Pathfinder Bancorp, Inc. (“Pathfinder” or the “Company”) (NASDAQ:

PBHC) announced its financial results for the third quarter ended

September 30, 2024.

The holding company for Pathfinder Bank (“the

Bank”) reported a third quarter 2024 net loss attributable to

common shareholders of $4.6 million or $0.75 per share, compared to

net income available to common shareholders of $2.0 million or

$0.32 per share in the second quarter of 2024 and $2.2 million or

$0.35 per share in the third quarter of 2023.

Third Quarter 2024 Highlights and Key

Developments

- The net loss reflected $9.0 million in provision expense that

primarily resulted from a comprehensive loan portfolio review that

the Bank elected to undertake as part of its commitment to

continuously improve its credit risk management approach. Following

its conclusion, the Company recorded net charge offs of $8.7

million in the quarter and reduced nonperforming loans by 34.0% to

$16.2 million at period end, or 1.8% of total loans. The allowance

for credit losses on September 30, 2024 represented 1.87% and

106.8% of total and nonperforming loans, respectively.

- Net interest income increased for the third consecutive quarter

to $11.7 million, including the benefit of a catch-up interest

payment of $887,000. Net interest income increased $2.3 million

from $9.5 million in the linked quarter ended June 30, 2024 and

$1.7 million from $10.1 million in the third quarter of 2023. Net

interest margin (“NIM”) expanded for the third consecutive quarter

to 3.34%, including the benefit of 25 basis points from the

catch-up interest payment. NIM increased 56 basis points from the

linked quarter and 27 basis points from the year-ago period.

- Non-interest income was $1.7 million, including a net death

benefit of $175,000 on bank owned life insurance ("BOLI"), compared

to $1.2 million in each of the linked and year-ago quarters.

- Non-interest expense was $10.3 million, including $1.6 million

in transaction-related expenses for the previously announced July

2024 closing of the East Syracuse branch acquisition, in addition

to third quarter 2024 operating costs of approximately $462,000

associated with Pathfinder’s newest location. Non-interest expense

was $7.9 million in the linked quarter and $7.7 million in the

year-ago period.

- Pre-tax, pre-provision net income was $3.4 million, including

the effect of transaction-related expenses, compared to $2.8

million in the linked quarter and $3.6 million in the year-ago

period. Pre-tax, pre-provision net income, which is not a financial

metric under generally accepted accounting principles (“GAAP”), is

a measure that the Company believes is helpful to understanding

profitability without giving effect to income taxes and provision

for credit losses.

- Total deposits were $1.20 billion at period end, compared to

$1.10 billion on June 30, 2024 and $1.13 billion on September 30,

2023. The Bank’s loan-to-deposit ratio was 77.1% on September 30,

2024.

- Total loans were $921.7 million at period end, compared to

$888.3 million on June 30, 2024 and $896.1 million on September 30,

2023.

“Pathfinder is well positioned for organic

growth opportunities in our attractive Central New York markets,

having closed the third quarter with significantly reduced levels

of nonperformers, healthy reserves, strong capital ratios, and

abundant liquidity,” said President and Chief Executive Officer

James A. Dowd. “Having completed a thorough, top-to-bottom review

of the loan portfolio at the end of September, we believe it is

sufficiently collateralized and reserved. Going forward, we intend

to take a more exacting loss-mitigation approach, and Pathfinder's

ongoing underwriting and credit risk management processes can be

expected to reflect the combined expertise of our entire management

team and professional staff, including our recently appointed Chief

Credit Officer Joseph Serbun and Chief Financial Officer Justin

Bigham.”

Dowd added, “Our financial performance also

reflects the positive impact of Pathfinder Bank’s in-market core

deposit franchise and immediate contributions from our recent East

Syracuse branch acquisition, including higher loan and deposit

balances, lower funding costs, revenue growth, and NIM

expansion. Looking ahead, as we end 2024 and begin the new

year, we intend to tightly manage operating expenses and expect

continued benefits from our core deposit franchise as a source of

low-cost, relationship-based funding for commercial and retail loan

growth in our local markets.”

East Syracuse Branch

AcquisitionAs previously announced, Pathfinder Bank

completed the purchase of its East Syracuse branch on July 19,

2024, assuming $186.0 million in associated deposits and acquiring

$30.6 million in assets including $29.9 million in loans. Acquired

assets include a core deposit intangible (“CDI”) valued at $6.3

million, and the valuation of acquired loans resulted in an

estimated discount of $1.8 million.

The addition of the East Syracuse branch

significantly increased the Bank's customer base, which expanded

the number of Pathfinder's relationships by approximately 25% and

grew non-brokered deposits by 21.5%.

At acquisition, the average cost of deposits

assumed with the branch acquisition was 1.99% (excluding the CDI)

and as of September 30, 2024, the Bank retained approximately 97%

of deposit balances. The Company utilized a portion of the low-cost

liquidity provided by the transaction to pay down $74.4 million in

borrowings and $106.0 million in high-cost brokered deposits during

the third quarter of 2024.

Insurance Business

DivestitureOn October 15, 2024, Pathfinder announced that

it sold its interest in the FitzGibbons Agency, LLC, which

contributed $28,000 to the Company’s net income and 24 basis points

to its consolidated efficiency ratio in the third quarter of 2024,

to Marshall & Sterling Enterprises, Inc. Reflecting an active

insurance brokerage market and the FitzGibbons Agency’s success

since initiating its partnership with the Bank 13 years ago,

Pathfinder will receive approximately $2.0 million from the sale,

which closed on October 1, 2024, and the Company expects to

recognize a portion of that amount as a net gain in the fourth

quarter of 2024.

Net Interest Income and Net Interest

Margin Third quarter 2024 net interest income was $11.7

million, an increase of 23.8% from the second quarter of 2024. An

increase in interest and dividend income of $2.2 million was

primarily attributed to average yield increases of 67 basis points

on loans including 39 basis points from an $887,000 catch-up

interest payment associated with purchased loan pool positions, 97

basis points on fed funds sold and interest-earning deposits, and

45 basis points on all earning assets. The corresponding increase

in loan interest income and federal funds sold and interest-earning

deposits was $1.9 million and $371,000, respectively. A decrease in

interest expense of $75,000 was attributed to reductions in

brokered deposits and short-term borrowings expense associated with

paydowns of brokered deposits and borrowings utilizing a portion of

the low-cost liquidity provided by the Bank’s East Syracuse branch

acquisition.

Net interest margin was 3.34% in the third

quarter of 2024 compared to 2.78% in the second quarter of 2024.

The increase of 56 basis points was driven by improvements in

earning asset yields and funding costs, as well as 25 basis points

attributed to the catch-up interest payment received in the third

quarter of 2024.

Third quarter 2024 net interest income was $11.7

million, an increase of 16.6% from the third quarter of 2023. An

increase in interest and dividend income of $3.5 million was

primarily attributed to average yield increases of 74 basis points

on loans including 39 basis points from the catch-up interest

payment, 67 basis points on taxable investment securities, 227

basis points on fed funds sold and interest-earning deposits, and

65 basis points on all earning assets. The corresponding increase

in loan interest income, taxable investment securities, and federal

funds sold and interest-earning deposits was $2.0 million, $1.2

million, and $426,000, respectively. Increased interest and

dividend income was partially offset by an increase in interest

expense of $1.9 million. This increase in interest expense

was predominantly the result of higher interest rates and balances

associated with borrowing and higher average rates paid on

interest-bearing deposits, compared to the third quarter of

2023.

Net interest margin was 3.34% in the third

quarter of 2024 compared to 3.07% in the third quarter of 2023. The

increase of 27 basis points was driven by improvements in earning

asset yields and lower average borrowings, partially offset by

higher funding costs, as well as 25 basis points attributed to the

catch-up interest payment received in the third quarter of

2024.

Noninterest Income Noninterest

income totaled $1.7 million in the third quarter of 2024, an

increase of $496,000 or 41.0% from the second quarter of 2024 and

an increase of $514,000 or 43.1% from the third quarter of

2023.

Compared to the linked quarter, noninterest

income growth included increases of $194,000 in earnings and gain

on BOLI including the net death benefit of $175,000, $109,000 in

debit card interchange fees, and $62,000 in service charges on

deposit accounts, as well as a $33,000 decrease in loan servicing

fees. Noninterest income growth from the linked quarter also

reflected an increase of $204,000 in net realized losses on sales

and redemptions of investment securities, as well as increases of

$201,000 in net realized gains on sales of marketable equity

securities and $50,000 in gains on sales of loans and foreclosed

real estate.

Compared to the year-ago quarter, noninterest

income growth for the third quarter of 2024 included increases of

$278,000 in interchange fees, $196,000 in earnings and gain on BOLI

including the net death benefit of $175,000 on BOLI, and $49,000 in

service charges on deposit accounts, as well as a $20,000 decrease

in loan servicing fees. Noninterest income growth from the year-ago

quarter also reflected a $178,000 increase in net realized losses

on sales and redemptions of investment securities, as well as

increases of $101,000 in net realized gains on sales of marketable

equity securities and $49,000 in gains on sales of loans and

foreclosed real estate.

Prior to the October 1, 2024 sale of the

Company’s insurance agency asset, it contributed $367,000 to

noninterest income in the third quarter of 2024, compared to

$260,000 and $310,000 in the linked and year-ago quarters,

respectively. Noninterest

ExpenseNoninterest expense totaled $10.3 million in the

third quarter of 2024, increasing $2.4 million and $2.6 million

from the linked and year-ago quarters, respectively. The increase

was primarily due to $1.6 million in transaction-related expenses

for the East Syracuse branch acquisition, in addition to third

quarter 2024 operating costs of approximately $462,000 associated

with operating Pathfinder Bank’s newest location.

Professional and other services expense was $1.8

million in the third quarter, increasing $1.1 million and $1.3

million from the linked and year-ago quarters, respectively. The

increase was primarily attributed to branch acquisition-related

expenses.

Salaries and benefits were $5.0 million in the

third quarter of 2024, increasing $560,000 and $805,000 from the

linked and year-ago quarters, respectively. The increase was

primarily due to $141,000 transaction-related bonuses to employees,

$115,000 reduced salary cost deferrals (“ASC 310-20”) associated

with reduced lending volumes, and $80,000 of ongoing

personnel-related costs associated with operating the branch

acquired early in the third quarter of 2024. The remaining increase

was primarily driven by higher salaries and benefits costs

associated with merit increases and wage inflation.

Building and occupancy was $1.1 million in the

third quarter of 2024, increasing $220,000 and $266,000 from the

linked and year-ago quarters, respectively. These increases were

due to ongoing facilities-related costs of approximately $322,000

associated with operating the branch acquired early in the third

quarter of 2024, partially offset by seasonal reductions in

building and occupancy expense categories when compared to the

second quarter of 2024.

Prior to the October 1, 2024 sale of the

Company’s insurance agency asset, it incurred $308,000 of

noninterest expense in the third quarter of 2024, compared to

$232,000 and $273,000 in the linked and year-ago quarters,

respectively. For the third quarter of 2024, annualized noninterest

expense represented 2.75% of average assets, including 8 basis

points from insurance agency expense and 43 basis points from

acquisition-related expenses. The efficiency ratio was

75.28%, including 24 basis points and 1,186 basis points attributed

to the insurance business and acquisition-related expenses,

respectively. The efficiency ratio, which is not a financial

metric under GAAP, is a measure that the Company believes is

helpful to understanding its level of non-interest expense as a

percentage of total revenue. For the linked and year-ago quarters,

annualized noninterest expense represented 2.19% and 2.20% of

average assets, respectively. The efficiency ratio was 74.08% and

67.93% in the linked and year-ago periods.

Statement of Financial

ConditionAs of September 30, 2024, the Company’s statement

of financial condition reflects total assets of $1.48 billion,

compared to $1.45 billion and $1.40 billion recorded on June 30,

2024 and September 30, 2023, respectively.

The increase in assets during the third quarter

of 2024 was primarily due to higher total loan balances, including

$29.9 million in primarily consumer, residential, and home equity

loans acquired with the East Syracuse branch transaction in the

third quarter of 2024.

Loans totaled $921.7 million on September 30,

2024, increasing 3.8% during the third quarter and 2.9% from one

year prior. Consumer and residential loans totaled $388.7 million,

increasing 7.6% during the third quarter and 4.8% from one year

prior. Commercial loans totaled $534.5 million, increasing 1.4%

during the third quarter and 1.7% from one year prior.

With respect to liabilities, deposits totaled

$1.20 billion on September 30, 2024, increasing 8.6% during the

third quarter and 6.1% from one year prior. The increase in

deposits during the third quarter of 2024 reflects $186.0 million

assumed with the East Syracuse branch acquisition, offset by a

reduction of $106.0 million in brokered deposits utilizing

lower-cost liquidity provided by the transaction, as well as

seasonal fluctuations in municipal deposits. The Company also

utilized liquidity provided by the transaction to reduce short-term

borrowings, which totaled $60.3 million on September 30, 2024 as

compared to $127.6 million on June 30, 2024 and $56.7 million on

September 30, 2023.

Shareholders equity totaled $120.3 million on

September 30, 2024, down $3.1 million or 2.5% in the third quarter

and $6.5 million or 5.7% from one year prior. The decrease reflects

lower retained earnings attributed primarily to the elevated third

quarter 2024 provision expense’s impact on net income in the

period, which more than offset a significant reduction in

accumulated other comprehensive loss (“AOCL”). AOCL improved to

$6.7 million on September 30, 2024, declining $2.1 million or 23.6%

during the third quarter and $6.6 million or 49.7% from one year

prior, reflecting a favorable change in the interest rate

environment.

Asset QualityThe Company’s

asset quality metrics reflect the comprehensive loan portfolio

review completed at the end of the third quarter of 2024.

Nonperforming loans were reduced by 34.0% in the

third quarter of 2024 to $16.2 million or 1.75% of total loans on

September 30, 2024. Nonperforming loans were $24.5 million or 2.76%

of total loans on June 30, 2024 and $16.2 million or 1.80% of total

loans on September 30, 2023.

Gross loan charge offs totaled $8.8 million in

the third quarter of 2024, following completion of the portfolio

review. Gross loan charge offs included $4.9 million for 13

nonperforming commercial loans, as well as $2.5 million for

nonperforming positions primarily associated with secured solar

purchased loan pools acquired in 2021.

Net charge offs (“NCOs”) after recoveries were

$8.7 million or an annualized 1.29% of average loans in the third

quarter of 2024, compared to $66,000 or 0.02% in the linked quarter

and $3.8 million or 0.61% in the prior year period.

The $9.0 million provision for credit losses

expense in the third quarter of 2024 primarily resulted from a

replenishment of the allowance for credit losses (“ACL”) for

commercial loan reserves and an adjustment to the lifetime loss

estimate for solar purchased loan pool positions, which followed

completion of the Company’s loan portfolio review. The Company

believes it is sufficiently collateralized and reserved, with its

ACL of $17.3 million on September 30, 2024 increasing by $382,000

from June 30, 2024 and $1.5 million from September 30, 2023. As a

percentage of total loans, ACL represented 1.87% on September 30,

2024, 1.90% on June 30, 2024, and 1.76% on September 30, 2023.

Liquidity The Company has

diligently ensured a strong liquidity profile as of September 30,

2024 to meet its ongoing financial obligations. The Bank’s

liquidity management, as evaluated by its cash reserves and

operational cash flows from loan repayments and investment

securities, remains robust and is effectively managed by the

institution’s leadership.

The Bank’s analysis indicates that expected cash

inflows from loans and investment securities are more than

sufficient to meet all projected financial obligations. Total

deposits increased to $1.20 billion on September 30, 2024 from

$1.10 billion on June 30, 2024 and $1.13 billion on September 30,

2023. Core deposits increased to 77.45% of total deposits on

September 30, 2024, from 67.98% on June 30, 2024 and 69.83% on

September 30, 2023. This further underscores the success of the

Bank’s strategic initiatives to enhance its core deposit franchise,

including targeted marketing campaigns and customer engagement

programs aimed at deepening banking relationships and enhancing

deposit stability.

At the end of the current quarter, Pathfinder

Bancorp had an available additional funding capacity of $105.2

million with the Federal Home Loan Bank of New York, which

complements its liquidity reserves. Moreover, the Bank maintains

additional unused credit lines totaling $27.3 million, which

provide a buffer for additional funding needs. These facilities,

including access to the Federal Reserve’s Discount Window, are part

of a comprehensive liquidity strategy that ensures flexibility and

readiness to respond to any funding requirements.

Cash Dividend DeclaredOn

September 30, 2024, Pathfinder’s Board of Directors declared a cash

dividend of $0.10 per share for holders of both voting common and

non-voting common stock.

In addition, this dividend also extends to the

notional shares of the Company’s warrants. Shareholders registered

by October 18, 2024 will be eligible for the dividend, which is

scheduled for disbursement on November 8, 2024. This distribution

aligns with Pathfinder Bancorp’s philosophy of consistent and

reliable delivery of shareholder value.

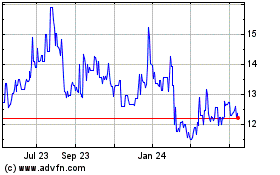

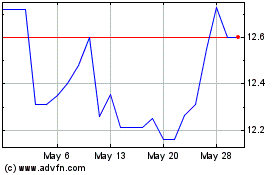

Evaluating the Company’s market performance, the

closing stock price as of September 30, 2024 stood at $15.83 per

share. This positions the dividend yield at an attractive

2.53%.

About Pathfinder Bancorp,

Inc.Pathfinder Bancorp, Inc. (NASDAQ: PBHC) is the

commercial bank holding company for Pathfinder Bank, which serves

Central New York customers throughout Oswego, Syracuse and their

neighboring communities. Strategically located branches averaging

approximately $100 million in deposits per location, as well as

diversified consumer, mortgage and commercial loan portfolios,

reflect the state-chartered Bank’s commitment to in-market

relationships and local customer service. The Company also offers

investment services to individuals and businesses. At September 30,

2024, the Oswego-headquartered Company had assets of $1.48 billion,

loans of $921.7 million, and deposits of $1.20 billion. More

information is available at pathfinderbank.com and

ir.pathfinderbank.com.

Forward-Looking Statements

Certain statements contained herein are “forward looking

statements” within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

These forward-looking statements are generally identified by use of

the words “believe,” “expect,” “intend,” “anticipate,” “estimate,”

“project” or similar expressions, or future or conditional verbs,

such as “will,” “would,” “should,” “could,” or “may.” These

forward-looking statements are based on current beliefs and

expectations of the Company’s and the Bank’s management and are

inherently subject to significant business, economic and

competitive uncertainties and contingencies, many of which are

beyond the Company’s and the Bank’s control. In addition, these

forward-looking statements are subject to assumptions with respect

to future business strategies and decisions that are subject to

change. Actual results may differ materially from those set forth

in the forward-looking statements as a result of numerous factors.

Factors that could cause such differences to exist include, but are

not limited to: risks related to the real estate and economic

environment, particularly in the market areas in which the Company

and the Bank operate; fiscal and monetary policies of the U.S.

Government; inflation; changes in government regulations affecting

financial institutions, including regulatory compliance costs and

capital requirements; fluctuations in the adequacy of the allowance

for credit losses; decreases in deposit levels necessitating

increased borrowing to fund loans and investments; operational

risks including, but not limited to, cybersecurity, fraud and

natural disasters; the risk that the Company may not be successful

in the implementation of its business strategy; changes in

prevailing interest rates; credit risk management; asset-liability

management; and other risks described in the Company’s filings with

the Securities and Exchange Commission, which are available at the

SEC’s website, www.sec.gov.

This release contains non-GAAP financial

measures. For purposes of Regulation G, a non-GAAP financial

measure is a numerical measure of a registrant’s historical or

future financial performance, financial position, or cash flows

that excludes amounts, or is subject to adjustments that have the

effect of excluding amounts, that are included in the most directly

comparable measure calculated and presented in accordance with GAAP

in the statement of income, balance sheet, or statement of cash

flows (or equivalent statements) of the registrant; or includes

amounts, or is subject to adjustments that have the effect of

including amounts, that are excluded from the most directly

comparable measure so calculated and presented. In this regard,

GAAP refers to generally accepted accounting principles in the

United States. Pursuant to the requirements of Regulation G, the

Company has provided reconciliations within the release of the

non-GAAP financial measures to the most directly comparable GAAP

financial.

| PATHFINDER BANCORP,

INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selected Financial

Information (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in thousands, except

per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2024 |

|

|

2023 |

|

|

SELECTED BALANCE SHEET DATA: |

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

| ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

$ |

18,923 |

|

|

$ |

12,022 |

|

|

$ |

13,565 |

|

|

$ |

12,338 |

|

|

$ |

12,822 |

|

|

Interest-earning deposits |

|

|

16,401 |

|

|

|

19,797 |

|

|

|

15,658 |

|

|

|

36,394 |

|

|

|

11,652 |

|

|

Total cash and cash equivalents |

|

|

35,324 |

|

|

|

31,819 |

|

|

|

29,223 |

|

|

|

48,732 |

|

|

|

24,474 |

|

|

Available-for-sale securities, at fair value |

|

|

271,977 |

|

|

|

274,977 |

|

|

|

279,012 |

|

|

|

258,716 |

|

|

|

206,848 |

|

|

Held-to-maturity securities, at amortized cost |

|

|

161,385 |

|

|

|

166,271 |

|

|

|

172,648 |

|

|

|

179,286 |

|

|

|

185,589 |

|

|

Marketable equity securities, at fair value |

|

|

3,872 |

|

|

|

3,793 |

|

|

|

3,342 |

|

|

|

3,206 |

|

|

|

3,013 |

|

|

Federal Home Loan Bank stock, at cost |

|

|

5,401 |

|

|

|

8,702 |

|

|

|

7,031 |

|

|

|

8,748 |

|

|

|

5,824 |

|

|

Loans |

|

|

921,660 |

|

|

|

888,263 |

|

|

|

891,531 |

|

|

|

897,207 |

|

|

|

896,123 |

|

|

Less: Allowance for credit losses |

|

|

17,274 |

|

|

|

16,892 |

|

|

|

16,655 |

|

|

|

15,975 |

|

|

|

15,767 |

|

|

Loans receivable, net |

|

|

904,386 |

|

|

|

871,371 |

|

|

|

874,876 |

|

|

|

881,232 |

|

|

|

880,356 |

|

|

Premises and equipment, net |

|

|

18,989 |

|

|

|

18,878 |

|

|

|

18,332 |

|

|

|

18,441 |

|

|

|

18,491 |

|

|

Assets held-for-sale |

|

|

- |

|

|

|

3,042 |

|

|

|

3,042 |

|

|

|

3,042 |

|

|

|

3,042 |

|

|

Operating lease right-of-use assets |

|

|

1,425 |

|

|

|

1,459 |

|

|

|

1,493 |

|

|

|

1,526 |

|

|

|

1,559 |

|

|

Finance lease right-of-use assets |

|

|

16,873 |

|

|

|

4,004 |

|

|

|

4,038 |

|

|

|

4,073 |

|

|

|

4,108 |

|

|

Accrued interest receivable |

|

|

6,806 |

|

|

|

7,076 |

|

|

|

7,170 |

|

|

|

7,286 |

|

|

|

6,594 |

|

|

Foreclosed real estate |

|

|

- |

|

|

|

60 |

|

|

|

82 |

|

|

|

151 |

|

|

|

189 |

|

|

Intangible assets, net |

|

|

6,217 |

|

|

|

76 |

|

|

|

80 |

|

|

|

85 |

|

|

|

88 |

|

|

Goodwill |

|

|

5,752 |

|

|

|

4,536 |

|

|

|

4,536 |

|

|

|

4,536 |

|

|

|

4,536 |

|

|

Bank owned life insurance |

|

|

24,560 |

|

|

|

24,967 |

|

|

|

24,799 |

|

|

|

24,641 |

|

|

|

24,479 |

|

|

Other assets |

|

|

20,159 |

|

|

|

25,180 |

|

|

|

23,968 |

|

|

|

22,097 |

|

|

|

31,459 |

|

|

Total assets |

|

$ |

1,483,126 |

|

|

$ |

1,446,211 |

|

|

$ |

1,453,672 |

|

|

$ |

1,465,798 |

|

|

$ |

1,400,649 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

|

$ |

986,103 |

|

|

$ |

932,132 |

|

|

$ |

969,692 |

|

|

$ |

949,898 |

|

|

$ |

953,143 |

|

|

Noninterest-bearing deposits |

|

|

210,110 |

|

|

|

169,145 |

|

|

|

176,421 |

|

|

|

170,169 |

|

|

|

174,710 |

|

|

Total deposits |

|

|

1,196,213 |

|

|

|

1,101,277 |

|

|

|

1,146,113 |

|

|

|

1,120,067 |

|

|

|

1,127,853 |

|

|

Short-term borrowings |

|

|

60,315 |

|

|

|

127,577 |

|

|

|

91,577 |

|

|

|

125,680 |

|

|

|

56,698 |

|

|

Long-term borrowings |

|

|

39,769 |

|

|

|

45,869 |

|

|

|

45,869 |

|

|

|

49,919 |

|

|

|

53,915 |

|

|

Subordinated debt |

|

|

30,057 |

|

|

|

30,008 |

|

|

|

29,961 |

|

|

|

29,914 |

|

|

|

29,867 |

|

|

Accrued interest payable |

|

|

236 |

|

|

|

2,092 |

|

|

|

1,963 |

|

|

|

2,245 |

|

|

|

1,731 |

|

|

Operating lease liabilities |

|

|

1,621 |

|

|

|

1,652 |

|

|

|

1,682 |

|

|

|

1,711 |

|

|

|

1,739 |

|

|

Finance lease liabilities |

|

|

16,829 |

|

|

|

4,359 |

|

|

|

4,370 |

|

|

|

4,381 |

|

|

|

4,391 |

|

|

Other liabilities |

|

|

16,986 |

|

|

|

9,203 |

|

|

|

9,505 |

|

|

|

11,625 |

|

|

|

10,013 |

|

|

Total liabilities |

|

|

1,362,026 |

|

|

|

1,322,037 |

|

|

|

1,331,040 |

|

|

|

1,345,542 |

|

|

|

1,286,207 |

|

|

Shareholders' equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voting common stock shares issued and outstanding |

|

|

4,719,788 |

|

|

|

4,719,788 |

|

|

|

4,719,788 |

|

|

|

4,719,288 |

|

|

|

4,713,353 |

|

|

Voting common stock |

|

|

47 |

|

|

|

47 |

|

|

|

47 |

|

|

|

47 |

|

|

|

47 |

|

|

Non-Voting common stock |

|

|

14 |

|

|

|

14 |

|

|

|

14 |

|

|

|

14 |

|

|

|

14 |

|

|

Additional paid in capital |

|

|

53,231 |

|

|

|

53,182 |

|

|

|

53,151 |

|

|

|

53,114 |

|

|

|

52,963 |

|

|

Retained earnings |

|

|

73,670 |

|

|

|

78,936 |

|

|

|

77,558 |

|

|

|

76,060 |

|

|

|

74,282 |

|

|

Accumulated other comprehensive loss |

|

|

(6,716 |

) |

|

|

(8,786 |

) |

|

|

(8,862 |

) |

|

|

(9,605 |

) |

|

|

(13,356 |

) |

|

Unearned ESOP shares |

|

|

- |

|

|

|

(45 |

) |

|

|

(90 |

) |

|

|

(135 |

) |

|

|

(180 |

) |

|

Total Pathfinder Bancorp, Inc. shareholders' equity |

|

|

120,246 |

|

|

|

123,348 |

|

|

|

121,818 |

|

|

|

119,495 |

|

|

|

113,770 |

|

|

Noncontrolling interest |

|

|

854 |

|

|

|

826 |

|

|

|

814 |

|

|

|

761 |

|

|

|

672 |

|

|

Total equity |

|

|

121,100 |

|

|

|

124,174 |

|

|

|

122,632 |

|

|

|

120,256 |

|

|

|

114,442 |

|

|

Total liabilities and shareholders' equity |

|

$ |

1,483,126 |

|

|

$ |

1,446,211 |

|

|

$ |

1,453,672 |

|

|

$ |

1,465,798 |

|

|

$ |

1,400,649 |

|

The above information is preliminary and based on the Company's

data available at the time of presentation.

| |

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

|

SELECTED INCOME STATEMENT DATA: |

|

2024 |

|

|

2023 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

| Interest and dividend

income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees |

|

$ |

39,182 |

|

|

$ |

34,919 |

|

|

$ |

14,425 |

|

|

$ |

12,489 |

|

|

$ |

12,268 |

|

|

$ |

12,429 |

|

|

$ |

12,470 |

|

| Debt securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

17,007 |

|

|

|

12,408 |

|

|

|

5,664 |

|

|

|

5,736 |

|

|

|

5,607 |

|

|

|

5,092 |

|

|

|

4,488 |

|

|

Tax-exempt |

|

|

1,475 |

|

|

|

1,441 |

|

|

|

469 |

|

|

|

498 |

|

|

|

508 |

|

|

|

506 |

|

|

|

507 |

|

| Dividends |

|

|

456 |

|

|

|

341 |

|

|

|

149 |

|

|

|

178 |

|

|

|

129 |

|

|

|

232 |

|

|

|

140 |

|

| Federal

funds sold and interest-earning deposits |

|

|

711 |

|

|

|

226 |

|

|

|

492 |

|

|

|

121 |

|

|

|

98 |

|

|

|

69 |

|

|

|

66 |

|

|

Total interest and dividend income |

|

|

58,831 |

|

|

|

49,335 |

|

|

|

21,199 |

|

|

|

19,022 |

|

|

|

18,610 |

|

|

|

18,328 |

|

|

|

17,671 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest on deposits |

|

|

22,670 |

|

|

|

15,885 |

|

|

|

7,633 |

|

|

|

7,626 |

|

|

|

7,411 |

|

|

|

7,380 |

|

|

|

6,223 |

|

| Interest on short-term

borrowings |

|

|

3,476 |

|

|

|

1,624 |

|

|

|

1,136 |

|

|

|

1,226 |

|

|

|

1,114 |

|

|

|

1,064 |

|

|

|

674 |

|

| Interest on long-term

borrowings |

|

|

597 |

|

|

|

619 |

|

|

|

202 |

|

|

|

201 |

|

|

|

194 |

|

|

|

231 |

|

|

|

222 |

|

|

Interest on subordinated debt |

|

|

1,476 |

|

|

|

1,447 |

|

|

|

496 |

|

|

|

489 |

|

|

|

491 |

|

|

|

494 |

|

|

|

492 |

|

|

Total interest expense |

|

|

28,219 |

|

|

|

19,575 |

|

|

|

9,467 |

|

|

|

9,542 |

|

|

|

9,210 |

|

|

|

9,169 |

|

|

|

7,611 |

|

|

Net interest income |

|

|

30,612 |

|

|

|

29,760 |

|

|

|

11,732 |

|

|

|

9,480 |

|

|

|

9,400 |

|

|

|

9,159 |

|

|

|

10,060 |

|

| Provision for (benefit from)

credit losses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

|

10,118 |

|

|

|

2,675 |

|

|

|

9,104 |

|

|

|

304 |

|

|

|

710 |

|

|

|

316 |

|

|

|

798 |

|

|

Held-to-maturity securities |

|

|

(90 |

) |

|

|

(24 |

) |

|

|

(31 |

) |

|

|

(74 |

) |

|

|

15 |

|

|

|

(74 |

) |

|

|

5 |

|

|

Unfunded commitments |

|

|

(43 |

) |

|

|

14 |

|

|

|

(104 |

) |

|

|

60 |

|

|

|

1 |

|

|

|

23 |

|

|

|

30 |

|

|

Total provision for credit losses |

|

|

9,985 |

|

|

|

2,665 |

|

|

|

8,969 |

|

|

|

290 |

|

|

|

726 |

|

|

|

265 |

|

|

|

833 |

|

|

Net interest income after provision for credit losses |

|

|

20,627 |

|

|

|

27,095 |

|

|

|

2,763 |

|

|

|

9,190 |

|

|

|

8,674 |

|

|

|

8,894 |

|

|

|

9,227 |

|

| Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Service charges on deposit

accounts |

|

|

1,031 |

|

|

|

913 |

|

|

|

392 |

|

|

|

330 |

|

|

|

309 |

|

|

|

336 |

|

|

|

343 |

|

| Earnings and gain on bank

owned life insurance |

|

|

685 |

|

|

|

466 |

|

|

|

361 |

|

|

|

167 |

|

|

|

157 |

|

|

|

164 |

|

|

|

165 |

|

| Loan servicing fees |

|

|

279 |

|

|

|

238 |

|

|

|

79 |

|

|

|

112 |

|

|

|

88 |

|

|

|

69 |

|

|

|

99 |

|

| Net realized (losses) gains on

sales and redemptions of investment securities |

|

|

(320 |

) |

|

|

60 |

|

|

|

(188 |

) |

|

|

16 |

|

|

|

(148 |

) |

|

|

2 |

|

|

|

(13 |

) |

| Net realized gains (losses) on

sales of marketable equity securities |

|

|

31 |

|

|

|

(208 |

) |

|

|

62 |

|

|

|

(139 |

) |

|

|

108 |

|

|

|

(47 |

) |

|

|

(39 |

) |

| Gains on sales of loans and

foreclosed real estate |

|

|

148 |

|

|

|

183 |

|

|

|

90 |

|

|

|

40 |

|

|

|

18 |

|

|

|

(2 |

) |

|

|

41 |

|

| Loss on sale of premises and

equipment |

|

|

(36 |

) |

|

|

- |

|

|

|

(36 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Debit card interchange

fees |

|

|

610 |

|

|

|

455 |

|

|

|

300 |

|

|

|

191 |

|

|

|

119 |

|

|

|

161 |

|

|

|

22 |

|

| Insurance agency revenue |

|

|

1,024 |

|

|

|

1,001 |

|

|

|

367 |

|

|

|

260 |

|

|

|

397 |

|

|

|

303 |

|

|

|

310 |

|

| Other

charges, commissions & fees |

|

|

1,203 |

|

|

|

764 |

|

|

|

280 |

|

|

|

234 |

|

|

|

689 |

|

|

|

332 |

|

|

|

265 |

|

|

Total noninterest income |

|

|

4,655 |

|

|

|

3,872 |

|

|

|

1,707 |

|

|

|

1,211 |

|

|

|

1,737 |

|

|

|

1,318 |

|

|

|

1,193 |

|

| Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and employee

benefits |

|

|

13,687 |

|

|

|

12,243 |

|

|

|

4,959 |

|

|

|

4,399 |

|

|

|

4,329 |

|

|

|

3,677 |

|

|

|

4,154 |

|

| Building and occupancy |

|

|

2,864 |

|

|

|

2,699 |

|

|

|

1,134 |

|

|

|

914 |

|

|

|

816 |

|

|

|

864 |

|

|

|

868 |

|

| Data processing |

|

|

1,750 |

|

|

|

1,519 |

|

|

|

672 |

|

|

|

550 |

|

|

|

528 |

|

|

|

499 |

|

|

|

483 |

|

| Professional and other

services |

|

|

3,078 |

|

|

|

1,531 |

|

|

|

1,820 |

|

|

|

696 |

|

|

|

562 |

|

|

|

488 |

|

|

|

492 |

|

| Advertising |

|

|

386 |

|

|

|

516 |

|

|

|

165 |

|

|

|

116 |

|

|

|

105 |

|

|

|

155 |

|

|

|

144 |

|

| FDIC assessments |

|

|

685 |

|

|

|

663 |

|

|

|

228 |

|

|

|

228 |

|

|

|

229 |

|

|

|

222 |

|

|

|

222 |

|

| Audits and exams |

|

|

416 |

|

|

|

476 |

|

|

|

123 |

|

|

|

123 |

|

|

|

170 |

|

|

|

259 |

|

|

|

159 |

|

| Insurance agency expense |

|

|

825 |

|

|

|

817 |

|

|

|

308 |

|

|

|

232 |

|

|

|

285 |

|

|

|

216 |

|

|

|

273 |

|

| Community service

activities |

|

|

111 |

|

|

|

151 |

|

|

|

20 |

|

|

|

39 |

|

|

|

52 |

|

|

|

49 |

|

|

|

55 |

|

| Foreclosed real estate

expenses |

|

|

82 |

|

|

|

76 |

|

|

|

27 |

|

|

|

30 |

|

|

|

25 |

|

|

|

35 |

|

|

|

44 |

|

| Other

expenses |

|

|

1,989 |

|

|

|

1,660 |

|

|

|

803 |

|

|

|

581 |

|

|

|

605 |

|

|

|

580 |

|

|

|

759 |

|

|

Total noninterest expense |

|

|

25,873 |

|

|

|

22,351 |

|

|

|

10,259 |

|

|

|

7,908 |

|

|

|

7,706 |

|

|

|

7,044 |

|

|

|

7,653 |

|

| (Loss)

income before provision for income taxes |

|

|

(591 |

) |

|

|

8,616 |

|

|

|

(5,789 |

) |

|

|

2,493 |

|

|

|

2,705 |

|

|

|

3,168 |

|

|

|

2,767 |

|

|

(Benefit) provision for income taxes |

|

|

(160 |

) |

|

|

1,772 |

|

|

|

(1,173 |

) |

|

|

481 |

|

|

|

532 |

|

|

|

590 |

|

|

|

573 |

|

| Net

(loss) income attributable to noncontrolling interest and

Pathfinder Bancorp, Inc. |

|

|

(431 |

) |

|

|

6,844 |

|

|

|

(4,616 |

) |

|

|

2,012 |

|

|

|

2,173 |

|

|

|

2,578 |

|

|

|

2,194 |

|

| Net

income attributable to noncontrolling interest |

|

|

93 |

|

|

|

87 |

|

|

|

28 |

|

|

|

12 |

|

|

|

53 |

|

|

|

42 |

|

|

|

18 |

|

| Net

(loss) income attributable to Pathfinder Bancorp Inc. |

|

$ |

(524 |

) |

|

$ |

6,757 |

|

|

$ |

(4,644 |

) |

|

$ |

2,000 |

|

|

$ |

2,120 |

|

|

$ |

2,536 |

|

|

$ |

2,176 |

|

| Voting

Earnings per common share - basic and diluted |

|

$ |

(0.09 |

) |

|

$ |

1.10 |

|

|

$ |

(0.75 |

) |

|

$ |

0.32 |

|

|

$ |

0.34 |

|

|

$ |

0.41 |

|

|

$ |

0.35 |

|

| Series

A Non-Voting Earnings per common share- basic and diluted |

|

$ |

(0.09 |

) |

|

$ |

1.10 |

|

|

$ |

(0.75 |

) |

|

$ |

0.32 |

|

|

$ |

0.34 |

|

|

$ |

0.41 |

|

|

$ |

0.35 |

|

|

Dividends per common share (Voting and Series A Non-Voting) |

|

$ |

0.30 |

|

|

$ |

0.27 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

The above information is preliminary and based on the Company's

data available at the time of presentation.

| |

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

|

FINANCIAL HIGHLIGHTS: |

|

2024 |

|

|

2023 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

| Selected

Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets |

|

|

-0.05 |

% |

|

|

0.65 |

% |

|

|

-1.25 |

% |

|

|

0.56 |

% |

|

|

0.59 |

% |

|

|

0.72 |

% |

|

|

0.63 |

% |

|

Return on average common equity |

|

|

-0.57 |

% |

|

|

7.88 |

% |

|

|

-14.79 |

% |

|

|

6.49 |

% |

|

|

7.01 |

% |

|

|

8.72 |

% |

|

|

7.50 |

% |

|

Return on average equity |

|

|

-0.57 |

% |

|

|

7.88 |

% |

|

|

-14.79 |

% |

|

|

6.49 |

% |

|

|

7.01 |

% |

|

|

8.72 |

% |

|

|

7.50 |

% |

|

Return on average tangible common equity (1) |

|

|

-0.59 |

% |

|

|

8.23 |

% |

|

|

-15.28 |

% |

|

|

6.78 |

% |

|

|

7.32 |

% |

|

|

9.01 |

% |

|

|

7.75 |

% |

|

Net interest margin |

|

|

2.97 |

% |

|

|

3.02 |

% |

|

|

3.34 |

% |

|

|

2.78 |

% |

|

|

2.75 |

% |

|

|

2.74 |

% |

|

|

3.07 |

% |

|

Loans/deposits |

|

|

77.05 |

% |

|

|

79.45 |

% |

|

|

77.05 |

% |

|

|

80.66 |

% |

|

|

77.79 |

% |

|

|

80.10 |

% |

|

|

79.45 |

% |

|

Core deposits/deposits (2) |

|

|

77.45 |

% |

|

|

69.83 |

% |

|

|

77.45 |

% |

|

|

67.98 |

% |

|

|

69.17 |

% |

|

|

69.83 |

% |

|

|

69.83 |

% |

|

Annualized non-interest expense/average assets |

|

|

2.39 |

% |

|

|

2.16 |

% |

|

|

2.75 |

% |

|

|

2.19 |

% |

|

|

2.16 |

% |

|

|

2.01 |

% |

|

|

2.20 |

% |

|

Efficiency ratio (1) |

|

|

72.70 |

% |

|

|

66.58 |

% |

|

|

75.28 |

% |

|

|

74.08 |

% |

|

|

68.29 |

% |

|

|

67.25 |

% |

|

|

67.93 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Selected

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average yield on loans |

|

|

5.82 |

% |

|

|

5.17 |

% |

|

|

6.31 |

% |

|

|

5.64 |

% |

|

|

5.48 |

% |

|

|

5.55 |

% |

|

|

5.57 |

% |

|

Average cost of interest bearing deposits |

|

|

3.12 |

% |

|

|

2.23 |

% |

|

|

3.11 |

% |

|

|

3.21 |

% |

|

|

3.07 |

% |

|

|

3.10 |

% |

|

|

2.65 |

% |

|

Average cost of total deposits, including non-interest bearing |

|

|

2.64 |

% |

|

|

1.88 |

% |

|

|

2.59 |

% |

|

|

2.72 |

% |

|

|

2.61 |

% |

|

|

2.63 |

% |

|

|

2.24 |

% |

|

Deposits/branch (4) |

|

$ |

99,684 |

|

|

$ |

102,532 |

|

|

$ |

99,684 |

|

|

$ |

100,116 |

|

|

$ |

104,192 |

|

|

$ |

101,824 |

|

|

$ |

102,532 |

|

|

Pre-tax, pre-provision net income (1) |

|

$ |

9,714 |

|

|

$ |

11,221 |

|

|

$ |

3,368 |

|

|

$ |

2,767 |

|

|

$ |

3,579 |

|

|

$ |

3,431 |

|

|

$ |

3,613 |

|

|

Total revenue (1) |

|

$ |

35,587 |

|

|

$ |

33,572 |

|

|

$ |

13,627 |

|

|

$ |

10,675 |

|

|

$ |

11,285 |

|

|

$ |

10,475 |

|

|

$ |

11,266 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share and Per Share

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per share |

|

$ |

0.30 |

|

|

$ |

0.27 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

|

Book value per common share |

|

$ |

19.71 |

|

|

$ |

18.67 |

|

|

$ |

19.71 |

|

|

$ |

20.22 |

|

|

$ |

19.97 |

|

|

$ |

19.59 |

|

|

$ |

18.67 |

|

|

Tangible book value per common share (1) |

|

$ |

17.75 |

|

|

$ |

17.91 |

|

|

$ |

17.75 |

|

|

$ |

19.46 |

|

|

$ |

19.21 |

|

|

$ |

18.83 |

|

|

$ |

17.91 |

|

|

Basic and diluted weighted average shares outstanding - Voting |

|

|

4,708 |

|

|

|

4,640 |

|

|

|

4,714 |

|

|

|

4,708 |

|

|

|

4,701 |

|

|

|

4,693 |

|

|

|

4,671 |

|

|

Basic and diluted earnings per share - Voting (3) |

|

$ |

(0.09 |

) |

|

$ |

1.10 |

|

|

$ |

(0.75 |

) |

|

$ |

0.32 |

|

|

$ |

0.34 |

|

|

$ |

0.41 |

|

|

$ |

0.35 |

|

|

Basic and diluted weighted average shares outstanding - Series A

Non-Voting |

|

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

|

1,380 |

|

|

Basic and diluted earnings per share - Series A Non-Voting (3) |

|

$ |

(0.09 |

) |

|

$ |

1.10 |

|

|

$ |

(0.75 |

) |

|

$ |

0.32 |

|

|

$ |

0.34 |

|

|

$ |

0.41 |

|

|

$ |

0.35 |

|

|

Common shares outstanding at period end |

|

|

6,100 |

|

|

|

6,094 |

|

|

|

6,100 |

|

|

|

6,100 |

|

|

|

6,100 |

|

|

|

6,100 |

|

|

|

6,094 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pathfinder Bancorp,

Inc. Capital Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company tangible common equity to tangible assets (1) |

|

|

7.36 |

% |

|

|

7.82 |

% |

|

|

7.36 |

% |

|

|

8.24 |

% |

|

|

8.09 |

% |

|

|

7.86 |

% |

|

|

7.82 |

% |

|

Company Total Core Capital (to Risk-Weighted Assets) |

|

|

15.55 |

% |

|

|

17.00 |

% |

|

|

15.55 |

% |

|

|

16.19 |

% |

|

|

16.23 |

% |

|

|

16.17 |

% |

|

|

17.00 |

% |

|

Company Tier 1 Capital (to Risk-Weighted Assets) |

|

|

11.84 |

% |

|

|

12.39 |

% |

|

|

11.84 |

% |

|

|

12.31 |

% |

|

|

12.33 |

% |

|

|

12.30 |

% |

|

|

12.39 |

% |

|

Company Tier 1 Common Equity (to Risk-Weighted Assets) |

|

|

11.33 |

% |

|

|

12.91 |

% |

|

|

11.33 |

% |

|

|

11.83 |

% |

|

|

11.85 |

% |

|

|

11.81 |

% |

|

|

12.91 |

% |

|

Company Tier 1 Capital (to Assets) |

|

|

8.29 |

% |

|

|

9.21 |

% |

|

|

8.29 |

% |

|

|

9.16 |

% |

|

|

9.16 |

% |

|

|

9.35 |

% |

|

|

9.21 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pathfinder Bank

Capital Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank Total Core Capital (to Risk-Weighted Assets) |

|

|

14.52 |

% |

|

|

14.76 |

% |

|

|

14.52 |

% |

|

|

16.04 |

% |

|

|

15.65 |

% |

|

|

15.05 |

% |

|

|

14.76 |

% |

|

Bank Tier 1 Capital (to Risk-Weighted Assets) |

|

|

13.26 |

% |

|

|

13.51 |

% |

|

|

13.26 |

% |

|

|

14.79 |

% |

|

|

14.39 |

% |

|

|

13.80 |

% |

|

|

13.51 |

% |

|

Bank Tier 1 Common Equity (to Risk-Weighted Assets) |

|

|

13.26 |

% |

|

|

13.51 |

% |

|

|

13.26 |

% |

|

|

14.79 |

% |

|

|

14.39 |

% |

|

|

13.80 |

% |

|

|

13.51 |

% |

|

Bank Tier 1 Capital (to Assets) |

|

|

9.13 |

% |

|

|

10.11 |

% |

|

|

9.13 |

% |

|

|

10.30 |

% |

|

|

10.13 |

% |

|

|

10.11 |

% |

|

|

10.11 |

% |

(1) Non-GAAP financial metrics. See non-GAAP reconciliation

included herein for the most directly comparable GAAP measures.(2)

Non-brokered deposits excluding certificates of deposit of $250,000

or more.(3) Basic and diluted earnings per share are calculated

based upon the two-class method. Weighted average shares

outstanding do not include unallocated ESOP shares.(4) Includes 11

full-service branches and one motor bank for September 30, 2024.

Includes 10 full-service branches and one motor bank for all

periods prior.

The above information is preliminary and based on the Company's

data available at the time of presentation.

| |

|

Nine Months Ended September 30, |

|

|

2024 |

|

|

2023 |

|

|

ASSET QUALITY: |

|

2024 |

|

|

2023 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

|

Total loan charge-offs |

|

$ |

8,992 |

|

|

$ |

4,365 |

|

|

$ |

8,812 |

|

|

$ |

112 |

|

|

$ |

68 |

|

|

$ |

211 |

|

|

$ |

3,874 |

|

|

Total recoveries |

|

|

174 |

|

|

|

252 |

|

|

|

90 |

|

|

|

46 |

|

|

|

38 |

|

|

|

103 |

|

|

|

45 |

|

|

Net loan charge-offs |

|

|

8,818 |

|

|

|

4,113 |

|

|

|

8,722 |

|

|

|

66 |

|

|

|

30 |

|

|

|

108 |

|

|

|

3,829 |

|

|

Allowance for credit losses at period end |

|

|

17,274 |

|

|

|

15,767 |

|

|

|

17,274 |

|

|

|

16,892 |

|

|

|

16,655 |

|

|

|

15,975 |

|

|

|

15,767 |

|

|

Nonperforming loans at period end |

|

|

16,170 |

|

|

|

16,173 |

|

|

|

16,170 |

|

|

|

24,490 |

|

|

|

19,652 |

|

|

|

17,227 |

|

|

|

16,173 |

|

|

Nonperforming assets at period end |

|

$ |

16,170 |

|

|

$ |

16,362 |

|

|

$ |

16,170 |

|

|

$ |

24,550 |

|

|

$ |

19,734 |

|

|

$ |

17,378 |

|

|

$ |

16,362 |

|

|

Annualized net loan charge-offs to average loans |

|

|

1.29 |

% |

|

|

0.61 |

% |

|

|

1.29 |

% |

|

|

0.02 |

% |

|

|

0.01 |

% |

|

|

0.47 |

% |

|

|

0.61 |

% |

|

Allowance for credit losses to period end loans |

|

|

1.87 |

% |

|

|

1.76 |

% |

|

|

1.87 |

% |

|

|

1.90 |

% |

|

|

1.87 |

% |

|

|

1.78 |

% |

|

|

1.76 |

% |

|

Allowance for credit losses to nonperforming loans |

|

|

106.83 |

% |

|

|

97.49 |

% |

|

|

106.83 |

% |

|

|

68.98 |

% |

|

|

84.75 |

% |

|

|

92.73 |

% |

|

|

97.49 |

% |

|

Nonperforming loans to period end loans |

|

|

1.75 |

% |

|

|

1.80 |

% |

|

|

1.75 |

% |

|

|

2.76 |

% |

|

|

2.20 |

% |

|

|

1.92 |

% |

|

|

1.80 |

% |

|

Nonperforming assets to period end assets |

|

|

1.09 |

% |

|

|

1.17 |

% |

|

|

1.09 |

% |

|

|

1.70 |

% |

|

|

1.36 |

% |

|

|

1.19 |

% |

|

|

1.17 |

% |

| |

|

2024 |

|

|

2023 |

|

|

LOAN COMPOSITION: |

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

|

1-4 family first-lien residential mortgages |

|

$ |

255,235 |

|

|

$ |

250,106 |

|

|

$ |

252,026 |

|

|

$ |

257,604 |

|

|

$ |

252,956 |

|

|

Residential construction |

|

|

4,077 |

|

|

|

309 |

|

|

|

1,689 |

|

|

|

1,355 |

|

|

|

2,090 |

|

|

Commercial real estate |

|

|

378,805 |

|

|

|

370,361 |

|

|

|

363,467 |

|

|

|

358,707 |

|

|

|

362,822 |

|

|

Commercial lines of credit |

|

|

64,672 |

|

|

|

62,711 |

|

|

|

67,416 |

|

|

|

72,069 |

|

|

|

73,497 |

|

|

Other commercial and industrial |

|

|

88,247 |

|

|

|

90,813 |

|

|

|

91,178 |

|

|

|

89,803 |

|

|

|

85,506 |

|

|

Paycheck protection program loans |

|

|

125 |

|

|

|

136 |

|

|

|

147 |

|

|

|

158 |

|

|

|

169 |

|

|

Tax exempt commercial loans |

|

|

2,658 |

|

|

|

3,228 |

|

|

|

3,374 |

|

|

|

3,430 |

|

|

|

3,451 |

|

|

Home equity and junior liens |

|

|

52,709 |

|

|

|

35,821 |

|

|

|

35,723 |

|

|

|

34,858 |

|

|

|

34,666 |

|

|

Other consumer |

|

|

76,703 |

|

|

|

75,195 |

|

|

|

77,106 |

|

|

|

79,797 |

|

|

|

81,319 |

|

|

Subtotal loans |

|

|

923,231 |

|

|

|

888,680 |

|

|

|

892,126 |

|

|

|

897,781 |

|

|

|

896,476 |

|

|

Deferred loan fees |

|

|

(1,571 |

) |

|

|

(417 |

) |

|

|

(595 |

) |

|

|

(574 |

) |

|

|

(353 |

) |

|

Total loans |

|

$ |

921,660 |

|

|

$ |

888,263 |

|

|

$ |

891,531 |

|

|

$ |

897,207 |

|

|

$ |

896,123 |

|

| |

|

2024 |

|

|

2023 |

|

|

DEPOSIT COMPOSITION: |

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

|

Savings accounts |

|

$ |

129,053 |

|

|

$ |

106,048 |

|

|

$ |

111,465 |

|

|

$ |

113,543 |

|

|

$ |

118,406 |

|

|

Time accounts |

|

|

352,729 |

|

|

|

368,262 |

|

|

|

378,103 |

|

|

|

377,570 |

|

|

|

359,011 |

|

|

Time accounts in excess of $250,000 |

|

|

140,181 |

|

|

|

117,021 |

|

|

|

114,514 |

|

|

|

95,272 |

|

|

|