Pacific Premier Bancorp, Inc. (NASDAQ: PPBI) (the “Company”),

the holding company of Pacific Premier Bank (the “Bank”), reported

adjusted earnings for the second quarter of 2013 of $3.0 million,

or $0.19 per share on a diluted basis, before non-recurring

merger-related expenses, compared with adjusted earnings for the

first quarter of 2013 of $3.1 million, or $0.20 per share on a

diluted basis, before non-recurring merger-related expenses. For

the three months ended June 30, 2013, the Company’s adjusted return

on average assets was 0.86% and adjusted return on average equity

was 7.59%, compared with an adjusted return on average assets of

1.05% and an adjusted return on average equity of 8.78% for the

three months ended March 31, 2013.

Taking into account the one-time merger-related expenses

incurred in the second quarter in connection with the acquisition

of San Diego Trust Bank (“San Diego Trust”) and in the first

quarter in connection with the acquisition of First Associations

Bank (“First Associations”) of $5.0 million and $1.7 million,

respectively, the Company recorded a net loss of $249,000, or $0.02

per share on a diluted basis, for the second quarter of 2013,

compared to net income of $2.0 million, or $0.13 per share on a

diluted basis, for the first quarter of 2013.

Steven R. Gardner, President and Chief Executive Officer of the

Company, commented on the results, “We saw a significant

improvement in business development activity in the second quarter,

as our loan production increased by 64% to $147 million. Our loan

production was broadly diversified, with strong growth coming in

owner-occupied commercial real estate, C&I and investor owned

commercial real estate loans. The growth in these areas helped to

offset a decline we saw in warehouse lending due to the impact of

higher mortgage rates.

“We are beginning to gain traction in the businesses where we

have recently added additional talent, including SBA, HOA and

construction lending, which complements our strong C&I and CRE

platforms and improves our ability to generate quality assets. Our

loan pipeline continues to be very healthy at $205 million as of

July 22, 2013, which should result in strong loan growth in the

second half of the year. Additionally, the former customers of San

Diego Trust Bank have been very receptive to the acquisition thus

far and we anticipate that our expanded product offerings will

allow us to gain substantive market share throughout the San Diego

market.”

“We have completed the integration and conversion of First

Associations Bank’s former customer accounts and anticipate the

conversion of San Diego Trust Bank systems to occur early in the

fourth quarter. We are excited about the prospects for our

franchise as these two acquisitions create a strong platform for

profitable growth in the future and have markedly improved our

deposit base which positions us well for a rising interest rate

environment. We have realized a significant amount of excess

liquidity by adding the attractive deposit bases of these two

institutions, which has had the immediate effect of compressing our

net interest margin. As we redeploy this liquidity into higher

yielding assets and allow higher cost time deposits to runoff, we

expect to see a steady improvement in our net interest margin and a

higher level of profitability in the future,” said Mr. Gardner.

Net Interest Income and Net Interest Margin

Net interest income totaled $13.6 million in the second quarter

of 2013, up $690,000 or 5.3%, compared to the first quarter of

2013. The increase in net interest income reflected higher average

interest-earning assets of $228.2 million, partially offset by a

decrease in net interest margin. The increase in average

interest-earning assets during the second quarter of 2013 was

primarily from a $163.0 million increase in securities, a $35.9

million increase in loans, and a $29.3 million increase in cash and

cash equivalents.

The net interest margin for the second quarter of 2013 was

4.01%, compared with 4.62% in the first quarter of 2013. The

decrease in net interest margin is primarily attributable to a

decrease in yield on average interest-earning assets of 69 basis

points, primarily from a higher mix of lower yielding investment

securities, which were acquired in our acquisition of First

Associations that closed in the first quarter of 2013 and a

decrease in our loan portfolio yield. The loan portfolio yield for

the second quarter was 5.69%, 16 basis points lower than the first

quarter and reflected lower rates on loan originations. Partially

offsetting this decrease was lower deposit costs of 8 basis points

resulting from an improved mix of lower cost deposits associated

with the First Associations and San Diego Trust acquisitions.

Provision for Loan Losses

We recorded a $322,000 provision for loan losses during the

second quarter of 2013, compared with $296,000 provision for loan

losses for the first quarter of 2013. Stable credit quality metrics

and the recent charge-off history within our loan portfolio were

significant factors in estimating the adequacy of our allowance for

loan losses. Net loan charge-offs amounted to $322,000 in the

second quarter of 2013, up $26,000 from $296,000 experienced during

the first quarter of 2013.

Noninterest income

Noninterest income for the second quarter of 2013 amounted to

$2.4 million, up $707,000 or 41.0%, compared to the first quarter

of 2013. The increase was primarily attributable to the sale of

$101.7 million in securities primarily acquired from First

Associations for a gain of $1.1 million in the current quarter, as

there were no sales of securities in the prior quarter, and other

income of $106,000, partially offset by a decrease in gain on sale

of loans of $501,000.

Noninterest Expense

Noninterest expense totaled $15.9 million for the second quarter

of 2013, up $4.7 million or 41.8%, compared to the first quarter of

2013. The increase primarily related to higher costs in the second

quarter of 2013 when compared to the first quarter of 2013

associated with the following expense categories:

- One-time merger related expenses

increased by $3.2 million;

- Compensation and benefits costs

increased by $590,000, primarily due to the increase in employees

for a full quarter from the First Associations acquisition and new

hires in the lending and credit areas to increase our production of

commercial and industrial (“C&I”) loans, commercial real estate

(“CRE”) loans, Small Business Administration (“SBA”) loans,

homeowner association (“HOA”) loans, and construction loans;

- Other real estate owned operations

increased by $537,000.

These higher costs were partially offset by a decline of

$346,000 in legal, audit and professional fees.

Income Tax

Operating results during the second quarter of 2013 included

$955,000 of merger costs that were treated as non-deductible for

tax purposes. These expenses were largely the cause for a negative

effective tax rate of 57.6% for the second quarter of 2013,

compared to an effective tax rate of 37.4% in the first quarter of

2013. The merger costs also primarily impacted the difference

between the effective tax rate for the first half of 2013 at 42.4%,

compared to 39.0% for the same comparable period of 2012.

Assets and Liabilities

At June 30, 2013, assets totaled $1.6 billion, up $151.8 million

or 10.8% from March 31, 2013 and up $384.7 million or 32.8% from

December 31, 2012. The increase in assets since year-end 2012 was

primarily related to the acquisitions of First Associations, which

added assets at the acquisition date of $394.1 million, partially

offset by $78.5 million of First Associations deposits held by the

Bank prior to the acquisition and San Diego Trust, which added

assets at the acquisition date of $201.1 million. Partially

offsetting these acquisition increases was a decrease of $82.3

million in deposits and to pay down of $67.4 million of Federal

Home Loan Bank (“FHLB”) borrowings. The increase in assets from

March 31, 2013 was primarily related to the acquisition of San

Diego Trust, which included at the acquisition date $124.8 million

in securities, $42.4 million in loans, $14.1 million in cash, $6.4

million in goodwill, $5.8 million in bank owned life insurance and

$7.6 million in other assets.

Investment securities available for sale totaled $313.0 million

at June 30, 2013, up $11.9 million or 3.9% from March 31, 2013, and

up $229.0 million or 272.4% from December 31, 2012. The increase in

securities since year-end 2012 was primarily due to the First

Associations acquisition in March, which added $222.4 million at

the acquisition date and the San Diego Trust acquisition in June,

which added $124.8 million at the acquisition date, partially

offset by the sale of $101.7 million of securities in the second

quarter of 2013, and $16.6 million in principal pay downs. The

investment activity in the second quarter of 2013 included the

acquisition of San Diego Trust and sales of securities described

above, and principal payments of $10.8 million.

Net loans held for investment totaled $1.0 billion at June 30,

2013, an increase of $113.6 million or 12.2% from March 31, 2013

and an increase of $73.2 million or 7.5% from December 31, 2012.

The increase in loans from December 31, 2012 was primarily related

to an increase in business loan balances of $20.2 million and real

estate loan balances of $49.7 million. The increase in loans from

the end of the first quarter was primarily related to an increase

in loan balances of commercial non-owner occupied of $39.8 million,

multi-family of $33.7 million, commercial owner occupied of $35.2

million and C&I of $5.6 million.

During the second quarter of 2013, commitments on our warehouse

repurchase facility credits increased $3.4 million to total $317.3

million with our end of period utilization rates for these loans

dropping from 44.3% at March 31, 2013 to 42.7% at June 30, 2013.

Our average daily outstanding balance for these warehouse

facilities decreased $19.6 million to $125.7 million when comparing

the second quarter with the first quarter of 2013.

Loan activity during the second quarter of 2013 included loan

originations of $123.8 million, loans acquired from San Diego Trust

of $43.0 million and loan purchases of $23.2 million, partially

offset by an increase in undisbursed loan funds of $39.7 million,

loan repayments of $33.4 million and loan sales of $2.2 million. At

June 30, 2013, our loan to deposit ratio was 80.6%, up from 79.7%

at March 31, 2013, but down from 109.0% at December 31, 2012.

Deposits totaled $1.3 billion at June 30, 2013, up $128.5

million or 10.8% from March 31, 2013 and up $409.4 million or 45.3%

from December 31, 2012. The increase over both prior periods was

primarily related to our acquisition activity. In the first quarter

of 2013, the First Associations acquisition added deposits of

$356.8 million at a cost of 21 basis points at the closing of the

acquisition, partially offset by $78.5 million of First

Associations deposits held by the Bank prior to acquisition. In the

second quarter of 2013, the San Diego Trust acquisition added

deposits of $183.9 million at a cost of 23 basis points at closing

of the acquisition. Excluding the deposit acquisition increases and

$49.0 million of First Association’s deposits held at December 31,

2012, we had an adjusted net decrease in deposits of $55.4 million

in the second quarter of 2013 and $82.3 million in the first half

of 2013. The net decrease in deposits for both the current quarter

and the current year-to-date period primarily resulted from

lowering our pricing on certificates of deposits, which resulted in

a desired runoff upon maturity.

Within particular deposit categories during the second quarter

of 2013, the Company had increases in interest-bearing transaction

accounts of $112.1 million and noninterest-bearing accounts of

$28.5 million, partially offset by a decrease in retail

certificates of deposit of $13.0 million. These deposit changes

have increased the mix of our transaction accounts to 74.3% at June

30, 2013, up from 60.1% at year-end 2012. The total end of period

cost of deposits at both June 30, 2013 was 0.35%, down from 0.37%

at March 31, 2013 and 0.51% at December 31, 2012.

The Company expects to see improvement in deposit costs as its

higher cost certificates of deposit mature and either reprice lower

or leave the Bank. At June 30, 2013, we had certificates of deposit

maturing in the third quarter of $90.6 million at a weighted

average rate of 0.89% and in the fourth quarter of $128.1 million

at a weighted average rate of 0.85%.

At June 30, 2013, total borrowings amounted to $58.4 million, up

$3.9 million or 7.1% from March 31, 2013, but down $67.4 million or

53.6% from December 31, 2012. The decrease since year-end 2012 was

primarily related to the reduction of FHLB overnight advances

previously taken out to fund loans, partially offset by $19.6

million in repurchase agreement debt. The increase from the prior

quarter was wholly related to the repurchase agreement debt. Total

borrowings at June 30, 2013 represented 3.7% of total assets and

had an end of period weighted average cost of 2.13%, compared with

3.9% of total assets at a weighted average cost of 2.29% at March

31, 2013, and 10.7% of total assets at a weighted average cost of

1.19% at December 31, 2012.

Asset Quality

At June 30, 2013, nonperforming assets totaled $3.2 million or

0.21% of total assets, down from $4.7 million or 0.33% of total

assets at March 31, 2013. During the second quarter of 2013,

nonperforming loans decreased $1.1 million to total $2.0 million

and other real estate owned decreased $375,000 to total $1.2

million.

Our allowance for loan losses at June 30, 2013 was $8.0 million,

unchanged from March 31, 2013. The allowance for loan losses as a

percent of nonaccrual loans was 393.4% at June 30, 2013, up from

257.7% at March 31, 2013. At June 30, 2013, the ratio of allowance

for loan losses to total gross loans was 0.75%, down from 0.85% at

March 31, 2013.

Capital Ratios

At June 30, 2013, our ratio of tangible common equity to total

assets was 9.36%, with a tangible book value of $8.62 per share and

a book value per share of $10.15.

At June 30, 2013, the Bank exceeded all regulatory capital

requirements with a ratio for tier 1 leverage capital of 10.97%,

tier 1 risked-based capital of 13.34% and total risk-based capital

of 14.07%. These capital ratios exceeded the “well capitalized”

standards defined by the federal banking regulators of 5.00% for

tier 1 leverage capital, 6.00% for tier 1 risked-based capital and

10.00%, for total risk-based capital. At March 31, 2013, the

Company had a ratio for tier 1 leverage capital of 11.15%, tier 1

risked-based capital of 13.54% and total risk-based capital of

14.27%.

Conference Call and Webcast

The Company will host a conference call at 9:00 a.m. PT / 12:00

p.m. ET on July 23, 2013 to discuss its financial results. Analysts

and investors may participate in the question-and-answer session.

The conference call will be webcast live on the Investor Relations

section of the Company’s website www.ppbi.com and an archived

version of the webcast will be available in the same location

shortly after the live call has ended. The conference call can be

accessed by telephone at (888) 549-7750, conference ID 4630165.

Additionally a telephone replay will be made available through July

30, 2013 at (800) 406-7325, conference ID 4630165.

The Company owns all of the capital stock of the Bank. The Bank

provides business and consumer banking products to customers

through its 13 full-service depository branches in Southern

California located in the cities of Encinitas, Huntington Beach,

Irvine, Los Alamitos, Newport Beach, Palm Desert, Palm Springs, San

Bernardino, San Diego and Seal Beach and one office in Dallas,

Texas.

FORWARD-LOOKING COMMENTS

The statements contained herein that are not historical facts

are forward-looking statements based on management's current

expectations and beliefs concerning future developments and their

potential effects on the Company. Such statements involve inherent

risks and uncertainties, many of which are difficult to predict and

are generally beyond the control of the Company. There can be no

assurance that future developments affecting the Company will be

the same as those anticipated by management. The Company cautions

readers that a number of important factors could cause actual

results to differ materially from those expressed in, or implied or

projected by, such forward-looking statements. These risks and

uncertainties include, but are not limited to, the following: the

strength of the United States economy in general and the strength

of the local economies in which we conduct operations; the effects

of, and changes in, trade, monetary and fiscal policies and laws,

including interest rate policies of the Board of Governors of the

Federal Reserve System; inflation, interest rate, market and

monetary fluctuations; the timely development of competitive new

products and services and the acceptance of these products and

services by new and existing customers; the willingness of users to

substitute competitors’ products and services for the Company’s

products and services; the impact of changes in financial services

policies, laws and regulations (including the Dodd-Frank Wall

Street Reform and Consumer Protection Act) and of governmental

efforts to restructure the U.S. financial regulatory system;

technological changes; the effect of acquisitions that the Company

may make, if any, including, without limitation, the failure to

achieve the expected revenue growth and/or expense savings from its

acquisitions; changes in the level of the Company’s nonperforming

assets and charge-offs; oversupply of inventory and continued

deterioration in values of California real estate, both residential

and commercial; the effect of changes in accounting policies and

practices, as may be adopted from time-to-time by bank regulatory

agencies, the Securities and Exchange Commission (“SEC”), the

Public Company Accounting Oversight Board, the Financial Accounting

Standards Board or other accounting standards setters; possible

other-than-temporary impairment of securities held by us; changes

in consumer spending, borrowing and savings habits; the effects of

the Company’s lack of a diversified loan portfolio, including the

risks of geographic and industry concentrations; ability to attract

deposits and other sources of liquidity; changes in the financial

performance and/or condition of our borrowers; changes in the

competitive environment among financial and bank holding companies

and other financial service providers; unanticipated regulatory or

judicial proceedings; and the Company’s ability to manage the risks

involved in the foregoing. Additional factors that could cause

actual results to differ materially from those expressed in the

forward-looking statements are discussed in the 2012 Annual Report

on Form 10-K, as amended, of Pacific Premier Bancorp, Inc. filed

with the SEC and available at the SEC’s Internet site

(http://www.sec.gov).

The Company specifically disclaims any obligation to update any

factors or to publicly announce the result of revisions to any of

the forward-looking statements included herein to reflect future

events or developments.

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF FINANCIAL CONDITION (dollars in thousands, except

share data)

June

30, March 31,

December 31,

September 30, June 30,

ASSETS

2013 2013

2012 2012 2012

(Unaudited) (Unaudited) (Audited) (Unaudited) (Unaudited)

Cash and due from banks $ 103,946 $ 99,431 $ 59,325 $ 58,216 $

64,945 Federal funds sold 26 27

27 27 27 Cash and cash

equivalents 103,972 99,458 59,352 58,243 64,972 Investment

securities available for sale 313,047 301,160 84,066 114,250

146,134 Securities held to maturity 11,917 10,974 11,247 12,191

12,744 Loans held for sale, net 3,617 3,643 3,681 4,728 2,401 Loans

held for investment 1,055,430 941,828 982,207 859,373 795,319

Allowance for loan losses (7,994 ) (7,994 )

(7,994 ) (7,658 ) (7,658 ) Loans held for investment,

net 1,047,436 933,834 974,213 851,715 787,661 Accrued interest

receivable 5,766 4,898 4,126 3,933 3,968 Other real estate owned

1,186 1,561 2,258 5,521 9,339 Premises and equipment 9,997 8,862

8,575 10,067 9,429 Deferred income taxes 8,644 2,646 6,887 5,515

5,585 Bank owned life insurance 23,674 17,701 13,485 13,362 13,240

Intangible assets 7,135 4,463 2,626 2,703 2,781 Goodwill 18,234

11,854 - - - Other assets 3,833 5,601

3,276 7,108 6,781 TOTAL

ASSETS $ 1,558,458 $ 1,406,655 $ 1,173,792 $

1,089,336 $ 1,065,035

LIABILITIES AND STOCKHOLDERS’

EQUITY

LIABILITIES: Deposit accounts: Noninterest bearing $ 345,063 $

316,536 $ 213,636 $ 211,410 $ 150,538 Interest bearing: Transaction

accounts 631,951 519,828 329,925 266,478 327,556 Retail

certificates of deposit 332,015 344,968 361,207 417,982 435,097

Wholesale certificates of deposit 5,160 4,387

- - - Total

deposits 1,314,189 1,185,719 904,768 895,870 913,191 FHLB advances

and other borrowings 48,082 44,191 115,500 75,500 28,500

Subordinated debentures 10,310 10,310 10,310 10,310 10,310 Accrued

expenses and other liabilities 17,066 8,846

8,697 7,770 16,965

TOTAL LIABILITIES 1,389,647 1,249,066

1,039,275 989,450 968,966

STOCKHOLDERS’ EQUITY:

Common stock, $.01 par value; 25,000,000

shares authorized;

shares issued and outstanding of

16,635,786, 15,437,531,13,661,648, 10,343,434 and 10,329,934 at

June 30, 2013, March31, 2013, December 31, 2012, September 30, 2012

and June 30,2012, respectively

166 154 137 103 103 Additional paid-in capital 142,759 128,075

107,453 76,414 76,258 Retained earnings 27,545 27,794 25,822 22,011

18,549

Accumulated other comprehensive income

(loss), net of tax(benefit) of ($1,160), $1,095, $772, $950 and

$810 at June 30,2013, March 31, 2013, December 31, 2012, September

30, 2012and June 30, 2012, respectively

(1,659 ) 1,566 1,105

1,358 1,159 TOTAL STOCKHOLDERS’ EQUITY

168,811 157,589 134,517

99,886 96,069 TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY $ 1,558,458 $ 1,406,655 $

1,173,792 $ 1,089,336 $ 1,065,035

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF OPERATIONS (dollars in thousands, except per share

data) (unaudited)

Three

Months Ended Six Months Ended

June 30, 2013

March 31, 2013 June 30, 2012 June 30, 2013 June 30, 2012

INTEREST INCOME Loans $ 13,688 $ 13,396 $ 12,098 $ 27,084 $

23,335 Investment securities and other interest-earning assets

1,248 839 948

2,087 1,827 Total interest income

14,936 14,235 13,046

29,171 25,162

INTEREST EXPENSE

Interest-bearing deposits: Interest on transaction accounts 280 218

223 498 552 Interest on certificates of deposit 753

801 1,224 1,554

2,651 Total interest-bearing deposits 1,033 1,019 1,447

2,052 3,203 FHLB advances and other borrowings 238 240 235 478 470

Subordinated debentures 76 77 82

153 166 Total interest expense

1,347 1,336 1,764

2,683 3,839 NET INTEREST INCOME BEFORE

PROVISION FOR LOAN LOSSES 13,589 12,899 11,282 26,488 21,323

PROVISION FOR LOAN LOSSES 322 296

- 618 - NET INTEREST

INCOME AFTER PROVISION FOR LOAN LOSSES 13,267

12,603 11,282 25,870

21,323

NONINTEREST INCOME Loan servicing fees 318 326

214 644 391 Deposit fees 457 440 472 897 973 Net gain from sales of

loans 222 723 10 945 10 Net gain from sales of investment

securities 1,068 - 174 1,068 174 Other-than-temporary impairment

loss on investment securities, net (5 ) (30 ) (45 ) (35 ) (82 )

Gain on FDIC transaction - - 5,340 - 5,340 Other income 371

265 364 636

662 Total noninterest income 2,431

1,724 6,529 4,155 7,468

NONINTEREST EXPENSE Compensation and benefits 5,687

5,097 3,947 10,784 7,467 Premises and occupancy 1,329 1,293 981

2,622 1,859 Data processing and communications 755 635 817 1,390

1,184 Other real estate owned operations, net 574 37 590 611 737

FDIC insurance premiums 196 140 168 336 301 Legal, audit and

professional expense 249 595 552 844 1,038 Marketing expense 264

206 264 470 479 Office and postage expense 322 263 217 585 380 Loan

expense 184 248 177 432 413 Deposit expense 515 160 34 675 97

Merger related expense 4,978 1,745 - 6,723 - Other expense

803 760 458 1,563

891 Total noninterest expense 15,856

11,179 8,205 27,035

14,846 NET INCOME (LOSS) BEFORE INCOME TAXES (158 )

3,148 9,606 2,990 13,945 INCOME TAX 91 1,176

3,795 1,267 5,442

NET INCOME (LOSS) $ (249 ) $ 1,972 $ 5,811 $ 1,723

$ 8,503

EARNINGS (LOSS) PER SHARE Basic

$ (0.02 ) $ 0.14 $ 0.56 $ 0.12 $ 0.82 Diluted $ (0.02 ) $ 0.13 $

0.54 $ 0.11 $ 0.80

WEIGHTED AVERAGE SHARES

OUTSTANDING Basic 15,516,537 14,355,407 10,329,934 14,939,179

10,332,935 Diluted 15,516,537 15,117,216 10,669,005 15,721,262

10,647,590

PACIFIC PREMIER BANCORP, INC. AND

SUBSIDIARIES STATISTICAL INFORMATION (dollars in

thousands)

For the

Three Months Ended For the Six Months Ended June 30, 2013 March 31,

2013 June 30, 2012 June 30, 2013 June 30, 2012

Profitability and

Productivity

Net interest margin 4.01 % 4.62 % 4.64 % 4.28 % 4.48 % Noninterest

expense to average total assets 4.51 3.82 3.21 4.19 2.98 Efficiency

ratio (1) 69.95 67.60 61.98 68.81 60.64 Return on average assets

(0.07 ) 0.67 2.28 0.27 1.71 Return on average equity (0.63 ) 5.65

25.21 2.30 18.88

Asset and

liability activity

Loans originated and purchased $ 189,443 $ 116,258 $ 176,769 $

305,701 $ 210,074 Repayments (33,375 ) (45,244 ) (56,967 ) (78,619

) (92,186 ) Loans sold (2,172 ) (5,048 ) (584 ) (7,220 ) (584 )

Increase (decrease) in loans, net 113,576 (40,417 ) 102,921 73,159

59,995 Increase in assets 151,803 232,863 79,864 384,666 103,907

Increase in deposits 128,470 280,951 66,474 409,421 84,314 Increase

(decrease) in borrowings 3,891 (71,309 ) - (67,418 ) -

(1)

Represent the ratio of noninterest expense

less OREO operations and merger related expense to the sum of net

interest income before provision for loan losses and total

noninterest income less gains/(loss) on sale of securities, and

gain on FDIC transactions.

Average Balance Sheet

Three Months Ended Three Months

Ended Three Months Ended June

30, 2013 March 31, 2013 June 30, 2012

Average Average

Average Average

Average Average

Balance Interest

Yield/Cost Balance Interest

Yield/Cost Balance

Interest Yield/Cost Assets

(dollars in thousands) Interest-earning assets: Cash and cash

equivalents $ 98,451 $ 60 0.24 % $ 69,143 $ 37 0.22 % $ 72,988 $ 35

0.19 % Federal funds sold 26 - 0.00 % 27 - 0.00 % 27 - 0.00 %

Investment securities 297,912 1,188 1.60 % 134,895 802 2.38 %

163,151 913 2.24 % Loans receivable, net (1) 964,486

13,688 5.69 % 928,577

13,396 5.85 % 736,178

12,098 6.57 % Total interest-earning

assets 1,360,875 14,936 4.40 % 1,132,642 14,235 5.09 % 972,344

13,046 5.36 % Noninterest-earning assets 44,064

38,911 48,880 Total assets $ 1,404,939 $ 1,171,553 $

1,021,224

Liabilities and Equity Deposit accounts:

Noninterest-bearing $ 309,311 $ - 0.00 % $ 237,081 $ - 0.00 % $

140,352 $ - 0.00 % Interest-bearing: Transaction accounts 521,784

280 0.22 % 379,638 218 0.23 % 323,813 223 0.28 % Retail

certificates of deposit 336,165 745 0.89 % 349,471 800 0.93 %

416,818 1,221 1.18 % Wholesale certificates of deposit 4,690

8 0.68 % 833

1 0.49 % 3,514

3 0.34 % Total deposits 1,171,950 1,033 0.35 %

967,023 1,019 0.43 % 884,497 1,447 0.66 % FHLB advances and other

borrowings 53,891 238 1.77 % 44,769 240 2.17 % 28,588 235 3.31 %

Subordinated debentures 10,310 76

2.96 % 10,310 77

3.03 % 10,310 82

3.20 % Total borrowings 64,201 314

1.96 % 55,079 317

2.33 % 38,898 317

3.28 % Total deposits and borrowings 1,236,151 1,347 0.44 %

1,022,102 1,336 0.53 % 923,395 1,764 0.77 % Other liabilities

9,645 9,766 5,627 Total liabilities 1,245,796

1,031,868 929,022 Stockholders' equity 159,143

139,685 92,202 Total liabilities and equity $ 1,404,939 $

1,171,553 $ 1,021,224 Net interest income $ 13,589 $ 12,899 $

11,282 Net interest rate spread (2) 3.96 % 4.56 % 4.59 % Net

interest margin (3) 4.01 % 4.62 % 4.64 % Ratio of interest-earning

assets to deposits and borrowings 110.09 % 110.81 % 105.30 %

(1) Average balance includes loans held for sale and

nonperforming loans and is net of deferred loan origination fees,

unamortized discounts and premiums, and allowance for loan losses.

(2) Represents the difference between the yield on interest-earning

assets and the cost of interest-bearing liabilities. (3) Represents

net interest income divided by average interest-earning assets.

Average Balance Sheet

Six Months Ended Six Months

Ended June 30, 2013 June 30, 2012 Average

Average Average

Average Balance

Interest Yield/Cost Balance

Interest Yield/Cost

Assets (dollars in thousands) Interest-earning assets: Cash

and cash equivalents $ 83,879 $ 98 0.24 % $ 84,583 $ 86 0.20 %

Federal funds sold 27 - 0.00 % 27 - 0.00 % Investment securities

216,854 1,989 1.83 % 149,683 1,741 2.33 % Loans receivable, net (1)

946,631 27,084 5.77 %

717,551 23,335 6.50 %

Total interest-earning assets 1,247,391 29,171 4.71 % 951,844

25,162 5.28 % Noninterest-earning assets 41,789

44,690 Total assets $ 1,289,180 $ 996,534

Liabilities and

Equity Deposit accounts: Noninterest-bearing $ 273,440 $ - 0.00

% $ 129,269 $ - 0.00 % Interest-bearing: Transaction accounts

451,104 498 0.22 % 309,614 552 0.36 % Retail certificates of

deposit 342,782 1,545 0.91 % 420,226 2,649 1.27 % Wholesale

certificates of deposit 2,772 9

0.65 % 1,757 2

0.23 % Total deposits 1,070,098 2,052 0.39 % 860,866 3,203 0.75 %

FHLB advances and other borrowings 49,355 478 1.95 % 28,577 470

3.31 % Subordinated debentures 10,310

153 2.99 % 10,310 166

3.24 % Total borrowings 59,665

631 2.13 % 38,887

636 3.29 % Total deposits and borrowings 1,129,763

2,683 0.48 % 899,753 3,839 0.86 % Other liabilities 9,685

6,689 Total liabilities 1,139,448 906,442 Stockholders'

equity 149,732 90,092 Total liabilities and equity $

1,289,180 $ 996,534 Net interest income $ 26,488 $ 21,323 Net

interest rate spread (2) 4.23 % 4.42 % Net interest margin (3) 4.28

% 4.48 % Ratio of interest-earning assets to deposits and

borrowings 110.41 % 105.79 % (1) Average balance includes

loans held for sale and nonperforming loans and is net of deferred

loan origination fees, unamortized discounts and premiums, and

allowance for loan losses. (2) Represents the difference between

the yield on interest-earning assets and the cost of

interest-bearing liabilities. (3) Represents net interest income

divided by average interest-earning assets.

PACIFIC

PREMIER BANCORP, INC. AND SUBSIDIARIES STATISTICAL

INFORMATION

June

30, 2013 March 31, 2013 December 31, 2012 September 30, 2012 June

30, 2012

Pacific Premier

Bank Capital Ratios

Tier 1 leverage ratio 10.97 % 12.55 % 12.07 % 9.48 % 9.48 % Tier 1

risk-based capital ratio 13.34 % 14.43 % 12.99 % 11.04 % 11.28 %

Total risk-based capital ratio 14.07 % 15.23 % 13.79 % 11.88 %

12.18 %

Pacific Premier

Bancorp, Inc. Capital Ratios

Tier 1 leverage ratio 11.15 % 12.84 % 12.71 % 9.58 % 9.60 % Tier 1

risk-based capital ratio 13.54 % 14.61 % 13.61 % 11.09 % 11.35 %

Total risk-based capital ratio 14.27 % 15.40 % 14.43 % 11.93 %

12.26 % Tangible common equity ratio (1) 9.36 % 10.16 % 11.26 %

8.94 % 8.78 %

Share

Data

Book value per share $ 10.15 $ 10.21 $ 9.85 $ 9.66 $ 9.30 Tangible

book value per share (1) 8.62 9.15 9.65 9.40 9.03 Closing stock

price 12.22 13.15 10.24 9.54 8.40 (1) Tangible common

equity to tangible assets (the "tangible common equity ratio") and

tangible book value per share are non-GAAP financial measures

derived from GAAP-based amounts. We calculate the tangible common

equity ratio by excluding the balance of intangible assets from

common shareholders' equity and dividing by tangible assets. We

calculate tangible book value per share by dividing tangible common

equity by common shares outstanding, as compared to book value per

share, which we calculate by dividing common shareholders' equity

by shares outstanding. We believe that this information is

consistent with the treatment by bank regulatory agencies, which

exclude intangible assets from the calculation of risk-based

capital ratios. Accordingly, we believe that these non-GAAP

financial measures provide information that is important to

investors and that is useful in understanding our capital position

and ratios. However, these non-GAAP financial measures are

supplemental and are not a substitute for an analysis based on GAAP

measures. As other companies may use different calculations for

these measures, this presentation may not be comparable to other

similarly titled measures reported by other companies. A

reconciliation of the non-GAAP measures of tangible common equity

and tangible book value per share to the GAAP measures of common

stockholder’s equity and book value per share is set forth below.

GAAP Reconciliation

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES

STATISTICAL INFORMATION (dollars in thousands, except per

share data)

June 30,

2013 March 31, 2013 December 31, 2012 September 30, 2012 June 30,

2012 Total stockholders' equity $ 168,811 $ 157,589 $

134,517 $ 99,886 $ 96,069 Less: Intangible assets (25,369 )

(16,317 ) (2,626 ) (2,703 ) (2,781 )

Tangible common equity $ 143,442 $ 141,272 $

131,891 $ 97,183 $ 93,288 Book value

per share $ 10.15 $ 10.21 $ 9.85 $ 9.66 $ 9.30 Less: Intangible

book value per share (1.53 ) (1.06 ) (0.20 )

(0.26 ) (0.27 )

Tangible book value per share

$ 8.62 $ 9.15 $ 9.65 $ 9.40 $ 9.03

Total assets $ 1,558,458 $ 1,406,655 $ 1,173,792 $

1,089,336 $ 1,065,035 Less: Intangible assets (25,369 )

(16,317 ) (2,626 ) (2,703 ) (2,781 )

Tangible assets $ 1,533,089 $ 1,390,338 $

1,171,166 $ 1,086,633 $ 1,062,254

Tangible common equity ratio 9.36 % 10.16 % 11.26 % 8.94 %

8.78 %

PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES

STATISTICAL INFORMATION (dollars in thousands)

June 30, 2013 March 31,

2013 December 31, 2012 September 30, 2012 June 30, 2012

Loan

Portfolio

Business loans: Commercial and industrial $ 146,240 $ 140,592 $

115,354 $ 88,105 $ 84,191 Commercial owner occupied (1) 201,802

166,571 150,934 148,139 150,428 SBA 5,820 5,116 6,882 4,736 3,995

Warehouse facilities 135,317 138,935 195,761 112,053 61,111 Real

estate loans: Commercial non-owner occupied 295,767 256,015 253,409

262,046 242,700 Multi-family 172,797 139,100 156,424 173,484

183,742 One-to-four family (2) 84,672 87,109 97,463 62,771 56,694

Construction 2,135 - - 308 281 Land 10,438 7,863 8,774 11,005

11,191 Other loans 4,969 4,690

1,193 2,191 4,019 Total gross

loans (3) 1,059,957 945,991 986,194 864,838 798,352 Less loans held

for sale, net (3,617 ) (3,643 ) (3,681 )

4,728 (2,401 ) Total gross loans held for

investment 1,056,340 942,348 982,513 860,110 795,951 Less: Deferred

loan origination costs/(fees) and premiums/(discounts) (910 ) (520

) (306 ) (737 ) (632 ) Allowance for loan losses (7,994 )

(7,994 ) (7,994 ) (7,658 ) (7,658 )

Loans held for investment, net $ 1,047,436 $ 933,834

$ 974,213 $ 851,715 $ 787,661

Asset

Quality

Nonaccrual loans $ 2,032 $ 3,102 $ 2,206 $ 6,280 $ 8,426 Other real

estate owned 1,186 1,561 2,258

5,521 9,339 Nonperforming assets

$ 3,218 4,663 $ 4,464 11,801

$ 17,765 Allowance for loan losses 7,994 7,994 7,994

7,658 7,658 Allowance for loan losses as a percent of total

nonperforming loans 393.41 % 257.70 % 362.38 % 121.94 % 90.89 %

Nonperforming loans as a percent of gross loans 0.19 0.33 0.22 0.73

1.06 Nonperforming assets as a percent of total assets 0.21 0.33

0.38 1.08 1.67 Net loan charge-offs for the quarter ended $ 322 $

296 $ 270 $ 145 $ 458 Net loan charge-offs for quarter to average

total loans, net 0.13 % 0.13 % 0.12 % 0.07 % 0.25 % Allowance for

loan losses to gross loans 0.75 0.85 0.81 0.89 0.96

Delinquent

Loans:

30 - 59 days $ 669 $ 58 $ 106 $ 2,565 $ 399 60 - 89 days 580 1,077

303 164 2,885 90+ days (4) 1,073 1,881

482 4,154 3,423 Total

delinquency $ 2,322 $ 3,016 $ 891 $ 6,883

$ 6,707 Delinquency as a % of total gross loans 0.22

% 0.32 % 0.09 % 0.80 % 0.84 %

(1)

Majority secured by real estate.

(2)

Includes second trust deeds.

(3)

Total gross loans for June 30, 2013 is net

of the mark-to-market discounts on Canyon National loans of $2.1

million, on Palm Desert National loans of $4.0 million, and on SDTB

loans of $560,000 and of the mark-to-market premium on FAB loans of

$103,000.

(4)

All 90 day or greater delinquencies are on

nonaccrual status and reported as part of nonperforming assets.

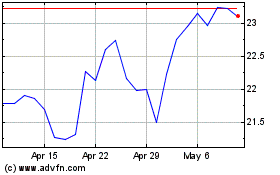

Pacific Premier Bancorp (NASDAQ:PPBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

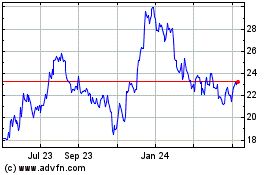

Pacific Premier Bancorp (NASDAQ:PPBI)

Historical Stock Chart

From Jul 2023 to Jul 2024