Mobilicom Limited

(

Nasdaq: MOB, MOBBW) (“Mobilicom” or “Company”), a

provider of cybersecurity and robust solutions for drones and

robotics, today announced financial results for the year ended

December 31, 2023.

Recent Operational

Highlights:

- Received initial production-scale order in Q3 2023 followed by

additional quantity-increase order in Q4 2023 from U.S. Tier-1

drone manufacturer which delivers to the U.S. Department of Defense

(“DOD”)

- Chosen by the U.S.DOD for Soldiers' Next Generation Wearable

Tactical AI-Enhanced Mission Kits

- Secured $900,000 initial production-scale order from global

Tier-1 Israeli-based manufacturer for loitering (kamikaze) drones

platform

- Secured initial production-scale order from another global

Tier-1 Israeli-based manufacturer for use by the Israeli Defense

Forces

- Secured license-based order for ICE Cybersecurity from Israel’s

Ministry of Defense for its small-sized drone program

- Launched MCU-70, cybersecure SDR Product with high

size-to-performance ratio addressing new target market for

mid-sized long-range UAVs

2023 Financial Highlights:

- Revenues increased 43% year-over-year to $2.3 million driven by

repeat orders

- Gross margin remained high, at 59% compared to 62% in 2022,

reflects our strong IP and know-how

- Confirmed order backlog of $1.4 million expected to be

fulfilled in first half of 2024

- Strong cash position of $8.4 million with narrowing monthly

burn rate affords Mobilicom a long cash runway to implement its

strategic plans, capture market share, and ramp revenues

- Completed $2.95 million capital raise in January 2024 adding to

strong cash position at year-end

- EBITDA decreased from approximately $(3.2) million as of

December 31, 2022 to approximately $(4.2) million as of December

31, 2023.

“2023 was a transformative year for Mobilicom

marked by several initial commercial scale orders from large global

defense manufacturers. Our cybersecure systems are now integrated

into drones and robotics purchased by the U.S. Department of

Defense, Israel’s Ministry of Defense and others” stated Mobilicom

CEO and Founder Oren Elkayam. “Our revenue growth, driven by our

design win customer- based expansion demonstrates Mobilicom ability

to deliver end-to-end systems that operate effectively under the

most difficult conditions.”

“During the year, we expanded our U.S. market presence and

business activities, product line and market segments. We’ve had

great traction with our newly launched MCU-70, a cybersecure

software defined radio that expands our reach into mid-sized and

long-range unmanned aerial vehicles (UAVs) that delivers a superior

size-to-performance ratio. Our solutions are now used in a broad

range of systems from mini and small-sized drones to high-speed

mid-range drone and robotics.”

“We foresee a strong financial start for 2024 based on our $1.4

million sales backlog. We anticipate additional repeat orders as

well as new contracts to drive 2024 revenues. We believe that with

$8.4 million in cash at the end of 2023 plus the recent $3 million

fund raise in January, we are well positioned to continue to

innovate, grow, and become a leading provider of cybersecure

solutions for the global small-sized drone and robotics industry.”

Key Sales and Contracts by

Region:

United States

- U.S. DoD/Leading robotics manufacturer: The

U.S. DoD chose Mobilicom’s SkyHopper to be integrated into the

soldiers’ next-generation wearable tactical AI-enhanced mission

kits made by a leading robotics manufacturer for the U.S. defense

industry, and will be integrated into the RAID System, a fully

integrated communications and common control solution for uncrewed

systems on land and air.

- Repeat initial commercial-scale order from a U.S.

Tier-1 defense manufacturer: Mobilicom received a

follow-on order from a U.S.-based Tier-1 customer for its SkyHopper

PRO, an essential component of the customer’s drone platform

manufactured for the U.S. defense industry and other U.S. federal

agencies.

- Initial $150,000 order for high-payload long-range

drones: This design win and initial order for two

products—Mobile Ground Control Stations and the SkyHopper Pro V

datalinks, is with a new customer, an innovative drone designer and

manufacturer that serves commercial and defense customers in the

U.S. and globally. Mobilicom’s systems will be integrated into

high-payload long- range drones that are set for intensive

commercial demonstrations to leading defense and commercial end

users across the U.S.

- Tier-1 customer purchases: One of the world’s

large manufacturers of small-sized drones and robotics has

integrated Mobilicom’s SkyHopper PRO into its new small-sized drone

platform and placed an initial commercial-scale order. The

customer’s small-sized drones are being manufactured for the U.S.

DoD.

Europe

- Initial order from one of Europe’s largest defense

contractors: The customer is integrating two of

Mobilicom’s products—the Mobile Ground Control Station and MCU Mesh

networking into a paired, networked ground vehicle and drone

system. This Tier-1 company serves the European market where NATO

countries have increased their defense budgets significantly in

response to the Russia-Ukraine conflict.

Israel and ROW

- $900,000

initial production-scale order from Tier-1 customer: An

Israel-based Tier-1 global defense and drone manufacturer, one of

the largest loitering munitions providers in the world, moved from

design to initial commercial-phase with Mobilicom’s SkyHopper,

which is integrated into its loitering munitions. Shipments

commenced in Q4 2023 and continued into Q1 2024. Driven by the high

replacement rates of loitering munitions, Mobilicom expects

follow-on orders and further demand.

- United

Arab Emirates (UAE): Mobilicom secured a repeat order for

its robust end-to-end solutions from a leading UAE government

organization. The customer purchased Mobilicom’s entire product

offering, including hardware and software.

- Israel Ministry of Defense: The

Company’s ICE Cybersecurity software drone solution was purchased

by Israel’s Ministry of Defense to be used in small-sized drones

for reconnaissance, surveillance, and intelligence gathering. The

initial order was fully delivered in January 2024, with additional

orders and deliveries expected in Q2 2024 and beyond.

- Initial

production-scale order from another Israeli-based global Tier-1

manufacturer: Mobilicom secured a new initial

production-scale order for its SkyHopper Pro Lite from Israel’s

major aerospace and aviation manufacturer for loitering drones to

be deployed by the Israel Defense Forces. This follows a successful

integration and testing of SkyHopper Pro in loitering drones. This

order is planned to ship in Q1 2024 and is expected to be followed

by larger purchases as the manufacturer demonstrates the drones to

other potential customers worldwide including the U.S. DoD.

- Leading

global provider of autonomous and remote-controlled armor

technology selected Mobilicom solutions: Based on a

previous design win, Mobilicom’s Mobile Ground Control Station 10”

Pro, MCU Mesh Networking, and SkyHopper are being installed into

autonomous and remote-controlled electric vehicles for the homeland

security and defense markets.

About Mobilicom

Mobilicom is a leading provider of cybersecure

robust solutions for the rapidly growing defense and commercial

drones and robotics market. Mobilicom’s large portfolio of

field-proven technologies includes cybersecurity, software,

hardware, and professional services that power, connect, guide, and

secure drones and robotics. Through deployments across the globe

with over 50 customers, including the world’s largest drone

manufacturers, Mobilicom’s end-to-end solutions are used in

mission-critical functions.

For investors, please use

https://ir.mobilicom.com/For company, please use

www.mobilicom.com

Forward Looking Statements

This press release contains “forward-looking

statements” that are subject to substantial risks and

uncertainties. For example, the Company is using forward-looking

statements when it discusses how the Company is trusted to deliver

end-to-end systems that operate effectively under the most

difficult conditions, how it foresees a strong financial start for

2024 based on it $1.4 million backlog and accounts receivable, its

anticipation that additional repeat orders as well as new contracts

will drive 2024 revenues growth and its belief that it is

positioned to continue to innovate, grow, and become a leading

provider of

cybersecure solutions for the global small-sized

drone and robotics industry. All statements, other than statements

of historical fact, contained in this press release are

forward-looking statements. Forward-looking statements contained in

this press release may be identified by the use of words such as

“anticipate,” “believe,” “contemplate,” “could,” “estimate,”

“expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,”

“predict,” “project,” “target,” “aim,” “should,” “will” “would,” or

the negative of these words or other similar expressions, although

not all forward-looking statements contain these words.

Forward-looking statements are based on Mobilicom Limited’s current

expectations and are subject to inherent uncertainties, risks and

assumptions that are difficult to predict. Further, certain

forward-looking statements are based on assumptions as to future

events that may not prove to be accurate. These and other risks and

uncertainties are described more fully in the Company’s filings

with the Securities and Exchange Commission. Forward-looking

statements contained in this announcement are made as of this date,

and Mobilicom Limited undertakes no duty to update such information

except as required under applicable law.

For more information on Mobilicom,

please contact:

Liad GelferMobilicom

Ltdliad.gelfer@mobilicom.com

Use of Non-IFRS Financial Information

In addition to disclosing financial results

calculated in accordance with the International Financial Reporting

Standards (“IFRS”) as issued by the International Accounting

Standards Board, this release also contains non-IFRS financial

measures, which Mobilicom believes are the principal indicators of

the operating and financial performance of its business.

Management believes the non-IFRS financial

measures provided are useful to investors' understanding and

assessment of Mobilicom’s ongoing core operations and prospects for

the future, as the charges eliminated are not part of the

day-to-day business or reflective of the core operational

activities of the company. Management uses these non-IFRS financial

measures as a basis for strategic decisions, and evaluating the

Company's current performance. The presentation of these non-IFRS

financial measures is not intended to be considered in isolation

from, or as a substitute for, or superior to, operating loss and or

net income (loss) or any other performance measures derived in

accordance with IFRS or as an alternative to net cash provided by

operating activities or any other measures of our cash flows or

liquidity.

EBITDA is a non-IFRS financial measure that is

defined as earnings before interest, taxes, depreciation,

amortization, and other non-cash or one-time expenses.

|

Mobilicom Limited |

|

Condensed Consolidated Statements of Profit or Loss |

| |

|

|

|

|

|

|

|

| |

AUD$ |

|

AUD$ |

|

$ * |

|

$ * |

| |

For the twelve months ended, December 31, |

|

For the twelve months ended, December 31, |

|

For the twelve months ended, December 31, |

|

For the twelve months ended, December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenue |

$ |

3,301,887 |

|

|

$ |

2,327,058 |

|

|

$ |

2,258,491 |

|

|

$ |

1,580,881 |

|

| Cost of sales |

|

1,357,614 |

|

|

|

883,483 |

|

|

|

928,608 |

|

|

|

600,193 |

|

| Gross margin |

|

1,944,273 |

|

|

|

1,443,575 |

|

|

|

1,329,883 |

|

|

|

980,688 |

|

| |

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

| Selling and marketing

expenses |

|

2,484,905 |

|

|

|

2,464,936 |

|

|

|

1,699,675 |

|

|

|

1,674,550 |

|

| Research and development,

net |

|

2,640,258 |

|

|

|

1,662,274 |

|

|

|

1,805,936 |

|

|

|

1,129,262 |

|

| General and administration

expenses |

|

4,032,454 |

|

|

|

2,690,920 |

|

|

|

2,758,199 |

|

|

|

1,828,071 |

|

| Total operating expenses |

|

9,157,617 |

|

|

|

6,818,130 |

|

|

|

6,263,810 |

|

|

|

4,631,883 |

|

| |

|

|

|

|

|

|

|

| Operating loss |

|

(7,213,344 |

) |

|

|

(5,374,555 |

) |

|

|

(4,933,927 |

) |

|

|

(3,651,195 |

) |

| |

|

|

|

|

|

|

|

| Other (expenses) income |

|

463,176 |

|

|

|

5,047,072 |

|

|

|

316,812 |

|

|

|

3,428,718 |

|

| |

|

|

|

|

|

|

|

| Loss before income tax

expenses |

$ |

(6,750,168 |

) |

|

$ |

(327,483 |

) |

|

$ |

(4,617,115 |

) |

|

$ |

(222,477 |

) |

| |

|

|

|

|

|

|

|

| Income tax expenses |

|

(121,797 |

) |

|

|

(13,986 |

) |

|

|

(83,309 |

) |

|

|

(9,501 |

) |

| |

|

|

|

|

|

|

|

| Loss after income tax

expenses |

$ |

(6,871,965 |

) |

|

$ |

(341,469 |

) |

|

$ |

(4,700,424 |

) |

|

$ |

(231,978 |

) |

| |

|

|

|

|

|

|

|

| Loss per share - basic and

diluted |

|

(0.52 |

) |

|

|

(0.05 |

) |

|

|

(0.35 |

) |

|

|

(0.03 |

) |

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding - basic and diluted |

|

1,328,152,166 |

|

|

|

664,158,704 |

|

|

|

1,328,152,166 |

|

|

|

664,158,704 |

|

* US Dollars numbers presented solely for convenience of the

reader

|

Mobilicom Limited |

|

Reconciliation table of EBITDA to Loss after income tax

expenses |

| |

|

|

|

|

|

|

|

| |

AUD$ |

|

AUD$ |

|

$ * |

|

$ * |

| |

For the twelve monthsended, December 31, |

|

For the twelve monthsended, December 31, |

|

For the twelve monthsended, December 31, |

|

For the twelve monthsended, December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Loss after income tax

expense |

$ |

(6,871,965 |

) |

|

$ |

(341,469 |

) |

|

$ |

(4,700,424 |

) |

|

$ |

(231,978 |

) |

| Financial expenses (income),

net |

|

(463,176 |

) |

|

|

(5,047,072 |

) |

|

|

(316,812 |

) |

|

|

(3,428,718 |

) |

| Depreciation |

|

412,093 |

|

|

|

375,516 |

|

|

|

253,075 |

|

|

|

255,106 |

|

| Share-based compensation |

|

882,055 |

|

|

|

309,256 |

|

|

|

603,326 |

|

|

|

210,092 |

|

| Income tax expense |

|

121,797 |

|

|

|

13,986 |

|

|

|

83,309 |

|

|

|

9,501 |

|

| EBITDA |

$ |

(5,919,196 |

) |

|

$ |

(4,689,783 |

) |

|

$ |

(4,160,835 |

) |

|

$ |

(3,195,498 |

) |

| |

|

|

|

|

|

|

|

* US Dollars numbers presented solely for convenience of the

reader

|

Mobilicom Limited |

|

Condensed Consolidated Statements of Financial Position |

| |

|

|

|

|

|

|

|

| |

AUD$ |

|

AUD$ |

|

$ * |

|

$ * |

| |

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

12,259,185 |

|

|

$ |

18,917,416 |

|

|

$ |

8,385,283 |

|

|

$ |

12,851,506 |

|

| Restricted cash |

|

86,880 |

|

|

|

59,126 |

|

|

|

59,426 |

|

|

|

40,166 |

|

| Trade and other receivables,

net |

|

1,429,209 |

|

|

|

828,351 |

|

|

|

977,578 |

|

|

|

562,740 |

|

| Inventories |

|

1,366,635 |

|

|

|

838,658 |

|

|

|

934,779 |

|

|

|

569,740 |

|

| Total current assets |

|

15,141,909 |

|

|

|

20,643,551 |

|

|

|

10,357,066 |

|

|

|

14,024,152 |

|

| |

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

| Property, plant and equipment,

net |

|

117,758 |

|

|

|

135,878 |

|

|

|

80,547 |

|

|

|

92,309 |

|

| Right-of-use assets |

|

672,954 |

|

|

|

426,817 |

|

|

|

460,300 |

|

|

|

289,957 |

|

| Total non-current assets |

|

790,712 |

|

|

|

562,695 |

|

|

|

540,847 |

|

|

|

382,266 |

|

| |

|

|

|

|

|

|

|

| Total assets |

$ |

15,932,621 |

|

|

$ |

21,206,246 |

|

|

$ |

10,897,913 |

|

|

$ |

14,406,418 |

|

| |

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

| Trade and other payables |

$ |

2,076,052 |

|

|

$ |

1,608,846 |

|

|

$ |

1,420,018 |

|

|

$ |

1,092,966 |

|

| Lease liabilities |

|

327,046 |

|

|

|

333,850 |

|

|

|

223,700 |

|

|

|

226,800 |

|

| Financial liability |

|

1,572,818 |

|

|

|

1,097,520 |

|

|

|

1,075,808 |

|

|

|

745,598 |

|

| Total current liabilities |

|

3,975,916 |

|

|

|

3,040,216 |

|

|

|

2,719,526 |

|

|

|

2,065,364 |

|

| |

|

|

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

|

| Lease liabilities |

|

334,909 |

|

|

|

95,403 |

|

|

|

229,078 |

|

|

|

64,812 |

|

| Employee benefits |

|

295,542 |

|

|

|

203,636 |

|

|

|

202,151 |

|

|

|

138,339 |

|

| Governmental liabilities on

grants received |

|

6,666 |

|

|

|

6,084 |

|

|

|

4,560 |

|

|

|

4,133 |

|

| Total non-current

liabilities |

|

637,117 |

|

|

|

305,123 |

|

|

|

435,789 |

|

|

|

207,284 |

|

| |

|

|

|

|

|

|

|

| Total liabilities |

|

4,613,033 |

|

|

|

3,345,339 |

|

|

|

3,155,315 |

|

|

|

2,272,648 |

|

| |

|

|

|

|

|

|

|

| Net assets |

$ |

11,319,588 |

|

|

$ |

17,860,907 |

|

|

$ |

7,742,598 |

|

|

$ |

12,133,770 |

|

| |

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Issued capital |

|

41,855,722 |

|

|

|

41,636,762 |

|

|

|

28,629,314 |

|

|

|

28,285,844 |

|

| Reserves |

|

388,674 |

|

|

|

276,988 |

|

|

|

265,853 |

|

|

|

188,172 |

|

| Accumulated losses |

|

(30,924,808 |

) |

|

|

(24,052,843 |

) |

|

|

(21,152,569 |

) |

|

|

(16,340,246 |

) |

| |

|

|

|

|

|

|

|

| Total equity |

$ |

11,319,588 |

|

|

$ |

17,860,907 |

|

|

$ |

7,742,598 |

|

|

$ |

12,133,770 |

|

| |

|

|

|

|

|

|

|

| * US Dollars numbers presented solely for

convenience of the reader |

|

|

|

|

|

|

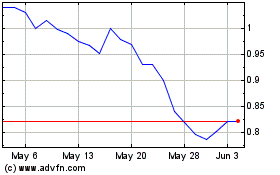

Mobilicom (NASDAQ:MOB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mobilicom (NASDAQ:MOB)

Historical Stock Chart

From Nov 2023 to Nov 2024