Outlook Therapeutics, Inc. (Nasdaq: OTLK), a biopharmaceutical

company working to develop and launch the first FDA-approved

ophthalmic formulation of bevacizumab for use in

retinal indications, today announced recent corporate highlights

and financial results for its fiscal first quarter ended December

31, 2022.

Recent Corporate Highlights

- Strengthened Medical Affairs and

Commercial Expertise with Appointments of Surendra Sharma, MD,

Senior Vice President of Medical Affairs, and Glen Olsheim,

Executive Director of Commercial Excellence.

- Closed on

approximately $54 million in net proceeds from two financings to

support pre-launch commercial activities through anticipated FDA

approval of ONS-5010 in third calendar quarter of 2023 and into the

fourth calendar quarter of 2023.

- Approximately $24

million registered direct equity offering priced at-the-market

under Nasdaq rules.

- Approximately $30

million net proceeds from issuance of an unsecured convertible

promissory note with an initial conversion price of $2.00 per

share.

- Received validation

of Marketing Authorization Application (MAA) by the European

Medicines Agency (EMA) for ONS-5010/ LYTENAVA™

(bevacizumab-vikg).

- Announced that the

FDA accepted its Biologics License Application (BLA) for ONS-5010 /

LYTENAVA™ (bevacizumab-vikg) for the treatment of wet AMD and set a

PDUFA goal date of August 29, 2023.

“Our first fiscal quarter of 2023 continued to

demonstrate solid execution toward the potential commercialization

of ONS-5010. With the accepted FDA filing of our BLA for ONS-5010

and PDUFA date set for August 29, 2023, and review of our MAA in

the EU underway with a decision date expected in early 2024, we are

well on our way toward our goal of becoming a commercial-stage

company,” commented Russell Trenary, President and Chief Executive

Officer of Outlook Therapeutics. “Looking ahead, we remain focused

on execution and positioning ourselves for a commercial launch of

ONS-5010 to enhance the standard of care in the retinal anti-VEGF

space.”

ONS-5010 / LYTENAVA™ (bevacizumab-vikg)

Pre-Launch Commercial Planning Underway

According to GlobalData, the use of unapproved

repackaged IV bevacizumab from compounding pharmacies is estimated

to account for approximately 50% of all wet AMD injections in the

United States each year. Globally, the nine major markets account

for an estimated $13.1 billion market for anti-VEGF drugs to treat

retina diseases.

In anticipation of potential FDA marketing

approval in 2023, Outlook Therapeutics has begun commercial launch

planning, including best-in-class partnerships with FUJIFILM

Diosynth Biotechnologies for drug substance, and with drug product

manufacturer Aji Bio-pharma Services for the finished drug

product.

Outlook Therapeutics is actively building out

its sales and commercial team, and in September 2022, Outlook

Therapeutics entered into a strategic partnership with

AmerisourceBergen in preparation for the anticipated commercial

launch in the United States of ONS-5010. As Outlook Therapeutics

moves toward a potential launch in the United States,

AmerisourceBergen’s commercialization support will expand to

include additional services. Through the agreement with

AmerisourceBergen, Outlook Therapeutics expects to significantly

increase market access and efficient distribution of ONS-5010, if

approved by the FDA. Moreover, working with AmerisourceBergen will

help to provide Outlook Therapeutics with an accelerated pathway to

deliver a high-quality customer experience to retina specialists.

To bring ONS-5010 to market in a way that benefits all stakeholders

– patients, clinicians, and payors – Outlook Therapeutics has also

been in collaborative discussions with payors and the retina

community.

Outlook Therapeutics is also developing

registration documents on a parallel path for approvals in Europe

and submitted them in December 2022. The formal review process of

the MAA by the EMA’s Committee for Medicinal Products for Human Use

(CHMP) is underway with an estimated decision date expected in

early 2024. In addition to pursuing potential strategic partnering

opportunities in the EU and other regions, such as the current

partnership with Syntone Biopharma JV in China, Outlook

Therapeutics is also exploring an expanded relationship with

AmerisourceBergen to support the launch of ONS-5010 in

international markets. AmerisourceBergen increased its global

distribution capabilities in 2021 with the acquisition of Alliance

Healthcare, a leading wholesaler of healthcare products in

Europe.

In addition to the clinical development program

evaluating ONS-5010 for wet AMD, Outlook Therapeutics has received

agreements from the FDA on three Special Protocol Assessments

(SPAs) for three additional registration clinical trials. These

SPAs cover the protocols for a planned registration clinical trial

evaluating ONS-5010 to treat branch retinal vein occlusion (BRVO),

NORSE FOUR, and two planned registration clinical trials evaluating

the drug candidate for the treatment of diabetic macular edema

(DME), NORSE FIVE and NORSE SIX.

Upcoming Anticipated

Milestones

- Continued progress with ongoing

pre-launch commercial preparations in anticipation of potential

approval for ONS-5010 in 2023;

- PDUFA goal date of August 29,

2023;

- Completion of enrollment in the

NORSE SEVEN clinical trial assessing the safety of ONS-5010 in a

pre-filled syringe; and

- Estimated decision date from the

EMA’s CHMP on the Company’s submitted MAA in EU for ONS-5010

expected in early 2024.

Financial Highlights for the Fiscal

First Quarter Ended December 31, 2022

For the fiscal first quarter ended December 31,

2022, Outlook Therapeutics reported a net loss attributable to

common stockholders of $18.7 million, or $0.08 per basic and

diluted share, compared to a net loss attributable to common

stockholders of $14.5 million, or $0.08 per basic and diluted

share, for the same period last year.

In December 2022, the Company closed a

registered direct equity offering priced at-the-market under Nasdaq

rules, resulting in net proceeds of approximately $24.0 million.

Additionally, the Company closed on an unsecured convertible

promissory note (the “Note”) with a face amount of $31.8 million

and net proceeds of approximately $30.0 million after original

issue discount and after deducting the lender’s transaction costs.

The net proceeds from these transactions are expected to provide

sufficient capital to support operations past the anticipated FDA

approval of ONS-5010 in the third calendar quarter of 2023 and into

the fourth calendar quarter of 2023.

At December 31, 2022, Outlook Therapeutics had

cash and cash equivalents of $52.3 million.

About ONS-5010 / LYTENAVA™

(bevacizumab-vikg)

ONS-5010 is an investigational ophthalmic

formulation of bevacizumab under development as an intravitreal

injection for the treatment of wet AMD and other retinal diseases.

Because no currently approved ophthalmic formulations of

bevacizumab are available, clinicians wishing to treat retinal

patients with bevacizumab have had to use unapproved repackaged IV

bevacizumab provided by compounding pharmacies, products that have

known risks of contamination and inconsistent potency and

availability. If approved, ONS-5010 can replace the need to use

unapproved repackaged oncologic IV bevacizumab from compounding

pharmacies for the treatment of wet AMD.

Bevacizumab-vikg is a recombinant humanized

monoclonal antibody (mAb) that selectively binds with high affinity

to all isoforms of human vascular endothelial growth factor (VEGF)

and neutralizes VEGF’s biologic activity through a steric blocking

of the binding of VEGF to its receptors Flt-1 (VEGFR-1) and KDR

(VEGFR-2) on the surface of endothelial cells. Following

intravitreal injection, the binding of bevacizumab-vikg to VEGF

prevents the interaction of VEGF with its receptors on the surface

of endothelial cells, reducing endothelial cell proliferation,

vascular leakage, and new blood vessel formation in the retina.

About Outlook Therapeutics,

Inc.

Outlook Therapeutics is a biopharmaceutical

company working to develop and launch ONS-5010/ LYTENAVA™

(bevacizumab-vikg) as the first FDA-approved ophthalmic formulation

of bevacizumab for use in retinal indications, including wet AMD,

DME and BRVO. The FDA accepted Outlook Therapeutics’ BLA submission

for ONS-5010 to treat wet AMD with a PDUFA goal date of August 29,

2023. The submission is supported by Outlook Therapeutics’ wet AMD

clinical program, which consists of three clinical trials: NORSE

ONE, NORSE TWO, and NORSE THREE. If ONS-5010 ophthalmic bevacizumab

is approved, Outlook Therapeutics expects to commercialize it as

the first and only FDA-approved ophthalmic formulation of

bevacizumab for use in treating retinal diseases in the United

States, United Kingdom, Europe, Japan, and other markets. As part

of the Company’s multi-year commercial planning process, and in

anticipation of potential FDA approval in August 2023, Outlook

Therapeutics and AmerisourceBergen have entered into a strategic

commercialization agreement to expand the Company’s reach for

connecting to retina specialists and their patients.

AmerisourceBergen will provide third-party logistics (3PL) services

and distribution, as well as pharmacovigilance services in the

United States. For more information, please visit

www.outlooktherapeutics.com.

Forward-Looking Statements

This press release contains forward-looking

statements. All statements other than statements of historical

facts are “forward-looking statements,” including those relating to

future events. In some cases, you can identify forward-looking

statements by terminology such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “may,” “might,”

“intend,” “potential,” “predict,” “should,” or “will,” the negative

of terms like these or other comparable terminology, and other

words or terms of similar meaning. These include, among others,

statements about ONS-5010’s potential as the first FDA-approved

ophthalmic formulation of bevacizumab-vikg, including benefits

therefrom to patients, payors and physicians, including

expectations of market exclusivity, potential approval and

commercial launch of ONS-5010 and the timing thereof, expectations

about the sufficiency of our capital, upcoming anticipated

milestones, expectations concerning decisions of regulatory bodies,

including the FDA and the EMA, and the timing thereof, our

estimated market, expectations concerning our relationship with

AmerisourceBergen and the benefits thereof, plans for and the

timing of potential future clinical trials, including the expected

completion of NORSE SEVEN and the expected commencement of NORSE

FOUR, NORSE FIVE and NORSE SIX, potential strategic partners, plans

for regulatory submissions, approvals and commercialization of

ONS-5010 in other markets and other statements that are not

historical fact. Although Outlook Therapeutics believes that it has

a reasonable basis for the forward-looking statements contained

herein, they are based on current expectations about future events

affecting Outlook Therapeutics and are subject to risks,

uncertainties and factors relating to its operations and business

environment, all of which are difficult to predict and many of

which are beyond its control. These risk factors include those

risks associated with developing pharmaceutical product candidates,

risks of conducting clinical trials and risks in obtaining

necessary regulatory approvals, as well as those risks detailed in

Outlook Therapeutics’ filings with the Securities and Exchange

Commission (the “SEC”), including the Annual Report on Form 10-K

for the fiscal year ended September 30, 2022 filed with the SEC and

future quarterly reports we file with the SEC, which include the

uncertainty of future impacts related to the ongoing COVID-19

pandemic and the impacts of the pandemic and other macroeconomic

factors, including as a result of the ongoing conflict between

Russia and Ukraine, on the global business environment. These risks

may cause actual results to differ materially from those expressed

or implied by forward-looking statements in this press release. All

forward-looking statements included in this press release are

expressly qualified in their entirety by the foregoing cautionary

statements. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date hereof.

Outlook Therapeutics does not undertake any obligation to update,

amend or clarify these forward-looking statements whether as a

result of new information, future events or otherwise, except as

may be required under applicable securities law.

CONTACTS:Media

Inquiries:Harriet UllmanVice PresidentLaVoie Health

ScienceT: 617-669-3082hullman@lavoiehealthscience.com

Investor

Inquiries: Jenene

ThomasChief Executive OfficerJTC Team, LLCT:

833.475.8247 OTLK@jtcir.com

|

Outlook Therapeutics, Inc. |

|

Consolidated Statements of Operations |

|

(Amounts in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

|

|

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

Research and development |

|

|

$ |

9,862 |

|

|

$ |

9,872 |

|

|

General and administrative |

|

|

|

5,826 |

|

|

|

3,277 |

|

|

Loss from operations |

|

|

|

|

(15,688 |

) |

|

|

(13,149 |

) |

|

|

|

|

|

|

|

|

|

|

(Income) loss on equity method investment |

|

|

|

(22 |

) |

|

|

24 |

|

|

Interest expense, net |

|

|

|

|

2,449 |

|

|

|

352 |

|

|

Loss on extinguishment of debt |

|

|

|

578 |

|

|

|

1,026 |

|

|

Change in fair value of promissory notes |

|

|

|

- |

|

|

|

162 |

|

|

Change in fair value of warrant liability |

|

|

|

(30 |

) |

|

|

(250 |

) |

|

Net loss attributable to common stockholders |

|

|

$ |

(18,663 |

) |

|

$ |

(14,463 |

) |

|

|

|

|

|

|

|

|

|

|

Per share information: |

|

|

|

|

|

|

|

Net loss per share of common stock, basic and diluted |

|

|

$ |

(0.08 |

) |

|

$ |

(0.08 |

) |

|

Weighted average shares outstanding, basic and diluted |

|

|

|

227,411 |

|

|

|

188,158 |

|

|

|

|

Consolidated Balance Sheet Data |

|

(Amounts in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2022 |

|

September 30, 2022 |

|

Cash and cash equivalents |

|

|

|

$ 52,341 |

|

$ 17,397 |

|

Total assets |

|

|

|

|

$ 62,688 |

|

$ 28,528 |

|

Current liabilities |

|

|

|

$ 15,082 |

|

$ 19,730 |

|

Total stockholders' equity |

|

|

|

$ 15,759 |

|

$ 8,737 |

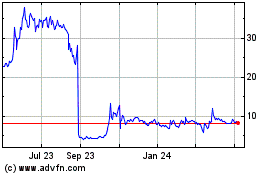

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Jun 2024 to Jul 2024

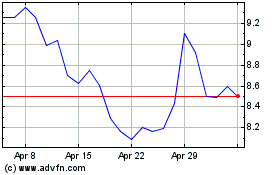

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Jul 2023 to Jul 2024