As

filed with the Securities and Exchange Commission on January 21, 2020

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

NanoVibronix,

Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

01-0801232

|

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(I.R.S.

Employer

Identification Number)

|

525

Executive Blvd.

Elmsford,

NY 10523

(914)

233-3004

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brian

Murphy

Chief Executive Officer

NanoVibronix, Inc.

525 Executive Blvd.

Elmsford,

New York

(914) 233-3004

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

of all communications, including communications sent to agent for service, should be sent to:

Rick

A. Werner, Esq.

Jayun

Koo, Esq.

Haynes and Boone, LLP

30 Rockefeller Plaza, 26th Floor

New York, New York 10112

Tel. (212) 659-7300

Fax (212) 884-8234

Approximate

date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check

the following box: þ

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement filed pursuant to General Instruction I.D. or a post-effective amendment thereto that shall

become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ☐

Indicate

by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

☐

|

Accelerated

filer

|

☐

|

|

Non-accelerated

filer

|

☐

|

Smaller

reporting company

|

þ

|

|

|

|

Emerging

Growth company

|

þ

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION

OF REGISTRATION FEE

Title of each class of securities

to be registered

|

|

Amount to be

Registered(1) (2)

|

|

|

Proposed

Maximum

Offering Price

Per Share(3)

|

|

|

Proposed

maximum

aggregate

offering price (3)

|

|

|

Amount of

registration fee (4)

|

|

|

Common Stock, $0.001 par value per share

|

|

|

4,250,000

|

|

|

$

|

2.79

|

|

|

$

|

11,857,500

|

|

|

$

|

1,539.10

|

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act of 1933, as amended, the shares of common stock offered by this registration statement

shall be deemed to cover such additional securities as may be issued as a result of share splits, share dividends or similar

transactions.

|

|

|

|

|

(2)

|

Comprised

of (i) 1,600,000 shares of common stock issuable upon conversion of the Series E Convertible Preferred Stock (the “Series

E Preferred Stock”) issued in a private placement on June 21, 2019, (ii) 1,600,000 shares of common stock issuable upon

conversion of the Series E Preferred Stock issuable upon exercise of the warrants issued in a private placement on June 21,

2019, (iii) 210,000 shares of common stock issuable upon conversion of the Series E Preferred Stock issued in a private placement

on July 31, 2019, (iv) 210,000 shares of common stock issuable upon conversion of the Series E Preferred Stock issuable upon

exercise of the warrants issued in a private placement on July 31, 2019, (v) 290,000 shares of common stock issued in a private

placement on July 31, 2019, (vi) 290,000 shares of common stock issuable upon exercise of the warrants issued in a private

placement on July 31, 2019, (vii) 25,000 shares of common stock issued in a private placement on August 27, 2019, and (viii)

25,000 shares of common stock issuable upon exercise of the warrants issued in a private placement on August 27, 2019.

|

|

|

|

|

(3)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended,

and based upon the average of the high and low sale prices of our shares of common stock on the Nasdaq Capital Market on January

14, 2020.

|

|

|

|

|

(4)

|

Calculated

in accordance with Rule 457(c) under the Securities Act, as amended.

|

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL

THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME

EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL

BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The

information in this prospectus is not complete and may be changed. The selling stockholder named in this prospectus may not sell

these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus

is not an offer to sell these securities and the selling stockholder named in this prospectus is not soliciting an offer to buy

these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED january 21, 2020

PROSPECTUS

4,250,000

Shares

NanoVibronix,

Inc.

Common

Stock

The

selling stockholders named in this prospectus may use this prospectus to offer and resell from time to time up to 4,250,000 shares

of our common stock, which are comprised of (i) 1,600,000 shares of common stock issuable upon conversion of the Series E Convertible

Preferred Stock (the “Series E Preferred Stock”) issued in a private placement on June 21, 2019, (ii) 1,600,000 shares

of common stock issuable upon conversion of the Series E Preferred Stock issuable upon exercise of the warrants to purchase Series

E Preferred Stock issued in a private placement on June 21, 2019, (iii) 210,000 shares of common stock issuable upon conversion

of the Series E Preferred Stock issued in a private placement on July 31, 2019, (iv) 210,000 shares of common stock issuable upon

conversion of the Series E Preferred Stock issuable upon exercise of the warrants to purchase Series E Preferred Stock issued

in a private placement on July 31, 2019, (v) 290,000 shares of common stock issued in a private placement on July 31, 2019, (vi)

290,000 shares of common stock issuable upon exercise of the common stock warrants issued in a private placement on July 31, 2019,

(vii) 25,000 shares of common stock issued in a private placement on August 27, 2019, and (viii) 25,000 shares of common stock

issuable upon exercise of the common stock warrants issued in a private placement on August 27, 2019.

The

selling stockholders acquired, as applicable, (1) the shares of Series E Preferred Stock and the warrants to purchase Series E

Preferred Stock from us in a private offering exempt from registration under the Securities Act of 1933, as amended (the “Securities

Act”), pursuant to either a securities purchase agreement, dated June 21, 2019 (the “June SPA”), or a securities

purchase agreement, dated July 31, 2019 (the “July Preferred SPA”), (2) the shares of common stock and the warrants

to purchase common stock from us in a private offering exempt from registration under the Securities Act pursuant to a securities

purchase agreement, dated July 31, 2019 (the “July Common SPA”), and (3) the shares of common stock and the warrants

to purchase common stock from us in a private offering exempt from registration under the Securities Act pursuant to a securities

purchase agreement we entered with Christopher Fasherk, one of our directors, dated August 27, 2019 (the “Affiliate SPA”)

. We are registering the offer and resale of the shares of our common stock issuable upon the conversion of the shares of Series

E Preferred Stock issued pursuant to the June SPA and the July Preferred SPA, and the shares of our common stock issuable upon

the conversion of the shares of Series E Preferred Stock issuable upon exercise of the warrants to purchase Series E Preferred

Stock issued pursuant to the June SPA and the July Preferred SPA to satisfy a provision in the June SPA or the July Preferred

SPA, as applicable, and the shares of our common stock and the shares of common stock issuable upon exercise of the common stock

warrants to satisfy a provision in the July Common SPA or the Affiliate SPA, as applicable, pursuant to each of which we agreed

to register the resale of the respective shares of common stock.

We

will not receive any of the proceeds from the sale of our common stock by the selling stockholders. However, we will receive proceeds

from the exercise of the warrants to purchase Series E Preferred Stock and the warrants to purchase common stock if such warrants

are exercised for cash. We intend to use those proceeds, if any, for working capital and general corporate purposes.

Any

shares of common stock subject to resale hereunder will have been issued by us and acquired by the selling stockholders prior

to any resale of such shares pursuant to this prospectus.

The

selling stockholders named in this prospectus, or their donees, pledgees, transferees or other successors-in-interest, may offer

or resell the shares from time to time through public or private transactions at prevailing market prices, at prices related to

prevailing market prices or at privately negotiated prices. The selling stockholders will bear all commissions and discounts,

if any, attributable to the sale of shares, and all selling and other expenses incurred by the selling stockholders. We will bear

all costs, expenses and fees in connection with the registration of the shares. For additional information on the methods of sale

that may be used by the selling stockholders, see “Plan of Distribution” beginning on page 18 of this prospectus.

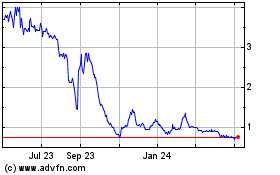

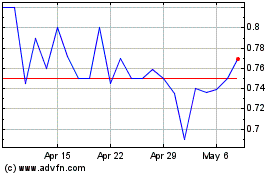

Our

common stock is listed on the Nasdaq Capital Market under the symbol “NAOV.” On January 17, 2020, the last reported

sale price of our common stock as reported on the Nasdaq Capital Market was $2.77 per share.

We

qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012, or JOBS Act,

and have elected to comply with certain reduced public company reporting requirements in this and future filings.

Investing

in our securities involves a high degree of risk. These risks are discussed in this prospectus under “Risk Factors”

beginning on page 5 and in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are incorporated

by reference in this prospectus and in any applicable prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is

, 2020

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission using a “shelf”

registration process. The selling stockholders named in this prospectus may resell, from time to time, in one or more offerings,

the common stock offered by this prospectus. Information about the selling stockholders may change over time. When the selling

stockholders sells shares of common stock under this prospectus, we will, if necessary and required by law, provide a prospectus

supplement that will contain specific information about the terms of that offering. Any prospectus supplement may also add to,

update, modify or replace information contained in this prospectus. If a prospectus supplement is provided and the description

of the offering in the prospectus supplement varies from the information in this prospectus, you should rely on the information

in the prospectus supplement. You should carefully read this prospectus and the accompanying prospectus supplement, if any, along

with all of the information incorporated by reference herein and therein, before making an investment decision.

You

should rely only on the information contained or incorporated by reference in this prospectus or any applicable prospectus supplement.

We have not, and the selling stockholders have not, authorized any other person to provide you with different or additional information.

If anyone provides you with different or additional information, you should not rely on it. This prospectus is not an offer to

sell, nor are the selling stockholders seeking an offer to buy, the shares offered by this prospectus in any jurisdiction where

the offer or sale is not permitted. No offers or sales of any of the shares of common stock are to be made in any jurisdiction

in which such an offer or sale is not permitted. You should assume that the information contained in this prospectus or in any

applicable prospectus supplement is accurate only as of the date on the front cover thereof or the date of the document incorporated

by reference, regardless of the time of delivery of this prospectus or any applicable prospectus supplement or any sales of the

shares of common stock offered hereby or thereby.

You

should read the entire prospectus and any prospectus supplement and any related issuer free writing prospectus, as well as the

documents incorporated by reference into this prospectus or any prospectus supplement or any related issuer free writing prospectus,

before making an investment decision. Neither the delivery of this prospectus or any prospectus supplement or any issuer free

writing prospectus nor any sale made hereunder shall under any circumstances imply that the information contained or incorporated

by reference herein or in any prospectus supplement or issuer free writing prospectus is correct as of any date subsequent to

the date hereof or of such prospectus supplement or issuer free writing prospectus, as applicable. You should assume that the

information appearing in this prospectus, any prospectus supplement or any document incorporated by reference is accurate only

as of the date of the applicable documents, regardless of the time of delivery of this prospectus or any sale of securities. Our

business, financial condition, results of operations and prospects may have changed since that date.

PROSPECTUS

SUMMARY

This

summary provides an overview of selected information contained elsewhere or incorporated by reference in this prospectus and does

not contain all of the information you should consider before investing in our securities. You should carefully read the prospectus,

the information incorporated by reference and the registration statement of which this prospectus is a part in their entirety

before investing in our securities, including the information discussed under “Risk Factors” in this prospectus and

the documents incorporated by reference and our financial statements and related notes that are incorporated by reference in this

prospectus. As used in this prospectus, unless the context otherwise indicates, the terms “we,” “our,”

“us,” or “the Company” refer to NanoVibronix, Inc., a Delaware corporation, and its subsidiaries taken

as a whole.

Overview

We

are a medical device company focusing on noninvasive biological response-activating devices that target wound healing and pain

therapy and can be administered at home, without the assistance of medical professionals. Our primary products, which are in various

stages of clinical and market development, currently consist of:

|

|

●

|

UroShield™,

an ultrasound-based product that is designed to prevent bacterial colonization and biofilm in urinary catheters, increase

antibiotic efficacy and decrease pain and discomfort associated with urinary catheter use.

|

|

|

●

|

PainShield™,

a patch-based therapeutic ultrasound technology to treat pain, muscle spasm and joint contractures by delivering a localized

ultrasound effect to treat pain and induce soft tissue healing in a targeted area; and

|

|

|

●

|

WoundShield™,

a patch-based therapeutic ultrasound device intended to facilitate tissue regeneration and wound healing by using ultrasound

to increase local capillary perfusion and tissue oxygenation.

|

Each

of our PainShield, UroShield, and WoundShield products employs a small, disposable transducer that transmits low frequency, low

intensity ultrasound acoustic waves that seek to repair and regenerate tissue, musculoskeletal and vascular structures, and decrease

biofilm formation on urinary catheters and associated urinary tract infections. Through their size, effectiveness and ease of

use, these products are intended to eliminate the need for technicians and medical personnel to manually administer ultrasound

treatment through large transducers, thereby promoting patient independence and enabling more cost-effective home-based care.

PainShield

is currently cleared for marketing in the United States by the U.S. Food and Drug Administration although to date there has not

been a significant sales and marketing effort. All three of our products have CE Mark approval in the European Union, and a certificate

allowing us to sell PainShield, UroShield and WoundShield in Israel. We are able to sell PainShield, UroShield and WoundShield

in India and Ecuador based on our CE Mark. We have consummated sales of PainShield and UroShield in the relevant markets, although

to date sales have been minimal; WoundShield has not generated significant revenue to date. Outside of the United States we generally

apply, through our distributor, for approval in a particular country for a particular product only when we have a distributor

in place with respect to such product.

Implications

of being an Emerging Growth Company

As

a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company”

as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”) enacted in April 2012. An “emerging growth

company” may take advantage of exemptions from some of the reporting requirements that are otherwise applicable to public

companies. These exceptions include:

|

|

●

|

being

permitted to present only two years of audited financial statements and only two years of related Management’s Discussion

and Analysis of Financial Condition and Results of Operations in this prospectus;

|

|

|

●

|

not

being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002,

as amended (the “Sarbanes-Oxley Act”);

|

|

|

●

|

reduced

disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements;

and

|

|

|

●

|

exemptions

from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden

parachute payments not previously approved.

|

We

may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the closing of

our initial public offering. However, if certain events occur prior to the end of such five-year period, including if we become

a “large accelerated filer,” our annual gross revenue exceeds $1.07 billion or we issue more than $1.0 billion

of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of

such five-year period.

In

addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying

with new or revised accounting standards. We have elected to avail ourselves of this exemption.

Corporate

Information

We

were organized in the State of Delaware on October 20, 2003. Our principal executive offices are located at 525 Executive Boulevard,

Elmsford, New York 10523. Our telephone number is (914) 233-3004. Our website address is www.nanovibronix.com. Information accessed

through our website is not incorporated into this prospectus and is not a part of this prospectus.

THE

OFFERING

|

Securities

offered by the selling stockholders

|

|

Up to 4,250,000 shares of our common stock, par value $0.001 per share, comprised of (i) 1,600,000 shares

of common stock issuable upon conversion of the Series E Preferred Stock issued in a private placement on June 21, 2019, (ii) 1,600,000

shares of common stock issuable upon conversion of the Series E Preferred Stock issuable upon exercise of the warrants to

purchase Series E Preferred Stock issued in a private placement on June 21, 2019, (iii) 210,000 shares of common stock issuable

upon conversion of the Series E Preferred Stock issued in a private placement on July 31, 2019, (iv) 210,000 shares of common stock

issuable upon conversion of the Series E Preferred Stock issuable upon exercise of the warrants to purchase Series E Preferred

Stock issued in a private placement on July 31, 2019, (v) 290,000 shares of common stock issued in a private placement on July

31, 2019, (vi) 290,000 shares of common stock issuable upon exercise of the common stock warrants issued in a private placement

on July 31, 2019, (vii) 25,000 shares of common stock issued in a private placement on August 27, 2019, and (viii) 25,000 shares

of common stock issuable upon exercise of the common stock warrants issued in a private placement on August 27, 2019.

|

|

|

|

|

|

Selling

stockholders

|

|

All

of the shares of common stock are being offered by the selling stockholders named herein. See “Selling Stockholders”

on page 7 of this prospectus for more information on the selling stockholders.

|

|

|

|

|

|

Use

of proceeds

|

|

We

will not receive any proceeds from the sale of the shares in this offering. However, we will receive proceeds from the exercise

of the warrants to purchase Series E Preferred Stock and the warrants to purchase common stock if such warrants are exercised

for cash. We intend to use those proceeds, if any, for working capital and general corporate purposes. See “Use of Proceeds”

beginning on page 7 of this prospectus for additional information.

|

|

Registration

Rights

|

|

In the June SPA and the July Preferred SPA, we agreed to prepare

and file with the Securities and Exchange Commission within 60 days of the date the stockholders of the Company at a special meeting

of stockholders approve resolutions providing for the issuance of all of the shares of common stock issuable upon conversion of

the Series E Preferred Stock in accordance with the applicable law and the rules and regulations of the Nasdaq Stock Market (such

affirmative approval being referred to herein as the “Stockholder Approval”, and the date such Stockholder Approval

is obtained, the “Stockholder Approval Date”), a registration statement covering the resale of the shares of common

stock issuable upon conversion of the Series E Preferred Stock and the shares of common stock issuable upon conversion of the Series

E Preferred Stock issuable upon exercise of the warrants. In the July Common SPA, we agreed to prepare and file with the Securities

and Exchange Commission within 60 days of the Stockholder Approval Date, a registration statement covering the resale of the shares

of common stock and the shares of common stock issuable upon exercise of the common stock warrants. In the Affiliate SPA, we agreed

to prepare and file with the Securities and Exchange Commission within 60 days of after the date that the stockholders approve

the resolution providing for the issuance of the common stock and common stock warrants to Mr. Fashek in accordance with the applicable

law and the rules and regulations of the Nasdaq Stock Market (such affirmative approval being referred to herein as the “Affiliate

Offering Approval”, and the date such Affiliate Offering Approval is obtained, the “Affiliate Offering Approval Date”)

a registration statement covering the resale of the shares of our common stock purchase by Mr. Fashek and the number of shares

of common stock issuable upon exercise of the common stock warrants.

In

each of the June SPA, July Preferred SPA, July Common SPA and Affiliate SPA, we also agreed to cause such registration

statement to become effective under the Securities Act, within 120 days of the Stockholder Approval Date or the Affiliate

Offering Approval Date, as applicable, if there is no review of the registration statement by the Securities and Exchange

Commission or within 150 days of the Stockholder Approval Date or the Affiliate Offering Approval Date, as applicable,

if there is a review of the registration statement by the Securities and Exchange Commission. We obtained the Stockholder

Approval and the Affiliate Offering Approval on November 18, 2019.

In

addition, we agreed that, upon this registration statement being declared effective, we will use our reasonable best efforts

to maintain the effectiveness of this registration statement until the shares of common stock may be resold by the selling

stockholders pursuant to Rule 144 of the Securities Act without volume limitations. See “Selling Stockholders”

on page 7 of this prospectus for additional information.

|

|

|

|

|

|

Plan

of Distribution

|

|

The

selling stockholders named in this prospectus, or their pledgees, donees, transferees, distributees, beneficiaries or other

successors-in-interest, may offer or sell the shares from time to time through public or private transactions at prevailing

market prices, at prices related to prevailing market prices or at privately negotiated prices. The selling stockholders may

also resell the shares of common stock to or through underwriters, broker-dealers or agents, who may receive compensation

in the form of discounts, concessions or commissions. See “Plan of Distribution” beginning on page 18

of this prospectus for additional information on the methods of sale that may be used by the selling stockholders.

|

|

|

|

|

|

Risk

factors

|

|

Investing

in our common stock involves a high degree of risk. You should carefully read and consider the information beginning on page

5 of this prospectus set forth under the heading “Risk Factors” and all other information set forth

in this prospectus, and the documents incorporated herein and therein by reference before deciding to invest in our common

stock.

|

|

|

|

|

|

NASDAQ

trading symbol for common stock

|

|

“NAOV”

|

RISK

FACTORS

An

investment in our securities involves certain risks. Before investing in our securities, you should carefully consider the risks,

uncertainties and assumptions discussed under the heading ”Risk Factors” included in our most recent Annual Report

on Form 10-K, or any updates in our Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, together with all of the other

information appearing in this prospectus or incorporated by reference into this prospectus and which may be amended, supplemented

or superseded from time to time by other reports we file with the Securities and Exchange Commission in the future. The risks

so described are not the only risks facing our company. Additional risks not presently known to us or that we currently deem immaterial

may also impair our business operations. Any of these risks could materially and adversely affect our business, financial condition,

results of operations and cash flows and could result in a loss of all or part of your investment. In any case, the value of the

securities offered by means of this prospectus could decline due to any of these risks, and you may lose all or part of your investment.

Please also read carefully the section below entitled “Special Note Regarding Forward-Looking Statements.”

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the information incorporated by reference in this prospectus contain “forward-looking statements,”

which include information relating to future events, future financial performance, strategies, expectations, competitive environment

and regulation. Our use of the words “may,” “will,” “would,” “could,” “should,”

“believes,” “estimates,” “projects,” “potential,” “expects,” “plans,”

“seeks,” “intends,” “evaluates,” “pursues,” “anticipates,” “continues,”

“designs,” “impacts,” “forecasts,” “target,” “outlook,” “initiative,”

“objective,” “designed,” “priorities,” “goal” or the negative of those words or

other similar expressions is intended to identify forward-looking statements that represent our current judgment about possible

future events. Forward-looking statements should not be read as a guarantee of future performance or results and will probably

not be accurate indications of when such performance or results will be achieved. All statements included or incorporated by reference

in this prospectus, and in related comments by our management, other than statements of historical facts, including without limitation,

statements about future events or financial performance, are forward-looking statements that involve certain risks and uncertainties.

These

statements are based on certain assumptions and analyses made in light of our experience and perception of historical trends,

current conditions and expected future developments as well as other factors that we believe are appropriate in the circumstances.

While these statements represent our judgment on what the future may hold, and we believe these judgments are reasonable, these

statements are not guarantees of any events or financial results. Whether actual future results and developments will conform

with our expectations and predictions is subject to a number of risks and uncertainties, including the risks and uncertainties

discussed in this prospectus, any prospectus supplement and the documents incorporated by reference under the captions “Risk

Factors” and “Special Note Regarding Forward-Looking Statements” and elsewhere in those documents.

Consequently,

all of the forward-looking statements made in this prospectus as well as all of the forward-looking statements incorporated by

reference to our filings under the Securities Exchange Act of 1934, as amended, are qualified by these cautionary statements and

there can be no assurance that the actual results or developments that we anticipate will be realized or, even if realized, that

they will have the expected consequences to or effects on us and our subsidiaries or our businesses or operations. We caution

investors not to place undue reliance on forward-looking statements. We undertake no obligation to update publicly or otherwise

revise any forward-looking statements, whether as a result of new information, future events, or other such factors that affect

the subject of these statements, except where we are expressly required to do so by law.

USE

OF PROCEEDS

All

shares of our common stock offered by this prospectus are being registered for the accounts of the selling stockholders, and we

will not receive any proceeds from the sale of these shares. However, we will receive proceeds from the exercise of the warrants

to purchase Series E Preferred Stock and the common stock warrants if such warrants are exercised for cash. We intend to use those

proceeds, if any, for working capital and general corporate purposes.

SELLING

STOCKHOLDERS

On June 21, 2019, we entered into the June SPA

with entities controlled by Mr. Packer and entities controlled by Mr. Hirshman, each of whom was a beneficial owner of more than

5.0% of our common stock, relating to the sale to such stockholders in a private placement of 1,600,000 shares of our Series E

Preferred Stock, and seven year warrants to purchase 1,600,000 shares of our Series E Preferred Stock at an exercise price of $2.50

per share, at a purchase price per unit of $2.00 (the “June Offering”), for aggregate gross proceeds of $3,200,000

(excluding the exercise of the warrants issued in the June Offering). The June Offering closed on June 21, 2019.

On July 31, 2019, we entered into the July Preferred

SPA with an entity controlled by Mr. Packer relating to the sale to such stockholder of 210,000 shares of our Series E Preferred

Stock and seven year warrants to purchase 210,000 shares of our Series E Preferred Stock at an exercise price of $2.50 per share,

at a purchase price per unit of $2.00 (the “July Preferred Offering”), for gross proceeds of $420,000 (excluding the

exercise of the warrants issued in the July Preferred Offering). The July Preferred Offering closed on July 31, 2019.

On July 31, 2019, we entered into the July Common

SPA with certain investors (selling stockholders other than Mr. Packer, Mr. Hirshman and Mr. Fashek) relating to the sale of 290,000

shares of our common stock and seven year warrants to purchase 290,000 shares of our common stock at an exercise price of $2.50

per share, at a purchase price per unit of $2.00 (the “July Common Offering”), for gross proceeds of $580,000 (excluding

the exercise of the warrants issued in the July Common Offering). The July Common Offering closed on July 31, 2019.

On

August 27, 2019, we entered into the Affiliate SPA with Christopher Fashek, one of our directors, relating to the sale of 25,000

shares of our common stock, and seven year warrants to purchase 25,000 shares of our common stock at an exercise price of $2.50

per share, at a purchase price per unit of $2.00 (the “Affiliated Offering”) for gross proceeds of $50,000 (excluding

the exercise of the warrants issued in the Affiliated Offering). The Affilaited Offering closed on August 27, 2019. The shares

of common stock and the common stock warrants sold to Mr. Fashek were not released until after the Affiliate Offering Approval

was obtained from our stockholders.

Up

to 4,250,000 shares of our common stock are currently being offered by the selling stockholders under this prospectus. This reflects

the sum of (i) 1,600,000 shares of common stock issuable upon conversion of the Series E Preferred Stock issued in the June Offering,

(ii) 1,600,000 shares of common stock issuable upon conversion of the Series E Preferred Stock issuable upon exercise of the warrants

to purchase Series E Preferred Stock issued in the June Offering, (iii) 210,000 shares of common stock issuable upon conversion

of the Series E Preferred Stock issued in the July Preferred Offering, (iv) 210,000 shares of common stock issuable upon conversion

of the Series E Preferred Stock issuable upon exercise of the warrants to purchase Series E Preferred Stock issued in the July

Preferred Offering, (v) 290,000 shares of common stock issued in the July Common Offering, (vi) 290,000 shares of common stock

issuable upon exercise of the common stock warrants issued in the July Common Offering, (vii) 25,000 shares of common stock issued

in the Affiliated Offering, and (viii) 25,000 shares of common stock issuable upon exercise of the warrants issued in the Affiliated

Offering.

Terms

of the Series E Preferred Stock

On

June 21, 2019, we filed a Certificate of Designation of the Series E Preferred Stock (the “Original Certificate of

Designation”) with the Secretary of State of the State of Delaware (the “Secretary of State”). The Original

Certificate of Designation was effective upon filing with the Secretary of State and designated the Series E Preferred Stock.

On July 31, 2019 and November 18, 2019, we filed with the Secretary of State an Amended and Restated Certificates of Designation

(as amended and restated on November 15, 2019, the “Amended Certificate of Designation”) which were effective upon

filing with the Secretary of State. Pursuant to the Amended Certificate of Designation, 1,999,494 shares are designated as Series

E Preferred Stock. As of January 8, 2020, we have 1,825,000 shares of Series E Preferred Stock outstanding.

The

Amended Certificate of Designation provided that, among other things, the Series E Preferred Stock is not convertible into our

common stock until we receive Stockholder Approval at a special meeting of resolutions providing for the issuance of all of the

shares of common stock issuable upon conversion of the Series E Preferred Stock in accordance with applicable law and the rules

and regulations of the Nasdaq Stock Market. On November 18, 2019, we obtained the Stockholder Approval.

Each

share of Series E Preferred Stock is convertible at any time and from time to time after the Stockholder Approval Date at the

option of a holder of Series E Preferred Stock into one share of our common stock, provided that each holder would be prohibited

from converting Series E Preferred Stock into shares of our common stock if, as a result of such conversion, any such holder,

together with its affiliates, would own more than 9.99% of the total number of shares of our common stock then issued and outstanding.

This limitation may be waived with respect to a holder upon such holder’s provision of not less than 61 days’ prior

written notice to us.

Upon

liquidation, dissolution or winding up of the Company, whether voluntary or involuntary, each holder of the Series E Preferred

Stock shall be entitled to receive the amount of cash, securities or other property to which such holder would be entitled to

receive with respect to such shares of Series E Preferred Stock if such shares had been converted to our common stock immediately

prior to such liquidation.

Shares

of Series E Preferred Stock are not entitled to receive any dividends, unless and until specifically declared by the board of

directors. However, holders of Series E Preferred Stock are entitled to receive dividends on shares of Series E Preferred stock

equal (on an as-if-converted-to-common-stock basis) to and in the same form as dividends actually paid on shares of the common

stock when such dividends are specifically declared by the board of directors. We are not obligated to redeem or repurchase any

shares of Series E Preferred Stock. Shares of Series E Preferred Stock are not otherwise entitled to any redemption rights, or

mandatory sinking fund or analogous fund provisions.

Subject

to the beneficial ownership limitations, each holder of Series E Preferred Stock are entitled to the number of votes equal to

the number of shares of our common stock equal to the voting ratio set forth in the Amended Certificate of Designation. The current

voting ratio, for each share of Series E Preferred Stock is equal to $2.00 divided by $3.53. Fractional votes shall not, however,

be permitted and any fractional voting rights resulting from the above formula (after aggregating all shares into which shares

of Series E Preferred Stock held by each Series E Holder could be converted) shall be rounded to the nearest whole number (with

one-half being rounded upward).

Terms

of the Warrants to Purchase Series E Preferred Stock

As

of January 8, 2020, we have warrants to purchase 1,810,000 shares of Series E Preferred Stock outstanding.

The

warrants to purchase Series E Preferred Stock issued in the June Offering and the July Preferred Offering are immediately exercisable

and can be exercised at any time from time to time for seven years following the date of issuance, at an exercise price of $2.50

per share of Series E Preferred Stock, subject to certain adjustments as set forth in the warrants. If at any time after the six

month anniversary of the date of issuance of the warrants, there is no effective registration statement under the Securities Act

registering the resale of the common stock underlying the Series E Preferred Stock by the selling shareholders, then the warrants

may also be exercised, in whole or in part, by means of a cashless exercise.

Terms

of the Warrants to Purchase Common Stock Sold in the July Common Offering and the Affiliated Offering

As

of January 8, 2020, warrants to purchase 290,000 shares of common stock sold in the July Common Offering and warrants to purchase

25,000 shares of common stock sold in the Affiliated Offering are outstanding.

The

warrants to purchase common stock issued in the July Common Offering and the Affiliated Offering are exercisable and can be exercised

at any time from time to time from the sixth month anniversary of the date of issuance until seven years following the date of

issuance, at an exercise price of $2.50 per share of common stock, subject to certain adjustments as set forth in the warrants;

provided that each holder would be prohibited from exercising the common stock warrant if, as a result of such conversion, any

such holder, together with its affiliates, would own more than 4.99% of the total number of shares of our common stock then issued

and outstanding. This limitation may be increased or decreased, but in no event exceed 4.99%, with respect to a holder upon such

holder’s provision of not less than 61 days’ prior written notice to us. If at any time after the six month anniversary

of the date of issuance of the warrants, there is no effective registration statement under the Securities Act registering the

resale of the common stock underlying the Series E Preferred Stock by the selling shareholders, then the warrants may also be

exercised, in whole or in part, by means of a cashless exercise.

Registration

Rights

June

SPA and July Preferred SPA

In

the June SPA and the July Preferred SPA, we agreed to prepare and file with the Securities and Exchange Commission within 60 days

of the Stockholder Approval Date a registration statement covering the resale of the shares of common stock issuable upon conversion

of the Series E Preferred Stock and the shares of common stock issuable upon conversion of the Series E Preferred Stock issuable

upon exercise of the warrants, and cause such registration statement to become effective under the Securities Act, within 120

days of the Stockholder Approval Date if there is no review of the registration statement by the Securities and Exchange Commission

or within 150 days of the Stockholder Approval Date if there is a review of the registration statement by the Securities and Exchange

Commission. We obtained the Stockholder Approval on November 18, 2019.

If

the registration statement (i) is not filed within 60 days after the Stockholder Approval Date, (ii) is not declared effective

within 120 days (or 150 days, as applicable) of the Stockholder Approval Date, or (iii) ceases for any reason to be effective

at any time prior to the expiration of its effectiveness period (as defined in the June SPA and the July Preferred SPA, as applicable)

for more than 20 consecutive trading days in any 12 month period, then we are required to pay to each investor who holds registrable

securities (as defined in the June SPA and the July Preferred SPA, as applicable) an amount in cash, as liquidated damages and

not as a penalty, equal to 1.0% of the purchase price paid by such investor for the Series E Preferred Stock and the warrants

to purchase shares of Series E Preferred Stock per month until the registration statement is filed or declared effective (as applicable);

provided that the total amount of payments shall not exceed, when aggregated with all such payments paid to all investors party

to the respective securities purchase agreement, 5% of the aggregate purchase price of the Series E Preferred Stock and warrants

to purchase shares of Series E Preferred Stock sold under that securities purchase agreement.

We

have also agreed that, upon this registration statement being declared effective, we will use our reasonable best efforts to maintain

the effectiveness of this registration statement until the shares of common stock may be resold by the selling stockholders pursuant

to Rule 144 of the Securities Act without volume limitations.

July

Common SPA

In

the July Common SPA, we agreed to prepare and file with the Securities and Exchange Commission within 60 days of the Stockholder

Approval Date a registration statement covering the resale of the shares of common stock and the shares of common stock issuable

upon exercise of the common stock warrants sold in the July Common Offering, and cause such registration statement to become effective

under the Securities Act, within 120 days of the Stockholder Approval Date if there is no review of the registration statement

by the Securities and Exchange Commission or within 150 days of the Stockholder Approval Date if there is a review of the registration

statement by the Securities and Exchange Commission. We obtained the Stockholder Approval on November 18, 2019.

If

the registration statement (i) is not filed within 60 days after the Stockholder Approval Date, (ii) is not declared effective

within 120 days (or 150 days, as applicable) of the Stockholder Approval Date, or (iii) ceases for any reason to be effective

at any time prior to the expiration of its effectiveness period (as defined in the July Common SPA) for more than 20 consecutive

trading days in any 12 month period, then we are required to pay to each investor who holds registrable securities (as defined

in the July Common SPA) an amount in cash, as liquidated damages and not as a penalty, equal to 1.0% of the purchase price paid

by such investor for the common stock and common stock warrants per month until the registration statement is filed or declared

effective (as applicable); provided that the total amount of payments shall not exceed, when aggregated with all such payments

paid to all investors party to the July Common SPA, 5% of the aggregate purchase price of the securities sold under the July Common

SPA.

We

have also agreed that, upon this registration statement being declared effective, we will use our reasonable best efforts to maintain

the effectiveness of this registration statement until the shares of common stock may be resold by the selling stockholders pursuant

to Rule 144 of the Securities Act without volume limitations.

Affiliate

SPA

In

the Affiliate SPA, we agreed to prepare and file with the Securities and Exchange Commission within 60 days of the Affiliate Offering

Approval Date a registration statement covering the resale of the shares of common stock and the shares of common stock issuable

upon exercise of the common stock warrants sold in the Affiliate Offering, and cause such registration statement to become effective

under the Securities Act, within 120 days of the Affiliate Offering Approval Date if there is no review of the registration statement

by the Securities and Exchange Commission or within 150 days of the Affiliate Offering Approval Date if there is a review of the

registration statement by the Securities and Exchange Commission. We obtained the Affiliate Offering Approval on November 18,

2019.

If

the registration statement (i) is not filed within 60 days after the Affiliate Offering Approval Date, (ii) is not declared effective

within 120 days (or 150 days, as applicable) of the Affiliate Offering Approval Date, or (iii) ceases for any reason to be effective

at any time prior to the expiration of its effectiveness period (as defined in the Affiliate SPA) for more than 20 consecutive

trading days in any 12 month period, then we are required to pay to each investor who holds registrable securities (as defined

in the Affiliate SPA) an amount in cash, as liquidated damages and not as a penalty, equal to 1.0% of the purchase price paid

by such investor for the common stock and common stock warrants per month until the registration statement is filed or declared

effective (as applicable); provided that the total amount of payments shall not exceed, when aggregated with all such payments

paid to all investors party to the Affiliate SPA, 5% of the aggregate purchase price of the securities sold under the Affiliate

SPA.

We

have also agreed that, upon this registration statement being declared effective, we will use our reasonable best efforts to maintain

the effectiveness of this registration statement until the shares of common stock may be resold by the selling stockholders pursuant

to Rule 144 of the Securities Act without volume limitations.

Relationships

with the Selling Stockholders

Each

of Mr. Packer and Mr. Hirschman currently beneficially owns 9.99% of our common stock. Mr. Fashek is one of our directors.

The

selling stockholders that participated in the July Common Offering (selling stockholders other than Mr. Packer, Mr. Hirschman

and Mr. Fashek) paid a price per share of common stock and a warrant to purchase common stock of $2.00 per unit.

Mr.

Fashek has served as our director and chairman of the board since October 2016. On October 13, 2016, we entered into an agreement

with Mr. Fashek to serve as the chairman of our board of directors. Under this agreement Mr. Fashek was paid $100,000 per year

payable in semi-monthly installments. On November 1, 2017, the Compensation committee voted to increase Mr. Fashek’s consulting

fee to $150,000 per year. Mr. Fashek has also received options to purchase an aggregate of 45,000 shares of our common stock during

the past three years.

2017

Bridge Financings, Note Conversion and Warrant Amendments

Effective

January 27, 2017, we amended certain two-year common stock warrants with an exercise price of either $3.00 or $6.00 previously

issued in January and February 2015 (the “Two-Year Warrants”) to extend the expiration date of the Two-Year Warrants

for two additional years. Pursuant to the warrant amendment,(i) the expiration date for the Two-Year Warrants to purchase 266,667

shares of common stock at $3.00 per share and the Two-Year Warrants to purchase 266,667 shares of common stock at $6.00 per share

was extended to January 29, 2019, (ii) the expiration date for the Two-Year Warrants to purchase 140,000 shares of common stock

at $3.00 per share and the Two-Year Warrants to purchase 140,000 shares of common stock at $6.00 per share was extended to February

10, 2019, and (iii) the expiration date for the Two-Year Warrants to purchase 13,333 shares of common stock at $3.00 per share

and the Two-Year Warrants to purchase 13,333 shares of common stock at $6.00 per share was extended to February 23, 2019. The

exercise price and all other terms of the original Two-Year Warrants remained the same. Holders of the Two-Year Warrants who entered

into the warrant amendment with us included entities controlled by Mr. Packer and Mr. Packer, who at the time of the warrant amendment

held Two-Year Warrants to purchase 66,666 shares of common stock at $3.00 per share and Two-Year Warrants to purchase 66,666 shares

of common stock at $6.00 per share.

On

March 1, 2017, we completed a bridge financing, pursuant to which we received from Mr. Packer and entities controlled by Mr. Packer

$250,000 of loans and issued to Mr. Packer and entities controlled by Mr. Packer convertible promissory notes (“2017 Notes”)

in an aggregate principal amount of $250,000 and seven-year warrants (“2017 Warrants”) to purchase an aggregate of

100,000 shares of common stock at an initial exercise price of $5.90 per share, subject to adjustment, and are immediately exercisable.

The principal amount and all accrued but unpaid interest on the 2017 Notes were due and payable on the date that is the earlier

of the (i) 5-year anniversary of the date of issuance, or (ii) the date the Company completes an equity financing pursuant to

which the Company issues and sells shares of capital stock resulting in aggregate proceeds of at least $2,000,000. The 2017 Notes

bore interest at a rate of 6% per annum, payable on the maturity date. The 2017 Warrants are immediately exercisable. The 2017

Warrants may be exercised on a cashless basis if there is no effective registration statement registering the resale of the shares

underlying the 2017 Warrants after the six month anniversary of the issuance date of the 2017 Warrants. The exercise price is

adjustable for certain events, such as distribution of stock dividends, stock splits or fundamental transactions including mergers

or sales of assets. A holder of the 2017 Warrants will not have the right to exercise any portion of the 2017Warrant if the holder

(together with its affiliates) would beneficially own in excess of 9.99% of the number of shares of our common stock outstanding

immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the

2017 Warrants. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99%, provided

that any increase in such percentage shall not be effective until 61 days after such notice to the Company.

On

May 3, 2017, we completed a bridge financing, pursuant to which we received from Mr. Packer $30,000 of loans and issued to Mr.

Packer 2017 Notes in an aggregate principal amount of $30,000 and 2017 Warrants to purchase an aggregate of 12,000 shares of common

stock at an initial exercise price of $5.90 per share, subject to adjustment, and are immediately exercisable.

On

June 3, 2017, we completed a bridge financing, pursuant to which we received from an entity controlled by Mr. Packer $500,000

of loans and issued to an entity controlled by Mr. Packer 2017 Notes in an aggregate principal amount of $500,000 and 2017 Warrants

to purchase an aggregate of 200,000 shares of common stock at an initial exercise price of $5.90 per share, subject to adjustment,

and are immediately exercisable.

On

November 6, 2017 Mr. Packer and entities controlled by Mr. Packer purchased approximately 51 shares of our Series D Convertible

Preferred Stock as part of our underwritten public offering that closed on November 6, 2018 and also received warrants to purchase

38,265 additional shares of our common stock with an exercise price of $6.95 per share. Entities controlled by Mr. Hirshman participated

in the same offering and purchased approximately 20 shares of our Series D Convertible Preferred Stock and 132,653 shares of common

stock and received warrants to purchase 114,795 additional shares of our common stock with an exercise price of $.95 per share.

On

November 8, 2017, the 2017 Notes owned by Mr. Packer and entities controlled by Mr. Packer were converted into 74,601 shares of

our common stock and 130,782 shares of our Series D Convertible Preferred Stock. Mr. Packer and entities controlled by Mr. Packer

also received seven-year warrants to purchase additional 154,037 shares of our common stock with an exercise price of $6.95 per

share.

On

February 5, 2019, we entered into amendments to our Two-Year Warrants, as previously amended (the “Warrant Amendment”)

to purchase an aggregate of 420,000 shares of common stock at an exercise price of $3.00 per share and warrants to purchase an

aggregate of 420,000 shares of common stock at an exercise price of $6.00 per share to further extend the expiration date of the

warrants for two additional years. In addition, the Warrant Amendment amended the exercise price with respect to the $3.00 Warrants

from $3.00 per share to $3.35 per share. The exercise price of the $6.00 Warrants was unchanged. Pursuant to the Warrant Amendment,

warrants to purchase 266,667 shares of common stock at $3.35 per share and warrants to purchase 266,667 shares of common stock

at $6.00 per share will expire on January 29, 2021, and the warrants to purchase 140,000 shares of common stock at $3.35 per share

and warrants to purchase 140,000 shares of common stock at $6.00 per share will expire on February 10, 2021, and the warrants

to purchase 13,333 shares of common stock at $3.35 per share and warrants to purchase 13,333 shares of common stock at $6.00 per

share will expire on February 23, 2021. The Warrant Amendment is effective as of January 29, 2019. All other terms of the original

warrants remain the same. Holders of the warrants who entered into the Warrant Amendment include entities controlled by Mr. Paul

Packer and Mr. Packer, who at the time of the Warrant Amendment held warrants to purchase 66,666 shares of common stock at $3.35

per share and warrants to purchase 66,666 shares of common stock at $6.00 per share.

2019

Bridge Financings

On

March 29, 2019, we completed a bridge financing, pursuant to which we issued to entities controlled by Mr. Packer and entities

controlled by Mr. Hirshman convertible notes on the aggregate principal amount of $125,000 and $100,000, respectively (collectively

the “Notes”) and seven-year warrants (the “Warrant”) to purchase an aggregate of 50,000 shares and 40,000

shares, respectively, of our common stock or series C preferred stock at an exercise price of the lesser of:

(a) 80% (i.e., a 20% discount) of the exercise price per share of the warrants to purchase shares of the Company’s

capital stock issued in the first equity financing of the Company following the date of issuance, or (b) $4.80, with a stipulation

that in no event will the exercise price be less than $3.00 per warrant share.

The

principal amount and all accrued but unpaid interest on the Notes are due and payable on the date (the “Maturity Date”)

that is the earlier of the (i) 5-year anniversary of the date of issuance, or (ii) the date the Company completes an equity financing

pursuant to which the Company issues and sells shares of capital stock resulting in aggregate proceeds of at least $2,000,000

(a “Qualified Financing”). The Notes bear interest at a rate of 6% per annum, payable on the Maturity Date. To the

extent not previously converted, on the Maturity Date, the investors will receive, at the option of each the investor, either

(a) cash equal to the original principal amount of the Note and interest then accrued and unpaid thereon, or (b) shares of common

stock or series C convertible preferred stock of the Company, at a price per share equal to the lesser of: (x) 80% of the amount

equal to the quotient obtained by dividing (i) the estimated value of the Company as of the Maturity Date, as determined

in good faith by the Company’s Board, by (ii) the aggregate number of outstanding shares of the Company’s common

stock, as of the Maturity Date on a fully diluted basis, and (y) $4.00 per share, as such amount may be adjusted for any stock

split, stock dividend, reclassification or similar events affecting the capital stock of the Company. Upon consummation of a Qualified

Financing, each investor may elect to have the outstanding principal and accrued but unpaid interest thereon converted into (a)

shares of the same class and series of equity securities sold in such Qualified Financing, (b) shares of series C convertible

preferred stock or (c) common stock, at a price per share equal to the lesser of: (a) 80% of the price per share at which such

securities are sold in such Qualified Financing and (b) $4.00 per share, as such amount may be adjusted for any stock split, stock

dividend, reclassification or similar events affecting the Company’s capital stock.

In

no event will the number of shares to be issued upon (i) exercise of this Warrants, (ii) conversion of the Notes exceed, in the

aggregate, 9.9% of the total shares outstanding or the voting power outstanding on the date immediately preceding the date of

issuance.

On

April 5, 2019, we completed additional amounts of bridge financing with the same terms, pursuant to which we issued to entities

controlled by Mr. Hirshman convertible notes on the aggregate principal amount of $25,000, respectively and seven-year warrants

to purchase an aggregate of 10,000 shares.

On

May 10, 2019, we completed additional amounts of bridge financing with the same terms, pursuant to which we issued to entities

controlled by Mr. Packer and entities controlled by Mr. Hirshman convertible notes on the aggregate principal amount of $125,000

and $100,000, respectively and seven-year warrants to purchase an aggregate of 50,000 shares and 40,000 shares, respectively.

2019

June Offering

Entities

controlled by Mr. Packer purchased an aggregate of 1,100,000 shares of Series E Preferred Stock and warrants to purchase 1,100,000

shares of Series E Preferred Stock in the June Offering, and an aggregate of 210,000 shares of Series E Preferred Stock.

Entities

controlled by Mr. Hirschman purchased an aggregate of 500,000 shares of Series E Preferred Stock and warrants to purchase 500,000

shares of Series E Preferred Stock in the June Offering.

2019

July Preferred Offering

Entities

controlled by Mr. Packer purchased an aggregate of 210,000 shares of Series E Preferred Stock and warrants to purchase 210,000

shares of Series E Preferred Stock in the July Preferred Offering.

Affiliate

Offering

Mr.

Fashek purchased an aggregate of 25,000 shares of Series E Preferred Stock and warrants to purchase 25,000 shares of Series E

Preferred Stock in the Affiliate Offering.

Information

About Selling Stockholder Offering

The

following table sets forth the number and percentage of our common stock beneficially owned by the selling stockholders as of

December 31, 2019, taking into account number of shares that may be offered under this prospectus and the number and percentage

of our common stock beneficially owned by the selling stockholders assuming all of the shares covered hereby are sold. Beneficial

ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting or investment

power with respect to our common stock. Generally, a person “beneficially owns” shares of our common stock if the

person has or shares with others the right to vote those shares or to dispose of them, or if the person has the right to acquire

voting or disposition rights within 60 days.

The

information in the table below and the footnotes thereto regarding shares of common stock to be beneficially owned after the offering

assumes that the selling stockholders (i) have exercised their warrants to purchase Series E Preferred Stock in full, (ii) have

converted the Series E Preferred Stock in full, without giving effect to the 9.99% beneficial ownership limitation as applicable

for the conversion of the Series E Preferred Stock into common stock as set forth in the Amended Certificate of Designation, and

(iii) have exercised their warrants to purchase common stock in full, without giving effect to the 4.99% beneficial ownership

limitation as applicable for the exercise of the common stock warrants sold in the July Common Offering and the Affiliate Offering.

The information in the table below and the footnotes thereto further assumes the sale of all shares being offered by the selling

stockholders under this prospectus.

The

percentage of shares owned prior to and after the offering is based on 4,203,764 shares of common stock outstanding as of December

31, 2019, and, with respect to the percentage of shares owned after the offering, on the assumption that (i) with respect to Mr.

Packer and Mr. Hirshman, the selling stockholder has exercised the warrants to purchase the Series E Preferred Stock in full and

converted the Series E Preferred Stock in full, and therefore that all shares of common stock issuable upon conversion of the

Series E Preferred Stock and all shares of common stock issuable upon conversion of the Series E Preferred Stock issuable upon

exercise of the warrants to purchase Series E Preferred Stock were outstanding as of that date, and (ii) with respect to the selling

stockholders other than Mr. Packer and Mr. Hirshman, the selling stockholder has exercised his or her common stock warrants purchased

in the July Common Offering and the Affiliate Offering. Unless otherwise indicated in the footnotes to this table, we believe

that the selling stockholders have sole voting and investment power with respect to the shares of common stock indicated as beneficially

owned.

As

used in this prospectus, the term “selling stockholders” includes the selling stockholders set forth below and any

donees, pledgees, transferees or other successors-in-interest selling shares of common stock received after the date of this prospectus

from the selling stockholders as a gift, pledge, or other non-sale related transfer.

The

number of shares in the column “Maximum Number of Shares Offered” represents all of the shares of common stock that

a selling stockholder may offer under this prospectus. Under the terms of the Series E Preferred Stock, a selling stockholder

may not convert the Series E Preferred Stock to the extent such conversion would cause such selling stockholder, together with

its affiliates, to beneficially own a number of shares of common stock which would exceed 9.99% of our then outstanding shares

of common stock following such exercise. Under the terms of the common stock warrants sold in the July Common Offering and the

Affiliate Offering, a selling stockholder may not exercise the common stock warrants to the extent such exercise would cause such

selling stockholder, together with its affiliates, to beneficially own a number of shares of common stock which would exceed 4.99%

of our then outstanding shares of common stock following such exercise. The number of shares in the second column does not reflect

these limitations. The fourth column assumes the sale of all the shares offered by the selling stockholders pursuant to this prospectus

and that the selling stockholders do not acquire any additional shares of common stock before the completion of this offering.

However, because the selling stockholders may sell all or some of its shares under this prospectus from time to time, or in another

permitted manner, we cannot assure you as to the actual number of shares that will be sold by the selling stockholder or that

will be held by the selling stockholder after completion of any sales. The selling stockholders may sell some, all or none of

their shares in this offering. We do not know how long the selling stockholders will hold the shares before selling them, and

we currently have no agreements, arrangements or understandings with the selling stockholders regarding the sale of any of the

shares.

|

|

|

Ownership Before Offering

|

|

|

Ownership After Offering

|

|

|

Selling Stockholder

|

|

Number of

shares

of common

stock

beneficially

owned

|

|

|

Maximum

number of

shares

offered

|

|

|

Number of

shares

of common

stock

beneficially

owned

|

|

|

Percentage

of

common

stock

beneficially

owned

|

|

|

Orin Hirshman

|

|

|

1,418,875

|

(1)

|

|

|

1,000,000

|

(2)

|

|

|

528,753

|

(3)

|

|

|

9.99

|

%

|

|

Paul Packer

|

|

|

3,081,900

|

(4)

|

|

|

2,620,000

|

(5)

|

|

|

749,781

|

(6)

|

|

|

9.99

|

%

|

|

Chris Fashek

|

|

|

163,759

|

(7)

|

|

|

50,000

|

(8)

|

|

|

113,759

|

(9)

|

|

|

2.6

|

%

|

|

Joseph Bronner

|

|

|

137,322

|

(10)

|

|

|

50,000

|

(11)

|

|

|

87,322

|

(12)

|

|

|

2.0

|

%

|

|

Marcia Kreinberg

|

|

|

75,000

|

(13)

|

|

|

75,000

|

(13)

|

|

|

--

|

|

|

|

*

|

|

|

Robin Press

|

|

|

50,000

|

(14)

|

|

|

50,000

|

(14)

|

|

|

--

|

|

|

|

*

|

|

|

Horn Grandchildren 2004 Trust

|

|

|

150,000

|

(15)

|

|

|

150,000

|

(15)

|

|

|

--

|

|

|

|

*

|

|

|

Debra Young

|

|

|

25,000

|

(16)

|

|

|

25,000

|

(16)

|

|

|

--

|

|

|

|

*

|

|

|

William F. Jones

|

|

|

30,000

|

(17)

|

|

|

30,000

|

(17)

|

|

|

--

|

|

|

|

*

|

|

|

William Smith

|

|

|

50,000

|

(18)

|

|

|

50,000

|

(18)

|

|

|

--

|

|

|

|

*

|

|

|

Eastern Capital LLC

|

|

|

100,000

|

(19)

|

|

|

100,000

|

(19)

|

|

|

--

|

|

|

|

*

|

|

|

Aryeh Victor

|

|

|

25,000

|

(20)

|

|

|

25,000

|

(20)

|

|

|

--

|

|

|

|

*

|

|

|

James Michael Zois

|

|

|

25,000

|

(21)

|

|

|

25,000

|

(21)

|

|

|

--

|

|

|

|

*

|

|

|

(1)

|

Based

on information contained in Schedule 13G filed on February 15, 2019. Comprised of (i) 5,911 shares of common stock held by Mr.

Hirschman, (ii) 70,803 shares of common stock held by AIGH Investment Partners LLC, of which Mr. Hirschman serves as president,

(iii) 314,860 shares of common stock held by AIGH Investment Partners L.P., of which Mr. Hirschman serves as general partner,

(iv) 6,893 shares of common stock beneficially owned or common stock issuable upon conversion of Series C Preferred Stock, (v)

20,408 shares of common stock beneficially owned or common stock issuable upon conversion of Series D Convertible Preferred Stock,

(v) 390,000 shares of common stock issuable upon conversion of Series E Convertible Preferred Stock beneficially owned by AIGH

Investment Partners L.P., (vi) 390,000 shares of common stock issuable upon conversion of Series E Convertible Preferred Stock

issuable upon exercise of the warrant beneficially owned by AIGH Investment Partners L.P., (vii) 82,500 shares of common stock

issuable upon conversion of Series E Convertible Preferred Stock beneficially owned by Emerging Manager Onshore Fund LLC, (viii)

82,500 shares of common stock issuable upon conversion of Series E Convertible Preferred Stock issuable upon exercise of the warrant

beneficially owned by Emerging Manager Onshore Fund LLC, (ix) 27,500 shares of common stock issuable upon conversion of Series

E Convertible Preferred Stock beneficially owned by WVP Emerging Manager Onshore Fund, (x) 27,500 shares of common stock issuable

upon conversion of Series E Convertible Preferred Stock issuable upon exercise of the warrant beneficially owned by WVP Emerging

Manager Onshore Fund.

|

|

|

Does not include 30,997 shares of Series C Convertible

Preferred Stock held by AIGH Investment Partners, L.P., which have been excluded because the shares contain provisions that block

conversion if such conversion will result in the holder having beneficial ownership of more than 9.99% of our common stock.

Does not include 278,105 shares of common stock that may be

purchased by AIGH Investment Partners, L.P., 2,500 shares of common stock that may be purchased by WVP Emerging Manager Offshore

Fund LLC and 7,500 shares of common stock that may be purchased by Emerging Manager Onshore Fund LLC upon the exercise of warrants,

which have been excluded because the warrants contain provisions that block exercise if such exercise will result in the holder

having beneficial ownership of more than 9.99% of our common stock. These shares of common stock are excluded because the warrants

contain provisions that block exercise if such exercise will result in the holder having beneficial ownership of more than 9.9%

of our common stock.