0001528287false00015282872023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2023

NEUROPACE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or Other Jurisdiction of Incorporation) | 001-40337 (Commission File Number) | 22-3550230 (IRS Employer Identification No.) |

455 N. Bernardo Avenue Mountain View, CA (Address of principal executive offices) | | 94043 (Zip Code) |

(650) 237-2700

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | NPCE | | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2023, NeuroPace, Inc. issued a press release announcing its financial results for the fiscal quarter ended June 30, 2023. A copy of the press release dated August 8, 2023, is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The foregoing information in this Item 2.02 (including the exhibit hereto) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | Press release dated August 8, 2023 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| NeuroPace, Inc. |

| |

| Dated: August 8, 2023 | By: | /s/ Rebecca Kuhn |

| | Rebecca Kuhn |

| | Chief Financial Officer and Vice President, Finance and Administration |

NeuroPace Reports Second Quarter 2023 Financial Results and Increases Full Year 2023 Revenue Guidance

Second quarter 2023 revenue of $16.5 million increased 62% year-over-year

Full-year revenue guidance increased to $59-$61 million, up from $52-$54 million

Cash burn reduced to $4 million in the second quarter of 2023, relative to $9.8 million in the first quarter of 2023

Mountain View, Calif. – August 8, 2023 – NeuroPace, Inc. (Nasdaq: NPCE), a commercial-stage medical device company focused on transforming the lives of people living with epilepsy, today reported financial results for the second quarter ended June 30, 2023.

Recent Highlights

•Achieved total revenue of $16.5 million for the second quarter of 2023, representing a 62% increase over the second quarter of 2022

•Through a disciplined approach to cash management, reduced cash burn to $4 million from $9.8 million in the first quarter of 2023, further extending the Company’s cash runway

•NAUTILUS trial enrollment remains on track to expand indication into generalized epilepsy, with completed enrollment anticipated in the first quarter of 2024

•Completed initial implants for first cohort of patients in NIH-funded feasibility study in Lennox-Gastaut syndrome, or LGS

•Enhanced efforts to expand access to 1,800 epileptologists and all functional neurosurgeons based on updated site qualification criteria, which NeuroPace believes significantly increases total addressable market in the U.S.

•Appointed Joel Becker as President, CEO and member of the Board of Directors

“I am pleased with the results from the second quarter and with the positive momentum in the business,” said Joel Becker, Chief Executive Officer of NeuroPace. “We are focused on closing the treatment gap for drug refractory epilepsy patients by increasing the availability and adoption of our RNS System, leveraging our partnership with DIXI Medical, and executing with operating discipline to manage and extend our cash runway. Importantly, the number of new RNS System implants in comprehensive epilepsy centers, or CECs, continues to grow, which is a testament to the distinct and compelling features offered by our RNS therapy, as well as the growing body of evidence of proven, long-term performance. Additionally, we continue to make promising clinical study progress in generalized epilepsy with the NAUTILUS trial. We have also recently begun working to expand access to RNS therapy. Based on FDA-approved updates to center and clinician qualifications, we will now have the opportunity to target the additional 1,800 epileptologists outside of Level 4 centers and the entire population of functional neurosurgeons, empowering them to provide the RNS System as a much-needed treatment option for their patients. The entire NeuroPace team is focused on taking advantage of these opportunities to deliver on the potential of RNS therapy for indicated drug refractory epilepsy patients.”

Second Quarter 2023 Financial Results

Total revenue was $16.5 million in the second quarter of 2023, representing growth of 62% compared to the prior year period and 14% compared to the prior quarter. The strong performance was primarily driven by increased utilization of the RNS System by physicians in treating new patients. NeuroPace also had meaningful revenue from DIXI Medical products, which was higher than anticipated previously. Replacement implant revenue continued to decline again this quarter, as anticipated, and was approximately 5% of total revenue.

Gross margin for the second quarter of 2023 was 72.5% compared to 73.2% in the second quarter of 2022 and 71.7% in the first quarter of 2023. The decline in gross margin relative to the prior year period was primarily due to a change in product mix as a result of the Company's agreement to distribute DIXI Medical products in the U.S., which have a lower gross margin than the Company’s core RNS products.

Total operating expenses in the second quarter of 2023 were $19.8 million compared with $18.4 million in the same period of the prior year. In the second quarter of 2023, operating expenses as a percentage of revenue were lower for both R&D and SG&A.

R&D expense in the second quarter of 2023 was $5.3 million compared with $5.7 million in the same period of 2022. The decrease in R&D expense included reductions in outside services for product development and clinical studies, largely resulting from an increased focus and prioritization of the key projects in these areas.

SG&A expense in the second quarter of 2023 was $14.5 million compared with $12.8 million in the prior year period. The increase in SG&A was primarily driven by personnel-related expenses, including sales-based compensation and one-time expenses related to the CEO transition, and expenses associated with distributing DIXI Medical products. These increases were partially offset by reduced general and administrative expenses, primarily outside services and insurance.

Net loss was $9.1 million for the second quarter of 2023, compared to a net loss of $12.7 million in the second quarter of 2022. Interest expense in the second quarter of 2023 was $2.1 million, compared to $1.9 million in the prior year period.

Cash, cash equivalents, and short-term investments as of June 30, 2023, totaled $63.6 million. Long-term borrowings totaled $54.9 million as of June 30, 2023, with the full principal due on September 30, 2025. Cash burn in the second quarter of 2023 was $4 million, a substantial reduction from the cash burn of $9.8 million in the first quarter of 2023.

Full Year 2023 Financial Guidance

•Increased total revenue guidance to range between $59 million and $61 million, representing growth of 30% to 34% over 2022, as compared to prior guidance of between $52 million and $54 million

•Increased gross margin to range between 70% and 72%, as compared to prior guidance of 69% to 71%

•Reiterated total operating expenses to range between $75 million and $77 million, which includes $9 to $10 million in non-cash expenses

NeuroPace continues to expect revenue growth to be primarily driven by increasing utilization of its RNS System and the full year impact of distributing DIXI Medical stereo EEG products, partially offset by a continuing decline in revenue from replacement device implants through the end of this year, as the Company completes its transition to its second-generation device, with a longer-lasting battery. NeuroPace continues to focus on bringing its novel RNS System to more patients living with drug-resistant epilepsy through both existing CECs as well as an expanded group of epileptologists and the entire population of functional neurosurgeons. It also expects to complete enrollment in NAUTILUS, its indication-expanding clinical trial, in the first quarter of 2024. The Company is committed to advancing its mission of transforming the lives of patients living with epilepsy while delivering shareholder value.

Webcast and Conference Call Information

NeuroPace will host a conference call to discuss the second quarter 2023 financial results after market close on Tuesday, August 8, 2023, at 4:30 P.M. Eastern Time.

Investors interested in listening to the conference call may do so by accessing a live and archived webcast of the event at www.neuropace.com, on the Investors page in the News & Events section. The webcast will be available for replay for at least 90 days after the event.

About NeuroPace, Inc.

Based in Mountain View, Calif., NeuroPace is a commercial-stage medical device company focused on transforming the lives of people living with epilepsy by reducing or eliminating the occurrence of debilitating seizures. Its novel and differentiated RNS System is the first and only commercially available, brain-responsive platform that delivers personalized, real-time treatment at the seizure source. This platform can drive a better standard of care for patients living with drug-resistant epilepsy and has the potential to offer a more personalized solution and improved outcomes to the large population of patients suffering from other brain disorders.

Forward Looking Statements

In addition to background and historical information, this press release contains “forward-looking statements” based on NeuroPace’s current expectations, forecasts and beliefs, including among other things, the statements related to commercial strategy, execution, expansion, expense management, operational performance, future financial performance, estimates of market opportunity and forecasts of market and revenue growth, above. These forward-looking statements are subject to inherent uncertainties, risks, and assumptions that are difficult to predict. Actual outcomes and results could differ materially due to a number of factors, including the ongoing uncertainty of the impact of COVID-19, as well as COVID recovery impact, on NeuroPace’s business. These and other risks and uncertainties include those described more fully in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in NeuroPace’s public filings with the U.S. Securities and Exchange Commission (SEC), including its Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 2, 2023 and its Quarterly Report on Form 10-Q for the period ended June 30, 2023 to be filed with the SEC, as well as any other reports that it may file with the SEC in the future. Forward-looking statements contained in this press release are based on information available to NeuroPace as of the date hereof. NeuroPace undertakes no obligation to update such information except as required under applicable law. These forward-looking statements should not be relied upon as representing NeuroPace’s views as of any date subsequent to the date of this press release and should not be relied upon as a prediction of future events. In light of the foregoing, investors are urged not to rely on any forward-looking statement in reaching any conclusion or making any investment decision about any securities of NeuroPace.

Investor Contact:

Jeremy Feffer

Managing Director

LifeSci Advisors

jfeffer@lifesciadvisors.com

NeuroPace, Inc.

Condensed Statements of Operations

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands, except share and per share amounts) | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 16,510 | | | $ | 10,200 | | | $ | 30,982 | | | $ | 21,574 | |

| Cost of goods sold | 4,538 | | 2,734 | | 8,638 | | 5,849 |

| Gross profit | 11,972 | | 7,466 | | 22,344 | | 15,725 |

| Operating expenses | | | | | | | |

| Research and development | 5,343 | | 5,669 | | 10,606 | | 11,246 |

| Selling, general and administrative | 14,483 | | 12,771 | | 27,911 | | 25,215 |

| Total operating expenses | 19,826 | | 18,440 | | 38,517 | | 36,461 |

| Loss from operations | (7,854) | | (10,974) | | (16,173) | | (20,736) |

| Interest income | 733 | | 221 | | 1,459 | | 355 |

| Interest expense | (2,125) | | (1,852) | | (4,090) | | (3,682) |

| Other income (expense), net | 122 | | (85) | | (695) | | (88) |

| Net loss | $ | (9,124) | | | $ | (12,690) | | | $ | (19,499) | | | $ | (24,151) | |

| Net loss per share attributable to common stockholders, basic and diluted | $ | (0.36) | | | $ | (0.52) | | | $ | (0.77) | | | $ | (0.99) | |

| Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted | 25,472,526 | | | 24,503,552 | | | 25,285,933 | | | 24,406,100 | |

NeuroPace, Inc.

Condensed Balance Sheets

(unaudited)

| | | | | | | | | | | |

| June 30, | | December 31, |

| (in thousands, except share and per share amounts) | 2023 | | 2022 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 7,855 | | | $ | 6,605 | |

| Short-term investments | 55,716 | | 70,804 |

| Accounts receivable | 10,876 | | 7,482 |

| Inventory | 10,014 | | 9,712 |

| Prepaid expenses and other current assets | 2,050 | | 3,111 |

| Total current assets | 86,511 | | 97,714 |

| Property and equipment, net | 976 | | 1,064 |

| Operating lease right-of-use asset | 14,136 | | | 14,838 |

| Restricted cash | 122 | | | 122 |

| Deferred offering costs | 466 | | 347 |

| Other assets | 21 | | 21 |

| Total assets | $ | 102,232 | | | $ | 114,106 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 1,807 | | | $ | 2,147 | |

| Accrued liabilities | 8,182 | | 7,414 |

| Operating lease liability | 1,519 | | | 1,415 | |

| Total current liabilities | 11,508 | | 10,976 |

| Long-term debt | 54,854 | | 52,913 |

Operating lease liability, net of current portion | 14,644 | | 15,440 |

| Total liabilities | 81,006 | | 79,329 |

| | | |

| Stockholders’ equity | | | |

| Common stock, $0.001 par value | 26 | | 25 |

| Additional paid-in capital | 511,552 | | 506,713 |

| Accumulated other comprehensive loss | — | | (1,108) |

| Accumulated deficit | (490,352) | | (470,853) |

| Total stockholders’ equity | 21,226 | | 34,777 |

| Total liabilities and stockholders’ equity | $ | 102,232 | | | $ | 114,106 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

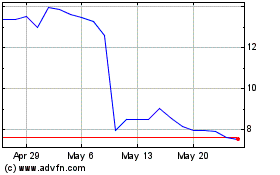

Neuropace (NASDAQ:NPCE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Neuropace (NASDAQ:NPCE)

Historical Stock Chart

From Nov 2023 to Nov 2024