0001138978

false

0001138978

2023-10-06

2023-10-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest reported): October 6, 2023

Novo

Integrated Sciences, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40089 |

|

59-3691650 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

Number) |

11120

NE 2nd Street, Suite 100, Bellevue, WA 98004

(Address

of principal executive offices)

(206)

617-9797

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.)

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CF$ 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on which Registered |

| Common

Stock, $0.001 par value |

|

NVOS |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01. Regulation FD Disclosure.

On

October 6, 2023, Novo Integrated Sciences, Inc. (the “Company”) issued a press release providing an update with respect to

the following previously disclosed pending transactions: (i) the Blacksheep Trust One Billion Dollar Master Collateral Transfer Agreement,

(ii) the Letter of Funding Commitment (the “Letter of Funding Commitment”) for a direct investment in the Company of $40,000,000

from Sheikh Khaled bin Mohammad bin Fahad Al Thanayan to develop eldercare facilities in Canada, and (iii) the unsecured 15-year $70,000,000

promissory note with RC Consulting LLC in favor of SCP Tourbillion Monaco for a lump sum debt funding of $57,000,000. A copy of the press

release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

A

copy of the Letter of Funding Commitment, dated May 5, 2023, is also attached hereto as Exhibit 99.2.

The

information included in this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth under this

Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required

to be disclosed solely to satisfy the requirements of Regulation FD.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Novo

Integrated Sciences, Inc. |

| |

|

|

| Dated:

October 6, 2023 |

By:

|

/s/

Robert Mattacchione |

| |

|

Robert

Mattacchione |

| |

|

Chief

Executive Officer |

Exhibit

99.1

Novo

Integrated Sciences Provides Update on Certain Current Events

BELLEVUE,

Wash., October 6, 2023 - Novo Integrated Sciences, Inc. (NASDAQ: NVOS) (the “Company” or “Novo”) today provides

an update with respect to the following previously disclosed pending transactions: (i) the Blacksheep Trust One Billion Dollar Master

Collateral Transfer Agreement (the “Collateral Transfer Facility”), (ii) the Letter of Funding Commitment for a direct investment

in the Company of $40,000,000 from Sheikh Khaled bin Mohammad bin Fahad Al Thanayan (“Sheikh Khaled”) to develop eldercare

facilities in Canada, and (iii) the unsecured 15-year $70,000,000 promissory note with RC Consulting LLC in favor of SCP Tourbillion

Monaco for a lump sum debt funding of $57,000,000:

Collateral

Transfer Facility. It is important to note that a facility of this nature is not a novelty nor unique to Novo, but rather an effective

financing tool in European and Asian marketplaces.

What

is the Collateral? The Company’s preliminary due diligence establishing the existence of the collateral in a form and amount

sufficient to fulfill the contemplated transfer reflected a GOLD-BACKED GUARANTEE (the “Collateral”).

Validation

and Authentication. The pending Collateral validation and authentication will be conducted by an independent PCAOB auditor as

the Collateral to be transferred will be reflected on the Company’s balance sheet. Upon verification and authentication of the

Collateral, the parties will enter into a Collateral Transfer Agreement and other ancillary agreements related to the book transfer and

segregation of collateral.

Monetization.

Upon completion of the Collateral transfer, the Company expects to leverage the Collateral in order to obtain a significant line

of credit. The line of credit would be secured solely by the Collateral, leaving the balance of the Company’s assets free and clear.

Blacksheep

Trust Compensation. Upon successful monetization, the Company will advance the prescribed fee of 15% of the monetization amount

to Blacksheep Trust. This is the first time Blacksheep Trust will be entitled to ANY compensation. Upon further draw-down of funds

from the Collateral backed line of credit for deal flow, Blacksheep Trust will be entitled to an annual distribution of 10% of net profits

as identified by an independent auditor based on the Company’s business activity resulting from the direct investment of any funds

derived from monetization.

Risk

to Company up to Monetization. Prior to monetization, there is no risk to the Company as a result of the Collateral Transfer

Facility.

What

is Blacksheep Trust? Blacksheep Trust is a New York-based private express trust settled for the purposes of Benevolent Services

with (i) a 33% allocation to charitable services, and (ii) 67% allocation to social economic development.

Who

is Blacksheep Trust?

| ● | Administered

by multiple Trustees. |

| ● | Mr.

Baron, Trustee. Prior to assuming his role as a trustee of Blacksheep Trust, Mr. Baron was

involved in an unfortunate circumstance that cost him his reputation and prompted his shift

of focus to charitable services and social economic development. |

| | | |

| ● | Mr.

Sanjeev Verma, Executive Trustee. Mr. Verma is a distinguished former international banker

with 30 years of banking and financial services expertise, having previously worked with

Goldman Sachs, Deutsche Bank, Standard Chartered Bank, and Charles Schwab. Mr. Verma has

extensive experience working with global regulators and implementing robust risk management

and governance structures. We anticipate that Mr. Verma will be Blacksheep Trust’s

nominee to serve on Novo’s Board of Directors. In this role, we expect that Mr. Verma

will bring his wealth of expertise and distinguished reputation, and will play a pivotal

role on Novo’s Board, pending the successful transfer of collateral through the Collateral

Transfer Facility. |

Expressing

his anticipation for this project, Mr. Verma stated, “As an Executive Trustee of Blacksheep Trust, I look forward to contributing

to Novo’s success. Our mission is to uphold the highest standards, and I am eager to bring my expertise to Novo’s Board upon

the successful completion of the collateral transfer.”

$40,000,000

Letter of Funding Commitment from Sheikh Khaled. As previously announced, the Company has a funding commitment for a direct investment

of $40,000,000 from Sheikh Khaled through Gulf International Minerals and Energy Group (GIMEG). The funding is expected to result in

project-specific joint ventures for development of elder care and senior living community facilities in Canada. The Company is actively

working to identify and secure the initial eldercare facility for this project.

Unsecured

15-year $70,000,000 Promissory Note. On April 27, 2023, the Company disclosed the issuance of an unsecured 15-year $70,000,000 promissory

note, for a lump sum debt funding of $57,000,000, to RC Consulting LLC in favor of SCP Tourbillion Monaco. As a result of the Company’s

then non-compliance with Nasdaq’s continued listing requirements, the Company was unable to receive any funds available to it through

the coupon. On May 31, 2023, the Company regained Nasdaq compliance, resulting in the commencement of underwriting and lender compliance

review.

Regarding

the current funding timeline, Roland Coston, President and CEO of RC Consulting LLC, commented, “RC Consulting Group L.L.C’s

duties as a fiduciary in any transaction are taken seriously and acted on with the utmost in professionalism and integrity. In short

order Novo Integrated Sciences Inc. will be granted the right of first draw against the coupon resulting in a more significant role for

RC as it relates to ensuring a good compliance standing. Our address of business is for convenience and privacy purposes as well as security,

the simple fact that this needs to be explained in any forum is a testament to the suspect motive behind the inquiry.”

About

Novo Integrated Sciences, Inc.

Novo

Integrated Sciences, Inc. is pioneering a holistic approach to patient-first health and wellness through a multidisciplinary healthcare

ecosystem of services and product innovation. Novo offers an essential and differentiated solution to deliver, or intend to deliver,

these services and products through the integration of medical technology, advanced therapeutics, and rehabilitative science.

We

believe that “decentralizing” healthcare, through the integration of medical technology and interconnectivity, is an essential

solution to the rapidly evolving fundamental transformation of how non-catastrophic healthcare is delivered both now and in the future.

Specific to non-critical care, ongoing advancements in both medical technology and inter-connectivity are allowing for a shift of the

patient/practitioner relationship to the patient’s home and away from on-site visits to primary medical centers with mass-services.

This acceleration of “ease-of-access” in the patient/practitioner interaction for non-critical care diagnosis and subsequent

treatment minimizes the degradation of non-critical health conditions to critical conditions as well as allowing for more cost-effective

healthcare distribution.

The

Company’s decentralized healthcare business model is centered on three primary pillars to best support the transformation of non-catastrophic

healthcare delivery to patients and consumers:

| ● | First

Pillar: Service Networks. Deliver multidisciplinary primary care services through (i) an

affiliate network of clinic facilities, (ii) small and micro footprint sized clinic facilities

primarily located within the footprint of box-store commercial enterprises, (iii) clinic

facilities operated through a franchise relationship with the Company, and (iv) corporate

operated clinic facilities. |

| | | |

| ● | Second

Pillar: Technology. Develop, deploy, and integrate sophisticated interconnected technology,

interfacing the patient to the healthcare practitioner thus expanding the reach and availability

of the Company’s services, beyond the traditional clinic location, to geographic areas

not readily providing advanced, peripheral based healthcare services, including the patient’s

home. |

| | | |

| ● | Third

Pillar: Products. Develop and distribute effective, personalized health and wellness product

solutions allowing for the customization of patient preventative care remedies and ultimately

a healthier population. The Company’s science-first approach to product innovation

further emphasizes our mandate to create and provide over-the-counter preventative and maintenance

care solutions. |

Innovation

through science combined with the integration of sophisticated, secure technology assures Novo Integrated Sciences of continued cutting-edge

advancement in patient-first platforms.

For

more information concerning Novo Integrated Sciences, please visit www.novointegrated.com.

Twitter,

LinkedIn, Facebook, Instagram, YouTube

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section

21E of the Securities Exchange Act of 1934, as amended, or the Private Securities Litigation Reform Act of 1995. All statements other

than statements of historical facts included in this press release are forward-looking statements. In some cases, forward-looking statements

can be identified by words such as “believe,” “intend,” “expect,” “anticipate,” “plan,”

“potential,” “continue,” or similar expressions. Such forward-looking statements include risks and uncertainties,

and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking

statements. These factors, risks, and uncertainties are discussed in Novo’s filings with the Securities and Exchange Commission.

Investors should not place any undue reliance on forward-looking statements since they involve known and unknown uncertainties and other

factors which are, in some cases, beyond Novo’s control which could, and likely will, materially affect actual results, levels

of activity, performance or achievements. Any forward-looking statement reflects Novo’s current views with respect to future events

and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy

and liquidity. Novo assumes no obligation to publicly update or revise these forward-looking statements for any reason, or to update

the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information

becomes available in the future. The contents of any website referenced in this press release are not incorporated by reference herein.

Chris

David, COO & President

Novo Integrated Sciences, Inc.

chris.david@novointegrated.com

(888) 512-1195

Exhibit

99.2

v3.23.3

Cover

|

Oct. 06, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 06, 2023

|

| Entity File Number |

001-40089

|

| Entity Registrant Name |

Novo

Integrated Sciences, Inc.

|

| Entity Central Index Key |

0001138978

|

| Entity Tax Identification Number |

59-3691650

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

11120

NE 2nd Street

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Bellevue

|

| Entity Address, State or Province |

WA

|

| Entity Address, Postal Zip Code |

98004

|

| City Area Code |

(206)

|

| Local Phone Number |

617-9797

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value

|

| Trading Symbol |

NVOS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

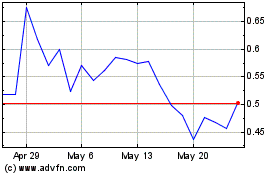

Novo Integrated Sciences (NASDAQ:NVOS)

Historical Stock Chart

From Apr 2024 to May 2024

Novo Integrated Sciences (NASDAQ:NVOS)

Historical Stock Chart

From May 2023 to May 2024