Appendix 4c Quarterly Activity Report for Quarter Ended March 31, 2024

April 29 2024 - 9:05PM

Mesoblast Limited (Nasdaq:MESO; ASX:MSB), global leader in

allogeneic cellular medicines for inflammatory diseases, today

provided an activity report for the third quarter ended March 31,

2024.

Mesoblast Chief Executive Silviu Itescu said:

“We are very pleased with the positive interactions we had last

quarter with the FDA, having received clarity on the path to

licensure for our product candidates in pediatric acute graft

versus host disease and in ischemic patients with chronic heart

failure.”

“Based on the clear responses and guidance from

FDA we intend this quarter to resubmit our Biologics License

Application (BLA) for approval of remestemcel-L in children with

SR-aGVHD,” said Mesoblast CEO Dr. Silviu Itescu. “In addition, FDA

informed us that the results from our pivotal study of

rexlemestrocel-L in end-stage heart failure patients may support an

accelerated approval, and we intend to have a pre-BLA meeting to

discuss the data that will be provided and the timing for an

accelerated approval filing.”

ACTIVITY REPORT

Graft versus Host Disease – Pediatric

and Adult Indications

- United States Food

and Drug Administration (FDA) informed Mesoblast after its Type C

meeting during the quarter that following additional consideration

the available clinical data from its Phase 3 study MSB-GVHD001

appears sufficient to support submission of the proposed Biologics

License Application (BLA) for remestemcel-L for treatment of

pediatric patients with steroid-refractory acute graft versus host

disease (SR-aGVHD).

- Mesoblast intends

to file the resubmission this quarter, potentially resulting in an

approval for Ryoncil® (remestemcel-L) in the second half of

CY2024.

- Mesoblast will now

focus on its original strategy to first gain pediatric approval for

RYONCIL, followed by label extension in the larger adult

population.

Cardiovascular – Chronic Heart Failure

with Reduced Ejection Fraction (HFrEF) in Adults

- FDA informed the

Company in formal minutes following the Type B meeting held in

February under Mesoblast’s existing Regenerative Medicine Advanced

Therapy (RMAT) designation, that it supports an accelerated

approval pathway for Revascor® (rexlemestrocel-L), Mesoblast’s

allogeneic mesenchymal precursor cell (MPC) product, in patients

with end-stage ischemic heart failure with reduced ejection

fraction (HFrEF) and a left ventricular assist device (LVAD).

- In these patients,

a single administration of REVASCOR reduced inflammation,

strengthened left ventricular function, reduced right ventricular

failure, reduced hospitalizations and reduced mortality.

- REVASCOR has also

shown the potential to reduce major adverse cardiac events (MACE)

such as cardiovascular death, heart attacks and strokes in ischemic

HFrEF patients with NYHA class II /III disease and

inflammation.

- Mesoblast intends

to request a pre-BLA meeting with FDA to discuss data presentation,

timing and FDA expectations for an accelerated approval filing in

ischemic HFrEF patients with end-stage heart failure.

Cardiovascular - Pediatric Congenital

Heart Disease

- During the quarter

FDA granted Mesoblast a Rare Pediatric Disease (RPD) Designation

for Revascor® (rexlemestrocel-L) following submission of results

from the randomized controlled trial in children with hypoplastic

left heart syndrome (HLHS), a potentially life-threatening

congenital heart condition.

- On FDA approval of

a BLA for REVASCOR for the treatment of HLHS, Mesoblast may be

eligible to receive a Priority Review Voucher (PRV) that can be

redeemed for any subsequent marketing application or may be sold or

transferred to a third party.

Chronic Low Back Pain – Phase 3

Program

- Second Phase 3

trial underway for rexlemestrocel-L in the treatment of chronic low

back pain (CLBP) due to inflammatory disc degeneration– a condition

affecting at least seven million people in both the US and Europe

alone.

FINANCIAL REPORT

Strengthened Balance

SheetCompleted the pro-rata accelerated non-renounceable

entitlement offer that was launched on 4 December, 2023

(Entitlement Offer). Together the entitlement offer and

institutional placement raised gross proceeds of A$97 million,

including A$36.7 million during the quarter on the same terms as

the Entitlement Offer. As part of its active approach to efficient

balance sheet management, during the quarter Mesoblast reduced debt

under its five-year facility, and its minimum cash balance

requirement under that facility, by US$10 million. Cash balance at

the end of the quarter was A$117.0 million (US$76.4 million).1

Cost containment strategy

on-trackCost containment strategies and payroll reductions

have been enacted by management and the Board enabling continuation

of Phase 3 programs for SR-aGVHD and CLBP in the quarter whilst

still achieving reductions in net operating cash spend:

- Net operating cash

spend of US$11.7 million for the quarter.

- 28% reduction in

net operating cash spend from the comparative quarter in

FY2023.

- On target to

achieve a 23% ($15m) reduction in net operating spend in FY2024

compared to FY2023 which will be partially offset by investment in

our commercial and clinical activities for SR-aGVHD and CLBP,

respectively.

We will maintain our focus on cutting costs and

preserving cash in the remainder of the year whilst we continue to

work on corporate and strategic initiatives to access commercial

distribution channels, supplement costs of development, and

strengthen our balance sheet.

Other Fees to Non-Executive

Directors were nil, consulting payments to Non-Executive Directors

were US$77,217 and salary payments to full-time Executive Directors

were US$228,769, detailed in Item 6 of the Appendix 4C cash flow

report for the quarter.2 From 1 August 2023, Non-Executive

directors have voluntarily deferred 50% cash payment of their

director fees and agreed to receive the remaining 50% of their fees

in equity-based incentives and Executive Directors (our Chief

Executive and Chief Medical Officers) have voluntarily reduced

their base salaries for FY24 by 30% in lieu of accepting

equity-based incentives.

A copy of the Appendix 4C – Quarterly Cash Flow

Report for the third quarter FY2024 is available on the investor

page of the company’s website www.mesoblast.com.

About Mesoblast Mesoblast is a

world leader in developing allogeneic (off-the-shelf) cellular

medicines for the treatment of severe and life-threatening

inflammatory conditions. The Company has leveraged its proprietary

mesenchymal lineage cell therapy technology platform to establish a

broad portfolio of late-stage product candidates which respond to

severe inflammation by releasing anti-inflammatory factors that

counter and modulate multiple effector arms of the immune system,

resulting in significant reduction of the damaging inflammatory

process.

Mesoblast has a strong and extensive global

intellectual property portfolio with protection extending through

to at least 2041 in all major markets. The Company’s proprietary

manufacturing processes yield industrial-scale, cryopreserved,

off-the-shelf, cellular medicines. These cell therapies, with

defined pharmaceutical release criteria, are planned to be readily

available to patients worldwide.

Mesoblast is developing product candidates for

distinct indications based on its remestemcel-L and

rexlemestrocel-L allogeneic stromal cell technology platforms.

Remestemcel-L is being developed for inflammatory diseases in

children and adults including steroid refractory acute graft versus

host disease, and biologic-resistant inflammatory bowel disease.

Rexlemestrocel-L is being developed for advanced chronic heart

failure and chronic low back pain. Two products have been

commercialized in Japan and Europe by Mesoblast’s licensees, and

the Company has established commercial partnerships in Europe and

China for certain Phase 3 assets.

Mesoblast has locations in Australia, the United

States and Singapore and is listed on the Australian Securities

Exchange (MSB) and on the Nasdaq (MESO). For more information,

please see www.mesoblast.com, LinkedIn: Mesoblast Limited and

Twitter: @Mesoblast

References / Footnotes

- Using Reserve Bank of Australia

(RBA) published exchange rate from March 31, 2024 of

1A$:0.6532US$.

- As required by ASX listing rule 4.7 and reported in Item 6 of

the Appendix 4C, reported are the aggregated total payments to

related parties being Executive Directors and Non-Executive

Directors.

Forward-Looking StatementsThis

press release includes forward-looking statements that relate to

future events or our future financial performance and involve known

and unknown risks, uncertainties and other factors that may cause

our actual results, levels of activity, performance or achievements

to differ materially from any future results, levels of activity,

performance or achievements expressed or implied by these

forward-looking statements. We make such forward-looking statements

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and other federal securities laws.

Forward-looking statements should not be read as a guarantee of

future performance or results, and actual results may differ from

the results anticipated in these forward-looking statements, and

the differences may be material and adverse. Forward-looking

statements include, but are not limited to, statements about: the

initiation, timing, progress and results of Mesoblast’s preclinical

and clinical studies, and Mesoblast’s research and development

programs; Mesoblast’s ability to advance product candidates into,

enroll and successfully complete, clinical studies, including

multi-national clinical trials; Mesoblast’s ability to advance its

manufacturing capabilities; the timing or likelihood of regulatory

filings and approvals, manufacturing activities and product

marketing activities, if any; the commercialization of Mesoblast’s

product candidates, if approved; regulatory or public perceptions

and market acceptance surrounding the use of stem-cell based

therapies; the potential for Mesoblast’s product candidates, if any

are approved, to be withdrawn from the market due to patient

adverse events or deaths; the potential benefits of strategic

collaboration agreements and Mesoblast’s ability to enter into and

maintain established strategic collaborations; Mesoblast’s ability

to establish and maintain intellectual property on its product

candidates and Mesoblast’s ability to successfully defend these in

cases of alleged infringement; the scope of protection Mesoblast is

able to establish and maintain for intellectual property rights

covering its product candidates and technology; estimates of

Mesoblast’s expenses, future revenues, capital requirements and its

needs for additional financing; Mesoblast’s financial performance;

developments relating to Mesoblast’s competitors and industry; and

the pricing and reimbursement of Mesoblast’s product candidates, if

approved. You should read this press release together with our risk

factors, in our most recently filed reports with the SEC or on our

website. Uncertainties and risks that may cause Mesoblast’s actual

results, performance or achievements to be materially different

from those which may be expressed or implied by such statements,

and accordingly, you should not place undue reliance on these

forward-looking statements. We do not undertake any obligations to

publicly update or revise any forward-looking statements, whether

as a result of new information, future developments or

otherwise.

Release authorized by the Chief Executive.

For more information, please contact:

|

Corporate Communications / Investors |

Media |

|

Paul Hughes |

BlueDot Media |

|

T: +61 3 9639 6036 |

Steve Dabkowski |

|

E: investors@mesoblast.com |

T: +61 419 880 486 |

|

|

E: steve@bluedot.net.au |

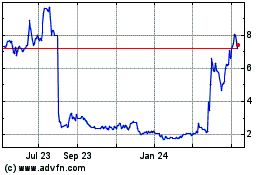

Mesoblast (NASDAQ:MESO)

Historical Stock Chart

From Nov 2024 to Dec 2024

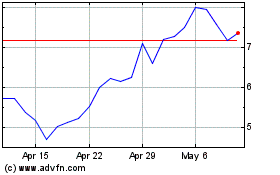

Mesoblast (NASDAQ:MESO)

Historical Stock Chart

From Dec 2023 to Dec 2024