Notification That Annual Report Will Be Submitted Late (nt 10-k)

April 01 2019 - 5:18PM

Edgar (US Regulatory)

|

|

|

|

|

FORM

12b-25

|

|

SEC

FILE NUMBER

001-35963

|

|

|

|

|

|

NOTIFICATION

OF LATE FILING

|

|

CUSIP

NUMBER

67778H20

0

|

|

(Check

One):

|

☒ Form

10-K

|

☐ Form

20-F

|

☐ Form

11-K

|

☐ Form

10-Q

|

☐ Form

10-D

|

☐ Form

N-SAR

|

|

|

☐ Form

N-CSR

|

|

|

|

|

|

For

Period Ended:

December 31, 2018

☐ Transition

Report on Form 10-K

☐ Transition

Report on Form 20-F

☐ Transition

Report on Form 11-K

☐ Transition

Report on Form 10-Q

☐ Transition

Report on Form N-SAR

For

the Transition Period Ended:

____________________________________________________________

|

Read

Instruction (on back page) Before Preparing Form. Please Print or Type.

Nothing

in this form shall be construed to imply that the Commission has verified any information contained herein.

|

|

If

the notification relates to a portion of the filing checked above, identify the Item(s)

to which the notification relates:

|

|

PART

I — REGISTRANT INFORMATION

NanoVibronix, Inc.

|

|

Full

Name of Registrant

|

|

Former

Name if Applicable

525 Executive Blvd.

|

|

Address

of Principal Executive Office

(Street and Number)

Elmsford, New York 10523

|

|

City,

State and Zip Code

|

PART

II — RULES 12b-25(b) AND (c)

If

the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule

12b-25(b), the following should be completed. (Check box if appropriate)

|

|

(a)

|

The

reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

☒

|

(b)

|

The

subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, 11-K, Form N-SAR or Form N-CSR, or portion

thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly

report of transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on

or before the fifth calendar day following the prescribed due date; and

|

|

|

(c)

|

The

accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART

III — NARRATIVE

State

below in reasonable detail the reasons why Forms 10-K, 20-F, 11-K, 10-Q, N-SAR, or the transition report or portion thereof, could

not be filed within the prescribed time period.

NanoVibronix,

Inc. (the “Company,” “we,” or “our”) was unable to complete its Annual Report on Form 10-K

for the year ended December 31, 2018 (the “Annual Report”) prior to the filing deadline for the Annual Report as a

result of the need to complete year end closing procedures and financial statement preparation, a delay in completing the disclosures

to be included in the Annual Report, and a delaying in receiving the consent of the Company’s former its independent registered

public accounting firm. As a result of this delay, the Company is unable to file its Annual Report by the prescribed filing date

without unreasonable effort or expense.

The

Company expects to file the Annual Report within the extension period of 15 calendar days as provided under Rule 12b-25 under

the Securities Exchange Act of 1934, as amended.

The

Company’s expectation regarding the timing of the filing of the Annual Report and the description of anticipated material

changes from the results of operation from the corresponding period of the last fiscal year are forward-looking statements as

defined in the Private Securities Litigation Reform Act of 1995, and actual events may differ from those contemplated by these

forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties, including the inability

of the Company or its current or former independent registered public accounting firm to complete the work necessary in order

to file the Annual Report in the time frame that is anticipated, or unanticipated changes being reported in the Company’s

operating results as reported in the Annual Report as filed. The Company undertakes no obligation to revise or update any forward-looking

statements to reflect events or circumstances after the date hereof.

|

PART

IV — OTHER INFORMATION

|

|

|

|

(1)

|

Name

and telephone number of person to contact in regard to this notification:

|

|

|

Stephen

Brown

|

|

212

|

|

(914)

233-3004

|

|

|

(Name)

|

|

(Area

Code)

|

|

(Telephone

Number)

|

|

(2)

|

Have

all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the

Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required

to file such report(s) been filed? If answer is no, identify report(s). YES ☒ No ☐

|

|

(3)

|

Is

it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year

will be reflected by the earnings statements to be included in the subject report or portion thereof? YES ☒ No

☐

|

|

|

|

|

|

|

If

so, attach an explanation of the anticipated change, both narratively and quantitatively,

and, if appropriate, state the reasons why a reasonable estimate of results cannot be

made.

Revenues

.

For the twelve months ended December 31, 2018 and 2017, our revenues were approximately $318,000 and $239,000, respectively,

an increase of approximately 33.1%, or $79,000, between the periods. The increase was mainly attributable to increased

sales from adding distributors. Our revenues may fluctuate as we add new customers or when existing distributors make

large purchases of our products during one period and no purchases during another period. Our revenues by quarter may

not be linear or consistent. We do not anticipate that our revenues will be impacted by inflation or changing prices in

the foreseeable future.

For

the twelve months ended December 31, 2018, the percentage of revenues attributable to our products was: PainShield – 73.9%

and UroShield – 26.1%. For the twelve months ended December 31, 2017, the percentage of revenues attributable to our products

was: PainShield – 75.7% and UroShield – 24.3%. For the twelve months ended December 31, 2018 and 2017, the percentage

of revenues attributable to our disposable products was 33.1% and 47.4%, respectively. For the twelve months ended December 31,

2018 and 2017, the portion of our revenues that was derived from distributors was 55% and 47%, respectively.

Gross

Profit

. For the twelve months ended December 31, 2018, gross profit increased by approximately 7.1%, or $8,000, to approximately

$159,000 from approximately $151,000 during the same period in 2017.

Gross

profit as a percentage of revenues were approximately 50% and 63.2% for the twelve months ended December 31, 2018 and 2017, respectively.

The decrease in gross profit as a percentage is mainly due to increased costs incurred in the process of moving the manufacturing

process from our facilities to a third-party manufacturer which entailed among other costs a one-time $18,000 set-up fee, a one-time

$41,000 price reduction awarded to a distributor and to a lesser degree due to the increased sales to distributors which typically

are sold at lower margins, as well as a lower percentage of sales of disposable products which contain a higher gross margin.

|

|

|

Our

gross profit may be affected year-over-year by the mix of revenues between sales to distributers and sales directly to

the end customers (where sales directly to the end customers generally have a higher margin). As a result, we are subject

to year-over-year fluctuation in our gross profits.

Research

and Development Expenses

. For the twelve months ended December 31, 2018 and 2017, research and development expenses

were $614,000 and $693,000, respectively, a decrease of approximately 11.4%, or $109,000, between the periods. This decrease

was mainly due to decreased payroll expenses.

Research

and development expenses as a percentage of total revenues were approximately 193.1% and 290.0% for the twelve months

ended December 31, 2018 and 2017, respectively.

Our

research and development expenses consist mainly of payroll expenses to employees involved in research and development

activities, stock based compensation expenses, expenses related to subcontracting, patents, clinical trial and facilities

expenses associated with and allocated to research and development activities.

Selling

and Marketing Expenses

. For the twelve months ended December 31, 2018 and 2017, selling and marketing expenses were

approximately $1,212,000 and $465,000, respectively, an increase of approximately 160.6%, or $747,000, between the periods.

The

increase in selling and marketing expenses was mainly due to increased sales and marketing personnel, and to a lesser

degree increased trade show expenses and marketing campaigns.

Selling

and marketing expenses as a percentage of total revenues were approximately 381.1% and 194.6% for the twelve months ended

December 31, 2018 and 2017, respectively. The increase in our percentage was due to the decreased spending mentioned above.

Selling

and marketing expenses consist mainly of payroll expenses to direct sales and marketing employees, stock-based compensation

expenses, travel expenses, advertising and marketing expenses, rent and facilities expenses associated with and allocated

to selling and marketing activities.

General

and Administrative Expenses

. For the twelve months ended December 31, 2018 and 2017, general and administrative expenses

were approximately $2,637,000 and $2,084,000, respectively, an increase of approximately 26.5%, or $553,000, between the

periods. The increase was mainly attributable to increased consulting and professional fees and to a smaller degree increased

management compensation.

General

and administrative expenses as a percentage of total revenues were approximately 829.2% and 872.0% for the twelve months

ended December 31, 2018 and 2017, respectively. The decrease was due to the increase in revenues.

|

|

|

Our

general and administrative expenses consist mainly of payroll expenses for management

and administrative employees, costs associated with being a publicly traded company,

stock-based compensation expenses, accounting and facilities expenses associated with

general and administrative activities.

Financial

Expenses, net

. For the twelve months ended December 31, 2018 and 2017, financial expenses, net were $22,000 and $1,836,000,

respectively, a decrease of approximately 98.8%, or $1,814,000, between the periods. The decrease resulted primarily from

no longer recording a valuation adjustment of our warrants which were exercised in 2017.

Tax

expenses.

For the twelve months ended December 31, 2018 and 2017, tax expenses were $46,000 and $38,000 respectively.

The tax expense is computed by multiplying income before taxes at our Israeli subsidiary by the appropriate tax rate and

unrecognized tax benefits as a result of tax positions taken.

Net

Loss

. Our net loss decreased by approximately $637,000, or 49.7%, to approximately $4,328,000 for the twelve months

ended December 31, 2018 from approximately $4,965,000 during the same period in 2017. The decrease in net loss resulted

primarily from the factors described above.

|

|

|

NanoVibronix,

Inc.

|

|

|

(Name

of Registrant as Specified in Charter)

|

has

caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date:

|

April

1, 2019

|

|

By:

|

/s/

Stephen Brown

|

|

|

|

|

|

Stephen Brown, Chief Financial Officer

|

INSTRUCTION:

The form may be signed by an executive officer of the registrant or by any other duly authorized representative. The name and

title of the person signing the form shall be typed or printed beneath the signature. If the statement is signed on behalf of

the registrant by an authorized representative (other than an executive officer), evidence of the representative’s authority

to sign on behalf of the registrant shall be filed with the form.

|

|

ATTENTION

|

|

|

|

|

|

Intentional

misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C.

1001).

|

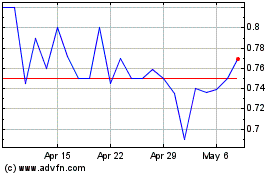

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Jul 2024 to Aug 2024

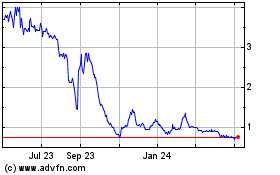

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Aug 2023 to Aug 2024