false

0001787297

0001787297

2023-12-20

2023-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 20, 2023

PASSAGE BIO, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-39231 |

82-2729751 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

One

Commerce Square

2005 Market Street, 39th Floor

Philadelphia, PA |

19103 |

| (Address of principal executive offices) |

(Zip Code) |

(267) 866-0311

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.0001 Par Value Per Share |

PASG |

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01 Other Events.

PBFT02 Program Updates

On

December 20, 2023, Passage Bio, Inc. (the “Company”) announced the following updates with respect

to its ongoing global Phase 1/2 clinical trial, or upliFT-D, evaluating PBFT02, an adeno-associated virus-delivery gene therapy for the

treatment of patients aged 35 to 75 years with frontotemporal dementia caused by progranulin deficiency, or FTD-GRN:

Initial Data from upliFT-D Phase 1/2 Trial

of PBFT02

The Company reported promising

initial safety and biomarker data from the first three Cohort 1 patients who received Dose 1 of PBFT02 from upliFT-D.

upliFT-D is expected to be

a two-cohort dose-escalation trial with a potential for a third higher-dose cohort, if considered necessary based on the results

of the first two cohorts. The starting dose (3.3x10˄10 genome copies/gm brain weight) exceeds the minimum effective dose in

the Company’s GRN knockout mouse model, with planned escalation to a higher dose (1.1x10˄11 genome copies/gm

brain weight). The primary endpoint of the trial is to assess safety and tolerability over 24 months, followed by an additional 36 months

of long-term follow-up. To better understand the clinical significance of the peripheral nerve findings in preclinical studies, the

Company implemented clinical monitoring in its upliFT-D interventional trial, consisting of both nerve conduction studies and neurological

exams focused on sensory and peripheral nerve function. Secondary endpoints are to assess change from baseline to 24 months on biomarkers,

including CSF and plasma progranulin, or PGRN, levels, biomarkers of neurodegeneration and disease progression, and on clinical outcomes

as measured by the Clinical Dementia Rating, or CDR, for improving evaluation of patients with frontotemporal lobar degeneration, or FTLD,

or CDR®, plus NACC FTLD, and other neurocognitive assessments. Interim analyses are planned for certain biomarkers starting at one

month post dosing and for clinical outcomes beginning at one year post dosing. All subjects will be followed for a total of five years

to monitor safety and selected biomarker and efficacy measures. The Company estimates the prevalence of FTD-GRN in the United States

and Europe to be approximately 18,000 patients.

Dose 1 of PBFT02 treatment

resulted in a 3.6 to 6.6-fold increase in PGRN levels in the cerebral spinal fluid, or CSF, at day 30 (n=3) relative to baseline. CSF

PGRN increased to supraphysiologic levels of 10.7 to 17.3 ng/mL at 30 days post-treatment, exceeding the range found in healthy adult

controls of 3.3 to 8.2 ng/mL (n=61). CSF PGRN remained at supraphysiologic levels at six months post-treatment with a concentration of

27.3 ng/mL (n=1). Plasma PGRN levels remained below levels found in healthy adult controls through the available follow-up period across

all three patients.

Dose

1 of PBFT02 was generally well-tolerated in patients 2 and 3, who received an enhanced steroid regimen (1,000 mg IV

methylprednisolone on Days 1-3 followed by 60 mg oral prednisone for 60 days) following an amendment to the trial protocol. In these

two patients, no serious adverse events, or SAEs, were reported, all treatment emergent adverse events, or AEs, were mild to

moderate in severity, and there was no evidence of a clinically significant immune response, hepatotoxicity, or safety related

imaging findings in either patient. Patient 1, who received a low level of immunosuppression (60 mg oral prednisone daily for 60

days), per the initial trial protocol, experienced two SAEs that were both asymptomatic and likely consistent with an immune

response. Following Patient 1, the protocol was amended to increase the steroid regimen for Patients 2 and 3. There was no

evidence of dorsal root ganglion toxicity, as measured by nerve conduction studies, and no complications were observed related to

intra-cisterna magna administration in any of the three patients. The Company intends to treat two additional patients at Dose 1,

with no required delay between these patients, to further study the safety and pharmacodynamic effects of PBFT02 at this dose.

The

Company expects to initiate dosing of Cohort 2 FTD-GRN patients in the upliFT-D trial in the first half of 2024, report full six-month

safety and biomarker data from Cohort 1 patients in the second half of 2024, and report 12-month follow-up data from Cohort 1 patients

and initial safety and biomarker data from Cohort 2 patients in the first half 2025.

PBFT02 Expansion

In

addition to the continued clinical development of PBFT02 to treat FTD-GRN, the Company intends to pursue PBFT02 in additional adult

neurodegenerative diseases where we believe supraphysiologic PGRN levels could provide benefit. Third-party preclinical studies have shown

that increased PGRN levels reduced buildup of TAR DNA binding protein 43, or TDP-43. TDP-43 pathology is a hallmark of multiple neurodegenerative

conditions, including FTD due to mutations in the C9orf72 gene, or FTD-C9orf72, amyotrophic lateral sclerosis, or ALS and

sporadic FTD. The prevalence of FTD-C9orf72 in the United States and European Union combined is estimated to be approximately 21,000,

while the estimated prevalence of ALS with TDP-43 pathology in the United States and European Union combined is estimated to be approximately

72,600. Additionally, the Company believes restoration of PGRN has the potential to modulate Alzheimer’s disease, or AD, in patients

that are carriers of the GRN rs5848 single nucleotide polymorphism, or SNP. Individuals with this polymorphism have reduced PGRN

levels and are at an increased risk for AD. Carriers of the GRN rs5848 SNP are estimated to be 30% of the general population, and

therefore is estimated to occur in approximately 3.9 million AD patients in the United States and European Union.

The

Company expects to obtain regulatory feedback on the clinical pathway to treating FTD-C9orf72 and ALS patients with PBFT02 in the

second half of 2024 and is exploring plans to initiate preclinical studies in AD.

Strategic Updates

On

December 20, 2023, the Company also announced updated strategic priorities to focus efforts on the continued clinical development

of PBFT02 to treat FTD-GRN, pursuit of PBFT02 in additional adult neurodegenerative diseases, and advancement of its preclinical

program in Huntington’s disease through its partnership with the University of Pennsylvania’s Gene Therapy Program. The Company

is now seeking potential partnership opportunities for its clinical-stage pediatric programs in GM1 gangliosidosis, Krabbe disease and

metachromatic leukodystrophy.

The Company also issued a press release on December 20, 2023 related to the PBFT02 Program Updates and Strategic Updates.

A copy of the

press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

Forward-Looking Statements

This

Current Report on Form 8-K contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform

Act of 1995 and other federal securities laws. Any statements contained herein that do not describe historical facts, including, but not

limited to, statements regarding our expectations about timing and execution of anticipated milestones, including the progress

of clinical trials and the availability of clinical data from such trials; our expectations about our collaborators’ and partners’

ability to execute key initiatives; our expectations about manufacturing plans and strategies; our expectations about cash runway; our

expectations about potential partnerships related to PBGM01, PBKR03 and PBML04 and the ability of our lead product candidates to treat

their respective target monogenic CNS disorders, are forward-looking statements that involve risks and uncertainties that could cause

actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include, among

others, the risks identified in the Company’s filings with the SEC, including its Quarterly Report on Form 10-Q for the three

months ended September 30, 2023, filed with the SEC on November 13, 2023 and subsequent filings with the SEC. Any of these risks

and uncertainties could materially and adversely affect the Company’s results of operations, which would, in turn, have a significant

and adverse impact on the Company’s stock price. The Company cautions you not to place undue reliance on any forward-looking statements,

which speak only as of the date they are made. The Company undertakes no obligation to update publicly any forward-looking statements

to reflect new information, events or circumstances after the date they were made or to reflect the occurrence of unanticipated events.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PASSAGE BIO, INC. |

| |

|

|

| Date: December 20, 2023 |

By: |

/s/ Kathleen Borthwick |

| |

|

Kathleen Borthwick |

| |

|

Senior Vice President, Interim Chief Financial Officer |

Exhibit 99.1

PASSAGE BIO ANNOUNCES PROMISING INITIAL DATA

FROM PHASE 1/2 CLINICAL TRIAL OF PBFT02 IN FTD-GRN AND UPDATED STRATEGIC PRIORITIES

| · | Dose

1 of PBFT02 achieved supraphysiologic CSF progranulin levels in each of the first three treated

patients at 30 days after treatment |

| · | Elevated

progranulin levels were sustained at up to six months post-treatment |

| · | Dose

1 of PBFT02 was generally well-tolerated in patients who received an enhanced steroid regimen

for immunosuppression |

| · | Pipeline

to focus on continued advancement of PBFT02 in FTD-GRN and explore PBFT02 in multiple additional

adult neurodegenerative diseases |

| · | Pursuing

potential partnership opportunities for clinical-stage pediatric lysosomal storage disease

programs including GM1 gangliosidosis |

| · | Management

to host a webcast presentation to review interim FTD data today at 8:30 a.m. ET |

PHILADELPHIA – December 20, 2023 – Passage

Bio, Inc. (Nasdaq: PASG), a clinical-stage genetic medicines company focused on improving the lives of patients with neurodegenerative

diseases, today announced initial safety and biomarker data from three Cohort 1 patients in the ongoing global Phase 1/2 upliFT-D

clinical trial evaluating PBFT02, an adeno-associated virus (AAV)-delivery gene therapy for the treatment of patients with frontotemporal

dementia (FTD) with granulin (GRN) mutations. FTD is a form of early onset dementia with no approved disease-modifying therapies.

Additionally, the company shared updated strategic priorities aimed at further optimizing its portfolio for the treatment of neurodegenerative

conditions.

"We are proud to announce initial clinical data from our upliFT-D

clinical trial, which showcases the ability of PBFT02 to elevate CSF progranulin to supraphysiologic levels at the lowest tested dose,

Dose 1, up to six months post-treatment. We believe these data, surpassing our expectations based on preclinical non-human primate models,

validate the compelling potential of PBFT02 to address progranulin deficiency—a key driver of disease progression in individuals

with FTD-GRN,” said Mark Forman, M.D., Ph.D., chief medical officer at Passage Bio.

FTD is one of the more common causes of early-onset dementia. In approximately

5 to 10 percent of individuals with FTD–approximately 18,000 individuals in the United States and Europe—the disease occurs

because of mutations in the GRN gene, causing a deficiency of progranulin (PGRN). PGRN is a complex and highly conserved protein

thought to have multiple roles in cell biology, development and inflammation. Emerging evidence suggests that PGRN deficiency may contribute

to lysosomal dysfunction.

The upliFT-D clinical trial evaluates PBFT02 as a single dose delivered

via intra-cisterna magna (ICM) injection. PBFT02 uses an AAV1 viral vector to deliver a functional copy of the GRN gene encoding

PGRN to a patient's cells.

Topline interim results from first three patients in the uplift-D

clinical trial

Safety (patient follow-up up to six months)

| · | Dose

1 of PBFT02 was generally well-tolerated in patients 2 and 3, who received an enhanced steroid

regimen following protocol amendment. |

| o | No serious adverse events (SAEs). |

| o | All treatment emergent adverse events (AEs) were mild to moderate

in severity. |

| o | No evidence of clinically significant immune response, hepatotoxicity

or safety related imaging abnormalities. |

| · | Patient

1 received a low level of immunosuppression (60 mg oral prednisone for 60 days) and experienced

two SAEs that were both asymptomatic and consistent with an immune response. |

| o | Following patient 1, the protocol was amended to increase the steroid

regimen (1,000 mg IV methylprednisolone on days 1-3 followed by 60 mg oral prednisone through

day 60) for patients 2 and 3. |

| · | No

evidence of dorsal root ganglion (DRG) toxicity, as measured by nerve conduction studies,

and no complications were observed related to ICM administration across any of the three

patients. |

Biomarkers

| · | Dose

1 of PBFT02 treatment resulted in a 3.6 to 6.6-fold increase in CSF PGRN at day 30 (n=3)

relative to baseline. CSF PGRN increased to supraphysiologic levels of 10.7 to 17.3 ng/mL

at day 30, exceeding the range found in healthy adult controls of 3.3 to 8.2 ng/mL (n=61). |

| · | CSF

PGRN remained at supraphysiologic levels at six months with a concentration of 27.3 ng/mL

(n=1). |

| · | Plasma

PGRN levels remained below levels found in healthy adult controls through the available follow-up

period across all patients. |

"Driven by promising initial data for PBFT02 in FTD-GRN

and evidence supporting progranulin’s role in neurodegeneration, we are refining our strategic priorities to explore the therapeutic

potential of PBFT02 in multiple diseases, including FTD-C9orf72, amyotrophic lateral sclerosis (ALS), and Alzheimer’s disease,”

said William Chou, M.D., president and chief executive officer at Passage Bio. “As we pursue this strategy, we are actively exploring

potential partnerships to advance our GM1 gangliosidosis program as well as our other clinical-stage pediatric programs. This shift in

strategy aims to optimize focus and resources and provides each of our gene therapy candidates the best chance to get to patients in

need.”

Strategic Priorities

We are focused on the following key strategic priorities:

| · | Continuing

clinical development of PBFT02 to treat FTD-GRN. |

| · | Pursuing

PBFT02 in additional adult neurodegenerative diseases, including FTD-C9orf72, ALS

and Alzheimer’s disease. |

| · | Prioritizing

Huntington’s disease preclinical program through existing Penn Gene Therapy Program

partnership. |

| · | Pursuing

potential partnership opportunities for clinical-stage pediatric programs in GM1 gangliosidosis,

Krabbe disease and metachromatic leukodystrophy (MLD). |

Anticipated Upcoming Milestones

FTD-GRN

| · | Initiate

dosing for Cohort 2 FTD-GRN patients in 1H 2024 |

| · | Report

full 6-month safety and biomarker data from Cohort 1 patients in 2H 2024 |

| · | Report

12-month follow-up data from Cohort 1 patients in 1H 2025 |

| · | Report

initial safety and biomarker data from Cohort 2 patients in 1H 2025 |

FTD-C9orf72 and ALS

| · | Obtain

regulatory feedback on the pathway to treating FTD-C9orf72 and ALS patients with PBFT02

in 2H 2024 |

These strategic priorities and clinical milestones underscore Passage

Bio's dedication to advancing cutting-edge, one-time genetic medicines and protecting patients and families against loss in neurodegenerative

conditions.

Conference Call Details

Passage Bio will host a conference call and webcast today at 8:30

a.m. ET. To register for the event, please use the following link. A live audio webcast of the event will be

available on the Investors & News section of Passage Bio’s website at investors.passagebio.com. The

archived webcast will be available on Passage Bio's website approximately two hours after the completion of the event and for 30 days

following the call.

About upliFT-D (NCT04747431)

upliFT-D is a Phase 1/2 global, multi-center, open-label, dose-escalation

clinical trial of PBFT02 administered by single injection into the cisterna magna in patients aged 35 to 75 years with FTD-GRN.

The upliFT-D clinical trial will investigate two dose levels of PBFT02.

The clinical trial will sequentially enroll two cohorts, with an optional third dose level cohort expected to be enrolled based on the

results of the first two cohorts. Enrollment is currently ongoing. The primary endpoint of the clinical trial is to evaluate the safety

and tolerability of PBFT02. Secondary endpoints include disease biomarkers and clinical outcome measures. upliFT-D is a two-year clinical

trial with a three-year safety extension. Passage Bio is pursuing several initiatives to support clinical trial recruitment and enrollment,

including a collaborative partnership with InformedDNA to provide no-cost genetic counseling and testing for adults who have been diagnosed

by their physicians with FTD. More information about upliFT-D can be found here.

About PBFT02

PBFT02 utilizes an AAV1 viral vector to deliver, through ICM administration,

a functional GRN gene to patients with mutations in the gene that encodes for progranulin (PGRN). This vector and delivery approach

aims to provide higher-than-normal levels of the PGRN protein to the CNS to overcome the progranulin deficiency in GRN gene mutation

carriers.

PBFT02 is supported by extensive preclinical studies conducted by

Passage Bio’s collaborator, the University of Pennsylvania’s Gene Therapy Program. The studies showed compelling evidence

indicating broad transduction across the brain, including high transduction of ependymal cells, and demonstrated robust increases in

cerebrospinal fluid (CSF) PGRN concentrations.

About Passage Bio

Passage Bio (Nasdaq: PASG) is a clinical stage genetic medicines company

on a mission to improve the lives of patients with neurodegenerative diseases. Our primary focus is the development and advancement of

cutting-edge, one-time therapies designed to target the underlying pathology of these conditions. Passage Bio’s lead product candidate,

PBFT02, seeks to treat neurodegenerative conditions, including frontotemporal dementia, by elevating progranulin levels to restore lysosomal

function and slow disease progression.

To learn more about Passage Bio and our steadfast commitment to protecting

patients and families against loss in neurodegenerative conditions, please visit: www.passagebio.com.

Forward-Looking Statements

This press release contains “forward-looking statements”

within the meaning of, and made pursuant to the safe harbor provisions of, the Private Securities Litigation Reform Act of 1995, including,

but not limited to: our expectations about timing and execution of anticipated milestones, including the progress of clinical trials

and the availability of clinical data from such trials; our expectations about our collaborators’ and partners’ ability to

execute key initiatives; our expectations about manufacturing plans and strategies; our expectations about cash runway; our expectations

about potential partnerships related to PBGM01, PBKR03 and PBML04 and the ability of our lead product candidates to treat their respective

target monogenic CNS disorders. These forward-looking statements may be accompanied by such words as “aim,” “anticipate,”

“believe,” “could,” “estimate,” “expect,” “forecast,” “goal,”

“intend,” “may,” “might,” “plan,” “potential,” “possible,” “will,”

“would,” and other words and terms of similar meaning. These statements involve risks and uncertainties that could cause

actual results to differ materially from those reflected in such statements, including: our ability to develop and obtain regulatory

approval for our product candidates; the timing and results of preclinical studies and clinical trials; risks associated with clinical

trials, including our ability to adequately manage clinical activities, unexpected concerns that may arise from additional data or analysis

obtained during clinical trials, regulatory authorities may require additional information or further studies, or may fail to approve

or may delay approval of our drug candidates; the occurrence of adverse safety events; the risk that positive results in a preclinical

study or clinical trial may not be replicated in subsequent trials or success in early stage clinical trials may not be predictive of

results in later stage clinical trials; failure to protect and enforce our intellectual property, and other proprietary rights; our dependence

on collaborators and other third parties for the development and manufacture of product candidates and other aspects of our business,

which are outside of our full control; risks associated with current and potential delays, work stoppages, or supply chain disruptions;

and the other risks and uncertainties that are described in the Risk Factors section in documents the company files from time to time

with the Securities and Exchange Commission (SEC), and other reports as filed with the SEC. Passage Bio undertakes no obligation to publicly

update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information,

future developments or otherwise.

For further information, please contact:

Investors:

Madeline Nafus

Passage Bio

910.401.7283

mnafus@passagebio.com

Media:

Mike Beyer

Sam Brown Inc. Healthcare Communications

312.961.2502

MikeBeyer@sambrown.com

v3.23.4

Cover

|

Dec. 20, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 20, 2023

|

| Entity File Number |

001-39231

|

| Entity Registrant Name |

PASSAGE BIO, INC.

|

| Entity Central Index Key |

0001787297

|

| Entity Tax Identification Number |

82-2729751

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

One

Commerce Square

|

| Entity Address, Address Line Two |

2005 Market Street, 39th Floor

|

| Entity Address, City or Town |

Philadelphia

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19103

|

| City Area Code |

267

|

| Local Phone Number |

866-0311

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 Par Value Per Share

|

| Trading Symbol |

PASG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

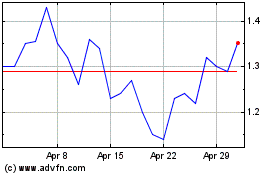

Passage Bio (NASDAQ:PASG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Passage Bio (NASDAQ:PASG)

Historical Stock Chart

From Jan 2024 to Jan 2025