130 million managed). Our new business pipeline is healthy, and

we continue to remain focused on delivering excellent service and

advice to our clients. Our highly skilled wealth management

professionals, our fiduciary powers and expertise, our financial

planning capabilities combined with our high-touch client service

model distinguishes us in our market and continues to drive our

growth and success.”

Loans / Commercial Banking

Total loans declined $116 million, or 2%, to

$5.3 billion at September 30, 2024 compared to December 31, 2023,

primarily driven by repayments, maturities and tighter lending

standards. Most of the decline in outstanding loans during the

first nine months of 2024 was related to reductions in multifamily

and commercial real estate balances. Total C&I loans and

leases at September 30, 2024 were $2.2 billion or 42% of the total

loan portfolio.

Mr. Kennedy noted, “Based on a more constructive

economic backdrop, we recently began building our pipeline of

C&I loans and leases and believe that loan demand will continue

to show improvement as we look forward to coming periods ahead. We

are proud to have built a leading middle market commercial banking

franchise, as evidenced by our C&I Portfolio, Treasury

Management services, Corporate Advisory and SBA businesses. We

anticipate these business lines fit perfectly with our private

banking business model and will generate solid production going

forward. During the quarter we originated loans that carried an

average spread of more than 4% above our cost of funds.

Having this capability will help us in the near term as the real

estate market adjusts to changing market conditions.”

Net Interest Income (NII)/Net Interest

Margin (NIM)

The Company’s NII of $37.7 million and NIM of

2.34% for Q3 2024 increased $2.6 million and 9 basis points from

NII of $35.0 million and NIM of 2.25% for the linked quarter (Q2

2024), and increased $1.2 million and 6 basis points from NII of

$36.5 million and NIM of 2.28% compared to the prior year period

(Q3 2023). Our single point of contact private banking

strategy continues to deliver lower cost core deposit

relationships. Noninterest-bearing checking deposits increased by

$130 million during the third quarter of 2024, which also drove the

improvement in NIM.

Funding / Liquidity / Interest Rate Risk

Management

Total deposits increased $661 million to $5.9

billion at September 30, 2024 from $5.3 billion at December 31,

2023. The change in deposit balances included a decline in

brokered deposits and non-core deposit relationships. The

overall growth in deposits has strengthened balance sheet liquidity

and reduced reliance on outside borrowings and other non-core

funding sources. There were no outstanding overnight borrowings at

September 30, 2024, compared to $404 million at December 31,

2023.

At September 30, 2024, the Company’s balance

sheet liquidity (investments available for sale, interest-earning

deposits and cash) totaled $1.2 billion, or 18% of assets. The

Company maintains additional liquidity resources of approximately

$3.0 billion through secured available borrowing facilities with

the Federal Home Loan Bank and the Federal Reserve Discount

Window. The available funding from the Federal Home Loan Bank

and the Federal Reserve are secured by the Company’s loan and

investment portfolios. The Company's total on and off-balance sheet

liquidity totaled $4.2 billion, which amounts to 293% of the total

uninsured/uncollateralized deposits currently on the Company’s

balance sheet.

Income from Capital Markets

Activities

Noninterest income from Capital Markets

activities (detailed below) totaled $435,000 for the September 2024

quarter compared to $586,000 for the June 2024 quarter and $613,000

for the September 2023 quarter.

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

| (Dollars in thousands,

except per share data) (unaudited) |

|

2024 |

|

|

2024 |

|

|

2023 |

|

| Gain on loans held for sale at

fair value (Mortgage banking) |

|

$ |

15 |

|

|

$ |

34 |

|

|

$ |

37 |

|

| Gain on sale of SBA loans |

|

|

365 |

|

|

|

449 |

|

|

|

491 |

|

| Corporate advisory fee

income |

|

|

55 |

|

|

|

103 |

|

|

|

85 |

|

| Total capital markets

activity |

|

$ |

435 |

|

|

$ |

586 |

|

|

$ |

613 |

|

Other Noninterest Income (other than

Wealth Management Fee Income and Income from Capital Markets

Activities)

Other noninterest income was $3.4 million for Q3

2024 compared to $4.6 million for Q2 2024 and $4.8 million for Q3

2023. Q3 2024 included $225,000 of income recorded by the Equipment

Finance Division related to equipment transfers to lessees upon the

termination of leases, compared to $1.6 million in Q2 2024 and $2.3

million in Q3 2023, respectively. Additionally, Q3 2024 included

$845,000 of unused line fees compared to $786,000 for Q2 2024 and

$794,000 for Q3 2023.

Operating Expenses

The Company’s total operating expenses were

$44.6 million for the third quarter of 2024, compared to $43.1

million for the second quarter of 2024 and $37.4 million for the

quarter ended September 2023. The third quarter of 2024 reflects

the full run rate of expenses associated with the Company’s

expansion into New York City.

Mr. Kennedy noted, “We continue to make

investments related to our strategic decision to expand into New

York City and are confident that these investments will position us

for future growth and profitability, which will ultimately

translate to increased shareholder value. We continue to look

for opportunities to create efficiencies and manage expenses

throughout the Company while investing in enhancements to the

client experience."

Income Taxes

The effective tax rate for the three months

ended September 30, 2024 was 29.4%, as compared to 21.2% for the

June 2024 quarter and 30.5% for the quarter ended September 30,

2023. The June 2024 quarter included a one-time benefit

related to the Company’s deferred tax assets associated with a

surtax imposed by the State of New Jersey in June 2024. Excluding

such benefit, the effective tax rate for the June 2024 quarter

would have been approximately 29.0%.

Asset Quality / Provision for Credit Losses

Nonperforming assets remained elevated at $80.5

million, or 1.18% of total assets, at September 30, 2024, as

compared to $82.1 million, or 1.26% of total assets, at June 30,

2024. Loans past due 30 to 89 days and still accruing were $31.4

million, or 0.59% of total loans, at September 30, 2024 compared to

$34.7 million, or 0.66% of total loans, at June 30, 2024.

Criticized and classified loans totaled $261.1 million at September

30, 2024, reflecting a decrease of $8.0 million as compared to

$269.1 million at June 30, 2024. The Company currently has no loans

or leases on deferral and still accruing.

For the quarter ended September 30, 2024, the

Company’s provision for credit losses was $1.2 million compared to

$3.9 million for the June 2024 quarter and $5.9 million for the

September 2023 quarter. The provision for credit losses in the

third quarter of 2024 was driven by overall slower loan growth

along with additional specific reserves related to certain isolated

credits, of $1.8 million partially offset by a recovery of

approximately $2.1 million. The higher provision for the

second quarter of 2024 was primarily driven by charge-offs related

to the sale of two problem loans, which were approaching

foreclosure and transferred to other real estate owned.

At September 30, 2024, the allowance for credit

losses was $71.3 million (1.34% of total loans), compared to $68.0

million (1.29% of total loans) at June 30, 2024, and $68.6 million

(1.25% of total loans) at September 30, 2023.

Mr. Kennedy noted, “We are starting to see some

of our asset quality metrics improve, which supports our position

that most of our credit issues are isolated to a small number of

specific borrowers and sponsors. We continue to work through each

credit one at a time while building up reserve coverage. All of the

multifamily loans that matured or repriced in 2024 have continued

to make their scheduled payments despite the higher rate

environment."

Capital

The Company’s capital position increased during

the third quarter of 2024 due to net income of $7.6 million, which

was partially offset by the repurchase of 100,000 shares through

the Company's repurchase program at a total cost of $2.6 million

and the quarterly dividend payment totaling $882,000. Additionally,

during the third quarter of 2024, capital benefited from a

reduction in accumulated other comprehensive losses of $13.5

million, net of tax. The total accumulated other comprehensive loss

declined to $54.8 million as of September 30, 2024 ($57.6 million

loss related to the available for sale securities portfolio

partially offset by a $2.8 million gain on the cash flow

hedges).

Tangible book value per share increased 6% to

$32.00 at September 30, 2024 from $30.31 at December 31, 2023.

Tangible book value per share is a non-GAAP financial

measure. See the reconciliation tables included in this

release for further detail. Book value per share increased 5% to

$34.57 per share at September 30, 2024 compared to $32.90 at

December 31, 2023. The Company’s and Bank’s regulatory capital

ratios as of September 30, 2024 remain strong and reflect increases

from December 31, 2023 levels. Where applicable, such ratios remain

well above regulatory well capitalized standards.

The Company employs quarterly capital stress

testing modeling of an adverse case and severely adverse case. In

the most recently completed stress test (as of June 30, 2024),

under the severely adverse case, and no growth scenario, the Bank

remains well capitalized over a two-year stress period.

On September 25, 2024, the Company declared a

cash dividend of $0.05 per share payable on November 22, 2024 to

shareholders of record on November 7, 2024.

ABOUT THE COMPANY

Peapack-Gladstone Financial Corporation is a New

Jersey based bank holding company with total assets of $6.8 billion

and assets under management/administration of $12.1 billion as of

September 30, 2024. Founded in 1921, Peapack-Gladstone Bank

is a commercial bank that provides Private Banking customized

solutions through its wealth management, commercial and retail

solutions, including residential lending and online platforms, to

businesses, not for profits and consumers. Peapack Private,

the bank’s wealth management division, offers comprehensive

financial, tax, fiduciary and investment advice and solutions to

individuals, families, privately-held businesses, family offices

and not-for-profit organizations, which help them to establish,

maintain and expand their legacy. Together, Peapack-Gladstone

Bank and Peapack Private offer an unparalleled commitment to client

service. Visit www.pgbank.com and www.peapackprivate.com for more

information.

FORWARD-LOOKING STATEMENTS

The foregoing may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements are not historical facts and

include expressions about management’s confidence and strategies

and management’s expectations about new and existing programs and

products, investments, relationships, opportunities and market

conditions. These statements may be identified by such

forward-looking terminology as “expect,” “look,” “believe,”

“anticipate,” “may” or similar statements or variations of such

terms. Actual results may differ materially from such

forward-looking statements. Factors that may cause results to

differ materially from such forward-looking statements include, but

are not limited to:

- our ability to

successfully grow our business and implement our strategic plan,

including our ability to generate revenues to offset the increased

personnel and other costs related to the strategic plan;

- the impact of anticipated higher

operating expenses in 2024 and beyond;

- our ability to successfully

integrate wealth management firm and team acquisitions;

- our ability to successfully

integrate our expanded employee base;

- an unexpected decline in the

economy, in particular in our New Jersey and New York market areas,

including potential recessionary conditions;

- declines in our net interest margin

caused by the interest rate environment and/or our highly

competitive market;

- declines in the value in our

investment portfolio;

- impact from a pandemic event on our

business, operations, customers, allowance for credit losses and

capital levels;

- higher than expected increases in

our allowance for credit losses;

- higher than expected increases in

credit losses or in the level of delinquent, nonperforming,

classified and criticized loans or charge-offs;

- inflation and changes in interest

rates, which may adversely impact our margins and yields, reduce

the fair value of our financial instruments, reduce our loan

originations and lead to higher operating costs;

- decline in real estate values

within our market areas;

- legislative and regulatory actions

(including the impact of the Dodd-Frank Wall Street Reform and

Consumer Protection Act, Basel III and related regulations) that

may result in increased compliance costs;

- successful cyberattacks against our

IT infrastructure and that of our IT and third-party

providers;

- higher than expected FDIC insurance

premiums;

- adverse weather conditions;

- the current or anticipated impact

of military conflict, terrorism or other geopolitical events;

- our inability to successfully

generate new business in new geographic markets, including our

expansion into New York City;

- a reduction in our lower-cost

funding sources;

- changes in liquidity, including the

size and composition of our deposit portfolio, including the

percentage of uninsured deposits in the portfolio;

- our inability to adapt to

technological changes;

- claims and litigation pertaining to

fiduciary responsibility, environmental laws and other

matters;

- our inability to retain key

employees;

- demands for loans and deposits in

our market areas;

- adverse changes in securities

markets;

- changes in New York City rent

regulation law;

- changes in governmental regulation,

including, but not limited to, any increase in FDIC insurance

premiums and changes in the monetary policies of the U.S. Treasury

and the Board of Governors of the Federal Reserve System;

- changes in accounting policies and

practices; and/or

- other unexpected material adverse

changes in our financial condition, operations or earnings.

A discussion of these and other factors that

could affect our results is included in our SEC filings, including

our Annual Report on Form 10-K for the year ended December 31,

2023. Except as may be required by the applicable law or

regulation, we undertake no duty to update any forward-looking

statement to conform the statement to actual results or changes in

the Company’s expectations.

Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or

achievements.

Contact:Frank A. Cavallaro,

SEVP and CFOPeapack-Gladstone Financial CorporationT:

908-306-8933

(Tables to follow)

PEAPACK-GLADSTONE FINANCIAL

CORPORATIONSELECTED CONSOLIDATED FINANCIAL

DATA(Dollars in Thousands, except per share

data) (Unaudited)

| |

|

For the Three Months Ended |

|

| |

|

Sept 30, |

|

|

June 30, |

|

|

March 31, |

|

|

Dec 31, |

|

|

Sept 30, |

|

| |

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

| Income Statement

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

$ |

83,203 |

|

|

$ |

79,238 |

|

|

$ |

79,194 |

|

|

$ |

80,178 |

|

|

$ |

78,489 |

|

| Interest expense |

|

|

45,522 |

|

|

|

44,196 |

|

|

|

44,819 |

|

|

|

43,503 |

|

|

|

41,974 |

|

|

Net interest income |

|

|

37,681 |

|

|

|

35,042 |

|

|

|

34,375 |

|

|

|

36,675 |

|

|

|

36,515 |

|

| Wealth management fee income |

|

|

15,150 |

|

|

|

16,419 |

|

|

|

14,407 |

|

|

|

13,758 |

|

|

|

13,975 |

|

| Service charges and fees |

|

|

1,327 |

|

|

|

1,345 |

|

|

|

1,322 |

|

|

|

1,255 |

|

|

|

1,319 |

|

| Bank owned life insurance |

|

|

390 |

|

|

|

328 |

|

|

|

503 |

|

|

|

357 |

|

|

|

310 |

|

| Gain on loans held for sale at

fair value (Mortgage banking) |

|

|

15 |

|

|

|

34 |

|

|

|

56 |

|

|

|

18 |

|

|

|

37 |

|

| Gain on loans held for sale at

lower of cost or fair value |

|

|

— |

|

|

|

23 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Gain on sale of SBA loans |

|

|

365 |

|

|

|

449 |

|

|

|

400 |

|

|

|

239 |

|

|

|

491 |

|

| Corporate advisory fee

income |

|

|

55 |

|

|

|

103 |

|

|

|

818 |

|

|

|

39 |

|

|

|

85 |

|

| Other income |

|

|

1,162 |

|

|

|

2,938 |

|

|

|

1,306 |

|

|

|

1,339 |

|

|

|

3,541 |

|

| Fair value adjustment for CRA

equity security |

|

|

474 |

|

|

|

(84 |

) |

|

|

(111 |

) |

|

|

585 |

|

|

|

(404 |

) |

|

Total other income |

|

|

18,938 |

|

|

|

21,555 |

|

|

|

18,701 |

|

|

|

17,590 |

|

|

|

19,354 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

56,619 |

|

|

|

56,597 |

|

|

|

53,076 |

|

|

|

54,265 |

|

|

|

55,869 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and employee

benefits |

|

|

31,050 |

|

|

|

29,884 |

|

|

|

28,476 |

|

|

|

24,320 |

|

|

|

25,264 |

|

| Premises and equipment |

|

|

5,633 |

|

|

|

5,776 |

|

|

|

5,081 |

|

|

|

5,416 |

|

|

|

5,214 |

|

| FDIC insurance expense |

|

|

870 |

|

|

|

870 |

|

|

|

945 |

|

|

|

765 |

|

|

|

741 |

|

| Other expenses |

|

|

7,096 |

|

|

|

6,596 |

|

|

|

5,539 |

|

|

|

7,115 |

|

|

|

6,194 |

|

|

Total operating expenses |

|

|

44,649 |

|

|

|

43,126 |

|

|

|

40,041 |

|

|

|

37,616 |

|

|

|

37,413 |

|

| Pretax income before provision

for credit losses |

|

|

11,970 |

|

|

|

13,471 |

|

|

|

13,035 |

|

|

|

16,649 |

|

|

|

18,456 |

|

| Provision for credit losses |

|

|

1,224 |

|

|

|

3,911 |

|

|

|

627 |

|

|

|

5,026 |

|

|

|

5,856 |

|

| Income before income taxes |

|

|

10,746 |

|

|

|

9,560 |

|

|

|

12,408 |

|

|

|

11,623 |

|

|

|

12,600 |

|

| Income tax expense |

|

|

3,159 |

|

|

|

2,030 |

|

|

|

3,777 |

|

|

|

3,024 |

|

|

|

3,845 |

|

| Net income |

|

$ |

7,587 |

|

|

$ |

7,530 |

|

|

$ |

8,631 |

|

|

$ |

8,599 |

|

|

$ |

8,755 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per Common Share

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share (basic) |

|

$ |

0.43 |

|

|

$ |

0.42 |

|

|

$ |

0.49 |

|

|

$ |

0.48 |

|

|

$ |

0.49 |

|

| Earnings per share (diluted) |

|

|

0.43 |

|

|

|

0.42 |

|

|

|

0.48 |

|

|

|

0.48 |

|

|

|

0.49 |

|

| Weighted average number

of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

17,616,046 |

|

|

|

17,747,070 |

|

|

|

17,711,639 |

|

|

|

17,770,158 |

|

|

|

17,856,961 |

|

| Diluted |

|

|

17,700,042 |

|

|

|

17,792,296 |

|

|

|

17,805,347 |

|

|

|

17,961,400 |

|

|

|

18,010,127 |

|

| Performance

Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets

annualized (ROAA) |

|

|

0.46 |

% |

|

|

0.47 |

% |

|

|

0.54 |

% |

|

|

0.53 |

% |

|

|

0.54 |

% |

| Return on average equity

annualized (ROAE) |

|

|

5.12 |

% |

|

|

5.22 |

% |

|

|

5.94 |

% |

|

|

6.13 |

% |

|

|

6.20 |

% |

| Return on average tangible equity

annualized (ROATCE) (A) |

|

|

5.54 |

% |

|

|

5.67 |

% |

|

|

6.45 |

% |

|

|

6.68 |

% |

|

|

6.75 |

% |

| Net interest margin

(tax-equivalent basis) |

|

|

2.34 |

% |

|

|

2.25 |

% |

|

|

2.20 |

% |

|

|

2.29 |

% |

|

|

2.28 |

% |

| GAAP efficiency ratio (B) |

|

|

78.86 |

% |

|

|

76.20 |

% |

|

|

75.44 |

% |

|

|

69.32 |

% |

|

|

66.97 |

% |

| Operating expenses / average

assets annualized |

|

|

2.73 |

% |

|

|

2.70 |

% |

|

|

2.51 |

% |

|

|

2.33 |

% |

|

|

2.31 |

% |

(A) Return on average tangible equity is

calculated by dividing tangible equity by annualized net income.

See Non-GAAP financial measures reconciliation included in these

tables.(B) Calculated as total operating expenses as a percentage

of total revenue. For Non-GAAP efficiency ratio, see the Non-GAAP

financial measures reconciliation included in these tables.

PEAPACK-GLADSTONE FINANCIAL

CORPORATIONSELECTED CONSOLIDATED FINANCIAL

DATA(Dollars in Thousands, except per share

data) (Unaudited)

| |

|

For the Nine Months Ended |

|

|

|

|

|

|

|

| |

|

September 30, |

|

|

Change |

|

| |

|

2024 |

|

|

2023 |

|

|

$ |

|

|

% |

|

| Income Statement

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

$ |

241,635 |

|

|

$ |

223,832 |

|

|

$ |

17,803 |

|

|

|

8 |

% |

| Interest expense |

|

|

134,537 |

|

|

|

104,418 |

|

|

|

30,119 |

|

|

|

29 |

% |

|

Net interest income |

|

|

107,098 |

|

|

|

119,414 |

|

|

|

(12,316 |

) |

|

|

-10 |

% |

| Wealth management fee income |

|

|

45,976 |

|

|

|

41,989 |

|

|

|

3,987 |

|

|

|

9 |

% |

| Service charges and fees |

|

|

3,994 |

|

|

|

3,897 |

|

|

|

97 |

|

|

|

2 |

% |

| Bank owned life insurance |

|

|

1,221 |

|

|

|

912 |

|

|

|

309 |

|

|

|

34 |

% |

| Gain on loans held for sale at

fair value (Mortgage banking) |

|

|

105 |

|

|

|

73 |

|

|

|

32 |

|

|

|

44 |

% |

| Gain on loans held for sale at

lower of cost or fair value |

|

|

23 |

|

|

|

— |

|

|

|

23 |

|

|

N/A |

|

| Gain on sale of SBA loans |

|

|

1,214 |

|

|

|

2,194 |

|

|

|

(980 |

) |

|

|

-45 |

% |

| Corporate advisory fee

income |

|

|

976 |

|

|

|

180 |

|

|

|

796 |

|

|

|

442 |

% |

| Other income |

|

|

5,406 |

|

|

|

7,147 |

|

|

|

(1,741 |

) |

|

|

-24 |

% |

| Fair value adjustment for CRA

equity security |

|

|

279 |

|

|

|

(404 |

) |

|

|

683 |

|

|

|

-169 |

% |

|

Total other income |

|

|

59,194 |

|

|

|

55,988 |

|

|

|

3,206 |

|

|

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

166,292 |

|

|

|

175,402 |

|

|

|

(9,110 |

) |

|

|

-5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and employee

benefits |

|

|

89,410 |

|

|

|

76,204 |

|

|

|

13,206 |

|

|

|

17 |

% |

| Premises and equipment |

|

|

16,490 |

|

|

|

14,317 |

|

|

|

2,173 |

|

|

|

15 |

% |

| FDIC insurance expense |

|

|

2,685 |

|

|

|

2,181 |

|

|

|

504 |

|

|

|

23 |

% |

| Other expenses |

|

|

19,231 |

|

|

|

17,977 |

|

|

|

1,254 |

|

|

|

7 |

% |

|

Total operating expenses |

|

|

127,816 |

|

|

|

110,679 |

|

|

|

17,137 |

|

|

|

15 |

% |

| Pretax income before provision

for credit losses |

|

|

38,476 |

|

|

|

64,723 |

|

|

|

(26,247 |

) |

|

|

-41 |

% |

| Provision for credit losses |

|

|

5,762 |

|

|

|

9,065 |

|

|

|

(3,303 |

) |

|

|

-36 |

% |

| Income before income taxes |

|

|

32,714 |

|

|

|

55,658 |

|

|

|

(22,944 |

) |

|

|

-41 |

% |

| Income tax expense |

|

|

8,966 |

|

|

|

15,403 |

|

|

|

(6,437 |

) |

|

|

-42 |

% |

| Net income |

|

$ |

23,748 |

|

|

$ |

40,255 |

|

|

$ |

(16,507 |

) |

|

|

-41 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Per Common Share

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share (basic) |

|

$ |

1.34 |

|

|

$ |

2.25 |

|

|

$ |

(0.91 |

) |

|

|

-40 |

% |

| Earnings per share (diluted) |

|

|

1.34 |

|

|

|

2.23 |

|

|

|

(0.89 |

) |

|

|

-40 |

% |

| Weighted average number

of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

17,691,309 |

|

|

|

17,876,316 |

|

|

|

(185,007 |

) |

|

|

-1 |

% |

| Diluted |

|

|

17,746,560 |

|

|

|

18,091,524 |

|

|

|

(344,964 |

) |

|

|

-2 |

% |

| Performance

Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets

(ROAA) |

|

|

0.49 |

% |

|

|

0.84 |

% |

|

|

(0.35 |

)% |

|

|

-41 |

% |

| Return on average equity

(ROAE) |

|

|

5.42 |

% |

|

|

9.66 |

% |

|

|

(4.24 |

)% |

|

|

-44 |

% |

| Return on average tangible equity

(ROATCE) (A) |

|

|

5.88 |

% |

|

|

10.55 |

% |

|

|

(4.67 |

)% |

|

|

-44 |

% |

| Net interest margin

(tax-equivalent basis) |

|

|

2.26 |

% |

|

|

2.54 |

% |

|

|

(0.28 |

)% |

|

|

-11 |

% |

| GAAP efficiency ratio (B) |

|

|

76.86 |

% |

|

|

63.10 |

% |

|

|

13.76 |

% |

|

|

22 |

% |

| Operating expenses / average

assets |

|

|

2.65 |

% |

|

|

2.31 |

% |

|

|

0.34 |

% |

|

|

15 |

% |

(A) Return on average tangible equity is

calculated by dividing tangible equity by annualized net

income. See Non-GAAP financial measures reconciliation

included in these tables.(B) Calculated as total operating expenses

as a percentage of total revenue. For Non-GAAP efficiency

ratio, see the Non-GAAP financial measures reconciliation included

in these tables.

PEAPACK-GLADSTONE FINANCIAL

CORPORATIONCONSOLIDATED STATEMENTS OF

CONDITION(Dollars in

Thousands)(Unaudited)

| |

|

As of |

|

| |

|

Sept 30, |

|

|

June 30, |

|

|

March 31, |

|

|

Dec 31, |

|

|

Sept 30, |

|

| |

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

8,129 |

|

|

$ |

5,586 |

|

|

$ |

5,769 |

|

|

$ |

5,887 |

|

|

$ |

7,400 |

|

| Federal funds sold |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Interest-earning deposits |

|

|

484,529 |

|

|

|

310,143 |

|

|

|

189,069 |

|

|

|

181,784 |

|

|

|

180,469 |

|

|

Total cash and cash equivalents |

|

|

492,658 |

|

|

|

315,729 |

|

|

|

194,838 |

|

|

|

187,671 |

|

|

|

187,869 |

|

| Securities available for

sale |

|

|

682,713 |

|

|

|

591,884 |

|

|

|

550,870 |

|

|

|

550,617 |

|

|

|

521,005 |

|

| Securities held to maturity |

|

|

103,158 |

|

|

|

105,013 |

|

|

|

106,498 |

|

|

|

107,755 |

|

|

|

108,940 |

|

| CRA equity security, at fair

value |

|

|

13,445 |

|

|

|

12,971 |

|

|

|

13,055 |

|

|

|

13,166 |

|

|

|

12,581 |

|

| FHLB and FRB stock, at cost

(A) |

|

|

12,459 |

|

|

|

12,478 |

|

|

|

18,079 |

|

|

|

31,044 |

|

|

|

34,158 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Residential mortgage |

|

|

591,374 |

|

|

|

579,057 |

|

|

|

581,426 |

|

|

|

578,427 |

|

|

|

585,295 |

|

| Multifamily mortgage |

|

|

1,784,861 |

|

|

|

1,796,687 |

|

|

|

1,827,165 |

|

|

|

1,836,390 |

|

|

|

1,871,853 |

|

| Commercial mortgage |

|

|

578,559 |

|

|

|

600,859 |

|

|

|

615,964 |

|

|

|

637,625 |

|

|

|

622,469 |

|

| Commercial and industrial

loans |

|

|

2,247,853 |

|

|

|

2,185,827 |

|

|

|

2,235,342 |

|

|

|

2,284,940 |

|

|

|

2,321,917 |

|

| Consumer loans |

|

|

78,160 |

|

|

|

69,579 |

|

|

|

66,827 |

|

|

|

62,036 |

|

|

|

57,227 |

|

| Home equity lines of credit |

|

|

38,971 |

|

|

|

37,117 |

|

|

|

35,542 |

|

|

|

36,464 |

|

|

|

34,411 |

|

| Other loans |

|

|

389 |

|

|

|

172 |

|

|

|

184 |

|

|

|

238 |

|

|

|

265 |

|

|

Total loans |

|

|

5,320,167 |

|

|

|

5,269,298 |

|

|

|

5,362,450 |

|

|

|

5,436,120 |

|

|

|

5,493,437 |

|

|

Less: Allowance for credit losses |

|

|

71,283 |

|

|

|

67,984 |

|

|

|

66,251 |

|

|

|

65,888 |

|

|

|

68,592 |

|

|

Net loans |

|

|

5,248,884 |

|

|

|

5,201,314 |

|

|

|

5,296,199 |

|

|

|

5,370,232 |

|

|

|

5,424,845 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Premises and equipment |

|

|

25,716 |

|

|

|

24,932 |

|

|

|

24,494 |

|

|

|

24,166 |

|

|

|

23,969 |

|

| Accrued interest receivable |

|

|

31,973 |

|

|

|

33,534 |

|

|

|

32,672 |

|

|

|

30,676 |

|

|

|

22,889 |

|

| Bank owned life insurance |

|

|

47,837 |

|

|

|

47,716 |

|

|

|

47,580 |

|

|

|

47,581 |

|

|

|

47,509 |

|

| Goodwill and other intangible

assets |

|

|

45,198 |

|

|

|

45,470 |

|

|

|

45,742 |

|

|

|

46,014 |

|

|

|

46,286 |

|

| Finance lease right-of-use

assets |

|

|

1,020 |

|

|

|

1,055 |

|

|

|

1,900 |

|

|

|

2,087 |

|

|

|

2,274 |

|

| Operating lease right-of-use

assets |

|

|

41,650 |

|

|

|

38,683 |

|

|

|

16,035 |

|

|

|

12,096 |

|

|

|

12,800 |

|

| Due from brokers |

|

|

— |

|

|

|

3,184 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Other assets |

|

|

47,081 |

|

|

|

71,387 |

|

|

|

60,591 |

|

|

|

53,752 |

|

|

|

76,456 |

|

|

TOTAL ASSETS |

|

$ |

6,793,792 |

|

|

$ |

6,505,350 |

|

|

$ |

6,408,553 |

|

|

$ |

6,476,857 |

|

|

$ |

6,521,581 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing demand deposits |

|

$ |

1,079,877 |

|

|

$ |

950,368 |

|

|

$ |

914,893 |

|

|

$ |

957,687 |

|

|

$ |

947,405 |

|

|

Interest-bearing demand deposits |

|

|

3,316,217 |

|

|

|

3,229,814 |

|

|

|

3,029,119 |

|

|

|

2,882,193 |

|

|

|

2,871,359 |

|

|

Savings |

|

|

103,979 |

|

|

|

105,602 |

|

|

|

108,305 |

|

|

|

111,573 |

|

|

|

117,905 |

|

|

Money market accounts |

|

|

902,562 |

|

|

|

824,158 |

|

|

|

775,132 |

|

|

|

740,559 |

|

|

|

761,833 |

|

|

Certificates of deposit – Retail |

|

|

515,297 |

|

|

|

502,810 |

|

|

|

486,079 |

|

|

|

443,791 |

|

|

|

422,291 |

|

|

Certificates of deposit – Listing Service |

|

|

7,454 |

|

|

|

7,454 |

|

|

|

7,704 |

|

|

|

7,804 |

|

|

|

9,103 |

|

| Subtotal “customer” deposits |

|

|

5,925,386 |

|

|

|

5,620,206 |

|

|

|

5,321,232 |

|

|

|

5,143,607 |

|

|

|

5,129,896 |

|

|

IB Demand – Brokered |

|

|

10,000 |

|

|

|

10,000 |

|

|

|

10,000 |

|

|

|

10,000 |

|

|

|

10,000 |

|

|

Certificates of deposit – Brokered |

|

|

— |

|

|

|

26,000 |

|

|

|

145,480 |

|

|

|

120,507 |

|

|

|

119,463 |

|

| Total deposits |

|

|

5,935,386 |

|

|

|

5,656,206 |

|

|

|

5,476,712 |

|

|

|

5,274,114 |

|

|

|

5,259,359 |

|

| Short-term borrowings |

|

|

— |

|

|

|

— |

|

|

|

119,490 |

|

|

|

403,814 |

|

|

|

470,576 |

|

| Finance lease liability |

|

|

1,388 |

|

|

|

1,427 |

|

|

|

3,104 |

|

|

|

3,430 |

|

|

|

3,752 |

|

| Operating lease liability |

|

|

44,775 |

|

|

|

41,347 |

|

|

|

17,630 |

|

|

|

12,876 |

|

|

|

13,595 |

|

| Subordinated debt, net |

|

|

133,489 |

|

|

|

133,417 |

|

|

|

133,346 |

|

|

|

133,274 |

|

|

|

133,203 |

|

| Due to brokers |

|

|

— |

|

|

|

9,981 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Other liabilities |

|

|

71,140 |

|

|

|

74,650 |

|

|

|

75,892 |

|

|

|

65,668 |

|

|

|

82,140 |

|

|

TOTAL LIABILITIES |

|

|

6,186,178 |

|

|

|

5,917,028 |

|

|

|

5,826,174 |

|

|

|

5,893,176 |

|

|

|

5,962,625 |

|

| Shareholders’ equity |

|

|

607,614 |

|

|

|

588,322 |

|

|

|

582,379 |

|

|

|

583,681 |

|

|

|

558,956 |

|

|

TOTAL LIABILITIES AND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

$ |

6,793,792 |

|

|

$ |

6,505,350 |

|

|

$ |

6,408,553 |

|

|

$ |

6,476,857 |

|

|

$ |

6,521,581 |

|

| Assets under management

and / or administration at Peapack-Gladstone

Bank’s Private Wealth Management Division (market

value, not included above-dollars in billions) |

|

$ |

12.1 |

|

|

$ |

11.5 |

|

|

$ |

11.5 |

|

|

$ |

10.9 |

|

|

$ |

10.4 |

|

(A) FHLB means "Federal Home Loan Bank" and FRB

means "Federal Reserve Bank."

PEAPACK-GLADSTONE FINANCIAL

CORPORATIONSELECTED BALANCE SHEET

DATA(Dollars in

Thousands)(Unaudited)

|

|

|

As of |

|

|

|

|

Sept 30, |

|

|

June 30, |

|

|

March 31, |

|

|

Dec 31, |

|

|

Sept 30, |

|

|

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

| Asset

Quality: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans past due over 90 days and

still accruing |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

35 |

|

|

$ |

— |

|

|

$ |

— |

|

| Nonaccrual loans |

|

|

80,453 |

|

|

|

82,075 |

|

|

|

69,811 |

|

|

|

61,324 |

|

|

|

70,809 |

|

| Other real estate owned |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total nonperforming assets |

|

$ |

80,453 |

|

|

$ |

82,075 |

|

|

$ |

69,846 |

|

|

$ |

61,324 |

|

|

$ |

70,809 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans to total

loans |

|

|

1.51 |

% |

|

|

1.56 |

% |

|

|

1.30 |

% |

|

|

1.13 |

% |

|

|

1.29 |

% |

| Nonperforming assets to total

assets |

|

|

1.18 |

% |

|

|

1.26 |

% |

|

|

1.09 |

% |

|

|

0.95 |

% |

|

|

1.09 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performing modifications

(A)(B) |

|

$ |

51,796 |

|

|

$ |

26,788 |

|

|

$ |

12,311 |

|

|

$ |

248 |

|

|

$ |

248 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans past due 30 through 89 days

and still accruing |

|

$ |

31,446 |

|

|

$ |

34,714 |

|

|

$ |

73,699 |

|

|

$ |

34,589 |

|

|

$ |

9,780 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans subject to special

mention |

|

$ |

113,655 |

|

|

$ |

140,791 |

|

|

$ |

59,450 |

|

|

$ |

71,397 |

|

|

$ |

53,328 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Classified loans |

|

$ |

147,422 |

|

|

$ |

128,311 |

|

|

$ |

117,869 |

|

|

$ |

84,372 |

|

|

$ |

94,866 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Individually evaluated loans |

|

$ |

79,972 |

|

|

$ |

81,802 |

|

|

$ |

69,530 |

|

|

$ |

60,710 |

|

|

$ |

70,184 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses

("ACL"): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning of quarter |

|

$ |

67,984 |

|

|

$ |

66,251 |

|

|

$ |

65,888 |

|

|

$ |

68,592 |

|

|

$ |

62,704 |

|

|

Provision for credit losses (C) |

|

|

1,227 |

|

|

|

3,901 |

|

|

|

615 |

|

|

|

5,082 |

|

|

|

5,944 |

|

|

(Charge-offs)/recoveries, net (D) |

|

|

2,072 |

|

|

|

(2,168 |

) |

|

|

(252 |

) |

|

|

(7,786 |

) |

|

|

(56 |

) |

|

End of quarter |

|

$ |

71,283 |

|

|

$ |

67,984 |

|

|

$ |

66,251 |

|

|

$ |

65,888 |

|

|

$ |

68,592 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ACL to nonperforming loans |

|

|

88.60 |

% |

|

|

82.83 |

% |

|

|

94.85 |

% |

|

|

107.44 |

% |

|

|

96.87 |

% |

| ACL to total loans |

|

|

1.34 |

% |

|

|

1.29 |

% |

|

|

1.24 |

% |

|

|

1.21 |

% |

|

|

1.25 |

% |

| Collectively evaluated ACL to

total loans (E) |

|

|

1.16 |

% |

|

|

1.14 |

% |

|

|

1.15 |

% |

|

|

1.13 |

% |

|

|

1.10 |

% |

(A) Amounts reflect modifications that are

paying according to modified terms.(B) Excludes modifications

included in nonaccrual loans of $3.7 million at September 30, 2024,

$3.2 million at June 30, 2024, $3.2 million at March 31, 2024, $3.0

million at December 31, 2023 and $3.1 million at September 30,

2023.(C) Excludes a credit of $3,000 at September 30, 2024, a

provision of $10,000 at June 30, 2024, a provision of $12,000 at

March 31, 2024, a credit of $55,000 at December 31, 2023 and a

credit of $88,000 at September 30, 2023 related to off-balance

sheet commitments.(D) Net charge-offs for the quarter ended

December 31, 2023 included charge-offs of $2.2 million of a

previously established reserve to loans individually evaluated on

one multifamily loan and $5.6 million on one equipment finance

relationship. (E) Total ACL less reserves to loans individually

evaluated equals collectively evaluated ACL.

PEAPACK-GLADSTONE FINANCIAL

CORPORATIONSELECTED BALANCE SHEET

DATA(Dollars in

Thousands)(Unaudited)

| |

|

As of |

|

| |

|

September 30, |

|

|

December 31, |

|

|

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2023 |

|

| Capital

Adequacy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity to total assets (A) |

|

|

|

|

8.94 |

% |

|

|

|

|

9.01 |

% |

|

|

|

|

8.57 |

% |

| Tangible equity to tangible

assets (B) |

|

|

|

|

8.33 |

% |

|

|

|

|

8.36 |

% |

|

|

|

|

7.92 |

% |

| Book value per share (C) |

|

|

|

$ |

34.57 |

|

|

|

|

$ |

32.90 |

|

|

|

|

$ |

31.37 |

|

| Tangible book value per share

(D) |

|

|

|

$ |

32.00 |

|

|

|

|

$ |

30.31 |

|

|

|

|

$ |

28.77 |

|

| |

|

|

|

|

|

|

|

|

|