0001357459Q1--12-31false0001357459pali:TwoLakhFiftyOneThousandAndTwoHundredAndSixtyTwoCommonStockMember2024-03-310001357459us-gaap:WarrantMember2023-12-3100013574592024-01-012024-03-310001357459us-gaap:AccruedLiabilitiesMember2024-03-310001357459pali:LicenseAgreementsWithTheRegentsOfTheUniversityOfCaliforniaMember2023-03-310001357459pali:StockPurchaseWarrantsMember2024-01-012024-03-310001357459pali:MayTwoThousandTwentyTwoWarrantsMemberpali:WarrantInducementAgreementsMember2024-01-300001357459us-gaap:RetainedEarningsMember2024-03-310001357459us-gaap:CommonStockMember2023-12-310001357459us-gaap:PreferredStockMember2023-03-310001357459pali:OfficeSpaceLeaseForCorporateHeadquartersInCarlsbadCAMember2024-03-310001357459us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001357459pali:OfficeSpaceLeaseForCorporateHeadquartersInCarlsbadCAMember2024-01-012024-03-3100013574592023-07-012023-09-300001357459us-gaap:CommonStockMember2023-01-012023-03-310001357459pali:TheEsppMember2024-01-012024-03-310001357459us-gaap:WarrantMember2023-01-012023-03-310001357459srt:MinimumMemberus-gaap:CommonStockMember2024-01-012024-03-310001357459us-gaap:SubsequentEventMember2024-04-052024-04-050001357459us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-310001357459pali:CostReductionPlanMember2023-01-012023-03-310001357459pali:CostReductionPlanMember2024-01-012024-03-310001357459pali:January2023OfferingMember2023-01-012023-03-3100013574592023-10-272023-10-270001357459us-gaap:PrivatePlacementMemberus-gaap:SubsequentEventMember2024-05-010001357459pali:May2024PlacementAgentWarrantsMemberus-gaap:SubsequentEventMember2024-05-010001357459us-gaap:PreferredStockMember2022-12-310001357459us-gaap:AdditionalPaidInCapitalMemberpali:January2023OfferingMember2023-01-012023-03-310001357459pali:SeptemberTwoThousandAndTwentyThreeOfferingMember2023-09-112023-09-110001357459us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-310001357459pali:WarrantInducementAgreementsMember2024-01-302024-01-3000013574592024-03-3100013574592024-05-080001357459us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001357459us-gaap:AdditionalPaidInCapitalMember2022-12-310001357459us-gaap:CommonStockMember2023-03-310001357459us-gaap:RetainedEarningsMember2023-01-012023-03-310001357459pali:WarrantInducementAgreementsMember2024-01-300001357459srt:MaximumMemberus-gaap:CommonStockMember2024-01-012024-03-310001357459pali:OfficeSpaceLeaseForCorporateHeadquartersInCarlsbadCAMember2023-01-012023-03-310001357459pali:LicenseAgreementsWithTheRegentsOfTheUniversityOfCaliforniaMembersrt:MinimumMember2024-03-310001357459pali:LicenseAgreementsWithTheRegentsOfTheUniversityOfCaliforniaMember2024-01-012024-03-310001357459us-gaap:CommonStockMemberpali:WarrantInducementAgreementsMember2024-01-012024-03-310001357459pali:January2023OfferingMemberus-gaap:CommonStockMember2023-01-012023-03-310001357459pali:ReplacementWarrantsMember2024-02-010001357459pali:LicenseAgreementsWithTheRegentsOfTheUniversityOfCaliforniaMember2023-10-200001357459pali:The2021EsppMember2024-01-012024-03-3100013574592022-12-310001357459us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001357459pali:CostReductionPlanTwentyTwentyThreeMember2024-03-310001357459us-gaap:AccruedLiabilitiesMember2023-12-310001357459us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310001357459pali:Series2WarrantsMemberpali:WarrantInducementAgreementsMember2024-01-300001357459pali:Nsi532Igf1Member2022-10-272022-10-270001357459us-gaap:RetainedEarningsMember2022-12-310001357459us-gaap:RetainedEarningsMember2024-01-012024-03-3100013574592023-01-012023-12-310001357459us-gaap:RetainedEarningsMember2023-03-310001357459us-gaap:CommonStockMember2024-03-310001357459us-gaap:WarrantMember2023-03-310001357459srt:MaximumMemberpali:The2021EsppMember2024-01-012024-03-310001357459pali:CostReductionPlanMember2022-09-090001357459pali:WarrantInducementAgreementsMemberpali:JanuaryTwoThousandTwentyThreeWarrantsMember2024-01-300001357459us-gaap:CommonStockMember2022-12-310001357459pali:PlacementAgentWarrantsMember2024-01-300001357459pali:TheEsppMember2023-01-012023-03-310001357459us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001357459pali:LicenseAgreementsWithTheRegentsOfTheUniversityOfCaliforniaMember2024-03-310001357459us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-03-310001357459us-gaap:WarrantMember2024-01-012024-03-310001357459pali:InsuranceFinancingArrangementMember2024-01-012024-03-310001357459us-gaap:SeriesAPreferredStockMember2023-12-310001357459us-gaap:ResearchAndDevelopmentExpenseMemberpali:LicenseAgreementsWithTheRegentsOfTheUniversityOfCaliforniaMember2023-03-310001357459pali:OfficeSpaceLeaseForCorporateHeadquartersInCarlsbadCAMember2022-05-120001357459pali:MayTwoThousandTwentyFourOfferingMemberus-gaap:SubsequentEventMember2024-05-062024-05-060001357459pali:SeriesAConvertiblePreferredStockMember2024-01-012024-03-310001357459us-gaap:AdditionalPaidInCapitalMemberpali:WarrantInducementAgreementsMember2024-01-012024-03-310001357459pali:WarrantInducementAgreementsMember2024-01-012024-03-310001357459us-gaap:AdditionalPaidInCapitalMember2023-12-310001357459pali:CostReductionPlanTwentyTwentyThreeMember2024-01-012024-03-310001357459us-gaap:SubsequentEventMemberus-gaap:CommonStockMember2024-04-052024-04-050001357459us-gaap:WarrantMember2024-01-012024-03-310001357459us-gaap:RetainedEarningsMember2023-12-310001357459us-gaap:CommonStockMember2024-01-012024-03-310001357459pali:SeriesA4Point5PercentConvertiblePreferredStockMember2024-03-310001357459us-gaap:PreferredStockMember2023-12-310001357459pali:CostReductionPlanTwentyTwentyThreeMember2023-01-012023-03-310001357459us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001357459us-gaap:RestrictedStockUnitsRSUMember2024-03-3100013574592023-09-300001357459pali:InsuranceFinancingArrangementMember2024-03-310001357459us-gaap:PreferredStockMember2024-03-310001357459us-gaap:AdditionalPaidInCapitalMember2024-03-310001357459srt:MaximumMemberpali:LicenseAgreementsWithTheRegentsOfTheUniversityOfCaliforniaMember2024-03-310001357459pali:AprilTwoThousandTwentyThreeWarrantsMemberpali:WarrantInducementAgreementsMember2024-01-300001357459pali:JanuaryTwoThousandAndTwentyThreeOfferingMember2023-01-042023-01-040001357459us-gaap:AdditionalPaidInCapitalMember2023-03-310001357459us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-3100013574592020-12-162023-12-160001357459pali:SeriesAConvertiblePreferredStockMember2023-01-012023-03-310001357459us-gaap:PrivatePlacementMemberus-gaap:SubsequentEventMemberpali:PreFundedWarrantsMember2024-05-010001357459pali:EquityIncentivePlanMember2024-03-310001357459srt:MinimumMember2020-12-162023-12-160001357459us-gaap:SeriesAPreferredStockMember2024-03-3100013574592023-01-012023-03-310001357459pali:WarrantInducementAgreementsMember2024-02-012024-02-010001357459us-gaap:ResearchAndDevelopmentExpenseMemberpali:LicenseAgreementsWithTheRegentsOfTheUniversityOfCaliforniaMember2024-03-3100013574592023-12-310001357459pali:MayTwoThousandTwentyFourOfferingMemberus-gaap:SubsequentEventMemberpali:UnregisteredSharesMember2024-05-010001357459pali:NineThousandFourHundredAndFourteenCommonStockMember2024-03-310001357459us-gaap:WarrantMember2024-03-310001357459us-gaap:WarrantMember2023-01-012023-03-310001357459us-gaap:MeasurementInputDiscountRateMember2024-03-3100013574592023-03-310001357459pali:MayTwoThousandTwentyFourOfferingMemberus-gaap:SubsequentEventMember2024-05-012024-05-010001357459pali:InsuranceFinancingArrangementMember2023-12-310001357459srt:MinimumMember2024-01-012024-03-310001357459pali:ThirtyFourThousandAndSixHundredAndFourtySixCommonStockMember2024-03-310001357459us-gaap:StockOptionMember2023-01-012023-03-310001357459us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001357459pali:AprilTwoThousandAndTwentyThreeOfferingMember2023-04-032023-04-030001357459us-gaap:WarrantMember2022-12-310001357459pali:PlacementAgentWarrantsMember2024-01-302024-01-30xbrli:purexbrli:sharespali:Segmentiso4217:USDpali:Agreement

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-33672

PALISADE BIO, INC.

(Exact name of registrant as specified in its charter)

|

|

Delaware |

52-2007292 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

|

|

7750 El Camino Real, Suite 2A Carlsbad, California |

92009 |

(Address of principal executive offices) |

(Zip Code) |

(858) 704-4900

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.01 par value |

|

PALI |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 8, 2024, there were 937,562 shares of common stock, $0.01 par value, outstanding.

Palisade Bio, Inc.

Table of Contents

PART I

FINANCIAL INFORMATION

ITEM 1. UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Palisade Bio, Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

11,276 |

|

|

$ |

12,432 |

|

Prepaid expenses and other current assets |

|

|

737 |

|

|

|

896 |

|

Total current assets |

|

|

12,013 |

|

|

|

13,328 |

|

Restricted cash |

|

|

26 |

|

|

|

26 |

|

Property and equipment, net |

|

|

5 |

|

|

|

10 |

|

Operating lease right-of-use asset |

|

|

170 |

|

|

|

198 |

|

Other noncurrent assets |

|

|

438 |

|

|

|

490 |

|

Total assets |

|

$ |

12,652 |

|

|

$ |

14,052 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

459 |

|

|

$ |

698 |

|

Accrued liabilities |

|

|

1,670 |

|

|

|

831 |

|

Accrued compensation and benefits |

|

|

213 |

|

|

|

778 |

|

Current portion of operating lease liability |

|

|

125 |

|

|

|

121 |

|

Insurance financing debt |

|

|

— |

|

|

|

158 |

|

Total current liabilities |

|

|

2,467 |

|

|

|

2,586 |

|

Warrant liability |

|

|

2 |

|

|

|

2 |

|

Contingent consideration obligation |

|

|

61 |

|

|

|

61 |

|

Operating lease liability, net of current portion |

|

|

58 |

|

|

|

90 |

|

Total liabilities |

|

|

2,588 |

|

|

|

2,739 |

|

Commitments and contingencies (Note 8) |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Series A Convertible Preferred Stock, $0.01 par value,

7,000,000 shares authorized; 200,000 issued and

outstanding at March 31, 2024 and December 31, 2023 |

|

|

2 |

|

|

|

2 |

|

Common stock, $0.01 par value; 280,000,000 shares authorized;

851,302 and 618,056 shares issued and outstanding

at March 31, 2024 and December 31, 2023, respectively |

|

|

8 |

|

|

|

6 |

|

Additional paid-in capital |

|

|

135,087 |

|

|

|

132,811 |

|

Accumulated deficit |

|

|

(125,033 |

) |

|

|

(121,506 |

) |

Total stockholders' equity |

|

|

10,064 |

|

|

|

11,313 |

|

Total liabilities and stockholders' equity |

|

$ |

12,652 |

|

|

$ |

14,052 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

Palisade Bio, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

License revenue |

|

$ |

— |

|

|

$ |

250 |

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

|

2,214 |

|

|

|

1,241 |

|

General and administrative |

|

|

1,459 |

|

|

|

1,538 |

|

Total operating expenses |

|

|

3,673 |

|

|

|

2,779 |

|

Loss from operations |

|

|

(3,673 |

) |

|

|

(2,529 |

) |

Other (expense) income: |

|

|

|

|

|

|

Interest expense |

|

|

(1 |

) |

|

|

— |

|

Other income |

|

|

147 |

|

|

|

189 |

|

Total other income, net |

|

|

146 |

|

|

|

189 |

|

Net loss |

|

$ |

(3,527 |

) |

|

$ |

(2,340 |

) |

|

|

|

|

|

|

|

Basic and diluted weighted average shares used in computing

basic and diluted net loss per common share* |

|

|

768,137 |

|

|

|

287,702 |

|

Basic and diluted net loss per common share* |

|

$ |

(4.59 |

) |

|

$ |

(8.13 |

) |

(*) Basic and diluted loss per common share and basic and diluted weighted average share used in computing basic and diluted loss per common share for the three months ended March 31, 2023 has been adjusted to reflect the 1-for-15 reverse stock split effected on April 5, 2024.

The accompanying notes are an integral part of these condensed consolidated financial statements.

Palisade Bio, Inc.

Condensed Consolidated Statements of Stockholders’ Equity

(in thousands, except share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2024 |

|

|

|

Preferred Stock |

|

|

Common Stock |

|

|

Additional

Paid-in

Capital* |

|

|

Accumulated

Deficit |

|

|

Total

Stockholders'

Equity |

|

|

|

Shares |

|

|

Amount |

|

|

Shares* |

|

|

Amount* |

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2023 |

|

|

200,000 |

|

|

$ |

2 |

|

|

|

618,056 |

|

|

$ |

6 |

|

|

$ |

132,811 |

|

|

$ |

(121,506 |

) |

|

$ |

11,313 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,527 |

) |

|

|

(3,527 |

) |

Stock-based compensation expense and related charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

118 |

|

|

|

— |

|

|

|

118 |

|

Issuance of common stock for vesting of restricted stock units |

|

|

— |

|

|

|

— |

|

|

|

5,186 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Issuance of common stock in connection with warrant inducement, net of issuance costs of $2,412 (Note 5) |

|

|

— |

|

|

|

— |

|

|

|

228,162 |

|

|

|

2 |

|

|

|

2,158 |

|

|

|

— |

|

|

|

2,160 |

|

Reverse stock split fractional share settlement |

|

|

— |

|

|

|

— |

|

|

|

(102 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Balance, March 31, 2024 |

|

|

200,000 |

|

|

$ |

2 |

|

|

|

851,302 |

|

|

$ |

8 |

|

|

$ |

135,087 |

|

|

$ |

(125,033 |

) |

|

$ |

10,064 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2023 |

|

|

|

Preferred Stock |

|

|

Common Stock |

|

|

Additional

Paid-in

Capital* |

|

|

Accumulated

Deficit |

|

|

Total

Stockholders'

Equity |

|

|

|

Shares |

|

|

Amount |

|

|

Shares* |

|

|

Amount* |

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2022 |

|

|

200,000 |

|

|

$ |

2 |

|

|

|

196,287 |

|

|

$ |

2 |

|

|

$ |

121,665 |

|

|

$ |

(109,190 |

) |

|

$ |

12,479 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,340 |

) |

|

|

(2,340 |

) |

Stock-based compensation expense and related charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

93 |

|

|

|

— |

|

|

|

93 |

|

Issuance of common stock in connection with exercise of warrants |

|

|

— |

|

|

|

— |

|

|

|

76,188 |

|

|

|

1 |

|

|

|

1,348 |

|

|

|

— |

|

|

|

1,349 |

|

Issuance of common stock and warrants in January 2023 Offering, net of issuance costs of $507 |

|

|

— |

|

|

|

— |

|

|

|

31,789 |

|

|

|

— |

|

|

|

2,166 |

|

|

|

— |

|

|

|

2,166 |

|

Balance, March 31, 2023 |

|

|

200,000 |

|

|

$ |

2 |

|

|

|

304,264 |

|

|

$ |

3 |

|

|

$ |

125,272 |

|

|

$ |

(111,530 |

) |

|

$ |

13,747 |

|

(*) Adjusted to reflect the 1-for-15 reverse stock split effected on April 5, 2024.

The accompanying notes are an integral part of these condensed consolidated financial statements.

Palisade Bio, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

Net loss |

|

$ |

(3,527 |

) |

|

$ |

(2,340 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation |

|

|

1 |

|

|

|

1 |

|

Non-cash operating lease expense |

|

|

28 |

|

|

|

25 |

|

Recurring fair value measurements of liabilities |

|

|

— |

|

|

|

(43 |

) |

Loss on disposal of property and equipment |

|

|

4 |

|

|

|

— |

|

Stock-based compensation and related charges |

|

|

118 |

|

|

|

93 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

— |

|

|

|

(250 |

) |

Prepaid and other current assets and other noncurrent assets |

|

|

174 |

|

|

|

278 |

|

Accounts payable and accrued liabilities |

|

|

615 |

|

|

|

(970 |

) |

Accrued compensation and benefits |

|

|

(565 |

) |

|

|

(295 |

) |

Operating lease liabilities |

|

|

(28 |

) |

|

|

(25 |

) |

Net cash used in operating activities |

|

|

(3,180 |

) |

|

|

(3,526 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Payments on insurance financing debt |

|

|

(158 |

) |

|

|

(88 |

) |

Proceeds from issuance of common stock and warrants |

|

|

— |

|

|

|

2,231 |

|

Proceeds from the exercise of warrants |

|

|

2,503 |

|

|

|

2,710 |

|

Payment of warrant inducement issuance costs |

|

|

(321 |

) |

|

|

— |

|

Payment of equity issuance costs |

|

|

— |

|

|

|

(413 |

) |

Net cash provided by financing activities |

|

|

2,024 |

|

|

|

4,440 |

|

Net (decrease) increase in cash, cash equivalents and restricted cash |

|

|

(1,156 |

) |

|

|

914 |

|

Cash, cash equivalents and restricted cash, beginning of year |

|

|

12,458 |

|

|

|

12,409 |

|

Cash, cash equivalents and restricted cash, end of period |

|

$ |

11,302 |

|

|

$ |

13,323 |

|

Reconciliation of cash, cash equivalents and restricted cash to the balance sheets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

11,276 |

|

|

$ |

13,297 |

|

Restricted cash |

|

|

26 |

|

|

|

26 |

|

Total cash, cash equivalents and restricted cash |

|

$ |

11,302 |

|

|

$ |

13,323 |

|

Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

Interest paid |

|

$ |

2 |

|

|

$ |

— |

|

Supplemental disclosures of non-cash investing and financing activities: |

|

|

|

|

|

|

Warrant inducement and equity issuance costs included in accounts payable and accrued liabilities |

|

$ |

22 |

|

|

$ |

12 |

|

Fair value of warrants issued to solicitation agent |

|

|

94 |

|

|

|

|

Fair value of warrants issued to placement agent |

|

|

— |

|

|

|

173 |

|

Cash receivable for exercises of warrants included in prepaid and other current assets |

|

|

— |

|

|

|

48 |

|

Incremental fair value of modified warrants (Note 5) |

|

|

1,975 |

|

|

|

— |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

PALISADE BIO, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Organization, Business and Financial Condition

As used in this Quarterly Report on Form 10-Q, unless the context indicates or otherwise requires, “Palisade,” “Palisade Bio,” the "Company,” “we,” “us,” and “our” or similar designations in this report refer to Palisade Bio, Inc., a Delaware Corporation, and its subsidiaries. Any reference to “common shares” or “common stock,” refers to the Company's $0.01 par value common stock. Any reference to “Series A Preferred Stock” refers to the Company's Series A 4.5% Convertible Preferred Stock. Any reference to “Leading Biosciences, Inc.” or “LBS” refers to the Company’s operations prior to the completion of its merger with Seneca Biopharma, Inc. ("Seneca") on April 27, 2021 (the "Merger"). Any reference herein that refers to pre-clinical studies also refers to nonclinical studies.

Description of Business

The Company is a pre-clinical stage biotechnology company focused on developing and advancing novel therapeutics for patients living with autoimmune, inflammatory, and fibrotic diseases. The Company's lead product candidate, PALI-2108, is being developed as a therapeutic for patients living with inflammatory bowel disease ("IBD"), including ulcerative colitis and Crohn's disease.

Liquidity and Going Concern

The Company has a limited operating history, and the sales and income potential of the Company’s business and market are unproven. The Company has experienced losses and negative cash flows from operations since its inception. As of March 31, 2024, the Company had an accumulated deficit of $125.0 million and cash and cash equivalents of approximately $11.3 million. The Company expects to continue to incur losses in the foreseeable future. The successful transition to achieving profitability is dependent upon achieving a level of revenues adequate to support the Company’s costs. There can be no assurances that such profitability will ever be achieved.

Based on the Company’s current working capital, anticipated operating expenses, and anticipated net operating losses, there is substantial doubt about the Company's ability to continue as a going concern for a period of one year following the date that these condensed consolidated financial statements are issued. The condensed consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and settlement of liabilities in the normal course of business. The condensed consolidated financial statements do not include any adjustments for the recovery and classification of assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Historically, the Company has funded its operations primarily through a combination of debt and equity financings. The Company plans to continue to fund its operations through its cash and cash equivalents on hand, as well as through future equity offerings, debt financings, other third-party funding, and potential licensing or collaboration arrangements. Refer to Note 5, Stockholders' Equity, for discussion of the recent financings undertaken by the Company. There can be no assurance that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to the Company. Even if the Company is successful in raising additional capital, it may also be required to modify, delay or abandon some of its plans, which could have a material adverse effect on the Company’s business, operating results and financial condition and the Company’s ability to achieve its intended business objectives. Any of these occurrences could materially harm the Company’s business, results of operations and future prospects.

2. Summary of Significant Accounting Policies

Basis of Presentation and Consolidation

In management’s opinion, the accompanying interim condensed consolidated financial statements include all adjustments, consisting of normal recurring adjustments, which are necessary to present fairly the Company's financial position, results of operations and cash flows. The interim results of operations are not necessarily indicative of the results that may occur for the full year. Certain information and note disclosures normally included in the consolidated financial statements prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) have been condensed or omitted pursuant to instructions, rules and regulations prescribed by the U.S. Securities and Exchange Commission (“SEC”). The Company believes that the disclosures provided herein are adequate to make the information presented not misleading when these condensed consolidated financial statements are read in conjunction with the consolidated financial statements and notes included in the Company’s financial statements filed in the Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on March 26, 2024.

The accompanying condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, LBS and Suzhou Neuralstem Biopharmaceutical Co., Ltd. All the entities are consolidated in the Company's condensed consolidated financial statements and all intercompany activity and transactions, if any, have been eliminated.

Reverse Stock Split

On April 5, 2024, the Company effected a 1-for-15 reverse stock split of its issued and outstanding common stock (the "Reverse Stock Split"). As a result of the Reverse Stock Split, each of the Company’s stockholders received one share of common stock for every 15 shares such stockholder held immediately prior to the effective time of the Reverse Stock Split. The Reverse Stock Split affected all the Company’s issued and outstanding shares of common stock equally. The par value and authorized shares of the Company's common stock were not adjusted as a result of the Reverse Stock Split. The Reverse Stock Split also affected the Company’s outstanding stock-based awards, common stock warrants, and other exercisable or convertible securities and resulted in the shares underlying such instruments being reduced and the exercise price or conversion price being increased proportionately. Unless otherwise noted, all common stock shares, common stock per share data and shares of common stock underlying convertible preferred stock, stock-based award and common stock warrants included in these condensed consolidated financial statements, including the exercise price or conversion price of such equity instruments, as applicable, have been retrospectively adjusted to reflect the Reverse Stock Split for all periods presented.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires the Company to make estimates, judgments, and assumptions that impact the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as of the date of the balance sheet, and the reported amounts of expenses during the reporting period. The most significant estimates in the Company’s condensed consolidated financial statements relate to accrued research and development expenses and its contingent consideration obligation. Although these estimates are based on the Company’s knowledge of current events and actions it may undertake in the future, actual results may materially differ from these estimates and assumptions.

Segment Information

Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision maker, which is the Company's Chief Executive Officer, to make decisions regarding resource allocation and assessing performance. The Company views its operations and manages its business as one operating segment, which is the Company's one reportable segment.

Cash and Cash Equivalents

Cash and cash equivalents represent cash in readily available checking and money market accounts. The Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents.

Restricted Cash

As of March 31, 2024 and December 31, 2023, the Company held restricted cash of $26,000, in a separate restricted bank account as collateral for the Company’s corporate credit card program. The Company has classified these deposits as long-term restricted cash on its condensed consolidated balance sheets.

Deferred Equity Issuance Costs

Deferred equity issuance costs consist of the legal, accounting and other direct and incremental costs incurred by the Company related to its equity offerings, if not yet finalized as of the balance sheet date, or shelf registration statement. As of March 31, 2024 and December 31, 2023, deferred equity issuance costs of $75,000 and $112,000, respectively, were included in prepaid expenses and other current assets in the condensed consolidated balance sheets. These costs will be netted against additional paid-in capital as a cost of the future equity issuances to which they relate. During the three months ended March 31, 2024, the Company netted previously deferred equity issuance costs of approximately $37,000 against the additional paid-in capital recognized in conjunction with the warrant inducement transaction that closed on February 1, 2024 (see Note 5, Stockholders' Equity).

Concentration of Credit Risk

Financial instruments, which potentially subject the Company to concentration of credit risk, consist primarily of cash and cash equivalents. The Company maintains deposits in federally insured financial institutions and in money market accounts, and at times balances may exceed federally insured limits. Management believes that the Company is not exposed to significant credit risk due to the financial position of the depository institutions in which those deposits are held nor has the Company experienced any losses in these accounts.

Fair Value of Financial Instruments

The Company’s financial instruments consist principally of cash and cash equivalents, restricted cash, other current receivables, accounts payable, accrued liabilities, insurance financing debt, liability-classified warrants and a contingent consideration obligation. The carrying amounts of financial instruments such as cash and cash equivalents, restricted cash, other current receivables, accounts payable, and accrued liabilities approximate their related fair values due to the short-term nature of these instruments. The Company invests its excess cash in money market funds that are classified as level 1 in the fair value hierarchy defined below, due to their short-term maturity, and measured the fair value based on quoted prices in active markets for identical assets. The carrying value of the Company’s insurance financing debt as of December 31, 2023 approximates its fair value due to the market rate of interest, which is based on level 2 inputs. The Company’s liability-classified common stock warrants and its contingent consideration obligation is carried at fair value based on level 3 inputs as defined below. None of the Company’s non-financial assets or liabilities are recorded at fair value on a nonrecurring basis.

The Company follows Accounting Standards Codification ("ASC") 820, Fair Value Measurements and Disclosures, which among other things, defines fair value, establishes a consistent framework for measuring fair value and expands disclosure for each major asset and liability category measured at fair value on either a recurring or nonrecurring basis. Fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement determined based on assumptions that market participants would use in pricing an asset or liability.

As a basis for considering such assumptions, a three-tier fair value hierarchy has been established, which prioritizes the inputs used in measuring fair value as follows:

(1)Level 1: observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities;

(2)Level 2: inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

(3)Level 3: unobservable inputs for which there is little or no market data, which require the reporting entity to develop its own assumptions, which reflect those that a market participant would use.

Further information on the fair value of the Company's liability-classified common stock warrants and its contingent consideration obligation can be found in Note 4, Fair Value Measurements.

Derivative Financial Instruments

The Company does not use derivative instruments to hedge exposures to cash flow, market, or foreign currency risks. The Company evaluates its financial instruments, including warrants, to determine if such instruments are derivatives or contain features that qualify as embedded derivatives. The Company values its derivatives using the Black-Scholes option pricing model or other acceptable valuation models, including the Monte-Carlo simulation model. Derivative instruments are valued at inception, upon events such as an exercise of the underlying financial instrument, and at subsequent reporting periods. The classification of derivative instruments, including whether such instruments should be recorded as liabilities, is reassessed at the end of each reporting period.

The Company reviews the terms of debt instruments, equity instruments, and other financing arrangements to determine whether there are embedded derivative features, including embedded conversion options that are required to be bifurcated and accounted for separately as a derivative financial instrument. Additionally, in connection with the issuance of financing instruments, the Company may issue freestanding options and warrants.

The Company accounts for its common stock warrants in accordance with ASC 480, Distinguishing Liabilities from Equity ("ASC 480") and ASC 815, Derivatives and Hedging (“ASC 815”). Based upon the provisions of ASC 480 and ASC 815, the Company accounts for common stock warrants as liabilities if the warrant requires net cash settlement or gives the holder the option of net cash settlement, or if it fails the equity classification criteria. The Company accounts for common stock warrants as equity if the contract requires physical settlement or net physical settlement or if the Company has the option of physical settlement or net physical settlement and the warrants meet the requirements to be classified as equity. Common stock warrants classified as liabilities are initially recorded at fair value on the grant date and remeasured at fair value at each balance sheet date with the offsetting adjustments recorded in change in fair value of warrant liability within the condensed consolidated statements of operations. If the terms of a common stock warrant previously classified as a liability are amended and pursuant to such amendment meet the requirements to be classified as equity, the common stock warrants are reclassified to equity at the fair value on the date of the amendment and are not subsequently remeasured. Common stock warrants classified as equity are recorded on a relative fair value basis when they are issued with other equity-classified financial instruments.

Leases

In accordance with ASC 842, Leases, the Company assesses contracts for lease arrangements at inception. Operating right-of-use (“ROU”) assets and operating lease liabilities are recognized at the lease commencement date equal to the present value of future lease payments using the implicit, if readily available, or incremental borrowing rate based on the information readily available at the commencement date. ROU assets include any lease payments as of commencement and initial direct costs but exclude any lease incentives. Lease and non-lease components are generally accounted for separately and the Company recognizes operating lease expense straight-line over the term of the lease.

The Company uses the revenue recognition guidance established by ASC 606, Revenue From Contracts With Customers (“ASC 606”). When an agreement falls under the scope of other standards, such as ASC 808, Collaborative Arrangements, the Company will apply the recognition, measurement, presentation, and disclosure guidance in ASC 606 to the performance obligations in the agreements if those performance obligations are with a customer. The Company currently does not have any collaborative arrangements with counterparties that are also considered customers. For arrangements that include amounts to be paid to the Company upon the achievement of certain development milestones of technology licensed by the Company, the Company recognizes such license revenue using the most likely method. At the end of each reporting period, the Company re-evaluates the probability or achievement of any potential milestones and any related constraints, and if necessary, adjusts its estimates of the overall transaction price. Any such adjustments are recorded on a cumulative catch-up basis, which would affect revenue in the period of adjustment.

Contingent Consideration Obligations

On September 1, 2023, the Company and Giiant Pharma, Inc. ("Giiant") entered into a research collaboration and license agreement (the “Giiant License Agreement”)(see Note 7, Collaborations and License Agreements). Pursuant to the Giiant License Agreement, the Company incurred a contingent consideration obligation consisting of milestone payments, which are recognized as a liability measured at fair value, and ongoing royalty payments of a mid-single-digit percentage of the adjusted gross proceeds, as defined in the Giiant License Agreement, upon the sales or sublicenses third parties of any products developed from the assets licensed under the Giiant License Agreement. Because the contingent consideration associated with the milestone payments may be settled in shares of the Company's common stock solely at the election of the Company, the Company has determined it should be accounted for under ASC 480 and accordingly the Company has recognized it as a liability measured at its estimated fair value. At the end of each reporting period, the Company re-measures the contingent consideration obligation to its estimated fair value and any resulting change is recognized in research and development expenses in the condensed consolidated statements of operations. The Company has determined that the contingent consideration associated with the royalty payments should be recognized as a liability when they are probable and estimable, in accordance with ASC 450, Contingencies.

Research and Development Costs

Research and development expenses consist primarily of salaries and other personnel related expenses including stock-based compensation costs, and, to the extent applicable, may include pre-clinical costs, clinical trial costs, costs related to acquiring and manufacturing clinical trial materials, and contract services. All research and development costs are expensed as incurred. Pursuant to situations whereby the Company performs any research and development or manufacturing activities under a co-development agreement, the Company records the expense reimbursements from the co-development partner as a reduction to research and development expense once the reimbursement amount is approved for payment by the co-development partner. Expense payments made to Giiant pursuant to the terms of the Giiant License Agreement for qualifying development costs are expensed only as the associated research and development costs are incurred or other aspects of the drug development or related activities are achieved. In instances where the expense determined to be recognized exceeds the payments made to Giiant, the Company recognizes an accrual of joint development expenses. In addition, there may be instances in which payments made to Giiant will temporarily exceed the level of services provided, which results in a prepayment of the joint development expenses.

Patent Costs

Costs related to filing and pursuing patent applications (including direct application fees, and the legal and consulting expenses related to making such applications) are expensed as incurred, as recoverability of such expenditures is uncertain. These costs are included in general and administrative expenses in the condensed consolidated statements of operations.

Income Taxes

The Company follows ASC 740, Income Taxes, or ASC Topic 740 (“ASC 740”), in reporting deferred income taxes. ASC 740 requires a company to recognize deferred tax assets and liabilities for expected future income tax consequences of events that have been recognized in the Company’s condensed consolidated financial statements. Under this method, deferred tax assets and liabilities are determined based on temporary differences between financial statement carrying amounts and the tax basis of assets and liabilities using enacted tax rates in the years in which the temporary differences are expected to reverse. Valuation allowances are provided if, based on the weight of available evidence, it is more likely than not that some of or all the deferred tax assets will not be realized.

The Company accounts for uncertain tax positions pursuant to ASC 740, which prescribes a recognition threshold and measurement process for financial statement recognition of uncertain tax positions taken or expected to be taken in a tax return. If the tax position meets this threshold, the benefit to be recognized is measured as the tax benefit having the highest likelihood of being realized upon ultimate settlement with the taxing authority. The Company recognizes interest accrued related to unrecognized tax benefits and penalties in the provision for income taxes.

Stock-Based Compensation

The Company’s stock-based compensation expense generally includes service-based restricted stock units (“RSUs”), stock options, and market-based performance RSUs (“PSUs”). The Company accounts for forfeitures as they occur

for each type of award as a reduction of expense. Stock-based compensation expense related to service-based RSUs is based on the market value of the underlying stock on the date of grant and the related expense is recognized ratably over the requisite service period, which is usually the vesting period. The Company estimates the fair value of employee and non-employee stock option grants using the Black-Scholes option pricing model. The determination of the fair value of stock-based payment awards on the date of grant using the Black-Scholes option pricing model is affected by the Company's stock price as well as assumptions, which include the expected term of the award, the expected stock price volatility, risk-free interest rate, and expected dividends over the expected term of the award. Stock-based compensation expense represents the cost of the estimated grant date fair value of employee and non-employee stock option grants recognized ratably over the requisite service period of the awards, which is usually the vesting period. For PSUs with vesting subject to market conditions, the fair value of the award is determined at grant date using the Monte Carlo simulation model, and expense is recognized ratably over the derived service period regardless of whether the market condition is satisfied. The Monte Carlo simulation model considers a variety of potential future scenarios under the market condition vesting criteria, including but not limited to share prices for the Company and its peer companies in a selected market index.

The Company does not recognize any share-based compensation expense related to conditional RSUs, stock options, or PSUs that are subject to stockholder approval. When and if approval is obtained, the Company recognizes share-based compensation expense related to the conditional equity grants ratably to the vesting of shares over the remaining requisite service period.

The Company offers to its employees an opportunity to participate in its shareholder approved Palisade Bio, Inc. 2021 Employee Stock Purchase Plan (the "ESPP"). All employees are eligible to participate in the ESPP while employed by the Company. The ESPP permits eligible employees to purchase common stock through payroll deductions, which may not exceed $25,000 or 666 shares of the Company's shares of common stock each offering period, as defined in the ESPP, at a price equal to 85% of the fair value of the Company's common stock at the beginning or end of the offering period, whichever is lower. The ESPP is intended to qualify under Section 423 of the Internal Revenue Code.

The Company estimates the fair value of ESPP awards on the first day of the offering period using the Black-Scholes option pricing model. The estimated fair value of ESPP awards is amortized on a straight-line basis over the requisite service period of the award. The Company reviews, and when deemed appropriate, updates the assumptions used on a periodic basis. The Company utilizes its estimated volatility in the Black-Scholes option pricing model to determine the fair value of ESPP awards.

Basic and Diluted Net Loss Per Common Share

Basic net loss per common share is computed by dividing net loss available to common stockholders by the weighted average number of shares of common stock outstanding during the period. Diluted net loss per share is calculated by dividing the net loss available to common stockholders by the weighted-average number of shares of common stock outstanding during the period, plus any potentially dilutive common shares, consisting of stock-based awards and equivalents, and common stock warrants. For purposes of this calculation, stock-based awards and equivalents and common stock warrants are considered to be potential common shares and are only included in the calculation of diluted net loss per common share when their effect is dilutive.

The Company's Series A Convertible Preferred Stock and certain of the Company's outstanding common stock warrants contain non-forfeitable rights to dividends with the common stockholders, and therefore are considered to be participating securities. The Series A Convertible Preferred Stock and the common stock warrants do not have a contractual obligation to fund the losses of the Company; therefore, the application of the two-class method is not required when the Company is in a net loss position but is required if the Company is in a net income position. When in a net income position, diluted net earnings per common share is computed using the more dilutive of the two-class method or the if-converted and treasury stock methods.

As the Company was in a net loss position for all periods presented, basic and diluted net loss per common share for the three months ended March 31, 2024 and March 31, 2023 were calculated under the if-converted and treasury stock methods. For both the three months ended March 31, 2024 and March 31, 2023, basic and diluted net loss per common share were the same as all common stock equivalents were anti-dilutive for both periods.

The following table presents the calculation of weighted average shares used to calculate basic and diluted net loss per common share (in thousands, except share and per share amounts):

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Basic and diluted net loss per common share: |

|

|

|

|

|

|

Net loss available to common stockholders - basic and diluted |

|

$ |

(3,527 |

) |

|

$ |

(2,340 |

) |

Weighted average shares used in calculating basic and diluted net loss per common share |

|

|

768,137 |

|

|

|

287,702 |

|

Basic and diluted net loss per common share |

|

$ |

(4.59 |

) |

|

$ |

(8.13 |

) |

The following potentially dilutive securities were excluded from the calculation of diluted net loss per share because their effects would be anti-dilutive:

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Stock options |

|

|

41,937 |

|

|

|

4,180 |

|

Restricted stock units |

|

|

20,833 |

|

|

|

2,802 |

|

Warrants for common stock |

|

|

285,891 |

|

|

|

107,115 |

|

Series A Convertible Preferred Stock |

|

|

8 |

|

|

|

8 |

|

Total |

|

|

348,669 |

|

|

|

114,105 |

|

Comprehensive Loss

Comprehensive income (loss) is defined as a change in equity during a period from transactions and other events and circumstances from non-owner sources. The Company’s comprehensive loss was the same as its reported net loss for all periods presented.

Recently Issued or Adopted Accounting Pronouncements

No new accounting pronouncements issued or adopted during the three months ended March 31, 2024 that had or are expected to have a material impact on the Company’s condensed consolidated financial statements or disclosures.

3. Balance Sheet Details

Prepaid expenses and other current assets consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Prepaid insurance |

|

$ |

294 |

|

|

$ |

428 |

|

Other receivables |

|

|

153 |

|

|

|

148 |

|

Prepaid subscriptions and fees |

|

|

173 |

|

|

|

138 |

|

Prepaid software licenses |

|

|

36 |

|

|

|

64 |

|

Deferred equity issuance costs |

|

|

75 |

|

|

|

112 |

|

Prepaid other |

|

|

6 |

|

|

|

6 |

|

|

|

$ |

737 |

|

|

$ |

896 |

|

Other noncurrent assets consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Prepaid insurance, less current portion |

|

$ |

426 |

|

|

$ |

478 |

|

Other noncurrent assets |

|

|

12 |

|

|

|

12 |

|

|

|

$ |

438 |

|

|

$ |

490 |

|

Accrued liabilities consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Accrued accounts payable |

|

$ |

89 |

|

|

$ |

166 |

|

Accrued clinical trial expenses |

|

|

10 |

|

|

|

20 |

|

Accrued director stipends |

|

|

35 |

|

|

|

106 |

|

Accrued severance and benefits (Note 8) |

|

|

35 |

|

|

|

131 |

|

Accrued joint development expenses (Note 7) |

|

|

1,180 |

|

|

|

98 |

|

Current portion of contingent consideration obligation (Note 4) |

|

|

143 |

|

|

|

143 |

|

Accrued other |

|

|

178 |

|

|

|

167 |

|

|

|

$ |

1,670 |

|

|

$ |

831 |

|

4. Fair Value Measurements

Contingent Consideration Obligation

Pursuant to the Giiant License Agreement, the Company incurred a contingent consideration obligation related to future milestone payments. The Company has an obligation to make contingent consideration payments to Giiant, in either cash or shares of the Company’s common stock solely at the Company’s election, upon the achievement of development milestones (as set forth in the Giiant License Agreement). Because the contingent consideration may be settled in shares of the Company's common stock, the Company has determined it should be accounted for under ASC 480, and accordingly has recognized it as a liability measured at its estimated fair value.

At the end of each reporting period, the Company re-measures the contingent consideration obligation to its estimated fair value and any resulting change is recognized in research and development expenses in the condensed consolidated statements of operations. The fair value of the contingent consideration obligation is determined using a probability-based model that estimates the likelihood of success in achieving each of the defined milestones that is then discounted to present value using the Company's incremental borrowing rate. The fair value measurement is based on significant inputs not observable in the market and thus represents a Level 3 measurement as defined in fair value measurement accounting. The significant assumptions used in the calculation of the fair value as of March 31, 2024 included a discount rate of 16.0% and management's updated projections of the likelihood of success in achieving each of the defined milestones based on empirical, published industry data.

As of both March 31, 2024 and December 31, 2023, the fair value of the contingent consideration liability was determined to be approximately $204,000. Accordingly, there was no change in the fair value of the contingent consideration obligation for the three months ended March 31, 2024. As of both March 31, 2024 and December 31, 2023, $143,000 of the contingent consideration obligation was recognized in accrued liabilities in the condensed consolidated balance sheet as it is expected to be settled within one-year of the balance sheet date. The remaining amount of the contingent consideration liability of $61,000 was recognized as a noncurrent liability in the condensed consolidated balance sheet as of both March 31, 2024 and December 31, 2023.

Liability-Classified Warrants

The Company has issued warrants that are accounted for as liabilities based upon the guidance of with ASC 480 and ASC 815. Estimating fair values of liability-classified financial instruments requires the development of estimates that may, and are likely to, change over the duration of the instrument with related changes in internal and external market factors. Changes in fair value of the liability-classified warrants, if any, are recognized as a component of other income in the condensed consolidated statement of operations.

As of March 31, 2024, the fair value of the Company's liability-classified warrants outstanding was determined using a Black-Scholes option pricing model valuation model to be insignificant due to the low market price of the Company's stock at the date of valuation relative to the exercise price of the underlying warrants outstanding.

The following table summarizes the activity of the Company’s Level 3 warrant liabilities during the three months ended March 31, 2024 and 2023 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Warrant Liabilities |

|

2024 |

|

|

2023 |

|

Fair value at beginning of year |

|

$ |

2 |

|

|

$ |

61 |

|

Change in fair value during the period |

|

|

— |

|

|

|

(43 |

) |

Fair value at end of period |

|

$ |

2 |

|

|

$ |

18 |

|

5. Stockholders’ Equity

Classes of Stock

Common Stock

As of March 31, 2024, the Company was authorized to issue 280,000,000 shares of $0.01 par value common stock. Each share of common stock entitles the holder thereof to one vote on each matter submitted to a vote at a meeting of stockholders.

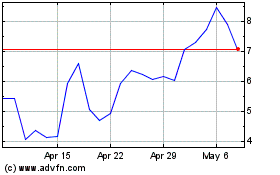

On April 5, 2024, the Company effected the Reverse Stock Split. Accordingly, each of the Company’s stockholders received one share of the Company's common stock for every 15 shares of the Company's common stock that such stockholder held immediately prior to the effective time of the Reverse Stock Split. The Reverse Stock Split affected all of the Company’s issued and outstanding shares of the Company's common stock equally. The Reverse Stock Split also affected the Company’s outstanding stock-based awards, warrants and other exercisable or convertible securities and resulted in the shares underlying such instruments being reduced and the exercise price or conversion price being increased proportionately by the Reverse Stock Split ratio. No fractional shares were issued as a result of the Reverse Stock Split with any fractional shares that would have otherwise resulted from the Reverse Stock Split paid in cash, at an amount equal to the resulting fractional interest in one share of the Company's common stock that the stockholder would otherwise be entitled, multiplied by the closing trading price of the Company's common stock on April 5, 2024. The amount of cash paid for fractional shares was immaterial to the Company's financial statements.

As a result of the Reverse Stock Split, the number of issued and outstanding shares of the Company's common stock was adjusted from 12,771,015 shares to 851,302 shares. Each share of the Company's common stock entitles the holder thereof to one vote on each matter submitted to a vote at a meeting of stockholders.

Preferred Stock

As of March 31, 2024, the Company was authorized to issue 7,000,000 shares of $0.01 par value preferred stock of which 1,000,000 shares have been designated as Series A 4.5% Convertible Preferred Stock ("Series A Convertible Preferred Stock") and 200,000 of which are issued and outstanding. As of March 31, 2024, all of the Company's 200,000 shares of Series A Convertible Preferred Stock outstanding are convertible into an aggregate of 8 shares of the Company's common stock.

Recent Equity Offerings

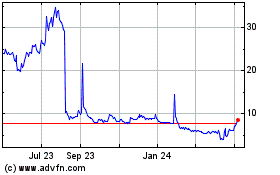

On September 11, 2023, the Company completed a registered direct offering of common stock pursuant to an effective shelf registration statement on Form S-3 (the "September 2023 Offering"). Gross cash proceeds from the September 2023 Offering were $2.0 million and net cash proceeds were $1.7 million after deducting cash equity issuance costs of approximately $0.3 million.

On April 3, 2023, the Company completed a registered direct offering and concurrent private placement of common stock and warrants to purchase common stock (the "April 2023 Offering"). Gross cash proceeds from the April 2023 Offering were $6.0 million and net cash proceeds were $5.3 million after deducting cash equity issuance costs of approximately $0.7 million.

On January 4, 2023, the Company completed a registered direct offering and concurrent private placement of common stock and warrants to purchase common stock (the "January 2023 Offering"). Gross cash proceeds from the January 2023 Offering were $2.5 million and net cash proceeds were approximately $2.2 million after deducting cash equity issuance costs of approximately $0.3 million.

Common Stock Warrants and Warrant Exercises

On January 30, 2024, the Company entered into warrant inducement agreements (the “Warrant Inducement Agreements”) with certain accredited and institutional holders (collectively, the “Warrant Holders”) of certain of the Company’s remaining outstanding common stock warrants issued on May 10, 2022 (the "May 2022 Warrants"), January 4, 2023 (the “January 2023 Warrants”), and April 5, 2023 (the “April 2023 Warrants”), as well as certain outstanding Series 2 warrants issued on August 16, 2022 (the "Series 2 Warrants) (collectively, the “Existing Warrants”). Pursuant to the Warrant Inducement Agreements, the exercise price of each of Existing Warrants exercised was reduced to $10.97 per share. Each of the Warrant Holders that exercised its Existing Warrants pursuant to the Warrant Inducement Agreements, received one replacement warrant to purchase a share of the Company's common stock (the “Replacement Warrants”) for each Existing Warrant exercised (in its entirety, the "February 2024 Warrant Inducement").

The Replacement Warrants are exercisable immediately, have an exercise price per share of $10.97, and expire five years from the date of issuance, which was February 1, 2024. The Replacement Warrants are subject to adjustment in the event of stock splits, dividends, subsequent rights offerings, pro rata distributions, and certain fundamental transactions, as more fully described in the Replacement Warrants. The Replacement Warrants contain standard anti-dilution provisions but do not contain any price protection provisions with respect to future securities offerings of the Company.

The Warrant Holders collectively exercised an aggregate of 228,162 Existing Warrants consisting of: (i) 4,865 May 2022 Warrants, (ii) 4,267 Series 2 Warrants, (iii) 67,511 January 2023 Warrants, and (iv) 151,519 April 2023 Warrants. As a result of the exercises of the Existing Warrants, the Company issued an aggregate of 228,162 shares of its common stock. The February 2024 Warrant Inducement closed on February 1, 2024 with the Company receiving net cash proceeds of approximately $2.2 million consisting of gross cash proceeds of $2.5 million, less cash equity issuance costs of approximately $0.3 million.

The February 2024 Warrant Inducement, which resulted in the lowering of the exercise price of the Existing Warrants and the issuance of the Replacement Warrants, is considered a modification of the Existing Warrants under the guidance of ASC 815-40. The modification is consistent with the Equity Issuance classification under that guidance as the reason for the modification was to induce the holders of the Existing Warrants to cash exercise their Existing Warrants, resulting in the imminent exercise of the Existing Warrants, which raised equity capital and generated gross cash proceeds for the Company of approximately $2.5 million. As pursuant to the guidance of ASC 480 and ASC 815 the Existing Warrants and Replacement Warrants were classified as equity instruments before and after the modification, and as the modification is directly attributable to an equity offering, the Company recognized the effect of the modification of approximately $2.0 million as an equity issuance cost netted against the additional paid-in capital recognized from the associated warrant exercises. The amount of the equity issuance cost recognized for the warrant modification was determined using the Black-Scholes option pricing model as the incremental fair value of the modified Existing Warrants and additional Replacement Warrants issued as compared to the fair value of the original Existing Warrants immediately prior to their modification.

The solicitation agent fees associated with the February 2024 Warrant Inducement consisted of: (i) a cash fee equal to 7.75% of the gross proceeds received by the Company, (ii) a common stock purchase warrant to purchase such number of shares of common stock equal to 6% of the aggregate number shares issued pursuant to the exercise of the Existing Warrants, with an exercise price of $10.97 per share, and a term of five years from issuance (the "Solicitation Agent Warrants"), and (iii) $35,000 of out-of-pocket expenses. The fair value of the Solicitation Agent Warrants was recognized by the Company as an equity issuance cost, which reduced the additional paid-in capital recognized from the issuance of common stock in connection with the exercise of the Existing Warrants.

Total equity issuance costs recognized in the February 2024 Warrant Inducement of $2.4 million include cash equity issuance costs of $0.3 million, non-cash warrant modification costs of approximately $2.0 million, and non-cash issuance costs associated with the Solicitation Agent Warrants of $0.1 million.

The Company accounts for the majority of its warrants as equity-classified in accordance with ASC 480 and ASC 815. The Company’s outstanding common stock warrants that are classified as equity warrants are included as a component of stockholders' equity based on their relative fair value on their date of issuance. Common stock warrants accounted for as liabilities in accordance with the authoritative accounting guidance are included in noncurrent liabilities. The Company had exercisable common stock warrants outstanding of 285,891 and 272,211 at March 31, 2024 and December 31, 2023, respectively. Of the Company's common stock warrants exercisable at March 31, 2024, 251,262 common stock warrants have an exercise price of $10.97 and the remaining 34,646 common stock warrants have a weighted average exercise price of $812.54. Of the outstanding common stock warrants, only 9,414 are subject

to price reset provisions in the event future sales of the Company's securities are sold at a price per share less than the exercise price of such warrants.

The following table summarizes warrant activity during the three months ended March 31, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of

Warrants |

|

|

Weighted

Average

Exercise Price |

|

|

Weighted

Average

Remaining

Contractual

Life (Years) |

|

Warrants outstanding, December 31, 2023 |

|

|

272,211 |

|

|

$ |

144.78 |

|

|

|

4.12 |

|

Granted |

|

|

241,848 |

|

|

|

10.97 |

|

|

|

4.84 |

|

Exercised |

|

|

(228,162 |

) |

|

|

10.97 |

|

|

|

— |

|

Forfeited, expired or cancelled |

|

|

(6 |

) |

|

|

27,000.00 |

|

|

|

— |

|

Warrants outstanding, March 31, 2024 |

|

|

285,891 |

|

|

|

107.85 |

|

|

|

4.66 |

|

6. Equity Incentive Plans

Equity Incentive Plans

The Company’s stock-based compensation generally includes RSUs, PSUs, and stock options.

There were no RSUs, stock options or other equity-based awards issued under any of the Company's equity incentive plans in the three months ended March 31, 2024. During the three months ended March 31, 2023, the Company granted 2,967 RSUs at a weighted-average fair market value of $48.79 per RSU, and 2,040 stock options at a weighted average grant date fair market value of $22.65 per stock option.

Employee Stock Purchase Plan

Compensation expense associated with the ESPP for the three months ended March 31, 2024 was approximately $5,000. There was no compensation expense associated with the ESPP in the three months ended March 31, 2023.

Share-Based Compensation Expense

The allocation of stock-based compensation for all stock awards is as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

Research and development expense |

|

$ |

47 |

|

|

$ |

49 |

|

General and administrative expense |

|

|

66 |

|

|

|

44 |

|

Total |

|

$ |

113 |

|

|

$ |

93 |

|

As of March 31, 2024, the unrecognized compensation cost related to outstanding options was $0.4 million, which is expected to be recognized over a weighted-average period of approximately 1.75 years and the unrecognized compensation cost related to outstanding time-based and performance-based RSUs was $0.3 million, which is expected to be recognized over a weighted average period of approximately 2.04 years.

7. Collaborations and License Agreements

Research Collaboration and License Agreement with Giiant

On September 1, 2023 (the “Effective Date”), the Company entered into the Giiant License Agreement whereby the Company received an exclusive, worldwide license (with the right to sublicense in multiple tiers) to develop, manufacture, and commercialize substantially all of the assets of Giiant, including: (i) the PALI-2108 compound, and (ii) the PALI-1908 compound and the associated intellectual property around each of the foregoing (the “Giiant Licensed Assets”). The Giiant License Agreement has a perpetual term.