UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): January 20, 2015

MICROFINANCIAL INCORPORATED

(Exact name of registrant as specified in its charter)

MASSACHUSETTS

(State or other jurisdiction of incorporation)

|

001-14771

(Commission

file number) |

|

04-2962824

(IRS Employer

Identification Number) |

16 New England Executive Park, Suite 200, Burlington MA 01803

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (781) 994-4800

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

As previously reported, on December 13, 2014, TimePayment Corp., a direct, wholly-owned subsidiary of the Company (as defined below) (“TimePayment”) and MF2 Holdings LLC, an indirect, wholly-owned subsidiary of Parent (as defined below) (together with TimePayment, the “Borrowers”) entered into a Third Amended and Restated Credit Agreement (the “New Credit Agreement”) with Santander Bank, N.A. (“Santander”), as agent and certain lenders for a $200 million revolving credit facility (the “Revolving Credit Facility”). The maximum principal amount of loans outstanding under the Revolving Credit Facility at any time is subject to a borrowing base based on, among other items, collateral value attributed to eligible receivables. Availability of loans under the Revolving Credit Facility will be reduced by $43 million as long as any borrowings under a bridge loan facility entered into between Purchaser (as defined below), as borrower and Santander, as lender (the “Bridge Loan Facility”) remain outstanding. As of January 22, 2015, the conditions precedent for borrowings under the Revolving Credit Facility and the Bridge Loan Facility have been met. The Revolving Credit Facility is available to (i) refinance the Bridge Loan Facility, (ii) pay related fees and expenses incurred in connection with the Merger and (iii) provide ongoing working capital and other funding needs for the Borrowers.

Item 1.02. Termination of Material Definitive Agreement.

As previously reported, the Revolving Credit Facility will refinance and replace the $150 million revolving credit facility of TimePayment provided by Santander as agent, and the other lenders party thereto (the “Old Credit Agreement”). The New Credit Agreement is an amendment and restatement of the Old Credit Agreement.

Item 2.01. Completion of Acquisition or Disposition of Assets.

As previously reported, on December 13, 2014, MicroFinancial Incorporated, a Massachusetts corporation (“MicroFinancial” or the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with MF Parent LP, a Delaware limited partnership (“Parent”) and MF Merger Sub Corp., a Massachusetts corporation and a wholly-owned subsidiary of Parent (“Purchaser”). Parent is an affiliate of funds managed by an affiliate of Fortress Investment Group LLC. In accordance with the Merger Agreement, Purchaser commenced a tender offer to purchase all outstanding shares of MicroFinancial’s common stock (the “Shares”) at a purchase price per Share of $10.20 in cash, without interest and less any applicable withholding taxes (the “Offer Price”), upon the terms and subject to the conditions set forth in the Offer to Purchase to the Schedule TO (as amended or supplemented from time to time), and in the related Letter of Transmittal, filed by Parent and Purchaser with the Securities and Exchange Commission (the “SEC”) on December 19, 2014 (which, collectively and together with any amendments or supplements, constitute the “Offer”).

The information set forth in Item 5.01 of this Current Report on Form 8-K is incorporated by reference into Item 2.01.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 is incorporated herein by reference.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

Pursuant to the terms and conditions of the Merger Agreement, Purchaser was merged with and into MicroFinancial (the “Merger”) on January 23, 2015 in accordance with the “short form” merger provisions available under Massachusetts law, which allow the completion of the Merger without a vote or meeting of stockholders of MicroFinancial, since Purchaser had acquired more than 90% of the outstanding Shares. On January 23, 2015, in connection with the Merger, MicroFinancial requested the Nasdaq Global Market (“Nasdaq”) remove its common stock from listing on Nasdaq, that the “MFI” trading designation be suspended and further requested that Nasdaq file a delisting application with the SEC to delist and deregister its common stock. On January 23, 2015, Nasdaq filed with the SEC a Notification of Removal from Listing and/or Registration under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on Form 25 to delist and deregister MicroFinancial’s common stock. MicroFinancial will file with the SEC a certification on Form 15 under the

2

Exchange Act, requesting the deregistration of MicroFinancial’s common stock and the termination or suspension of MicroFinancial’s reporting obligations under Sections 13 and 15(d) of the Exchange Act.

The information set forth in Item 5.01 of this Current Report on Form 8-K is incorporated by reference into Item 3.01.

Item 3.02 Unregistered Sales of Equity Securities.

In order to complete the Merger, on January 21, 2015, pursuant to Section 1.4 of the Merger Agreement, Purchaser gave notice of its intent to exercise its top-up option (the “Top-Up Option”) to purchase shares of MicroFinancial’s common stock to enable it to hold more than 90% of MicroFinancial’s outstanding Shares so that it could use the “short form” merger provisions available under Massachusetts law. Accordingly, on January 22, 2015, MicroFinancial issued 3,361,699 Shares (the “Top-Up Option Shares”) to Purchaser, at a price per Share of $10.20. Purchaser paid for the Top-Up Option Shares by delivery of a promissory note in the aggregate principal amount of $34,289,329.80.

MicroFinancial offered and sold the Top-Up Option Shares as a private placement pursuant to an exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended.

The information set forth in Item 5.01 of this Current Report on Form 8-K is incorporated by reference into Item 3.02.

Item 3.03. Material Modifications to Rights of Security Holders.

At the effective time of the Merger, each issued and outstanding Share (other than any Shares owned by Parent, Merger Sub, MicroFinancial or any of their respective subsidiaries, including (i) shares previously held by certain executive officers of MicroFinancial that they agreed to contribute to Parent and (ii) shares held by shareholders who properly exercised their appraisal rights in connection with the Merger under Massachusetts law) was converted into the right to receive the Offer Price. At the effective time of the Merger, holders of such Shares ceased to have any rights as holders of Shares (other than their right to receive the Offer Price) and accordingly no longer have any interest in MicroFinancial’s future earnings or growth.

The information set forth in Item 5.01 of this Current Report on Form 8-K is incorporated by reference into Item 3.03.

Item 5.01. Changes in Control of Registrant.

As previously reported, the offering period under the Offer expired at 5:00 p.m., Eastern time, on Wednesday, January 21, 2015. According to American Stock Transfer & Trust Company, LLC, the depositary for the Offer (the “Depositary”), as of such time, 12,687,228 Shares (excluding 73,585 Shares that were committed to be tendered pursuant to guaranteed delivery procedures) were validly tendered and not withdrawn pursuant to the Offer, which represented approximately 87.7% of the then issued and outstanding Shares. Purchaser accepted for payment and paid for all of the Shares that were validly tendered and not withdrawn pursuant to the terms of the Offer (the “Acceptance Time”).

Pursuant to the terms and conditions of the Merger Agreement, Purchaser exercised the Top-Up Option, which permitted it to purchase the Top-Up Option Shares, at a price per Share of $10.20. Purchaser paid for the Top-Up Option Shares by delivery of a promissory note. Purchaser was merged with and into MicroFinancial on January 23, 2015 in accordance with the “short form” merger provisions available under Massachusetts law, which allow the completion of the Merger without a vote or meeting of stockholders of MicroFinancial, since Purchaser had acquired more than 90% of the outstanding Shares.

In connection with the Merger, each issued and outstanding Share (other than any Shares owned by Parent, Merger Sub, MicroFinancial or any of their respective subsidiaries, including (i) shares previously held by certain executive officers of MicroFinancial that they agreed to contribute to Parent and (ii) shares held by shareholders who properly exercised their appraisal rights in connection with the Merger under Massachusetts law) was converted

3

into the right to receive the Offer Price. Following the consummation of the Merger, MicroFinancial continued as the surviving corporation and an indirect wholly owned subsidiary of Parent.

The foregoing description of the Merger Agreement and related transactions is qualified in its entirety by reference to the full text of the Merger Agreement, a copy of which is filed as Exhibit 2.1 to this report and is incorporated herein by reference.

In connection with the Offer and the Merger (but not including payment for the Top-Up Option Shares), Parent and Purchaser paid, in the aggregate, approximately $149.3 million in cash consideration, consisting of a combination of available cash and borrowings from existing revolving credit facilities.

To the knowledge of MicroFinancial, except as set forth herein, there are no arrangements, including any pledge by any person of securities of MicroFinancial or Parent, the operation of which may at a subsequent date result in a further change in control of MicroFinancial.

Other information that may be required by Item 5.01(a) of Form 8-K is contained in (i) MicroFinancial’s Solicitation/Recommendation Statement on Schedule 14D-9, originally filed with the SEC on December 19, 2014, as subsequently amended and supplemented, and (ii) the Tender Offer Statement on Schedule TO, originally filed by Parent and Purchaser with the SEC on December 19, 2014, as subsequently amended and supplemented, and such information is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 20, 2015, the Company and Stephen J. Constantino, its Vice President, Human Resources, entered into a Severance Agreement and General Release that provided for the termination of Mr. Constantino’s employment with the Company effective as of January 22, 2015. As contemplated by his existing employment agreement with the Company dated as of May 4, 2005, as amended December 24, 2008, Mr. Constantino will be paid his current base salary over a period of eighteen months, and he will be eligible for continued health and welfare benefits under the Company’s group health plan until the earlier of eighteen months or his becoming eligible for benefits under the plan of another employer. His outstanding equity awards will be treated as provided in the Merger Agreement. The Company and Mr. Constantino also entered into a Consulting Agreement, dated January 23, 2015, under which Mr. Constantino may provide transitional human resource services to the Company, as requested, in connection with the training of a successor, with compensation at an hourly rate of $88.55 per hour, which agreement is terminable by the Company upon three days’ notice.

On January 21, 2015, in accordance with the Company’s bylaws, prior to the time Purchaser accepted the Shares for payment in the Offer (the “Acceptance Time”), (i) Peter R. Bleyleben, Brian E. Boyle and Richard F. Latour resigned from the Board of Directors of the Company (the “Board”), effective as of the Acceptance Time, and (ii) the members of the Board elected each of Steven Campbell, Douglas Greeff, David King and Scott Lustig (collectively, the “New Directors”) to the Board as directors of the Company by unanimous consent, effective as of the Acceptance Time. Each of the New Directors has advised the Company that, to the best of his knowledge, he is not currently a director of, and does not hold any position with, the Company or any of its subsidiaries. Each of the New Directors has further advised the Company that, to the best of his knowledge, neither he nor any of his immediate family members (i) has a familial relationship with any directors, other nominees or executive officers of the Company or any of its subsidiaries or (ii) has been involved in any transactions with the Company or any of its subsidiaries, in each case, that are required to be disclosed pursuant to the rules and regulations of the SEC, except as disclosed herein and in the Schedule 14F-1 which was filed by the Company with the SEC on December 19, 2014 (the “Schedule 14F-1”).

On January 23, 2015, in accordance with the Company’s bylaws, following the Acceptance Time but prior to the time the Merger became effective (the “Effective Time”), Fritz von Mering, Torrence C. Harder and Alan J. Zakon resigned from the Board, effective as of the Effective Time.

Biographical and other information with respect to each of the New Directors has been previously disclosed in the Schedule 14F-1 and is incorporated herein by reference.

4

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On January 23, 2015, effective upon the closing of the Merger, the certificate of incorporation of MicroFinancial was amended and restated (the “Amended Charter”), and the bylaws of MicroFinancial were amended and restated (the “Amended Bylaws”). The Amended Charter and Amended Bylaws are attached hereto as Exhibit 3.1 and Exhibit 3.2, respectively, and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

|

Exhibit No. |

|

Description |

|

2.1 |

|

Agreement and Plan of Merger, dated as of December 13, 2014, by and among MF Merger Sub Corp., MF Parent LP and MicroFinancial Incorporated (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K filed by MicroFinancial Incorporated on December 16, 2014).* |

|

|

|

|

|

3.1 |

|

Amended and Restated Certificate of Incorporation of MicroFinancial Incorporated, dated January 23, 2015 |

|

|

|

|

|

3.2 |

|

Amended and Restated By-Laws of MicroFinancial Incorporated, dated January 23, 2015 |

|

|

|

|

|

10.1 |

|

Third Amended and Restated Credit Agreement among Santander Bank N.A., as Agent, the Lenders party thereto, TimePayment Corp., and MF2 Holdings LLC, dated December 13, 2014 (incorporated by reference to Exhibit 10.5 to the Current Report on Form 8-K/A filed by MicroFinancial Incorporated on December 18, 2014).* |

*Previously filed.

5

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MICROFINANCIAL INCORPORATED |

|

|

Registrant |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ James R. Jackson, Jr. |

|

|

|

James R. Jackson, Jr. |

|

|

|

Vice President and Chief Financial Officer |

Dated: January 23, 2015

6

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

2.1 |

|

Agreement and Plan of Merger, dated as of December 13, 2014, by and among MF Merger Sub Corp., MF Parent LP and MicroFinancial Incorporated (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K filed by MicroFinancial Incorporated on December 16, 2014).* |

|

|

|

|

|

3.1 |

|

Amended and Restated Certificate of Incorporation of MicroFinancial Incorporated, dated January 23, 2015 |

|

|

|

|

|

3.2 |

|

Amended and Restated By-Laws of MicroFinancial Incorporated, dated January 23, 2015 |

|

|

|

|

|

10.1 |

|

Third Amended and Restated Credit Agreement among Santander Bank N.A., as Agent, the Lenders party thereto, TimePayment Corp., and MF2 Holdings LLC, dated December 13, 2014 (incorporated by reference to Exhibit 10.5 to the Current Report on Form 8-K/A filed by MicroFinancial Incorporated on December 18, 2014).* |

*Previously filed.

7

Exhibit 3.1

|

D

PC |

The Commonwealth of Massachusetts |

|

William Francis Galvin

Secretary of the Commonwealth

One Ashburton Place, Boston, Massachusetts 02108-1512

Restated Articles of Organization

(General Laws Chapter 156D, Section 10.07; 950 CMR 113,35)

(1) Exact name of corporation: MicroFinancial Incorporated

(2) Registered office address: 16 New England Executive Park, Suite 200, Burlington, MA 01803

(number, street, city or town, state, zip code)

(3) Date adopted: January 23, 2015

(month, day, year)

(4) Approved by:

(check appropriate box)

o the directors without shareholder approval and shareholder approval was not required;

OR

x the board of directors and the shareholders in the manner required by G.L. Chapter 156D and the corporation’s articles of organization.

(5) The following information is required to be included in the articles of organization pursuant to G.L. Chapter 156D, Section 2.02 except that the supplemental information provided for in Article VIII is not required:*

ARTICLE I

The exact name of the corporation is:

MicroFinancial incorporated

ARTICLE II

Unless the articles of organization otherwise provide, all corporations formed pursuant to G.L. Chapter 156D have the purpose of engaging in any lawful business. Please specify if you want a more limited purpose:**

* Changes to Article VIII must be made by filing a statement of change of supplemental information form.

** Professional corporations governed by G.L Chapter 156A and must specify the professional activities of the corporation.

ARTICLE III

State the total number of shares and par value,* if any, of each class of stock that the corporation is authorized to issue. All corporations must authorize stock. If only one class or series is authorized, it is not necessary to specify any particular designation.

|

WITHOUT PAR VALUE |

|

WITH PAR VALUE |

|

|

TYPE |

|

NUMBER OF SHARES |

|

TYPE |

|

NUMBER OF SHARES |

|

PAR VALUE |

|

|

|

|

|

|

Common |

|

2,000 |

|

$ |

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

ARTICLE IV

Prior to the issuance of shares of any class or series, the articles of organization must set forth the preferences, limitations and relative rights of that class or series. The articles may also limit the type or specify the minimum amount of consideration for which shares of any class or series may be issued. Please set forth the preferences, limitations and relative rights of each class or series and, if desired, the required type and minimum amount of consideration to be received.

Intentionally omitted.

ARTICLE V

The restrictions, if any, imposed by the articles or organization upon the transfer of shares of any class or series of stock are:

None.

ARTICLE VI

Other lawful provisions, and if there are no such provisions, this article may be left blank.

See Article VI attached hereto and made a part hereof.

Note: The preceding six (6) articles are considered to be permanent and may be changed only by filing appropriate articles of amendment.

* G.L. Chapter 156D eliminates the concept of par value, however a corporation may specify par value in

Article III. See G.L. Chapter 156D, Section 6.21, and the comments relative thereto.

ARTICLE VII

The effective date of organization of the corporation is the date and time the articles were received for filing if the articles are not rejected within the time prescribed by law. If a later effective date is desired, specify such date, which may not be later than the 90th day after the articles are received for filing:

It is hereby certified that these restated articles of organization consolidate all amendments into a single document. If a new amendment authorizes an exchange, or effects a reclassification or cancellation, of issued shares, provisions for implementing that action are set forth in these restated articles unless contained in the text of the amendment.

Specify the number(s) of the article(s) being amended: Article II, Article III, Article IV, Article V, Article VI and Article VII

|

Signed by: |

|

|

/s/ Richard F. Latour |

|

(signature of authorized individual) |

|

Richard F. Latour, President |

|

|

|

MicroFinancial Incorporated |

o Chairman of the board of directors,

x President,

o Other officer,

o Court-appointed fiduciary,

on this 23rd day of January, 2015

ARTICLE VI

6.1 The board of directors may make, amend, or repeal the by-laws in whole or in part, except with respect to any provision thereof which by virtue of an express provision in Chapter 156D of the Massachusetts General Laws, the articles of organization or the by-laws requires action by the shareholders.

6.2 The number of authorized shares of any class or series, the distinguishing designation thereof and the preferences, limitations and relative rights applicable thereto shall be set forth in the articles of organization or any amendment thereto approved by the board of directors. All or a specified number of directors may be elected by the holders of one or more authorized classes or series of shares, as set forth in an amendment to these articles of organization. At any time after the initial issuance of shares of any class or series, the board of directors may reclassify any unissued shares of the class or series into one or more existing or new classes or series. Shares of any class or series may be issued as a share dividend in respect of shares of another class or series.

6.3 Action required or permitted by Chapter 156D of the Massachusetts General Laws to be taken at a shareholders’ meeting may be taken without a meeting if the action is taken by shareholders having not fewer than the minimum number of votes necessary to take the action at a meeting at which all shareholders entitled to vote on the action are present and voting.

6.4 If any provision of Chapter 156D of the Massachusetts General Laws would otherwise require the affirmative vote of more than a majority of the shares in any voting group for favorable action to be taken on a matter, favorable action may nevertheless be taken by vote of a majority of all the shares in the voting group entitled to vote on the matter.

6.5 To the maximum extent permitted by Chapter 156D of the Massachusetts General Laws, as the same exists or may hereafter be amended, no director of the corporation shall be personally liable to the corporation for monetary damages for breach of fiduciary duty as a director, notwithstanding any provision of law imposing such liability. No amendment to or repeal of the provisions of this paragraph shall apply to or have any effect on the liability or alleged liability of any director of the corporation for or with respect to any act or failure to act of such director occurring prior to such amendment or repeal.

6.6 The number of directors of the corporation shall be fixed in or specified in accordance with the bylaws. The corporation may have fewer than three directors, notwithstanding the number of shareholders of the corporation.

6.7 The directors may specify the manner in which the accounts of the corporation shall be kept and may determine what constitutes net earnings, profits and surplus, what amounts, if any, shall be reserved for any corporate purpose, and what amounts, if any, shall be declared as dividends, Unless the board of directors otherwise specifies, the excess of the consideration for any share with par value issued by it over such par value shall be surplus. The board of directors may allocate to capital less than all of the consideration for any share without par value issued by it, in which case the balance of such consideration shall be surplus. All surplus shall be available for any corporate purpose, including the payment of dividends.

6.8 The purchase or other acquisition by the corporation of its own shares shall not be deemed a reduction of its capital. Upon any reduction of capital or shares, no shareholder shall have any right to demand any distribution from the corporation, except as and to the extent that the shareholders shall have provided at the time of authorizing such reduction.

Exhibit 3.2

AMENDED AND RESTATED BY-LAWS

OF

MICROFINANCIAL INCORPORATED

ARTICLE I

ARTICLES OF ORGANIZATION

The name of the corporation shall be as set forth in the articles of organization of the corporation (the “Articles”). The corporation shall have the purpose of engaging in any lawful business, unless a more limited purpose is set forth in the Articles. The powers of the corporation shall be all powers as set forth in the Massachusetts Business Corporation Act (the “Act”), unless more limited powers or restrictions on any powers are set forth in the Articles. The powers of the corporation’s directors and shareholders, or any class of shareholders if the corporation has more than one class of shares, and all matters concerning the conduct and regulation of the business and affairs of the corporation shall be subject to such provisions in regard thereto, if any, as are set forth in the Articles as from time to time in effect.

ARTICLE II

SHAREHOLDERS

1. Annual Meeting.

The annual meeting of shareholders shall be held at 10:00 A.M., or at such other time as the board of directors shall determine, on the second Wednesday of May in each year unless such date is a legal holiday. If such date is a legal holiday, then the annual meeting shall be held at the same hour on the next succeeding business day not a legal holiday. The purposes for which an annual meeting is to be held include the election of directors and transacting such other business as may properly be brought before such meeting.

2. Special Meetings.

A special meeting of shareholders, including a special meeting held in lieu of the annual meeting, may be called at any time by the president or by the directors. Upon written application of one or more shareholders who hold in the aggregate at least ten percent (10%) of all votes, which written application or applications shall be signed and dated by such shareholders and shall state the purpose for which the meeting is to be held, a special meeting shall be called by the secretary, or in case of the death, absence, incapacity or refusal of the secretary, by any other officer. Each call of a meeting shall state the place, date, hour and purposes of the meeting.

3. Place of Meetings.

The place at which any special or annual meeting of shareholders shall be held shall be fixed by the board of directors. Meetings of shareholders may be held at any physical location in or outside Massachusetts. Any adjourned session of any meeting of the shareholders shall be

held at the place designated in the vote of adjournment, or if no such place is designated, at the same place or by the same remote communication method as the adjourned meeting.

In addition, the board of directors may authorize any meeting to be held solely by remote communication with no fixed physical location, or may authorize that any shareholder or proxy not physically present at a meeting may participate in the meeting and be deemed present and entitled to vote. In the event that any shareholder or proxy is permitted to participate in a meeting by means of remote electronic communication: (a) the corporation shall implement reasonable measures to verify that each person present and permitted to vote at a meeting is a shareholder or proxy; (b) the corporation shall implement reasonable measures to provide such shareholders and proxies a reasonable opportunity to participate in the meeting and to vote on matters submitted to the shareholders, including an opportunity to read or hear the proceedings of the meeting substantially concurrently with such proceedings; and (c) if a shareholder or proxy votes or takes other action by remote communication at the meeting, a record of the vote or other action shall be maintained by the corporation.

4. Record Date for Purpose of Meetings.

The directors may fix in advance a time not more than seventy (70) days before the date of any meeting of shareholders as the record date for determining the shareholders having the right to notice of and to vote at such meeting and any adjournment thereof. In such case, only shareholders of record on such date shall have such right, notwithstanding any transfer of shares on the books of the corporation after the record date. If no record date is fixed, the record date for determining shareholders having the right to notice of or to vote at a meeting of shareholders shall be at the close of business on the day before the day on which notice is given. If any meeting is adjourned to a date more than 120 days after the date fixed for the original meeting, the directors shall fix a new record date.

5. Notice of Meetings.

Written notice of the date, time and place of all meetings of shareholders shall be given by the secretary, the assistant secretary or an officer designated by the directors, at least seven (7) days but no more than sixty (60) days before the meeting, to each shareholder entitled to vote thereat and to each shareholder who, by the Act, under the Articles or under these by-laws of the corporation (these “By-laws”), is entitled to such notice. Notice of an adjourned meeting shall be given only if a new record date is fixed, in which case notice shall be given to all shareholders as of the new record date. The notice of a meeting shall state the purposes of the meeting. At a special meeting of shareholders, only business within the purpose or purposes described in the meeting notice may be conducted. Notice may be given by leaving such notice with the shareholder or at his, her or its residence or usual place of business, by mailing it, postage prepaid, and addressed to such shareholder at his, her or its address as it appears in the books of the corporation, by facsimile telecommunication directed to a number furnished by the shareholder for the purpose, by electronic mail to the electronic mail address furnished by the shareholder for the purpose, or by any other electronic transmission (defined as any process of communication that does not directly involve the physical transfer of paper and that is suitable for the retention, retrieval and reproduction of information by the recipient). The corporation shall be entitled to rely on the address of a shareholder last notified to the corporation. In case of

2

the death, absence, incapacity or refusal of the secretary, the assistant secretary or the officer designated by the directors, such notice may be given by any other officer or by a person designated either by the secretary or by the person or persons calling the meeting or by the board of directors. Whenever notice of a meeting is required to be given to a shareholder under any provision of the Act or of the Articles or these By-laws, no such notice need be given to a shareholder, if a written waiver of notice, executed before or after the meeting by such shareholder or his, her or its attorney, thereunto authorized, is filed with the records of the meeting.

6. Shareholders List for Meeting.

After fixing a record date for a meeting of shareholders, the secretary shall prepare an alphabetical list of all shareholders who are entitled to notice of the meeting. The list shall be arranged by voting group, and within each voting group by class or series of shares, and show the address of and number of shares held by each shareholder, but need not include an electronic mail address or other electronic contact information for any shareholders. The shareholders list shall be available for inspection by any shareholder: (a) before the meeting, during the period beginning two days after notice of the meeting is given, at the corporation’s principal office or, if the meeting is to be held only by remote communication, on an electronic network; and (b) at the meeting. A shareholder or his, her or its agent or attorney may inspect the list at the principal office during regular business hours, and may also inspect the list at the meeting. A shareholder or his agent or attorney may copy the list at the principal office at his, her or its own expense as permitted by the Act.

7. Quorum.

At any meeting of the shareholders, a majority in interest of all the shares issued, outstanding and entitled to vote upon a question to be considered at such meeting shall constitute a quorum for the consideration of such question, except that, if two or more voting groups are entitled to vote upon such question as separate voting groups, then, in the case of each such voting group, a quorum shall consist of a majority of the votes entitled to be cast by the voting group for action on that matter. Notwithstanding the foregoing, shareholders, by a majority of the votes properly cast upon the question whether or not a quorum is present, may adjourn any meeting from time to time, and the meeting may be held as adjourned without further notice. A share once represented for any purpose at a meeting is deemed present for quorum purposes for the remainder of the meeting and for any adjournment thereof, unless (a) the shareholder attends solely to object to lack of notice, defective notice, or the conduct of the meeting on other grounds, and does not vote the shares or otherwise consent that they are to be deemed present; or (b) in the case of an adjournment, a new record date is or shall be set for that adjourned meeting.

8. Voting and Proxies.

Unless otherwise provided by the Articles, each shareholder shall have one vote for each share held by him, her or it of record on the record date and entitled to vote on the question or questions to be considered at any meeting of the shareholders according to the records of the corporation. Shareholders may vote either in person or by proxy appointed by written appointment form signed by the shareholder or his, her or its attorney in fact. An appointment

3

form shall be valid for the period stated therein, or, if no period is stated, for a period of eleven (11) months from the date the shareholder signed the form, or the date of its receipt by the secretary or his or her agent, if undated. Appointment forms shall be filed with the secretary of the meeting, or of any adjournment thereof, before being voted. Except as otherwise limited therein, appointment forms appointing proxies for a particular meeting shall entitle the persons named therein to vote at any adjournment of such meeting but shall not be valid after final adjournment of such meeting. An appointment form with respect to shares held in the name of two or more persons shall be valid if executed by one of them unless, at or prior to exercise of the appointment, the corporation receives a specific written notice to the contrary from any one of them. An appointment form purporting to be executed by or on behalf of a shareholder shall be deemed valid unless challenged at or prior to its exercise.

9. Action at Meeting.

When a quorum of a voting group is present for the consideration of a matter at any meeting of the shareholders, favorable action on a matter, otherwise than the election of directors, is taken by the voting group if a majority in interest of the shares present in person or by proxy and entitled to vote on such question votes in favor of the action, except where a larger vote is required by the Act, the Articles or these By-laws. Any election of directors by a voting group shall be determined by a majority of the votes cast by shareholders in the voting group present in person or by proxy at the meeting and entitled to vote in the election. No ballot shall be required for such election unless requested by a shareholder present in person or by proxy at the meeting and entitled to vote in the election. Shares of the corporation are not entitled to vote if they are owned, directly or indirectly, by another entity of which the corporation owns, directly or indirectly, a majority of the voting interests. The corporation may, however, vote any shares, including its own shares, held by it, directly or indirectly, in a fiduciary capacity.

10. Action without Meeting.

Any action required or permitted to be taken at any meeting of the shareholders may be taken without a meeting by all shareholders entitled to vote on the action, or if the Articles so provide, by shareholders having not less than the minimum number of votes necessary to take the action at a meeting at which all shareholders entitled to vote on the action are present and voting, as evidenced by written consents of such shareholders that describe the action taken, are signed by shareholders having the requisite votes, bear the date of the signatures of such shareholders, and are delivered to the corporation for inclusion with the records of meetings within sixty (60) days of the date of the earliest dated consent delivered to the corporation. The corporation must, at least seven (7) days before it takes any action in reliance on consent obtained in accordance with this provision, give written notice of its intended action to shareholders not entitled to vote on the action in any case where the Act would require such notice if the action were to be taken by voting shareholders at a meeting, and, if the action will be taken with less than unanimous consent, to all shareholders entitled to vote who did not consent to the action. Such notice shall be accompanied by the same material that the Act or these By-laws would require to be sent to such shareholders with a notice of meeting. The corporation may, for convenience, specify an effective date for such consents, provided that the corporation shall not take action in reliance upon such consents except in compliance with the Articles and these By-laws.

4

11. Electronic Action.

Any vote, consent, waiver, proxy appointment or other action by a shareholder shall be considered given in writing, dated and signed if it consists of an electronic transmission that allows the corporation to determine: (a) the date the transmission was sent; and (b) that the sender of the transmission was the relevant shareholder, proxy, or agent, or a person authorized to act on such shareholder’s behalf. The date on which the electronic transmission was sent shall be considered the date on which it was signed.

ARTICLE III

DIRECTORS

1. Powers.

All corporate power shall be exercised by or under the authority of, and the business and affairs of the corporation shall be managed under the direction of, a board of directors, subject to any limitation set forth in the Articles or in a shareholders’ agreement. In particular, and without limiting the generality of the foregoing, the directors may from time to time issue all or any part of the unissued shares of the corporation authorized under the Articles, determine the number of authorized shares in any class or series, the distinguishing designation thereof, and the preferences, limitations and relative rights applicable thereto, provided that the board of directors may not approve an aggregate number of authorized shares of all classes and series which exceeds the total number of authorized shares specified in the Articles approved by the shareholders. The directors may determine the consideration for which shares are to be issued and the manner of allocating such consideration between capital and surplus, and, before the corporation issues shares, shall determine that the consideration received or to be received is adequate. In the event of a vacancy in the board of directors, the remaining directors may exercise the powers of the full board until the vacancy is filled.

2. Election and Enlargement of Board.

A board of directors shall consist of at least one director, the number of directors to be fixed from time to time by vote of a majority of the directors then in office. The board of directors may be enlarged by the shareholders at any meeting or by vote of a majority of the directors then in office. Except in connection with the election of directors at the annual meeting of shareholders, the number of directors may be decreased only to eliminate vacancies existing by reason of death, resignation, removal, or disqualification of one or more directors. No director need be a shareholder.

3. Vacancies.

Any vacancy in the board of directors, including a vacancy resulting from the enlargement of the board, may be filled by the shareholders, by the board of directors, or if the directors remaining in office constitute fewer than a quorum, they may fill the vacancy by the vote of a majority of all the directors remaining in office. If the vacant office was held by a director elected by a voting group of shareholders, only the shareholders of that voting group or directors elected by that voting group are entitled to fill the vacancy.

5

4. Tenure.

Except as otherwise provided by the Articles or by these By-laws, each director shall hold office until the next annual meeting of shareholders or the special meeting in lieu thereof and thereafter until such director’s successor is elected and qualified or until such director sooner dies, resigns, is removed or becomes disqualified.

5. Committees.

The directors may, by vote of a majority of all directors then in office, elect from their number an executive or other committees, provided however that if the Articles or these By-laws provide that the number of directors required to take board action is greater than a majority of all directors then in office, then the vote of such greater number shall be required to elect any committee. Except as the directors may otherwise determine, any such committee may make rules for the conduct of its business, but unless otherwise provided by the directors or in such rules, its business shall be conducted as nearly as may be in the same manner as is provided by these By-laws for the directors. The directors may delegate to any committee some or all of their powers except those which they are prohibited from delegating by any provision of law or by the Articles or these By-laws. Without limitation of the foregoing, a committee may not (a) authorize distributions; (b) approve or propose to shareholders action that is required by law to be approved by shareholders; (c) change the number of the board of directors, remove directors from office or fill vacancies on the board of directors; (d) amend the Articles; (e) adopt, amend or repeal bylaws; or (f) authorize or approve reacquisition of shares, except according to a formula or method prescribed by the board of directors.

6. Meetings.

Regular meetings of the directors may be held without call or notice at such places and at such times as the directors may from time to time determine, provided that any director who is absent when such determination is made shall be given reasonable notice of the determination. Any or all of the directors may participate in a meeting of the directors or of a committee thereof by, or conduct the meeting through the use of, any means of communication by which all directors participating may simultaneously hear each other during the meeting; and participation by such means shall constitute presence in person at any such meeting.

A regular meeting of the directors may be held immediately following the annual meeting of shareholders, or special meeting in lieu thereof, at the same place as such shareholders’ meeting. Special meetings of the directors may be held at any time and place designated in a call of the meeting by the chairman of the board, if any, the president or two or more directors.

7. Notice of Special Meetings.

Notice of all special meetings of the directors shall be given to each director by the secretary, or assistant secretary, or by the officer or one of the directors calling the meeting. Notice shall be given to each director at least twenty-four (24) hours in advance of the meeting. Notice may be given by leaving such notice with the director at the residential or business address last notified to the corporation, by mailing it, postage prepaid, and addressed to such director at his, her or its address as last notified to the corporation, by facsimile

6

telecommunication directed to a number as last notified to the corporation, or by electronic mail to the electronic mail address of the director as last notified to the corporation. Notice need not be given to any director if a written waiver of notice, executed by him or her before or after the meeting, is filed with the records of the meeting, or to any director who attends the meeting without protesting, prior to or at the meeting’s commencement, the lack of notice to him or her. A notice or waiver of notice of a directors’ meeting need not specify the purposes of the meeting.

8. Quorum.

At any meeting of the directors, a quorum of the board of directors shall be a majority of the number of directors fixed by the board of directors or stockholders as constituting the board, or if no such number was prescribed, a majority of the directors in office immediately before the meeting begins. Any meeting may be adjourned from time to time by a majority of the votes cast upon the question, whether or not a quorum is present, and the meeting may be held as adjourned without further notice.

9. Action at Meeting.

If a quorum is present when a vote is taken, the vote of a majority of the directors present is an act of the board of directors, unless the Articles or these By-laws require the vote of a greater number of directors.

10. Action by Consent.

Any action required or permitted to be taken at any meeting of the directors may be taken without a meeting if all directors then in office consent to the action in writing signed by each director, or by electronic transmission delivered to the corporation to the address specified by the corporation or, if no address is specified, to the principal office of the corporation addressed to the secretary, provided that such written consents and/or electronic transmissions shall be included in the minutes or filed with the corporate records reflecting the action taken. Action taken by written consent is effective when the last director signs or delivers consent, unless the consent specifies a different effective date. Consents given in accordance with this provision shall be treated as a vote of the directors for all purposes.

11. Director Conflict of Interest

A conflict of interest transaction is a transaction with the corporation in which a director has a material direct or indirect interest (an “Interested Director”). Without limiting the interests that may create conflict of interest transactions, a director has an indirect interest in a transaction if another entity in which such director has a material financial interest or in which such director is a general partner is a party to the transaction (a “Related Party”), or if another entity of which such director is a director, officer, or trustee or other position is a party to the transaction and the transaction is or should be considered by the board of directors of the corporation.

A conflict of interest transaction is not voidable by the corporation solely because of the director’s interest in the transaction if: (a) the material facts of the transaction and the director’s interest were disclosed or known to the board or a committee of the board, and the board or committee authorized, approved or ratified the transaction by the vote of a majority of the

7

directors on the board or committee who have no direct or indirect interest in the transaction, but a transaction may not be authorized, approved, or ratified by a single director; or (b) the material facts of the transaction and the director’s interest were disclosed or known to the shareholders entitled to vote and they authorized, approved, or ratified the transaction by the vote of a majority of the shares entitled to vote. Shares owned by or voted under the control of any Interested Director or Related Party shall not be entitled to vote.

ARTICLE IV

OFFICERS

1. Enumeration.

The officers of the corporation shall consist of a president, a treasurer, a secretary, and such other officers, if any, including a chairman and a vice chairman of the board of directors, one or more vice presidents, assistant treasurers and assistant secretaries, as the incorporators at their initial meeting or the directors from time to time may choose or appoint.

2. Appointment.

The president, treasurer and secretary shall be appointed annually by the directors at their first meeting following the annual meeting of shareholders or the special meeting in lieu thereof. Other officers, if any, may be appointed by the board of directors at such meeting or at any other time.

3. Vacancies.

If any office becomes vacant by reason of death, resignation, removal, disqualification or otherwise, the directors may choose a successor or successors, who shall hold office for the unexpired term, except as otherwise provided by the Act, the Articles or these By-laws.

4. Qualification.

The president may be, but need not be, a director. No officer need be a shareholder. Any two or more offices may be held by the same person. Any officer may be required by the directors to give bond for the faithful performance of his duties to the corporation in such amount and with such sureties as the directors may determine.

5. Tenure.

Except as otherwise provided by the Articles or these By-laws, the president, treasurer and secretary shall hold office until the first meeting of the directors following the annual meeting of shareholders or the special meeting in lieu thereof, and thereafter until such officer’s successor is chosen and qualified; and all other officers shall hold office until the first meeting of the directors following the annual meeting of the shareholders or the special meeting in lieu thereof, unless a shorter term is specified in the vote choosing or appointing them, or in each case until such officer sooner dies, resigns, is removed or becomes disqualified.

8

6. Chairman and Vice Chairman of the Board.

A chairman or vice chairman of the board of directors shall have such powers as the directors may from time to time designate. Unless the board of directors otherwise specifies, the chairman of the board, or in his or her absence the vice chairman, shall preside at all meetings of the shareholders and of the board of directors. The chairman or vice chairman must be a director.

7. President and Vice President.

Except as otherwise determined by the directors, the president shall be the chief executive officer of the corporation and shall, subject to the direction of the directors, have general supervision and control of its business. Unless the board of directors otherwise specifies, in absence of the chairman and vice chairman, if any, of the board of directors, the president shall preside, when present, at all meetings of shareholders and of the directors.

Any vice president shall have such powers as the directors may from time to time designate.

8. Treasurer and Assistant Treasurers.

The treasurer shall, subject to the direction of the directors, be the chief financial and accounting officer of the corporation, and shall have general charge of the financial concerns of the corporation and the care and custody of the funds and valuable papers of the corporation, and books of account and accounting records. He or she shall have power to endorse for deposit or collection all notes, checks, drafts, and other obligations for the payment of money payable to the corporation or its order, and to accept drafts on behalf of the corporation.

Any assistant treasurer shall have such powers as the directors may from time to time designate.

9. Secretary and Assistant Secretary.

Unless a transfer agent is appointed, the secretary shall keep or cause to be kept the share and transfer records of the corporation in which are contained the names of all shareholders and the record address and the amount of shares held by each. The secretary shall record all proceedings of the shareholders in a paper record, or in another form capable of conversion into a paper record within a reasonable time. Such records shall be kept at the principal office of the corporation or at the office of its transfer agent or of the secretary and shall be open at all reasonable times to the inspection of any shareholder.

If a secretary is elected, the secretary shall record all proceedings of the directors in a paper record, or in another form capable of conversion into a paper record within a reasonable time. Any assistant secretary shall have such powers as the directors may from time to time designate. In the absence of the secretary from any meeting of the directors, any assistant secretary, or a temporary secretary designated by the person presiding at such meeting, shall record such proceedings.

9

10. Other Powers and Duties.

Each officer shall, subject to these By-laws, have in addition to the duties and powers specifically set forth in these By-laws, such duties and powers as are customarily incident to his office, and such duties and powers as the directors may from time to time designate.

ARTICLE V

RESIGNATIONS AND REMOVALS

1. Resignation.

Any director or officer may resign at any time by delivering his or her resignation in writing to the chairman of the board, if any, the president, the treasurer or the secretary or to a meeting of the directors. Such resignation shall be effective upon receipt unless specified to be effective at some other time.

2. Removal of Director.

A director (including persons elected by directors to fill vacancies in the board) may be removed from office (a) with or without cause by majority vote of the shareholder voting group entitled to appoint such director, or (b) with cause by vote of the greater of a majority of the directors then in office or of the number of directors otherwise required to take action of the board, except that if a director is appointed by a voting group of shareholders, only directors appointed by that voting group may vote to remove him or her. A director may be removed by the shareholders or the directors only at a meeting called for the purpose of removing him or her and the meeting notice must state that the purpose, or one of the purposes, of the meeting is removal of the director.

3. Removal of Officer.

The directors may remove any officer at any time with or without cause.

4. No Right to Compensation.

No director or officer resigning and (except where a right to receive compensation shall be expressly provided in a duly authorized written agreement with the corporation) no director or officer removed, shall have any right to any compensation as such director or officer for any period following his or her resignation or removal, or any right to damages on account of such removal, whether his or her compensation be by the month or by the year or otherwise, unless in the case of a resignation, the directors, or in the case of a removal, the body acting on the removal, shall in their or its discretion provide for compensation.

10

ARTICLE VI

SHARES

1. Amount Authorized.

The total number of authorized shares shall be as fixed in the Articles.

2. Share Certificates; Statements for Uncertificated Shares.

Shares of the corporation may be certificated or uncertificated. Each shareholder shall be entitled to: (a) for certificated shares, a certificate of the shares of the corporation setting forth the name of the corporation and that it is organized under the laws of the Commonwealth of Massachusetts, the name of the person to whom the shares represented by the certificate are issued and the number and class of shares and the designation of the series, if any, the certificate represents; and (b) for uncertificated shares, a written information statement, delivered within a reasonable time after the issuance or transfer of shares, setting forth the same information as would be found on a certificate for certificated shares. Each certificate shall be signed by the president or a vice president, and by the treasurer or an assistant treasurer, either by real or facsimile signatures, and shall bear the corporate seal or its facsimile. In case any officer who has signed or whose facsimile signature has been placed on such certificate shall have ceased to be such officer before such certificate is issued, it may be issued by the corporation with the same effect as if he or she were such officer at the time of its issue.

Every certificate or information statement for shares which are subject to any restriction on transfer pursuant to the Articles, the By-laws or any agreement to which the corporation is a party shall have the restriction noted conspicuously on the certificate or information statement and shall also set forth on the face or back either the full text of the restriction or a statement of the existence of such restriction and a statement that the corporation will furnish a copy thereof to the holder of such certificate or statement upon written request and without charge. Every certificate or statement issued when the corporation is authorized to issue more than one class or series of shares shall set forth on its face or back either the full text of the preferences, voting powers, qualifications and special and relative rights of the shares of each class and series authorized to be issued or a statement of the existence of such preferences, powers, qualifications and rights and a statement that the corporation will furnish a copy thereof to the holder of such certificate or statement upon written request and without charge.

3. Transfers.

Subject to the restrictions, if any, stated or noted on the share certificates or information statements, shares may be transferred on the books of the corporation by: (a) for certificated shares, the surrender to the corporation or its transfer agent of the certificate therefor properly endorsed or accompanied by a written assignment and power of attorney properly executed, with necessary transfer stamps affixed, and with such proof of the authenticity of signature as the corporation or its transfer agent may reasonably require; and (b) for uncertificated shares, by delivery to the corporation or its transfer agent an instruction with a request to register a transfer properly executed by the transferring shareholder, and with such proof of authenticity of

11

signature as the corporation or its transfer agent may reasonably require. Except as may be otherwise required by the Act, the Articles or these By-laws, the corporation shall be entitled to treat the record holder of shares as shown on its books as the owner of such shares for all purposes, including the payment of dividends and the right to receive notice and to vote with respect thereto, regardless of any transfer, pledge or other disposition of such shares, until the shares have been transferred on the books of the corporation in accordance with the requirements of these By-laws.

4. Record Date for Purposes Other Than Meetings.

The directors may fix in advance a time not more than seventy (70) days preceding the date for the payment of any dividend or the making of any distribution to shareholders or the last day on which the consent or dissent of shareholders may be effectively expressed for any purpose, as the record date for determining the shareholders having the right to receive such dividend or distribution or the right to express such consent or dissent. In such case only shareholders of record on such date shall have such right, notwithstanding any transfer of shares on the books of the corporation after the record date. If no record date is fixed, the record date for determining shareholders shall be at the close of business on the day on which the board of directors acts with respect thereto.

5. Replacement of Certificates.

In case of the alleged loss or destruction or the mutilation of a share certificate, a duplicate certificate may be issued in place thereof, upon such terms as the directors may prescribe.

ARTICLE VII

INDEMNIFICATION

1. Mandatory Indemnification.

The corporation shall, to the extent legally permissible, indemnify each of its directors and officers (including persons who serve at its request as directors, officers, or trustees of another organization in which it has any interest as a shareholder, creditor or otherwise or in any capacity with respect to any employee benefit plan), against all liabilities and expenses, including amounts paid in satisfaction of judgments, in settlement or as fines and penalties, and counsel fees, reasonably incurred by him or her in connection with the defense or disposition of any action, suit or other proceeding, whether civil or criminal, in which he or she may be involved or with which he or she may be threatened, while in office or thereafter, by reason of his or her being or having been such a director or officer, if: (a) he or she acted in good faith and in the reasonable belief that his or her conduct was in the best interests of the corporation or at least not opposed to the best interests of the corporation, and, in the case of any criminal proceeding, he or she had no reasonable cause to believe his or her conduct was unlawful; or (b) he or she engaged in conduct for which he or she shall not be liable under the Articles; provided, however, that the corporation shall not indemnify or advance expenses to any person in connection with any action, suit, proceeding, claim or counterclaim initiated by or on behalf of

12

such person. Such indemnification shall be provided although the person to be indemnified is not currently a director, officer, partner, trustee, employee or agent of the corporation or such other organization or no longer serves with respect to any such employee benefit plan.

2. Indemnification Procedure.

Notwithstanding the foregoing, no indemnification shall be provided unless a determination has been made that indemnification is permissible for a specific proceeding:

(a) if there are two (2) or more disinterested directors, by the board of directors by a majority vote of all the disinterested directors, a majority of whom for such purpose shall constitute a quorum, or by a majority of the members of a committee of two (2) or more disinterested directors appointed by vote; or

(b) by special legal counsel selected either (i) in the manner prescribed in clause (a) above, or (ii) if there are fewer than two (2) disinterested directors, by the board of directors, in which case directors who do not qualify as disinterested directors may participate in the selection; or

(c) by the holders of a majority of the shares of the corporation’s outstanding shares at the time entitled to vote for directors, voting as a single voting group, exclusive of any shares owned by or voted under the control of any interested director or officer.

The right of indemnification hereby provided shall not be exclusive of or affect any other rights to which any director or officer may be entitled; nothing contained in this section shall affect any rights to indemnification to which employees, independent contractors or agents, other than directors and officers, may be entitled by contract or otherwise under law. As used in this paragraph, the terms “director” and “officer” include their respective heirs, executors and administrators, and an “interested” director or officer is one against whom in such capacity the proceedings in question or another proceeding on the same or similar grounds is then pending.

Any repeal or modification of the foregoing provisions of this section shall not adversely affect any right or protection of a director or officer of the corporation with respect to any acts or omission of such director or officer occurring prior to such repeal or modification.

3. Advance of Expenses.

The corporation may, before final disposition of a proceeding, advance funds to pay for or reimburse the reasonable expenses incurred by a director, officer or other person who is a party to a proceeding for which he or she would be or may be entitled to indemnification as set forth in these By-laws, provided that he or she delivers to the corporation a written affirmation of his or her good faith belief that he or she has met the relevant standard of conduct described in these By-laws, and his or her written undertaking to repay any funds advanced if he or she is not entitled to mandatory indemnification under the Act and it is ultimately determined that he or she has not met the relevant standard for indemnification set forth in these By-laws.

13

ARTICLE VIII

MISCELLANEOUS PROVISIONS

1. Fiscal Year.

The fiscal year of the corporation shall end on the date determined from time to time by the board of directors.

2. Seal.

The seal of the corporation shall, subject to alteration by the directors, consist of a flat-faced circular die with the word “Massachusetts”, together with the name of the corporation and the year of its organization cut or engraved thereon.

3. Registered Agent and Registered Office.

The corporation shall continuously maintain in Massachusetts: (a) a registered agent who may be an officer of the corporation or another individual, a domestic corporation or not-for-profit domestic corporation, or a foreign corporation or not-for-profit foreign corporation qualified to do business in Massachusetts; and (b) a registered office, which may, but need not be, the same as any of its places of business. The business office of the registered agent shall also be the registered office of the corporation. The corporation shall record any change of its registered office by filing a statement of change with the Secretary of the Commonwealth of Massachusetts.

4. Execution of Instruments.

All deeds, leases, transfers, contracts, bonds, notes and other obligations authorized to be executed on behalf of the corporation shall be signed by the chairman of the board, if any, the president or the treasurer except as the directors may generally or in particular cases otherwise determine.

5. Voting of Securities.

Except as the directors may otherwise designate, the president or treasurer may waive notice of, act and appoint any person or persons to act as proxy or attorney in fact for this corporation (with or without power of substitution) at any meeting of the shareholders, members or other constituent parties of any other corporation, organization or entity in which the corporation holds securities or other type of ownership interest.

6. Corporate Records to be Maintained and Available to All Shareholders.

The corporation shall keep in Massachusetts at the principal office of the corporation, or at an office of its transfer agent, secretary, assistant secretary or registered agent, a copy of the following records: (a) its Articles and By-laws then in effect; (b) resolutions adopted by the directors creating classes or series of shares and fixing their relative rights, preferences and limitations, if shares issued pursuant to those resolutions are outstanding; (c) the minutes for all

14

shareholders’ meetings, and records of all action taken by shareholders without a meeting, for the past 3 years; (d) all written communications to shareholders generally during the past three years, including annual financial statements issued pursuant to the Act; (e) a list of the names and business addresses of its current directors and officers; and (f) its most recent annual report delivered to the Massachusetts Secretary of the Commonwealth of Massachusetts. Said copies and records may be kept in written form or in another form capable of conversion into written form within a reasonable time. A shareholder is entitled to inspect and copy such records, during regular business hours at the office at which they are maintained, on written notice given at least five business days before the date he, she or it wishes to inspect and copy.

7. Additional Corporate Records Available to Shareholders.

The corporation shall allow a shareholder to inspect and copy: (a) excerpts from minutes reflecting action taken at any meeting of the board of directors, records of any action of a committee of the board of directors when acting in place of the board of directors, minutes of any meeting of the shareholders, and records of action taken by the shareholders or board of directors without a meeting, to the extent not subject to inspection by Section 6 above; (b) accounting records of the corporation, but if the financial statements of the corporation are audited by a certified public accountant, inspection and copying shall be limited to the financial statements and the supporting schedules reasonably necessary to verify any line item on those statements; and (c) the names and addresses of all shareholders, in alphabetical order by class of shares showing the number and class of shares held by each; provided that the shareholder may only inspect and copy the above records if (i) such shareholder makes a demand in good faith and for a proper purpose, with reasonable particularity, (ii) such records are directly connected with such purpose, and (iii) the corporation has not determined in good faith that the disclosure of the records sought would adversely affect the corporation in the conduct of its business.

8. Amendments to Bylaws.

These By-laws may at any time be amended by vote of the shareholders at an annual or special meeting of the shareholders called for such purpose, provided that notice of the substance of the proposed amendment is stated in the notice of the meeting, or may be amended by vote of a majority of the directors then in office, except that bylaw provisions dealing with quorum or voting requirements for shareholders, including additional voting groups, may not be adopted, amended or repealed by the board of directors. Notice of any change to these By-laws by the directors, stating the substance of such change, shall be given to all shareholders entitled to vote on amending these By-laws not later than the time that notice of the shareholders’ meeting next following such change is required to be given. Any bylaw adopted by the board of directors may be amended or repealed by the shareholders.

15

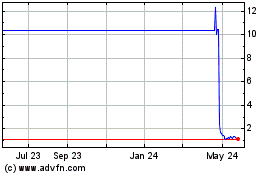

mF (NASDAQ:MFI)

Historical Stock Chart

From Nov 2024 to Dec 2024

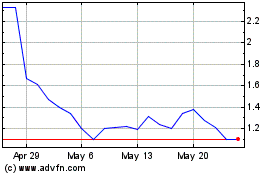

mF (NASDAQ:MFI)

Historical Stock Chart

From Dec 2023 to Dec 2024