By Corrie Driebusch and Maureen Farrell

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 9, 2019).

Uber Technologies Inc. is on track to price its initial public

offering at the midpoint of its target or below, according to

people familiar with the matter, following a big stock-market drop

and the disappointing debut of rival Lyft Inc.

Uber is currently pitching investors across the country on its

shares, which are set to price Thursday ahead of a Friday trading

debut. The ride-hailing giant has set a range of $44 to $50 share,

or about $80 billion to $90 billion, already down from its earlier

indication.

Investors are still putting in their orders for the shares and

things could shift before the price is set later Thursday. There is

currently enthusiasm for shares in the bottom half of the range,

one person familiar with the matter said.

If the stock is priced at the $47-a-share midpoint, Uber's

valuation on a fully diluted basis would be roughly $86 billion.

That would still enable current investors like SoftBank Group Corp.

to reap major windfalls, but not quite as big as ones they had been

eyeing.

In the weeks before it officially set a price range, Uber had

provided documentation to holders of its convertible notes setting

a potential band of $48 to $55 a share, or $90 billion to $100

billion, including what it expects to raise in the offering -- now

about $8 billion to $10 billion. Last year, lead underwriters

Morgan Stanley and Goldman Sachs Group Inc. had pitched the company

on a valuation of as much as $120 billion.

Uber's offering appears to be falling victim at least in part to

unfortunate timing. On Tuesday, the Dow Jones Industrial Average

suffered its biggest decline in months on escalating trade-dispute

fears, a selloff that hit tech stocks hardest. The Dow industrials

are down roughly 2% this week, and investors and traders say they

expect more choppiness ahead.

The ride-hailing giant's listing has been overshadowed in recent

weeks by Lyft's woes. Its smaller rival's shares dropped 11% on

Wednesday, closing at their lowest level ever after the company

reported first-quarter results late Tuesday.

Lyft shares have now fallen by nearly 27% from their IPO price,

which exceeded the range the company was targeting during its

roadshow, something that may also be weighing on the minds of the

decision makers at Uber.

Another factor that could be prompting caution among potential

Uber investors: Drivers protested around the country Wednesday

against Uber and Lyft, saying they've failed to pay them a living

wage.

Diminishing expectations for Uber's IPO, the biggest in years,

could put somewhat of a damper on what is expected to be one of the

best years ever for new issues as many big technology startups rush

to the public markets. Still, others that have made their debuts in

recent weeks have performed well. Pinterest Inc.'s shares are up

more than 50% from their offer price, and Zoom Video Communications

Inc.'s stock is trading at more than double its initial level.

Alternative-meat startup Beyond Meat Inc. has more than

tripled.

SoftBank is set to be one of the biggest beneficiaries of

investors' general enthusiasm for IPOs.

Its Vision Fund, the world's largest technology investor, is in

line to reap a paper profit of roughly $3 billion on Uber's debut.

When SoftBank bought into the company in early 2018, writing a $7.7

billion check for a roughly 15% stake, Uber had been reeling from a

series of crises and was valued at around $48 billion.

The gain represents one of the biggest triumphs so far for the

$100 billion Vision Fund, which was launched in spring 2017. It

could aid its aggressive growth plans, including a possible IPO of

its current fund and potentially raising another one of the same

size or larger.

There have been other wins too. SoftBank's roughly $300 million

investment in Guardant Health Inc., which went public in October

2018, is now valued at more than six times that. The fund is also

an investor in Slack Technologies Inc. and WeWork Cos., both of

which are preparing for big 2019 debuts.

Vision Fund executives say that by later this year, they expect

at least one company from the portfolio will make a debut each

month on average.

The circumstances of SoftBank's investment in Uber are unique,

however. Early in 2017, Travis Kalanick, Uber's co-founder and

chief executive at the time, was under fire from unhappy customers

and competitors, as well as from employees who were voicing

concerns over a culture that allegedly permitted sexual harassment

and sexism.

In the spring of that year, Peter Fenton, a general partner at

early Uber investor Benchmark, flew to London to meet Rajeev Misra,

CEO of the Vision Fund, at SoftBank's office in the posh Mayfair

district. As part of that conversation and in follow-up meetings,

they discussed whether SoftBank would consider a fresh investment

in Uber or buying existing stakes, people familiar with the meeting

said. But the two sides were far apart on price and the talks

eventually flamed out.

By late June 2017, Mr. Kalanick resigned under pressure from a

group of investors including Benchmark. Shortly thereafter,

SoftBank started talking to Uber's board and other investors about

an investment, people familiar with the conversations said.

During more than a dozen meetings that followed, Benchmark and

other key investors who had the right to block any share sales

sought two crucial promises from the Vision Fund should it become a

big shareholder with important sway: It wouldn't support a return

of Mr. Kalanick as CEO, and it would back the elimination of excess

voting rights for Uber's founders and certain existing

shareholders.

SoftBank agreed to both terms. Mr. Misra met with the three key

CEO candidates and supported the board's decision to choose Dara

Khosrowshahi, according to people familiar with the meetings. By

October 2017, Uber's board had approved a deal with SoftBank that

closed in January 2018.

Write to Corrie Driebusch at corrie.driebusch@wsj.com and

Maureen Farrell at maureen.farrell@wsj.com

(END) Dow Jones Newswires

May 09, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

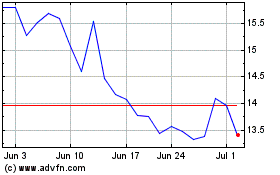

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Apr 2023 to Apr 2024