false

0001938046

0001938046

2024-11-11

2024-11-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): November 11, 2024

MANGOCEUTICALS,

INC.

(Exact

name of registrant as specified in its charter)

| Texas |

|

001-41615 |

|

87-3841292 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

15110

N. Dallas Parkway, Suite 600

Dallas,

Texas |

|

75248 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (214) 242-9619

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

Common

Stock, $0.0001 Par Value Per Share |

|

MGRX |

|

The

NASDAQ Stock Market LLC

(Nasdaq

Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

(e)

On November 11, 2024 and effective on October 1, 2024, Mangoceuticals, Inc. (the “Company”,

“we” and “us”), entered into a Consulting agreement with Eugene M. Johnston, the

Company’s Chief Financial Officer (the “Consulting Agreement”).

Pursuant

to the Consulting Agreement, Mr. Johnston agreed to serve as the Chief Financial Officer of the Company and to provide services to the

Company as reasonably requested during the term of the Consulting Agreement, which is 12 months. As consideration for the services to

be provided by Mr. Johnston under the Consulting Agreement, the Company agreed to pay him (a) $4,000 per month; and (b) to issue him

25,000 shares of Company common stock under the Company’s 2022 Equity Incentive Plan, as amended, which shares vested upon execution

of the Consulting Agreement.

Pursuant

to the Consulting Agreement, we agreed to reimburse Mr. Johnston’s expenses, subject to pre-approval for any expense greater than

$500.

The

Consulting Agreement may be terminated prior to the end of the term (i) with the mutual approval of the parties; (ii) with written notice

by the non-breaching party, upon the breach of the agreement by the other party, and the failure to cure such breach within 30 days;

or (iii) by Mr. Johnston, at any time, for any reason.

The

Consulting Agreement also contains standard assignment of inventions, indemnification and confidentiality provisions, subject to customary

exceptions. Further, Mr. Johnston is subject to certain non-solicitation covenants during the term of the agreement and for 12 months

thereafter.

Mr.

Johnston is also eligible for discretionary equity bonuses and/or cash awards, from time to time in the discretion of the Compensation

Committee and/or Board of Directors.

Mr.

Johnston’s compensation under the Consulting Agreement may be increased from time to time, by the Compensation Committee, or the

Board of Directors (with the recommendation of the Compensation Committee), which increases do not require the entry into an amended

Consulting Agreement.

The

description of the Consulting Agreement is not complete and is qualified in its entirety by the full text of the Consulting Agreement,

a copy of which is attached hereto as Exhibit 10.1, and which is incorporated by reference into this Item 5.02 in its entirety.

Item

9.01 Financial Statements and Exhibits.

*

Filed herewith.

#

Indicates management contract or compensatory plan or arrangement.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MANGOCEUTICALS,

INC. |

| |

|

| Date:

November 12, 2024 |

By: |

/s/

Jacob D. Cohen |

| |

|

Jacob

D. Cohen |

| |

|

Chief

Executive Officer |

Exhibit

10.1

CONSULTING

AGREEMENT

THIS

CONSULTING AGREEMENT (this “Agreement”) is made as of this 11th day of November, 2024 with an

effective date of October 1st, 2024 (the “Effective Date”), by and between Mangoceuticals, Inc.,

a Texas corporation (the “Company”), and Eugene Johnston, an individual (the “Consultant”)

(each of the Company and Consultant is referred to herein as a “Party”, and collectively referred to herein

as the “Parties”).

W

I T N E S S E T H:

WHEREAS,

the Company desires to obtain the services of Consultant to continue his services acting as Chief Financial Officer of the Company, and

Consultant desires to provide consulting services to the Company upon the terms and conditions hereinafter set forth.

NOW,

THEREFORE, in consideration of the premises, the agreements herein contained and other good and valuable consideration, receipt and

sufficiency of which is hereby acknowledged, the Parties hereto agree as of the Effective Date as follows:

ARTICLE

I.

ENGAGEMENT;

TERM; SERVICES

1.1.

Services. Pursuant to the terms and conditions hereinafter set forth, the Company hereby engages Consultant, and Consultant hereby

accepts such engagement, to serve as the Chief Financial Officer of the Company and as reasonably requested by the Company during the

Term of this Agreement (the “Services”).

1.2.

Term. Consultant shall begin providing Services hereunder on the date of this Agreement above (the “Effective Date”),

and this Agreement shall remain in effect until the earlier of (a) 12 months, or (b) terminated as provided in ARTICLE III, below (the

“Term”).

1.3.

Allocation of Time and Energies. The Consultant hereby promises to perform and discharge faithfully the Services which may be

requested from the Consultant from time to time by the Company and duly authorized representatives of the Company. The Consultant shall

provide the Services required hereunder in a diligent and professional manner. During the Term, Consultant approximates spending five

(5) hours per week on Company matters.

ARTICLE

II.

CONSIDERATION;

EXPENSES; INDEPENDENT CONTRACTOR; TAXES

2.1.

Consideration. During the Term of this Agreement, for all Services rendered by Consultant hereunder and all covenants and conditions

undertaken by the Parties pursuant to this Agreement, the Company shall pay, and Consultant shall accept, as compensation a) $4,000 per

month and b) twenty-five thousand (25,000) shares of Company common stock (the “Consulting Shares”), on the

date that the Board of Directors of the Company approves this Agreement, which shall not be any later than 15 days after the Effective

Date, and shall vest upon the execution of this Agreement. 25,000 shares of the Consulting Shares shall be issued under, and subject

to the terms of, the Company’s 2022 Equity Incentive Plan.

Consulting

Agreement

2.2.

Expenses. The Company agrees to reimburse Consultant for his reasonable, documented out-of-pocket expenses associated with the

Services (the “Expenses”), subject to the Company’s normal and usual reimbursement policies of its employees

and consultants, provided that the Consultant shall receive written authorization of any one-time Expense greater than $500 not included

in a pre-approved budget for any study relating to the Services.

2.3.

Independent Contractor. It is the express intention of the Company and Consultant that Consultant perform the Services as an independent

contractor to the Company. Nothing in this Agreement shall in any way be construed to constitute Consultant as an agent or employee of

the Company. Without limiting the generality of the foregoing, Consultant is not authorized to bind the Company to any liability or obligation

or to represent that Consultant has any such authority in connection with the Services. Consultant acknowledges and agrees that Consultant

is obligated to report as income all compensation received by Consultant pursuant to this Agreement. Consultant agrees to and acknowledges

the obligation to pay all self-employment and other taxes on such income. The Company and Consultant agree that Consultant will receive

no Company- sponsored benefits from the Company pursuant to this Agreement.

2.4.

Taxes. The Company makes no representations or warranties with respect to the tax consequences of the payments and any other consideration

provided to Consultant under the terms of this Agreement. Consultant agrees and understands that it is responsible for payment, if any,

of local, state, and/or federal taxes on the payments and any other consideration provided hereunder by the Company and any penalties

or assessments thereon. Consultant agrees to indemnify and hold harmless the Company and his affiliates and their directors, officers

and employees from and against all taxes, losses, damages, liabilities, costs and expenses, including attorneys’ fees and other

legal expenses, arising solely from or in connection with (i) any obligation imposed on the Company to pay withholding taxes or similar

items, or (ii) any determination by a court or agency that the Consultant is not an independent contractor pursuant to this Agreement.

ARTICLE

III.

TERMINATION

3.1.

Termination. The obligations under this Agreement shall begin on the Effective Date and continue to bind the Parties until the

earlier of the (a) the expiration of the Term; (b) the date this Agreement is mutually terminated by the Parties; (c) the date this Agreement

is terminated by the Company due to the breach by the Consultant of any term or condition of this Agreement, which breach is not cured

within thirty (30) days of written notice thereof by the Company to the Consultant and (d) the date the Consultant issues a written termination

notice to the Company, which may be issued at any time, for any reason or no reason.

3.2.

Termination Date. “Termination Date” shall mean the date on which Consultant’s engagement with

the Company hereunder is actually terminated.

3.3.

Rights Upon Termination. Upon termination of the Term, the Consultant shall be paid any and all Consulting Fees and Expenses accrued

and due through the Termination Date, which shall represent the sole compensation and fees due to Consultant. The Consultant shall also

continue to comply with the terms of ARTICLE IV hereof following the Termination Date. The Company

shall also continue to comply with the terms of Section 2.5 hereof following the Termination Date.

Consulting

Agreement

ARTICLE

IV.

CONFIDENTIAL/TRADE

SECRET INFORMATION;

COMPANY

PROPERTY; NON-SOLICITATION

4.1.

Confidential/Trade Secret Information/Non-Disclosure/Non-Solicitation.

4.1.1

Confidential/Trade Secret Information Defined. During the course of Consultant’s engagement, Consultant will have access

to various Confidential/Trade Secret Information of the Company and information developed for the Company. For purposes of this Agreement,

the term “Confidential/Trade Secret Information” is information that is not generally known to the public and,

as a result, is of economic benefit to the Company in the conduct of its business, and the business of the Company’s subsidiaries.

Consultant and the Company agree that the term “Confidential/Trade Secret Information” includes but is not

limited to all information developed or obtained by the Company, including its affiliates, and predecessors, and comprising the following

items, whether or not such items have been reduced to tangible form (e.g., physical writing, computer hard drive, disk, tape, etc.):

all methods, techniques, processes, ideas, research and development, product designs, engineering designs, plans, models, production

plans, business plans, add-on features, trade names, service marks, slogans, forms, pricing structures, business forms, marketing programs

and plans, layouts and designs, financial structures, operational methods and tactics, cost information, the identity of and/or contractual

arrangements with suppliers and/or vendors, accounting procedures, and any document, record or other information of the Company relating

to the above. Confidential/Trade Secret Information includes not only information directly belonging to the Company which existed before

the date of this Agreement, but also information developed by Consultant for the Company, including its subsidiaries, affiliates and

predecessors, during the term of Consultant’s engagement with the Company. Confidential/Trade Secret Information does not include

any information which (a) was in the lawful and unrestricted possession of Consultant prior to its disclosure to Consultant by the Company,

its subsidiaries, affiliates or predecessors, or owned thereby, which shall be included in Confidential/Trade Secret Information, (b)

is or becomes generally available to the public by lawful acts other than those of Consultant after receiving it, or (c) has been received

lawfully and in good faith by Consultant from a third party who is not and has never been a Consultant of the Company, its subsidiaries,

affiliates or predecessors, and who did not derive it from the Company, its subsidiaries, affiliates or predecessors.

4.1.2

Restriction on Use of Confidential/Trade Secret Information. Consultant agrees that during the Term and the two-year period following

the Termination Date his use of Confidential/Trade Secret Information is subject to the following restrictions so long as the Confidential/Trade

Secret Information has not become generally known to the public:

(i)

Non-Disclosure. Consultant agrees that it will not publish or disclose, or allow to be published or disclosed, Confidential/Trade Secret

Information to any person without the prior written authorization of the Company unless pursuant to or in connection with Consultant’s

job duties to the Company under this Agreement; and

(ii)

Non-Removal/Surrender. Consultant agrees that it will not remove any Confidential/Trade Secret Information from the offices of the Company

or the premises of any facility in which the Consultant is performing services for the Company, except pursuant to his duties under this

Agreement. Consultant further agrees that it shall surrender to the Company all documents and materials in his possession or control

which contain Confidential/Trade Secret Information and which are the property of the Company upon the termination of his engagement

with the Company, and that it shall not thereafter retain any copies of any such materials.

Consulting

Agreement

4.2.

Non-Solicitation of Employees and Consultants. Consultant agrees that during the Term and the twelve-month period following the

Termination Date, he shall not, directly or indirectly, solicit or otherwise encourage any employees or consultants of the Company to

leave the employ or service of the Company, or solicit, directly or indirectly, any of the Company’s employees or consultants for

employment or service; provided, however, that Consultant may solicit an employee or consultant if (i) such employee or consultant has

resigned voluntarily (without any solicitation from Consultant), and at least one (1) year has elapsed since such employee’s or

consultant’s resignation from employment or termination of service with the Company, (ii) such employee’s employment or consultant’s

services was terminated by the Company, and if one (1) year has elapsed since such employee or consultant was terminated by the Company,

(iii) the Company has consented to the solicitation of such employee or consultant in writing, which consent the Company may withhold

in its sole discretion, or (iv) such solicitation solely occurs by general solicitations for employment to the public.

4.3.

Non-Solicitation of Contacts. Consultant agrees that during the Term and the twelve-month period following the Termination Date,

Consultant shall not: (a) interfere with the Company’s business relationship with its customers or suppliers, (b) solicit, directly

or indirectly, or otherwise encourage any of the Company’s customers or suppliers to terminate their business relationship with

the Company, or (c) solicit, directly or indirectly, or otherwise encourage any employees of the Company to leave the employ of the Company,

or solicit any of the Company’s employees for employment.

4.4.

Breach of Provisions. If Consultant materially breaches any of the provisions of this ARTICLE IV, or in the event that any such

breach is threatened by Consultant, in addition to and without limiting or waiving any other remedies available to the Company at law

or in equity, the Company shall be entitled to immediate injunctive relief in any court, domestic or foreign, having the capacity to

grant such relief, to restrain any such breach or threatened breach and to enforce the provisions of this ARTICLE IV.

4.5.

Reasonable Restrictions. The Parties acknowledge that the foregoing restrictions, as well as the duration and the territorial

scope thereof as set forth in this ARTICLE IV, are under all of the circumstances reasonable and necessary for the protection of the

Company and its business.

4.6.

Specific Performance. Consultant acknowledges and agrees that the Company’s remedies at law for a breach or threatened breach

of any of the provisions of ARTICLE IV would be inadequate and, in recognition of this fact, Consultant agrees that, in the event of

such a breach or threatened breach, in addition to any remedies at law, the Company, without posting any bond, shall

be entitled to obtain equitable relief in the form of specific performance, temporary restraining order, temporary or permanent injunction

or any other equitable remedy which may then be available.

4.7.

Company Property. Upon termination of this Agreement, or on demand by the Company during the Term of this Agreement, Consultant

will immediately deliver to the Company, and will not keep in his possession, recreate or deliver to anyone else, any and all Company

property, records, data, notes, notebooks, reports, files, proposals, lists, correspondence, specifications, drawings blueprints, sketches,

materials, photographs, charts, all documents and property, and reproductions of any of the aforementioned items that were developed

by Consultant pursuant to the terms of this Agreement, obtained by Consultant in connection with the provision of the Services, or otherwise

belonging to the Company or its successors or assigns.

4.8.

Response to Legal Process; Allowable Disclosures. Notwithstanding any other term of this Agreement, the Consultant’s reporting

of possible violations of federal law or regulation to any governmental agency or entity in accordance with the provisions of and rules

promulgated under Section 21F of the Exchange Act of 1934, as amended, or any other whistleblower protection provisions of state or federal

law or regulation shall not violate or constitute a breach of this Agreement. Nothing contained in this Agreement (or any exhibit hereto)

shall be construed to prevent the Consultant from reporting any act or failure to act to the Securities and Exchange Commission or other

governmental body or prevent the Consultant from obtaining a fee as a “whistleblower” under Rule 21F-17(a) under the Exchange

Act or other rules or regulations implemented under the Dodd-Frank Wall Street Reform Act and Consumer Protection Act.

Consulting

Agreement

ARTICLE

V.

MUTUAL

REPRESENTATIONS, COVENANTS AND

WARRANTIES

OF THE PARTIES; LIMITATION OF LIABILITY

5.1.

Power and Authority. The Parties have all requisite power and authority, corporate or otherwise, to execute and deliver this Agreement

and to consummate the transactions contemplated hereby and thereby. The Parties have duly and validly executed and delivered this Agreement

and will, on or prior to the consummation of the transactions contemplated herein, execute, such other documents as may be required hereunder

and, assuming the due authorization, execution and delivery of this Agreement by the Parties hereto and thereto, this Agreement constitutes,

the legal, valid and binding obligation of the Parties enforceable against each Party in accordance with its terms, except as such enforcement

may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the Parties rights generally

and general equitable principles.

5.2.

Execution and Delivery. The execution and delivery by the Parties of this Agreement and the consummation of the transactions contemplated

hereby and thereby do not and shall not, by the lapse of time, the giving of notice or otherwise: (a) constitute a violation of any law;

or (b) constitute a breach or violation of any provision contained in the Articles of Incorporation or Bylaws, or such other document(s)

regarding organization and/or management of the Parties, if applicable; or (c) constitute a breach of any provision contained in, or

a default under, any governmental approval, any writ, injunction, order, judgment or decree of any governmental authority or any contract

to which the Parties are bound or affected.

5.3.

Authority of Entities. Any individual executing this Agreement on behalf of an entity

has authority to act on behalf of such entity and has been duly and properly authorized to sign this Agreement on behalf of such entity.

5.4.

In no event will either Party be liable to the other Party for any claim or cause of action requesting or claiming any incidental, consequential,

special, indirect, statutory, punitive or reliance damages. Any claim or cause of action requesting or claiming such damages is specifically

waived and barred, whether such damages were foreseeable or not or a Party was notified in advance of the possibility of such damages.

Damages prohibited under this Agreement will include, without limitation, damage or loss of property or equipment, loss of profits, revenues

or savings, cost of capital, cost of replacement services, opportunity costs and cover damages.

5.5.

The Company agrees to indemnify, defend and hold harmless the Consultant from and against any loss, costs or damage of any kind (including

reasonable attorneys’ fees) arising from or related to the services or other performance provided by the Consultant pursuant to

this Agreement; provided, however, that Consultant shall not be entitled to indemnification for such loss, costs or damages arising as

a result of the Consultant’s fraud, gross negligence or willful misconduct, as finally determined by a court of competent jurisdiction,

In addition, except in the case of the Consultant’s fraud, gross negligence or willful misconduct, as finally determined by a court

of competent jurisdiction, the Consultant’s liability under this Agreement for damages will not, in any event, exceed the lesser

of $50,000 or the value of the Consulting Shares paid to the Consultant under this Agreement.

ARTICLE

VI.

REPRESENTATIONS

OF THE CONSULTANT

6.1.

Representations of the Consultant. The Consultant acknowledges, represents and warranties to the Company that the Consultant has

received a document or documents, providing the information required by Rule 428(b)(1) promulgated under the Securities Act of 1933,

as amended.

ARTICLE

VII.

MISCELLANEOUS

7.1.

Notices. All notices, approvals, consents, requests, and other communications hereunder shall be in writing and shall be delivered

(i) by personal delivery, or (ii) by national overnight courier service, or (iii) by certified or registered mail, return receipt requested,

or (iv) via facsimile transmission, with confirmed receipt, or (v) via email. Notice shall be effective upon receipt except for notice

via fax (as discussed above) or email, which shall be effective only when the recipient, by return or reply email or notice delivered

by other method provided for in this Section 7.1, acknowledges having received that email (with an automatic “read receipt”

or similar notice not constituting an acknowledgement of an email receipt for purposes of this Section 7.1, or which such recipient ‘replies’

to such prior email). Such notices shall be sent to the applicable party or parties at the address specified below:

| |

If to the Company: |

Mangoceuticals, Inc. |

| |

|

Attn: Jacob Cohen |

| |

|

15110 Dallas Parkway, Suite

600 |

| |

|

Dallas, Texas 75248 |

| |

|

Phone: (214) 845-6412 |

| |

|

Email: jacob@mangorx.com |

| |

|

|

| |

If to the Consultant: |

Eugene Johnston |

| |

|

3820 Blairwood Street |

| |

|

High Point, NC 27265 |

| |

|

Email: gene@mangorx.com |

| |

|

Phone: (704) 724-6436 |

Consulting

Agreement

7.2.

Binding Effect; Assignment. This Agreement shall be binding upon and inure to the benefit of the Parties and their respective

legal representatives, heirs, successors and assigns. Consultant may not assign any of its rights or obligations under this Agreement.

The Company may assign its rights and obligations under this Agreement to any successor entity.

7.3.

Severability. If any provision of this Agreement, or portion thereof, shall be held invalid or unenforceable by a court of competent

jurisdiction, such invalidity or unenforceability shall attach only to such provision or portion thereof, and shall not in any manner

affect or render invalid or unenforceable any other provision of this Agreement or portion thereof, and this Agreement shall be carried

out as if any such invalid or unenforceable provision or portion thereof were not contained herein. In addition, any such invalid or

unenforceable provision or portion thereof shall be deemed, without further action on the part of the Parties hereto, modified, amended

or limited to the extent necessary to render the same valid and enforceable.

7.4.

Waiver. No waiver by a Party of a breach or default hereunder by the other Party shall be considered valid, unless expressed in

a writing signed by such first Party, and no such waiver shall be deemed a waiver of any subsequent breach or default of the same or

any other nature.

7.5.

Entire Agreement. This Agreement sets forth the entire agreement between the Parties with respect to the subject matter hereof,

and supersedes any and all prior agreements between the Company and Consultant, whether written or oral, relating to any or all matters

covered by and contained or otherwise dealt with in this Agreement. This Agreement does not constitute a commitment of the Company with

regard to Consultant’s engagement, express or implied, other than to the extent expressly provided for herein.

7.6.

Amendment. No modification, change or amendment of this Agreement or any of its provisions shall be valid, unless in a writing

signed by the Parties.

7.7.

Captions. The captions, headings and titles of the sections of this Agreement are inserted merely for convenience and ease of

reference and shall not affect or modify the meaning of any of the terms, covenants or conditions of this Agreement.

7.8.

Governing Law. This Agreement, and all of the rights and obligations of the Parties in connection with the relationship established

hereby, shall be governed by and construed in accordance with the substantive laws of the State of Texas without giving effect to principles

relating to conflicts of law.

7.9.

Survival. The termination of Consultant’s engagement with the Company pursuant to the provisions of this Agreement shall

not affect Consultant’s obligations to the Company hereunder which by the nature thereof are intended to survive any such termination,

including, without limitation, Consultant’s obligations under ARTICLE IV of this Agreement and the Company’s obligations

under Article II and Article V of this Agreement.

Consulting

Agreement

7.10.

No Presumption from Drafting. This Agreement has been negotiated at arm’s- length between persons knowledgeable in the matters

set forth within this Agreement. Accordingly, given that all Parties have had the opportunity to draft, review and/or edit the language

of this Agreement, no presumption for or against any Party arising out of drafting all or any part of this Agreement will be applied

in any action relating to, connected with or involving this Agreement. In particular, any rule of law, legal decisions, or common law

principles of similar effect that would require interpretation of any ambiguities in this Agreement against the Party that has drafted

it, is of no application and is hereby expressly waived. The provisions of this Agreement shall be interpreted in a reasonable manner

to affect the intentions of the Parties.

7.11.

Review and Construction of Documents. Each Party herein expressly represents and warrants to all other Parties hereto that (a)

before executing this Agreement, said Party has fully informed itself of the terms, contents, conditions and effects of this Agreement;

(b) said Party has relied solely and completely upon its own judgment in executing this Agreement; (c) said Party has had the opportunity

to seek and has obtained the advice of its own legal, tax and business advisors before executing this Agreement; (d) said Party has acted

voluntarily and of its own free will in executing this Agreement; and (e) this Agreement is the result of arm’s length negotiations

conducted by and among the Parties and their respective counsel.

7.12.

Interpretation. When used in this Agreement, unless a contrary intention appears:

(i)

a term has the meaning assigned to it; (ii) “or” is not exclusive; (iii) “including”

means including without limitation; (iv) words used herein regardless of the number and gender specifically used, shall be deemed and

construed to include any other number, singular or plural, and any other gender, masculine, feminine or neuter, as the context requires;

(v) any agreement, instrument or statute defined or referred to herein or in any instrument or certificate delivered in connection herewith

means such agreement, instrument or statute as from time to time amended, modified or supplemented and includes (in the case of agreements

or instruments) references to all attachments thereto and instruments incorporated therein; (vi) the words “hereof”,

“herein” and “hereunder” and words of similar import when used in this Agreement

shall refer to this Agreement as a whole and not to any particular provision hereof; (vii) references contained herein to Article, Section,

Schedule and Exhibit, as applicable, are references to Articles, Sections, Schedules and Exhibits in this Agreement unless otherwise

specified; and (viii) references to “writing” include printing, typing, lithography and other means of reproducing

words in a visible form, including, but not limited to email.

7.13.

Electronic Signatures and Counterparts. This Agreement and any signed agreement or instrument entered into in connection with

this Agreement, and any amendments hereto or thereto, may be executed in one or more counterparts, all of which shall constitute one

and the same instrument. Any such counterpart, to the extent delivered by means of a facsimile machine or by .pdf, .tif, .gif, .jpeg

or similar attachment to electronic mail (any such delivery, an “Electronic Delivery”) shall be treated in

all manner and respects as an original executed counterpart and shall be considered to have the same binding legal effect as if it were

the original signed version thereof delivered in person. At the request of any Party, each other Party shall re execute the original

form of this Agreement and deliver such form to all other Parties. No Party shall raise the use of Electronic Delivery to deliver a signature

or the fact that any signature or agreement or instrument was transmitted or communicated through the use of Electronic Delivery as

a defense to the formation of a contract, and each such Party forever waives any such defense, except to the extent such defense relates

to lack of authenticity.

Consulting

Agreement

IN

WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the day and year first above written, to be effective as of

the Effective Date.

| “COMPANY” |

Mangoceuticals, Inc. |

| |

|

|

| |

By: |

/s/ Jacob D. Cohen |

| |

Name: |

Jacob D. Cohen |

| |

Its: |

Chief Executive Officer |

| |

|

|

| “CONSULTANT” |

|

/s/ Eugene M. Johnston |

| |

|

Eugene M. Johnston |

Consulting

Agreement

v3.24.3

Cover

|

Nov. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 11, 2024

|

| Entity File Number |

001-41615

|

| Entity Registrant Name |

MANGOCEUTICALS,

INC.

|

| Entity Central Index Key |

0001938046

|

| Entity Tax Identification Number |

87-3841292

|

| Entity Incorporation, State or Country Code |

TX

|

| Entity Address, Address Line One |

15110

N. Dallas Parkway

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75248

|

| City Area Code |

(214)

|

| Local Phone Number |

242-9619

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 Par Value Per Share

|

| Trading Symbol |

MGRX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

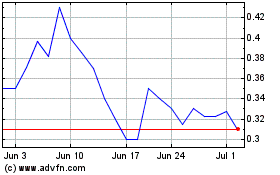

Mangoceuticals (NASDAQ:MGRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Mangoceuticals (NASDAQ:MGRX)

Historical Stock Chart

From Feb 2024 to Feb 2025