0001315399FALSE00013153992023-10-252023-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 25, 2023

| | | | | | | | | | | | | | |

| | | | |

| PARKE BANCORP, INC. | |

| (Exact name of registrant as specified in its charter) | |

| | | | |

| | | | | | | | | | | | | | |

| New Jersey | | 0-51338 | | 65-1241959 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | |

| | | | | | | | |

601 Delsea Drive, Washington Township, New Jersey | | 08080 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

Registrant’s telephone number, including area code: (856) 256-2500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, Par Value $0.10 per share | | PKBK | | The Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

PARKE BANCORP, INC.

INFORMATION TO BE INCLUDED IN THE REPORT

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition.

On October 25, 2023, Parke Bancorp, Inc. issued a press release to report earnings for the three and nine months ended September 30, 2023. A copy of the press release is furnished with this Current Report as Exhibit 99.1 hereto and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

Section 9 - Financial Statements and Exhibits

Item 9.01 Exhibits.

| | | | | | | | | | | | | | | | | |

| Exhibit No. | Description | | | | |

| 99.1 | | | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

PARKE BANCORP, INC.

| | | | | | | | | | | | | | |

| Date: October 25, 2023 | By | /s/ John S. Kaufman | |

| | | John S. Kaufman | |

| | | Senior Vice President and Chief Financial Officer | |

| | | (Duly Authorized Representative) | |

| | | | |

Parke Bancorp, Inc.

601 Delsea Drive,

Washington Township, NJ 08080

Contact:

Vito S. Pantilione, President and CEO

John S. Kaufman, Senior Vice President and CFO

(856) 256-2500

PARKE BANCORP, INC. ANNOUNCES THIRD QUARTER 2023 EARNINGS

| | | | | | | | | | | | | | |

| Highlights: | | |

| | | | |

| Net Income: | | $1.0 million for Q3 2023 |

| | |

| | |

| Revenue: | | $30.9 million for Q3 2023, increased 6.92% over Q2 2023 |

| Total Assets: | | $1.98 billion, decreased 0.1% from December 31, 2022 |

| Total Loans: | | $1.80 billion, increased 2.8% over December 31, 2022 |

| Total Deposits: | | $1.53 billion, decreased 2.7% from December 31, 2022 |

| | |

|

WASHINGTON TOWNSHIP, NJ, October 25, 2023 - Parke Bancorp, Inc. (“Parke Bancorp” or the "Company") (NASDAQ: “PKBK”), the parent company of Parke Bank, announced its operating results for the three and nine months ended September 30, 2023.

Highlights for the three and nine months ended September 30, 2023:

•Net income available to common shareholders was $1.0 million, or $0.09 per basic common share and $0.08 per diluted common share, for the three months ended September 30, 2023, a decrease of $9.5 million, or 90.3%, compared to net income available to common shareholders of $10.5 million, or $0.88 per basic common share and $0.87 per diluted common share, for the three months ended September 30, 2022. The decrease was primarily due to a $9.3 million increase in other operating expenses resulting from the recognition of a $9.5 million contingent loss related to cash that was stolen from a third-party armored car carrier facility that was used by the Company, and lower net interest income, partially offset by lower provision for credit losses.

•When adjusted for the $9.5 million contingent loss recognition (tax effected $7.3 million), net income available to common shareholders would have been $8.3 million, or $0.70 per basic common share and $0.68 per diluted common share, for the three months ended September 30, 2023. Adjusted net income available to common shareholders and adjusted earnings per share are non-GAAP financial measures. Please refer to the table at the end of this release which reconciles net income available to common shareholders and earnings per share to adjusted net income available to common shareholders and adjusted earnings per share.

•Net interest income decreased 18.7% to $15.7 million for the three months ended September 30, 2023, compared to $19.3 million for the same period in 2022.

•Provision for credit losses was $0.3 million for the three months ended September 30, 2023, compared to a provision for credit losses of $0.6 million for the same period in 2022.

•Non-interest income decreased $0.2 million, or 9.5%, to $1.8 million for the three months ended September 30, 2023, compared to $2.0 million for the same period in 2022.

•Non-interest expense increased $9.6 million, or 151.9%, to $15.8 million for the three months ended September 30, 2023, compared to $6.3 million for the same period in 2022, primarily driven by the $9.5 million contingent loss recognition related to cash that was stolen from a third-party armored car carrier facility that was used by the Company.

•Net income available to common shareholders was $20.3 million, or $1.70 per basic common share and $1.67 per diluted common share, for the nine months ended September 30, 2023, a decrease of $11.1 million, or 35.3%, compared to net income available to common shareholders of $31.3 million, or $2.63 per basic common share and $2.58 per diluted common share, for the same period in 2022. The decrease was primarily due to a $9.3 million increase in other operating expenses resulting from the previously mentioned contingent loss recognition, and lower net interest income, partially offset by lower provision for credit losses.

•When adjusted for the $9.5 million contingent loss recognition (tax effected $7.3 million) net income available to common shareholders would have been $27.6 million, or $2.31 per basic common share and $2.27 per diluted common share, for the nine months ended September 30, 2023. Adjusted net income available to common shareholders and adjusted earnings per share are non-GAAP financial measures. Please refer to the table at the end of this release which reconciles net income available to common shareholders and earnings per share to adjusted net income available to common shareholders and adjusted earnings per share.

•Net interest income decreased 10.5% to $48.7 million for the nine months ended September 30, 2023, compared to $54.4 million for the same period in 2022.

•Non-interest income decreased $1.4 million, or 20.7%, to $5.2 million for the nine months ended September 30, 2023, compared to $6.6 million for the same period in 2022.

•Non-interest expense increased 63.9% to $29.0 million for the nine months ended September 30, 2023, compared to $17.7 million for the same period in 2022.

The following is a recap of the significant items that impacted the three and nine months ended September 30, 2023:

Interest income increased $6.8 million for the third quarter of 2023 compared to the same period in 2022, primarily due to an increase in interest and fees on loans of $6.4 million to $27.3 million, a 30.9% increase, primarily driven by an increase in average outstanding loan balances and higher market interest rates. Additionally, interest earned on average deposits held at the Federal Reserve Bank ("FRB") increased by $0.2 million to $1.5 million during the three months ended September 30, 2023, due to higher interest rates paid on such deposits. For the nine months ended September 30, 2023, interest income increased $19.9 million from the same period in 2022, primarily due to an increase in interest and fees on loans of $18.1 million to $77.6 million, a 30.4% increase, resulting from the same factors that drove the three month change.

Interest expense increased $10.4 million, or 341.5%, to $13.4 million for the three months ended September 30, 2023, compared to the same period in 2022, primarily due to higher market interest rates, combined with changes in the mix of deposits and increased borrowings. For the nine months ended September 30, 2023, interest expense increased $25.6 million, or 317.7%, to $33.7 million, primarily due to the same factors that drove the three month change.

The provision for credit losses was $0.3 million for the three months ended September 30, 2023, compared to $0.6 million for the same period in 2022. For the nine months ended September 30, 2023, the recovery of credit losses improved $1.6 million, compared to the provision of $1.0 million for the same period in 2022. The provision credit for the nine months ended September 30, 2023 was primarily related to decreases in loss

factors related to the commercial owner occupied, and residential 1 to 4 family investment portfolios from December 31, 2022, partially offset by increases in outstanding balance.

Non-interest income decreased $0.2 million, or 9.6%, for the three months ended September 30, 2023 compared to the same period in 2022, primarily as a result of a decrease in loan fees of $0.2 million, and a decrease in service fees on deposit accounts of $0.1 million, partially offset by a gain in other income of $0.2 million. For the nine months ended September 30, 2023, non-interest income decreased $1.4 million, or 20.7%, compared to the same period in 2022, to $5.2 million. The decrease was primarily driven by a $0.6 million decrease in service fees on deposit accounts, a $0.5 million decrease in loan fees, and a decrease in gain on sale of OREO of $0.3 million.

Non-interest expense increased $9.6 million, or 151.9%, for the three months ended September 30, 2023 compared to the same period in 2022, primarily driven by the recognition of a $9.5 million contingent loss related to cash that was stolen from a third-party armored car carrier facility that was used by the Company. The recognition of the loss during the quarter was driven by the completion of an outside forensic accountant's report confirming the loss. For the nine months ended September 30, 2023, non-interest expense increased $11.3 million, or 63.9%, to $29.0 million, compared to the same period in 2022. The increase in non-interest expense for the nine months ended September 30, 2023, was primarily driven by the $9.5 million write off discussed above, as well as an increase in compensation and benefits of $1.5 million, and an increase in OREO expense of $0.2 million. For the nine months ended September 30, 2023, the increase in compensation and benefits was primarily due to an increase in salary expense of $0.4 million, and a reduction in deferred loan origination costs of $0.8 million due to a decrease in the number of loans originated. The increase in OREO expense for that same period is mainly due to increases in legal, utilities, and real estate taxes related to our OREO portfolio.

Income tax expense decreased $3.6 million for the three months ended September 30, 2023 compared to the same period in 2022. For the nine months ended September 30, 2023 income tax expense decreased $4.7 million, compared to the same period in 2022. The effective tax rate for the three and nine months ended September 30, 2023 was 24.8% and 23.5%, respectively, compared to 27.0% and 25.9% for the same periods in 2022.

September 30, 2023 discussion of financial condition

•Total assets were flat at $1.98 billion at September 30, 2023 as compared to December 31, 2022.

•Cash and cash equivalents totaled $126.7 million at September 30, 2023, as compared to $182.2 million at December 31, 2022. The decrease in cash and cash equivalents was due to a decrease in deposits, an increase in loans receivable, and the write off of stolen cash that was held at the armored car service, partially offset by an increase in FHLBNY borrowings.

•The investment securities portfolio decreased to $16.6 million at September 30, 2023, from $18.7 million at December 31, 2022, a decrease of $2.2 million, or 11.5%, primarily due to pay downs of securities.

•Gross loans increased to $1.80 billion at September 30, 2023, from $1.75 billion at December 31, 2022, an increase of $48.6 million or 2.8%.

•Nonperforming loans at September 30, 2023 increased to $20.3 million, representing 1.13% of total loans, an increase of $4.1 million, or 25.1%, from $16.3 million of nonperforming loans at December 31, 2022. The increase in nonperforming loans was primarily due to the modification of two commercial real estate loans where unpaid interest and fees were capitalized to the loans principal balance, as well as the addition of three commercial real estate loans that became nonperforming during the nine months ended September 30, 2023. OREO at September 30, 2023 was $1.6 million, unchanged from December 31, 2022. Nonperforming assets (consisting of nonperforming loans and OREO) represented 1.10% and 0.90% of total assets at September 30, 2023 and December 31, 2022, respectively. Loans past due 30 to 89 days were $4.5 million at September 30, 2023, an increase of $4.3 million from December 31, 2022.

•The allowance for credit losses was $32.3 million at September 30, 2023, as compared to $31.8 million at December 31, 2022. The ratio of the allowance for credit losses to total loans was 1.80% and 1.82% at September 30, 2023 and at December 31, 2022, respectively. The ratio of allowance for credit losses to non-performing loans was 158.8% at September 30, 2023, compared to 195.7%, at December 31, 2022.

•Other assets increased $8.1 million during the nine months ended September 30, 2023, to $38.4 million at September 30, 2023 from $30.3 million at December 31, 2022, primarily driven by an increase of $1.6 million in restricted FHLBNY stock as a result of the increase in associated borrowings, and a $7.2 million increase in prepaid taxes.

•Total deposits were $1.53 billion at September 30, 2023, down from $1.58 billion at December 31, 2022, a decrease of $43.0 million or 2.7% compared to December 31, 2022. The decrease in deposits was attributed to a decrease in non-interest demand deposits of $121.4 million, and a decrease in savings deposits of $92.3 million, partially offset by an increase in interest checking deposits of $28.2 million, an increase in money market balances of $117.8 million, and an increase in time deposit balances of $24.8 million.

•Total borrowings increased $28.1 million during the nine months ended September 30, 2023, to $154.2 million at September 30, 2023 from $126.1 million at December 31, 2022, driven by $28.0 million in FHLBNY term borrowings.

.

•Total equity increased to $278.0 million at September 30, 2023, up from $266.0 million at December 31, 2022, an increase of $11.9 million, or 4.5%, primarily due to the retention of earnings, partially offset by the payment of $6.5 million of cash dividends and a $2.1 million charge to equity resulting from the adoption of ASC 326. Tangible book value per common share at September 30, 2023 was $23.23, compared to $22.24 at December 31, 2022.

CEO outlook and commentary

Vito S. Pantilione, President and Chief Executive Officer of Parke Bancorp, Inc. and Parke Bank, provided the following statement:

"We previously reported a suspected $9.5 million theft by one of the cash couriers utilized by our bank. We contracted with an outside accounting firm to provide forensic accounting services to confirm the amount stolen. The report was recently completed confirming the $9.5 million theft. Based on that report, we are able to book the loss this quarter. The final report also provides us with the necessary documentation to pursue possible sources for recovery, including insurance policies. We are aggressively pursuing these sources and will book any recovery when received. Although this theft is painful and was unexpected, we are fortunate to have the financial strength and earnings to absorb the loss. The strength of our company is evidenced by a Return on Average Assets of 1.38% and a Return on Average Equity of close to 10%, including this one time charge off."

"The continued challenges in the market and the economy worsened with the start of the war in Israel. The loss of life and the atrocities of the attack have generated outrage worldwide. The conflict continues to widen and threatens to include other bad players that could cause oil prices to increase significantly. These many factors combined have again brought the possibility of a recession to the forefront of many economic experts. Our loan portfolio has grown in 2023, although cautiously. We continue to maintain strong loan loss reserves as reflected by our allowance for credit losses to total loans of 1.8% at September 30, 2023"

"Industry and economic challenges will continue and may even worsen in the near term. It is the time for caution, while also watching for possible opportunities in the market. We continue to closely monitor any changes in the performance of our loan portfolio and are well structured to quickly react to any increase in delinquencies. Our primary focus remains operating a safe and sound bank while generating a good return for our shareholders. This includes maintaining tight controls of our expenses and being in a strong position to take advantage of any opportunity that may appear in the market."

Forward Looking Statement Disclaimer

This release may contain forward-looking statements. Such forward-looking statements are subject to risks and uncertainties which may cause actual results to differ materially from those currently anticipated due to a number of factors; our ability to maintain a strong capital base, strong earning and strict cost controls; our ability to generate strong revenues with increased interest income and net interest income;; our ability to continue the financial strength and growth of our Company and Parke Bank; our ability to continue to increase shareholders’ equity, maintain strong reserves and good credit quality; our ability to ensure our Company continues to have strong loan loss reserves; our ability to ensure that our loan loss provision is well positioned for the future; our ability to react quickly to any increase in loan delinquencies; our ability to face current challenges in the market; our ability to be well positioned to take advantage of opportunities; our ability to continue to reduce our nonperforming loans and delinquencies and the expenses associated with them; our ability to realize a high recovery rate on disposition of troubled assets; our ability to continue to pay a dividend in the future; our ability to enhance shareholder value in the future; our ability to continue growing our Company, our earnings and shareholders’ equity; and our ability to continue to grow our loan portfolio; the possibility of additional corrective actions or limitations on the operations of the Company. and Parke Bank being imposed by banking regulators, therefore, readers should not place undue reliance on any forward-looking statements. The Company does not undertake, and specifically disclaims, any obligations to publicly release the results of any revisions that may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such circumstance.

(PKBK-ER)

Financial Supplement:

Table 1: Condensed Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | |

| Parke Bancorp, Inc. and Subsidiaries |

| Condensed Consolidated Balance Sheets |

|

| September 30, | | December 31, |

| 2023 | | 2022 |

| (Dollars in thousands) |

| Assets | | | |

| Cash and cash equivalents | $ | 126,740 | | | $ | 182,150 | |

| Investment securities | 16,590 | | | 18,744 | |

| | | |

| Loans, net of unearned income | 1,800,023 | | | 1,751,459 | |

| Less: Allowance for credit losses | (32,319) | | | (31,845) | |

| Net loans | 1,767,704 | | | 1,719,615 | |

| Premises and equipment, net | 5,665 | | | 5,958 | |

| Bank owned life insurance (BOLI) | 28,587 | | | 28,145 | |

| Other assets | 38,386 | | | 30,303 | |

| Total assets | $ | 1,983,672 | | | $ | 1,984,915 | |

| | | |

| Liabilities and Equity | | | |

| | | |

| Non-interest bearing deposits | $ | 231,116 | | | $ | 352,546 | |

| Interest bearing deposits | 1,301,865 | | | 1,223,436 | |

| FHLBNY borrowings | 111,150 | | | 83,150 | |

| | | |

| Subordinated debentures | 43,063 | | | 42,921 | |

| Other liabilities | 18,499 | | | 16,828 | |

| Total liabilities | 1,705,693 | | | 1,718,881 | |

| | | |

| Total shareholders’ equity | 277,979 | | | 266,034 | |

| | | |

| Total equity | 277,979 | | | 266,034 | |

| | | |

| Total liabilities and equity | $ | 1,983,672 | | | $ | 1,984,915 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Table 2: Consolidated Income Statements (Unaudited) | | | | | | | |

| | For the three months ended September 30, | | For the nine months ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (Dollars in thousands, except per share data) |

| Interest income: | | | | | | | |

| Interest and fees on loans | $ | 27,294 | | | $ | 20,854 | | | $ | 77,602 | | | $ | 59,511 | |

| Interest and dividends on investments | 308 | | | 194 | | | 745 | | | 565 | |

| Interest on deposits with banks | 1,512 | | | 1,290 | | | 4,059 | | | 2,404 | |

| Total interest income | 29,114 | | | 22,338 | | | 82,406 | | | 62,480 | |

| Interest expense: | | | | | | | |

| Interest on deposits | 11,385 | | | 2,284 | | | 28,046 | | | 5,893 | |

| Interest on borrowings | 2,046 | | | 758 | | | 5,661 | | | 2,176 | |

| Total interest expense | 13,431 | | | 3,042 | | | 33,707 | | | 8,069 | |

| Net interest income | 15,683 | | | 19,296 | | | 48,699 | | | 54,411 | |

| (Recovery of) provision for credit losses | 300 | | | 600 | | | (1,600) | | | 950 | |

| Net interest income after provision for credit losses | 15,383 | | | 18,696 | | | 50,299 | | | 53,461 | |

| Non-interest income | | | | | | | |

| Service fees on deposit accounts | 1,003 | | | 1,133 | | | 3,149 | | | 3,762 | |

| Gain on sale of SBA loans | — | | | 76 | | | — | | | 98 | |

| Other loan fees | 192 | | | 422 | | | 611 | | | 1,138 | |

| Bank owned life insurance income | 153 | | | 144 | | | 443 | | | 424 | |

| Net gain on sale and valuation adjustment of OREO | 38 | | | — | | | 38 | | | 328 | |

| Other | 449 | | | 253 | | | 972 | | | 827 | |

| Total non-interest income | 1,835 | | | 2,028 | | | 5,213 | | | 6,577 | |

| Non-interest expense | | | | | | | |

| Compensation and benefits | 2,834 | | | 2,819 | | | 9,414 | | | 7,964 | |

| Professional services | 659 | | | 578 | | | 1,746 | | | 1,670 | |

| Occupancy and equipment | 649 | | | 621 | | | 1,938 | | | 1,891 | |

| Data processing | 368 | | | 348 | | | 1,037 | | | 985 | |

| FDIC insurance and other assessments | 388 | | | 265 | | | 960 | | | 811 | |

| OREO expense | 240 | | | 314 | | | 610 | | | 404 | |

| Other operating expense | 10,711 | | | 1,347 | | | 13,276 | | | 3,957 | |

| Total non-interest expense | 15,849 | | | 6,292 | | | 28,981 | | | 17,682 | |

| Income before income tax expense | 1,369 | | | 14,432 | | | 26,531 | | | 42,356 | |

| Income tax expense | 340 | | | 3,892 | | | 6,242 | | | 10,987 | |

| Net income attributable to Company | 1,029 | | | 10,540 | | | 20,289 | | | 31,369 | |

| | | | | | | |

| | | | | | | |

| Less: Preferred stock dividend | (7) | | | (7) | | | (20) | | | (20) | |

| Net income available to common shareholders | $ | 1,022 | | | $ | 10,533 | | | $ | 20,269 | | | $ | 31,349 | |

| Earnings per common share | | | | | | | |

| Basic | $ | 0.09 | | | $ | 0.88 | | | $ | 1.70 | | | $ | 2.63 | |

| Diluted | $ | 0.08 | | | $ | 0.87 | | | $ | 1.67 | | | $ | 2.58 | |

| Weighted average common shares outstanding | | | | | | | |

| Basic | 11,945,844 | | | 11,919,472 | | | 11,945,144 | | | 11,913,085 | |

| Diluted | 12,131,825 | | | 12,170,144 | | | 12,137,208 | | | 12,178,572 | |

Table 3: Operating Ratios

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Return on average assets | 0.21 | % | | 2.16 | % | | 1.38 | % | | 2.09 | % |

| Return on average common equity | 1.43 | % | | 16.44 | % | | 9.77 | % | | 17.06 | % |

| Interest rate spread | 2.24 | % | | 3.67 | % | | 2.51 | % | | 3.37 | % |

| Net interest margin | 3.21 | % | | 4.00 | % | | 3.40 | % | | 3.66 | % |

| Efficiency ratio* | 90.47 | % | | 29.51 | % | | 53.76 | % | | 28.99 | % |

* Efficiency ratio is calculated using non-interest expense divided by the sum of net interest income and non-interest income.

Table 4: Asset Quality Data

| | | | | | | | | | | |

| September 30, | | December 31, |

| 2023 | | 2022 |

| (Amounts in thousands except ratio data) |

| Allowance for credit losses on loans | $ | 32,319 | | | $ | 31,845 | |

| Allowance for credit losses to total loans | 1.80 | % | | 1.82 | % |

| Allowance for credit losses to non-accrual loans | 158.82 | % | | 195.66 | % |

| Non-accrual loans | $ | 20,349 | | | $ | 16,276 | |

| OREO | $ | 1,550 | | | $ | 1,550 | |

Non-GAAP Measures

This release references adjusted pre-tax income and adjusted earnings per basic common share which are non-GAAP financial measures. The following table reconciles pre-tax income and earnings per basic common share to adjusted pre-tax income and adjusted earnings per basic common share.

Reconciliation of GAAP to Non-GAAP Financial Measures

| | | | | | | | | | | | | | |

| (Dollars in thousands, except per share data) | | | | |

| Adjusted Pre-tax Income | | Q3 2023 | | YTD 2023 |

| GAAP net income available to common shareholders | | $ | 1,022 | | | $ | 20,269 | |

| Reconciling items: | | | | |

| Recognition of loss contingency | | 9,517 | | | 9,517 | |

| Tax expense | | (2,215) | | | (2,215) | |

| Adjusted net income available to common shareholders | | $ | 8,324 | | | $ | 27,571 | |

| | | | |

| | Three months ended | | Nine months ended |

| | September 30, 2023 | | September 30, 2023 |

| GAAP Earnings per Basic Common Share | | $ | 0.09 | | | $ | 1.70 | |

| After tax recognition of loss contingency | | 7,302 | | | 7,302 | |

| Basic weighted average shares of common | | 11,945,844 | | | 11,945,144 | |

| Adjustment to Basic Common Share | | 0.61 | | | 0.61 | |

| Adjusted Earnings per Basic Common Share | | $ | 0.70 | | | $ | 2.31 | |

| | | | |

| GAAP Earnings per Diluted Common Share | | $ | 0.08 | | | $ | 1.67 | |

| After tax recognition of loss contingency | | 7,302 | | | 7,302 | |

| Diluted weighted average shares of common | | 12,131,825 | | | 12,137,208 | |

| Adjustment to Diluted Common Share | | 0.60 | | | 0.60 | |

| Adjusted Earnings per Diluted Common Share | | $ | 0.68 | | | $ | 2.27 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

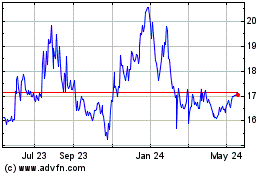

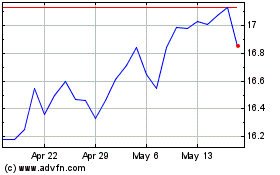

Parke Bancorp (NASDAQ:PKBK)

Historical Stock Chart

From Apr 2024 to May 2024

Parke Bancorp (NASDAQ:PKBK)

Historical Stock Chart

From May 2023 to May 2024